Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem h - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 26.02.20 20:01:23 von

neuester Beitrag 24.01.24 12:29:12 von

neuester Beitrag 24.01.24 12:29:12 von

Beiträge: 71

ID: 1.320.917

ID: 1.320.917

Aufrufe heute: 0

Gesamt: 6.375

Gesamt: 6.375

Aktive User: 0

ISIN: DE0008469008 · WKN: 846900

18.014,50

PKT

-0,33 %

-60,50 PKT

Letzter Kurs 07:41:02 Lang & Schwarz

Neuigkeiten

25.04.24 · wallstreetONLINE Redaktion |

06:44 Uhr · dpa-AFX |

05:50 Uhr · dpa-AFX |

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem hysterischen Crashpropheten-Chor zu lange zu zuhören" vom Autor wallstreet:online Zentralredaktion

Im Börsenmedien-Gewitter, das die Corona-Krise auslöst, bleiben zwei recht junge Börsianer auffallend cool: Jannes Lorenzen von Aktienrebell.de analysiert kühl. Wall Street-Experte Tim Schäfer bleibt „stur und stetig“: „Ich kaufe jedenfalls weiter …

Lesen Sie den ganzen Artikel: Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem hysterischen Crashpropheten-Chor zu lange zu zuhören

Im Börsenmedien-Gewitter, das die Corona-Krise auslöst, bleiben zwei recht junge Börsianer auffallend cool: Jannes Lorenzen von Aktienrebell.de analysiert kühl. Wall Street-Experte Tim Schäfer bleibt „stur und stetig“: „Ich kaufe jedenfalls weiter …

Lesen Sie den ganzen Artikel: Keine Angst vom "schwarzen Schwan": Corona-Börsen: Ruhig bleiben und zukaufen, statt dem hysterischen Crashpropheten-Chor zu lange zu zuhören

Da seien unter anderem Gerd Kommer, Ben Carlson, Meb Faber, Rob Arnott, David Swensen und Ray Dalio zu nennen“, so Lorenzen.

=> Ray Dalio lebt spätestens seit 1975 nicht vom Handel mit Aktien, sondern davon daß er das Geld anderer Leute Gasse führt, bzw. führen lässt: Bridgewater Associates

=> Ray Dalio lebt spätestens seit 1975 nicht vom Handel mit Aktien, sondern davon daß er das Geld anderer Leute Gasse führt, bzw. führen lässt: Bridgewater Associates

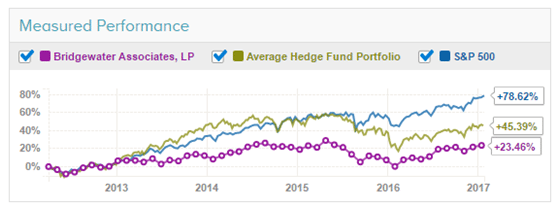

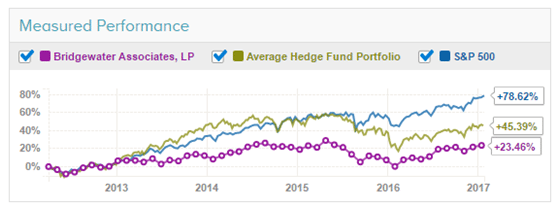

Antwort auf Beitrag Nr.: 62.798.936 von faultcode am 26.02.20 20:01:23Bridgewater fällt schon seit Jahren mit Underperformance auf; in derselben Peer Group wohlgemerkt; vermutlich schon wegen ihrer Größe:

https://www.smarteranalyst.com/bloggers-corner/heres-ray-dal…

https://www.smarteranalyst.com/bloggers-corner/heres-ray-dal…

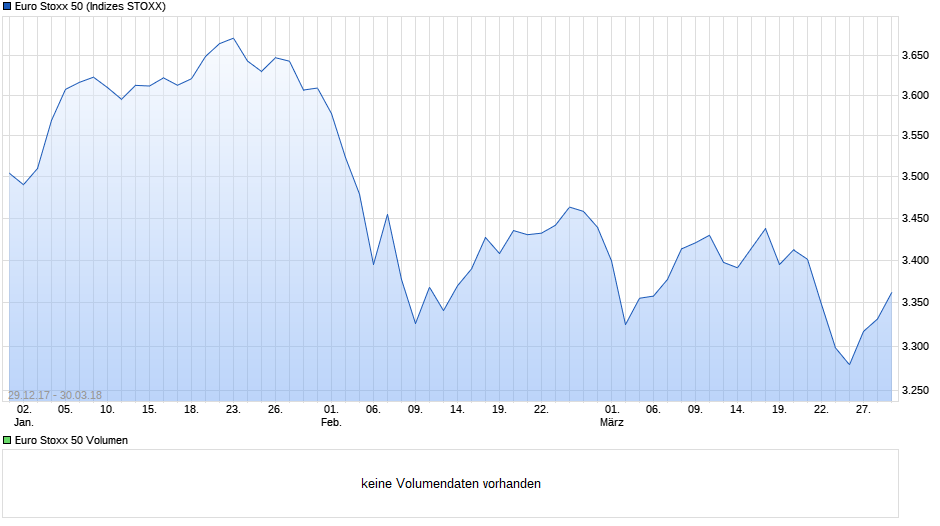

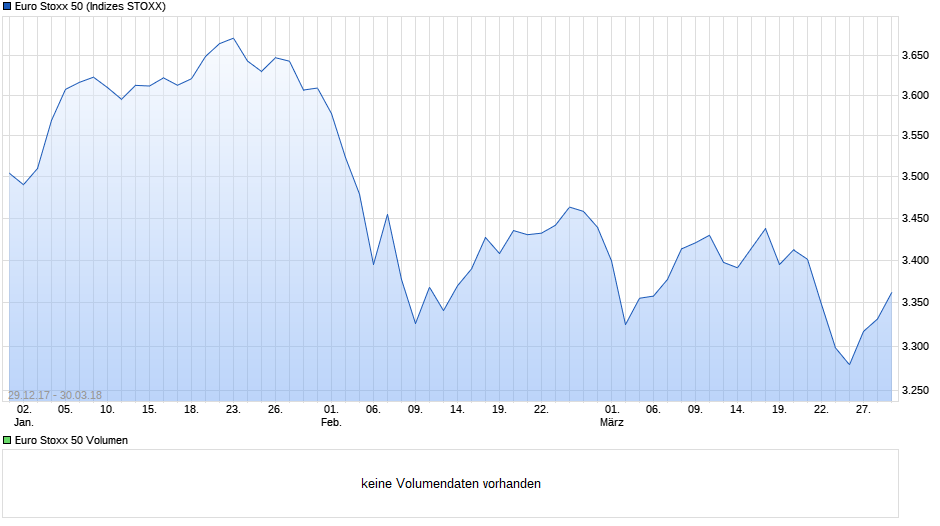

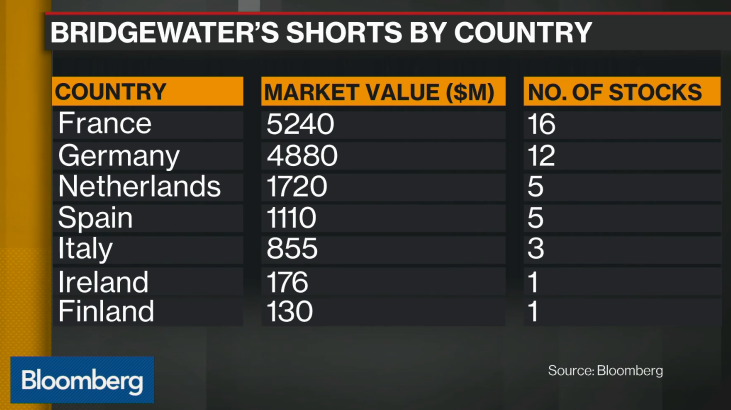

Antwort auf Beitrag Nr.: 62.798.978 von faultcode am 26.02.20 20:04:42außerdem ist Ray Dalio bzw. Bridgewater Associates in Deutschland eher keine besonders sympathische Größe, da er seine Kiddies in Westport, Connecticut, in diesem Zyklus besonders gerne europäische und deutsche Standardwerte shorten lässt:

--> wobei man sagen muss, daß sie damit seinerzeit im Schnitt richtig lagen

=> mit anderen Worten:

• Bridgewater gehört genau zu den Marktteilnehmern, die Kursrückgänge immer mal wieder verstärken:

Euro Stoxx 50, Jan-Mär 2018

--> wobei man sagen muss, daß sie damit seinerzeit im Schnitt richtig lagen

=> mit anderen Worten:

• Bridgewater gehört genau zu den Marktteilnehmern, die Kursrückgänge immer mal wieder verstärken:

Euro Stoxx 50, Jan-Mär 2018

Tja, dann viel Spaß beim Zukaufen.

1) Neuartiger Virus => keine Impfstoff

2) asymptomatisch

3) Überlebt bei Kälte auf Flächen 9 Tage.

4) Hoch infektiös Ro = 2,3 bis 5,6 ?

5) Reinfektion möglich wie bei einem Aidskranken.

6) Statistiken von China gefälscht ohne Ende.

7) Mortalitätsrate in Italien und Iran deutlich höher => mutiert schon genetisch ?!

1) Neuartiger Virus => keine Impfstoff

2) asymptomatisch

3) Überlebt bei Kälte auf Flächen 9 Tage.

4) Hoch infektiös Ro = 2,3 bis 5,6 ?

5) Reinfektion möglich wie bei einem Aidskranken.

6) Statistiken von China gefälscht ohne Ende.

7) Mortalitätsrate in Italien und Iran deutlich höher => mutiert schon genetisch ?!

haha, wenn die Marktschreier kaufen rufen, dann ist es zeit in Deckung zu gehen.

die Kiste DAX wird total im Graben landen.

Öl wird faktisch wertlos.

Immobilien werden pro objekt (auch mehrfamilienhäuser) für 1 unze gold in hülle und fülle

zu kaufen sein. 20-35 % aller infizierten werden nämlich sterben.

das bedeutet für alles an Konsum und Existenzgüter : Unendliche Angebote, 0 Nachfrage.

und jetzt EZB, versuche mal diese Deflation mit Geldrucken auftzuhalten. LL Lächerlich Lagarde....

die Kiste DAX wird total im Graben landen.

Öl wird faktisch wertlos.

Immobilien werden pro objekt (auch mehrfamilienhäuser) für 1 unze gold in hülle und fülle

zu kaufen sein. 20-35 % aller infizierten werden nämlich sterben.

das bedeutet für alles an Konsum und Existenzgüter : Unendliche Angebote, 0 Nachfrage.

und jetzt EZB, versuche mal diese Deflation mit Geldrucken auftzuhalten. LL Lächerlich Lagarde....

Bei mir alles Rot. Zwischen 15 und 28% im Minus. Aber das kann liegen bleiben. Mit Zukauf noch zu früh. Ich warte. Ihr könnt ruhig verkaufen 😁 umso preiswerter bekomme ich meine 😁💰💸💵💴

Antwort auf Beitrag Nr.: 62.801.021 von Abfischer am 27.02.20 03:20:33Meinst du wirklich für 8 Stk. 1-fach Dukaten (ca. 1 Unze) mit dem aktuellen Wert von ca. 160 Euro je Stück wird man ganze Häuser kaufen können?

Antwort auf Beitrag Nr.: 62.798.978 von faultcode am 26.02.20 20:04:42

https://www.bloomberg.com/news/articles/2020-03-14/dalio-s-m…

...

The Bridgewater founder offered a fairly rosy outlook for markets as recently as last month. Dalio said in mid-February that investor concerns over the virus “probably had a bit of an exaggerated effect on the pricing of assets because of the temporary nature of that, so I would expect more of a rebound.” He later issued a statement clarifying his remarks.

In January, Dalio had urged investors to get off the sidelines and benefit from strong markets, telling CNBC in an interview, “Cash is trash.”

Bridgewater’s worst month on record for the Pure Alpha II strategy was a 10.5% drop in April 2008. Even so, it ended that year up 9.4%.

Since 2011, the Westport, Connecticut-based firm has found it harder to make money, posting averaging low-single digit returns. In 2019, Pure Alpha II lost money for the first time in two decades, declining 0.5%.

A representative for Bridgewater declined to comment.

...

"Principles": https://www.principles.com/

Zitat von faultcode: Bridgewater fällt schon seit Jahren mit Underperformance auf; in derselben Peer Group wohlgemerkt...

https://www.bloomberg.com/news/articles/2020-03-14/dalio-s-m…

...

The Bridgewater founder offered a fairly rosy outlook for markets as recently as last month. Dalio said in mid-February that investor concerns over the virus “probably had a bit of an exaggerated effect on the pricing of assets because of the temporary nature of that, so I would expect more of a rebound.” He later issued a statement clarifying his remarks.

In January, Dalio had urged investors to get off the sidelines and benefit from strong markets, telling CNBC in an interview, “Cash is trash.”

Bridgewater’s worst month on record for the Pure Alpha II strategy was a 10.5% drop in April 2008. Even so, it ended that year up 9.4%.

Since 2011, the Westport, Connecticut-based firm has found it harder to make money, posting averaging low-single digit returns. In 2019, Pure Alpha II lost money for the first time in two decades, declining 0.5%.

A representative for Bridgewater declined to comment.

...

"Principles": https://www.principles.com/

Antwort auf Beitrag Nr.: 63.008.780 von faultcode am 14.03.20 17:12:1815.3.

Bridgewater's Dalio says his flagship fund lost money amid market turmoil -FT

https://www.reuters.com/article/health-coronavirus-funds-bri…

...

“We did not know how to navigate the virus and chose not to because we didn’t think we had an edge in trading it. So, we stayed in our positions and in retrospect we should have cut all risk,” the newspaper quoted Dalio as saying.

“We’re disappointed because we should have made money rather than lost money in this move the way we did in 2008.”

...

Bridgewater's Dalio says his flagship fund lost money amid market turmoil -FT

https://www.reuters.com/article/health-coronavirus-funds-bri…

...

“We did not know how to navigate the virus and chose not to because we didn’t think we had an edge in trading it. So, we stayed in our positions and in retrospect we should have cut all risk,” the newspaper quoted Dalio as saying.

“We’re disappointed because we should have made money rather than lost money in this move the way we did in 2008.”

...

Antwort auf Beitrag Nr.: 63.015.325 von faultcode am 15.03.20 18:55:30Ray Dalio, der Nacherklärer. Nachher weiß es jeder:

https://twitter.com/RayDalio/status/1239555524376645640

https://twitter.com/RayDalio/status/1239555524376645640

Antwort auf Beitrag Nr.: 63.036.076 von faultcode am 17.03.20 12:23:00Der feine Herr Dalio wettet also gegen "coronavirus ridden countries":

17.3.

Bridgewater's $14 Billion Bet Against European Stocks

https://www.bloomberg.com/news/videos/2020-03-17/bridgewater…

Bridgewater Associates, the world’s biggest hedge fund, has built up a $14 billion bet that shares in European companies will continue to sink amid the worsening coronavirus outbreak. Bloomberg's Sonali Basak has more on "Bloomberg Daybreak: Americas."

17.3.

Bridgewater's $14 Billion Bet Against European Stocks

https://www.bloomberg.com/news/videos/2020-03-17/bridgewater…

Bridgewater Associates, the world’s biggest hedge fund, has built up a $14 billion bet that shares in European companies will continue to sink amid the worsening coronavirus outbreak. Bloomberg's Sonali Basak has more on "Bloomberg Daybreak: Americas."

Antwort auf Beitrag Nr.: 63.036.076 von faultcode am 17.03.20 12:23:00

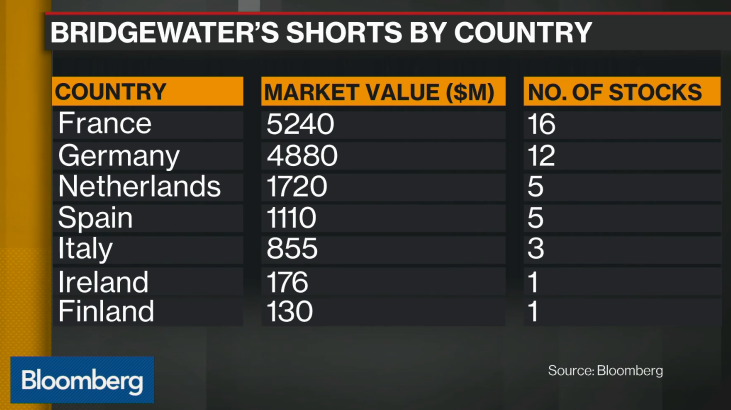

https://www.bloomberg.com/news/articles/2020-04-03/bridgewat…

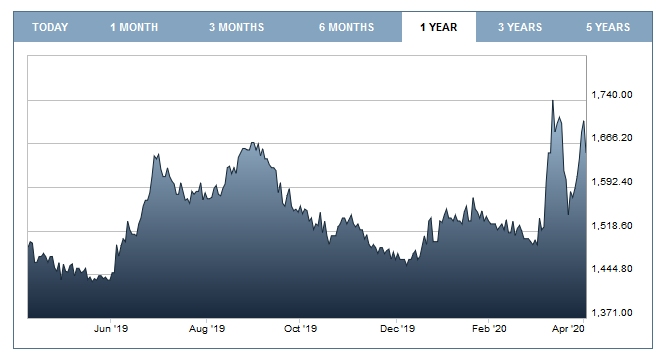

--> darin werden Brevan Howard (Asset Management) erwähnt. Zumindest diesen beiden closed-end funds machten es richtig:

BHGG BH GLOBAL LD ORD NPV GBP

GG00B2QQPT96

https://www.londonstockexchange.com/exchange/prices-and-mark…

BHMG BH MACRO LD ORD NPV (GBP)

GG00B1NP5142

https://www.londonstockexchange.com/exchange/prices-and-mark…

https://www.bhglobal.com/reporting/monthly-shareholder-repor…

• die Monthly Shareholder Reports werden mit ~1 1/2 Monaten Verspätung effektiv veröffentlicht

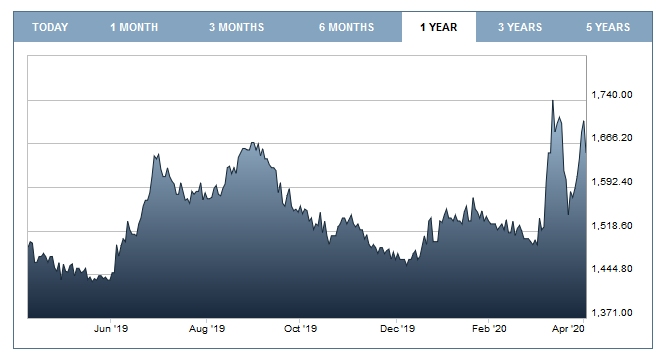

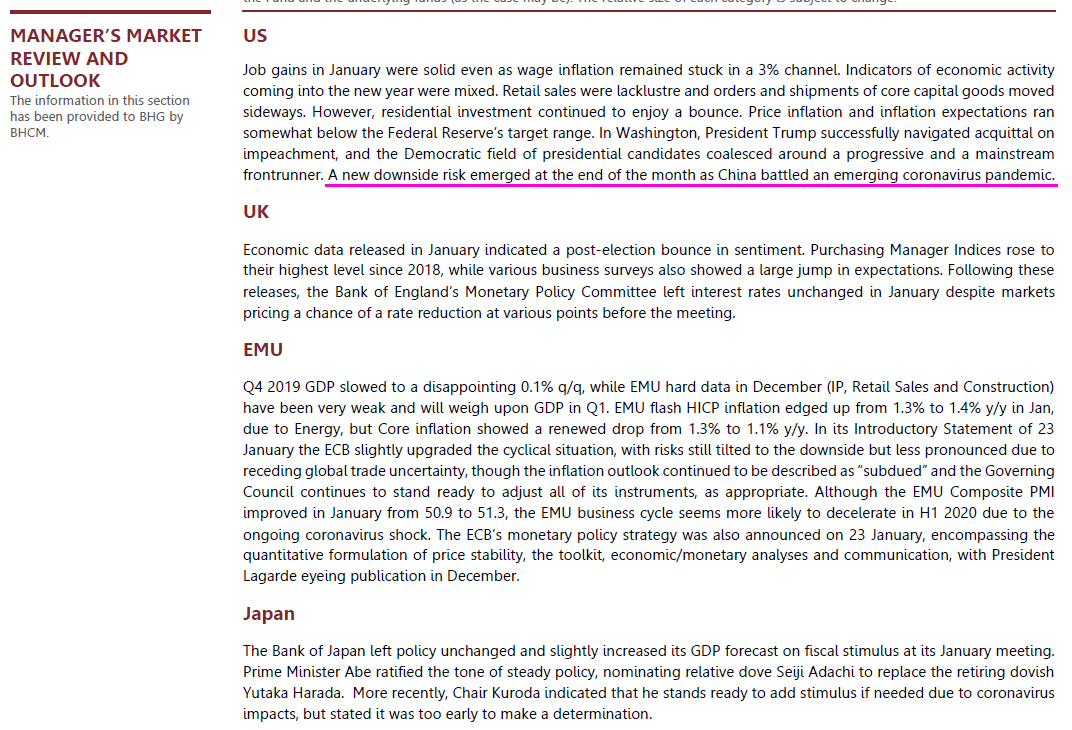

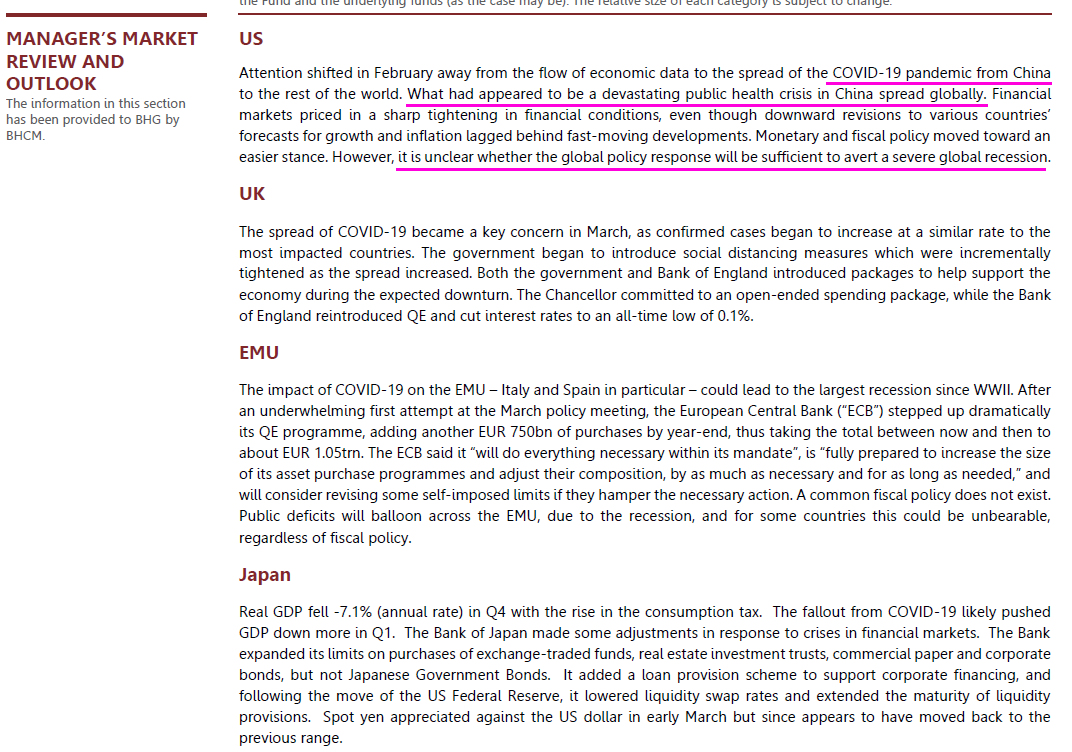

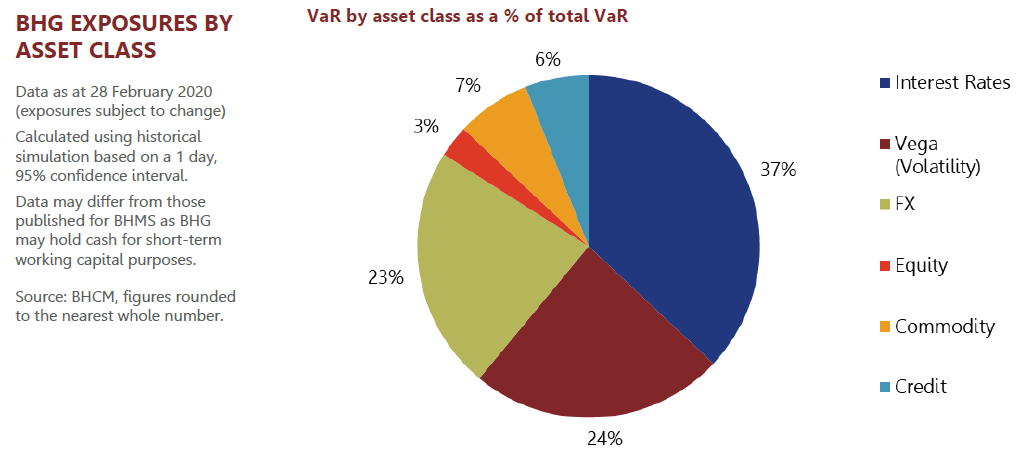

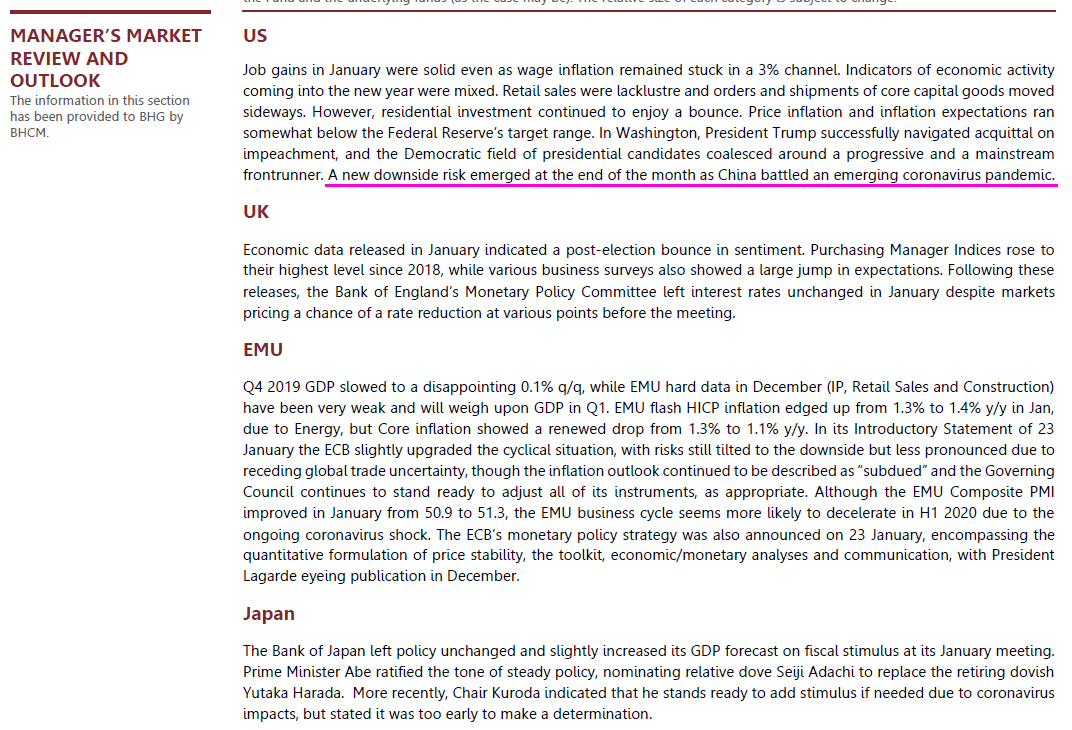

• das ist aus dem "BH GLOBAL LIMITED MONTHLY SHAREHOLDER REPORT FEBRUARY 2020":

--> fast alle Assets sind an Zinsen, Vola und FX gebunden:

<das PDF selber ist vom 1.4.2020>

BHCM = Brevan Howard Capital Management LP

Im Februar tut sich bei beiden Fonds noch "nichts". Aber dann im März. Aus dem Januar-Brief vom 11.3.2020:

=> nur eine Andeutung zu COVID-19 (zu diesem Zeitpunkt, 11.3.2020, hat der DJIA bereits -19% seines Wertes verloren (*))

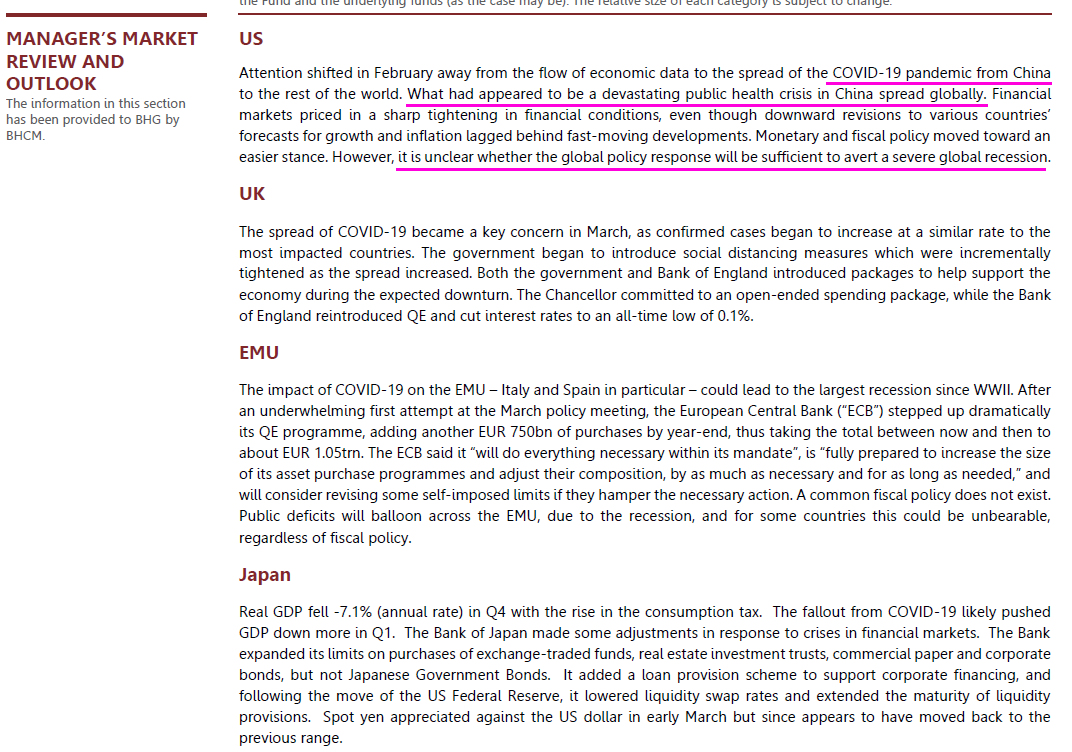

...und im Februar-Brief als globalen Rezessionstreiber beschrieben (1.4.2020):

=> irgendetwas müssen die sehr richtig gemacht haben (im Gegensatz zu Bridgewater). Aber man weiß halt nicht (ich zumindest nicht), wann der jeweilige MANAGER’S MARKET REVIEW AND OUTLOOK wirklich geschrieben wurde

Und lesen lohnt mMn nicht, da zu spät (*).

https://www.bloomberg.com/news/articles/2020-04-03/bridgewat…

--> darin werden Brevan Howard (Asset Management) erwähnt. Zumindest diesen beiden closed-end funds machten es richtig:

BHGG BH GLOBAL LD ORD NPV GBP

GG00B2QQPT96

https://www.londonstockexchange.com/exchange/prices-and-mark…

BHMG BH MACRO LD ORD NPV (GBP)

GG00B1NP5142

https://www.londonstockexchange.com/exchange/prices-and-mark…

https://www.bhglobal.com/reporting/monthly-shareholder-repor…

• die Monthly Shareholder Reports werden mit ~1 1/2 Monaten Verspätung effektiv veröffentlicht

• das ist aus dem "BH GLOBAL LIMITED MONTHLY SHAREHOLDER REPORT FEBRUARY 2020":

--> fast alle Assets sind an Zinsen, Vola und FX gebunden:

<das PDF selber ist vom 1.4.2020>

BHCM = Brevan Howard Capital Management LP

Im Februar tut sich bei beiden Fonds noch "nichts". Aber dann im März. Aus dem Januar-Brief vom 11.3.2020:

=> nur eine Andeutung zu COVID-19 (zu diesem Zeitpunkt, 11.3.2020, hat der DJIA bereits -19% seines Wertes verloren (*))

...und im Februar-Brief als globalen Rezessionstreiber beschrieben (1.4.2020):

=> irgendetwas müssen die sehr richtig gemacht haben (im Gegensatz zu Bridgewater). Aber man weiß halt nicht (ich zumindest nicht), wann der jeweilige MANAGER’S MARKET REVIEW AND OUTLOOK wirklich geschrieben wurde

Und lesen lohnt mMn nicht, da zu spät (*).

Antwort auf Beitrag Nr.: 63.036.886 von faultcode am 17.03.20 13:28:47

...scheint aber zuletzt eher in die Hose gegangen zu sein:

24.7.

Bridgewater Associates Lays Off Several Dozen Employees

World’s largest hedge fund made cuts in its research department, client-services team, among recruiters

https://www.wsj.com/articles/bridgewater-associates-lays-off…

...

Zitat von faultcode: Der feine Herr Dalio wettet also gegen "coronavirus ridden countries":

...

...scheint aber zuletzt eher in die Hose gegangen zu sein:

24.7.

Bridgewater Associates Lays Off Several Dozen Employees

World’s largest hedge fund made cuts in its research department, client-services team, among recruiters

https://www.wsj.com/articles/bridgewater-associates-lays-off…

...

7.2.

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1

https://finance.yahoo.com/news/renaissance-hit-5-billion-red…

...

Clients pulled a net $1.85 billion across the three hedge funds in December and requested a net $1.9 billion back in January, according to investor letters seen by Bloomberg. Investors are poised to yank another $1.65 billion this month, the letters show.

Those figures could be offset if there are any inflows in February or if investors decided to walk back any of their redemption requests.

...

Renaissance told clients in a September letter that its losses were due to being under-hedged during March’s collapse and then over-hedged in the rebound from April through June. That happened because its trading models “overcompensated” for the original trouble.

...

=> der Witz an der Sache ist, daß weniger AUM praktisch jedem Portfolio Manager das Leben leichter macht (außer man ist als großer/größerer Value-Investor unterwegs)

Also würde es mich nicht wundern, wenn Renaissance Technologies (RenTec) am Ende von 2021 ein recht gutes Jahr haben sollten

Renaissance Hit With $5 Billion in Redemptions Since Dec. 1

https://finance.yahoo.com/news/renaissance-hit-5-billion-red…

...

Clients pulled a net $1.85 billion across the three hedge funds in December and requested a net $1.9 billion back in January, according to investor letters seen by Bloomberg. Investors are poised to yank another $1.65 billion this month, the letters show.

Those figures could be offset if there are any inflows in February or if investors decided to walk back any of their redemption requests.

...

Renaissance told clients in a September letter that its losses were due to being under-hedged during March’s collapse and then over-hedged in the rebound from April through June. That happened because its trading models “overcompensated” for the original trouble.

...

=> der Witz an der Sache ist, daß weniger AUM praktisch jedem Portfolio Manager das Leben leichter macht (außer man ist als großer/größerer Value-Investor unterwegs)

Also würde es mich nicht wundern, wenn Renaissance Technologies (RenTec) am Ende von 2021 ein recht gutes Jahr haben sollten

22.4.

Hedge Fund IPM Shuts Doors After Losing $4 Billion in Pandemic

https://finance.yahoo.com/news/hedge-fund-ipm-shuts-doors-08…

...

Informed Portfolio Management, a Swedish hedge fund that had relied on statistical models to devise its strategies, is set to shut its doors and return investor capital after losing roughly $4 billion during the pandemic.

IPM, whose main owner is Stockholm-based investment firm Catella AB, had assets under

management of close to $5 billion in late 2019, before the pandemic hit. A year later, that amount had more than halved to $2 billion, with the investor exodus since then depleting assets to about $750 million.

“The recent investment market for systematic macro-funds has unfortunately been very challenging and IPM has had weak returns and large capital outflows,” Catella said in a statement on Thursday. “IPM will ensure that all investors are treated fairly. This includes that all investors will be able to redeem their capital in the coming months according to each fund’s specific liquidity rules.”

IPM had used quantitative strategies, which rely on mathematical models instead of on-the-ground analysis of portfolio assets. But the historical statistical models the fund built proved unequal to the task of predicting how markets would move during the volatility brought on by the coronavirus pandemic.

IPM joins a growing list of hedge funds shutting down in recent years as investors rethink their allocations to the industry. More hedge funds have closed than started in the last six years, with 770 of them shuttering in 2020, according to data compiled by Hedge Fund Research Inc.

Last year was particularly tough for computer-driven quant funds. Algorithms largely failed to decipher the impact of a rapidly moving virus and the response from central banks to contain economic damage. The market selloff in March last year and subsequent recovery humbled some of the most sophisticated of quants -- most notably behemoths such as Renaissance Technologies, Winton and Two Sigma.

IPM was founded over two decades ago. Catella had hoped to find a buyer for the troubled fund, and it recently even announced several new hires amid a plan to branch out into new strategies.

“Despite many promising dialogues during the spring, we have not been able to find a suitable buyer for IPM,” Catella said.

...

Hedge Fund IPM Shuts Doors After Losing $4 Billion in Pandemic

https://finance.yahoo.com/news/hedge-fund-ipm-shuts-doors-08…

...

Informed Portfolio Management, a Swedish hedge fund that had relied on statistical models to devise its strategies, is set to shut its doors and return investor capital after losing roughly $4 billion during the pandemic.

IPM, whose main owner is Stockholm-based investment firm Catella AB, had assets under

management of close to $5 billion in late 2019, before the pandemic hit. A year later, that amount had more than halved to $2 billion, with the investor exodus since then depleting assets to about $750 million.

“The recent investment market for systematic macro-funds has unfortunately been very challenging and IPM has had weak returns and large capital outflows,” Catella said in a statement on Thursday. “IPM will ensure that all investors are treated fairly. This includes that all investors will be able to redeem their capital in the coming months according to each fund’s specific liquidity rules.”

IPM had used quantitative strategies, which rely on mathematical models instead of on-the-ground analysis of portfolio assets. But the historical statistical models the fund built proved unequal to the task of predicting how markets would move during the volatility brought on by the coronavirus pandemic.

IPM joins a growing list of hedge funds shutting down in recent years as investors rethink their allocations to the industry. More hedge funds have closed than started in the last six years, with 770 of them shuttering in 2020, according to data compiled by Hedge Fund Research Inc.

Last year was particularly tough for computer-driven quant funds. Algorithms largely failed to decipher the impact of a rapidly moving virus and the response from central banks to contain economic damage. The market selloff in March last year and subsequent recovery humbled some of the most sophisticated of quants -- most notably behemoths such as Renaissance Technologies, Winton and Two Sigma.

IPM was founded over two decades ago. Catella had hoped to find a buyer for the troubled fund, and it recently even announced several new hires amid a plan to branch out into new strategies.

“Despite many promising dialogues during the spring, we have not been able to find a suitable buyer for IPM,” Catella said.

...

28.5.

Credit Suisse’s RenTech Fund Holds Back Some Client Withdrawals

https://finance.yahoo.com/news/credit-suisse-rentech-fund-ho…

...

Credit Suisse Group AG is temporarily barring clients from withdrawing all their cash from a fund that invests with Renaissance Technologies after the strategy tanked and investors rushed to exit.

The bank has invoked a so-called hold back clause, after assets in the CS Renaissance Alternative Access Fund slumped to about $250 million this month from approximately $700 million at the start of 2020, according to people with knowledge of the matter. While investors will receive 95% of their redemption requests after two months, the remaining 5% is expected to be paid out in January, after the fund’s year-end audit, the people said.

The fund lost about 32% last year, in line with the decline in the Renaissance Institutional Diversified Alpha Fund International fund that it invests into, the people said. Renaissance, regarded as one of the most successful quant investing firms in the world, was rocked by billion of dollars in redemptions earlier this year after unprecedented losses in 2020. Three of its funds open to external investors fell by double digits last year.

Credit Suisse and Renaissance declined to comment.

...

Credit Suisse’s RenTech Fund Holds Back Some Client Withdrawals

https://finance.yahoo.com/news/credit-suisse-rentech-fund-ho…

...

Credit Suisse Group AG is temporarily barring clients from withdrawing all their cash from a fund that invests with Renaissance Technologies after the strategy tanked and investors rushed to exit.

The bank has invoked a so-called hold back clause, after assets in the CS Renaissance Alternative Access Fund slumped to about $250 million this month from approximately $700 million at the start of 2020, according to people with knowledge of the matter. While investors will receive 95% of their redemption requests after two months, the remaining 5% is expected to be paid out in January, after the fund’s year-end audit, the people said.

The fund lost about 32% last year, in line with the decline in the Renaissance Institutional Diversified Alpha Fund International fund that it invests into, the people said. Renaissance, regarded as one of the most successful quant investing firms in the world, was rocked by billion of dollars in redemptions earlier this year after unprecedented losses in 2020. Three of its funds open to external investors fell by double digits last year.

Credit Suisse and Renaissance declined to comment.

...

einmal ist immer das erste Mal:

Alphadyne’s losses, the largest to be publicly revealed among macro hedge funds, are particularly surprising because its strategy has never had a down year since it started up in 2006.

3.8.

Hedge Fund Alphadyne Loses $1.5 Billion in Rates Short Squeeze

https://finance.yahoo.com/news/hedge-fund-alphadyne-loses-1-…

...

Alphadyne was founded by Khuong-Huu and Bart Broadman, who were colleagues at JPMorgan Chase & Co. Its investors include pensions, insurance companies and sovereign wealth funds, according to its website. In 2017, Alphadyne spun off its Asia team into Astignes Capital Asia Pte, which focuses on trading interest rate and currency instruments in the region. Broadman is now CIO of Singapore-based Astignes.

Khuong-Huu, who the New York Times described in a May article as a Frenchman of Vietnamese descent, was Goldman Sachs Group Inc.’s head of interest rates in the early 2000s before forming Alphadyne. During his time at the Wall Street bank, he overlapped with Glenn Hadden, who spent more than a decade there trading global government bonds and U.S. Treasuries before leaving in 2011 to run interest-rate trading at Morgan Stanley.

Hadden joined Alphadyne in 2014 and is considered one of its top portfolio managers, according to people familiar with his trading. That’s largely paid off -- Alphadyne posted double-digit gains in each of the previous four years.

...

Alphadyne’s losses, the largest to be publicly revealed among macro hedge funds, are particularly surprising because its strategy has never had a down year since it started up in 2006.

3.8.

Hedge Fund Alphadyne Loses $1.5 Billion in Rates Short Squeeze

https://finance.yahoo.com/news/hedge-fund-alphadyne-loses-1-…

...

Alphadyne was founded by Khuong-Huu and Bart Broadman, who were colleagues at JPMorgan Chase & Co. Its investors include pensions, insurance companies and sovereign wealth funds, according to its website. In 2017, Alphadyne spun off its Asia team into Astignes Capital Asia Pte, which focuses on trading interest rate and currency instruments in the region. Broadman is now CIO of Singapore-based Astignes.

Khuong-Huu, who the New York Times described in a May article as a Frenchman of Vietnamese descent, was Goldman Sachs Group Inc.’s head of interest rates in the early 2000s before forming Alphadyne. During his time at the Wall Street bank, he overlapped with Glenn Hadden, who spent more than a decade there trading global government bonds and U.S. Treasuries before leaving in 2011 to run interest-rate trading at Morgan Stanley.

Hadden joined Alphadyne in 2014 and is considered one of its top portfolio managers, according to people familiar with his trading. That’s largely paid off -- Alphadyne posted double-digit gains in each of the previous four years.

...

Antwort auf Beitrag Nr.: 68.340.494 von faultcode am 28.05.21 20:25:18es gibt eine Vor-Steuer-Rendite und eine Nach-Steuer-Rendite:

3.9.

Jim Simons, RenTech Insiders to Pay Billions in Back Taxes

https://finance.yahoo.com/news/jim-simons-rentech-insiders-p…

...

Jim Simons, one of the world’s most successful investors, has just been handed a rare defeat.

The founder of quantitative hedge-fund manager Renaissance Technologies and his colleagues will pay billions of dollars in back taxes, interest and penalties to resolve one of the biggest tax disputes in U.S. history, under the terms of a deal reached by the firm and the Internal Revenue Service.

Renaissance Chief Executive Officer Peter Brown disclosed the agreement Thursday in a letter to investors seen by Bloomberg. While it doesn’t say how much money will be paid, U.S. Senate investigators in 2014 pegged potential unpaid taxes in the case at $6.8 billion, before interest and penalties.

The IRS has long contended that Renaissance mischaracterized profits from its flagship Medallion Fund, using a complex options arrangement to transform short-term capital gains into long-term gains, which are taxed at a lower rate.

Medallion is owned almost exclusively by current and former employees of the East Setauket, New York-based firm. Renaissance funds that are open to outsiders, such as the institutional equities fund, aren’t part of the tax dispute.

Under the terms of the deal, Simons and six other current and former members of Renaissance’s board will pay 100% of the additional tax that would have been due if they had characterized the gains as short-term, as the IRS said they should.

That group includes Brown as well as Robert Mercer, a former co-CEO and noted conservative political donor who was a prominent backer of former President Donald Trump. The board members will also pay unspecified interest and penalties.

Other Medallion investors will pay 80% of the additional tax for short-term gains, along with interest.

Simons, 83, who served as chairman of Renaissance during the period when the options were in use, paid an additional $670 million to the IRS, according to the letter. That resolves another problem that the agency identified with the options arrangements, involving dividend withholding tax.

The board opted for a settlement “rather than risking a worse outcome, including harsher terms and penalties, that could result from litigation,” Brown wrote. He said the firm spent years engaging with the IRS’s Office of Appeals. If a taxpayer can’t reach a resolution there, a dispute typically moves to U.S. Tax Court or another federal court.

A spokesman for the firm said Simons, Brown and Mercer weren’t available for comment.

Seven years ago, the Senate Permanent Subcommittee on Investigations revealed that, for more than a decade, Renaissance used options sold by Deutsche Bank AG and Barclays Plc to shelter some $34 billion of income in Medallion, cutting the rate paid by fund investors by as much as 20 percentage points.

Brown and other Renaissance executives defended the transactions at a hearing in Washington, arguing that the firm had entered into the deals for non-tax reasons and that they complied with the law.

The hearing “really knocked the IRS around and shook them up to start pursuing this more aggressively,” said Steven Rosenthal, a tax lawyer and senior fellow at the Urban-Brookings Tax Policy Center in Washington who also testified. “The IRS is so resource-strained that it often can’t pursue good cases, but here they nabbed one.”

Medallion is one of the best-performing funds in history, returning about 40% annualized since its formation in 1988. Simons has a net worth of $25.7 billion, according to the Bloomberg Billionaires Index.

...

3.9.

Jim Simons, RenTech Insiders to Pay Billions in Back Taxes

https://finance.yahoo.com/news/jim-simons-rentech-insiders-p…

...

Jim Simons, one of the world’s most successful investors, has just been handed a rare defeat.

The founder of quantitative hedge-fund manager Renaissance Technologies and his colleagues will pay billions of dollars in back taxes, interest and penalties to resolve one of the biggest tax disputes in U.S. history, under the terms of a deal reached by the firm and the Internal Revenue Service.

Renaissance Chief Executive Officer Peter Brown disclosed the agreement Thursday in a letter to investors seen by Bloomberg. While it doesn’t say how much money will be paid, U.S. Senate investigators in 2014 pegged potential unpaid taxes in the case at $6.8 billion, before interest and penalties.

The IRS has long contended that Renaissance mischaracterized profits from its flagship Medallion Fund, using a complex options arrangement to transform short-term capital gains into long-term gains, which are taxed at a lower rate.

Medallion is owned almost exclusively by current and former employees of the East Setauket, New York-based firm. Renaissance funds that are open to outsiders, such as the institutional equities fund, aren’t part of the tax dispute.

Under the terms of the deal, Simons and six other current and former members of Renaissance’s board will pay 100% of the additional tax that would have been due if they had characterized the gains as short-term, as the IRS said they should.

That group includes Brown as well as Robert Mercer, a former co-CEO and noted conservative political donor who was a prominent backer of former President Donald Trump. The board members will also pay unspecified interest and penalties.

Other Medallion investors will pay 80% of the additional tax for short-term gains, along with interest.

Simons, 83, who served as chairman of Renaissance during the period when the options were in use, paid an additional $670 million to the IRS, according to the letter. That resolves another problem that the agency identified with the options arrangements, involving dividend withholding tax.

The board opted for a settlement “rather than risking a worse outcome, including harsher terms and penalties, that could result from litigation,” Brown wrote. He said the firm spent years engaging with the IRS’s Office of Appeals. If a taxpayer can’t reach a resolution there, a dispute typically moves to U.S. Tax Court or another federal court.

A spokesman for the firm said Simons, Brown and Mercer weren’t available for comment.

Seven years ago, the Senate Permanent Subcommittee on Investigations revealed that, for more than a decade, Renaissance used options sold by Deutsche Bank AG and Barclays Plc to shelter some $34 billion of income in Medallion, cutting the rate paid by fund investors by as much as 20 percentage points.

Brown and other Renaissance executives defended the transactions at a hearing in Washington, arguing that the firm had entered into the deals for non-tax reasons and that they complied with the law.

The hearing “really knocked the IRS around and shook them up to start pursuing this more aggressively,” said Steven Rosenthal, a tax lawyer and senior fellow at the Urban-Brookings Tax Policy Center in Washington who also testified. “The IRS is so resource-strained that it often can’t pursue good cases, but here they nabbed one.”

Medallion is one of the best-performing funds in history, returning about 40% annualized since its formation in 1988. Simons has a net worth of $25.7 billion, according to the Bloomberg Billionaires Index.

...

Antwort auf Beitrag Nr.: 69.238.419 von faultcode am 04.09.21 13:19:57Das WSJ schreibt, das es sich um die bislang höchste Steuernachzahlung in den USA handeln könnte: https://www.wsj.com/articles/james-simons-robert-mercer-othe…

PDF mit Executive Summary von 8 Seiten, auf das am Ende alles zurückging: https://t.co/SZphcL86d0?amp=1

JULY 22, 2014 HEARING

ABUSE OF STRUCTURED FINANCIAL PRODUCTS:

Misusing Basket Options to Avoid Taxes and Leverage Limits

...

=> man könnte fast sagen, so eine Art Cum-Ex-Skandal in den USA, denn ohne die Hilfe der zwei Banken ginge das so nicht, nicht zuletzt deshalb, weil die Hedge Funds mit Hilfe von bankeigenen Konten ihre Trades ausgeführt haben

Und Kredite haben sie dafür auch noch von den Banken bekommen.

I. EXECUTIVE SUMMARY

...

The basket option contracts examined by the Subcommittee investigation were used by at least 13 hedge funds to conduct over $100 billion in securities trades, most of which were short-term transactions and some of which lasted only seconds.

Yet the resulting short-term profits were frequently cast as long-term capital gains subject to a 20% tax rate (previously 15%) rather than the ordinary income tax rate (currently as high as 39%) that would otherwise apply to investors in hedge funds engaged in daily trading.

While the banks styled the trading arrangement as an “option” under which profits from short-term trades would be treated as long-term capital gains, in essence, the banks loaned the hedge funds money to finance their trading and allowed them to trade for themselves in highly leveraged positions in the banks’ proprietary accounts and reap the resulting profits.

The banks offering the “options” benefited from the financing, trading, and other fees charged to the hedge funds initiating the trades.

In the end, the trading conducted by the hedge funds using the basket option accounts was virtually indistinguishable from the trading conducted by hedge funds using their own brokerage accounts, and provided no justification for treating the resulting short-term trading profits as long-term capital gains.

...

zuvor:

This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barclays Bank PLC – developed structured financial products called MAPS and COLT, two types of basket options, and sold them to one or more hedge funds, including Renaissance Technologies LLC and George Weiss Associates, that used them to avoid federal taxes and leverage limits on buying securities with borrowed funds.

PDF mit Executive Summary von 8 Seiten, auf das am Ende alles zurückging: https://t.co/SZphcL86d0?amp=1

JULY 22, 2014 HEARING

ABUSE OF STRUCTURED FINANCIAL PRODUCTS:

Misusing Basket Options to Avoid Taxes and Leverage Limits

...

=> man könnte fast sagen, so eine Art Cum-Ex-Skandal in den USA, denn ohne die Hilfe der zwei Banken ginge das so nicht, nicht zuletzt deshalb, weil die Hedge Funds mit Hilfe von bankeigenen Konten ihre Trades ausgeführt haben

Und Kredite haben sie dafür auch noch von den Banken bekommen.

I. EXECUTIVE SUMMARY

...

The basket option contracts examined by the Subcommittee investigation were used by at least 13 hedge funds to conduct over $100 billion in securities trades, most of which were short-term transactions and some of which lasted only seconds.

Yet the resulting short-term profits were frequently cast as long-term capital gains subject to a 20% tax rate (previously 15%) rather than the ordinary income tax rate (currently as high as 39%) that would otherwise apply to investors in hedge funds engaged in daily trading.

While the banks styled the trading arrangement as an “option” under which profits from short-term trades would be treated as long-term capital gains, in essence, the banks loaned the hedge funds money to finance their trading and allowed them to trade for themselves in highly leveraged positions in the banks’ proprietary accounts and reap the resulting profits.

The banks offering the “options” benefited from the financing, trading, and other fees charged to the hedge funds initiating the trades.

In the end, the trading conducted by the hedge funds using the basket option accounts was virtually indistinguishable from the trading conducted by hedge funds using their own brokerage accounts, and provided no justification for treating the resulting short-term trading profits as long-term capital gains.

...

zuvor:

This investigation offers yet another detailed case study of how two financial institutions – Deutsche Bank AG and Barclays Bank PLC – developed structured financial products called MAPS and COLT, two types of basket options, and sold them to one or more hedge funds, including Renaissance Technologies LLC and George Weiss Associates, that used them to avoid federal taxes and leverage limits on buying securities with borrowed funds.

so fängt das Hedge Fund-Elend oft an:

Ron Ozer’s vehicle was one of the world’s top performers last year

27.9.

Natural gas hedge fund Statar suffers $130m hit

https://www.ft.com/content/2b347fd8-0334-4f70-a8c1-46725643e…

...

A top-performing US hedge fund specialising in natural gas has suffered a large hit to its performance this month in a sign that even commodity experts are struggling to deal with soaring prices.

Miami-based Statar Capital, which manages $1.7bn in assets and is run by Ron Ozer, a former trader at Citadel and DE Shaw, made a hefty gain in the first 10 days of this month, according to a person familiar with its performance. But it suffered a pullback the following week, leaving it down about 7.7 per cent for September before fees, according to documentation seen by the Financial Times.

The reversal in fortunes wiped out gains made earlier in the month and left the fund with a loss of about $130m in the first two and a half weeks of the month. Statar declined to comment.

...

The “exodus of risk capital from the commodity markets” has exacerbated temporary market mispricings, while producers increasingly want to hedge, Statar says on its website. “This has provided the best opportunity set for natural gas trading in many years.”

Ozer, who studied at Massachusetts Institute of Technology, joined DE Shaw in 2008 and focused on trading natural gas futures and options, before moving to Citadel to become head portfolio manager for US natural gas. According to Statar’s website, he was promoted after his first year to report directly to the firm’s founder, Ken Griffin.

Ron Ozer’s vehicle was one of the world’s top performers last year

27.9.

Natural gas hedge fund Statar suffers $130m hit

https://www.ft.com/content/2b347fd8-0334-4f70-a8c1-46725643e…

...

A top-performing US hedge fund specialising in natural gas has suffered a large hit to its performance this month in a sign that even commodity experts are struggling to deal with soaring prices.

Miami-based Statar Capital, which manages $1.7bn in assets and is run by Ron Ozer, a former trader at Citadel and DE Shaw, made a hefty gain in the first 10 days of this month, according to a person familiar with its performance. But it suffered a pullback the following week, leaving it down about 7.7 per cent for September before fees, according to documentation seen by the Financial Times.

The reversal in fortunes wiped out gains made earlier in the month and left the fund with a loss of about $130m in the first two and a half weeks of the month. Statar declined to comment.

...

The “exodus of risk capital from the commodity markets” has exacerbated temporary market mispricings, while producers increasingly want to hedge, Statar says on its website. “This has provided the best opportunity set for natural gas trading in many years.”

Ozer, who studied at Massachusetts Institute of Technology, joined DE Shaw in 2008 and focused on trading natural gas futures and options, before moving to Citadel to become head portfolio manager for US natural gas. According to Statar’s website, he was promoted after his first year to report directly to the firm’s founder, Ken Griffin.

13.10.

Man Group Gets $5.3 Billion to Lift Assets to Another Record

https://finance.yahoo.com/news/man-group-pulls-5-3-062226946…

...

Man Group Plc pulled in $5.3 billion in new cash during third quarter, the highest for any quarter in at least a decade, showing the rising interest in the hedge fund industry. Its shares rose.

The world’s largest publicly traded hedge fund firm said assets hit yet another record of $139.5 billion, thanks mainly to inflows into its alternative funds and $400 million in performance gains. Inflows beat analyst forecasts.

“We see positive momentum continuing into the fourth quarter, with a high level of client engagement on a number of larger institutional mandates across our systematic long-only and multi-manager strategies,” Chief Executive Officer Luke Ellis said in a statement on Wednesday.

...

Man Group Gets $5.3 Billion to Lift Assets to Another Record

https://finance.yahoo.com/news/man-group-pulls-5-3-062226946…

...

Man Group Plc pulled in $5.3 billion in new cash during third quarter, the highest for any quarter in at least a decade, showing the rising interest in the hedge fund industry. Its shares rose.

The world’s largest publicly traded hedge fund firm said assets hit yet another record of $139.5 billion, thanks mainly to inflows into its alternative funds and $400 million in performance gains. Inflows beat analyst forecasts.

“We see positive momentum continuing into the fourth quarter, with a high level of client engagement on a number of larger institutional mandates across our systematic long-only and multi-manager strategies,” Chief Executive Officer Luke Ellis said in a statement on Wednesday.

...

2.12.

Alphadyne’s Hedge Fund Loss Widens to 22% After November Rout

https://finance.yahoo.com/news/alphadyne-hedge-fund-loss-wid…

...

Alphadyne’s macro hedge fund tumbled 6.4% in November, extending its decline for the year to 22%, according to a person with knowledge of the matter, who didn’t elaborate on what trades contributed to the losses. The fund logged a similar drop in October, when its macro and relative value trades backfired amid volatility in the interest rates market.

...

Alphadyne was founded by former JPMorgan Chase & Co. colleagues Philippe Khuong-Huu and Bart Broadman. The Alphadyne International Master Fund hasn’t recorded an annual loss since its 2006 debut.

The firm managed $10.2 billion at the start of last month, down from about $12 billion earlier in the year.

Alphadyne’s Hedge Fund Loss Widens to 22% After November Rout

https://finance.yahoo.com/news/alphadyne-hedge-fund-loss-wid…

...

Alphadyne’s macro hedge fund tumbled 6.4% in November, extending its decline for the year to 22%, according to a person with knowledge of the matter, who didn’t elaborate on what trades contributed to the losses. The fund logged a similar drop in October, when its macro and relative value trades backfired amid volatility in the interest rates market.

...

Alphadyne was founded by former JPMorgan Chase & Co. colleagues Philippe Khuong-Huu and Bart Broadman. The Alphadyne International Master Fund hasn’t recorded an annual loss since its 2006 debut.

The firm managed $10.2 billion at the start of last month, down from about $12 billion earlier in the year.

6.12.

Billionaire Chris Rokos Hedge Fund Breaks Five-Month Losing Streak

https://finance.yahoo.com/news/billionaire-chris-rokos-hedge…

Chris Rokos’s hedge fund gained about 1.5% last month, ending five months of losses for the billionaire macro trader.

The hedge fund, which manages about $12 billion, is still down 25% this year, according to a person with knowledge of the matter who asked not to be identified because the information is private.

A spokesman for the London-based money manager declined to comment.

...

verständlich

wie gesagt S&P 500 total return bislang in 2021 > 20%

...

Rokos fell about 18% in October in his biggest-ever monthly decline since he started trading for his own hedge fund firm in 2015. It is heading for a record year of losses after returning 44% in 2020. Macro hedge funds tracked by Bloomberg were up an average of almost 8% in the first 10 months of this year.

...

Billionaire Chris Rokos Hedge Fund Breaks Five-Month Losing Streak

https://finance.yahoo.com/news/billionaire-chris-rokos-hedge…

Chris Rokos’s hedge fund gained about 1.5% last month, ending five months of losses for the billionaire macro trader.

The hedge fund, which manages about $12 billion, is still down 25% this year, according to a person with knowledge of the matter who asked not to be identified because the information is private.

A spokesman for the London-based money manager declined to comment.

...

verständlich

wie gesagt S&P 500 total return bislang in 2021 > 20%

...

Rokos fell about 18% in October in his biggest-ever monthly decline since he started trading for his own hedge fund firm in 2015. It is heading for a record year of losses after returning 44% in 2020. Macro hedge funds tracked by Bloomberg were up an average of almost 8% in the first 10 months of this year.

...

9.12.

JPMorgan Offers Hedge Funds a Way to Dodge Meme Stock Shocks

https://www.bnnbloomberg.ca/jpmorgan-offers-hedge-funds-a-wa…

...

JPMorgan Chase & Co. is testing a product to guard big-ticket clients from losses linked to the meme stock phenomenon that has captivated Wall Street this year.

Around 30 asset managers and quant fund managers have been trying out the “through the retail lens” product since September, the bank said. It’s a response to the surprise that hammered investment professionals in January when day traders rushed in to buy stocks, sending the share price of firms including GameStop Corp. and AMC Entertainment Holdings Inc. soaring.

The screening tool is a dataset on U.S. retail investor trends sold to institutional clients. It provides predicted retail flows, significant buy or sell signals on single stocks, negative or positive sentiment based on the bank’s internal data and scouring of social media forums, such as Reddit or Twitter.

“If you don’t have a clear view of what retail is up to, it feels like you’re driving partially blind,” said JPMorgan’s Chris Berthe, global co-head of cash equities trading, by phone. The lens is also serving as a guide to JPMorgan’s own traders.

The focus isn’t just on meme stocks: During the Black Friday selloff, retail investors were big buyers and that’s the kind of signal billion-plus dollar funds actively seek, he said. “That was a real source of interest for our clients.”

Until recently, so-called retail traders were seen as small-time players dabbling in stock markets. But Covid-led lockdown boredom and the rise of zero-commission trading now means amateur investors make up 20% to 30% of trading volume in the U.S., according to JPMorgan.

...

JPMorgan Offers Hedge Funds a Way to Dodge Meme Stock Shocks

https://www.bnnbloomberg.ca/jpmorgan-offers-hedge-funds-a-wa…

...

JPMorgan Chase & Co. is testing a product to guard big-ticket clients from losses linked to the meme stock phenomenon that has captivated Wall Street this year.

Around 30 asset managers and quant fund managers have been trying out the “through the retail lens” product since September, the bank said. It’s a response to the surprise that hammered investment professionals in January when day traders rushed in to buy stocks, sending the share price of firms including GameStop Corp. and AMC Entertainment Holdings Inc. soaring.

The screening tool is a dataset on U.S. retail investor trends sold to institutional clients. It provides predicted retail flows, significant buy or sell signals on single stocks, negative or positive sentiment based on the bank’s internal data and scouring of social media forums, such as Reddit or Twitter.

“If you don’t have a clear view of what retail is up to, it feels like you’re driving partially blind,” said JPMorgan’s Chris Berthe, global co-head of cash equities trading, by phone. The lens is also serving as a guide to JPMorgan’s own traders.

The focus isn’t just on meme stocks: During the Black Friday selloff, retail investors were big buyers and that’s the kind of signal billion-plus dollar funds actively seek, he said. “That was a real source of interest for our clients.”

Until recently, so-called retail traders were seen as small-time players dabbling in stock markets. But Covid-led lockdown boredom and the rise of zero-commission trading now means amateur investors make up 20% to 30% of trading volume in the U.S., according to JPMorgan.

...

15.12.

Anchorage Capital Is Closing $7.4 Billion Flagship Hedge Fund

Letter to investors reports closing of Anchorage Capital Partners and eventual return of money to clients

https://www.wsj.com/articles/anchorage-capital-closing-7-4-b…

...

Anchorage Capital Group, one of the biggest hedge-fund investors in distressed debt, is closing its flagship fund after 18 years and returning the $7.4 billion it manages to clients, citing a market environment in which cheap money has helped keep stock and bond prices elevated while suppressing corporate defaults.

...

Anchorage Capital Is Closing $7.4 Billion Flagship Hedge Fund

Letter to investors reports closing of Anchorage Capital Partners and eventual return of money to clients

https://www.wsj.com/articles/anchorage-capital-closing-7-4-b…

...

Anchorage Capital Group, one of the biggest hedge-fund investors in distressed debt, is closing its flagship fund after 18 years and returning the $7.4 billion it manages to clients, citing a market environment in which cheap money has helped keep stock and bond prices elevated while suppressing corporate defaults.

...

12,1.

Quant Hedge Fund Solaise to Shutter After 11 Years of Trading

https://finance.yahoo.com/news/quant-hedge-fund-solaise-shut…

...

Quantitative investing firm Solaise Capital Management is closing down after 11 years following a decline in assets amid poor performance.

The London-based hedge fund firm’s Solaise Systematic Program was up 5.5% in 2021 and had lost 13% the year before, trailing peers over the period, according to an investor letter seen by Bloomberg. The fund was left with assets of just $51 million.

“It has been a tough environment for futures traders and our absolute returns have not been as we would have hoped,” Ali Nejjar, founding partner and chairman of the firm, said in the letter. “We have thus decided to call a halt.”

James Walker, a managing partner at the firm, confirmed the decision and said that while they continued to believe in the power of their trading system, asset levels were insufficient to support the business. The firm managed more than $400 million at its peak in 2015, he said.

Smaller funds are finding it increasingly difficult to remain in business as costs rise and investors migrate to bigger investment firms. More than 400 hedge funds shuttered during the first three quarters of last year, according to data compiled by Hedge Fund Research Inc.

...

Quant Hedge Fund Solaise to Shutter After 11 Years of Trading

https://finance.yahoo.com/news/quant-hedge-fund-solaise-shut…

...

Quantitative investing firm Solaise Capital Management is closing down after 11 years following a decline in assets amid poor performance.

The London-based hedge fund firm’s Solaise Systematic Program was up 5.5% in 2021 and had lost 13% the year before, trailing peers over the period, according to an investor letter seen by Bloomberg. The fund was left with assets of just $51 million.

“It has been a tough environment for futures traders and our absolute returns have not been as we would have hoped,” Ali Nejjar, founding partner and chairman of the firm, said in the letter. “We have thus decided to call a halt.”

James Walker, a managing partner at the firm, confirmed the decision and said that while they continued to believe in the power of their trading system, asset levels were insufficient to support the business. The firm managed more than $400 million at its peak in 2015, he said.

Smaller funds are finding it increasingly difficult to remain in business as costs rise and investors migrate to bigger investment firms. More than 400 hedge funds shuttered during the first three quarters of last year, according to data compiled by Hedge Fund Research Inc.

...

23.2.

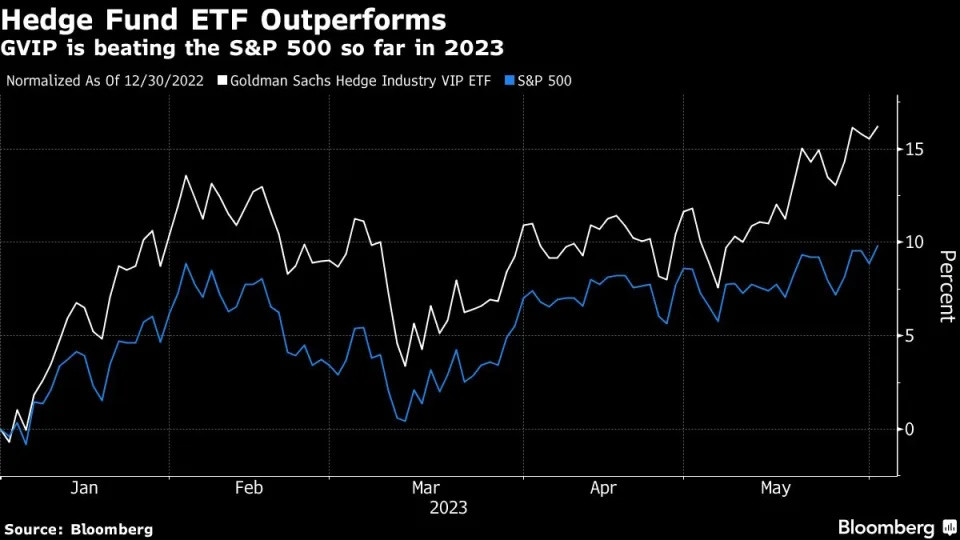

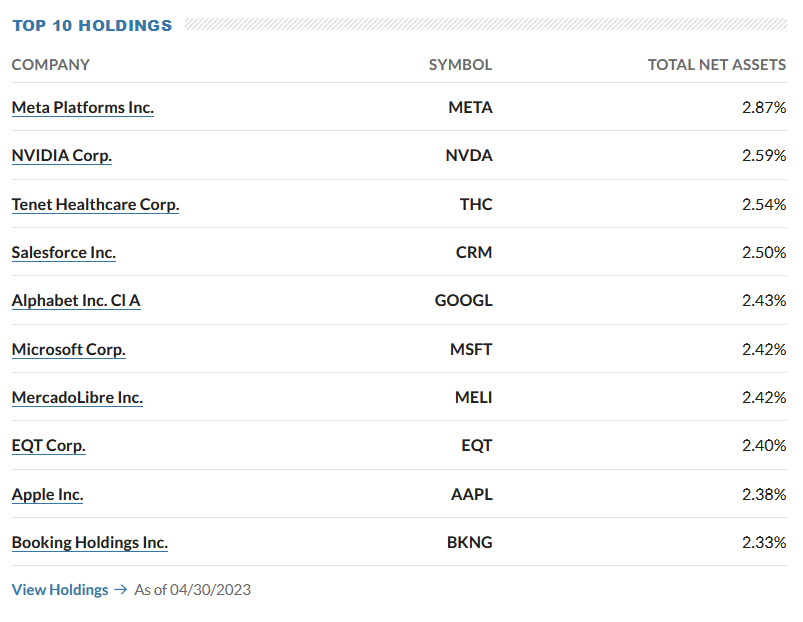

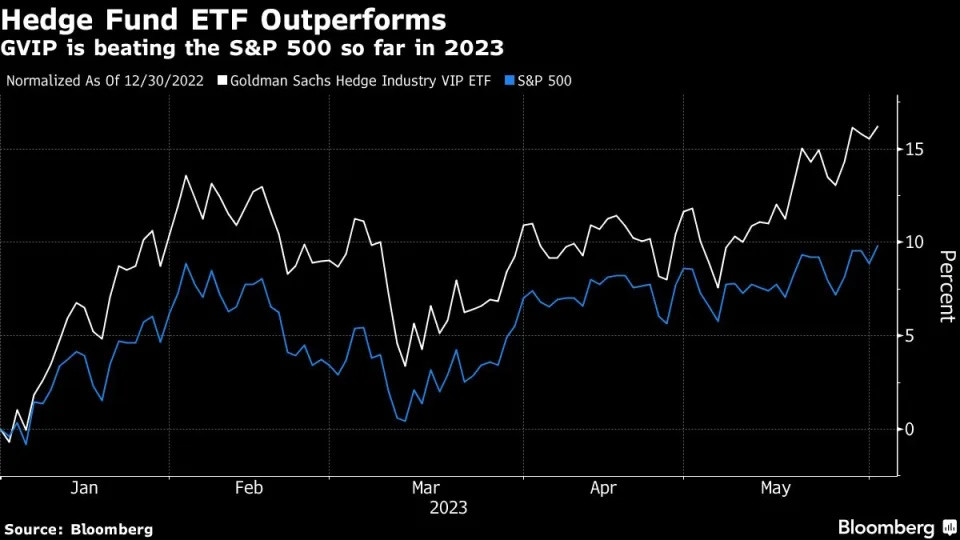

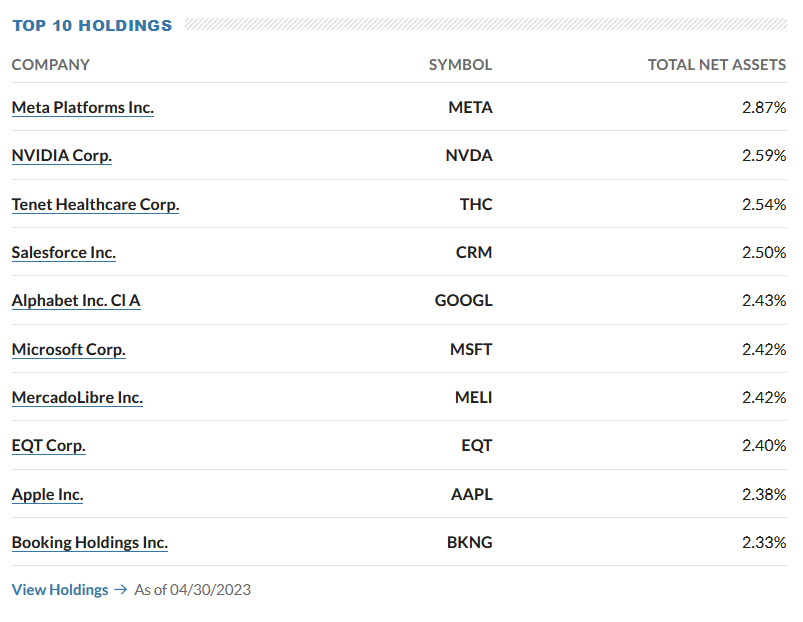

Hedge Funds Slash Tech in Pivot to Other Strategies, Goldman Report Says

https://finance.yahoo.com/news/hedge-funds-slash-tech-pivot-…

...

U.S. hedge funds have been slashing positions in technology stocks, and started 2022 more tilted toward cheaper shares than at any time in over a decade, according to Goldman Sachs Group Inc.

...

The analysis looked at 13F filings for 788 hedge funds, released on Feb. 15. It showed that while the so-called “FAAMG” group of S&P 500 tech giants including Apple Inc. and Microsoft Corp. still rank as the most popular long positions, hedge funds continued to rotate their portfolios from growth into so-called value shares.

...

Contributing to the losses was a ‘VIP list’ of 50 stocks that appear most often in the top 10 holdings of fundamental hedge funds, which has lagged the benchmark by 21 percentage points during the last 12 months. That’s the worst performance in the 20-year history of the basket, which includes Facebook parent Meta Platforms Inc. and Netflix Inc.

...

"so-called value shares"

Zitat von faultcode: Gabe Plotkin hört auf

18.5.

Gabe Plotkin’s Melvin Capital to Wind Down After Losses

https://finance.yahoo.com/news/gabe-plotkin-melvin-capital-w…

...

Gabe Plotkin plans to wind down Melvin Capital Management after suffering billions of dollars of losses and angering investors with a botched plan to reboot the firm.

...

Antwort auf Beitrag Nr.: 71.607.714 von faultcode am 19.05.22 00:18:35

das kam offensichtlich schon zu spät:

Plotkin laid out a plan last month to overhaul Melvin by capping the size of the fund at about $5 billion -- at the time it was $8.7 billion -- and he told investors he wouldn’t allow it to expand above $7 billion until at least June 2027.

Feb 10, 2021

The fund began this year with $12.5 billion in assets under management,... (AUM)

https://markets.businessinsider.com/news/stocks/melvin-capit…

Ich nehme einfach mal an, daß das um das Top herum war beim AUM, obwohl ich auch andere Zahlen dazu gelesen habe.

Irgendwann ist man - nach einer jahrelangen Welle des gehebelten Erfolgs - zu groß in dem Sinne, daß man sich laufend - egal ob long oder short - in "Crowded positions" wiederfindet und damit nur noch schwer ein Alpha (difference between a stock’s return and the market’s return) zu erreichen ist.

=> kommen dann noch persönliche Fehlannahmen und damit Fehlentscheidungen hinzu, war's das mit irgendwelchen Überrenditen und "der Markt korrigiert" diese wieder auf Normalmaß zurück - minus der eigenen Kosten

"capping the size of the fund"

ein Wort dazu: SIZE MATTERS!das kam offensichtlich schon zu spät:

Plotkin laid out a plan last month to overhaul Melvin by capping the size of the fund at about $5 billion -- at the time it was $8.7 billion -- and he told investors he wouldn’t allow it to expand above $7 billion until at least June 2027.

Feb 10, 2021

The fund began this year with $12.5 billion in assets under management,... (AUM)

https://markets.businessinsider.com/news/stocks/melvin-capit…

Ich nehme einfach mal an, daß das um das Top herum war beim AUM, obwohl ich auch andere Zahlen dazu gelesen habe.

Irgendwann ist man - nach einer jahrelangen Welle des gehebelten Erfolgs - zu groß in dem Sinne, daß man sich laufend - egal ob long oder short - in "Crowded positions" wiederfindet und damit nur noch schwer ein Alpha (difference between a stock’s return and the market’s return) zu erreichen ist.

=> kommen dann noch persönliche Fehlannahmen und damit Fehlentscheidungen hinzu, war's das mit irgendwelchen Überrenditen und "der Markt korrigiert" diese wieder auf Normalmaß zurück - minus der eigenen Kosten

Antwort auf Beitrag Nr.: 62.799.149 von faultcode am 26.02.20 20:19:42siehe oben: ich bin alt genug mich noch daran zu erinnern, daß sowas schon mal schiefgegangen ist

<aber pssst: es ist ja heute wie damals (meist) nur das Geld anderer Leute>

23.6.

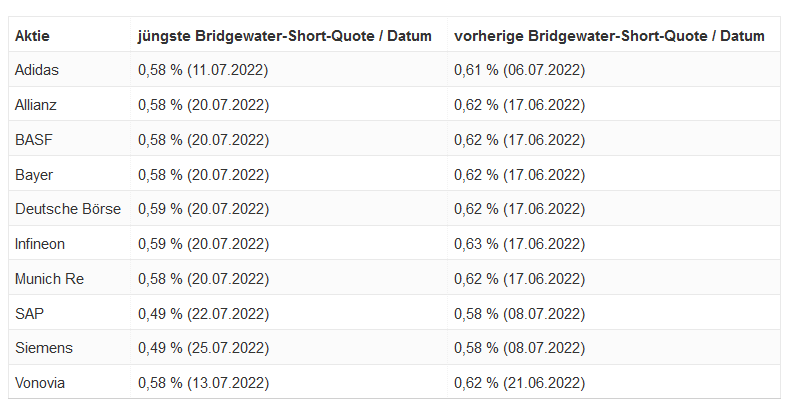

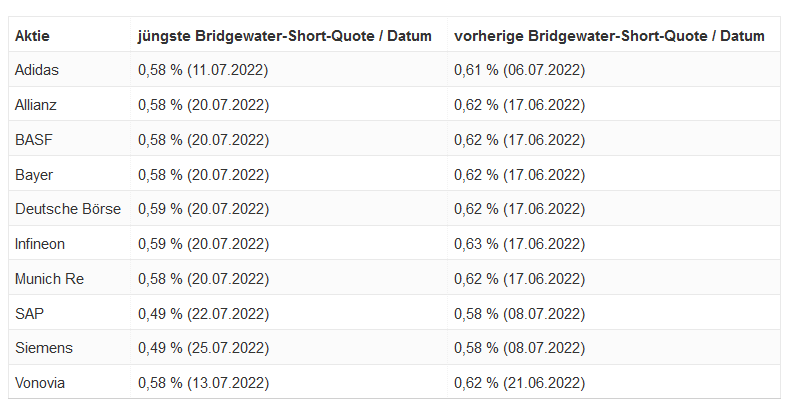

Bridgewater Doubles Short Wagers in Europe to $10.5 Billion

https://ca.finance.yahoo.com/news/bridgewater-doubles-bet-ag…

...

Ray Dalio’s Bridgewater Associates has built a $10.5 billion bet against European companies, almost doubling its wager in the past week to its most bearish stance against the region’s stocks in two years.

The world’s biggest hedge fund firm disclosed short bets against 28 companies that include individual wagers of more than $500 million against ASML Holding NV, TotalEnergies SE, Sanofi and SAP SE, according to data compiled by Bloomberg. The total bet is up from $5.7 billion against 18 firms last week, the data shows.

All the companies that Bridgewater is shorting are part of the Euro Stoxx 50 index. The move comes as Euro-area economic expansion slows sharply amid surging prices. An indicator for economic activity by S&P Global fell to a 16-month low in June, driven by rampant inflation, concerns over energy and rising borrowing costs.

Short sellers try to profit from declining stock prices by selling borrowed shares and buying them back when they fall. They are mounting their bets at a time of rising interest rates and inflation that are increasing the chances of recession. It’s not clear whether Bridgewater’s bets are aimed at pure profit or part of a broader hedging strategy.

In a Bloomberg TV interview last week, Greg Jensen, the co-chief investment officer of the firm, said the sell-off in stocks was still small as compared to the rally they had seen over the last decade and that bigger moves in Europe and the US was still possible. He declined to comment on Bridgewater’s European bets.

The current wagers are the highest since the firm built a $14 billion position against European companies in 2020 and before that, a $22 billion bet in 2018. The total may be even greater since hedge funds are only required to disclose their biggest bets.

...

<aber pssst: es ist ja heute wie damals (meist) nur das Geld anderer Leute>

23.6.

Bridgewater Doubles Short Wagers in Europe to $10.5 Billion

https://ca.finance.yahoo.com/news/bridgewater-doubles-bet-ag…

...

Ray Dalio’s Bridgewater Associates has built a $10.5 billion bet against European companies, almost doubling its wager in the past week to its most bearish stance against the region’s stocks in two years.

The world’s biggest hedge fund firm disclosed short bets against 28 companies that include individual wagers of more than $500 million against ASML Holding NV, TotalEnergies SE, Sanofi and SAP SE, according to data compiled by Bloomberg. The total bet is up from $5.7 billion against 18 firms last week, the data shows.

All the companies that Bridgewater is shorting are part of the Euro Stoxx 50 index. The move comes as Euro-area economic expansion slows sharply amid surging prices. An indicator for economic activity by S&P Global fell to a 16-month low in June, driven by rampant inflation, concerns over energy and rising borrowing costs.

Short sellers try to profit from declining stock prices by selling borrowed shares and buying them back when they fall. They are mounting their bets at a time of rising interest rates and inflation that are increasing the chances of recession. It’s not clear whether Bridgewater’s bets are aimed at pure profit or part of a broader hedging strategy.

In a Bloomberg TV interview last week, Greg Jensen, the co-chief investment officer of the firm, said the sell-off in stocks was still small as compared to the rally they had seen over the last decade and that bigger moves in Europe and the US was still possible. He declined to comment on Bridgewater’s European bets.

The current wagers are the highest since the firm built a $14 billion position against European companies in 2020 and before that, a $22 billion bet in 2018. The total may be even greater since hedge funds are only required to disclose their biggest bets.

...

Antwort auf Beitrag Nr.: 71.839.802 von faultcode am 23.06.22 12:41:0615.7.

Bridgewater’s Giant Bet Against Europe Stocks is Starting to Pay Off

https://ca.finance.yahoo.com/news/bridgewater-giant-bet-agai…

...

The world’s biggest hedge fund firm now has about $9.4 billion worth of wagers against 26 companies in Europe’s large-cap Euro Stoxx 50 index, according to data compiled by Bloomberg. Since Bridgewater’s initial bets were disclosed last month, the gauge has lagged major equity benchmarks in the US, the UK and Japan.

A protracted global equity selloff combined with a worsening economic outlook, exacerbated by an energy crisis and political turmoil, has created fertile ground for these bearish wagers in Europe. And Bridgewater’s call against the region’s largest companies is already bearing fruit.

The US firm has made large wagers against ASML Holding NV, TotalEnergies SE, SAP SE and Siemens AG, which have all underperformed the Euro Stoxx 50 over the past month, with Sanofi the only stock among its biggest shorts to rise.

...

Bridgewater’s Giant Bet Against Europe Stocks is Starting to Pay Off

https://ca.finance.yahoo.com/news/bridgewater-giant-bet-agai…

...

The world’s biggest hedge fund firm now has about $9.4 billion worth of wagers against 26 companies in Europe’s large-cap Euro Stoxx 50 index, according to data compiled by Bloomberg. Since Bridgewater’s initial bets were disclosed last month, the gauge has lagged major equity benchmarks in the US, the UK and Japan.

A protracted global equity selloff combined with a worsening economic outlook, exacerbated by an energy crisis and political turmoil, has created fertile ground for these bearish wagers in Europe. And Bridgewater’s call against the region’s largest companies is already bearing fruit.

The US firm has made large wagers against ASML Holding NV, TotalEnergies SE, SAP SE and Siemens AG, which have all underperformed the Euro Stoxx 50 over the past month, with Sanofi the only stock among its biggest shorts to rise.

...

Antwort auf Beitrag Nr.: 71.988.979 von faultcode am 15.07.22 14:03:40..und wieder retour

26.7.

Bridgewater Associates baut Short-Positionen ab

Der weltgrößte Hedgefonds Bridgewater Associates von Starinvestor Ray Dalio ist im Juni milliardenschwere Short-Positionen auf zahlreiche deutsche sowie europäische Aktien eingegangen. Inzwischen baut Bridgewater seine Leerverkäufe aber langsam wieder ab, wie jüngste Meldungen aus dem Bundesanzeiger belegen.

https://www.godmode-trader.de/artikel/bridgewater-associates…

...

...

26.7.

Bridgewater Associates baut Short-Positionen ab

Der weltgrößte Hedgefonds Bridgewater Associates von Starinvestor Ray Dalio ist im Juni milliardenschwere Short-Positionen auf zahlreiche deutsche sowie europäische Aktien eingegangen. Inzwischen baut Bridgewater seine Leerverkäufe aber langsam wieder ab, wie jüngste Meldungen aus dem Bundesanzeiger belegen.

https://www.godmode-trader.de/artikel/bridgewater-associates…

...

...

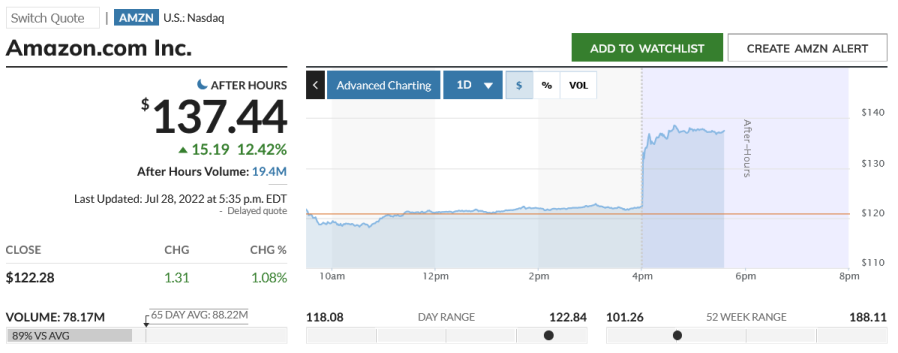

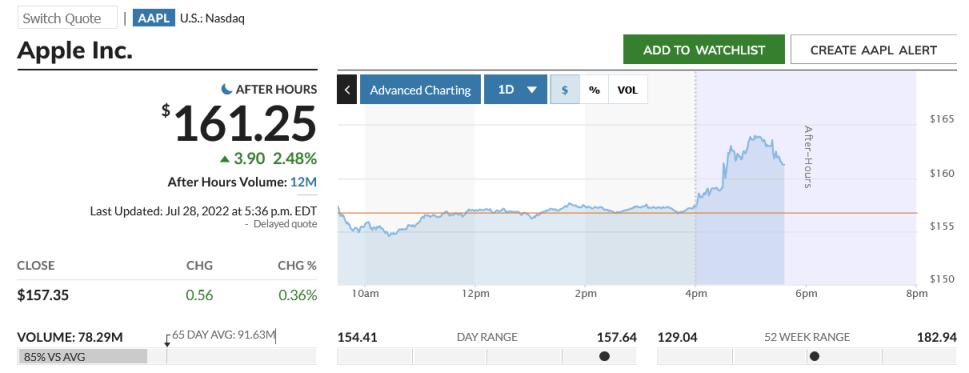

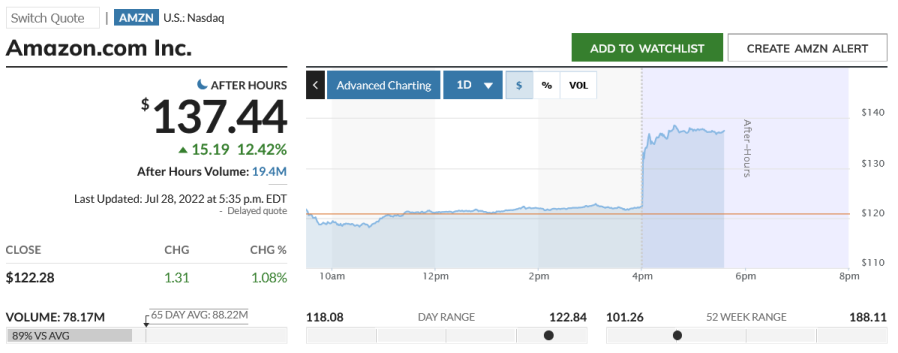

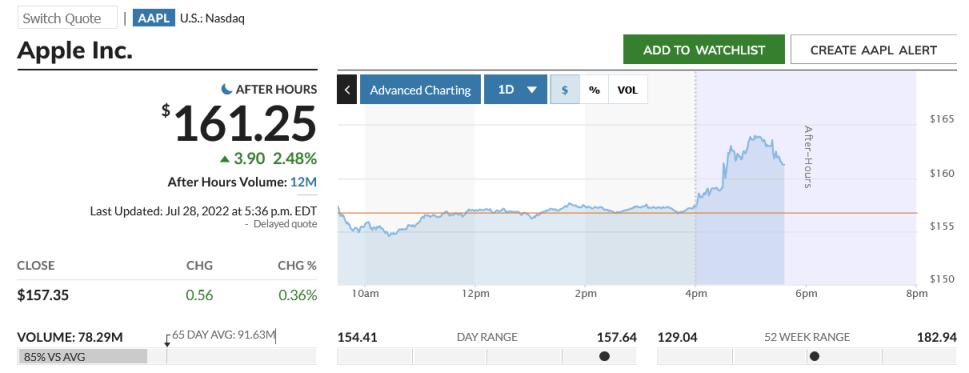

Jul 28, 2022 - 06:21 PM

Hedge Funds Massacred As "Most Hated" Tech Stocks Explode Higher

https://www.zerohedge.com/markets/hedge-funds-massacred-most…

https://twitter.com/zerohedge/status/1552764056192286720

...

=>

Hedge Funds Massacred As "Most Hated" Tech Stocks Explode Higher

https://www.zerohedge.com/markets/hedge-funds-massacred-most…

https://twitter.com/zerohedge/status/1552764056192286720

...

=>

Antwort auf Beitrag Nr.: 72.062.030 von faultcode am 26.07.22 21:14:38..und wieder re-retour:

2.9.

Bridgewater again builds European shorts with €4bn bet on market plunge

Bridgewater at the end of August held short positions of at least 0.5% in 13 stocks in the Euro Stoxx 50 index

https://www.fnlondon.com/articles/bridgewater-shorts-euro-st…

...

Bridgewater Associates has once again made big bets on European stock declines as the hedge fund discloses huge short positions in European stocks.

On 31 August, Bridgewater disclosed that it held short positions in 13 companies that each made up at least 0.5% of their shares, according to research firm Breakout Point. The stock are all members of the Euro Stoxx 50 index. These short positions include French energy firm TotalEnergies, financial services firm Allianz, and pharmaceutical giant Bayer.

...

2.9.

Bridgewater again builds European shorts with €4bn bet on market plunge

Bridgewater at the end of August held short positions of at least 0.5% in 13 stocks in the Euro Stoxx 50 index

https://www.fnlondon.com/articles/bridgewater-shorts-euro-st…

...

Bridgewater Associates has once again made big bets on European stock declines as the hedge fund discloses huge short positions in European stocks.

On 31 August, Bridgewater disclosed that it held short positions in 13 companies that each made up at least 0.5% of their shares, according to research firm Breakout Point. The stock are all members of the Euro Stoxx 50 index. These short positions include French energy firm TotalEnergies, financial services firm Allianz, and pharmaceutical giant Bayer.

...

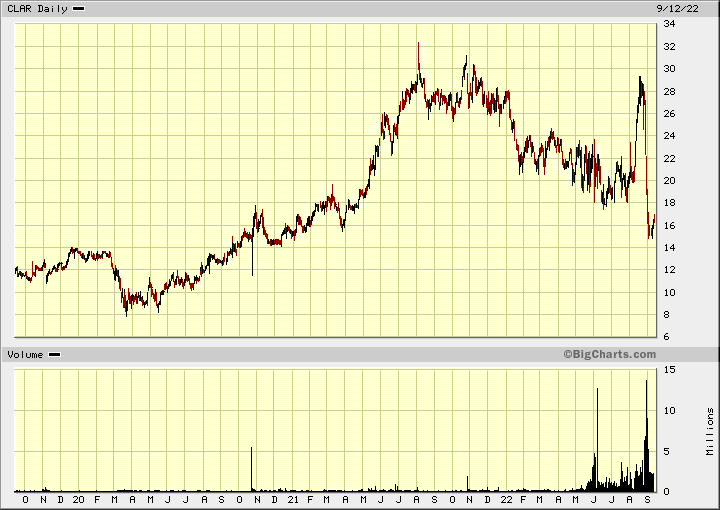

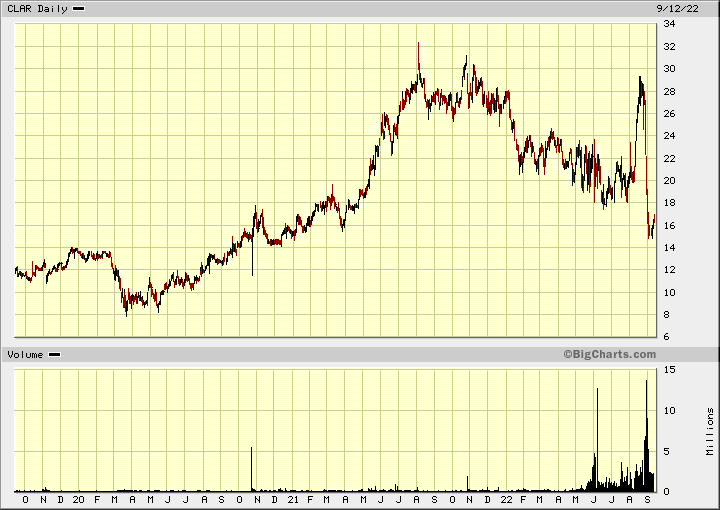

aufpassen mit Leverage -- know what you have:

12.9.

https://uk.news.yahoo.com/fraga-backed-fund-faces-88-1817503…

Fraga-Backed Fund Faces 88% Drop as Leveraged Clarus Bet Sours

...

A small equity fund backed by former Brazilian central bank chief Arminio Fraga suffered an 88% rout after leveraged bets in American outdoor sports gear company Clarus Corp. went wrong.

The Rio de Janeiro-based asset manager TT Investimentos Ltda, which has two of Fraga’s nephews as founding partners, saw its TT Global Equities FIA IE fund shed about 73 million reais ($14 million) in assets after peaking in March of last year. Losses accelerated recently after the fund failed to meet a margin call and was forced by its custodian to liquidate its Clarus position, according to Arthur Fraga Bahia.

The trade consisted of selling put options and buying call options of Clarus. Fraga Bahia apologized to clients in an emailed message, adding that losses were “irreparable.”

Arminio Fraga, who lifted Brazil’s benchmark interest rates to 45% on his first day as central bank president in 1999, was the fund’s largest client. He had no involvement with the fund’s management activity and was solely an investor.

...

Clarus Corp:

12.9.

https://uk.news.yahoo.com/fraga-backed-fund-faces-88-1817503…

Fraga-Backed Fund Faces 88% Drop as Leveraged Clarus Bet Sours

...

A small equity fund backed by former Brazilian central bank chief Arminio Fraga suffered an 88% rout after leveraged bets in American outdoor sports gear company Clarus Corp. went wrong.

The Rio de Janeiro-based asset manager TT Investimentos Ltda, which has two of Fraga’s nephews as founding partners, saw its TT Global Equities FIA IE fund shed about 73 million reais ($14 million) in assets after peaking in March of last year. Losses accelerated recently after the fund failed to meet a margin call and was forced by its custodian to liquidate its Clarus position, according to Arthur Fraga Bahia.

The trade consisted of selling put options and buying call options of Clarus. Fraga Bahia apologized to clients in an emailed message, adding that losses were “irreparable.”

Arminio Fraga, who lifted Brazil’s benchmark interest rates to 45% on his first day as central bank president in 1999, was the fund’s largest client. He had no involvement with the fund’s management activity and was solely an investor.

...

Clarus Corp:

26.10.

Pimco Reloads Stock Shorts, Says Tech Is ‘Canary in Coal Mine’

https://finance.yahoo.com/news/pimco-reloads-stock-shorts-sa…

...

Pacific Investment Management Co. raised bearish stock wagers as the market bounced back, according to portfolio manager Erin Browne, who warns that the latest earnings woes from tech giants are a sign of what’s coming next for Wall Street.

“Over the last week or so, we’ve been resetting shorts at higher levels, taking that as an opportunity to get more underweight stocks,” Browne told Bloomberg TV. “I don’t think yet that we have received the all-clear signal,” she added. “What I think tech is highlighting now is they’re the canary in the coal mine for the broad market.”

Stocks have recovered after hitting their bear-market low earlier this month as speculation grew that the Federal Reserve will slow its aggressive monetary tightening amid a weakening economy. Despite disappointing results from Microsoft Corp. and Google parent Alphabet Inc., the S&P 500 erased earlier losses, rising 0.6% as of 11:50 a.m. in New York. The index has climbed about 8% this month.

Browne isn’t alone in her skepticism. Hedge funds tracked by JPMorgan Chase & Co., for instance, also sold stocks during last week’s bounce.

...

Pimco Reloads Stock Shorts, Says Tech Is ‘Canary in Coal Mine’

https://finance.yahoo.com/news/pimco-reloads-stock-shorts-sa…

...

Pacific Investment Management Co. raised bearish stock wagers as the market bounced back, according to portfolio manager Erin Browne, who warns that the latest earnings woes from tech giants are a sign of what’s coming next for Wall Street.

“Over the last week or so, we’ve been resetting shorts at higher levels, taking that as an opportunity to get more underweight stocks,” Browne told Bloomberg TV. “I don’t think yet that we have received the all-clear signal,” she added. “What I think tech is highlighting now is they’re the canary in the coal mine for the broad market.”

Stocks have recovered after hitting their bear-market low earlier this month as speculation grew that the Federal Reserve will slow its aggressive monetary tightening amid a weakening economy. Despite disappointing results from Microsoft Corp. and Google parent Alphabet Inc., the S&P 500 erased earlier losses, rising 0.6% as of 11:50 a.m. in New York. The index has climbed about 8% this month.

Browne isn’t alone in her skepticism. Hedge funds tracked by JPMorgan Chase & Co., for instance, also sold stocks during last week’s bounce.

...

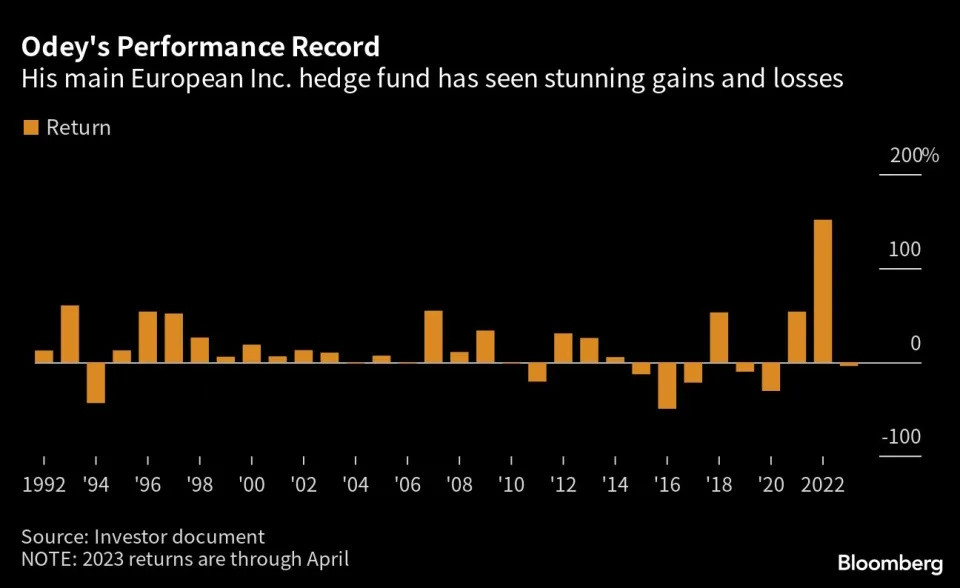

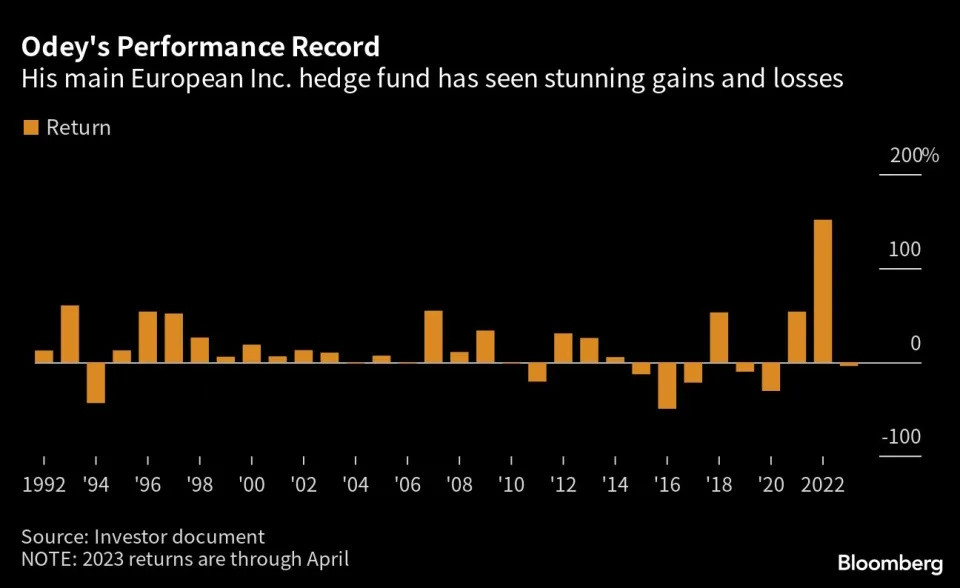

4.1.

Odey’s Hedge Fund Soars 152% in Best Ever Year on Inflation Bet

https://finance.yahoo.com/news/odey-hedge-fund-soars-152-102…

...

His flagship European Inc. hedge fund surged 152% last year, powered mainly by his highly leveraged short wagers on long-dated UK government bonds as inflation and political turmoil roiled the British economy, according to an investor document seen by Bloomberg.

A spokesman for London-based Odey Asset Management declined to comment.

The returns mark a stunning comeback for Odey, who has now fully recouped losses accumulated between 2015 and 2020 when his bearish wagers repeatedly failed to pay off. The fund was up as much as 193% last year but gave up some of the gains during the fourth quarter, another document shows.

The money manager joins a group of macro hedge funds, such as those managed by Said Haidar and Chris Rokos, seeing their fortunes turn as central banks roll back years of quantitative easing to control soaring inflation.

Odey had built up a huge short wager against UK government bonds mostly related to two U.K. government securities that mature in 2050 and 2061. At one point, the bet totaled almost 800% of the net asset value of his hedge fund.

The position turned in profits as inflationary pressures soared in the UK and around the world. The fund manager has since reduced the size of that trade to about 200% of the fund’s net asset value as of the end of November, according to the investor document. Macro hedge funds were up about 2% on average through November last year, according to data compiled by Bloomberg.

...

4.1.

New Hedge Fund Soars 163% Betting Everything Is Going Down

https://finance.yahoo.com/news/hedge-fund-soars-163-betting-…

...

A veteran trader’s well-timed bet on the end of easy money has achieved triple-digit returns in his new hedge fund’s first full year.

After running Eagle’s View Capital Management as a fund of funds for 16 years, founder Neal Berger decided to add his own fund to the mix. The Contrarian Macro Fund launched initially with partner capital in April 2021 to load up on bets that the Federal Reserve would unwind a decade of stimulus — even as policy makers were describing inflation as “transitory.” By the time the Fed reversed course, Berger was starting to accept external money.

“The reason why I started the fund was that central bank flows were going to change 180 degrees. That key difference would be a headwind on all asset prices,” said Berger. “One had to believe that the prices we saw were, to use the academic term, wackadoodle.”

The wager proved prescient, delivering the new fund a return of about 163% in 2022, according to an investor document seen by Bloomberg. Berger declined to comment on the fund’s returns. New York-based Eagle’s View manages about $700 million in total, with $200 million in the Contrarian Macro Fund.

He joins a number of macro hedge fund managers, including Said Haider, Crispin Odey and Michael Platt’s BlueCrest Capital Management, who managed to use bets on the economy to multiply their money during the past year of turbulence that spelled lackluster returns at many other funds.

Berger said he’s using futures contracts to short stocks and bonds he saw as distorted by years of monetary stimulus.

“The $19 trillion of sovereign debt trading at negative yields, the SPAC boom, the crypto boom, private equity valuations and public equity valuations — they’re all stripes of the same zebra,” said Berger, whose prior macro trading experience includes Millennium Management, Chase Manhattan Bank and Fuji Bank. “The zebra being the ocean of liquidity, first in response to the Great Financial Crisis and then to Covid.”

The Contrarian Macro Fund mostly holds bearish bets on Europe and American assets, with hedges that pay off during more positive periods. After the Bank of Japan widened the upper limit for 10 year-yields, the fund also set up short positions against Japanese bonds and wagered that the yen would rise.

According to Berger, this is only the beginning of the end of the global carry trade, which aims to use low-yielding currencies such as the yen to buy something with higher returns.

Berger plans to keep his short positions for years. The pain isn’t over yet, and its end will only be clear after assets trade sideways for multiple months, he said.

“You have your variations, your rallies day-to-day, month-to-month,” he said. “But big picture, everything is going down. Price action is ultimately the bible.”

...

New Hedge Fund Soars 163% Betting Everything Is Going Down

https://finance.yahoo.com/news/hedge-fund-soars-163-betting-…

...

A veteran trader’s well-timed bet on the end of easy money has achieved triple-digit returns in his new hedge fund’s first full year.

After running Eagle’s View Capital Management as a fund of funds for 16 years, founder Neal Berger decided to add his own fund to the mix. The Contrarian Macro Fund launched initially with partner capital in April 2021 to load up on bets that the Federal Reserve would unwind a decade of stimulus — even as policy makers were describing inflation as “transitory.” By the time the Fed reversed course, Berger was starting to accept external money.

“The reason why I started the fund was that central bank flows were going to change 180 degrees. That key difference would be a headwind on all asset prices,” said Berger. “One had to believe that the prices we saw were, to use the academic term, wackadoodle.”