The Big 4 (Seite 2)

eröffnet am 14.01.20 22:21:12 von

neuester Beitrag 02.02.24 13:19:17 von

neuester Beitrag 02.02.24 13:19:17 von

Beiträge: 51

ID: 1.318.601

ID: 1.318.601

Aufrufe heute: 2

Gesamt: 3.160

Gesamt: 3.160

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 23 Minuten | 5673 | |

| vor 16 Minuten | 4609 | |

| vor 28 Minuten | 3870 | |

| vor 1 Stunde | 3321 | |

| vor 58 Minuten | 2383 | |

| heute 14:53 | 1926 | |

| vor 1 Stunde | 1767 | |

| heute 13:07 | 1416 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.157,90 | +1,27 | 226 | |||

| 2. | 2. | 1,1300 | -18,12 | 126 | |||

| 3. | 3. | 0,1905 | +0,79 | 105 | |||

| 4. | 5. | 9,2850 | +0,43 | 68 | |||

| 5. | 4. | 169,20 | -0,58 | 56 | |||

| 6. | Neu! | 11,905 | +14,97 | 39 | |||

| 7. | Neu! | 0,4250 | -1,16 | 38 | |||

| 8. | Neu! | 4,7500 | +5,91 | 35 |

Beitrag zu dieser Diskussion schreiben

5.9.

WSJ: Ernst & Young Leaders Expected to Approve Plan to Split Accounting Company

Decision to push ahead with proposal to spin off consulting arm could lead to firm splitting in late 2023

https://www.wsj.com/articles/ernst-young-leaders-expected-to…

...

EY is facing multibillion-dollar legal claims in Germany and the U.K. over its allegedly failed audits of two corporate blowups, fintech company Wirecard AG and hospital operator NMC Health PLC. EY has said it stands by its audit work.

...

=> offenbar will man so auch mMn die Wirecard-Katastrophe in den Griff bekommen

WSJ: Ernst & Young Leaders Expected to Approve Plan to Split Accounting Company

Decision to push ahead with proposal to spin off consulting arm could lead to firm splitting in late 2023

https://www.wsj.com/articles/ernst-young-leaders-expected-to…

...

EY is facing multibillion-dollar legal claims in Germany and the U.K. over its allegedly failed audits of two corporate blowups, fintech company Wirecard AG and hospital operator NMC Health PLC. EY has said it stands by its audit work.

...

=> offenbar will man so auch mMn die Wirecard-Katastrophe in den Griff bekommen

28.6.

EY Pays $100 Million SEC Fine Over CPA Ethics Exam Cheaters

https://finance.yahoo.com/news/ey-pays-100-million-sec-10220…

...

Ernst & Young LLP admitted that dozens of its audit personnel cheated on the ethics portion of the Certified Public Accountant exam and that the firm misled US regulators probing the misconduct, according to the Securities and Exchange Commission.

The SEC announced on Tuesday that EY would pay a $100 million fine -- the largest ever penalty for an audit firm. In addition to violating accounting rules, EY didn’t cooperate with a key part of the regulator’s probe, the agency said.

Almost 50 EY audit employees improperly shared answer keys to the ethics portion of the CPA exam between 2017 and 2021 and hundreds more cheated on continuing professional education courses, the SEC said.

The firm didn’t immediately respond to a request for comment sent outside of normal business hours on Tuesday.

Despite having been informed of possibly dishonest behavior, the firm conveyed to the agency that it didn’t have a problem with cheating. The auditor then failed to promptly correct those statements when it later launched an internal investigation.

Many EY employees knew that their behavior violated the company’s code of conduct, but some still did it because they couldn’t pass on their own, according to the SEC. The firm ultimately disciplined and, in some cases, fired individuals for their actions, according to the SEC, which said it’s investigation is ongoing.

...

EY Pays $100 Million SEC Fine Over CPA Ethics Exam Cheaters

https://finance.yahoo.com/news/ey-pays-100-million-sec-10220…

...

Ernst & Young LLP admitted that dozens of its audit personnel cheated on the ethics portion of the Certified Public Accountant exam and that the firm misled US regulators probing the misconduct, according to the Securities and Exchange Commission.

The SEC announced on Tuesday that EY would pay a $100 million fine -- the largest ever penalty for an audit firm. In addition to violating accounting rules, EY didn’t cooperate with a key part of the regulator’s probe, the agency said.

Almost 50 EY audit employees improperly shared answer keys to the ethics portion of the CPA exam between 2017 and 2021 and hundreds more cheated on continuing professional education courses, the SEC said.

The firm didn’t immediately respond to a request for comment sent outside of normal business hours on Tuesday.

Despite having been informed of possibly dishonest behavior, the firm conveyed to the agency that it didn’t have a problem with cheating. The auditor then failed to promptly correct those statements when it later launched an internal investigation.

Many EY employees knew that their behavior violated the company’s code of conduct, but some still did it because they couldn’t pass on their own, according to the SEC. The firm ultimately disciplined and, in some cases, fired individuals for their actions, according to the SEC, which said it’s investigation is ongoing.

...

PwC: "We are sorry"

...PricewaterhouseCoopers was fined almost £5 million pounds ($6.22 million) for a series of poor audits of two UK construction companies, as the regulator continued to crack down on audit failings by the Big Four.

PwC will pay £3 million in relation to its audits of Galliford Try Plc, and £1.96 million over a review of Kier Group Plc, the Financial Reporting Council said Tuesday. It was also ordered to report on its most modern audits that considered long-term contracts, the FRC said.

The UK is bringing in sweeping audit reforms aimed at reining in the dominance of the largest accountancy firms and cleaning up the industry following a string of high-profile scandals.

The breaches “concern failures to properly audit revenue recognised under specific complex long-term contracts,” said Claudia Mortimore, the FRC’s deputy executive counsel.

“We are sorry that aspects of our work were not of the required standard,” PwC said in a statement. The auditor said it’s “invested heavily” in a program to strengthen audit quality, including those on long term contracts and has “seen the positive impact of the actions we’ve taken.”

...

7.6.

PwC Fined £5 Million for Shoddy Audits at Two Construction Firms

https://www.bnnbloomberg.ca/pwc-fined-5-million-for-shoddy-a…

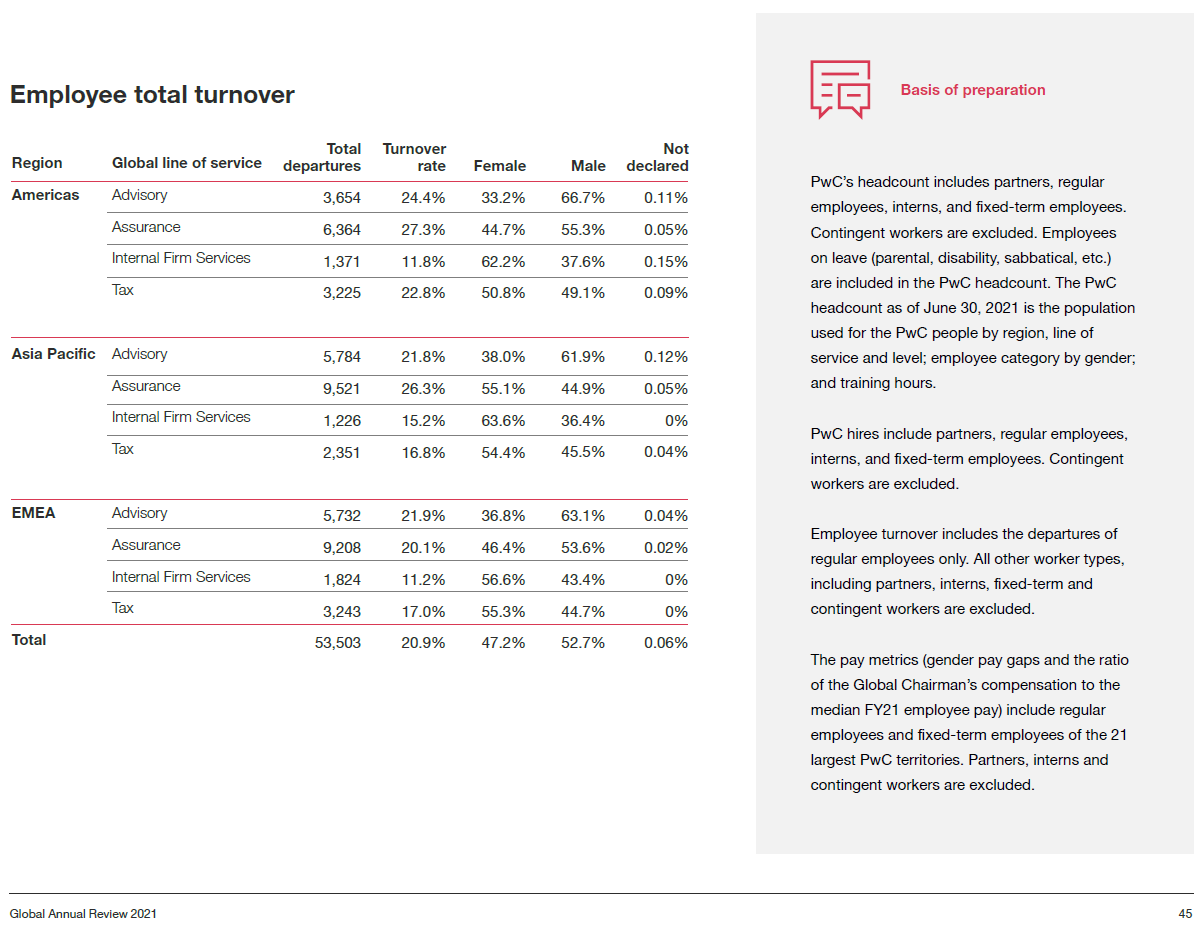

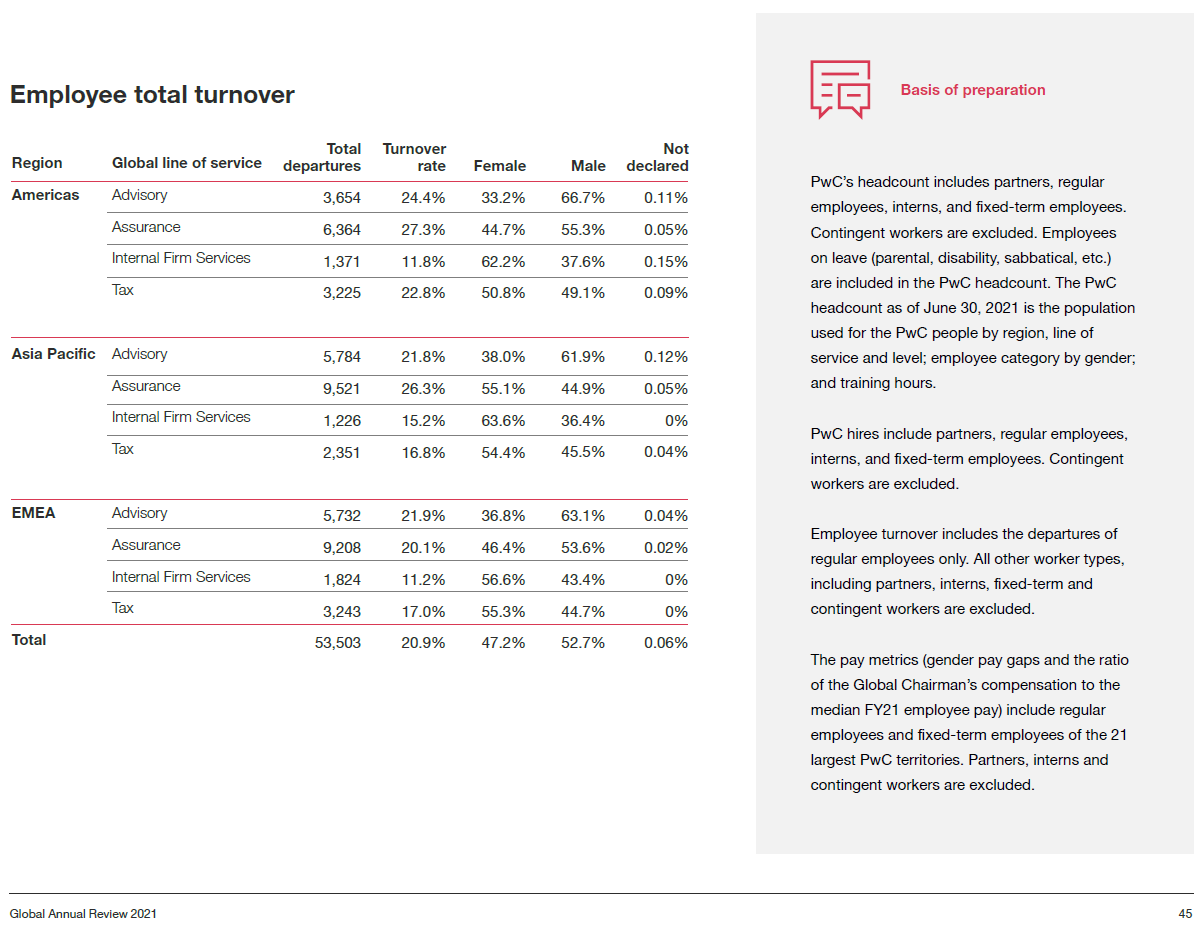

bekanntermaßen ist es nicht sehr lustig für die Big 4 zu arbeiten. Entsprechend schlägt sich das auch in den hohen Zahlen zum Employee total turnover nieder.

Global und so wie definiert bei PwC in 2020/2021 (Juni zu Juni) bei satten 20.9%

28.10.2021

<Global Annual Review 2021>

https://www.pwc.com/gx/en/about/global-annual-review-2021/go…

“Consistent high standards across everything we do are fundamental to the success of PwC. Our global governance board plays a key role in overseeing the rigorous standards that every PwC member firm agrees to comply with and the monitoring of compliance”

Lisa Sawicki

Governance Chair of PwCIL

Global und so wie definiert bei PwC in 2020/2021 (Juni zu Juni) bei satten 20.9%

28.10.2021

<Global Annual Review 2021>

https://www.pwc.com/gx/en/about/global-annual-review-2021/go…

“Consistent high standards across everything we do are fundamental to the success of PwC. Our global governance board plays a key role in overseeing the rigorous standards that every PwC member firm agrees to comply with and the monitoring of compliance”

Lisa Sawicki

Governance Chair of PwCIL

PwC war der langjährige Wirtschaftsprüfer von Evergrande, China:

11.10.2021

Evergrande crisis puts PwC role in spotlight

https://www.ft.com/content/b60bc8d6-611b-41f9-b755-064054e27…

...

The quality of Evergrande’s assets is also likely be one of the main issues picked over if the lid is lifted by its creditors.

In 2016, Hong Kong-based accounting research firm GMT Research visited 40 Evergrande development sites and concluded that Rmb150bn of asset writedowns were needed — then three times shareholders’ equity. It claimed that for years Evergrande had allowed failed projects such as abandoned hotels to accumulate on its balance sheet without writedowns.

GMT also took issue with how Evergrande classified the car parking spaces and commercial properties in its residential developments in its accounts. It said the company had “persuaded” PwC to accept the classification of these as investment properties, rather than as inventory of assets to be sold.

“Are its auditors asleep?” GMT wrote. “The company is insolvent by our reckoning and its equity worth nothing.”

...

11.10.2021

Evergrande crisis puts PwC role in spotlight

https://www.ft.com/content/b60bc8d6-611b-41f9-b755-064054e27…

...

The quality of Evergrande’s assets is also likely be one of the main issues picked over if the lid is lifted by its creditors.

In 2016, Hong Kong-based accounting research firm GMT Research visited 40 Evergrande development sites and concluded that Rmb150bn of asset writedowns were needed — then three times shareholders’ equity. It claimed that for years Evergrande had allowed failed projects such as abandoned hotels to accumulate on its balance sheet without writedowns.

GMT also took issue with how Evergrande classified the car parking spaces and commercial properties in its residential developments in its accounts. It said the company had “persuaded” PwC to accept the classification of these as investment properties, rather than as inventory of assets to be sold.

“Are its auditors asleep?” GMT wrote. “The company is insolvent by our reckoning and its equity worth nothing.”

...

27.9.

U.K.’s FRC Fines Grant Thornton $3.1 Million for Audit Work

https://www.bnnbloomberg.ca/u-k-watchdog-fines-grant-thornto…

...

The U.K.’s accounting watchdog has imposed sanctions against Grant Thornton Ltd. and a partner at the business, for its role in the alleged accounting fraud at the Patisserie Valerie bakery chain.

The Financial Reporting Council fined Grant Thornton 2.3 million pounds ($3.1 million), for its auditing work on the company between 2015 and 2017, the regulator said Monday. It also ordered non-financial sanctions including a review of the audit practice’s culture and reporting to the FRC annually for four years.

The cafe group collapsed in 2019 after more than 90 years in business following an investigation that revealed thousands of false entries in its accounts and resulted in 920 employees losing their jobs. The company was ultimately rescued by Irish private-equity firm Causeway Capital Partners.

David Newstead, Grant Thornton’s audit engagement partner, was fined 87,750 pounds, and given a three-year prohibition from carrying out statutory audits, for missing the red flags in the audit of Patisserie Holdings Plc, the bakery’s holding company.

“The audit of Patisserie Holdings Plc’s revenue and cash in particular involved missed red flags, a failure to obtain sufficient audit evidence and a failure to stand back and question information provided by management,” Claudia Mortimore, deputy executive counsel to the FRC, said.

The FRC said both Grant Thornton and Newstead have accepted the failures in the audit work.

...

U.K.’s FRC Fines Grant Thornton $3.1 Million for Audit Work

https://www.bnnbloomberg.ca/u-k-watchdog-fines-grant-thornto…

...

The U.K.’s accounting watchdog has imposed sanctions against Grant Thornton Ltd. and a partner at the business, for its role in the alleged accounting fraud at the Patisserie Valerie bakery chain.

The Financial Reporting Council fined Grant Thornton 2.3 million pounds ($3.1 million), for its auditing work on the company between 2015 and 2017, the regulator said Monday. It also ordered non-financial sanctions including a review of the audit practice’s culture and reporting to the FRC annually for four years.

The cafe group collapsed in 2019 after more than 90 years in business following an investigation that revealed thousands of false entries in its accounts and resulted in 920 employees losing their jobs. The company was ultimately rescued by Irish private-equity firm Causeway Capital Partners.

David Newstead, Grant Thornton’s audit engagement partner, was fined 87,750 pounds, and given a three-year prohibition from carrying out statutory audits, for missing the red flags in the audit of Patisserie Holdings Plc, the bakery’s holding company.

“The audit of Patisserie Holdings Plc’s revenue and cash in particular involved missed red flags, a failure to obtain sufficient audit evidence and a failure to stand back and question information provided by management,” Claudia Mortimore, deputy executive counsel to the FRC, said.

The FRC said both Grant Thornton and Newstead have accepted the failures in the audit work.

...

24.9.

WSJ: China Evergrande Auditor Gave Clean Bill of Health Despite Debt

PwC didn’t include a going-concern warning in its annual report for the ailing property developer

https://www.wsj.com/articles/china-evergrande-never-got-audi…

...

=> das machen die fast nie. Würde ja nur zu unschöner Hektik und Fragen führen

Die Big 4 sind bis heute vielfach nicht dazu da, um aufzuklären, sondern um Schummel-Bilanzen einen vermeintlich sauberen Anstrich zu geben.

Sad but true.

WSJ: China Evergrande Auditor Gave Clean Bill of Health Despite Debt

PwC didn’t include a going-concern warning in its annual report for the ailing property developer

https://www.wsj.com/articles/china-evergrande-never-got-audi…

...

=> das machen die fast nie. Würde ja nur zu unschöner Hektik und Fragen führen

Die Big 4 sind bis heute vielfach nicht dazu da, um aufzuklären, sondern um Schummel-Bilanzen einen vermeintlich sauberen Anstrich zu geben.

Sad but true.

Antwort auf Beitrag Nr.: 63.787.892 von faultcode am 24.05.20 23:14:32

22.7.

EY Accused of Actively Concealing NMC Health Audit Fraud From Investors

https://www.bnnbloomberg.ca/ey-accused-of-actively-concealin…

...

Ernst & Young faces accusations it “actively concealed” a six-year fraud from investors in a fresh lawsuit over its auditing work for the troubled NMC Health.

The hospital operator’s founder, Bavaguthu Raghuram Shetty, said the accounting giant enjoyed a “deep and cozy” relationship with executives at the troubled firm, alleging that the auditors turned a blind eye to thousands of suspicious transactions. Shetty is seeking $7 billion from the lawsuit.

The Indian entrepreneur filed a suit in New York last week, naming Ernst & Young as a co-conspirator in the fraud alongside former executives, and said investors lost more than $10 billion.

“EY’s misconduct was not one of professional negligence, but rather EY actively and intentionally conspired with the defendants to conceal their fraudulent conduct,” Shetty’s lawyer said in the court filings.

The allegations of fictitious invoices and inflated financial health between 2013 and 2019 are the most detailed yet from Shetty, who’s separately fighting claims from creditors following NMC’s collapse in April last year.

...

Zitat von faultcode: ...

• 2020: Klient NMC Health geht in die Insolvenz, nachdem sie mit dem Segen von EY allzu sehr Schulden kleingerechnet haben

...

22.7.

EY Accused of Actively Concealing NMC Health Audit Fraud From Investors

https://www.bnnbloomberg.ca/ey-accused-of-actively-concealin…

...

Ernst & Young faces accusations it “actively concealed” a six-year fraud from investors in a fresh lawsuit over its auditing work for the troubled NMC Health.

The hospital operator’s founder, Bavaguthu Raghuram Shetty, said the accounting giant enjoyed a “deep and cozy” relationship with executives at the troubled firm, alleging that the auditors turned a blind eye to thousands of suspicious transactions. Shetty is seeking $7 billion from the lawsuit.

The Indian entrepreneur filed a suit in New York last week, naming Ernst & Young as a co-conspirator in the fraud alongside former executives, and said investors lost more than $10 billion.

“EY’s misconduct was not one of professional negligence, but rather EY actively and intentionally conspired with the defendants to conceal their fraudulent conduct,” Shetty’s lawyer said in the court filings.

The allegations of fictitious invoices and inflated financial health between 2013 and 2019 are the most detailed yet from Shetty, who’s separately fighting claims from creditors following NMC’s collapse in April last year.

...

9.7.

Malaysia, 1MDB File Suit Against KPMG Partners for $5.64B: Report

https://www.bloomberg.com/news/articles/2021-07-09/malaysia-…

The Malaysian government, 1MDB and their units filed a lawsuit seeking more than $5.6 billion from 44 KPMG Malaysia partners for their role in auditing the state investment fund.

The lawsuit filed on Tuesday alleges that KPMG committed breaches of contract and negligence in its audit and certification of 1MDB’s financial statements for the financial years 2010 to 2012.

The lawsuit was first reported by the Edge newspaper. KPMG Malaysia as well as spokespeople for the Finance Ministry and the Prime Minister’s Office did not immediately respond to a request for comment.

The 1MDB scam set off investigations in Asia, the U.S. and Europe, and led to a historic change in government in 2018. Goldman Sachs Group Inc. last year admitted its role in the biggest foreign bribery case in U.S. enforcement history, reaching multiple international settlements in the billions of dollars to end probes into its fund-raising for 1MDB

The statement of claim alleged that more than $5.6 billion had been misappropriated from 1MDB and its subsidiaries to benefit former Prime Minister Najib Razak and his associates between 2009 and 2014. Of that sum, about $3.20 billion was misappropriated during the three financial years that KPMG was its auditor.

The claimants said that KPMG’s audited financial statements between 2010 to 2012 “did not give a true and fair view” of the state investment fund’s financial affairs. Had KPMG not been negligent, it would have prevented further misappropriations in the following years, they said.

As of May 6 this year, interest of at least $1.43 billion has accrued from the $5.6 billion sum, it added.

KPMG was terminated as 1MDB’s auditor in December 2013 during the audit of that year’s financial statements, the accounting firm had previously said in a statement on its website.

The firm in 2018 retracted its 1MDB audit reports as it didn’t have access to relevant documents that were declassified by the Mahathir Mohamad administration, 1MDB said in a statement that year.

Malaysia last month received $80 million from Deloitte PLT in a settlement over the firm’s audit of 1MDB and its former unit SRC International between 2011 to 2014. Malaysia received the first payment of 1.8 billion ringgit ($432 million) from AMMB Holdings Bhd. in settlement over the local lender’s involvement in the 1MDB scandal, according to the finance ministry.

Malaysia, 1MDB File Suit Against KPMG Partners for $5.64B: Report

https://www.bloomberg.com/news/articles/2021-07-09/malaysia-…

The Malaysian government, 1MDB and their units filed a lawsuit seeking more than $5.6 billion from 44 KPMG Malaysia partners for their role in auditing the state investment fund.

The lawsuit filed on Tuesday alleges that KPMG committed breaches of contract and negligence in its audit and certification of 1MDB’s financial statements for the financial years 2010 to 2012.

The lawsuit was first reported by the Edge newspaper. KPMG Malaysia as well as spokespeople for the Finance Ministry and the Prime Minister’s Office did not immediately respond to a request for comment.

The 1MDB scam set off investigations in Asia, the U.S. and Europe, and led to a historic change in government in 2018. Goldman Sachs Group Inc. last year admitted its role in the biggest foreign bribery case in U.S. enforcement history, reaching multiple international settlements in the billions of dollars to end probes into its fund-raising for 1MDB

The statement of claim alleged that more than $5.6 billion had been misappropriated from 1MDB and its subsidiaries to benefit former Prime Minister Najib Razak and his associates between 2009 and 2014. Of that sum, about $3.20 billion was misappropriated during the three financial years that KPMG was its auditor.

The claimants said that KPMG’s audited financial statements between 2010 to 2012 “did not give a true and fair view” of the state investment fund’s financial affairs. Had KPMG not been negligent, it would have prevented further misappropriations in the following years, they said.

As of May 6 this year, interest of at least $1.43 billion has accrued from the $5.6 billion sum, it added.

KPMG was terminated as 1MDB’s auditor in December 2013 during the audit of that year’s financial statements, the accounting firm had previously said in a statement on its website.

The firm in 2018 retracted its 1MDB audit reports as it didn’t have access to relevant documents that were declassified by the Mahathir Mohamad administration, 1MDB said in a statement that year.

Malaysia last month received $80 million from Deloitte PLT in a settlement over the firm’s audit of 1MDB and its former unit SRC International between 2011 to 2014. Malaysia received the first payment of 1.8 billion ringgit ($432 million) from AMMB Holdings Bhd. in settlement over the local lender’s involvement in the 1MDB scandal, according to the finance ministry.

10.6.

Deloitte Sued Over Alleged Role in Collapse of Singapore Trader

https://finance.yahoo.com/news/deloitte-sued-over-alleged-ro…

...

A failed oil trader in Singapore that owes creditors more than $3.5 billion is suing Deloitte & Touche LLP, alleging the auditing firm failed to detect “serious irregularities” in its financial statements for more than a decade.

Deloitte audited the books of Hin Leong Trading Ltd. for at least 16 years before the firm collapsed last year when founding tycoon Lim Oon Kuin admitted trading losses of $808 million weren’t reflected in the firm’s financial statements, according to a court filing.

“Deloitte failed to detect the irregularities and the material misstatements” in Hin Leong’s financial affairs, a March 5 lawsuit filed with the High Court of Singapore alleges. “Deloitte acted in breach of the terms of its engagement with the plaintiff.”

...

In a statement last year, Deloitte said its audit of Hin Leong’s accounts “was performed with the highest standards of audit and compliance with the information made known to us at the time.”

“We stand behind the quality of our work,” a Deloitte spokesperson said in the April 2020 statement

A hearing is set for next week in the case.

Wrong-Way Bets

The oil trading firm began to unravel last year following wrong-way energy bets that eventually led to one of the biggest collapses ever in the Asian city-state. The trading losses triggered demands for loan repayments by more than 20 banks, including London-based HSBC Holdings Plc and Singapore’s DBS Group Holdings Ltd. The case also prompted several major banks to review their exposure to commodities trading.

According to the suit, Deloitte audited and issued “unqualified opinions” for Hin Leong’s financial statements for each of the fiscal years from 2014 through 2019. The firm had in fact been insolvent since at least 2012, and the assets were overstated, the suit claims.

“The material misstatements in the plaintiff’s audited financial statements led to various banks and financial institutions being grossly misled as to the financial health and state of affairs,” Hin Leong claimed in the suit. “Deloitte knew or ought to have known that these banks and financial institutions were intended users of the plaintiff’s audited financial statements and would have relied on the same to extend financing.”

Few Assets

The New York-based auditing firm signed off on Hin Leong’s 2019 financial statements, which reported a 69% profit increase from the previous year, to $78.2 million. The report dated March 12, 2020, showed assets of $4.6 billion. A month later, Hin Leong was placed in interim judicial management, claiming liabilities of $3.5 billion and assets of just $257 million, according to the suit.

“Had Deloitte carried out the audits of the plaintiff’s financial statements properly, Deloitte would have detected the material misstatements,” and would not have issued unqualified audit opinions, the lawsuit alleges. As a result, “the fraudulent trading and unlawful actions by the directors and former managing director” of Hin Leong would have been discovered much earlier.

Lim, 79, has been charged with forgery. Assets, which include bank accounts, properties and club memberships -- and those of his two children -- have been frozen by the court. Lim has denied the forgery claim.

Hin Leong was run by court-appointed managers Goh Thien Phong and Chan Kheng Tek since April 2020, and was put into liquidation in March this year.

...

Deloitte Sued Over Alleged Role in Collapse of Singapore Trader

https://finance.yahoo.com/news/deloitte-sued-over-alleged-ro…

...

A failed oil trader in Singapore that owes creditors more than $3.5 billion is suing Deloitte & Touche LLP, alleging the auditing firm failed to detect “serious irregularities” in its financial statements for more than a decade.

Deloitte audited the books of Hin Leong Trading Ltd. for at least 16 years before the firm collapsed last year when founding tycoon Lim Oon Kuin admitted trading losses of $808 million weren’t reflected in the firm’s financial statements, according to a court filing.

“Deloitte failed to detect the irregularities and the material misstatements” in Hin Leong’s financial affairs, a March 5 lawsuit filed with the High Court of Singapore alleges. “Deloitte acted in breach of the terms of its engagement with the plaintiff.”

...

In a statement last year, Deloitte said its audit of Hin Leong’s accounts “was performed with the highest standards of audit and compliance with the information made known to us at the time.”

“We stand behind the quality of our work,” a Deloitte spokesperson said in the April 2020 statement

A hearing is set for next week in the case.

Wrong-Way Bets

The oil trading firm began to unravel last year following wrong-way energy bets that eventually led to one of the biggest collapses ever in the Asian city-state. The trading losses triggered demands for loan repayments by more than 20 banks, including London-based HSBC Holdings Plc and Singapore’s DBS Group Holdings Ltd. The case also prompted several major banks to review their exposure to commodities trading.

According to the suit, Deloitte audited and issued “unqualified opinions” for Hin Leong’s financial statements for each of the fiscal years from 2014 through 2019. The firm had in fact been insolvent since at least 2012, and the assets were overstated, the suit claims.

“The material misstatements in the plaintiff’s audited financial statements led to various banks and financial institutions being grossly misled as to the financial health and state of affairs,” Hin Leong claimed in the suit. “Deloitte knew or ought to have known that these banks and financial institutions were intended users of the plaintiff’s audited financial statements and would have relied on the same to extend financing.”

Few Assets

The New York-based auditing firm signed off on Hin Leong’s 2019 financial statements, which reported a 69% profit increase from the previous year, to $78.2 million. The report dated March 12, 2020, showed assets of $4.6 billion. A month later, Hin Leong was placed in interim judicial management, claiming liabilities of $3.5 billion and assets of just $257 million, according to the suit.

“Had Deloitte carried out the audits of the plaintiff’s financial statements properly, Deloitte would have detected the material misstatements,” and would not have issued unqualified audit opinions, the lawsuit alleges. As a result, “the fraudulent trading and unlawful actions by the directors and former managing director” of Hin Leong would have been discovered much earlier.

Lim, 79, has been charged with forgery. Assets, which include bank accounts, properties and club memberships -- and those of his two children -- have been frozen by the court. Lim has denied the forgery claim.

Hin Leong was run by court-appointed managers Goh Thien Phong and Chan Kheng Tek since April 2020, and was put into liquidation in March this year.

...