ALAMOS GOLD INC. (NEW) - Die Neue --- Hält dieses Unternehmen . . . . . (Seite 11)

eröffnet am 14.07.15 23:59:19 von

neuester Beitrag 11.05.24 18:31:00 von

neuester Beitrag 11.05.24 18:31:00 von

Beiträge: 445

ID: 1.215.750

ID: 1.215.750

Aufrufe heute: 1

Gesamt: 33.507

Gesamt: 33.507

Aktive User: 0

ISIN: CA0115321089 · WKN: A14WBB · Symbol: 1AL

14,445

EUR

+0,94 %

+0,135 EUR

Letzter Kurs 09:00:27 Tradegate

Neuigkeiten

06.05.24 · wallstreetONLINE Redaktion |

05.05.24 · wallstreetONLINE Redaktion |

29.04.24 · Swiss Resource Capital AG Anzeige |

26.04.24 · Swiss Resource Capital AG Anzeige |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,0000 | +809,09 | |

| 0,5020 | +34,58 | |

| 0,8500 | +26,87 | |

| 0,5200 | +26,21 | |

| 0,6280 | +10,56 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6200 | -8,82 | |

| 0,5001 | -9,07 | |

| 1,5500 | -9,94 | |

| 0,7000 | -10,26 | |

| 46,85 | -98,02 |

Beitrag zu dieser Diskussion schreiben

Bin seid Jan. 2015 hier drin und muss sagen ... die Entwicklung ist schon enttäuschend. Erst recht nach all den Meldungen. Vielleicht ist ja wirklich die Türkei die "Bremse" aber vor paar Jahren war doch diesbezüglich alles noch " Toppi" ?  Bleibe nach wie vor investiert. Bin ja kurstechnisch vorne von daher .... lass ich`s liegen.

Bleibe nach wie vor investiert. Bin ja kurstechnisch vorne von daher .... lass ich`s liegen.

Bleibe nach wie vor investiert. Bin ja kurstechnisch vorne von daher .... lass ich`s liegen.

Bleibe nach wie vor investiert. Bin ja kurstechnisch vorne von daher .... lass ich`s liegen.

die Probleme in der Türkei sind eine "Handbremse" beim Kurs von Alamos, denke ich...

Solange die nicht gelöst sind, wird sich im Kurs auch nicht überdurchschnittlich entwickeln.

Die letzten Zahlen waren nun auch nicht unbedingt der Knaller im Marktvergleich. Es ist wohl noch Geduld gefragt, aber ich bleibe auf jeden Fall drin...

Solange die nicht gelöst sind, wird sich im Kurs auch nicht überdurchschnittlich entwickeln.

Die letzten Zahlen waren nun auch nicht unbedingt der Knaller im Marktvergleich. Es ist wohl noch Geduld gefragt, aber ich bleibe auf jeden Fall drin...

Nach diesem Bericht haben wir mit ALAMOS GOLD noch einiges zu erwarten.

Denn immerhin simd 12,75 US $ noch mindestens fast 40 % vom jetzigen Kurs entfernt. Versor Investments LP Purchases 10,200 Shares of Alamos Gold Inc. (NYSE:AGI)

Versor Investments LP boosted its position in Alamos Gold Inc. (NYSE:AGI) (TSE:AGI) by 97.1% during the 3rd quarter, according to the company in its most recent Form 13F filing with the SEC. The institutional investor owned 20,700 shares of the basic materials company’s stock after acquiring an additional 10,200 shares during the period. Versor Investments LP’s holdings in Alamos Gold were worth $149,000 as of its most recent SEC filing.

A number of other large investors have also recently made changes to their positions in AGI. RiverGlades Family Offices LLC bought a new position in Alamos Gold in the second quarter worth approximately $84,000. U.S. Capital Wealth Advisors LLC bought a new position in shares of Alamos Gold in the third quarter valued at approximately $102,000. Rockefeller Capital Management L.P. lifted its holdings in shares of Alamos Gold by 100.0% in the second quarter. Rockefeller Capital Management L.P. now owns 15,106 shares of the basic materials company’s stock valued at $115,000 after purchasing an additional 7,553 shares in the last quarter.

HC Advisors LLC bought a new position in shares of Alamos Gold in the third quarter valued at approximately $115,000. Finally, Bridgefront Capital LLC bought a new position in shares of Alamos Gold in the second quarter valued at approximately $128,000. Institutional investors and hedge funds own 65.60% of the company’s stock.

Get Alamos Gold alerts:

Shares of AGI opened at $7.69 on Monday. The stock has a 50 day moving average of $7.73 and a 200 day moving average of $7.72. Alamos Gold Inc. has a 12 month low of $6.64 and a 12 month high of $9.87.

Alamos Gold (NYSE:AGI) (TSE:AGI) last issued its quarterly earnings results on Tuesday, October 26th. The basic materials company reported $0.10 EPS for the quarter, missing the Zacks’ consensus estimate of $0.11 by ($0.01). The business had revenue of $198.00 million for the quarter, compared to analysts’ expectations of $221.49 million. Alamos Gold had a negative net margin of 2.28% and a positive return on equity of 6.57%. The business’s revenue was down 9.3% compared to the same quarter last year. During the same period in the previous year, the business posted $0.15 earnings per share. On average, equities research analysts predict that Alamos Gold Inc. will post 0.43 EPS for the current year.

The company also recently announced a quarterly dividend, which was paid on Tuesday, December 21st. Shareholders of record on Tuesday, December 7th were given a $0.025 dividend. This represents a $0.10 dividend on an annualized basis and a yield of 1.30%. The ex-dividend date of this dividend was Monday, December 6th. Alamos Gold’s dividend payout ratio is currently -166.64%.

A number of research analysts have recently weighed in on AGI shares. CIBC dropped their target price on Alamos Gold from C$15.50 to C$14.50 and set an “outperform” rating on the stock in a report on Thursday, October 28th. National Bank Financial lowered Alamos Gold from an “outperform” rating to a “sector perform” rating in a report on Friday, October 22nd. Zacks Investment Research lowered Alamos Gold from a “buy” rating to a “hold” rating in a report on Thursday. Finally, TD Securities dropped their target price on Alamos Gold from C$15.50 to C$14.50 and set a “buy” rating on the stock in a report on Friday, October 29th.

Three research analysts have rated the stock with a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the stock currently has an average rating of “Hold” and a consensus target price of $12.75.

https://zolmax.com/investing/versor-investments-lp-purchases…

Antwort auf Beitrag Nr.: 70.282.719 von boersentrader02 am 20.12.21 22:39:31ich verstehe die Kursschwäche der guten Minen (da zähle ich Alamos auf jeden Fall zu) eh nicht mehr... die verdienen sich bei AISC um die 1000$/oz aktuell dumm und dämlich, sind mittlerweile schuldenfrei, kaufen eigene Aktien zurück und übernehmen kleinere Mitbewerber, aber der Kurs kommt einfach nicht in Gang... wahrscheinlich kommt der Kursanstieg irgendwann mit Anlauf und dann richtig... 🙄

Und sie wollen im kommenden Jahr weitere fast 30 Mill Aktien zurück kaufen.

Ob es dem Kurs diesmal helfen wird ? Alamos Gold gets TSX OK for 29.99M share buyback

2021-12-20 07:54 ET - News Release

Mr. Scott Parsons reports

ALAMOS GOLD ANNOUNCES RENEWAL OF NORMAL COURSE ISSUER BID

Alamos Gold Inc. has filed with and received acceptance from the Toronto Stock Exchange for a notice of intention to make a normal course issuer bid permitting Alamos to purchase for cancellation up to 29,994,398 Class A common shares, representing 10 per cent of the company's public float of the common shares as of Dec. 15, 2021, being 299,943,980 common shares. As at Dec. 15, 2021, there were 391,962,704 common shares issued and outstanding.

Alamos may purchase common shares under the normal course issuer bid over the next 12-month period beginning Dec. 24, 2021, and ending Dec. 23, 2022. Any purchases made under the normal course issuer bid will be effected through the facilities of the TSX, alternative Canadian trading systems and/or the New York Stock Exchange. The maximum number of common shares that Alamos may purchase on the TSX on a daily basis, other than block purchase exceptions, is 158,037 common shares.

The price for any repurchased common shares will be the prevailing market price at the time of the purchase. All common shares purchased by Alamos will be cancelled. Purchase and payment for the common shares will be made by Alamos in accordance with the requirements of the TSX and applicable securities laws.

A normal course issuer bid is being undertaken as the company and its board of directors believe the price of its common shares from time to time to be not reflective of the underlying value of the company. The company believes it is advantageous to its shareholders to engage in repurchases of common shares, from time to time, when they are trading at prices that reflect a discount from their value by increasing the proportionate share of ownership of the company to remaining shareholders. Under its previous normal course issuer bid, which commenced on Dec. 24, 2020, and will terminate on Dec. 23, 2021, Alamos sought the purchase of up to 35,145,504 common shares and has purchased and cancelled (or will cancel) 1,436,562 common shares of the company through open market purchases through the facilities of the TSX and the New York Stock Exchange at a weighted average price paid per common share of $9.34.

https://www.stockwatch.com/News/Item/Z-C!AGI-3186522/C/AGI

ALAMOS GOLD sichert sich ein weiteres Unternehmen mit vielversprechenden Ländereien

die hoffentlich auch wieder vielversprechend sind , wie z. B Lynn Lake und andere. Manitou Gold Announces Closing of $1,638,000 Private Placement, Strategic Investments by Alamos Gold Inc. and O3 Mining

December 16, 2021 07:00 ET | Source: Manitou Gold Inc.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES OF AMERICA

SUDBURY, Ontario, Dec. 16, 2021 (GLOBE NEWSWIRE) -- Manitou Gold Inc. (TSXV: MTU) (the “Company” or “Manitou”) is pleased to announce that it has closed a non-brokered private placement (the “Offering”) pursuant to which it has issued an aggregate of 9,000,000 common shares (“Shares”) at a price of $0.06 per Share and 15,685,714 “flow-through” common shares (“FT Shares”) at a price of $0.07 per FT Share, to raise aggregate gross proceeds of $1,638,000.

The Company also issued an aggregate of 98,000 finder’s shares and 941,142 broker warrants to certain eligible registrants assisting in the Offering. Each broker warrant entitles the holder to acquire one common share of the Company at a purchase price of $0.07 per share for a period of two years from the closing of the Offering.

An amount equal to the gross proceeds from the sale of the FT Shares will be used for expenditures which qualify as Canadian exploration expenses (“CEE”) and “flow-through mining expenditures” (within the meaning of the Income Tax Act (Canada)). The Company will renounce such CEE with an effective date of no later than December 31, 2021. The balance of the net proceeds raised pursuant to the Offering will be used for working capital and exploration expenditures.

Pursuant to the previously announced investment agreement entered into between Manitou and Alamos Gold Inc. (“Alamos”) (TSX: AGI, NYSE: AGI), Alamos purchased an aggregate of 7,000,000 Shares in the Offering to maintain its pro rata interest in the Company. In addition, O3 Mining Inc. (TSX-V: OIII) exercised its right to maintain its pro-rata ownership in the Company by purchasing an aggregate of 2,000,000 Shares in the Offering.

( Die Übersetzung dieses Parts ist unter dem Artikel z. K. eingestellt)

The Offering remains subject to the final approval of the TSX Venture Exchange. All securities issued and issuable in connection with the Offering are subject to a statutory hold period expiring on April 16, 2022.

For further information on Manitou Gold Inc., contact:

Richard Murphy, CEO

Telephone: 1 (705) 698-1962

Pat Dubreuil, Vice-President

Telephone: 1 (705) 626-0666

https://www.globenewswire.com/news-release/2021/12/16/235347…

Gemäß der zuvor angekündigten Investitionsvereinbarung zwischen Manitou und Alamos Gold Inc. („Alamos“) (TSX: AGI, NYSE: AGI) kaufte Alamos insgesamt 7.000.000 Aktien im Rahmen des Angebots, um seinen anteiligen Anteil am Unternehmen zu erhalten . Darüber hinaus übte O3 Mining Inc. (TSX-V: OIII) sein Recht zur Beibehaltung seines anteiligen Eigentums am Unternehmen durch den Kauf von insgesamt 2.000.000 Aktien im Rahmen des Angebots aus.

Gestern war ALAMOS GOLD der Tiefflieger der Börse und heute

. . . melden sie Bohrergebnisse die sich sehen lassen können.Diese werden sich auch in der nächsten Zeit innerhalb des Altienkurses von ALAMOS GOLD bemerkbar machen werden. Und das ist nur ein Teil der hier gemeldeten Ergebnisse. Lasst euch den Rest der guten Zahlen nicht entgehen.

Und das heißt, es wird nach oben gehen, oder eben auch nicht, wer weiß das schon.

Alamos Gold Provides Exploration Update for the Lynn Lake Project, Manitoba, Including a New Greenfields Discovery

Download Press Release PDF Format (opens in new window) PDF 2.36 MB

TORONTO, Dec. 16, 2021 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported new results from its ongoing exploration program on the Lynn Lake Project in Manitoba, Canada.

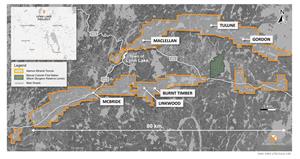

Figure 1: Lynn Lake Project

Figure 2: Lynn Lake – Tulune Target Area – Drillhole Plan Map

Figure 3: Lynn Lake – Gordon Deposit – Drillhole Plan and Cross Section Looking West

Figure 4: Lynn Lake – MacLellan Deposit – Drillhole Plan and Composite Longitudinal Looking Northwest

Figure 5: Lynn Lake – Burnt Timber and Linkwood – Drillhole Plan Map

New greenfields discovery (Tulune target): broad zones of shallow gold mineralization intersected between the Gordon and MacLellan deposits which were the basis for the positive 2017 Feasibility Study. All 17 holes drilled to date in this new target have intersected gold mineralization. New highlights include1:

1.22 g/t Au over 47.25 m (20LLX010);

0.50 g/t Au over 63.00 m, and 0.82 g/t over 29.00 m (21LLX019);

1.43 g/t Au over 16.40 m (21LLX017);

0.52 g/t Au over 41.80 m (21LLX020);

0.83 g/t Au over 17.90 m (21LLX016);

1.05 g/t Au over 12.75 m (21LLX026); and

0.53 g/t Au over 25.87 m (20LLX009), including;

20.20 g/t Au over 0.47m.

1 Gold grades are reported as uncut, composite intervals reported as core length, true width is unknown at this time.

Gordon deposit: high-grade mineralization intersected in the southeast portion of the Mineral Reserve pit in an area currently modelled as waste. This includes high-grade gold mineralization intersected in a series of narrow quartz veins within a diorite intrusion. High-grade near-surface gold mineralization was also intersected along the diorite-banded iron formation contact at the eastern extent of the Mineral Reserve pit (21GDX074). New highlights include2:

28.36 g/t Au (7.77 g/t cut) over 10.40 m (21GDX054), including;

302.00 g/t Au (40 g/t cut) over 0.24 m;

372.00 g/t Au (40 g/t cut) over 0.21 m;

176.00 g/t Au (40 g/t cut) over 0.24 m;

96.20 g/t Au (40 g/t cut) over 0.70 m; and

73.30 g/t Au (40 g/t cut) over 0.23 m;

67.64 g/t Au (4.38 g/t cut) over 5.04 m (21GDX052), including;

1,105.00 g/t Au (40 g/t cut) over 0.30 m;

7.42 g/t Au (4.73 g/t cut) over 7.20 m (21GDX074), including;

35.07 g/t Au (17.34 g/t cut) over 1.07 m; and

1.49 g/t Au (1.49 g/t cut) over 20.53 m (21GDX042).

https://alamosgold.com/news-and-events/default.aspx#news--wi…

Warum fällt nur der Kurs ?

Alamos Gold Inc. (NYSE:AGI) Given Average Recommendation of "Hold" by BrokeragesShare

Wednesday, December 15, 2021 | MarketBeat

Alamos Gold logoShares of Alamos Gold Inc. (NYSE:AGI) (TSE:AGI) have been given a consensus rating of "Hold" by the six analysts that are presently covering the stock, MarketBeat Ratings reports. Three investment analysts have rated the stock with a hold recommendation and two have issued a buy recommendation on the company. The average 1 year price target among brokers that have issued ratings on the stock in the last year is $14.50.

https://www.marketbeat.com/instant-alerts/nyse-agi-consensus…

Antwort auf Beitrag Nr.: 69.905.834 von boersentrader02 am 12.11.21 21:28:54die Probleme rund um die Kirazli-Mine drücken auf den Kurs.... wenn das Drama in der Türkei (hoffentlich zeitnah) beigelegt wird bzw werden sollte, geht es auch mit dem Kurs (vermutlich deutlich) nach oben... denke ich zumindest...

Gemeldet wurden ja recht gute ZAHLEN aber so gute Zahlen wie bei anderen

Unternehmen gibt es hier bei ALAMOS GOLD leider nicht. Bin echt gespannt wann sich diese Zahlen und der hohe Goldpreis endlich auch ALAMOS GOLD zu höheren Kursen treiben wird `November 11, 2021

Alamos Gold Extends High-Grade Gold Mineralization 300 Metres Down-Plunge from Mineral Resources in Island Gold East

Download Press Release PDF Format (opens in new window) PDF 1.04 MB

TORONTO, Nov. 11, 2021 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported new results from surface and underground exploration drilling at the Island Gold mine, further extending high-grade gold mineralization in the middle and lower portions of Island East. All reported drill widths are true width of the mineralized zones, unless otherwise stated.

Figure 1 - Island Gold Mine Longitudinal

Figure 2 - Island Gold Mine East Area Detailed Longitudinal –

Surface Directional Drilling Results

Figure 3 - Island Gold Mine East Area Detailed Longitudinal –

Underground Drilling Results

Island East Lower: high-grade gold mineralization significantly extended up to 300 metres (“m”) down-plunge from existing Inferred Mineral Resources in Island East (MH27-02). This confirms high-grade mineralization extends east of the most easterly diabase dyke in a previously untested area. This is the deepest hole drilled to date at Island Gold confirming high-grade gold mineralization extends well beyond Mineral Resources to a depth of more than 1,700 m. Wide, high-grade gold mineralization was also extended 50 m beyond the nearest Inferred Mineral Resource block and down-plunge from previously reported drill hole MH25-08 (71.21 g/t Au (39.24 g/t cut) over 21.33 m), the best hole drilled to date at Island Gold. New highlights include:

15.86 g/t Au (10.74 g/t cut) over 16.04 m (MH25-10);

15.76 g/t Au (15.76 g/t cut) over 10.82 m (MH25-11); and

11.90 g/t Au (11.90 g/t cut) over 4.60 m (MH27-02).

Island East Middle: underground exploration drilling continues to extend high-grade gold mineralization within the gap between Mineral Reserves and Resources in the upper and middle portions of Island East. New highlights include:

12.03 g/t Au (12.03 g/t cut) over 8.26 m (840-602-23);

9.65 g/t Au (9.65 g/t cut) over 7.16 m (840-608-09);

14.24 g/t Au (13.88 g/t cut) over 3.77 m (840-602-29); and

11.39 g/t Au (11.39 g/t cut) over 2.50 m (840-618-01A).

Note: Drillhole composite intervals reported as “cut” may include higher grade samples which have been cut to 185 g/t Au for the Island East Area.

“Ongoing exploration success at Island Gold continues to demonstrate the significant potential for further growth in Mineral Reserves and Resources. This included intersecting high-grade mineralization 300 metres beyond existing Mineral Resources in the deepest hole drilled to date at Island Gold. These results are in proximity to the planned shaft and highlight the tremendous upside potential beyond what was outlined in the Phase III Expansion study,” said John A. McCluskey, President and Chief Executive Officer.

New highlight intercepts can be found in Tables 1 and 2, and in Figures 1 to 3 at the end of this news release.

Island East

Surface Directional Drilling

Surface directional drilling continues to extend high-grade gold mineralization beyond Mineral Resource blocks in the lower portions of Island East (Figures 1 and 2). New highlights from the drilling program include (E1E-Zone) (Table 1):

15.86 g/t Au (10.74 g/t cut) over 16.04 m (MH25-10);

15.76 g/t Au (15.76 g/t cut) over 10.82 m (MH25-11);

11.90 g/t Au (11.90 g/t cut) over 4.60 m (MH27-02); and

9.07 g/t Au (9.07 g/t cut) over 2.12 m (MH27-01).

Drill holes MH25-10 (15.86 g/t Au (10.74 g/t cut) over 16.04 m) and MH25-11 (15.76 g/t Au (15.76 g/t cut) over 10.82 m) intersected wide, high-grade mineralization 50 m and 45 m beyond the nearest Inferred Mineral Resource block in Island East. These drill holes continue to extend gold mineralization down-plunge from drillhole MH25-08 (71.21 g/t Au (39.24 g/t cut) over 21.33 m), the best hole ever drilled at Island Gold, and drillhole MH25-04 (28.97 g/t Au (27.96 g/t cut) over 21.76 m) (both previously released; see press release dated June 15, 2021).

In addition, drill holes MH27-02 (11.90 g/t Au (11.90 g/t cut) over 4.60 m) and MH27-01 (9.07 g/t Au (9.07 g/t cut) over 2.12 m) intersected high-grade mineralization 300 m and 235 m from the nearest Inferred Mineral Resource block in Island East. Drillhole MH27-02 is the deepest hole drilled to date at Island Gold, intersecting high-grade mineralization at a depth of 1,717 m, well below existing Mineral Resources which extend to a depth of approximately 1,500 m. This also extended high-grade mineralization to within 200 m of the former Trillium Mining mineral tenure, reinforcing the strategic merit of acquiring Trillium and this property in December 2020.

Drill holes MH27-02 and MH27-01 targeted the main Island Gold zone to the east of a north-south trending diabase dyke which was emplaced along a pre-existing fault. The current geological interpretation, based on the initial holes, is that the zone appears to be displaced across the fault approximately 140 m to the north and closer to the planned shaft bottom. Additional drilling will be completed to confirm these intersections are within the same structure with the results to date highlighting the significant potential for further Mineral Reserve and Resource growth well below and down-plunge from existing Mineral Resources, and in closer proximity to planned infrastructure.

Underground Exploration Drilling

Underground drilling from the 840-level exploration drift continues to extend high-grade mineralization and close the gap between Mineral Reserves and Resources in the upper and middle portions of Island East (between depths of 800 m and 1,000 m) (Figure 3). New highlights include (E1E-Zone) (Table 2):

12.03 g/t Au (12.03 g/t cut) over 8.26 m (840-602-23);

9.65 g/t Au (9.65 g/t cut) over 7.16 m (840-608-09);

14.24 g/t Au (13.88 g/t cut) over 3.77 m (840-602-29); and

11.39 g/t Au (11.39 g/t cut) over 2.50 m (840-618-01A).

Other Zones

The Island Gold Deposit consists of a number of subparallel mineralized zones, with the majority of Mineral Reserves and Resources defined in the C Zone and E1E-Zone which constitute the main production horizons at the Island Gold Mine. Highlights of new intersections from underground and surface exploration drilling of parallel zones and zones in which the lateral continuity is not yet established (“Unknown Zone”) include (reported composite intervals are core lengths) (Tables 1 and 2):

39.64 g/t Au (20.27 g/t cut) over 3.00 m (840-602-21); and

10.28 g/t Au (10.28 g/t cut) over 7.05 m (840-530-02);

Qualified Persons

Scott R.G. Parsons, P.Geo., FAusIMM, Alamos Gold’s Vice President, Exploration, has reviewed and approved the scientific and technical information contained in this news release. Scott R.G. Parsons is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”).

https://www.alamosgold.com/news-and-events/default.aspx

06.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

05.05.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

21.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

15.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

06.04.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

30.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |

24.03.24 · wallstreetONLINE Redaktion · Barrick Gold Corporation |