Wann und wie kommt der nächste Crash? (Seite 8)

eröffnet am 15.07.14 10:19:59 von

neuester Beitrag 23.01.24 14:11:46 von

neuester Beitrag 23.01.24 14:11:46 von

Beiträge: 1.339

ID: 1.196.416

ID: 1.196.416

Aufrufe heute: 4

Gesamt: 179.920

Gesamt: 179.920

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 19:46 | 6756 | |

| vor 1 Stunde | 5393 | |

| vor 51 Minuten | 4549 | |

| vor 43 Minuten | 4226 | |

| vor 1 Stunde | 2947 | |

| heute 19:32 | 2179 | |

| heute 14:53 | 1971 | |

| vor 29 Minuten | 1717 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.174,00 | +0,55 | 229 | |||

| 2. | 3. | 0,1885 | -0,26 | 96 | |||

| 3. | 2. | 1,1800 | -14,49 | 87 | |||

| 4. | 5. | 9,3575 | +0,27 | 60 | |||

| 5. | 4. | 168,39 | -1,05 | 55 | |||

| 6. | Neu! | 0,4250 | -1,16 | 38 | |||

| 7. | Neu! | 4,8025 | +6,45 | 34 | |||

| 8. | Neu! | 11,828 | +13,73 | 32 |

Beitrag zu dieser Diskussion schreiben

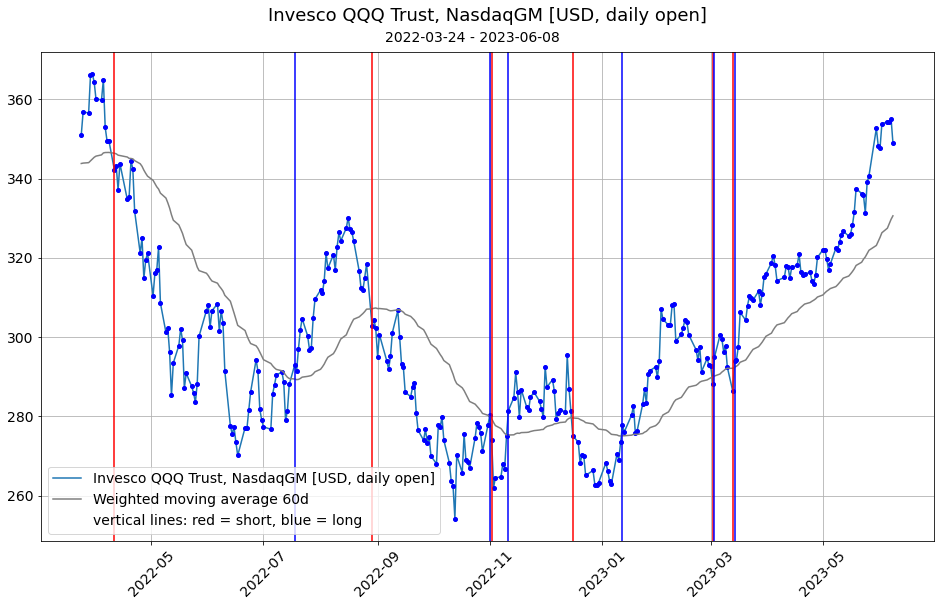

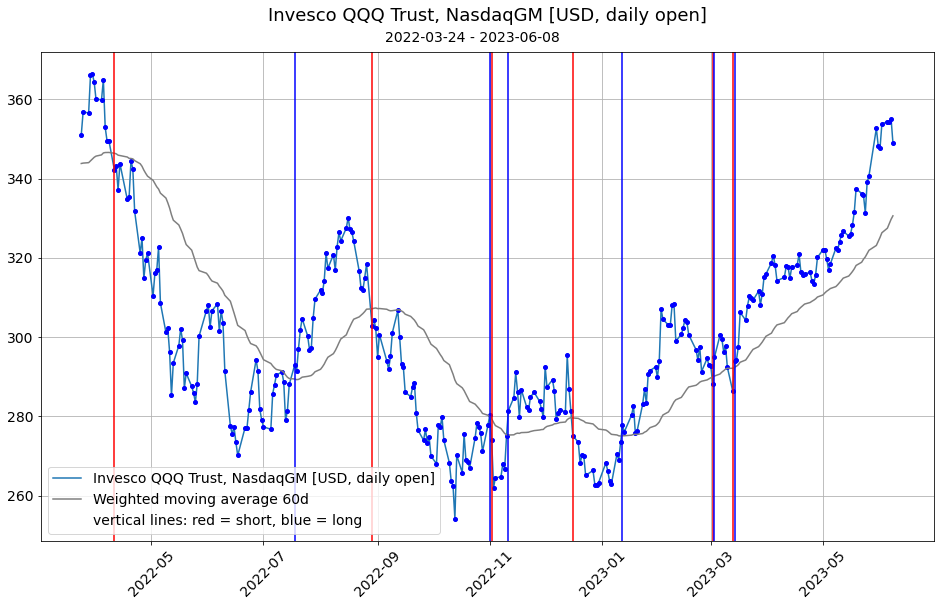

dasselbe Spiel wie hier (Evotec), nur beim NASDAQ100-Proxy, dem $QQQ ETF: https://www.wallstreet-online.de/diskussion/1267359-1-10/typ…

=> WMA50 > EMA50 > HMA50

=> etwas handoptimiert => WMA55:

Die blauen (long) und roten (short) Vertikal-Linien können sehr eng beieinander liegen (also von Handelstag, Open zu Handelstag, Open wechseln):

Auf eine blaue Linie muss sinngemäß immer eine rote folgen und umgekehrt.

Long seit 14.3.2023 (Close). Wenn die letzten drei Jahre ein Maßstab sein sollen, dann ist am Dienstag, 15.08.2023, also nach 154 Kalendertagen, sehr wahrscheinlich Schluß mit der laufenden Rally.

=> WMA50 > EMA50 > HMA50

=> etwas handoptimiert => WMA55:

Die blauen (long) und roten (short) Vertikal-Linien können sehr eng beieinander liegen (also von Handelstag, Open zu Handelstag, Open wechseln):

Auf eine blaue Linie muss sinngemäß immer eine rote folgen und umgekehrt.

Long seit 14.3.2023 (Close). Wenn die letzten drei Jahre ein Maßstab sein sollen, dann ist am Dienstag, 15.08.2023, also nach 154 Kalendertagen, sehr wahrscheinlich Schluß mit der laufenden Rally.

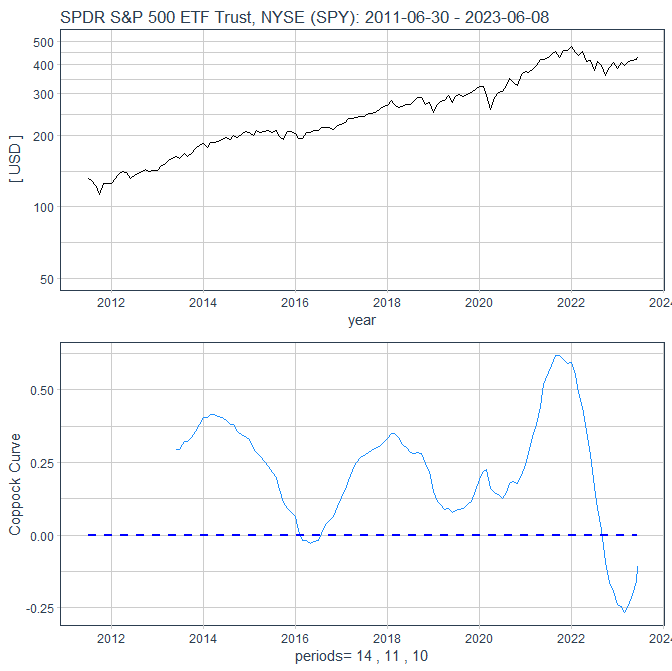

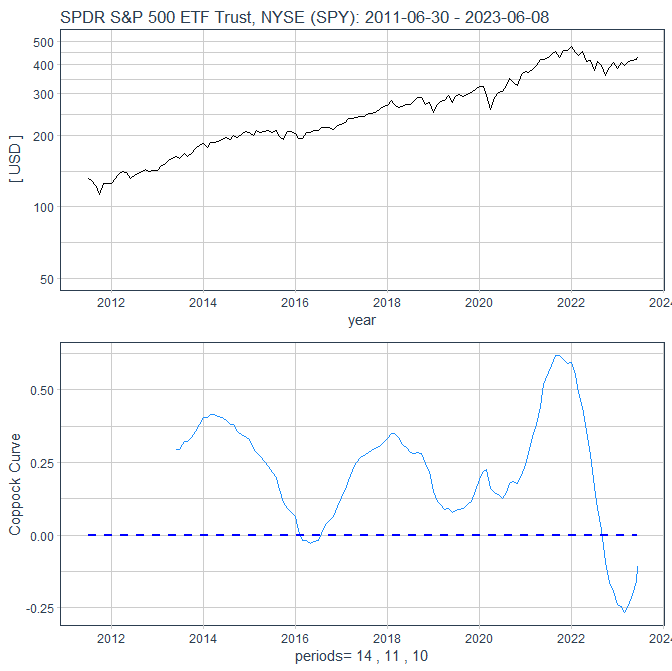

Antwort auf Beitrag Nr.: 73.584.342 von faultcode am 30.03.23 16:06:56Update Coppock Curve:

• vom vielfach bereits ausgerufenen Ende des Bärenmarktes ("a 20% rise from a recent low") kann demnach noch keine Rede sein (nicht > 0):

Aber die Erholung vom letzten Boden aus verlief bislang schon recht scharf.

• vom vielfach bereits ausgerufenen Ende des Bärenmarktes ("a 20% rise from a recent low") kann demnach noch keine Rede sein (nicht > 0):

Aber die Erholung vom letzten Boden aus verlief bislang schon recht scharf.

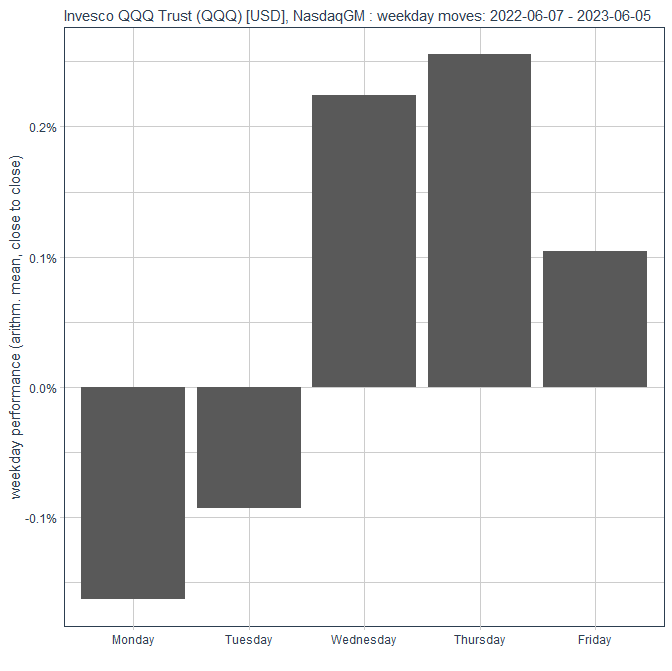

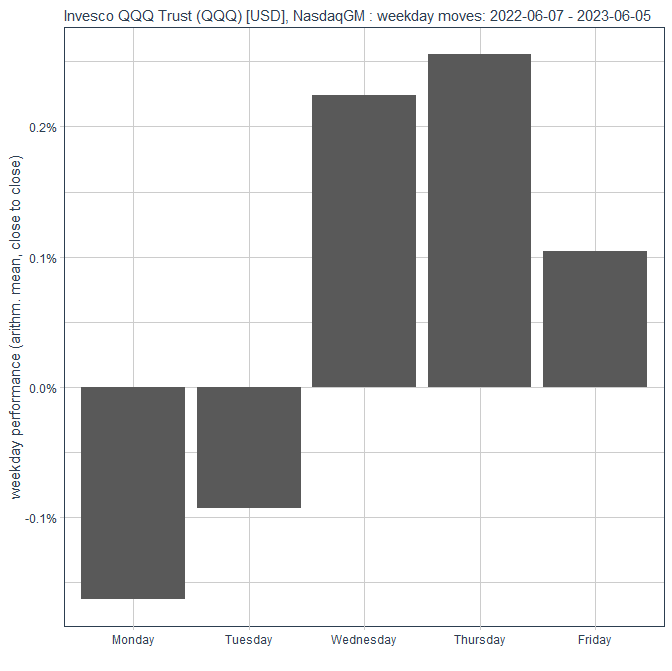

~NASDAQ100-ETF ($QQQ):

5.6.

Biden Debt-Bill Signing Set to Unleash Tsunami of US Debt Sales

https://finance.yahoo.com/news/biden-debt-bill-signing-set-2…

...

President Joe Biden’s signature of legislation suspending the federal debt ceiling has given the Treasury Department the green light to resume net new debt issuance after months of disruption.

Ever since mid-January, when it hit the $31.4 trillion debt ceiling, the Treasury has been using special accounting measures to maintain payments on all federal obligations. There were just $33 billion of those left available as of May 31.

It’s also been running down its cash balance, which dropped below $23 billion on June 1 — a level seen by experts as dangerously low given the volatility in day-to-day federal revenues and payments.

The bill Biden signed Saturday suspended the debt limit until Jan. 1, 2025, allowing the Treasury to rebuild its cash to more normal levels.

Early last month, the department had penciled in a $550 billion cash-balance level for the end of June. A widening fiscal deficit also puts pressure on the Treasury to step up borrowing.

...

Biden Debt-Bill Signing Set to Unleash Tsunami of US Debt Sales

https://finance.yahoo.com/news/biden-debt-bill-signing-set-2…

...

President Joe Biden’s signature of legislation suspending the federal debt ceiling has given the Treasury Department the green light to resume net new debt issuance after months of disruption.

Ever since mid-January, when it hit the $31.4 trillion debt ceiling, the Treasury has been using special accounting measures to maintain payments on all federal obligations. There were just $33 billion of those left available as of May 31.

It’s also been running down its cash balance, which dropped below $23 billion on June 1 — a level seen by experts as dangerously low given the volatility in day-to-day federal revenues and payments.

The bill Biden signed Saturday suspended the debt limit until Jan. 1, 2025, allowing the Treasury to rebuild its cash to more normal levels.

Early last month, the department had penciled in a $550 billion cash-balance level for the end of June. A widening fiscal deficit also puts pressure on the Treasury to step up borrowing.

...

Antwort auf Beitrag Nr.: 73.881.370 von Numalfix am 20.05.23 20:05:27

Hallo, ich wollte mal nett fragen, was ist ein Gold

XLF, wie in dem letzten Beitrag von Numalfix?

Ist das so ein üblicher Gold Fond, oder wie?

Und wo exakt finde ich den, vielleicht mit angezeigter Vola?

Vielen Dank, im Voraus.

Hallo, ich wollte mal nett fragen, was ist ein Gold

XLF, wie in dem letzten Beitrag von Numalfix?

Ist das so ein üblicher Gold Fond, oder wie?

Und wo exakt finde ich den, vielleicht mit angezeigter Vola?

Vielen Dank, im Voraus.

31.5.

Default wave imminent, will peak in 2024- Deutsche Bank

https://financialpost.com/pmn/business-pmn/default-wave-immi…

...

A wave of debt defaults by companies in the United States and Europe is imminent, due in part to the fastest monetary tightening cycle in 15 years, Deutsche Bank said in its annual default study released on Wednesday.

Deutsche expects default rates to peak in the fourth quarter of next year. It forecast peak default rates to reach 9% for U.S. high-yield debt, 11.3% for U.S. loans, 4.4% for European high-yield bonds and 7.3% for European loans.

Aggressive interest rate hikes to tame inflation from major central banks, including the U.S. Federal Reserve, have raised global recession risks. Europe’s biggest economy, Germany, has slipped into a recession.

The estimate for a U.S. loan peak default rate of 11.3% would be a near all-time high, compared to a peak of 12% during the 2007-2008 global financial crisis and 7.7% during the U.S. technology bubble in the late 1990s, Deutsche noted.

Default risks for European firms appeared lower than U.S. peers given a higher percentage of better-rated bonds as well as greater European fiscal support and lower amounts of debt in high-growth sectors, such as technology.

Within the European high-yield bond market, real estate was the sector facing the greatest pressure and accounted for over half of all European high-yield distressed debt, Deutsche said.

It noted that the contribution of new capital from companies’ private equity owners, fiscal stimulus in Europe and central bank rate cuts may help mitigate some risks and avoid a worst-case scenario.

Still, that would not prevent a base case of rising default rates, Deutsche said.

Default wave imminent, will peak in 2024- Deutsche Bank

https://financialpost.com/pmn/business-pmn/default-wave-immi…

...

A wave of debt defaults by companies in the United States and Europe is imminent, due in part to the fastest monetary tightening cycle in 15 years, Deutsche Bank said in its annual default study released on Wednesday.

Deutsche expects default rates to peak in the fourth quarter of next year. It forecast peak default rates to reach 9% for U.S. high-yield debt, 11.3% for U.S. loans, 4.4% for European high-yield bonds and 7.3% for European loans.

Aggressive interest rate hikes to tame inflation from major central banks, including the U.S. Federal Reserve, have raised global recession risks. Europe’s biggest economy, Germany, has slipped into a recession.

The estimate for a U.S. loan peak default rate of 11.3% would be a near all-time high, compared to a peak of 12% during the 2007-2008 global financial crisis and 7.7% during the U.S. technology bubble in the late 1990s, Deutsche noted.

Default risks for European firms appeared lower than U.S. peers given a higher percentage of better-rated bonds as well as greater European fiscal support and lower amounts of debt in high-growth sectors, such as technology.

Within the European high-yield bond market, real estate was the sector facing the greatest pressure and accounted for over half of all European high-yield distressed debt, Deutsche said.

It noted that the contribution of new capital from companies’ private equity owners, fiscal stimulus in Europe and central bank rate cuts may help mitigate some risks and avoid a worst-case scenario.

Still, that would not prevent a base case of rising default rates, Deutsche said.

Antwort auf Beitrag Nr.: 73.705.304 von faultcode am 20.04.23 16:12:3020.04.2023

--> möglicherweise falsch, aber gut, was heißt "noch viel höher" hier:

31.5.

Glencore arbeitet an Angebotsnachbesserung für Teck

https://www.wallstreet-online.de/nachricht/16994852-kreise-g…

...

Zitat von faultcode:

<

ich hab nun meine 2. und letzte $TECK-Tranche verkauft. Ich denke nicht mehr, daß die Angebote vor Kohle-Spinoff oder erst danach noch viel höher ausfallen werden: https://uk.finance.yahoo.com/news/sumitomo-metal-mining-conf…

>

--> möglicherweise falsch, aber gut, was heißt "noch viel höher" hier:

31.5.

Glencore arbeitet an Angebotsnachbesserung für Teck

https://www.wallstreet-online.de/nachricht/16994852-kreise-g…

...

Let's go, recession

Fed funds futures see rate hike likely in June

https://www.reuters.com/article/usa-bonds-fedfunds-idUSL1N37…

May 30 (Reuters) - Fed funds futures traders now see the Federal Reserve as more likely to hike interest rates next month than leave them unchanged, as economic data beats expectations and lawmakers appear to have reached a deal to raise the debt ceiling.

The market is now pricing for a 63% chance of a 25 basis point increase at the Fed’s June 13-14 meeting.

Traders have also almost priced out all the rate cuts they had previously expected in the second half of this year, with only 10 basis points in cuts now priced in for December.

...

Fed funds futures see rate hike likely in June

https://www.reuters.com/article/usa-bonds-fedfunds-idUSL1N37…

May 30 (Reuters) - Fed funds futures traders now see the Federal Reserve as more likely to hike interest rates next month than leave them unchanged, as economic data beats expectations and lawmakers appear to have reached a deal to raise the debt ceiling.

The market is now pricing for a 63% chance of a 25 basis point increase at the Fed’s June 13-14 meeting.

Traders have also almost priced out all the rate cuts they had previously expected in the second half of this year, with only 10 basis points in cuts now priced in for December.

...

Antwort auf Beitrag Nr.: 73.900.760 von faultcode am 24.05.23 18:32:217%

...

Yields on securities due in early June surged Wednesday as investors steered clear of more at-risk bills, with rates on several instruments topping 7%. Bills maturing in that time frame, a window that Treasury Secretary Janet Yellen has warned about repeatedly, are seen as most at risk of non-payment if the US government exhausts its borrowing capacity.

Rates on those due June 1 and June 6 at one stage on Wednesday topped 7%, around 4 percentage points above instruments maturing May 30, while other securities in the first weeks of June also saw their yields leap.

...

24.5.

Debt-Ceiling Fear Sends Yields on At Risk T-Bills Above 7%

https://finance.yahoo.com/news/t-bills-no-longer-only-164509…

...

Yields on securities due in early June surged Wednesday as investors steered clear of more at-risk bills, with rates on several instruments topping 7%. Bills maturing in that time frame, a window that Treasury Secretary Janet Yellen has warned about repeatedly, are seen as most at risk of non-payment if the US government exhausts its borrowing capacity.

Rates on those due June 1 and June 6 at one stage on Wednesday topped 7%, around 4 percentage points above instruments maturing May 30, while other securities in the first weeks of June also saw their yields leap.

...

24.5.

Debt-Ceiling Fear Sends Yields on At Risk T-Bills Above 7%

https://finance.yahoo.com/news/t-bills-no-longer-only-164509…