Africa Oil Corp. - World-Class East Africa Oil Exploration (Seite 178)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 28.04.24 15:36:08 von

neuester Beitrag 28.04.24 15:36:08 von

Beiträge: 4.121

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 3

Gesamt: 628.770

Gesamt: 628.770

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AFZ

1,6400

EUR

+0,31 %

+0,0050 EUR

Letzter Kurs 09.05.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,1500 | +27,78 | |

| 13,300 | +27,27 | |

| 1,0400 | +18,18 | |

| 4,5500 | +9,90 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8650 | -7,88 | |

| 2,4000 | -9,43 | |

| 850,20 | -12,51 | |

| 11,790 | -12,67 | |

| 12,14 | -16,28 |

Beitrag zu dieser Diskussion schreiben

Ein prima Update... Etuko 40m Pay sind der Hammer... (Insbesondere mit Blick auf die horizontale Ausdehnung des Prospects...) - das kam doch überraschend (auch wenn der rumours sich in dieser Sache einmal mehr bestätigt hat...  )

)

200+m Pay at Ngamia.. sensationell...

Sabisa habe ich jedoch auch auf eine Discovery gehofft... Aber gut...

"Heavy Gas" meint Condensate/Liquids!!

Mindestens 250 mmbbls resource bei Twiga und Ngamia... Wow... Und ich bin sicher, dass hier noch jede Menge Luft nach oben ist...

Das wird alles so groß - wunderbar....

Zu den Flowrates; motz1 hat natürlich recht: je größer der tägliche Flow, um so größer die täglichen revenues. Aber bis zur Produktion werden ohnehin noch einige Appraisal Wells gedrillt; die Flow Rates hängen an vielen Faktoren; die wichtigsten sind Reservoir Qualität und Formationsdruck; die Reservoir Qualität ist herausragend (Porosität und Permeability) - der Formationsdruck ist jedoch gering... Dennoch sind 5.000 bbls/d ein gutes Ergebnis - so wird man halt (wie bmann bereits formulierte) viele Jahrzehnte dort Öl produzieren... Alles gut!

I Love my AOCs...

)

)200+m Pay at Ngamia.. sensationell...

Sabisa habe ich jedoch auch auf eine Discovery gehofft... Aber gut...

"Heavy Gas" meint Condensate/Liquids!!

Mindestens 250 mmbbls resource bei Twiga und Ngamia... Wow... Und ich bin sicher, dass hier noch jede Menge Luft nach oben ist...

Das wird alles so groß - wunderbar....

Zu den Flowrates; motz1 hat natürlich recht: je größer der tägliche Flow, um so größer die täglichen revenues. Aber bis zur Produktion werden ohnehin noch einige Appraisal Wells gedrillt; die Flow Rates hängen an vielen Faktoren; die wichtigsten sind Reservoir Qualität und Formationsdruck; die Reservoir Qualität ist herausragend (Porosität und Permeability) - der Formationsdruck ist jedoch gering... Dennoch sind 5.000 bbls/d ein gutes Ergebnis - so wird man halt (wie bmann bereits formulierte) viele Jahrzehnte dort Öl produzieren... Alles gut!

I Love my AOCs...

City Research:

....................

Africa Oil Corp (AOIC.ST)

Alert: Moving Towards Commerciality in Kenya

- Positive results in Kenya sees big step forward towards commerciality –

Positive results from the flow tests at Ngamia and Twiga South have led to a

doubling of net pay estimates with resources at both Ngamia and Twiga South now

estimated by Tullow at over 250m bbls. In addition, the news that the Etuko well has

already discovered net pay of 40 metres brings the partners close to the threshold

for a commercial development project, in our view (c. 400m bbls). A project that

would sit attractively on our global cost curve at c. US$45/bbl break-even. High

drilling activity continues that could further de-risk the material resource base

identified across Kenya and is included in our Africa Oil base NAV of SEK82/share.

The shares look to be discounting c. 250mboe of net discovered resources (at

US$90/bbl) from Kenya, but we believe the full resource potential could be

significantly larger given the significant drilling inventory (>120 targets).

- Positive flow test results lead to a doubling of net pay at Ngamia – The

cumulative flow rate from the 6 drill stem tests at Ngamia was 3.2k b/d, which would

increase to c. 5k b/d under production conditions. The flow tests proved good

quality reservoir, which has led to a doubling of the net pay estimate in Ngamia to

over 200 metres. Tullow has indicated that the Ngamia and Twiga fields contain

over 250m bbls of recoverable oil, above our risked estimate of 220m bbls in our

Africa Oil NAV. Appraisal work (3D and appraisal wells) will be undertaken over the

next year to confirm these estimates. The rig will now move to drill the Ekales

prospect in July, which sits between the Twiga/Ngamia discoveries.

- Etuko discovery opens up new play in the Lokichar basin, drilling to complete

in July – the Etuko well has discovered net pay of 40 metres in the Auwerwer and

Upper Lokhone targets which demonstrate good reservoir properties and oil quality.

The well is currently drilling in the Lower Lokhone sands and results from this lower

section are expected by the end of July. The Etuko prospect is a large structure that

was estimated to hold up to 230 m bbls of gross resources before drilling.

- Sabisa result provides encouragement in Ethiopia – The well encountered

reservoir quality sands, oil shows and heavy gas shows, which provides

encouragement of a working hydrocarbon system in northern part of the Turkana

basin in the South Omo block (Ethiopia). The partners plan to drill the nearby Tultule

prospect in 3Q13, which appears to be a horst-block structure 4kms east of Sabisa.

- Near-term activity focused primarily on core play – Africa Oil plans to drill in

three key areas across Kenya and Ethiopia during 2013. However, the near-term

focus will remain the core play of the Lokichar Basin in Kenya (Block 10BB/13T)

where Africa Oil plans to complete the high-impact Etuko prospect in July and also

drill the Ekales-1 prospect in July. In addition, the Tultule prospect in the South Omo

block (Ethiopia) should also be drilled in 3Q13, with a two further rigs sourced to drill

in Block 8 in Ethiopia and in Block 9 (Kenya) during 3Q/4Q13.

https://ir.citi.com/FhfcRGBY1C7jthnuN3G%2BiEyYznDEfMOAFbuxsU…

....................

Africa Oil Corp (AOIC.ST)

Alert: Moving Towards Commerciality in Kenya

- Positive results in Kenya sees big step forward towards commerciality –

Positive results from the flow tests at Ngamia and Twiga South have led to a

doubling of net pay estimates with resources at both Ngamia and Twiga South now

estimated by Tullow at over 250m bbls. In addition, the news that the Etuko well has

already discovered net pay of 40 metres brings the partners close to the threshold

for a commercial development project, in our view (c. 400m bbls). A project that

would sit attractively on our global cost curve at c. US$45/bbl break-even. High

drilling activity continues that could further de-risk the material resource base

identified across Kenya and is included in our Africa Oil base NAV of SEK82/share.

The shares look to be discounting c. 250mboe of net discovered resources (at

US$90/bbl) from Kenya, but we believe the full resource potential could be

significantly larger given the significant drilling inventory (>120 targets).

- Positive flow test results lead to a doubling of net pay at Ngamia – The

cumulative flow rate from the 6 drill stem tests at Ngamia was 3.2k b/d, which would

increase to c. 5k b/d under production conditions. The flow tests proved good

quality reservoir, which has led to a doubling of the net pay estimate in Ngamia to

over 200 metres. Tullow has indicated that the Ngamia and Twiga fields contain

over 250m bbls of recoverable oil, above our risked estimate of 220m bbls in our

Africa Oil NAV. Appraisal work (3D and appraisal wells) will be undertaken over the

next year to confirm these estimates. The rig will now move to drill the Ekales

prospect in July, which sits between the Twiga/Ngamia discoveries.

- Etuko discovery opens up new play in the Lokichar basin, drilling to complete

in July – the Etuko well has discovered net pay of 40 metres in the Auwerwer and

Upper Lokhone targets which demonstrate good reservoir properties and oil quality.

The well is currently drilling in the Lower Lokhone sands and results from this lower

section are expected by the end of July. The Etuko prospect is a large structure that

was estimated to hold up to 230 m bbls of gross resources before drilling.

- Sabisa result provides encouragement in Ethiopia – The well encountered

reservoir quality sands, oil shows and heavy gas shows, which provides

encouragement of a working hydrocarbon system in northern part of the Turkana

basin in the South Omo block (Ethiopia). The partners plan to drill the nearby Tultule

prospect in 3Q13, which appears to be a horst-block structure 4kms east of Sabisa.

- Near-term activity focused primarily on core play – Africa Oil plans to drill in

three key areas across Kenya and Ethiopia during 2013. However, the near-term

focus will remain the core play of the Lokichar Basin in Kenya (Block 10BB/13T)

where Africa Oil plans to complete the high-impact Etuko prospect in July and also

drill the Ekales-1 prospect in July. In addition, the Tultule prospect in the South Omo

block (Ethiopia) should also be drilled in 3Q13, with a two further rigs sourced to drill

in Block 8 in Ethiopia and in Block 9 (Kenya) during 3Q/4Q13.

https://ir.citi.com/FhfcRGBY1C7jthnuN3G%2BiEyYznDEfMOAFbuxsU…

Antwort auf Beitrag Nr.: 44.972.637 von bmann025 am 03.07.13 10:59:13bmann,

sowohl Reservoirgröße als auch flow rates sind entscheidend.

Die flow rate spiegelt das Aufwand(Bohrkosten) / Ertrag(Förderbare Menge/Tag)-Verhältnis der Förderung wider, die Reservoirgröße lässt Rückschlüsse auf die maximal förderbare Menge zu und beeinflusst die Anzahl der zu bohrenden production wells.

Die erzielbaren flow rates beeinflussen wiederum wesentlich den asset-value, da eine hohe flow rate gleichbedeutend mit einer kurzen Amortisationsdauer ist. Für ein Farmout oder Verkauf der Company bedeutet das für den Käufer schnelleren Rückfluss des investierten Kapitals. Diese Rückflussdauer bestimmt wiederum nicht unerheblich den Kaufpreis mit...

Bisher sind die onshore gedrillten Kenya-wells noch sehr teuer (~40Mio USD), mit den jetzt gewonnenen Erkenntnissen hoffe ich auf eine signifikante Reduzierung der Bohrzeiten im Lokichar Basin und damit auf geringere Bohrkosten/well.

Ob die Rechnung mit niedrigen 4-stelligen flows (bei heutigen Bedingungen in East Africa) aufgeht wage ich zu bezweifeln. Mit zunehmender Infrastruktur und besserem geologischen Verständnis sollte das klappen. Mit 5.400bopd fühle ich mich in der Hinsicht aber ziemlich wohl.

Wenn AOI/Tullow eine Menge von 250MMbbls recoverable benennen, dann liegt der Oil in Place-Wert wohl bei rund einer Milliarde Barrels (Annahme: Recovery-Factor von 25%). Das ist alles alleine auf Ngamia und Twiga bezogen, das ist schon eine Hausnummer.

Eine vertikale Länge von über 200m ölführender Schicht in Ngamia ist überragend, bzw. "world class" wie es KH nennt...

sowohl Reservoirgröße als auch flow rates sind entscheidend.

Die flow rate spiegelt das Aufwand(Bohrkosten) / Ertrag(Förderbare Menge/Tag)-Verhältnis der Förderung wider, die Reservoirgröße lässt Rückschlüsse auf die maximal förderbare Menge zu und beeinflusst die Anzahl der zu bohrenden production wells.

Die erzielbaren flow rates beeinflussen wiederum wesentlich den asset-value, da eine hohe flow rate gleichbedeutend mit einer kurzen Amortisationsdauer ist. Für ein Farmout oder Verkauf der Company bedeutet das für den Käufer schnelleren Rückfluss des investierten Kapitals. Diese Rückflussdauer bestimmt wiederum nicht unerheblich den Kaufpreis mit...

Bisher sind die onshore gedrillten Kenya-wells noch sehr teuer (~40Mio USD), mit den jetzt gewonnenen Erkenntnissen hoffe ich auf eine signifikante Reduzierung der Bohrzeiten im Lokichar Basin und damit auf geringere Bohrkosten/well.

Ob die Rechnung mit niedrigen 4-stelligen flows (bei heutigen Bedingungen in East Africa) aufgeht wage ich zu bezweifeln. Mit zunehmender Infrastruktur und besserem geologischen Verständnis sollte das klappen. Mit 5.400bopd fühle ich mich in der Hinsicht aber ziemlich wohl.

Wenn AOI/Tullow eine Menge von 250MMbbls recoverable benennen, dann liegt der Oil in Place-Wert wohl bei rund einer Milliarde Barrels (Annahme: Recovery-Factor von 25%). Das ist alles alleine auf Ngamia und Twiga bezogen, das ist schon eine Hausnummer.

Eine vertikale Länge von über 200m ölführender Schicht in Ngamia ist überragend, bzw. "world class" wie es KH nennt...

"This encouragement has caused us to set in motion appraisal of the Ngamia-Twiga trend and to assemble a technical team to commence early development planning both for a large scale pipeline development and an early development scheme."

Diese Entscheidung zeigt die Überzeugung, in die weitere Zukunft und langfristig erfolgreich zu investieren und zeigt, dass AOI und Tullow noch von mehr Funden überzeugt sind.

Barack Obama sagte bei der Ehrung der damaligen Anschlagsopfer in Nairobi, dass sich die USA bei den Ölfunden in Ostafrika beteiligen will.

Alles ist großartig!

Diese Entscheidung zeigt die Überzeugung, in die weitere Zukunft und langfristig erfolgreich zu investieren und zeigt, dass AOI und Tullow noch von mehr Funden überzeugt sind.

Barack Obama sagte bei der Ehrung der damaligen Anschlagsopfer in Nairobi, dass sich die USA bei den Ölfunden in Ostafrika beteiligen will.

Alles ist großartig!

Ist folgende Interpretation richtig ?

Bei 5400 Barrels/day und >125 Mio Barrels Reservoir dauert es mindestens 63 Jahre, bis das Oel gefoerdert ist.

Meinem naiven Verstaendnis nach bohrt man dann einfach zusaetzliche Zugaenge und vermehrfacht dadurch die Flowrate. Insofern ist die Reservoirgroesse die entscheidende Kennzahl und nicht die Flowrate.

{Das stimmt natuerlich nur, solange die Kosten einer Bohrung klein sind gegenueber dem Ertrag aus dem zusaetzlicehn Bohrloch, aber mit 4-stelliger Flowrrate ist das sicher gegeben.}

Bei 5400 Barrels/day und >125 Mio Barrels Reservoir dauert es mindestens 63 Jahre, bis das Oel gefoerdert ist.

Meinem naiven Verstaendnis nach bohrt man dann einfach zusaetzliche Zugaenge und vermehrfacht dadurch die Flowrate. Insofern ist die Reservoirgroesse die entscheidende Kennzahl und nicht die Flowrate.

{Das stimmt natuerlich nur, solange die Kosten einer Bohrung klein sind gegenueber dem Ertrag aus dem zusaetzlicehn Bohrloch, aber mit 4-stelliger Flowrrate ist das sicher gegeben.}

Ein gutes Update. Wermutstropfen sind imho die Flow Rate von Ngamia, da hatte ich mir mehr erhofft und das Sabisa-Ergebnis. Nun ja, Appraisal bzw. Follow Up abwarten.

Insgesamt ist festzustellen, dass Tullow Kenya und Ethiopia nun an forderster Stelle nennen und in der Beschreibung selbst einen äußerst positiven Ton anschlägt.

Ngamia:

- Net Pay > 200m

- Flow Rate optimiert ~5.400bopd

- Tullow glaubt an > 250Miobbl recoverable oil in Ngamia und Twiga zusammen

Twiga:

- Net Pay > 75m

Etuko:

- 40m net pay in Auwerwer und Upper Lokhone

- öffnet neuen play type: Basin Flank Play, bereits mehrere follow ups identifiziert

- Derzeit Drilling im Lower Lokhone, Ergebnisse bis Ende July erwartet

- Sampling bereits erfolgreich

Sabisa:

- Total depth 2082m

- established oil prone hydrocarbon system

- Tultule als nächstes Drilling, beginnt Ende Q3

- Aidan Heavey (Tullow):

“Over the past two months, Tullow has made major progress in three key areas of its operations. In Kenya, we

have significantly upgraded our resource estimates for the South Lokichar Basin following the highly successful

flow testing of Ngamia and Twiga-South. Additionally in Kenya, Tullow has made a new discovery at Etuko-1.

[...]"

Kenya wird von Tullow bereits als eine ihrer drei key Areas bezeichnet - nice

Heavey scheint mit den flows recht zufrieden zu sein...

- Keith Hill: "We are very pleased with the results of the Ngamia-1 testing program which has confirmed the productivity of both the Lower Lokhone reservoir and the high quality Auwerwer reservoir and significantly increased the net pay in the well. Ngamia is a world-class oil discovery and these results move us towards achieving the threshold for a commercial development in the Lokichar basin. This encouragement has caused us to set in motion appraisal of the Ngamia-Twiga trend and to assemble a technical team to commence early development planning both for a large scale pipeline development and an early development scheme. The Etuko discovery also opens up a new fairway on the eastern flank play in Lokichar where a number of other large scale prospects have been identified. The Sabisa results are also highly encouraging as all the major components for oil accumulation appear to have been proven in one of our largest and most prospective frontier basins in the portfolio. The second half of 2013 promises to be an exciting and transformational period in the growth history of the Company."

- Block 9, Bahasi: Vorbereitungen laufen

- El Kuran (New Age): Spud in July

- Resource Report: Q3

- Weatherford 804 Rig zu Ekales Unterwegs (String of Pearls, zwischen Ngamia und Twiga), sehr hohe CoS, spud noch im July...

Alles in allem scheint Etuko der "Star" des Updates zu sein, damit sind einige andere ähnlich große prospects derisked... Btw, Etuko war von Beginn an das favorisierte Drilling von KH und AOI, wird mit Best Estimate von 231MMbbl (!) gschätzt.

Der Wert von Sabisa wird sich im Folgedrilling zeigen, allerdings stimmen die Vorzeichen.

Wie die Flow Rate von Ngamia im Appraisal aussieht bleibt abzuwarten.

Das Resource Update wird interessant, insbesondere wie die Reservoir-Qualität und die gesteigerten net pay-Werte sich aufeinander auswirken.

Tullow/AOI finden Öl, die Richtung stimmt.

Alles wie immer imho.

Insgesamt ist festzustellen, dass Tullow Kenya und Ethiopia nun an forderster Stelle nennen und in der Beschreibung selbst einen äußerst positiven Ton anschlägt.

Ngamia:

- Net Pay > 200m

- Flow Rate optimiert ~5.400bopd

- Tullow glaubt an > 250Miobbl recoverable oil in Ngamia und Twiga zusammen

Twiga:

- Net Pay > 75m

Etuko:

- 40m net pay in Auwerwer und Upper Lokhone

- öffnet neuen play type: Basin Flank Play, bereits mehrere follow ups identifiziert

- Derzeit Drilling im Lower Lokhone, Ergebnisse bis Ende July erwartet

- Sampling bereits erfolgreich

Sabisa:

- Total depth 2082m

- established oil prone hydrocarbon system

- Tultule als nächstes Drilling, beginnt Ende Q3

- Aidan Heavey (Tullow):

“Over the past two months, Tullow has made major progress in three key areas of its operations. In Kenya, we

have significantly upgraded our resource estimates for the South Lokichar Basin following the highly successful

flow testing of Ngamia and Twiga-South. Additionally in Kenya, Tullow has made a new discovery at Etuko-1.

[...]"

Kenya wird von Tullow bereits als eine ihrer drei key Areas bezeichnet - nice

Heavey scheint mit den flows recht zufrieden zu sein...

- Keith Hill: "We are very pleased with the results of the Ngamia-1 testing program which has confirmed the productivity of both the Lower Lokhone reservoir and the high quality Auwerwer reservoir and significantly increased the net pay in the well. Ngamia is a world-class oil discovery and these results move us towards achieving the threshold for a commercial development in the Lokichar basin. This encouragement has caused us to set in motion appraisal of the Ngamia-Twiga trend and to assemble a technical team to commence early development planning both for a large scale pipeline development and an early development scheme. The Etuko discovery also opens up a new fairway on the eastern flank play in Lokichar where a number of other large scale prospects have been identified. The Sabisa results are also highly encouraging as all the major components for oil accumulation appear to have been proven in one of our largest and most prospective frontier basins in the portfolio. The second half of 2013 promises to be an exciting and transformational period in the growth history of the Company."

- Block 9, Bahasi: Vorbereitungen laufen

- El Kuran (New Age): Spud in July

- Resource Report: Q3

- Weatherford 804 Rig zu Ekales Unterwegs (String of Pearls, zwischen Ngamia und Twiga), sehr hohe CoS, spud noch im July...

Alles in allem scheint Etuko der "Star" des Updates zu sein, damit sind einige andere ähnlich große prospects derisked... Btw, Etuko war von Beginn an das favorisierte Drilling von KH und AOI, wird mit Best Estimate von 231MMbbl (!) gschätzt.

Der Wert von Sabisa wird sich im Folgedrilling zeigen, allerdings stimmen die Vorzeichen.

Wie die Flow Rate von Ngamia im Appraisal aussieht bleibt abzuwarten.

Das Resource Update wird interessant, insbesondere wie die Reservoir-Qualität und die gesteigerten net pay-Werte sich aufeinander auswirken.

Tullow/AOI finden Öl, die Richtung stimmt.

Alles wie immer imho.

Antwort auf Beitrag Nr.: 44.971.377 von motz1 am 03.07.13 08:53:49Das Bild wurde scheinbar nicht richtig hochgeladen:

@Niki: Ich war zu langsam... Interessant wird die Börsenöffnung in Stockholm: http://www.nasdaqomxnordic.com/aktier/fnshareinformation?Ins…

Hier noch die Infos von Tullow:

..................

3 Jul 2013

Trading statement and operational update

•New oil discovery at Etuko-1; Sabisa-1 sidetrack establishes oil prone system

•Significant upgrade to Ngamia and Twiga-South oil resources

•Government approval of TEN project; contract awards under way

03 July 2013 – Tullow Oil plc (Tullow) issues an Operational Update summarising key activities since the Interim Management Statement on 8 May 2013 and a Trading Statement in respect of its half yearly financials to 30 June 2013. This is in advance of the Group’s Half-Yearly Results, which are scheduled for release on Wednesday 31 July 2013. The information contained herein has not been audited and may be subject to further review.

Download Tullow Oil plc Trading Statement and Operational Update

COMMENTING TODAY, AIDAN HEAVEY, CHIEF EXECUTIVE SAID:

“Over the past two months, Tullow has made major progress in three key areas of its operations. In Kenya, we have significantly upgraded our resource estimates for the South Lokichar Basin following the highly successful flow testing of Ngamia and Twiga-South. Additionally in Kenya, Tullow has made a new discovery at Etuko-1. In Ghana, the Government has approved the plan of development for the TEN project, our second offshore project in the country. In Uganda, we have made substantial progress with our partners and the Government and expect to sign a Memorandum of Understanding which will outline the key principles for the development of the Lake Albert Basin development. We also continue to have an industry-leading exploration and appraisal programme with results from key frontier wells in Kenya, Ethiopia, French Guiana, Norway and Mauritania all expected in the second half of the year. With high-quality production continuing to underpin our financial position, we are well placed for the remainder of this year and into 2014.”

http://www.tullowoil.com/index.asp?pageid=137&newsid=849

Operational Update

Exploration & Appraisal

In the first half of 2013 Tullow has drilled 9 exploration wells and 11 appraisal wells across the portfolio with a

60% overall success ratio. The most significant well results during the period were the Etuko-1 oil discovery in

Kenya and encountering an oil prone system in Ethiopia with the Sabisa-1 well. Additionally, we have

successfully flow-tested Ngamia-1 and Twiga South-1 in Kenya and materially increased our estimate of the

resources from both fields. In the second half of the year, some 20 exploration wells are planned targeting

multiple basins in Kenya, Ethiopia, Mozambique, Mauritania, French Guiana and our first operated well in

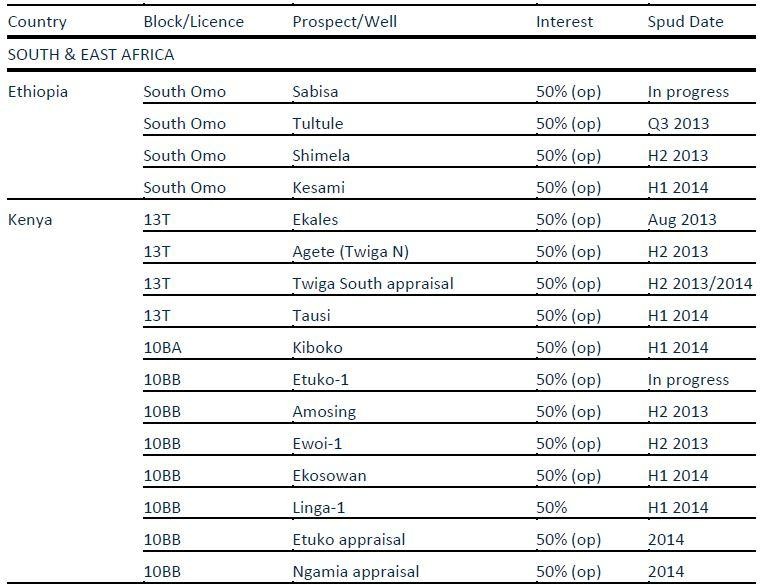

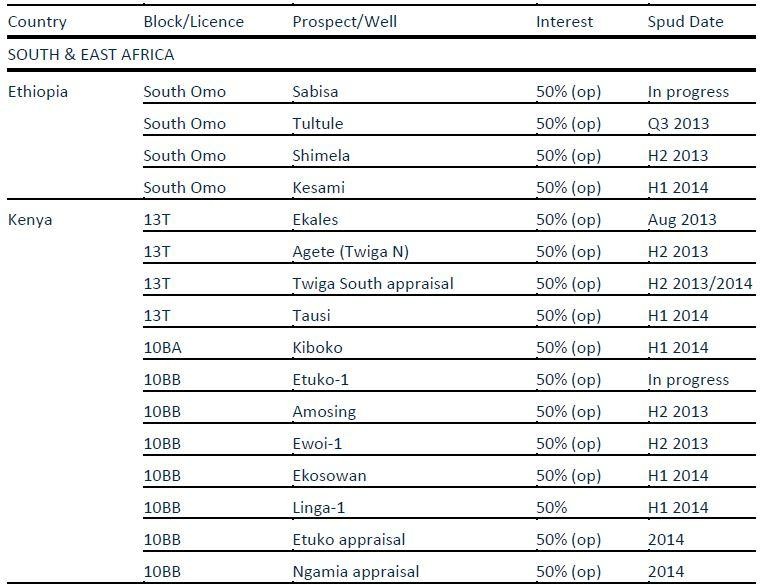

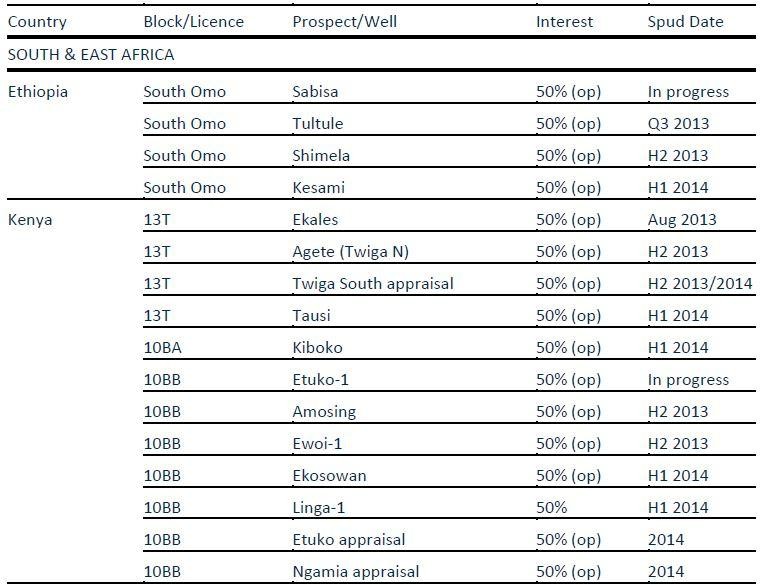

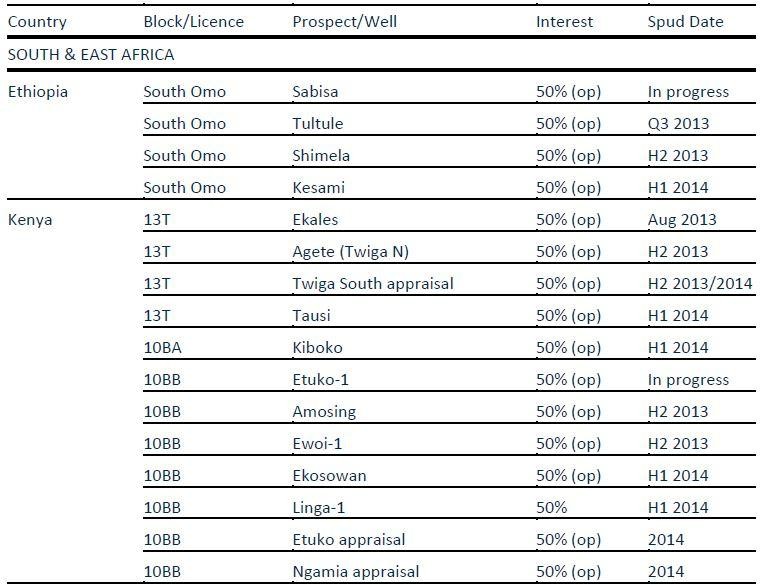

Norway. The current view of the rolling 12 month exploration and appraisal programme is contained in Table 1

at the end of this announcement.

Kenya

Exploration and Appraisal activity across Tullow’s operated acreage in Kenya continues to be very successful.

The flow testing programme at Ngamia-1 in the Lokichar Basin has now been successfully completed with a

cumulative constrained flow rate totalling 3,200 bpd of 25 to 35 degree API sweet waxy oil with no indication

of pressure depletion. Analysis of the test data from both the Ngamia-1 and Twiga South-1 wells has resulted in

the doubling of our previous estimates of net oil pay to 200 metres and 75 metres respectively, an optimised

flow rate potential of around 5,000 bopd per well and significantly increased discovered volumes. The

combined mean associated resources for the two discoveries is now estimated to be over 250 mmbo with the

potential to increase further following appraisal.

Ekales-1, the next exploration well in the Basin Bounding Fault Play on trend with Ngamia and Twiga-South, will

commence drilling in late July 2013. A 550sqkm 3D survey over the area, which will support our appraisal

programme, will commence in the third quarter of 2013. The full Kenya schedule is detailed in Table 1 at the

end of this announcement.

In May 2013, drilling commenced on the Etuko prospect, 14 km east of Twiga South-1 in Block 10BB. This is the

first test of the Basin Flank Play in the South Lockichar Basin and results of drilling, wireline logs and samples of

reservoir fluid confirm a new oil discovery with net pay of over 40 metres in the Auwerwer and Upper Lokhone

targets. The well is now drilling the Lower Lokhone sands and results from this lower section are expected by

the end of July.These results are an important step towards understanding the commerciality of the Lokichar Basin and, as we

advance towards the commercial threshold for development, Tullow continues to work in consultation with the

Government of Kenya on development options.

Following recent successes a third rig and a dedicated testing unit have been contracted to support increased

exploration and appraisal activity in Kenya by year-end.

Ethiopia

In Ethiopia, the Sabisa-1 well, the most northerly well drilled in our East African acreage to date, has

established that the hydrocarbon system in that area is oil prone. The well commenced drilling in the South

Omo licence in January 2013 but due to hole instability a sidetrack had to be drilled. The well has encountered

reservoir quality sands, oil and heavy gas shows indicating an oil prone source rock and a thick shale section

which should provide good seals for the numerous fault bounded traps identified in the basin. Following this

encouraging result, the decision has been taken to drill the nearby Tultule prospect, an attractive structure four

kilometres east of Sabisa-1. The well is expected to commence late in the third quarter of 2013. Numerous

additional follow-up prospects have been mapped in this part of the South Omo Block and in the adjacent

Chew Bahir Basin.

http://files.the-group.net/library/tullow/pdf/Tullow_Oil_plc…

Was Tullow in Kenya und Ethiopia plant:

Hier noch die Infos von Tullow:

..................

3 Jul 2013

Trading statement and operational update

•New oil discovery at Etuko-1; Sabisa-1 sidetrack establishes oil prone system

•Significant upgrade to Ngamia and Twiga-South oil resources

•Government approval of TEN project; contract awards under way

03 July 2013 – Tullow Oil plc (Tullow) issues an Operational Update summarising key activities since the Interim Management Statement on 8 May 2013 and a Trading Statement in respect of its half yearly financials to 30 June 2013. This is in advance of the Group’s Half-Yearly Results, which are scheduled for release on Wednesday 31 July 2013. The information contained herein has not been audited and may be subject to further review.

Download Tullow Oil plc Trading Statement and Operational Update

COMMENTING TODAY, AIDAN HEAVEY, CHIEF EXECUTIVE SAID:

“Over the past two months, Tullow has made major progress in three key areas of its operations. In Kenya, we have significantly upgraded our resource estimates for the South Lokichar Basin following the highly successful flow testing of Ngamia and Twiga-South. Additionally in Kenya, Tullow has made a new discovery at Etuko-1. In Ghana, the Government has approved the plan of development for the TEN project, our second offshore project in the country. In Uganda, we have made substantial progress with our partners and the Government and expect to sign a Memorandum of Understanding which will outline the key principles for the development of the Lake Albert Basin development. We also continue to have an industry-leading exploration and appraisal programme with results from key frontier wells in Kenya, Ethiopia, French Guiana, Norway and Mauritania all expected in the second half of the year. With high-quality production continuing to underpin our financial position, we are well placed for the remainder of this year and into 2014.”

http://www.tullowoil.com/index.asp?pageid=137&newsid=849

Operational Update

Exploration & Appraisal

In the first half of 2013 Tullow has drilled 9 exploration wells and 11 appraisal wells across the portfolio with a

60% overall success ratio. The most significant well results during the period were the Etuko-1 oil discovery in

Kenya and encountering an oil prone system in Ethiopia with the Sabisa-1 well. Additionally, we have

successfully flow-tested Ngamia-1 and Twiga South-1 in Kenya and materially increased our estimate of the

resources from both fields. In the second half of the year, some 20 exploration wells are planned targeting

multiple basins in Kenya, Ethiopia, Mozambique, Mauritania, French Guiana and our first operated well in

Norway. The current view of the rolling 12 month exploration and appraisal programme is contained in Table 1

at the end of this announcement.

Kenya

Exploration and Appraisal activity across Tullow’s operated acreage in Kenya continues to be very successful.

The flow testing programme at Ngamia-1 in the Lokichar Basin has now been successfully completed with a

cumulative constrained flow rate totalling 3,200 bpd of 25 to 35 degree API sweet waxy oil with no indication

of pressure depletion. Analysis of the test data from both the Ngamia-1 and Twiga South-1 wells has resulted in

the doubling of our previous estimates of net oil pay to 200 metres and 75 metres respectively, an optimised

flow rate potential of around 5,000 bopd per well and significantly increased discovered volumes. The

combined mean associated resources for the two discoveries is now estimated to be over 250 mmbo with the

potential to increase further following appraisal.

Ekales-1, the next exploration well in the Basin Bounding Fault Play on trend with Ngamia and Twiga-South, will

commence drilling in late July 2013. A 550sqkm 3D survey over the area, which will support our appraisal

programme, will commence in the third quarter of 2013. The full Kenya schedule is detailed in Table 1 at the

end of this announcement.

In May 2013, drilling commenced on the Etuko prospect, 14 km east of Twiga South-1 in Block 10BB. This is the

first test of the Basin Flank Play in the South Lockichar Basin and results of drilling, wireline logs and samples of

reservoir fluid confirm a new oil discovery with net pay of over 40 metres in the Auwerwer and Upper Lokhone

targets. The well is now drilling the Lower Lokhone sands and results from this lower section are expected by

the end of July.These results are an important step towards understanding the commerciality of the Lokichar Basin and, as we

advance towards the commercial threshold for development, Tullow continues to work in consultation with the

Government of Kenya on development options.

Following recent successes a third rig and a dedicated testing unit have been contracted to support increased

exploration and appraisal activity in Kenya by year-end.

Ethiopia

In Ethiopia, the Sabisa-1 well, the most northerly well drilled in our East African acreage to date, has

established that the hydrocarbon system in that area is oil prone. The well commenced drilling in the South

Omo licence in January 2013 but due to hole instability a sidetrack had to be drilled. The well has encountered

reservoir quality sands, oil and heavy gas shows indicating an oil prone source rock and a thick shale section

which should provide good seals for the numerous fault bounded traps identified in the basin. Following this

encouraging result, the decision has been taken to drill the nearby Tultule prospect, an attractive structure four

kilometres east of Sabisa-1. The well is expected to commence late in the third quarter of 2013. Numerous

additional follow-up prospects have been mapped in this part of the South Omo Block and in the adjacent

Chew Bahir Basin.

http://files.the-group.net/library/tullow/pdf/Tullow_Oil_plc…

Was Tullow in Kenya und Ethiopia plant:

lapsus calami:

eppur

eppur

...epur si muove