Africa Oil Corp. - World-Class East Africa Oil Exploration (Seite 194)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 28.04.24 15:36:08 von

neuester Beitrag 28.04.24 15:36:08 von

Beiträge: 4.121

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 5

Gesamt: 628.772

Gesamt: 628.772

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AFZ

1,6600

EUR

+1,22 %

+0,0200 EUR

Letzter Kurs 20:35:16 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 4,8050 | +39,52 | |

| 1,2000 | +29,03 | |

| 1,0400 | +18,18 | |

| 5,6270 | +15,44 | |

| 14,990 | +15,31 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 2,8850 | -7,23 | |

| 175,00 | -7,35 | |

| 2,0500 | -9,69 | |

| 1,0340 | -18,97 | |

| 5,9460 | -75,48 |

Beitrag zu dieser Diskussion schreiben

Schon merkwürdig, dass der Shortbestand wieder leicht gestiegen ist.

Short Summary

Short Volume As Of

1,516,309 31/Mar/2013

1,460,613 15/Mar/2013

1,563,408 28/Feb/2013

http://infoventure.tsx.com/TSXVenture/TSXVentureHttpControll…

Short Summary

Short Volume As Of

1,516,309 31/Mar/2013

1,460,613 15/Mar/2013

1,563,408 28/Feb/2013

http://infoventure.tsx.com/TSXVenture/TSXVentureHttpControll…

Goldman Sachs covert AOI - imho eine etwas eigenwillige Betrachtungsweise...

---------------

Goldman Sachs: Africa Oil's assets have great potential

By: Direct / Business World

Published today, 10:241 comment

Goldman Sachs has initiated coverage of Africa Oil, recommending neutral, target price $ 60.

It is clear from an analysis of 4 april.

The investment bank is basically positive to Africa Oil, whose assets are estimated as attractive with great potential. The risk level of the company's business is relatively high, so that even more interesting companies are elsewhere in the sector, according to the bank's analysts.

The majority of the company's activities in 2013 focused on the only partially translucent blocks 10BB and 13T in Kenya.

"While this should lead to a number of catalysts during the year, we believe that the market price already reflects exploration success in these blocks," wrote Goldman Sachs.

The target price $ 60 [Anm.: Währung muss auf SEK lauten] applies for 12 months and is based on an average oil price of $ 100 per barrel.

By: Direct / Business World

Email reporter

http://www.affarsvarlden.se/hem/nyheter/article3671020.ece (google-übersetzt)

---------------

Goldman Sachs: Africa Oil's assets have great potential

By: Direct / Business World

Published today, 10:241 comment

Goldman Sachs has initiated coverage of Africa Oil, recommending neutral, target price $ 60.

It is clear from an analysis of 4 april.

The investment bank is basically positive to Africa Oil, whose assets are estimated as attractive with great potential. The risk level of the company's business is relatively high, so that even more interesting companies are elsewhere in the sector, according to the bank's analysts.

The majority of the company's activities in 2013 focused on the only partially translucent blocks 10BB and 13T in Kenya.

"While this should lead to a number of catalysts during the year, we believe that the market price already reflects exploration success in these blocks," wrote Goldman Sachs.

The target price $ 60 [Anm.: Währung muss auf SEK lauten] applies for 12 months and is based on an average oil price of $ 100 per barrel.

By: Direct / Business World

Email reporter

http://www.affarsvarlden.se/hem/nyheter/article3671020.ece (google-übersetzt)

Uhuru Kenyatta sucht also junges Personal für seine Führung.

29/03/2013

The Indian Ocean Newsletter N°1353

KENYA

Uhuru Kenyatta’s ‘young guard’

In a country where 75% of the population is under thirty, the outgoing Deputy Prime Minister Uhuru Kenyatta is banking on a group of young Turks to entice the youth vote. [275 words] [€5,2]

KENYA

Kenyatta’s problem with childhood friends

Uhuru Kenyatta is meditating on his future team in the State House. He is wondering whether to include two of his childhood friends whose reputations are questionable. [186 words] [€5,2]

29/03/2013

The Indian Ocean Newsletter N°1353

KENYA

Uhuru Kenyatta’s ‘young guard’

In a country where 75% of the population is under thirty, the outgoing Deputy Prime Minister Uhuru Kenyatta is banking on a group of young Turks to entice the youth vote. [275 words] [€5,2]

KENYA

Kenyatta’s problem with childhood friends

Uhuru Kenyatta is meditating on his future team in the State House. He is wondering whether to include two of his childhood friends whose reputations are questionable. [186 words] [€5,2]

http://www.taggesschau.de/ausland/kenia-unruhen-wahl100.html

"Odinga gratuliert Kenyatta" zum Wahlsieg.

"Mittlerweile scheint sich Lage aber wieder beruhigt zu haben. Kleinere Zusammenstöße gab es nur noch in Außenbezirken von Kisumu."

Klingt ja beruhigend. Das sollte das Vertrauen der Investoren in absehbarer Zeit wieder herstellen.

"Odinga gratuliert Kenyatta" zum Wahlsieg.

"Mittlerweile scheint sich Lage aber wieder beruhigt zu haben. Kleinere Zusammenstöße gab es nur noch in Außenbezirken von Kisumu."

Klingt ja beruhigend. Das sollte das Vertrauen der Investoren in absehbarer Zeit wieder herstellen.

Eine weitere gute Nachricht: Kenyas neuer Präsident heißt Kenyatta und wurde offiziell bestätigt. Die Wahlüberprüfung des höchsten Gericht Kenias kam zum Ergebnis, dass die Wahlen rechtmäßig sind und haben die vom bisherigen Amtsinhaber Odinga vorgebrachte Beschwerde abgewiesen.

http://www.tagesschau.de/multimedia/sendung/ts41188.html

Ab Minute 5:45.

http://www.tagesschau.de/multimedia/sendung/ts41188.html

Ab Minute 5:45.

Antwort auf Beitrag Nr.: 44.315.823 von gimo211 am 27.03.13 16:36:44Das Thema "AOI=Area Of Interest" wurde von der Presse aufgegriffen:

.....................

Tullow gets nod to fast-track commercial viability of Kenya’s oil

By Paul Wafula

Nairobi, Kenya: Tullow Oil has now changed tact in the evaluation of local oil deposits. The firm’s new move is meant to speed up the determination of the viability of commercial oil deposits.

The firm will now carry out a combined exploration and evaluation programme over Turkana’s Lokichar Basin – a departure from the well-by-well analysis.

This is after the British oil explorer’s received an approval from the Government to combine the exploration and evaluation programme in the Basin. The firm had submitted this proposal to the Ministry of Energy when filing its latest testing results and a notice of discovery.

Deposits justification

The change of tact according to the proposal is to speed up the exploration and evaluation work and reach a commercial threshold of reserves required to justify any large-scale oil development.

The revelation is contained in a report prepared by the Africa Oil Corporation, a Canadian oil and Gas Company presented to its shareholders on Wednesday. Africa Oil and Tullow Oil are prospecting for oil in the Basin in a joint venture.

“Following this notice of discovery, the Ministry of Energy has agreed to the Tullow proposal, as operator of Blocks 10BB and 13T, to carry out a combined exploration and evaluation programme over a defined Area of Interest (AOI),” the highlights of the 2012 Financial and Operating report read in part.

“This includes all of the mapped prospects and leads along the basin bounding fault on the western edge of the Lokichar Basin.”

Tullow has a 50 per cent operating interest in the Twiga South-1 well, Block 13T, with the Africa Oil holding the remaining. “The basis of the AOI approach is to adopt a basin-wide approach to concurrently explore and evaluate the area as opposed to undertaking well-by-well appraisals for each discovery well,” the report adds.

Tullow and its partner have so far struck oil in two wells in the Lokichar Basin. The first discovery was in Ngamia 1 well located in the same basin. Several months later, the firm announced it had found oil of a similar quality at the Twiga South-1 well, just 22km away. “This basin-wide approach (AOI) is agreed to be the efficient and quickest approach to moving the exploration and evaluation work programme forward towards reaching a commercial threshold of reserves required to justify any large scale oil development,” it added.

The Canadian firm told its shareholders that its improved performance would help it drill and test multiple wells in the Turkana oil basin. “Africa Oil is encouraged with the results of our first two exploration wells in the Lockichar Basin.

Our improved financial position as a result of the non-brokered private placement and the farm outs completed in the fourth quarter of last year will enable the Company to drill and test multiple wells in the Lokichar sub-Basin,” Mr Keith Hill, President and chief executive of Africa Oil said in a statement accompanying the financial report. “This will be in an effort to reach commercial thresholds, and to drill multiple additional potential basin-opening wells across its vast East African exploration acreage,” he added.

Early this month, Tullow said it was moving to Lokichar Basin in Block 10BB to drill the ‘Etuko’ prospect following its suspension operations in Marsabit’s Paipai-1 well.

http://www.standardmedia.co.ke/?articleID=2000080362&pageNo=…

.....................

Tullow gets nod to fast-track commercial viability of Kenya’s oil

By Paul Wafula

Nairobi, Kenya: Tullow Oil has now changed tact in the evaluation of local oil deposits. The firm’s new move is meant to speed up the determination of the viability of commercial oil deposits.

The firm will now carry out a combined exploration and evaluation programme over Turkana’s Lokichar Basin – a departure from the well-by-well analysis.

This is after the British oil explorer’s received an approval from the Government to combine the exploration and evaluation programme in the Basin. The firm had submitted this proposal to the Ministry of Energy when filing its latest testing results and a notice of discovery.

Deposits justification

The change of tact according to the proposal is to speed up the exploration and evaluation work and reach a commercial threshold of reserves required to justify any large-scale oil development.

The revelation is contained in a report prepared by the Africa Oil Corporation, a Canadian oil and Gas Company presented to its shareholders on Wednesday. Africa Oil and Tullow Oil are prospecting for oil in the Basin in a joint venture.

“Following this notice of discovery, the Ministry of Energy has agreed to the Tullow proposal, as operator of Blocks 10BB and 13T, to carry out a combined exploration and evaluation programme over a defined Area of Interest (AOI),” the highlights of the 2012 Financial and Operating report read in part.

“This includes all of the mapped prospects and leads along the basin bounding fault on the western edge of the Lokichar Basin.”

Tullow has a 50 per cent operating interest in the Twiga South-1 well, Block 13T, with the Africa Oil holding the remaining. “The basis of the AOI approach is to adopt a basin-wide approach to concurrently explore and evaluate the area as opposed to undertaking well-by-well appraisals for each discovery well,” the report adds.

Tullow and its partner have so far struck oil in two wells in the Lokichar Basin. The first discovery was in Ngamia 1 well located in the same basin. Several months later, the firm announced it had found oil of a similar quality at the Twiga South-1 well, just 22km away. “This basin-wide approach (AOI) is agreed to be the efficient and quickest approach to moving the exploration and evaluation work programme forward towards reaching a commercial threshold of reserves required to justify any large scale oil development,” it added.

The Canadian firm told its shareholders that its improved performance would help it drill and test multiple wells in the Turkana oil basin. “Africa Oil is encouraged with the results of our first two exploration wells in the Lockichar Basin.

Our improved financial position as a result of the non-brokered private placement and the farm outs completed in the fourth quarter of last year will enable the Company to drill and test multiple wells in the Lokichar sub-Basin,” Mr Keith Hill, President and chief executive of Africa Oil said in a statement accompanying the financial report. “This will be in an effort to reach commercial thresholds, and to drill multiple additional potential basin-opening wells across its vast East African exploration acreage,” he added.

Early this month, Tullow said it was moving to Lokichar Basin in Block 10BB to drill the ‘Etuko’ prospect following its suspension operations in Marsabit’s Paipai-1 well.

http://www.standardmedia.co.ke/?articleID=2000080362&pageNo=…

AOI hat mittlerweile die Homepage auf Vordermann gebracht, es wurden die Dokumente die im Zusammenhang mit dem Jahresbericht stehen veröffentlicht. Darin finden sich sehr detaillierte und hilfreiche Informationen  .

.

- Annual Report

http://www.africaoilcorp.com/i/pdf/2012AR.pdf

- Management's Discussion and Analysis

http://www.africaoilcorp.com/i/pdf/2012YE_MDA.pdf

- Annual Information Form

http://www.africaoilcorp.com/i/pdf/2012_AIF.pdf

- Year End Financials

http://www.africaoilcorp.com/i/pdf/2012YE_FS.pdf

- Management Information Circular

http://www.africaoilcorp.com/i/pdf/2012_MIC.pdf

Hier geht es zur Übersichtsseite: http://www.africaoilcorp.com/s/CFR.asp

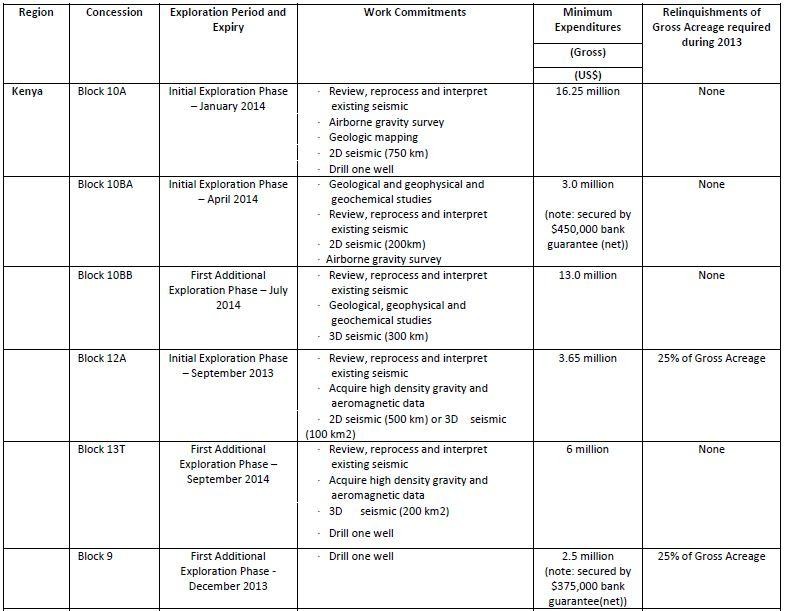

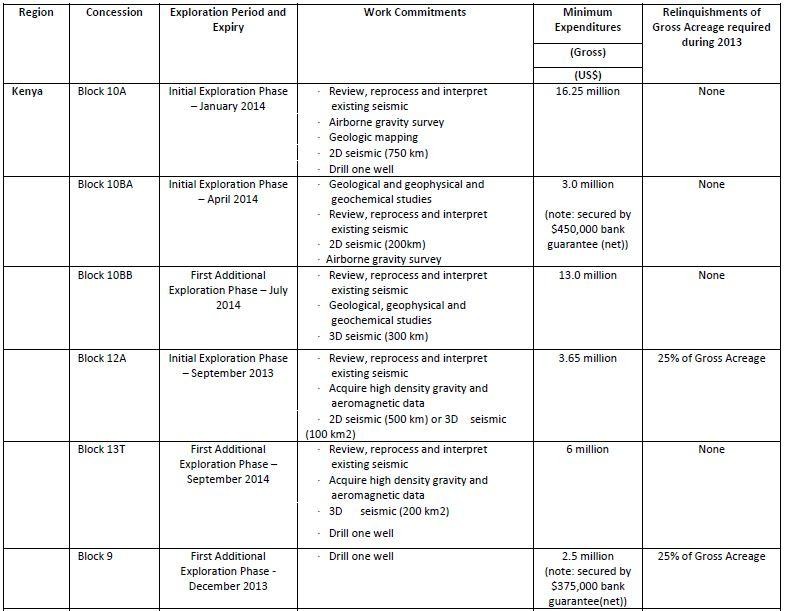

In den Dokumenten sind auch viele Übersichten und Infos z.B. zu den PSCs enthalten. Hier z.B. eine Zusammenfassung zu den Kenya-PSCs:

.

.- Annual Report

http://www.africaoilcorp.com/i/pdf/2012AR.pdf

- Management's Discussion and Analysis

http://www.africaoilcorp.com/i/pdf/2012YE_MDA.pdf

- Annual Information Form

http://www.africaoilcorp.com/i/pdf/2012_AIF.pdf

- Year End Financials

http://www.africaoilcorp.com/i/pdf/2012YE_FS.pdf

- Management Information Circular

http://www.africaoilcorp.com/i/pdf/2012_MIC.pdf

Hier geht es zur Übersichtsseite: http://www.africaoilcorp.com/s/CFR.asp

In den Dokumenten sind auch viele Übersichten und Infos z.B. zu den PSCs enthalten. Hier z.B. eine Zusammenfassung zu den Kenya-PSCs:

Wie immer, großartige Analysen von motz1!!

AOI = "Area of Interest" im zweiten Absatz - eine Abkürzung, die zu Verwirrung führen könnte...

Das heißt, wir sehen dort nun einen Approach zunächst die wildcats (es sind ja inzwischen ohnehin eher Appraisal Wells) der verschiedene prospects und leads zu drillen und nicht die bisherigen Discoveries in ihrem vollem Ausmass zu bestimmen. Also Ngamia und Twiga Appraisal Wells werden später gebohrt - zunächst die anderen prospects. Man hat für diese Strategie nun ein approval seitens der Kenianischen Behörden. Gut so. Und man ist sich seiner Sache wohl auch sehr sicher...

4 Rigs im Tertiary Trend bedeutet, dass noch in diesem Jahr ein weiteres neues Rig von Tullow für Kenia addiert werden wird. Wir werden also permanent Drillen und Testen und der Newsflow ist vermutlich auch immens... Zumal wir ja noch ein fünftes Rig gemeinsam mit Marathon in Block 9 haben werden und ein sechstes im Adiga-Block in Ethiopien mit New Age.

Wir schauen mit AOC (um jede Verwechslung zu vermeiden) auf spannende Wochen (Ngamia Flow Rates, Sabisa-1 results) Monate und Jahre... I Like it...

AOI = "Area of Interest" im zweiten Absatz - eine Abkürzung, die zu Verwirrung führen könnte...

Das heißt, wir sehen dort nun einen Approach zunächst die wildcats (es sind ja inzwischen ohnehin eher Appraisal Wells) der verschiedene prospects und leads zu drillen und nicht die bisherigen Discoveries in ihrem vollem Ausmass zu bestimmen. Also Ngamia und Twiga Appraisal Wells werden später gebohrt - zunächst die anderen prospects. Man hat für diese Strategie nun ein approval seitens der Kenianischen Behörden. Gut so. Und man ist sich seiner Sache wohl auch sehr sicher...

4 Rigs im Tertiary Trend bedeutet, dass noch in diesem Jahr ein weiteres neues Rig von Tullow für Kenia addiert werden wird. Wir werden also permanent Drillen und Testen und der Newsflow ist vermutlich auch immens... Zumal wir ja noch ein fünftes Rig gemeinsam mit Marathon in Block 9 haben werden und ein sechstes im Adiga-Block in Ethiopien mit New Age.

Wir schauen mit AOC (um jede Verwechslung zu vermeiden) auf spannende Wochen (Ngamia Flow Rates, Sabisa-1 results) Monate und Jahre... I Like it...

Zitat von motz1: The rig has now been moved to Ngamia-1 where testing operations on five to six zones have commenced.

Interessant. Das Ngamia-Testing läuft also bereits. Damit haben wir m.E. neben Sabisa einen weiteren möglichen Grund für den gestrigen Kursanstieg. Zudem spricht AOI nun vom Test von 5-6 Zonen, bisher waren es 4-5...

Zitat von motz1: •The Ministry of Energy in Kenya has been provided with the Twiga South-1 testing results, which accompanied a formal Notice of Discovery under the terms of the Block 13T PSC. Following this Notice of Discovery, the Ministry of Energy has agreed to the Tullow proposal, as operator of Blocks 10BB and 13T, to carry out a combined exploration and evaluation program over a defined Area of Interest ("AOI") including all of the mapped prospects and leads along the basin bounding fault on the western edge of the Lokichar Basin. The basis of the AOI approach is to adopt a basin-wide approach to concurrently explore and evaluate the area as opposed to undertaking well-by-well appraisals for each discovery well. This basin-wide approach, with regards to the AOI, is mutually agreed to be the most efficient and quickest approach to moving the exploration and evaluation work program forward towards reaching a commercial threshold of reserves required to justify any large scale oil development.

Dadurch dürften Planung und Umsetzung der Öl-Infrastruktur deutlich beschleunigt werden...

Zitat von motz1: Outlook

The Ngamia-1 and Twiga South-1 light oil discoveries in the Lokichar sub-basin, combined with positive results from reservoir analysis and flow rate tests at Twiga South-1, has led to a significant increase in the pace of exploration focused on tertiary rift basins. The Company and its joint venture partners in the tertiary rift play in east Africa plan to have four rigs operating by the end of 2013. The focus of these rigs in 2013 will be to continue drilling and testing wells in the Lokichar sub-basin in Kenya with improved efficiencies in an effort to reach commercial thresholds, and to drill potential basin-opener wells in the Turkana and the Chew B'hir basins in the tertiary rift play within Ethiopia. The Company and its partners will continue to acquire seismic data throughout the tertiary rift in Kenya and Ethiopia in an effort to add to its existing portfolio of drill-ready prospects.

Die Strategie liegt also weiterhin in der Konzentration auf das Lokichar Basin und damit im Nachweis der kommerziellen Nutzbarkeit...

Müsste ich heute einen Tip auf den Grund des gestrigen Kurssprungs abgeben, würde ich auf einen frühen Ngamia-Test-Erfolg setzen.

Wie immer alles imvho.

Mar 26, 2013 - 17:30 ET Africa Oil 2012 Financial and Operating Results -------------------------------------------------------------------------

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 26, 2013) - Africa Oil Corp. (TSX VENTURE:AOI)(NASDAQ OMX:AOI) ("Africa Oil", "the Company" or "AOC") is pleased to announce its financial and operating results for the year ended December 31, 2012.

•Following the significant light oil discovery at Ngamia-1 exploration well in Block 10BB, the Company and its partner moved the rig 22 kilometers to drill the Twiga South-1 exploration well in Block 13T (Kenya) which is on trend with Ngamia-1. Twiga South-1 successfully encountered 30 meters of net oil pay in three Auwerwer sandstone intervals analogous to Ngamia-1. The Company and its partner performed a DST on five intervals at Twiga South-1. The DST on three Auwerwer sandstone intervals resulted in a cumulative flow rate of 2,812 bopd, constrained by surface equipment. With optimized testing equipment, these flow rates are anticipated to have increased to a cumulative rate of approximately 5,200 bopd. Two deeper tests were also completed on the tight reservoir rock at the bottom of the well, and despite reconfirming the presence of movable oil, both zones produced at sub-commercial flow rates. The well has been suspended as a potential future production well. The rig has now been moved to Ngamia-1 where testing operations on five to six zones have commenced.

•The Ministry of Energy in Kenya has been provided with the Twiga South-1 testing results, which accompanied a formal Notice of Discovery under the terms of the Block 13T PSC. Following this Notice of Discovery, the Ministry of Energy has agreed to the Tullow proposal, as operator of Blocks 10BB and 13T, to carry out a combined exploration and evaluation program over a defined Area of Interest ("AOI") including all of the mapped prospects and leads along the basin bounding fault on the western edge of the Lokichar Basin. The basis of the AOI approach is to adopt a basin-wide approach to concurrently explore and evaluate the area as opposed to undertaking well-by-well appraisals for each discovery well. This basin-wide approach, with regards to the AOI, is mutually agreed to be the most efficient and quickest approach to moving the exploration and evaluation work program forward towards reaching a commercial threshold of reserves required to justify any large scale oil development.

•During December 2012, the Company completed a non-brokered private placement issuing an aggregate of 30 million common shares at a price of CAD$7.75 per common share for gross proceeds of CAD$232.5 million. The Company paid a finder's fee of CAD$8.3 million in cash on the private placement.

•The Company and its operating partners on Block 10A (Kenya) spud the Paipai-1 exploration well in September 2012. Paipai-1 was drilled to a total depth of 4,255 meters. Light hydrocarbons were encountered while drilling a 55 meter thick gross sandstone interval. Attempts to sample the reservoir fluid were unsuccessful and the hydrocarbons encountered while drilling were not recovered to surface. The Company and its partners were unable to test the well at the time due to the unavailability in country of testing equipment capable of handling the higher reservoir pressures encountered at this depth. As a result, the well has been temporarily suspended pending further data evaluation.

•The Company and its partners selected Sabisa-1 as the first drilling location in the South Omo Block (Ethiopia). Sabisa-1 spud in January 2013 and is currently drilling.

•In Puntland (Somalia), the Company, through its 44.6% ownership interest in Horn Petroleum Corporation ("Horn"), completed site restoration at both Shabeel-1 and Shabeel North-1 wells and demobilization from Puntland has been completed. While the Company was disappointed that the first two exploration wells in Puntland did not flow oil, the Company remains highly encouraged that all of the critical elements exist for oil accumulations and based on this encouragement, the Company and its partners have entered into the next exploration period in both the Dharoor Valley and Nugaal Valley PSC's which carry a commitment to drill one exploration well in each block by October 2015.

•The Company completed a farmout transaction with Marathon Oil Corporation ("Marathon") during the fourth quarter of 2012 whereby Marathon acquired a 50% interest in Block 9 (Kenya) and a 15% interest in Block 12A (Kenya). In accordance with the farmout agreement, Marathon paid the Company $32.0 million in consideration of past exploration expenditures, and has agreed to fund the Company's working interest share of future joint venture expenditures on these blocks to a maximum of $25.0 million. The Company has retained a 20% working interest in Block 12A and a 50% working interest in Block 9.

•The Company completed a farmout transaction with New Age (Africa Global Energy) Limited ("New Age") during the fourth quarter of 2012 whereby New Age acquired an additional 25% interest in the Company's Blocks 7 & 8 (Ethiopia), together with operatorship of Blocks 7 & 8 and the Adigala Area (Ethiopia). In accordance with the farmout agreement, New Age paid the Company $1.5 million in consideration of past exploration expenditures. The Company has retained a 30% working interest in Blocks 7/8.

•The Company continues to actively acquire, process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo with three seismic crews currently active.

•In first quarter of 2013, the Company executed a PSA for the Rift Basin Area in Ethiopia. Located north of the South Omo Block, the Rift Basin Area covers 42,519 square kilometers. This block is on trend with highly prospective blocks in the Tertiary rift valley including the South Omo Block in Ethiopia, and Kenyan Blocks 10BA, 10BB, 13T, and 12A.

•Africa Oil ended the quarter in a strong financial position with cash of $272.2 million and working capital of $237.7 million as compared to cash of $109.6 million and working capital of $90.2 million at December 31, 2011.

Keith Hill, President and CEO, commented, "Africa Oil is very encouraged with the results of our first two exploration wells in the Lockichar basin. Our improved financial position as a result of the non-brokered private placement and the farmouts completed in the fourth quarter of 2012 will enable the Company to drill and test multiple wells in the Lokichar sub-basin in Kenya in an effort to reach commercial thresholds, and to drill multiple additional potential basin-opening wells across its vast East African exploration acreage."

2012 Financial and Operating Highlights

[Anm.: Teil aus Darstellungsgründen entfernt]

Outlook

The Ngamia-1 and Twiga South-1 light oil discoveries in the Lokichar sub-basin, combined with positive results from reservoir analysis and flow rate tests at Twiga South-1, has led to a significant increase in the pace of exploration focused on tertiary rift basins. The Company and its joint venture partners in the tertiary rift play in east Africa plan to have four rigs operating by the end of 2013. The focus of these rigs in 2013 will be to continue drilling and testing wells in the Lokichar sub-basin in Kenya with improved efficiencies in an effort to reach commercial thresholds, and to drill potential basin-opener wells in the Turkana and the Chew B'hir basins in the tertiary rift play within Ethiopia. The Company and its partners will continue to acquire seismic data throughout the tertiary rift in Kenya and Ethiopia in an effort to add to its existing portfolio of drill-ready prospects.

The Company and its operating partner in Block 9 in Kenya are currently planning to drill the Bahasi-1 exploratory well. This well will be drilled on a large anticlinal structure targeting tertiary and cretaceous sandstones where six billion barrels of oil was discovered along trend in Sudan in a similar geologic setting. A follow-up well is also being considered towards the end of 2013 in Block 9. The Company and its operating partners in Blocks 7/8 in Ethiopia are currently planning to drill a well to appraise reservoir characteristics of Jurassic carbonates on the El Kuran oil accumulation. The main focus of this well is to establish commercial rates with acidizing, fraccing and horizontal sidetracks being considered.

http://africaoilcorp.mwnewsroom.com/press-releases/africa-oi…

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 26, 2013) - Africa Oil Corp. (TSX VENTURE:AOI)(NASDAQ OMX:AOI) ("Africa Oil", "the Company" or "AOC") is pleased to announce its financial and operating results for the year ended December 31, 2012.

•Following the significant light oil discovery at Ngamia-1 exploration well in Block 10BB, the Company and its partner moved the rig 22 kilometers to drill the Twiga South-1 exploration well in Block 13T (Kenya) which is on trend with Ngamia-1. Twiga South-1 successfully encountered 30 meters of net oil pay in three Auwerwer sandstone intervals analogous to Ngamia-1. The Company and its partner performed a DST on five intervals at Twiga South-1. The DST on three Auwerwer sandstone intervals resulted in a cumulative flow rate of 2,812 bopd, constrained by surface equipment. With optimized testing equipment, these flow rates are anticipated to have increased to a cumulative rate of approximately 5,200 bopd. Two deeper tests were also completed on the tight reservoir rock at the bottom of the well, and despite reconfirming the presence of movable oil, both zones produced at sub-commercial flow rates. The well has been suspended as a potential future production well. The rig has now been moved to Ngamia-1 where testing operations on five to six zones have commenced.

•The Ministry of Energy in Kenya has been provided with the Twiga South-1 testing results, which accompanied a formal Notice of Discovery under the terms of the Block 13T PSC. Following this Notice of Discovery, the Ministry of Energy has agreed to the Tullow proposal, as operator of Blocks 10BB and 13T, to carry out a combined exploration and evaluation program over a defined Area of Interest ("AOI") including all of the mapped prospects and leads along the basin bounding fault on the western edge of the Lokichar Basin. The basis of the AOI approach is to adopt a basin-wide approach to concurrently explore and evaluate the area as opposed to undertaking well-by-well appraisals for each discovery well. This basin-wide approach, with regards to the AOI, is mutually agreed to be the most efficient and quickest approach to moving the exploration and evaluation work program forward towards reaching a commercial threshold of reserves required to justify any large scale oil development.

•During December 2012, the Company completed a non-brokered private placement issuing an aggregate of 30 million common shares at a price of CAD$7.75 per common share for gross proceeds of CAD$232.5 million. The Company paid a finder's fee of CAD$8.3 million in cash on the private placement.

•The Company and its operating partners on Block 10A (Kenya) spud the Paipai-1 exploration well in September 2012. Paipai-1 was drilled to a total depth of 4,255 meters. Light hydrocarbons were encountered while drilling a 55 meter thick gross sandstone interval. Attempts to sample the reservoir fluid were unsuccessful and the hydrocarbons encountered while drilling were not recovered to surface. The Company and its partners were unable to test the well at the time due to the unavailability in country of testing equipment capable of handling the higher reservoir pressures encountered at this depth. As a result, the well has been temporarily suspended pending further data evaluation.

•The Company and its partners selected Sabisa-1 as the first drilling location in the South Omo Block (Ethiopia). Sabisa-1 spud in January 2013 and is currently drilling.

•In Puntland (Somalia), the Company, through its 44.6% ownership interest in Horn Petroleum Corporation ("Horn"), completed site restoration at both Shabeel-1 and Shabeel North-1 wells and demobilization from Puntland has been completed. While the Company was disappointed that the first two exploration wells in Puntland did not flow oil, the Company remains highly encouraged that all of the critical elements exist for oil accumulations and based on this encouragement, the Company and its partners have entered into the next exploration period in both the Dharoor Valley and Nugaal Valley PSC's which carry a commitment to drill one exploration well in each block by October 2015.

•The Company completed a farmout transaction with Marathon Oil Corporation ("Marathon") during the fourth quarter of 2012 whereby Marathon acquired a 50% interest in Block 9 (Kenya) and a 15% interest in Block 12A (Kenya). In accordance with the farmout agreement, Marathon paid the Company $32.0 million in consideration of past exploration expenditures, and has agreed to fund the Company's working interest share of future joint venture expenditures on these blocks to a maximum of $25.0 million. The Company has retained a 20% working interest in Block 12A and a 50% working interest in Block 9.

•The Company completed a farmout transaction with New Age (Africa Global Energy) Limited ("New Age") during the fourth quarter of 2012 whereby New Age acquired an additional 25% interest in the Company's Blocks 7 & 8 (Ethiopia), together with operatorship of Blocks 7 & 8 and the Adigala Area (Ethiopia). In accordance with the farmout agreement, New Age paid the Company $1.5 million in consideration of past exploration expenditures. The Company has retained a 30% working interest in Blocks 7/8.

•The Company continues to actively acquire, process and interpret 2D seismic over Blocks 10BA, 10BB, 12A, 13T and South Omo with three seismic crews currently active.

•In first quarter of 2013, the Company executed a PSA for the Rift Basin Area in Ethiopia. Located north of the South Omo Block, the Rift Basin Area covers 42,519 square kilometers. This block is on trend with highly prospective blocks in the Tertiary rift valley including the South Omo Block in Ethiopia, and Kenyan Blocks 10BA, 10BB, 13T, and 12A.

•Africa Oil ended the quarter in a strong financial position with cash of $272.2 million and working capital of $237.7 million as compared to cash of $109.6 million and working capital of $90.2 million at December 31, 2011.

Keith Hill, President and CEO, commented, "Africa Oil is very encouraged with the results of our first two exploration wells in the Lockichar basin. Our improved financial position as a result of the non-brokered private placement and the farmouts completed in the fourth quarter of 2012 will enable the Company to drill and test multiple wells in the Lokichar sub-basin in Kenya in an effort to reach commercial thresholds, and to drill multiple additional potential basin-opening wells across its vast East African exploration acreage."

2012 Financial and Operating Highlights

[Anm.: Teil aus Darstellungsgründen entfernt]

Outlook

The Ngamia-1 and Twiga South-1 light oil discoveries in the Lokichar sub-basin, combined with positive results from reservoir analysis and flow rate tests at Twiga South-1, has led to a significant increase in the pace of exploration focused on tertiary rift basins. The Company and its joint venture partners in the tertiary rift play in east Africa plan to have four rigs operating by the end of 2013. The focus of these rigs in 2013 will be to continue drilling and testing wells in the Lokichar sub-basin in Kenya with improved efficiencies in an effort to reach commercial thresholds, and to drill potential basin-opener wells in the Turkana and the Chew B'hir basins in the tertiary rift play within Ethiopia. The Company and its partners will continue to acquire seismic data throughout the tertiary rift in Kenya and Ethiopia in an effort to add to its existing portfolio of drill-ready prospects.

The Company and its operating partner in Block 9 in Kenya are currently planning to drill the Bahasi-1 exploratory well. This well will be drilled on a large anticlinal structure targeting tertiary and cretaceous sandstones where six billion barrels of oil was discovered along trend in Sudan in a similar geologic setting. A follow-up well is also being considered towards the end of 2013 in Block 9. The Company and its operating partners in Blocks 7/8 in Ethiopia are currently planning to drill a well to appraise reservoir characteristics of Jurassic carbonates on the El Kuran oil accumulation. The main focus of this well is to establish commercial rates with acidizing, fraccing and horizontal sidetracks being considered.

http://africaoilcorp.mwnewsroom.com/press-releases/africa-oi…