FIRSTSOLAR - $1,50 pro Wp - Werden die etablierten Solarzellenhersteller unter Druck kommen? (Seite 245)

eröffnet am 20.11.06 12:29:22 von

neuester Beitrag 02.05.24 10:30:50 von

neuester Beitrag 02.05.24 10:30:50 von

Beiträge: 3.107

ID: 1.095.508

ID: 1.095.508

Aufrufe heute: 23

Gesamt: 322.432

Gesamt: 322.432

Aktive User: 0

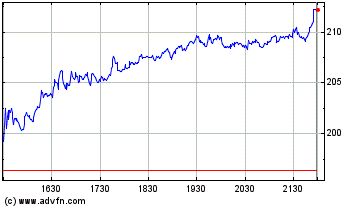

ISIN: US3364331070 · WKN: A0LEKM · Symbol: F3A

192,64

EUR

+7,18 %

+12,90 EUR

Letzter Kurs 20:25:51 Tradegate

Neuigkeiten

19.05.24 · wallstreetONLINE Redaktion |

17:50 Uhr · wO Newsflash |

18.05.24 · Felix Haupt Anzeige |

14.05.24 · wO Newsflash |

Werte aus der Branche Erneuerbare Energien

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 16,400 | +9,33 | |

| 192,64 | +7,18 | |

| 19,000 | +6,74 | |

| 0,6450 | +5,74 | |

| 34,70 | +5,15 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,5900 | -6,94 | |

| 0,5200 | -10,03 | |

| 5,3500 | -10,08 | |

| 1,7500 | -11,62 | |

| 76,00 | -13,64 |

Beitrag zu dieser Diskussion schreiben

Die Webseite von DTS ist auch schon von FSLR gekapert worden

Antwort auf Beitrag Nr.: 32.636.277 von meinolf67 am 01.12.07 09:36:52Cleverer Schachzug, jetzt geht es darum Großkraftwerke zu planen und zu realisieren!

Bin gesannt, wann die nächsten Produktionslinien hochgezogen werden! Schätze Mitte 08 ist es soweit.

Bin gesannt, wann die nächsten Produktionslinien hochgezogen werden! Schätze Mitte 08 ist es soweit.

Jetzt machen Sie Sunpower nach:

First Solar Announces Acquisition of Turner Renewable Energy

PHOENIX, Nov 30, 2007 (PrimeNewswire via COMTEX News Network) -- First Solar, Inc. (Nasdaq:FSLR) announced that it has acquired Turner Renewable Energy, LLC for a purchase price of approximately $34.3 million paid in a combination of common stock of First Solar, Inc. and cash. The company will operate as a wholly owned subsidiary of First Solar, Inc. under the name First Solar Electric, LLC.

Turner Renewable Energy, LLC has operated under the name DT Solar, a Turner Renewable Energy Company, since January 2007 when entrepreneur and philanthropist Ted Turner invested in the company. DT Solar has designed and deployed commercial solar projects for utilities and Fortune 500 companies in the U.S. since 2004. The acquisition brings to First Solar a team of people experienced in the development of independent power projects, marketing of energy, and operation of commercial power plants in the United States.

About First Solar

First Solar, Inc. (Nasdaq:FSLR) manufactures solar modules with an advanced thin film semiconductor process that significantly lowers solar electricity costs. By enabling clean renewable electricity at affordable prices, First Solar provides an economic alternative to peak conventional electricity and the related fossil fuel dependence, greenhouse gas emissions and peak time grid constraints. For more information about First Solar, please visit www.firstsolar.com.

First Solar Announces Acquisition of Turner Renewable Energy

PHOENIX, Nov 30, 2007 (PrimeNewswire via COMTEX News Network) -- First Solar, Inc. (Nasdaq:FSLR) announced that it has acquired Turner Renewable Energy, LLC for a purchase price of approximately $34.3 million paid in a combination of common stock of First Solar, Inc. and cash. The company will operate as a wholly owned subsidiary of First Solar, Inc. under the name First Solar Electric, LLC.

Turner Renewable Energy, LLC has operated under the name DT Solar, a Turner Renewable Energy Company, since January 2007 when entrepreneur and philanthropist Ted Turner invested in the company. DT Solar has designed and deployed commercial solar projects for utilities and Fortune 500 companies in the U.S. since 2004. The acquisition brings to First Solar a team of people experienced in the development of independent power projects, marketing of energy, and operation of commercial power plants in the United States.

About First Solar

First Solar, Inc. (Nasdaq:FSLR) manufactures solar modules with an advanced thin film semiconductor process that significantly lowers solar electricity costs. By enabling clean renewable electricity at affordable prices, First Solar provides an economic alternative to peak conventional electricity and the related fossil fuel dependence, greenhouse gas emissions and peak time grid constraints. For more information about First Solar, please visit www.firstsolar.com.

Jo, so sind se

hier mal eine Meinung aus Amiland:

Solar Power as the Next Great Investment Bonanza

Nov. 29 (Bloomberg) -- Now that you've blown your next two years' bonuses on subprime mortgages and homebuilder stocks, you need a recovery strategy.

Look no farther. Solar power.

It's irresistible. You can recoup your losses and fight global warming at the same time. Companies that make equipment to convert sunlight into electricity -- rather than by producing it with coal and natural gas that pollute -- are already profitable. No gambling on an unknown startup.

First Solar Inc., a Phoenix-based company that makes modules used in solar panels, reported its third-quarter profit was up 10 times to $46 million, or 58 cents a share, as sales more than tripled to $159 million.

Demand for solar equipment is growing at an annual rate of 40 percent. Google Inc., the Internet search engine company, just announced it would spend hundreds of millions of dollars to develop alternative forms of energy such as solar power. It plans to reduce the electricity costs of its power-hungry computers and sell cheaper energy to others.

While solar equipment, like any new technology, is relatively expensive, subsidies from national and state governments make it affordable for business and homeowner customers and profitable for the manufacturers.

So profitable that First Solar, which went public a year ago at $20 a share, closed yesterday at $215.88. The company now has a total stock market value of almost $17 billion, exceeding that of either General Motors Corp. or Ford Motor Co. If you don't think that's a big deal, consider that the solar company's value isn't that far behind the $23 billion number for NYSE Euronext, which owns the world's biggest stock exchange and has been a hot stock much of this year.

Global Spread

You can play sun power all over the world. Q-Cells AG in Thalheim, Germany, reported third-quarter profit of 34 million euros ($50 million) and this month forecast 2009 sales of 1.7 billion euros, compared with 540 million euros in 2006. Q-Cells, which makes the solar cells that make the modules that make the panels, is even more inviting if you think the euro will continue to rise against the dollar.

There's a China angle too. Suntech Power Holdings Co. in Jaingsu province, makes solar cells and had a third-quarter profit of $53 million. Its shares have more than doubled this year in New York Stock Exchange trading.

Demand for solar equipment may be just beginning to grow. Increased sales will help manufacturers bring down their unit costs. The price of refined silicon, a key ingredient for solar products, should decline as the capacity for making the material grows.

A Bit Pricey

Solar stocks aren't for the fainthearted, though that won't bother you. Skeptics will advise against buying First Solar or, say, SunPower Corp., a Sunnyvale, California, maker of solar panels that stands to get as much as $190 million in financing from Morgan Stanley, even though they are both in the black.

First Solar trades at 288 times earnings in the latest 12 months, SunPower at 275 times, while the price-to-earnings ratio on Google, everybody's favorite speculation, is 56.

Don't listen. After all, based on estimated profit for 2007, First Solar's P/E is a mere 170, SunPower's 98.

Oh sure, there's also a chance you might bet on the wrong company. Some upstart may develop superior technology. Or solar power may never be profitable without government handouts. Ethanol as an alternative energy has had a rocky road.

Forget the warnings. You can be partners with Al Gore and the kids at Google -- and you need a winner. Leap for the sun.

So sind sie halt - die Amis

Solar Power as the Next Great Investment Bonanza

Nov. 29 (Bloomberg) -- Now that you've blown your next two years' bonuses on subprime mortgages and homebuilder stocks, you need a recovery strategy.

Look no farther. Solar power.

It's irresistible. You can recoup your losses and fight global warming at the same time. Companies that make equipment to convert sunlight into electricity -- rather than by producing it with coal and natural gas that pollute -- are already profitable. No gambling on an unknown startup.

First Solar Inc., a Phoenix-based company that makes modules used in solar panels, reported its third-quarter profit was up 10 times to $46 million, or 58 cents a share, as sales more than tripled to $159 million.

Demand for solar equipment is growing at an annual rate of 40 percent. Google Inc., the Internet search engine company, just announced it would spend hundreds of millions of dollars to develop alternative forms of energy such as solar power. It plans to reduce the electricity costs of its power-hungry computers and sell cheaper energy to others.

While solar equipment, like any new technology, is relatively expensive, subsidies from national and state governments make it affordable for business and homeowner customers and profitable for the manufacturers.

So profitable that First Solar, which went public a year ago at $20 a share, closed yesterday at $215.88. The company now has a total stock market value of almost $17 billion, exceeding that of either General Motors Corp. or Ford Motor Co. If you don't think that's a big deal, consider that the solar company's value isn't that far behind the $23 billion number for NYSE Euronext, which owns the world's biggest stock exchange and has been a hot stock much of this year.

Global Spread

You can play sun power all over the world. Q-Cells AG in Thalheim, Germany, reported third-quarter profit of 34 million euros ($50 million) and this month forecast 2009 sales of 1.7 billion euros, compared with 540 million euros in 2006. Q-Cells, which makes the solar cells that make the modules that make the panels, is even more inviting if you think the euro will continue to rise against the dollar.

There's a China angle too. Suntech Power Holdings Co. in Jaingsu province, makes solar cells and had a third-quarter profit of $53 million. Its shares have more than doubled this year in New York Stock Exchange trading.

Demand for solar equipment may be just beginning to grow. Increased sales will help manufacturers bring down their unit costs. The price of refined silicon, a key ingredient for solar products, should decline as the capacity for making the material grows.

A Bit Pricey

Solar stocks aren't for the fainthearted, though that won't bother you. Skeptics will advise against buying First Solar or, say, SunPower Corp., a Sunnyvale, California, maker of solar panels that stands to get as much as $190 million in financing from Morgan Stanley, even though they are both in the black.

First Solar trades at 288 times earnings in the latest 12 months, SunPower at 275 times, while the price-to-earnings ratio on Google, everybody's favorite speculation, is 56.

Don't listen. After all, based on estimated profit for 2007, First Solar's P/E is a mere 170, SunPower's 98.

Oh sure, there's also a chance you might bet on the wrong company. Some upstart may develop superior technology. Or solar power may never be profitable without government handouts. Ethanol as an alternative energy has had a rocky road.

Forget the warnings. You can be partners with Al Gore and the kids at Google -- and you need a winner. Leap for the sun.

So sind sie halt - die Amis

rennt aber gut los heute, schon 2 Mio shares in der ersten Handelsstunde. allerdings konnte ich keine news finden, die das veranlasst haben könnte.

Die Verkäufe von Sohn und Kacir werden es nicht sein, die den Kurs beflügeln. Aber sorgen mache ich mir deswegen auch nicht unbedingt.

Die Verkäufe von Sohn und Kacir werden es nicht sein, die den Kurs beflügeln. Aber sorgen mache ich mir deswegen auch nicht unbedingt.

Antwort auf Beitrag Nr.: 32.609.340 von Hoerschwelle am 29.11.07 09:39:49Auf neue Kursziele reagiert FSLR immer sehr prompt

Antwort auf Beitrag Nr.: 32.612.335 von meinolf67 am 29.11.07 13:10:21Jaja, habsch auch gelesen, zum geiern

Da war aber noch was, nämlich das hier ... http://www.ftd.de/technik/medien_internet/:Google%20Wege/285…

Da war aber noch was, nämlich das hier ... http://www.ftd.de/technik/medien_internet/:Google%20Wege/285…

17:50 Uhr · wO Newsflash · Amazon |

19.05.24 · wallstreetONLINE Redaktion · Morgan Stanley |

14.05.24 · wO Newsflash · Boeing |

01.05.24 · wallstreetONLINE Redaktion · Allstate |

30.04.24 · BörsenNEWS.de · Allstate |