starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 8)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 2

Gesamt: 279.239

Gesamt: 279.239

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 1288 | |

| vor 55 Minuten | 1170 | |

| heute 10:06 | 1149 | |

| heute 01:24 | 1019 | |

| gestern 19:20 | 999 | |

| heute 08:37 | 827 | |

| heute 11:57 | 765 | |

| vor 1 Stunde | 729 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.704,42 | -0,18 | 186 | |||

| 2. | 4. | 6,5320 | -2,74 | 81 | |||

| 3. | 14. | 20,435 | -19,78 | 73 | |||

| 4. | 18. | 31,51 | +6,45 | 69 | |||

| 5. | 6. | 10,700 | +1,71 | 66 | |||

| 6. | 10. | 16,750 | +4,69 | 47 | |||

| 7. | 5. | 163,32 | +1,48 | 47 | |||

| 8. | 3. | 4,0515 | -5,02 | 42 |

Antwort auf Beitrag Nr.: 57.392.210 von Popeye82 am 26.03.18 21:29:27MOD Resources

http://docs.wixstatic.com/ugd/a5d095_fa0c7e5422d141cba4399a8…

http://docs.wixstatic.com/ugd/a5d095_010f2978bd314ee78489387…

http://docs.wixstatic.com/ugd/a5d095_fa0c7e5422d141cba4399a8…

http://docs.wixstatic.com/ugd/a5d095_010f2978bd314ee78489387…

Antwort auf Beitrag Nr.: 57.314.813 von Popeye82 am 19.03.18 00:44:36Kidman Resources

http://www.asx.com.au/documents/research/kidman-resources-eq…

http://www.asx.com.au/documents/research/kidman-resources-eq…

Antwort auf Beitrag Nr.: 57.443.438 von Popeye82 am 02.04.18 16:47:21wird interessant.

MFX Minerals

http://www.mgxminerals.com/investors/news/2018/339-mgx-miner…

www.zincnyx.com

http://www.zincnyx.com/technology/

"MGX Minerals Announces Intent to List Zinc-Air Fuel Cell Division; Issue Dividend to Shareholders

VANCOUVER, BRITISH COLUMBIA / April 3, 2018 / MGX Minerals Inc. (“MGX” or the “Company”) (CSE: XMG / FKT: 1MG / OTCQB: MGXMF) is pleased to announce its intention to publicly list its wholly owned subsidiary ZincNyx Energy Solutions Inc. (“ZincNyx”) and pay a partial share dividend of ZincNyx directly to MGX shareholders of record. The planned result will be a separate publicly-traded company (the “Transaction”) primarily owned by MGX and its shareholders of record. The Transaction is aimed at realizing the full value of ZincNyx and the unique opportunity of replacing or augmenting diesel generators globally with zinc-air mass storage systems in addition to backup and load balancing applications. The opportunity to replace marine diesel engines with electric engines and zinc-air fuel cells is now being evaluated due to the ability to refuel the systems in a method similar to traditional refueling, from onshore refueling tanks, but using the environmentally benign charged zinc electrolyte.

“The scale of the opportunity and the value of the intellectual property, now in excess of 20 issued patents developed by ZincNyx, has setup an ideal scenario for a spinoff transaction and return of value to shareholders through partial dividend of shares,” stated MGX’s CEO Jared Lazerson. Adding, “This is an important standalone technology that needs to grow unbridled on the global stage, a public listing creates this platform.”

As part of the Transaction, MGX has immediate plans to dividend a portion of shares in the current privately held subsidiary as part of a one-time distribution to existing shareholders. The date of record for the share dividend distribution will be announced shortly.

Overview of Technology

ZincNyx has developed a patented regenerative zinc-air flow battery that efficiently stores energy in the form of zinc particles and contains none of the traditional high cost battery commodities such as lithium, vanadium, or cobalt. The technology allows for low cost mass storage of energy and can be deployed into a wide range of applications.

Unlike conventional batteries, which have a fixed energy/power ratio, ZincNyx’s technology uses a fuel tank system that offers flexible energy/power ratios and scalability. The storage capacity is directly tied to the size of the fuel tank and the quantity of recharged zinc fuel, making scalability a major advantage of the flow battery system. The system can operate as a traditional engine in the sense that the zinc electrolyte of the fuel and can be stored and used in the same way other fuels are used. The system can be self-contained but can also be filled with charged electrolyte just as a car is filled at a gas station. The electrolyte is stable and environmentally benign. In addition, a further major advantage of the zinc-air flow battery is the ability to charge and discharge simultaneously and at different maximum charge or discharge rates since each of the charge and discharge circuits is separate and independent. Other types of standard and flow batteries are limited to a maximum charge and discharge by the total number of cells as there is no separation of the charge and discharge components.

MGX Minerals 4 3 2018

To watch a short video outlining ZincNyx technology, please visit http://www.zincnyx.com/technology/

About ZincNyx Energy Solutions

To learn more about ZincNyx technology visit www.zincnyx.com."

MFX Minerals

http://www.mgxminerals.com/investors/news/2018/339-mgx-miner…

www.zincnyx.com

http://www.zincnyx.com/technology/

"MGX Minerals Announces Intent to List Zinc-Air Fuel Cell Division; Issue Dividend to Shareholders

VANCOUVER, BRITISH COLUMBIA / April 3, 2018 / MGX Minerals Inc. (“MGX” or the “Company”) (CSE: XMG / FKT: 1MG / OTCQB: MGXMF) is pleased to announce its intention to publicly list its wholly owned subsidiary ZincNyx Energy Solutions Inc. (“ZincNyx”) and pay a partial share dividend of ZincNyx directly to MGX shareholders of record. The planned result will be a separate publicly-traded company (the “Transaction”) primarily owned by MGX and its shareholders of record. The Transaction is aimed at realizing the full value of ZincNyx and the unique opportunity of replacing or augmenting diesel generators globally with zinc-air mass storage systems in addition to backup and load balancing applications. The opportunity to replace marine diesel engines with electric engines and zinc-air fuel cells is now being evaluated due to the ability to refuel the systems in a method similar to traditional refueling, from onshore refueling tanks, but using the environmentally benign charged zinc electrolyte.

“The scale of the opportunity and the value of the intellectual property, now in excess of 20 issued patents developed by ZincNyx, has setup an ideal scenario for a spinoff transaction and return of value to shareholders through partial dividend of shares,” stated MGX’s CEO Jared Lazerson. Adding, “This is an important standalone technology that needs to grow unbridled on the global stage, a public listing creates this platform.”

As part of the Transaction, MGX has immediate plans to dividend a portion of shares in the current privately held subsidiary as part of a one-time distribution to existing shareholders. The date of record for the share dividend distribution will be announced shortly.

Overview of Technology

ZincNyx has developed a patented regenerative zinc-air flow battery that efficiently stores energy in the form of zinc particles and contains none of the traditional high cost battery commodities such as lithium, vanadium, or cobalt. The technology allows for low cost mass storage of energy and can be deployed into a wide range of applications.

Unlike conventional batteries, which have a fixed energy/power ratio, ZincNyx’s technology uses a fuel tank system that offers flexible energy/power ratios and scalability. The storage capacity is directly tied to the size of the fuel tank and the quantity of recharged zinc fuel, making scalability a major advantage of the flow battery system. The system can operate as a traditional engine in the sense that the zinc electrolyte of the fuel and can be stored and used in the same way other fuels are used. The system can be self-contained but can also be filled with charged electrolyte just as a car is filled at a gas station. The electrolyte is stable and environmentally benign. In addition, a further major advantage of the zinc-air flow battery is the ability to charge and discharge simultaneously and at different maximum charge or discharge rates since each of the charge and discharge circuits is separate and independent. Other types of standard and flow batteries are limited to a maximum charge and discharge by the total number of cells as there is no separation of the charge and discharge components.

MGX Minerals 4 3 2018

To watch a short video outlining ZincNyx technology, please visit http://www.zincnyx.com/technology/

About ZincNyx Energy Solutions

To learn more about ZincNyx technology visit www.zincnyx.com."

Antwort auf Beitrag Nr.: 57.013.380 von Popeye82 am 13.02.18 13:59:48Pure Gold Mining

http://puregoldmining.ca/news/pure-gold-announces-excellent-…

http://puregoldmining.ca/news/pure-gold-expands-scale-madsen…

http://puregoldmining.ca/news/pure-gold-completes-undergroun…

http://puregoldmining.ca/news/pure-gold-announces-excellent-…

http://puregoldmining.ca/news/pure-gold-expands-scale-madsen…

http://puregoldmining.ca/news/pure-gold-completes-undergroun…

Antwort auf Beitrag Nr.: 56.972.969 von Popeye82 am 08.02.18 14:31:07BlueJay Mining

https://thediplomat.com/2018/03/the-many-roles-of-greenland-…

http://www.rdmag.com/article/2018/04/ice-sheet-greenland-mel…

https://thediplomat.com/2018/03/the-many-roles-of-greenland-…

http://www.rdmag.com/article/2018/04/ice-sheet-greenland-mel…

Antwort auf Beitrag Nr.: 57.051.503 von Popeye82 am 17.02.18 15:43:30ScoZinc Mining

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.mri-group.com/

"ScoZinc and MRI Announce Offtake and Financing Agreement

Weiterempfehlen

Print

April 03, 2018 08:13 ET | Source: ScoZinc Mining Ltd.

COOKS BROOK, Nova Scotia, April 03, 2018 (GLOBE NEWSWIRE) -- ScoZinc Mining Ltd. (TSX-V:SZM) (“ScoZinc” or the “Company”) is pleased to announce the execution of a strategic term sheet with MRI Trading AG (“MRI”). The terms include:

Life of mine offtake agreement for lead and zinc concentrates,

CAD$14M debt at competitive terms, and

CAD$1M as an equity “lead order” for a planned financing.

The debt and equity components provide for over half of the required funds to recommence mining and milling operation. The offtake agreement provides competitive terms for 333,000 wmt of zinc concentrate and 133,000 wmt of lead concentrate from the Company’s ScoZinc mine in Nova Scotia. Due diligence has commenced and is expected to be completed in early May.

Considerable interest was shown in ScoZinc’s high-quality concentrate with numerous competing parties offering terms for the project’s zinc and lead concentrates. MRI was selected following collaborative negotiations due to their familiarity and history with the project, their willingness to include an equity investment in the Company, favorable debt terms and ability to quickly complete the transaction in support of restarting operations as soon as possible.

ScoZinc CEO Joseph Ringwald stated “We are very pleased with the comprehensive terms provided by MRI and our ability to finance over half of the required capital to restart operations. With this financing in place, we will commence a focused marketing campaign to secure the remaining funds to put the mine into production in 2018.”

The closing of the MRI transaction is conditional upon successful due diligence by MRI and ScoZinc securing the remainder of restart capex, estimated to be a total of CAD$15M.

About MRI Trading AG

MRI is a leader in trading, metals and minerals, petroleum products, bulk and freight. It specializes in non-ferrous ores, concentrates, refined and precious metals and their related by-products for a global smelting and processing customer base.

About ScoZinc Mining Ltd.

ScoZinc Mining Ltd. is an established Canadian-based zinc and lead company that owns 100% of the ScoZinc Mine (ScoZinc Limited) and related facilities near Halifax, Nova Scotia. The project is currently on care and maintenance. The Company intends to restart operations as soon as possible. The Company has a strong working capital position and no debt. The Company has 4,216,044 common shares outstanding which are traded on the TSX Venture Exchange under the symbol “SZM”.

For more information, please contact:

Mr. Joseph Ringwald – President and CEO Telephone: +1 (604) 347-7661 info@scozinc.com "

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.mri-group.com/

"ScoZinc and MRI Announce Offtake and Financing Agreement

Weiterempfehlen

April 03, 2018 08:13 ET | Source: ScoZinc Mining Ltd.

COOKS BROOK, Nova Scotia, April 03, 2018 (GLOBE NEWSWIRE) -- ScoZinc Mining Ltd. (TSX-V:SZM) (“ScoZinc” or the “Company”) is pleased to announce the execution of a strategic term sheet with MRI Trading AG (“MRI”). The terms include:

Life of mine offtake agreement for lead and zinc concentrates,

CAD$14M debt at competitive terms, and

CAD$1M as an equity “lead order” for a planned financing.

The debt and equity components provide for over half of the required funds to recommence mining and milling operation. The offtake agreement provides competitive terms for 333,000 wmt of zinc concentrate and 133,000 wmt of lead concentrate from the Company’s ScoZinc mine in Nova Scotia. Due diligence has commenced and is expected to be completed in early May.

Considerable interest was shown in ScoZinc’s high-quality concentrate with numerous competing parties offering terms for the project’s zinc and lead concentrates. MRI was selected following collaborative negotiations due to their familiarity and history with the project, their willingness to include an equity investment in the Company, favorable debt terms and ability to quickly complete the transaction in support of restarting operations as soon as possible.

ScoZinc CEO Joseph Ringwald stated “We are very pleased with the comprehensive terms provided by MRI and our ability to finance over half of the required capital to restart operations. With this financing in place, we will commence a focused marketing campaign to secure the remaining funds to put the mine into production in 2018.”

The closing of the MRI transaction is conditional upon successful due diligence by MRI and ScoZinc securing the remainder of restart capex, estimated to be a total of CAD$15M.

About MRI Trading AG

MRI is a leader in trading, metals and minerals, petroleum products, bulk and freight. It specializes in non-ferrous ores, concentrates, refined and precious metals and their related by-products for a global smelting and processing customer base.

About ScoZinc Mining Ltd.

ScoZinc Mining Ltd. is an established Canadian-based zinc and lead company that owns 100% of the ScoZinc Mine (ScoZinc Limited) and related facilities near Halifax, Nova Scotia. The project is currently on care and maintenance. The Company intends to restart operations as soon as possible. The Company has a strong working capital position and no debt. The Company has 4,216,044 common shares outstanding which are traded on the TSX Venture Exchange under the symbol “SZM”.

For more information, please contact:

Mr. Joseph Ringwald – President and CEO Telephone: +1 (604) 347-7661 info@scozinc.com "

Antwort auf Beitrag Nr.: 57.454.622 von Popeye82 am 04.04.18 00:36:42BlueJay Mining

http://www.pressreader.com/uk/shares/20180329/28181857938476…

http://www.pressreader.com/uk/shares/20180329/28181857938476…

das DIng will ich Hier mal mit reinnehmen,

"POTENTIAL(ly) to be one of the largest high grade silica sand deposits, in the World".

liegt auch nicht GigaSchlecht.

mal SEHEN Was passiert.

Vetnor Resources

http://clients3.weblink.com.au/pdf/VRX/01965410.pdf

http://www.ventnorresources.com.au/projects/arrowsmith-proje…

http://clients3.weblink.com.au/pdf/VRX/01928522.pdf

"POTENTIAL(ly) to be one of the largest high grade silica sand deposits, in the World".

liegt auch nicht GigaSchlecht.

mal SEHEN Was passiert.

Vetnor Resources

http://clients3.weblink.com.au/pdf/VRX/01965410.pdf

http://www.ventnorresources.com.au/projects/arrowsmith-proje…

http://clients3.weblink.com.au/pdf/VRX/01928522.pdf

Antwort auf Beitrag Nr.: 57.375.128 von Popeye82 am 24.03.18 04:36:10Nusantara Resources

http://www.asx.com.au/asxpdf/20180404/pdf/43sxxt7h70bvvr.pdf

http://www.asx.com.au/asxpdf/20180329/pdf/43stghq4rgx0ln.pdf

http://www.asx.com.au/asxpdf/20180404/pdf/43sxxt7h70bvvr.pdf

http://www.asx.com.au/asxpdf/20180329/pdf/43stghq4rgx0ln.pdf

Antwort auf Beitrag Nr.: 57.444.962 von Popeye82 am 02.04.18 20:59:46noch so ein GraphiteUnfall.

auch Tanzania,

im Dunstkreis von ein paar Anderen.

Armadale Capital Plc

https://polaris.brighterir.com/public/armadale_capital/news/…

https://polaris.brighterir.com/public/armadale_capital/news/…

https://polaris.brighterir.com/public/armadale_capital/news/…

http://armadalecapitalplc.com/mahengue-liandu-graphite-proje…

http://armadalecapitalplc.com/wp-content/uploads/2018/03/fin…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Ann…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Arm…

"Armadale, the AIM quoted investment company focused on natural resource projects in Africa, is pleased to announce the results of the Scoping Study completed by BatteryLimits on the Mahenge Liandu Graphite Project in Tanzania (‘Mahenge’ or the ‘Project’), which demonstrates highly robust and compelling economics.

Overview

- Scoping study completed at Mahenge on a 400,000 tpa throughput, producing an average of 49,000tpa of high quality graphite products during a 32 year life of mine

- The Project has a low operating cost of US$408/t and is based on an average life of mine grade of 12.5% Total Graphitic Carbon (‘TGC’)

- Results deliver a pre-tax IRR of 122% and NPV of US$349m with a low development capex of US$35m

- The maximum drawdown during the construction of the Project is US$34.9m and the after-tax payback period is 1.2 years

- Average basket price used in the Scoping Study (US$1,271 / t) considered very conservative and allows for significant upward improvements as potential off take agreements negotiated

- The deposit is one of the highest grade large flake deposits globally after the recent upgrade to 51.1Mt at 9.3% TGC, including 38.7Mt Indicted at 9.3% and 12.4Mt Inferred at 9.1% TGC – represents a 25% increase from the previous 40.9Mt inferred resource at 9.41% TGC

- There remains significant scope to further improve returns, with staged expansions as the current mine plan is based on approximately 25% of the total resource

- Results to feed into a feasibility study to progress the Project to a decision to mine early in 2019 – in the interim Company will commence negotiations with identified strategic funders and offtake partners.

Nick Johansen, Director of Armadale said: “We have long held confidence in the commercial potential and economic value of Mahenge and the results of this Scoping Study greatly reinforces this view. The Project’s NPV of US$US349m is significant, especially when compared to our current market cap of ~£5m. With an IRR of 122%, 1.2 year payback and low development costs, we firmly believe that Mahenge is an attractive asset for development. Crucially, the Scoping Study was limited to just 25% of the Project’s current resource, which forms Stage 1 of a planned staged development programme. Accordingly, with an upgrade in throughput there is significant potential to improve the Project economics even further. Our next steps will now be to commence a definitive feasibility study so that we can advance Mahenge to a decision to mine early in 2019.”

Dave Pass, Scoping Study Manager said: “The results of the Scoping Study confirm the combination of high graphite feed grade and coarse flake high purity graphite product, delivering robust project economics and warranting progress to the next phase of feasibility studies. Given the size of the resource it would be expected that there remains significant room for further project optimisation.”

Study Design Parameters

The Mahenge Scoping study was based on a throughput of 400,000tpa over a 32 year mine life from the start of construction. The deposit has a low average strip ration of 1:1 for the life of the mine and a very low operating cost of US$408/t. A summary of the parameters is shown in Table 1.

Table 1 Scoping Study Parameters

Design Parameters Units Value

Nominal concentrate production at 12.5% TGC kt/y 49

Nominal strip ratio Waste : Ore 1:01

Graphite average basket price (US$ /t, real) 1,271

Project Life (including construction) (years) 32

Financial Results

The Project has a pre-tax IRR of 122% based on a relatively low capital cost of US$35m. The after-tax payback period is expected to 1.2 years.

Financial Parameters Units Value

Discount Rate % 10%

Exchange Rate USD : AUD 0.75

Capital Cost (US$ m, real) 35

IRR - after tax (%, real) 89%

NPV @ 10.0% - after tax (US$ m, real) 239

Payback Period - after tax, from 1st ore processed (Years) 1.2

Cash Costs (FOB DES) (US$/t, real) 408

IRR - before tax (%, real) 122%

NPV @ 10.0% - before tax (US$ m, real) 348.7

The information communicated in this announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary

+44 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Simon Hicks

+44 20 7220 0500

Press Relations: St Brides Partners Ltd

Susie Geliher / Charlotte Page

+44 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a portfolio of investments, targeting the natural resources and/or infrastructure sectors in Africa. The Company, led by a team with operational experience and a strong track record in Africa, has a strategy of identifying high growth businesses where it can take an active role in their advancement.

The Company owns the Mahenge Liandu graphite project in south-east Tanzania, which is now its main focus. The Project is located in a highly prospective region with a high-grade JORC compliant Indicated and inferred mineral resource estimate of 51.1Mt @ 9.3% TGC, making it one of the largest high-grade resources in Tanzania, and work to date has demonstrated Mahenge Liandu’s potential as a commercially viable deposit with significant tonnage, high-grade coarse flake and near surface mineralisation (implying a low strip ratio) contained within one contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto Gold project in the Democratic Republic of Congo and a portfolio of quoted investments.

More information can be found on the website www.armadalecapitalplc.com

View source version on businesswire.com:https://www.businesswire.com/news/home/20180327005553/en/"

https://polaris.brighterir.com/public/armadale_capital/news/…

"Mahenge Liandu Resource Upgrade to 51.1Mt at 9.3% TGC

With 75% now in the Indicated Category

Armadale, the AIM quoted investment company focused on natural resource projects in Africa, is pleased to announce a Resource upgrade at the Mahenge Liandu Graphite Project in Tanzania (‘Mahenge Liandu’).

Overview

- Infill drilling of the resource at Mahenge Liandu undertaken to upgrade the category from Inferred to Indicated to allow for feasibility studies, mine planning and economics

- Resource successfully upgraded to 51.1Mt at 9.3% Total Graphitic Carbon (‘TGC’), including 38.7Mt Indicted at 9.3% and 12.4Mt at 9.1% TGC

- Upgrade represents a 25% increase from the previous 40.9Mt inferred resource at 9.41% TGC

- Over 75% of the Resource now in the Indicated category

- TGC grade and quantum of indicated resource confirms Mahenge Liandu as one of the highest-grade graphite deposits in Tanzania and the rest of the world

- Areas of high-grade, near surface mineralisation have been confirmed, allowing a staged approach to development, which lowers the capital development and operating costs early in the mine life

- Test work completed to date has confirmed that premium quality, high purity concentrates can be produced using a conventional flotation circuit

- A diamond drilling programme is planned to commence at the conclusion of the wet season (March / April 2018) to provide samples for more extensive metallurgical test work

- The deposit remains open to the north south and down dip, meaning there is significant potential to increase the resource further, with further drilling planned for later in 2018

- Mine planning has now commenced and the results from this and the updated resource will be incorporated in the Scoping Study being carried out by experienced engineering consultancy BatteryLimits, which is currently underway – results of the Scoping Study are expected by the end of Q1 2018

- Combination of a number of key factors – high overall TGC grade, sizable indicated resource, ability to utilise convention flotation circuit to produce premium quality product and near surface mineralisation with super high grade TGC (see below) – all point to the ability to produce an extremely robust initial scoping study which will provide first pass project economics

Nick Johansen, Director of Armadale said: “A 25% increase in the known graphite resource is a significant achievement. Add to this the fact that over 75% of the resource is now in the indicated category and it is clear to see both the value of our project and the success of our work programmes to-date. We are committed to maintaining this pace of development, and testament to this we are pleased to confirm that mine planning has now commenced. The results of this, together with the expanded and upgraded resource, will feed into the on-going Scoping Study, which is targeted for completion by the end of Q1 2018 and will give further clarity on the commercial potential of Mahenge Liandu. Critically, our Project has already been proven to be one of the highest-grade graphite deposits in Tanzania, and with significant amounts of this mineralisation located near surface we will be able to commence mining via staged development, which will help fast-track to production and also lower the capital development and operating costs early in the mine life. We look forward to providing shareholders with further updates on our progress in the near term.”

High Grade near Surface mineralisation

The Mahenge Liandu Resource has increased to 51.1Mt with greater than 75% in the indicated Resource Category. The resource is an increase of 25% from the 40.9Mt previously reported. The updated resource figures are reported in Table 1.

Table 1. Mahenge Liandu Resource Statement

Tonnage (Mt) % Cut-Off TGC Average %TGC

Inferred 12.4 3.5 9.1

Indicated 38.7 3.5 9.3

Measured 0 3.5 0

Total 51.1 3.5 9.3

The Resource contains areas of high grade near surface mineralisation. Armadale is currently working on mine optimisation with a focus on targeting this near surface high grade mineralisation. Some of the better near surface high-grade intercepts include;

-- 6m @ 12.8% Total Graphitic Content (‘TGC’) from surface

14m @ 16.7% TGC from 2m

15m @ 14% TGC from surface

11m @ 14.8% TGC from 15m

10m @ 18.5% TGC from 16m

The information communicated in this announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary

+44 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Simon Hicks

+44 20 7220 0500

Joint Broker: Beaufort Securities Limited

Jon Belliss

+44 20 7382 8300

Press Relations: St Brides Partners Ltd

Susie Geliher / Charlotte Page

+44 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a portfolio of investments, targeting the natural resources and/or infrastructure sectors in Africa. The Company, led by a team with operational experience and a strong track record in Africa, has a strategy of identifying high growth businesses where it can take an active role in their advancement.

The Company owns the Mahenge Liandu graphite project in south-east Tanzania, which is now its main focus. The Project is located in a highly prospective region with a high-grade JORC compliant Indicated and inferred mineral resource estimate of 51.1Mt @ 9.3% TGC, making it one of the largest high-grade resources in Tanzania, and work to date has demonstrated Mahenge Liandu’s potential as a commercially viable deposit with significant tonnage, high-grade coarse flake and near surface mineralisation (implying a low strip ratio) contained within one contiguous ore body.

Aside from Mahenge Liandu, Armadale has an interest in a portfolio of quoted investments and in January 2018 agreed to sell its interest in the Mpokoto Gold Project in the Democratic Republic of Congo for total potential consideration of US$562,500 and a 1.5% royalty on gold produced. Completion of the sale agreement is subject to execution of a formal binding agreement, which is expected in Q1 2018.

More information can be found on the website www.armadalecapitalplc.com

Competent Person statement

The Resource Statement has been prepared by Mark Biggs for and on behalf of Armadale Capital Plc. Mark Biggs has over 34 years of experience in base metal, industrial mineral, coal exploration and mine evaluation throughout Australia, South Africa, Mongolia and China. He has worked extensively within the Bowen and Surat Basins and was resident at several Central Queensland coal mines for 22 years. He has held a number of roles in these mine’s Technical Services, including Senior Geologist, Chief Geologist, Coal Quality and Scheduling Superintendent and Acting Technical Services Manager. Mark has extensive experience in open cut and underground exploration techniques, geophysical techniques, assay interpretation, geotechnical and structural modelling, mining, and scheduling. The information in this announcement that relates to exploration results is based on information compiled by Mr Matt Bull, a competent person, who is a Member of the Australian Institute of Geoscientists. Mr Bull has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a competent person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Both Mr Biggs and Mr Bull consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

View source version on businesswire.com:http://www.businesswire.com/news/home/20180207005561/en/"

- Proactive Investors Stocktube

Am 28.10.2016 veröffentlicht

Charles Zorab of Armadale Capital PLC (LON:ACP) talks to Proactive Investors about the 2016 drilling campaign at the Mahenge Liandu graphite project in Tanzania.

Of a total of 21 drill holes, 18 hit coarse-grained graphite mineralisation along a two kilometre strike length, and Zorab said,

“We’re very pleased with the results, and they really do indicate what our chairman has been saying, which is we believe we have a very substantial graphite resource here”.

What’s more, all the graphite intersected has been near the surface, and what this means, Zorab explained, “is that the cost of getting it out of the ground is going to be consequently less”.

The graphite is coarse grade, which Zorab said typically sells at a premium to fine grade.

Graphite is used in many applications, so demand is good, particularly from the technology industries.

“The big elephant in the room is clearly going to be – in fact, is – these lithium ion batteries, which go into electric cars, smartphones, tablets, computers etc.

“Obviously with the advent of electric vehicles, that [demand] can only increase, and some estimates say that demand will double in the next eight years for graphite,” Zorab said.

"We think we're in the right space," Zorab declared. -

auch Tanzania,

im Dunstkreis von ein paar Anderen.

Armadale Capital Plc

https://polaris.brighterir.com/public/armadale_capital/news/…

https://polaris.brighterir.com/public/armadale_capital/news/…

https://polaris.brighterir.com/public/armadale_capital/news/…

http://armadalecapitalplc.com/mahengue-liandu-graphite-proje…

http://armadalecapitalplc.com/wp-content/uploads/2018/03/fin…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Ann…

http://armadalecapitalplc.com/wp-content/uploads/2017/01/Arm…

"Armadale, the AIM quoted investment company focused on natural resource projects in Africa, is pleased to announce the results of the Scoping Study completed by BatteryLimits on the Mahenge Liandu Graphite Project in Tanzania (‘Mahenge’ or the ‘Project’), which demonstrates highly robust and compelling economics.

Overview

- Scoping study completed at Mahenge on a 400,000 tpa throughput, producing an average of 49,000tpa of high quality graphite products during a 32 year life of mine

- The Project has a low operating cost of US$408/t and is based on an average life of mine grade of 12.5% Total Graphitic Carbon (‘TGC’)

- Results deliver a pre-tax IRR of 122% and NPV of US$349m with a low development capex of US$35m

- The maximum drawdown during the construction of the Project is US$34.9m and the after-tax payback period is 1.2 years

- Average basket price used in the Scoping Study (US$1,271 / t) considered very conservative and allows for significant upward improvements as potential off take agreements negotiated

- The deposit is one of the highest grade large flake deposits globally after the recent upgrade to 51.1Mt at 9.3% TGC, including 38.7Mt Indicted at 9.3% and 12.4Mt Inferred at 9.1% TGC – represents a 25% increase from the previous 40.9Mt inferred resource at 9.41% TGC

- There remains significant scope to further improve returns, with staged expansions as the current mine plan is based on approximately 25% of the total resource

- Results to feed into a feasibility study to progress the Project to a decision to mine early in 2019 – in the interim Company will commence negotiations with identified strategic funders and offtake partners.

Nick Johansen, Director of Armadale said: “We have long held confidence in the commercial potential and economic value of Mahenge and the results of this Scoping Study greatly reinforces this view. The Project’s NPV of US$US349m is significant, especially when compared to our current market cap of ~£5m. With an IRR of 122%, 1.2 year payback and low development costs, we firmly believe that Mahenge is an attractive asset for development. Crucially, the Scoping Study was limited to just 25% of the Project’s current resource, which forms Stage 1 of a planned staged development programme. Accordingly, with an upgrade in throughput there is significant potential to improve the Project economics even further. Our next steps will now be to commence a definitive feasibility study so that we can advance Mahenge to a decision to mine early in 2019.”

Dave Pass, Scoping Study Manager said: “The results of the Scoping Study confirm the combination of high graphite feed grade and coarse flake high purity graphite product, delivering robust project economics and warranting progress to the next phase of feasibility studies. Given the size of the resource it would be expected that there remains significant room for further project optimisation.”

Study Design Parameters

The Mahenge Scoping study was based on a throughput of 400,000tpa over a 32 year mine life from the start of construction. The deposit has a low average strip ration of 1:1 for the life of the mine and a very low operating cost of US$408/t. A summary of the parameters is shown in Table 1.

Table 1 Scoping Study Parameters

Design Parameters Units Value

Nominal concentrate production at 12.5% TGC kt/y 49

Nominal strip ratio Waste : Ore 1:01

Graphite average basket price (US$ /t, real) 1,271

Project Life (including construction) (years) 32

Financial Results

The Project has a pre-tax IRR of 122% based on a relatively low capital cost of US$35m. The after-tax payback period is expected to 1.2 years.

Financial Parameters Units Value

Discount Rate % 10%

Exchange Rate USD : AUD 0.75

Capital Cost (US$ m, real) 35

IRR - after tax (%, real) 89%

NPV @ 10.0% - after tax (US$ m, real) 239

Payback Period - after tax, from 1st ore processed (Years) 1.2

Cash Costs (FOB DES) (US$/t, real) 408

IRR - before tax (%, real) 122%

NPV @ 10.0% - before tax (US$ m, real) 348.7

The information communicated in this announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary

+44 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Simon Hicks

+44 20 7220 0500

Press Relations: St Brides Partners Ltd

Susie Geliher / Charlotte Page

+44 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a portfolio of investments, targeting the natural resources and/or infrastructure sectors in Africa. The Company, led by a team with operational experience and a strong track record in Africa, has a strategy of identifying high growth businesses where it can take an active role in their advancement.

The Company owns the Mahenge Liandu graphite project in south-east Tanzania, which is now its main focus. The Project is located in a highly prospective region with a high-grade JORC compliant Indicated and inferred mineral resource estimate of 51.1Mt @ 9.3% TGC, making it one of the largest high-grade resources in Tanzania, and work to date has demonstrated Mahenge Liandu’s potential as a commercially viable deposit with significant tonnage, high-grade coarse flake and near surface mineralisation (implying a low strip ratio) contained within one contiguous ore body.

Other assets Armadale has an interest in, include the Mpokoto Gold project in the Democratic Republic of Congo and a portfolio of quoted investments.

More information can be found on the website www.armadalecapitalplc.com

View source version on businesswire.com:https://www.businesswire.com/news/home/20180327005553/en/"

https://polaris.brighterir.com/public/armadale_capital/news/…

"Mahenge Liandu Resource Upgrade to 51.1Mt at 9.3% TGC

With 75% now in the Indicated Category

Armadale, the AIM quoted investment company focused on natural resource projects in Africa, is pleased to announce a Resource upgrade at the Mahenge Liandu Graphite Project in Tanzania (‘Mahenge Liandu’).

Overview

- Infill drilling of the resource at Mahenge Liandu undertaken to upgrade the category from Inferred to Indicated to allow for feasibility studies, mine planning and economics

- Resource successfully upgraded to 51.1Mt at 9.3% Total Graphitic Carbon (‘TGC’), including 38.7Mt Indicted at 9.3% and 12.4Mt at 9.1% TGC

- Upgrade represents a 25% increase from the previous 40.9Mt inferred resource at 9.41% TGC

- Over 75% of the Resource now in the Indicated category

- TGC grade and quantum of indicated resource confirms Mahenge Liandu as one of the highest-grade graphite deposits in Tanzania and the rest of the world

- Areas of high-grade, near surface mineralisation have been confirmed, allowing a staged approach to development, which lowers the capital development and operating costs early in the mine life

- Test work completed to date has confirmed that premium quality, high purity concentrates can be produced using a conventional flotation circuit

- A diamond drilling programme is planned to commence at the conclusion of the wet season (March / April 2018) to provide samples for more extensive metallurgical test work

- The deposit remains open to the north south and down dip, meaning there is significant potential to increase the resource further, with further drilling planned for later in 2018

- Mine planning has now commenced and the results from this and the updated resource will be incorporated in the Scoping Study being carried out by experienced engineering consultancy BatteryLimits, which is currently underway – results of the Scoping Study are expected by the end of Q1 2018

- Combination of a number of key factors – high overall TGC grade, sizable indicated resource, ability to utilise convention flotation circuit to produce premium quality product and near surface mineralisation with super high grade TGC (see below) – all point to the ability to produce an extremely robust initial scoping study which will provide first pass project economics

Nick Johansen, Director of Armadale said: “A 25% increase in the known graphite resource is a significant achievement. Add to this the fact that over 75% of the resource is now in the indicated category and it is clear to see both the value of our project and the success of our work programmes to-date. We are committed to maintaining this pace of development, and testament to this we are pleased to confirm that mine planning has now commenced. The results of this, together with the expanded and upgraded resource, will feed into the on-going Scoping Study, which is targeted for completion by the end of Q1 2018 and will give further clarity on the commercial potential of Mahenge Liandu. Critically, our Project has already been proven to be one of the highest-grade graphite deposits in Tanzania, and with significant amounts of this mineralisation located near surface we will be able to commence mining via staged development, which will help fast-track to production and also lower the capital development and operating costs early in the mine life. We look forward to providing shareholders with further updates on our progress in the near term.”

High Grade near Surface mineralisation

The Mahenge Liandu Resource has increased to 51.1Mt with greater than 75% in the indicated Resource Category. The resource is an increase of 25% from the 40.9Mt previously reported. The updated resource figures are reported in Table 1.

Table 1. Mahenge Liandu Resource Statement

Tonnage (Mt) % Cut-Off TGC Average %TGC

Inferred 12.4 3.5 9.1

Indicated 38.7 3.5 9.3

Measured 0 3.5 0

Total 51.1 3.5 9.3

The Resource contains areas of high grade near surface mineralisation. Armadale is currently working on mine optimisation with a focus on targeting this near surface high grade mineralisation. Some of the better near surface high-grade intercepts include;

-- 6m @ 12.8% Total Graphitic Content (‘TGC’) from surface

14m @ 16.7% TGC from 2m

15m @ 14% TGC from surface

11m @ 14.8% TGC from 15m

10m @ 18.5% TGC from 16m

The information communicated in this announcement contains inside information for the purposes of Article 7 of the Market Abuse Regulation (EU) No. 596/2014.

**ENDS**

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary

+44 20 7236 1177

Nomad and broker: finnCap Ltd

Christopher Raggett / Simon Hicks

+44 20 7220 0500

Joint Broker: Beaufort Securities Limited

Jon Belliss

+44 20 7382 8300

Press Relations: St Brides Partners Ltd

Susie Geliher / Charlotte Page

+44 20 7236 1177

Notes

Armadale Capital Plc is focused on investing in and developing a portfolio of investments, targeting the natural resources and/or infrastructure sectors in Africa. The Company, led by a team with operational experience and a strong track record in Africa, has a strategy of identifying high growth businesses where it can take an active role in their advancement.

The Company owns the Mahenge Liandu graphite project in south-east Tanzania, which is now its main focus. The Project is located in a highly prospective region with a high-grade JORC compliant Indicated and inferred mineral resource estimate of 51.1Mt @ 9.3% TGC, making it one of the largest high-grade resources in Tanzania, and work to date has demonstrated Mahenge Liandu’s potential as a commercially viable deposit with significant tonnage, high-grade coarse flake and near surface mineralisation (implying a low strip ratio) contained within one contiguous ore body.

Aside from Mahenge Liandu, Armadale has an interest in a portfolio of quoted investments and in January 2018 agreed to sell its interest in the Mpokoto Gold Project in the Democratic Republic of Congo for total potential consideration of US$562,500 and a 1.5% royalty on gold produced. Completion of the sale agreement is subject to execution of a formal binding agreement, which is expected in Q1 2018.

More information can be found on the website www.armadalecapitalplc.com

Competent Person statement

The Resource Statement has been prepared by Mark Biggs for and on behalf of Armadale Capital Plc. Mark Biggs has over 34 years of experience in base metal, industrial mineral, coal exploration and mine evaluation throughout Australia, South Africa, Mongolia and China. He has worked extensively within the Bowen and Surat Basins and was resident at several Central Queensland coal mines for 22 years. He has held a number of roles in these mine’s Technical Services, including Senior Geologist, Chief Geologist, Coal Quality and Scheduling Superintendent and Acting Technical Services Manager. Mark has extensive experience in open cut and underground exploration techniques, geophysical techniques, assay interpretation, geotechnical and structural modelling, mining, and scheduling. The information in this announcement that relates to exploration results is based on information compiled by Mr Matt Bull, a competent person, who is a Member of the Australian Institute of Geoscientists. Mr Bull has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a competent person as defined in the 2012 Edition of the “Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves”. Both Mr Biggs and Mr Bull consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

View source version on businesswire.com:http://www.businesswire.com/news/home/20180207005561/en/"

- Proactive Investors Stocktube

Am 28.10.2016 veröffentlicht

Charles Zorab of Armadale Capital PLC (LON:ACP) talks to Proactive Investors about the 2016 drilling campaign at the Mahenge Liandu graphite project in Tanzania.

Of a total of 21 drill holes, 18 hit coarse-grained graphite mineralisation along a two kilometre strike length, and Zorab said,

“We’re very pleased with the results, and they really do indicate what our chairman has been saying, which is we believe we have a very substantial graphite resource here”.

What’s more, all the graphite intersected has been near the surface, and what this means, Zorab explained, “is that the cost of getting it out of the ground is going to be consequently less”.

The graphite is coarse grade, which Zorab said typically sells at a premium to fine grade.

Graphite is used in many applications, so demand is good, particularly from the technology industries.

“The big elephant in the room is clearly going to be – in fact, is – these lithium ion batteries, which go into electric cars, smartphones, tablets, computers etc.

“Obviously with the advent of electric vehicles, that [demand] can only increase, and some estimates say that demand will double in the next eight years for graphite,” Zorab said.

"We think we're in the right space," Zorab declared. -

Antwort auf Beitrag Nr.: 57.453.932 von Popeye82 am 03.04.18 22:08:25MGX Minerals

http://www.mgxminerals.com/investors/news/2018/340-mgx-miner…

http://rockstone-research.com/index.php/en/research-reports/…

http://www.mgxminerals.com/investors/news/2018/340-mgx-miner…

http://rockstone-research.com/index.php/en/research-reports/…

Antwort auf Beitrag Nr.: 57.454.793 von Popeye82 am 04.04.18 02:22:50BlueJay Mining/Allba Mineral Resources

http://www.mining-journal.com/discovery/news/1335332/copycat…

http://www.mining-journal.com/discovery/news/1335332/copycat…

Antwort auf Beitrag Nr.: 57.455.891 von Popeye82 am 04.04.18 09:07:48Armadale Capital Plc

http://www.voxmarkets.co.uk/blogs/3-reasons-add-armadale-cap…

http://www.voxmarkets.co.uk/blogs/3-reasons-add-armadale-cap…

http://www.voxmarkets.co.uk/blogs/3-reasons-add-armadale-cap…

http://www.voxmarkets.co.uk/blogs/3-reasons-add-armadale-cap…

Antwort auf Beitrag Nr.: 57.293.803 von Popeye82 am 15.03.18 23:05:45Piedmont Lithium

https://d1io3yog0oux5.cloudfront.net/_770da3343cf21593843968…

https://d1io3yog0oux5.cloudfront.net/_770da3343cf21593843968…

https://d1io3yog0oux5.cloudfront.net/_770da3343cf21593843968…

https://d1io3yog0oux5.cloudfront.net/_770da3343cf21593843968…

Antwort auf Beitrag Nr.: 57.401.927 von Popeye82 am 27.03.18 19:35:30von "Rolleg"  .

.

DANKEschön dass Sie es Mir nicht erlaubt haben.

paar Interessante DInger drin.

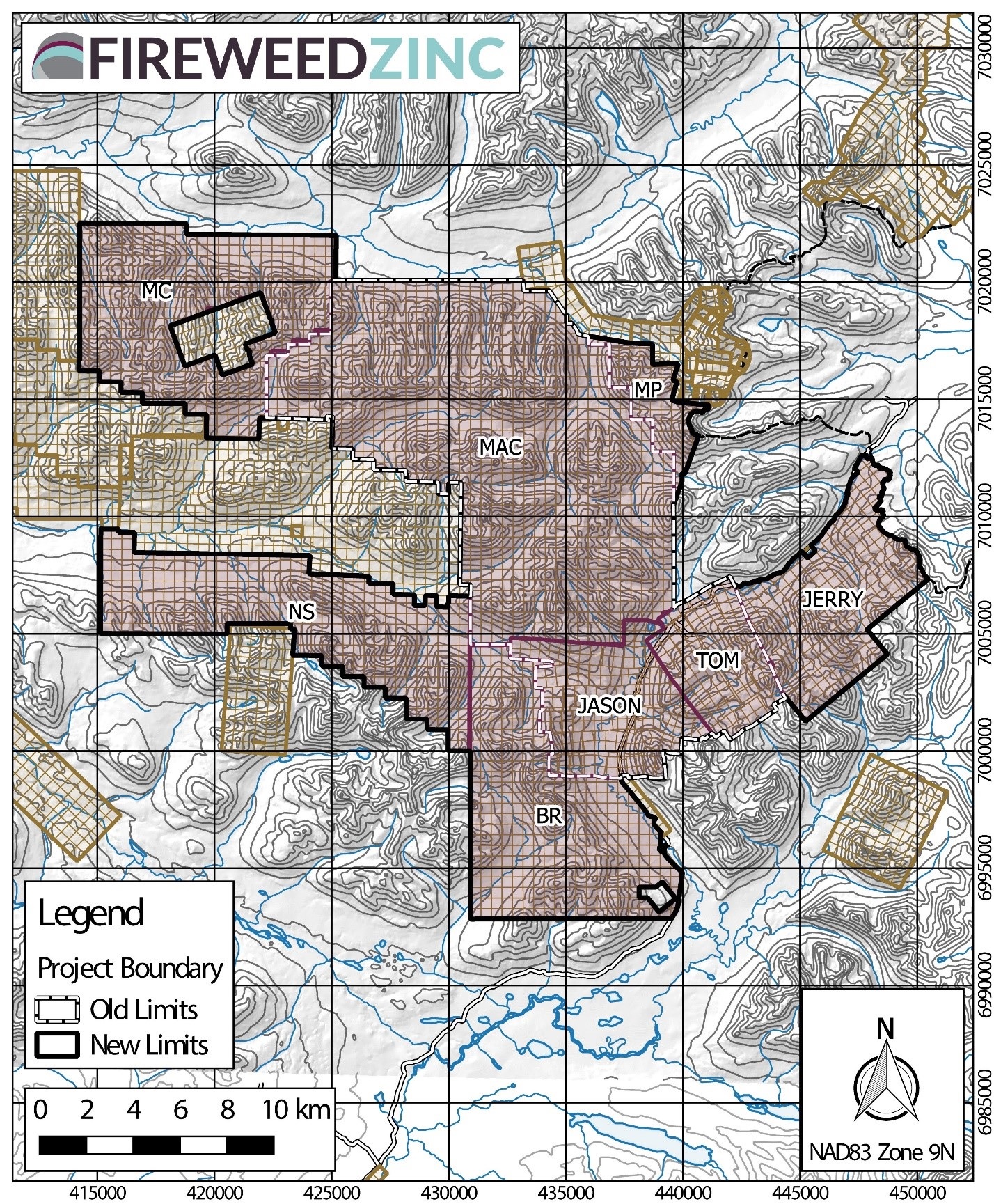

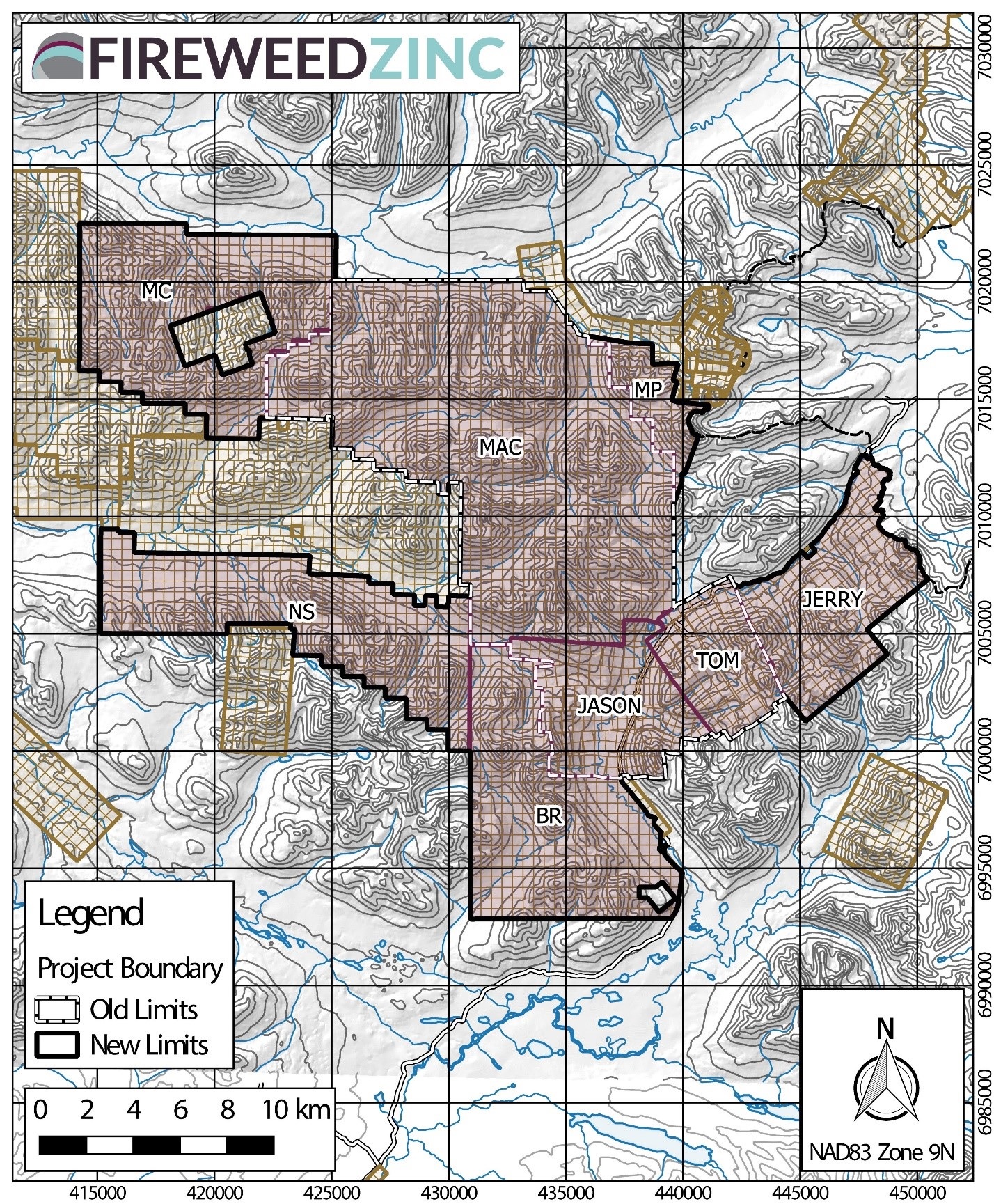

FireWeed Zinc/Trilogy Metals/Xanadu Mines/IDM Mining

http://cdn.ceo.ca.s3-us-west-2.amazonaws.com/1d9do9t-JrXFeb2…

DANKEschön dass Sie es Mir nicht erlaubt haben.

paar Interessante DInger drin.

FireWeed Zinc/Trilogy Metals/Xanadu Mines/IDM Mining

http://cdn.ceo.ca.s3-us-west-2.amazonaws.com/1d9do9t-JrXFeb2…

Antwort auf Beitrag Nr.: 57.454.808 von Popeye82 am 04.04.18 02:46:06Ventnor Resources

http://clients3.weblink.com.au/pdf/VRX/01968376.pdf

http://clients3.weblink.com.au/pdf/VRX/01968376.pdf

Antwort auf Beitrag Nr.: 57.413.753 von Popeye82 am 28.03.18 18:09:38Galena Mining

https://gallery.mailchimp.com/ff61321dee50f7e7a1a9d9db8/file…

https://gallery.mailchimp.com/ff61321dee50f7e7a1a9d9db8/file…

Antwort auf Beitrag Nr.: 57.433.517 von Popeye82 am 30.03.18 23:20:00Trilogy Metals

https://trilogymetals.com/news/2018/trilogy-metals-reports-f…

https://trilogymetals.com/news/2018/trilogy-metals-reports-f…

Antwort auf Beitrag Nr.: 57.444.458 von Popeye82 am 02.04.18 19:48:33Scoping Study expected end Q2 2018

Savannah Resources Plc

http://www.savannahresources.com/cms/wp-content/uploads/2018…

http://www.savannahresources.com/cms/wp-content/uploads/2018…

Savannah Resources Plc

http://www.savannahresources.com/cms/wp-content/uploads/2018…

http://www.savannahresources.com/cms/wp-content/uploads/2018…

Antwort auf Beitrag Nr.: 57.059.505 von Popeye82 am 19.02.18 11:40:59KEFI Minerals

http://www.kefi-minerals.com/files/announcements/kefi-qtly-u…

http://www.kefi-minerals.com/files/announcements/kefi-qtly-u…

Antwort auf Beitrag Nr.: 57.103.569 von Popeye82 am 23.02.18 16:38:04Global Atomic Fuels

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.globalatomiccorp.com/global-atomic-announces-pass…

http://www.juniorminingnetwork.com/junior-miner-news/press-r…

http://www.globalatomiccorp.com/global-atomic-announces-pass…

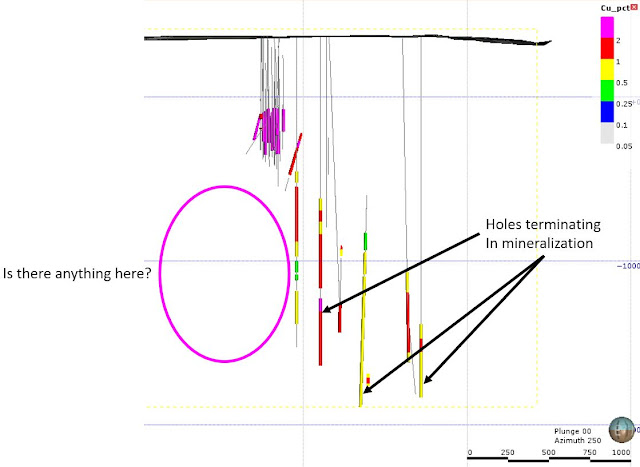

Antwort auf Beitrag Nr.: 57.414.698 von Popeye82 am 28.03.18 19:11:26Asiamet Resources

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

http://www.asiametresources.com/s/PressReleases.asp?ReportID…

Antwort auf Beitrag Nr.: 56.272.544 von Popeye82 am 25.11.17 10:52:46GoviEx Uranium

http://www.goviex.com/content/pdf/2018%2004%2005%20Study%20h…

http://www.goviex.com/content/pdf/GoviEx%20and%20Toshiba%20a…

http://www.goviex.com/content/pdf/2018%2003%2002%20GoviEx%20…

http://www.goviex.com/content/pdf/GoviEx%20Uranium%202017%20…

http://www.goviex.com/content/pdf/2018%2004%2005%20Study%20h…

http://www.goviex.com/content/pdf/GoviEx%20and%20Toshiba%20a…

http://www.goviex.com/content/pdf/2018%2003%2002%20GoviEx%20…

http://www.goviex.com/content/pdf/GoviEx%20Uranium%202017%20…

Antwort auf Beitrag Nr.: 57.464.519 von Popeye82 am 04.04.18 22:02:52FireWeed Zinc

- We recently created a video on our Macmillan Pass Project to provide more insight into our project in a unique way. This video explains and shows in detail the massive scale of our land package. The Macmillan Pass project boasts not only an established resource that makes it among the best undeveloped zinc projects in the world, but also one with exceptional exploration potential.

With the imminent release of our Preliminary Economic Assessment (PEA), we hope this video will give you a chance to get to know our story and understand why Macmillan Pass is truly a world-class asset. -

- We recently created a video on our Macmillan Pass Project to provide more insight into our project in a unique way. This video explains and shows in detail the massive scale of our land package. The Macmillan Pass project boasts not only an established resource that makes it among the best undeveloped zinc projects in the world, but also one with exceptional exploration potential.

With the imminent release of our Preliminary Economic Assessment (PEA), we hope this video will give you a chance to get to know our story and understand why Macmillan Pass is truly a world-class asset. -

Antwort auf Beitrag Nr.: 57.336.821 von Popeye82 am 21.03.18 00:37:20AVZ Minerals

https://static1.squarespace.com/static/5934d2ae6b8f5beeb5ba2…

https://static1.squarespace.com/static/5934d2ae6b8f5beeb5ba2…

Antwort auf Beitrag Nr.: 57.075.822 von Popeye82 am 21.02.18 05:45:58Pioneer Resources

http://pioresources.com.au/downloads/asx/pio2018040601.pdf

http://pioresources.com.au/downloads/asx/pio2018040601.pdf

Antwort auf Beitrag Nr.: 57.273.679 von Popeye82 am 14.03.18 11:39:35Altech Chemicals

http://www.altechchemicals.com/sites/altechchemicals.com/fil…

http://www.altechchemicals.com/sites/altechchemicals.com/fil…

Antwort auf Beitrag Nr.: 57.219.103 von Popeye82 am 08.03.18 08:46:22Core Exploration

http://coreexploration.com.au/user_files/reports/High-Grade_…

http://coreexploration.com.au/user_files/reports/High-Grade_…

Antwort auf Beitrag Nr.: 57.289.876 von Popeye82 am 15.03.18 16:44:15D'Arianne Phosphate

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

https://mern.gouv.qc.ca/en/department/

http://www.gouv.qc.ca/EN/

http://www.dec-ced.gc.ca/eng/regions/saguenay/index.html

https://plannord.gouv.qc.ca/en/

http://www.corem.qc.ca/en

http://www.canada.ca/en.html

http://www.arianne-inc.com/en/pressroom/press-releases/arian…

https://mern.gouv.qc.ca/en/department/

http://www.gouv.qc.ca/EN/

http://www.dec-ced.gc.ca/eng/regions/saguenay/index.html

https://plannord.gouv.qc.ca/en/

http://www.corem.qc.ca/en

http://www.canada.ca/en.html

Antwort auf Beitrag Nr.: 57.416.072 von Popeye82 am 28.03.18 21:00:00Korab Resources

http://www.asx.com.au/asxpdf/20180405/pdf/43sztsg1r7wfmz.pdf

https://stockhead.com.au/resources/korab-nixes-phosphate-dea…

http://www.asx.com.au/asxpdf/20180326/pdf/43sqz6xw7khwxh.pdf

http://www.asx.com.au/asxpdf/20180405/pdf/43sztsg1r7wfmz.pdf

https://stockhead.com.au/resources/korab-nixes-phosphate-dea…

http://www.asx.com.au/asxpdf/20180326/pdf/43sqz6xw7khwxh.pdf

Antwort auf Beitrag Nr.: 57.441.095 von Popeye82 am 02.04.18 05:12:24Verde Agritech

The Company’s expected milestones and announcements for 2018 are:

- New plant construction update;

- New plant debt finance;

- Vice President Business Development hire and enhanced investor relations;

- New plant comissioning;

- Domestic sales ramp-up and update;

- International sales ramp-up and update;

- Mining permit for a total of 300 thousand tons per annum;

- Environmental license for a total of 300 thousand tons per annum;

- Plant expansion announcement.

http://verdeagritech.com/uploads/releases/53e12318d155c57cd8…

http://www.mme.gov.br/

The Company’s expected milestones and announcements for 2018 are:

- New plant construction update;

- New plant debt finance;

- Vice President Business Development hire and enhanced investor relations;

- New plant comissioning;

- Domestic sales ramp-up and update;

- International sales ramp-up and update;

- Mining permit for a total of 300 thousand tons per annum;

- Environmental license for a total of 300 thousand tons per annum;

- Plant expansion announcement.

http://verdeagritech.com/uploads/releases/53e12318d155c57cd8…

http://www.mme.gov.br/

Antwort auf Beitrag Nr.: 57.248.098 von Popeye82 am 11.03.18 20:59:40Eine Meiner Aktien.

Interessierte GUT durchlesen.

Continental Gold

http://www.financecolombia.com/ari-sussman-continental-gold-…

"Interview: Continental Gold CEO Ari Sussman Says ‘There Is a lot More Gold to Find’ in Colombia

By Loren Moss

Published in Finance Colombia

“Our current reserves and resources are just a tip of the iceberg of what’s to come,” Ari Sussman, CEO of Continental Gold (center), told Finance Colombia. (Photo credit: Loren Moss)

Mining has come under increasing scrutiny over the past year in Colombia, as various communities have voted to ban the practice in their local area.

While this has led to difficulty operating for some industry firms, including AngloGold Ashanti of South Africa, Canadian mining company Continental Gold continues to celebrate milestones in its push toward commercial production at its main holding, the Buriticá gold mine in the central Colombian department of Antioquia.

The Toronto-based company secured some key financing in May 2017, with a $109 million USD investment from Newmont Mining Corporation. It also secured a debt facility of $250 million USD from RK Mine Finance in January 2017.

“Are we fully financed? No,” Ari Sussman, CEO of Continental Gold, told Finance Colombia. “We’re going to need some money in 2019. But we financed the vast majority of what we need.”

Sussman recently sat down with Loren Moss, executive editor of Finance Colombia, to talk about Continental Gold’s financing and the ongoing work the company is doing to meets its goals. Overall, he is optimistic about sticking to the company’s timeline to start production in 2020.

“We’re expecting to pour our first gold bar in the first half of 2020,” Sussman told Finance Colombia. “And from the date of that first pour, we expect commercial production to be reached approximately six months after that.”

Below, Sussman elaborates on these plans, the push to make a new discovery, the ore that is already coming out of the ground in Buriticá, meeting the company’s current needs for funding, and how the firm has been prioritizing its relationship with the local community.

Earthworks are almost complete for the mine infrastructure, including mills, crushers, detoxification, and water treatment plant. (Photo credit: Loren Moss)

Loren Moss: So I’m speaking with Ari Sussman, the CEO of Continental Gold, and Continental Gold is making significant progress at Buriticá gold mine in Colombia. Let’s start by going over what you’ve been able to accomplish this past year. Tell me about your exploration at the mine. You started a 25,000-meter exploration program I believe, last year?

Ari Sussman: That’s correct, Loren. We actually started with a 25,000-meter program but announced that it has been expanded to up to a 137,000-meter program, which will culminate at the end of this 2018 calendar year. We are hoping we can drill a lot. We are hoping to do many things.

“We’ve set a goal to make a new discovery in this calendar year, and that’s what we are aiming to do.” – Ari Sussman

First and foremost, we want to infill — or tighten up — the density of drilling on the two deposits that make up the mineral resources. As you know, we are finding much broader results, potentially for mining, and we want to make sure that we asses those to assure that we have a clear understanding of the mechanics.

But, also, we’ve set a corporate goal to make a new discovery. You know that we are excited about the project — and to think that our current reserves and resources are just a tip of the iceberg of what’s to come. We think there is a lot more gold to find. So, we set a goal — it’s a hard goal to accomplish — but we’ve set a goal to make a new discovery in this calendar year, and that’s what we are aiming to do with the drill.

Test bores in the broad mineralized zones (BMZs) at Continental Gold’s Buritacá mine often show large amounts of visible gold. “We’re expecting to pour our first gold bar on the first half of 2020 and from the date of that first pour, we expect commercial production to be reached approximately six months after that,” said Ari Sussman, head of Continental Gold. (Photo credit: Loren Moss)

Loren Moss: Yes, the ore examples that you showed me were extremely high quality. I was very impressed. What kinds of yields and grades are you expecting out of your BMZ, or broad mineralized zone, to use some of your industry lingo?

Ari Sussman: Yeah, so broad mineralized zones, so your readers are clear, will be defined as everywhere where we aggregate the series of veins together into one zone where there is mineralization existing between those known veins. We’re finding new mineralization in between.

Look, we’ve only drilled one of six broad mineralized zone targets to date. And, as it stands right now, the average grade of the broad mineralized zones that we’ve been drilling is about 10 grams per ton of gold. You might say, “Well, 10 grams per ton of gold — that’s just slightly higher than the mineral reserve grade of about 8.5 grams per ton.”

That’s true. However, the width of the zone is more than 10 times greater. So when you multiply your average grade times your width, you’re looking at a much more robust amount of rock — a lot more rock that’s mineralized at a high grade — than we were initially contemplating on the original mine plan.

Some bores are showing gold reserves exceeding 21 grams per ton of ore. (Photo credit: Loren Moss)

Loren Moss: It’s amazing the amount of gold here in the Antioquia area, here in Colombia. I was at the Secretaría de Minas, the Secretary of Mines for Antioquia, earlier this week and looking at some of the maps they showed me. It’s obviously a rich area. Let’s talk about the progress on the site development. How is the site infrastructure and construction moving along?

Ari Sussman: We’re moving along at a very good pace. It’s going well. We are really at, I guess, what you’d call the exciting portion of the construction of the mine. We’re about to pour concrete for the first time, so major ore works are underway. There are all kinds of trucks in the valley where we are going to build the mill, and we are looking forward to that concrete pour this month.

“There’s over 1,000 people now working either as employees for the company or as contractors for the company.” – Ari Sussman

You know, there’s a lot of people now. It’s a lot to manage as you would expect. There’s over 1,000 people now working either as employees for the company or as contractors for the company. But we’re making great progress.

In addition to the surface construction, we are also developing on three separate headings underground. So we are tunneling on three different locations underground, and we’re making positive progress on that regard in terms of advance rate per day. So we’re roughly on schedule, which is good. As you know, we’re expecting to pour our first gold bar in the first half of 2020 and from the date of that first pour, we expect commercial production to be reached approximately six months after that.

Mauricio Castañeda of Continental Gold shows off high-grade ore deposits. (Photo credit: Loren Moss)

Loren Moss: This past year also has been very eventful for Continental Gold financially. You’ve secured a very significant line of credit and received two Certificate Equity Investments. Can you tell me about that? How does that position Continental Gold for completing the mine build out and going into full production in 2020?

Ari Sussman: Well, we finance a large portion of what we are going to need for the mine. We took a credit facility from a group called Red Kite Mine Finance out of London, who are specialists on lending to the mining industry. They offer very flexible and fair terms for companies going through a construction period as far as debt.

And then we were fortunate enough to achieve a strategic investment from Newmont Mining, which is the largest gold company in the world. So, they bought 19.9% of the equity of our company for $110 million USD, about one year ago.

So, look, are we fully financed? No. We’re going to need some money in 2019. But we financed the vast majority of what we need, and we expect the working capital shortfall that we will have heading closer to production to be very manageable to say the least.

One of several primary tunnel entrances — and some big machinery — at Continental Gold’s Buriticá mine in Antioquia, Colombia. (Photo credit: Loren Moss)

Loren Moss: One of the things that I have been impressed by, on my visits — to not just the mine but the surrounding community — is that Continental Gold has put a lot of effort on sustainability and social infrastructure. The area where the mine is located has traditionally seen a lot of artisan, and even illegal mining. Tell me about your outreach efforts and how you are working to coexist with this small-scale and subsistence miners in the areas.

Ari Sussman: So, two things: One — sustainability efforts. I think, sustaining an area and ensuring that you have alignment of the local population is arguably more challenging than constructing a mine, especially in this day and age. And it comes now to ensuring that there’s education, education, education. And then that is followed by benefits to the community.

So, we spend almost on the model of one dollar in the ground deserves a high percentage into the social infrastructure of the area. And that’s worked very well for us.

You are correct, you know, we have a very high grade project and with that came a gold rush — an illegal mining gold rush, which we had to face and go through. Thankfully, first off, we’re thankful for the support that the government of Colombia has shown for the project in cleaning up the area so to speak — or eradicating the illegal mining in the area.

“We’re expecting to pour our first gold bar in the first half of 2020, and from the date of that first pour, we expect commercial production to be reached approximately six months after that.” – Ari Sussman

But with that came an innovative program that we put in place, with the support of the government, to formalize local small-scale miners. So in order to be formalized you need to be from the municipalities that are impacted by the project, and right now we have about 200 people working as small-scale formalized miners, and we expect that number to grow to over 300 as the program ramps up over the next 12 months.

It’s an excellent program for everybody involved. First and foremost, the individuals who were mining without a permanent title, now are getting trained on how to mine properly and safely and how to take care of the environment. And they also are now living within the law. They pay taxes. We buy their ore from them — and that eliminates the need to sell ore to more-challenged individuals that buy ore. We buy their ore from them, we pay a fair price, and everybody wins.

And the hope is that some — or all, maybe all, one day — of these small-scale miners will ultimately become employees of our company as they learn the methods of mining and as they get more comfortable operating within the law versus outside of it.

Colombia’s stunning central Andean mountain range, or cordillera, is home to mining projects like Buriticá and the nation’s second largest city, Medellín. (Photo credit: Loren Moss)

Loren Moss: Yeah, that certainly would make it not just safer but probably more profitable for them. They get the healthcare benefits and would be less prone to injury or to poisoning — a lot of the illegal mining uses mercury and things like that. That sounds like a win/win all the way around.

Speaking of training and the people, Colombia has something of a national community college program called SENA (Servicio Nacional de Aprendizaje). I saw something at your mine — something I didn’t expect to see — that really impressed me and that was that there were several women miners — not just on the surface but full-fledge miners working underground. Colombia is a very traditional country and mining is very much a male-dominated industry, especially once you go underground. How did that come to be and tell me more broadly about your collaboration with SENA and the local Buriticá community?

Ari Sussman: Well part of our sustainability strategy, with education, is to employee people right? And the best employees you can have are people that are invested in the area. So we did an alliance with SENA — even ahead of getting our environmental permit — which gave us permission to start the construction. We put this alliance in place and SENA agreed to open up a job-training facility right in the community of Buriticá.

“Are we fully financed? No. We’re going to need some money in 2019. But we financed the vast majority of what we need.” – Ari Sussman

And incredibly, to your point that Colombia is a traditional country, it was only recently that it became legal under law for women to mine underground. So our timing happened to be good because the law had just changed where anybody could become a miner underground, and we opened this school where anybody could register. You had to be a high-school graduate to register to go through the SENA program, which ultimately earned you a degree in mining.

Amazingly, we kind of had two groups in the first set of classes — you were split up — and you chose that you want to work on surface-related trades to mining or did you want to work underground. And to our surprise, the vast majority of the applicants for the underground portion were women. Right? So maybe it’s a traditional country but I think that the women haven’t been given enough of a voice, and I think giving them a voice and an opportunity has shown where Colombia can go.

In fact I’m happy to say that the next program just launched recently. So another 60 students are starting a class where they’ll be learning trades related to operating the mining plant itself. That just kicked off — there was a big event in Buriticá at the outside community center, which was very good."

Interessierte GUT durchlesen.

Continental Gold

http://www.financecolombia.com/ari-sussman-continental-gold-…

"Interview: Continental Gold CEO Ari Sussman Says ‘There Is a lot More Gold to Find’ in Colombia

By Loren Moss

Published in Finance Colombia

“Our current reserves and resources are just a tip of the iceberg of what’s to come,” Ari Sussman, CEO of Continental Gold (center), told Finance Colombia. (Photo credit: Loren Moss)

Mining has come under increasing scrutiny over the past year in Colombia, as various communities have voted to ban the practice in their local area.

While this has led to difficulty operating for some industry firms, including AngloGold Ashanti of South Africa, Canadian mining company Continental Gold continues to celebrate milestones in its push toward commercial production at its main holding, the Buriticá gold mine in the central Colombian department of Antioquia.

The Toronto-based company secured some key financing in May 2017, with a $109 million USD investment from Newmont Mining Corporation. It also secured a debt facility of $250 million USD from RK Mine Finance in January 2017.

“Are we fully financed? No,” Ari Sussman, CEO of Continental Gold, told Finance Colombia. “We’re going to need some money in 2019. But we financed the vast majority of what we need.”

Sussman recently sat down with Loren Moss, executive editor of Finance Colombia, to talk about Continental Gold’s financing and the ongoing work the company is doing to meets its goals. Overall, he is optimistic about sticking to the company’s timeline to start production in 2020.

“We’re expecting to pour our first gold bar in the first half of 2020,” Sussman told Finance Colombia. “And from the date of that first pour, we expect commercial production to be reached approximately six months after that.”

Below, Sussman elaborates on these plans, the push to make a new discovery, the ore that is already coming out of the ground in Buriticá, meeting the company’s current needs for funding, and how the firm has been prioritizing its relationship with the local community.

Earthworks are almost complete for the mine infrastructure, including mills, crushers, detoxification, and water treatment plant. (Photo credit: Loren Moss)

Loren Moss: So I’m speaking with Ari Sussman, the CEO of Continental Gold, and Continental Gold is making significant progress at Buriticá gold mine in Colombia. Let’s start by going over what you’ve been able to accomplish this past year. Tell me about your exploration at the mine. You started a 25,000-meter exploration program I believe, last year?

Ari Sussman: That’s correct, Loren. We actually started with a 25,000-meter program but announced that it has been expanded to up to a 137,000-meter program, which will culminate at the end of this 2018 calendar year. We are hoping we can drill a lot. We are hoping to do many things.

“We’ve set a goal to make a new discovery in this calendar year, and that’s what we are aiming to do.” – Ari Sussman

First and foremost, we want to infill — or tighten up — the density of drilling on the two deposits that make up the mineral resources. As you know, we are finding much broader results, potentially for mining, and we want to make sure that we asses those to assure that we have a clear understanding of the mechanics.

But, also, we’ve set a corporate goal to make a new discovery. You know that we are excited about the project — and to think that our current reserves and resources are just a tip of the iceberg of what’s to come. We think there is a lot more gold to find. So, we set a goal — it’s a hard goal to accomplish — but we’ve set a goal to make a new discovery in this calendar year, and that’s what we are aiming to do with the drill.

Test bores in the broad mineralized zones (BMZs) at Continental Gold’s Buritacá mine often show large amounts of visible gold. “We’re expecting to pour our first gold bar on the first half of 2020 and from the date of that first pour, we expect commercial production to be reached approximately six months after that,” said Ari Sussman, head of Continental Gold. (Photo credit: Loren Moss)

Loren Moss: Yes, the ore examples that you showed me were extremely high quality. I was very impressed. What kinds of yields and grades are you expecting out of your BMZ, or broad mineralized zone, to use some of your industry lingo?

Ari Sussman: Yeah, so broad mineralized zones, so your readers are clear, will be defined as everywhere where we aggregate the series of veins together into one zone where there is mineralization existing between those known veins. We’re finding new mineralization in between.

Look, we’ve only drilled one of six broad mineralized zone targets to date. And, as it stands right now, the average grade of the broad mineralized zones that we’ve been drilling is about 10 grams per ton of gold. You might say, “Well, 10 grams per ton of gold — that’s just slightly higher than the mineral reserve grade of about 8.5 grams per ton.”

That’s true. However, the width of the zone is more than 10 times greater. So when you multiply your average grade times your width, you’re looking at a much more robust amount of rock — a lot more rock that’s mineralized at a high grade — than we were initially contemplating on the original mine plan.

Some bores are showing gold reserves exceeding 21 grams per ton of ore. (Photo credit: Loren Moss)

Loren Moss: It’s amazing the amount of gold here in the Antioquia area, here in Colombia. I was at the Secretaría de Minas, the Secretary of Mines for Antioquia, earlier this week and looking at some of the maps they showed me. It’s obviously a rich area. Let’s talk about the progress on the site development. How is the site infrastructure and construction moving along?

Ari Sussman: We’re moving along at a very good pace. It’s going well. We are really at, I guess, what you’d call the exciting portion of the construction of the mine. We’re about to pour concrete for the first time, so major ore works are underway. There are all kinds of trucks in the valley where we are going to build the mill, and we are looking forward to that concrete pour this month.

“There’s over 1,000 people now working either as employees for the company or as contractors for the company.” – Ari Sussman