BUSHVELD kurz vor (Kurs-)Explosion/Transformation (Seite 10)

eröffnet am 30.03.17 07:34:51 von

neuester Beitrag 02.02.24 15:56:59 von

neuester Beitrag 02.02.24 15:56:59 von

Beiträge: 109

ID: 1.249.829

ID: 1.249.829

Aufrufe heute: 0

Gesamt: 9.221

Gesamt: 9.221

Aktive User: 0

ISIN: GG00B4TM3943 · WKN: A1KBVY · Symbol: BMN

0,0060

GBP

-7,41 %

-0,0005 GBP

Letzter Kurs 14.06.24 London

Neuigkeiten

| TitelBeiträge |

|---|

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,7437 | +20,93 | |

| 0,8906 | +20,35 | |

| 1,1500 | +15,00 | |

| 0,6650 | +9,02 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,7982 | -8,25 | |

| 8,1100 | -8,26 | |

| 10,455 | -8,53 | |

| 97,50 | -9,13 | |

| 12,460 | -16,06 |

Beitrag zu dieser Diskussion schreiben

Ich bin nun seit Anfang Jänner dabei, interessante Story - ich bin gespannt ob nach Lithium, Cobalt und (jetzt vielleicht am Start) Graphit mit Vanadium die nächste Sau durchs Dorf getrieben würde.

Das Volumen sieht gut aus. Preis für Vanadium die letzten Tage stark am steigen, sonst hatte ich keine News gefunden.

VG TommyX11

Das Volumen sieht gut aus. Preis für Vanadium die letzten Tage stark am steigen, sonst hatte ich keine News gefunden.

VG TommyX11

Rocket Started?!

Der politische Umbruch hat seit gestern in SA begonnen.

Damit wird es Zeit für BMN, die Unterbewertung abzubauen bzw. aufzulösen!

Good Luck!

Greetz

PIBO

Antwort auf Beitrag Nr.: 56.964.794 von timesystem1100 am 07.02.18 19:11:45

Ja, da hast du recht, Kollege.

Die Kursentwicklung ist seit den Höchstständen im Vorjahr (9,5 - 10 Pence) alles andere als zufriedenstellend.

Gründe dafür gibt es einige, nicht zuletzt die ständig eingelösten Optionen bei 2,5 Pence, die die Kursentwicklung sehr stark abbremsten.

Jedoch dürfte es auch dem unbegabtesten Mathematiker ein Leichtes sein hier zu errechnen, dass eine grobe Unterbewertung der MK vorliegt.

Diese liegt aktuell bei 76,3 Mio Pfund, Kollege Nickderby hat einen Jahresgewinn von 54 Mio Pfund errechnet, was -bei sehr konservativer Schätzung- von KGV 5 eine MK von 270 Mio Pfund ergeben würde!

Diese MK ergäbe ein Kurspotenzial bis 30 Pence!

Hatte es ja schon mehrfach geschrieben, dieser Wert ist -zumindest für mich- ein absolutes Langzeitinvestment und ich nutze diesen Wert als "Spardose", in den ich immer wieder Tradinggewinne investiere.

Good Luck 2 us all!

Greetz

PIBO

Zitat von timesystem1100: PIBO

alles richtig. Nur vom Kurs her tot. Klar, auch in den letzten 2 Tagen nix verloren....klar. Das gibt Sicherheit im Depot. Aber fixt mich irgendwie nicht so an.

Ja, da hast du recht, Kollege.

Die Kursentwicklung ist seit den Höchstständen im Vorjahr (9,5 - 10 Pence) alles andere als zufriedenstellend.

Gründe dafür gibt es einige, nicht zuletzt die ständig eingelösten Optionen bei 2,5 Pence, die die Kursentwicklung sehr stark abbremsten.

Jedoch dürfte es auch dem unbegabtesten Mathematiker ein Leichtes sein hier zu errechnen, dass eine grobe Unterbewertung der MK vorliegt.

Diese liegt aktuell bei 76,3 Mio Pfund, Kollege Nickderby hat einen Jahresgewinn von 54 Mio Pfund errechnet, was -bei sehr konservativer Schätzung- von KGV 5 eine MK von 270 Mio Pfund ergeben würde!

Diese MK ergäbe ein Kurspotenzial bis 30 Pence!

Hatte es ja schon mehrfach geschrieben, dieser Wert ist -zumindest für mich- ein absolutes Langzeitinvestment und ich nutze diesen Wert als "Spardose", in den ich immer wieder Tradinggewinne investiere.

Good Luck 2 us all!

Greetz

PIBO

Antwort auf Beitrag Nr.: 56.963.846 von PIBO am 07.02.18 18:06:47PIBO

alles richtig. Nur vom Kurs her tot. Klar, auch in den letzten 2 Tagen nix verloren....klar. Das gibt Sicherheit im Depot. Aber fixt mich irgendwie nicht so an.

alles richtig. Nur vom Kurs her tot. Klar, auch in den letzten 2 Tagen nix verloren....klar. Das gibt Sicherheit im Depot. Aber fixt mich irgendwie nicht so an.

mich wundert es ein bischen, dass hier nicht mehr los ist.

Gut, schon wieder Südafrika => das ist ein bestimmtes administratives und operatives Risiko, und das ist z.Z. eben nicht gerade klein. Sehr wahrscheinlich wird das auch so bleiben auf unabsehbare Zeit.

Aber sonst so vom Projekt her?

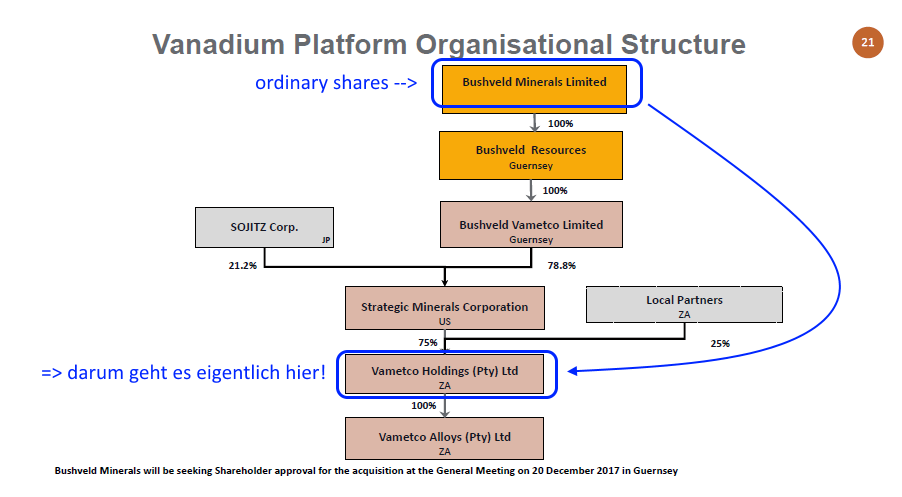

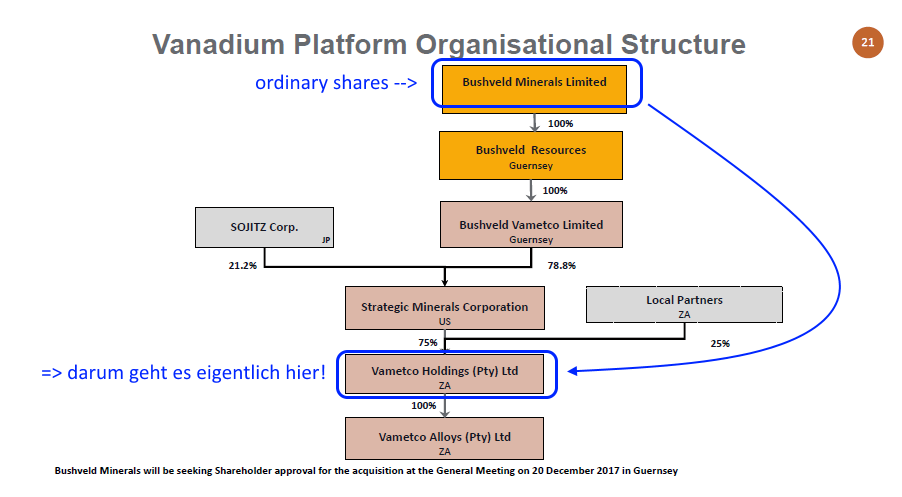

=> das Organigramm sieht dann entsprechend so aus:

aus der empfehlenswerten Präsentation 2017-12: http://www.bushveldminerals.com/wp-content/uploads/2018/01/B…

Gut, schon wieder Südafrika => das ist ein bestimmtes administratives und operatives Risiko, und das ist z.Z. eben nicht gerade klein. Sehr wahrscheinlich wird das auch so bleiben auf unabsehbare Zeit.

Aber sonst so vom Projekt her?

=> das Organigramm sieht dann entsprechend so aus:

aus der empfehlenswerten Präsentation 2017-12: http://www.bushveldminerals.com/wp-content/uploads/2018/01/B…

Bushveld Minerals Limited’s (BMN) Speculative Buy Rating Reiterated at Beaufort Securities

https://www.thecerbatgem.com/2017/04/19/beaufort-securities-…Beaufort Securities reissued their speculative buy rating on shares of Bushveld Minerals Limited (LON:BMN) in a research note published on Tuesday morning.

Bushveld Minerals Limited (LON:BMN) traded down 0.33% during trading on Tuesday, hitting GBX 7.60. 2,781,559 shares of the stock were exchanged. The firm’s market cap is GBX 44.92 million. The stock’s 50-day moving average price is GBX 5.92 and its 200-day moving average price is GBX 2.92. Bushveld Minerals Limited has a 12-month low of GBX 1.20 and a 12-month high of GBX 8.97.

Bushveld Minerals Limited Company Profile

Bushveld Minerals Limited is a mineral development company with a portfolio of vanadium and titanium bearing magnetite ore, tin and thermal coal assets in Southern Africa. The Company’s principal activity is the exploration and development of projects in the Bushveld Complex in South Africa. It operates through three segments: Iron ore exploration, Tin exploration and Coal exploration.

NEWSFLOW läuft!!

Bushveld hat nach Abschluß der Aquisitionsprozedur nun den Newsflow ins Rollen gebracht und hat als strategischen Pressepartner die Webseite http://www.proactiveinvestors.co.uk an seiner Seite.Die berichten mindestens 1 x jede Woche über die Neuigkeiten bei Bushveld und damit werden potenzielle Investoren informiert und angelockt.

Neuestes Beispiel:

A fairly busy week for the junior diggers, which ended with news Bushveld Minerals (LON:BMN) has long awaited.

It has now completed its purchase of a 78.8% stake in Strategic Minerals Corporation, transforming it into a "significant player in the global vanadium market".

Strategic is the Evraz subsidiary that owns the Vametco open pit mine and processing plant, which is already next to to Bushveld's Brits Vanadium project in South Africa.

Vametco already boasts reserves of JORC 27 million tonnes (Mt) with some of the highest in-magnetite vanadium pentoxide (V2O5) grades in the world, averaging of 2.55% vanadium pentoxide in magnetite.

These are sufficient to support operations for 24 years at current production levels.

And there is scope to expand production capacity relatively quickly from 2,750 to 3,340 tonnes Vanadium per year, Bushveld said.

http://www.proactiveinvestors.co.uk/companies/market_reports/176153/proactive-weekly-mining-news-bushveld-minerals-uru-metals-and-more-176153.html

Es ist vollbracht!!

Gestern nach Börsenschluß veröffentlichte Bushveld die News, dass man die zum Abschluß der Transaktion notwendige Zahlung von 16,466 Mio USD geleistet hat und dass man sich demnach nunmehr als Produzent bezeichnen darf!Dies dürfte eine komplette Neubewertung dieses Wertes zur Folge haben und die Transormation von einem Explorer zu einem Produzenten widerspegeln!

Man darf gespannt sein, was da jetzt passiert und alle investierten herzlich beglückwünschen!

Greetz

PIBO

Hier die News im Original:

RNS Number : 8601B

Bushveld Minerals Limited

06 April 2017

Bushveld Minerals Ltd

("Bushveld" or the "Company")

Completion of Vametco Acquisition

Bushveld Minerals Limited (AIM: BMN), a diversified mineral development company with a portfolio of vanadium, titanium, iron ore, tin and coal assets in Southern Africa, is pleased to announce that, further to the announcement made on 31 March 2017, Bushveld Vametco Limited ("Bushveld Vametco") has today completed the acquisition of a 78.8% shareholding in Strategic Minerals Corporation ("SMC", the ultimate holding company of Vametco Alloys Proprietary Limited, "Vametco") from the Evraz Group S.A. ("Evraz") (the "Acquisition").

Acquisition Highlights

· The US$16.466 million consideration paid is substantially less than the cost of a greenfield mine and plant of the same capacity;

· Bushveld Vametco financed the acquisition as follows:

I. Exclusivity fee cash payments to Evraz of US$1.646 million;

II. Bridge loan facility of US$11.0 million from The Barak Fund SPC Limited;

III. A US$3.0 million facility from the Financing and Sales and Marketing Agreement with Wogen Resources Limited; and

IV. A cash contribution of US$820,000 from Bushveld and Yellow Dragon Holdings Limited.

· The transformational acquisition is in line with Bushveld's stated strategy to develop a significant, vertically integrated vanadium platform and accelerate Bushveld's path to production by several years;

· The acquisition is further aligned with the Company's aspirations in the global energy storage space by providing capacity for potential electrolyte manufacturing.

Vametco Alloys Highlights

Vametco Alloys is a high quality, low cost mine and plant with a patented vanadium product and a global vanadium customer base. The property is located 8 kilometres to the Northeast of Brits, in the North West Province of the Republic of South Africa, and is owned by SMC through its 75% shareholding in South African domiciled Vametco Holdings Proprietary Limited ("Vametco Holdings"). Vametco Alloys is a 100% subsidiary of Vametco Holdings. Key highlights of the Vametco operations include:

· Mining right for vanadium and other associated minerals over Portion 1 of the farm Uitvalgrond 431 JQ and Portion 1 of the farm Krokodilwaal 426 JQ in Brits, where it operates an open pit mine supplying ore to its vanadium processing plant located on the same properties;

· Ore Reserves of 27Mt (JORC) with some of the highest in-magnetite vanadium pentoxide (V2O5) grades in the world, averaging of 2.55% vanadium pentoxide in magnetite. The Ore Reserves are sufficient to support the operations for 24 years at current production levels;

· Mineral Resources in excess of 135Mt (JORC) with average vanadium pentoxide ("V2O5") grades of 2.10% vanadium pentoxide in magnetite;

· Significant scope to increase the reserve base by targeted exploration of the inferred resources;

· Adjacent to Bushveld's Brits Vanadium Project, which is the continuation of the strike of the Vametco mine's deposit with similar vanadium grades to the mine. The deposit, which contains outcropping mineralisation, offers an extension of the life of operations and presents cheaper near-surface ore for the Vametco processing plant;

· Current plant annual capacity of 2,750 metric tonnes vanadium in the form of Nitrovan and MVO;

· Scope to materially expand own production capacity within a short time period from 2,750 to 3,340 tonnes Vanadium per year through targeted de-bottlenecking interventions at limited capital expenditure funded from operating cash flows, subject to conclusion of the necessary feasibility studies;

· An established leadership team with extensive experience in vanadium processing, having collectively worked on all vanadium processing plants in South Africa. The management team is being retained in the business;

· One of the cheapest primary producers of vanadium in the world, realising an all-in cash cost of US$17.33/kgV (US$3.57/lb V2O5 equivalent) for the year 2015.

· The low cost position saw Vametco report 2015, revenues of ZAR629 million and an operating profit of ZAR26,724 in a constrained economic environment and low vanadium prices (average 2015 market V price was 18.60/kg V). The 2015 closing cash position for the company was ZAR47 million;

· The positive performance continued into 2016 with the operations reporting markedly improved results for the year headlined by production volume increases to 2,850 mtv. The audited 2016 financial results will be announced to the market once available; and

· Owned as to 25% by Black Economic Empowerment shareholders including the local land owners, with provisions to increase this to 26%.

Further updates will be provided as appropriate.

Fortune Mojapelo, CEO of Bushveld Minerals Limited, "We are delighted to finally complete this transformational transaction which sees Bushveld transition into a significant player in the global vanadium markte. Vametco is a high quality, low cost operation with a strong management team that combines extensive experience in primary vanadium production. We are particularly pleased to have acquired such a quality operation for what we believe is a very low price relative to its value in use to Bushveld. The acquisition marks an exciting new chapter for Bushveld and provides an important catalytic platform as we continue our quest to build a large vertically integrated vanadium platform."

The information contained within this announcement is deemed by the Company to constitute inside information under the Market Abuse Regulations (EU) No. 596/2014.

Enquiries: info@bushveldminerals.com

Bushveld Minerals Limited

Fortune Mojapelo +27 (0) 11 268 6555

Strand Hanson Limited (Nominated Adviser)

Andrew Emmott / Ritchie Balmer +44 (0) 20 7409 3494

Beaufort Securities (Joint broker)

Jon Bellis +44 (0) 20 7382 8300

SP Angel Corporate Finance (Joint broker)

Ewan Leggat +44 (0) 20 3470 0470

Blytheweigh (Public Relations)

Tim Blythe / Camila Horsfall +44 (0) 20 7138 3204

Gabriella von llle +27 (0) 711 121 907

ABOUT BUSHVELD MINERALS LIMITED

Bushveld Minerals is a diversified AIM listed mineral development company with a portfolio of vanadium, iron ore, tin and coal greenfield assets in Southern Africa and Madagascar. The Company's flagship platform, the vanadium platform, includes the Mokopane Vanadium Project, the Brits Vanadium Project, and the Bushveld Iron Ore & Titanium Project. The tin platform comprises the Mokopane Tin Project whereas the Imaloto Coal Project, which is being developed as one of Madagascar's leading independent power producers, makes up the Company's coal platform.

The Company's vision is to become the largest low cost integrated primary vanadium producer through owned low-cost high-grade assets. This incorporates development and promotion of the role of vanadium in the growing global energy storage market through Bushveld Energy, the Company's energy storage solutions provider. Whilst the demand for vanadium remains largely anchored in a slow growing steel industry, Bushveld Minerals believes there is a strong potential for imminent significant global vanadium demand surge from the fast-growing energy storage market, particularly through the use and adoption of Vanadium Redox Flow Batteries.

Bushveld Minerals' approach to project development recognises that whilst attractive project economics are imperative, they are insufficient to secure capital to bring them to account. A clear path to production with a visible timeframe, low capex requirements and scalability are important factors in retaining an attractive exit option. This philosophy is core to the Company's strategy in developing projects. Detailed information on the Company and progress to date can be accessed on the website: www.bushveldminerals.com

Quelle: http://www.londonstockexchange.com/exchange/news/market-news…

Handel nun auch über STU möglich

Moinsen @ all!Seit kurzem ist nun auch der Handel dieser Perle über Stuttgart möglich, was vielen potenziellen Investoren die Möglichkeit eröffnet, Shares dieses Wertes zu kaufen/verkaufen.

Heute findet in London eine Investorenkonferenz statt, bei der der CEO, Fortune Mojapelo, über bisherige und zukünftige Entwicklungen der Firma referiert.

Dabei hat er einiges zu erzählen, was die bisherige Transformation Bushvelds von einem (nach außen hin) diffusen Explorerkonglomerat zu einem der weltgrößten (!) Vanadiumproduzenten betrifft bis hin zu den Zukunftsaussichten der Tochterfirmen Lemur (Thermalkohle in Madagascar) und den Zinnliegenschaften in Namibia.

Es verdient sehr viel Respekt, was der gute Mann in den letzten Monaten alles geschafft und geschaffen hat und dies wird sich auch sehr bald im Sharepreis widerspiegeln.

Good Luck @ all!