Wann und wie kommt der nächste Crash? (Seite 61)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 1

Gesamt: 179.926

Gesamt: 179.926

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 26.04.24, 14:53 | 662 | |

| gestern 23:32 | 257 | |

| heute 04:11 | 233 | |

| gestern 18:36 | 214 | |

| heute 00:14 | 210 | |

| heute 00:33 | 209 | |

| gestern 22:06 | 197 | |

| gestern 22:18 | 128 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.159,50 | -0,16 | 207 | |||

| 2. | 2. | 194,05 | +15,31 | 119 | |||

| 3. | 3. | 2.325,58 | -0,40 | 59 | |||

| 4. | 4. | 65,95 | -2,66 | 50 | |||

| 5. | 5. | 7,9000 | +7,48 | 46 | |||

| 6. | 6. | 0,8300 | -29,66 | 39 | |||

| 7. | 7. | 15,116 | -5,73 | 38 | |||

| 8. | 8. | 0,1785 | -7,03 | 30 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 66.520.700 von faultcode am 20.01.21 12:00:16

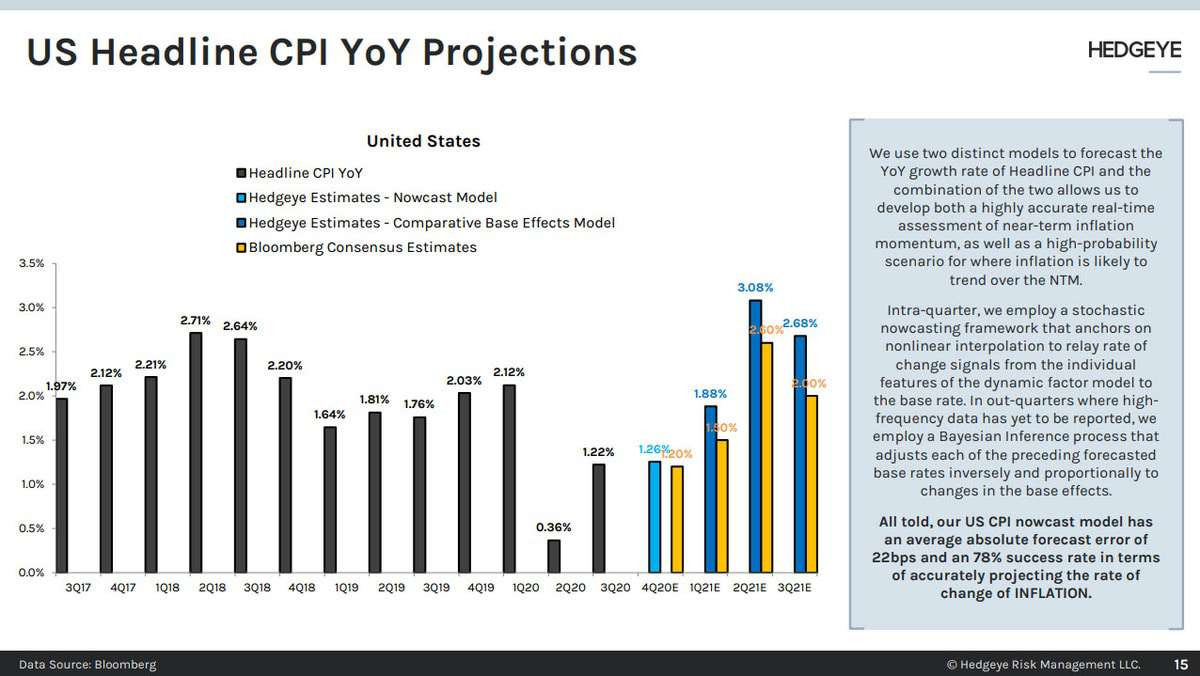

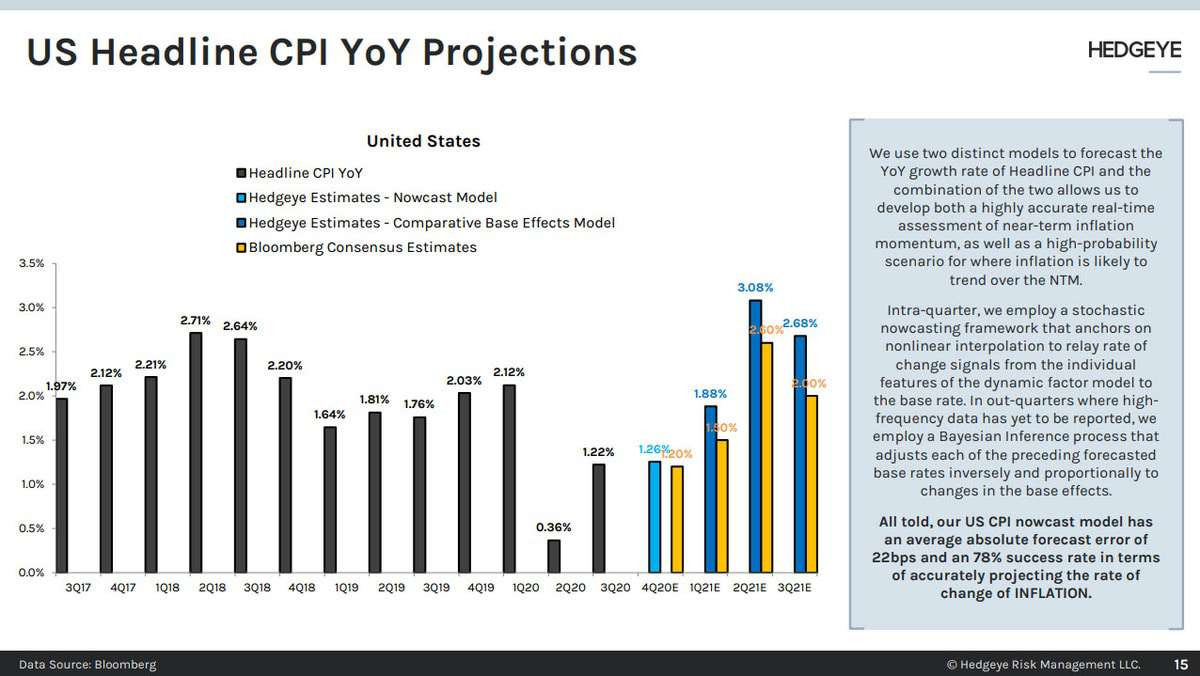

https://app.hedgeye.com/insights/94343-mccullough-where-s-in…

https://app.hedgeye.com/insights/94343-mccullough-where-s-in…

Antwort auf Beitrag Nr.: 66.417.941 von faultcode am 13.01.21 13:01:13

19.1.

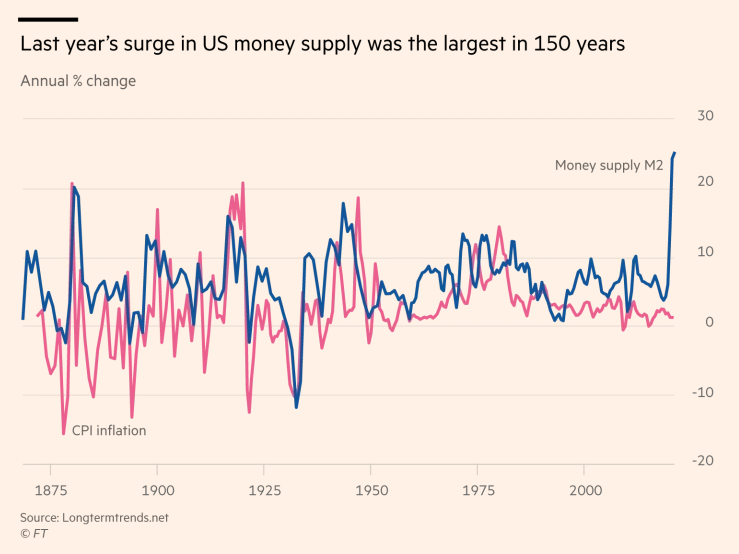

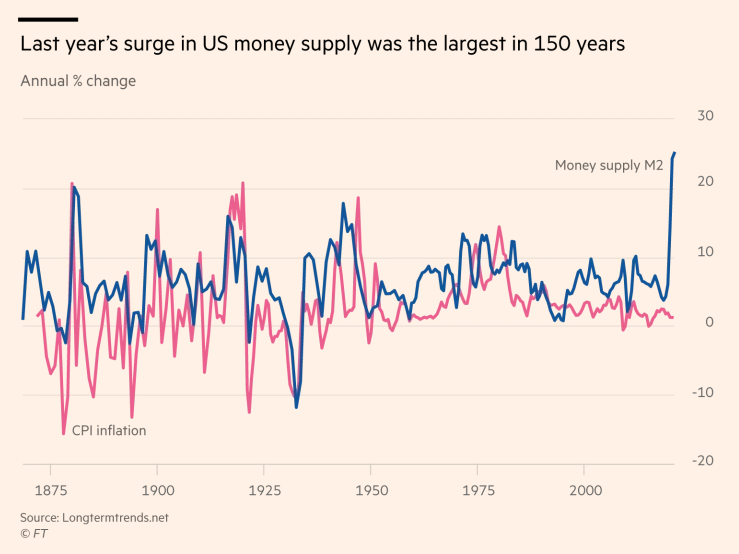

Higher inflation is coming and it will hit bondholders

Historic increase in monetary supply to fight Covid crisis will lead to higher consumer prices

https://www.ft.com/content/6536113f-f509-41e2-bee0-597ed9084…

...

I certainly do not expect hyperinflation, or even high single-digit inflation. But I do believe that inflation will run well above the Fed’s 2 per cent target, and will do so for several years.

This is not good for bondholders. The huge demand for Treasuries, which has kept their yields so low, is driven by their strong short-term hedge characteristics — their ability to cushion sharp declines in risk assets.

But this insurance is going to get more and more expensive as higher consumer prices erode the purchasing power of these bonds. It is inevitable that bond rates will rise, and rise far more than now envisioned by the Fed and most forecasters.

The multi-trillion dollar war on Covid-19 was not paid for by higher taxes or bond sales to the public. But there is no such thing as a free lunch. It will be the Treasury bondholder, through rising inflation, who will be paying for the unprecedented fiscal and monetary stimulus over the past year.

(FC: Format)

"there is no such thing as a free lunch"

Jeremy Siegel in der FT:19.1.

Higher inflation is coming and it will hit bondholders

Historic increase in monetary supply to fight Covid crisis will lead to higher consumer prices

https://www.ft.com/content/6536113f-f509-41e2-bee0-597ed9084…

...

I certainly do not expect hyperinflation, or even high single-digit inflation. But I do believe that inflation will run well above the Fed’s 2 per cent target, and will do so for several years.

This is not good for bondholders. The huge demand for Treasuries, which has kept their yields so low, is driven by their strong short-term hedge characteristics — their ability to cushion sharp declines in risk assets.

But this insurance is going to get more and more expensive as higher consumer prices erode the purchasing power of these bonds. It is inevitable that bond rates will rise, and rise far more than now envisioned by the Fed and most forecasters.

The multi-trillion dollar war on Covid-19 was not paid for by higher taxes or bond sales to the public. But there is no such thing as a free lunch. It will be the Treasury bondholder, through rising inflation, who will be paying for the unprecedented fiscal and monetary stimulus over the past year.

(FC: Format)

Antwort auf Beitrag Nr.: 66.473.687 von faultcode am 16.01.21 23:55:23..und Janet Yellen will viel Geld unter's Volk bringen:

...

With interest rates at historic lows, the best course for American economic policy is to “act big,” said Janet Yellen, President-elect Joe Biden’s pick to run the Treasury Department.

In testimony prepared for delivery to the Senate Finance Committee on Tuesday, Yellen said that she and the president-elect have an appreciation for the country’s debt burden.

“But right now, with interest rates at historic lows, the smartest thing we can do is act big,” Yellen said. “I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”

Her advance remarks were obtained by MarketWatch. Yellen is no stranger to Washington, having been the first woman to lead the Federal Reserve. If confirmed by the Senate, she would be the first female Treasury secretary.

...

https://www.marketwatch.com/story/yellen-says-smartest-thing…

...

With interest rates at historic lows, the best course for American economic policy is to “act big,” said Janet Yellen, President-elect Joe Biden’s pick to run the Treasury Department.

In testimony prepared for delivery to the Senate Finance Committee on Tuesday, Yellen said that she and the president-elect have an appreciation for the country’s debt burden.

“But right now, with interest rates at historic lows, the smartest thing we can do is act big,” Yellen said. “I believe the benefits will far outweigh the costs, especially if we care about helping people who have been struggling for a very long time.”

Her advance remarks were obtained by MarketWatch. Yellen is no stranger to Washington, having been the first woman to lead the Federal Reserve. If confirmed by the Senate, she would be the first female Treasury secretary.

...

https://www.marketwatch.com/story/yellen-says-smartest-thing…

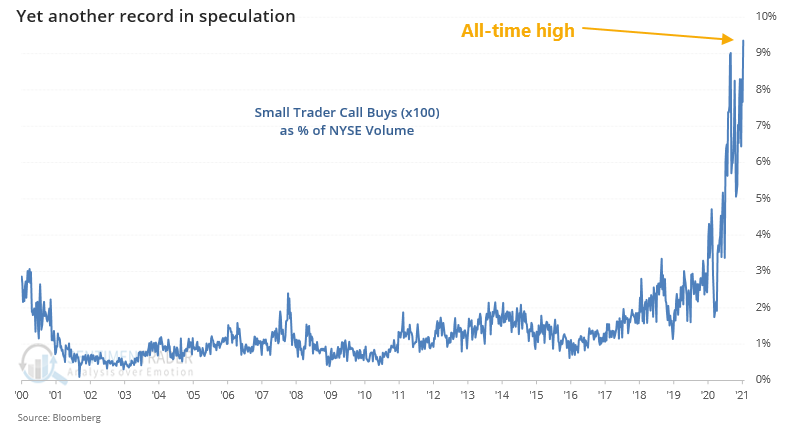

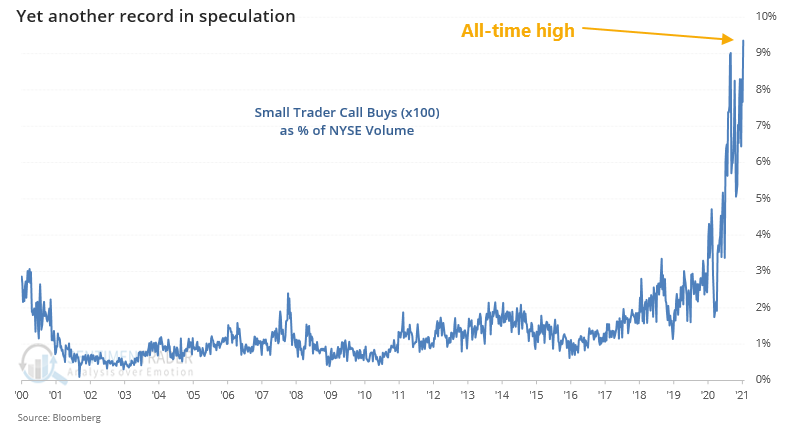

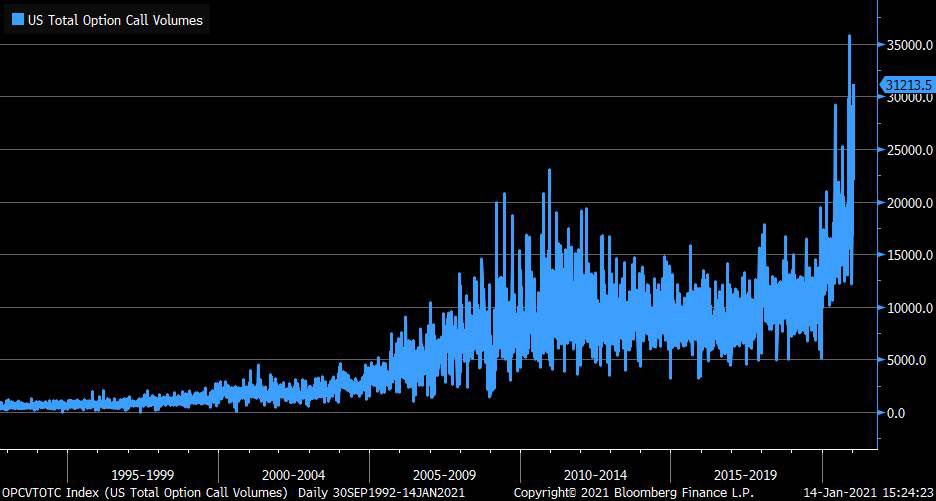

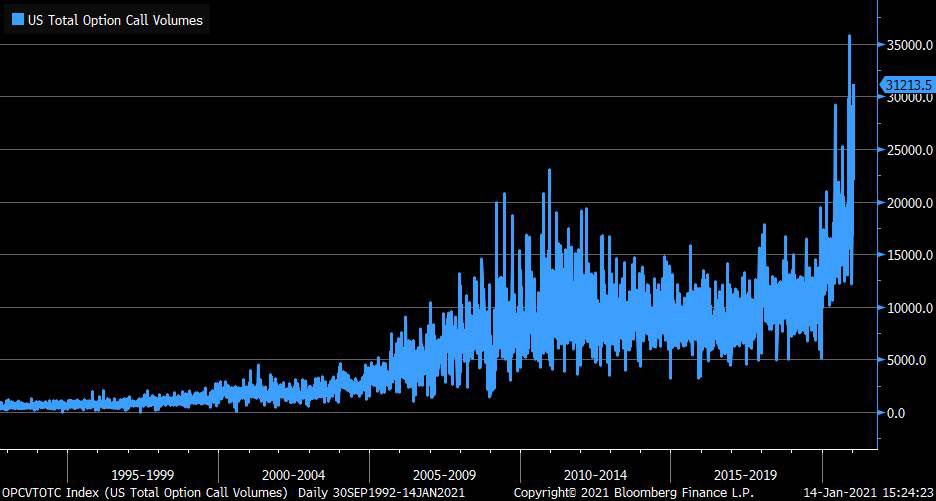

die Tech-Bubble 1999/2000 war ein laues Lüftchen dagegen:

Antwort auf Beitrag Nr.: 66.457.325 von faultcode am 15.01.21 14:11:13insofern steckt in diesem Witz zur Zeit viel Wahrheit:

https://twitter.com/kerberos007/status/1349885779103920133

https://twitter.com/kerberos007/status/1349885779103920133

Antwort auf Beitrag Nr.: 66.457.169 von faultcode am 15.01.21 14:02:19..und nun ist auch das untere Ende der "Freßkette" drangekommen, der OTC-Markt:

aus:

14.1.

Newbies Discover Penny Stocks and 1 Trillion Shares Get Traded

https://www.msn.com/en-us/money/markets/newbies-discover-pen…

...

“When you see all this stuff coming out and all these people talking about penny stocks and pushing them higher, it’s got to make you wonder, where is the top? Is it too frothy? Is there too much exuberance out there?” said Ryan Nauman, market strategist at Informa Financial Intelligence’s Zephyr.

“That’s my concern -- the fear of missing out is driving stock prices.”

...

Tag:

• FOMO

aus:

14.1.

Newbies Discover Penny Stocks and 1 Trillion Shares Get Traded

https://www.msn.com/en-us/money/markets/newbies-discover-pen…

...

“When you see all this stuff coming out and all these people talking about penny stocks and pushing them higher, it’s got to make you wonder, where is the top? Is it too frothy? Is there too much exuberance out there?” said Ryan Nauman, market strategist at Informa Financial Intelligence’s Zephyr.

“That’s my concern -- the fear of missing out is driving stock prices.”

...

Tag:

• FOMO

Antwort auf Beitrag Nr.: 66.457.097 von faultcode am 15.01.21 13:58:08siehe auch hier:

(wobei, siehe oben, das zumindest bislang Calls auf Einzel- nicht Index-Werte waren, die für den Anstieg sorgten)

Tag:

• Gamma squeeze

(wobei, siehe oben, das zumindest bislang Calls auf Einzel- nicht Index-Werte waren, die für den Anstieg sorgten)

Tag:

• Gamma squeeze

Antwort auf Beitrag Nr.: 66.456.989 von faultcode am 15.01.21 13:51:25auch dieser Vorschlag würde bei vielen US-Kleinanlegern, die das eigentlich nicht nötig hätten, selbst derzeit nicht, Cash freihalten, um...

...damit auch Call-Optionen zu kaufen:

https://www.marketwatch.com/story/biden-calls-for-extending-…

...damit auch Call-Optionen zu kaufen:

https://www.marketwatch.com/story/biden-calls-for-extending-…

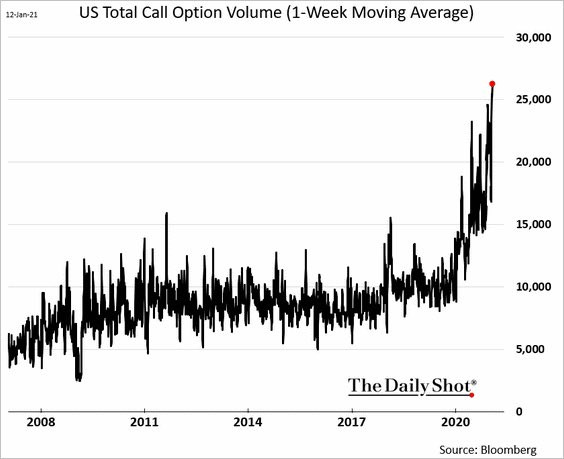

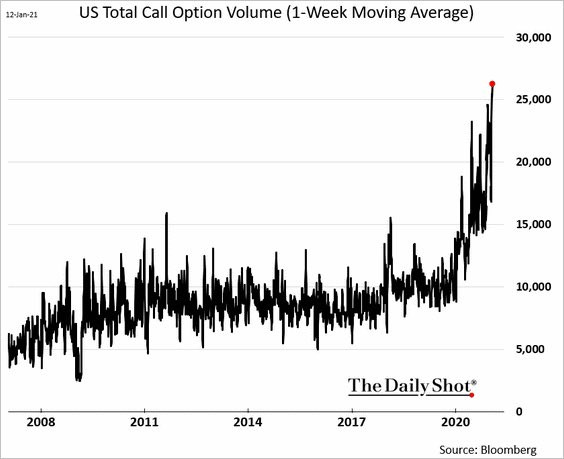

Antwort auf Beitrag Nr.: 66.437.135 von faultcode am 14.01.21 13:10:55Yesterday saw second-highest call option volume on record … 31.2 million

https://twitter.com/LizAnnSonders/status/1350060269645537280

https://twitter.com/LizAnnSonders/status/1350060269645537280

Tag:

• Playbook