Synta pharmaceuticals - 500 Beiträge pro Seite

eröffnet am 27.02.11 19:43:03 von

neuester Beitrag 11.07.12 20:59:03 von

neuester Beitrag 11.07.12 20:59:03 von

Beiträge: 11

ID: 1.164.146

ID: 1.164.146

Aufrufe heute: 0

Gesamt: 513

Gesamt: 513

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 40 Minuten | 5629 | |

| vor 34 Minuten | 4267 | |

| heute 14:33 | 3645 | |

| heute 14:14 | 3399 | |

| vor 39 Minuten | 3362 | |

| vor 1 Stunde | 2423 | |

| vor 27 Minuten | 1578 | |

| vor 1 Stunde | 1445 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.756,31 | +0,20 | 175 | |||

| 2. | 3. | 0,2130 | +1,43 | 127 | |||

| 3. | 4. | 156,78 | -2,11 | 101 | |||

| 4. | Neu! | 9,3490 | +122,67 | 79 | |||

| 5. | 2. | 0,3000 | -3,23 | 72 | |||

| 6. | 7. | 6,7400 | +1,48 | 50 | |||

| 7. | 5. | 2,3865 | -6,98 | 45 | |||

| 8. | 10. | 2.357,79 | +0,49 | 42 |

Wurde hier schon mal gepostet ist aber in der ewigen Hystorie entschwunden. Scvhade denn jetzt wird's intewressant.

Gestern good news.

Ist einer meiner Favoriten für 2011

Gestern good news.

Ist einer meiner Favoriten für 2011

Antwort auf Beitrag Nr.: 41.114.277 von lunatics am 27.02.11 19:43:03Hast du mal ein Chart?

Antwort auf Beitrag Nr.: 41.114.277 von lunatics am 27.02.11 19:43:03Vielleicht ist lunatics auch so frei, uns mitzuteilen, was seiner Meinung jetzt interessant wird!?

Bei 3$ wird die bestimmt interessant vorher nicht für mich,ab dann könnte man ne gewisse volatilität nutzen.

Umsatz hat die ja.

Umsatz hat die ja.

Auf die Volatilität würde ich hier nicht setzen eher auf die Pipeline.

Phase II/III sind für ein solches Unternehmen immer interessant und erst recht für die Investoren. Vorallem in diesem Forschungssegment.

Der Kandidat STA-9090 hat sich bereits in anderen Indikationen erfolgreich gezeigt. Ist halt einfach ein neuer Hoffnungsträger in der Antikreps-Therapie.

Phase II/III sind für ein solches Unternehmen immer interessant und erst recht für die Investoren. Vorallem in diesem Forschungssegment.

Der Kandidat STA-9090 hat sich bereits in anderen Indikationen erfolgreich gezeigt. Ist halt einfach ein neuer Hoffnungsträger in der Antikreps-Therapie.

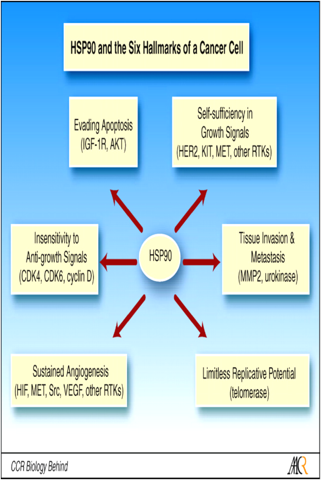

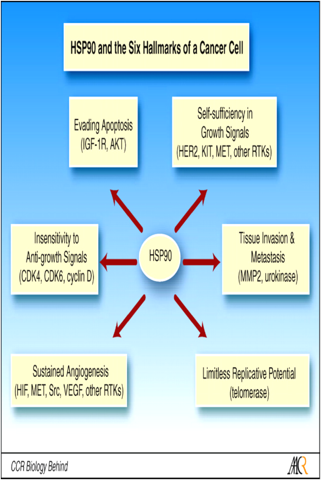

In der Tat handelt es sich bei dem HSP90-Inhibitor von Synta um einen neuen Hofungsträger in der Krebs-Therapie. Das kann man in diesem Fall sogar in dieser Allgemeinheit mal so stehen lassen.

Hier mal ein guter Artikel, der die Sache übersichtlich, umfangreich und aktuell darstellt:

(und auch Elesclomol ist noch nicht tot!)

Synta Pharmaceuticals (NASDAQ:SNTA) is gearing up to begin two key clinical trials in non-small cell lung cancer (NSCLC) with its two novel compounds – ganetespib and elesclomol – that are being closely watched by potential Big Pharma partners.

“Both are differentiated from anything else that’s out there,” CEO Dr. Safi Bahcall says in an exclusive interview with BioTuesdays.com.

Ganetespib is a potent, second-generation inhibitor of heat shock protein 90 (Hsp90), a well known cancer target. Hsp90 is a molecular chaperone required for the proper activation of many cancer-promoting proteins and is recognized as a key facilitator of cancer cell growth and survival. “It is one of the highest priority cancer targets because of its critical role across multiple cancer indications and in promoting resistance to chemotherapy as well targeted therapies,” he adds.

At a meeting of the International Association for the Study of Lung Cancer in February, Synta presented positive preliminary Phase 2 clinical data for ganetespib in treating NSCLC. In 33 patients with stage 3b/4 lung cancer, three had durable objective responses, ten had lesion tumor shrinkage, and 22 achieved lesion stabilization.

In a recent report, Roth Capital Partners analyst Andrew Vaino said ganetespib is the “most promising current Hsp90 inhibitor” in development and is poised to be the first second-generation Hsp90 inhibitor to make it to a Phase 3 clinical study. “While the preliminary data presented are early-stage … that 66% of patients experienced lesion stabilization shows, to us, a strong sign of activity.”

Ganetespib’s “safety appears remarkable,” Mr. Vaino added, with diarrhea, fatigue and nausea being the most common adverse events. Several multinational drug companies have stopped work on their second-generation Hsp90 inhibitors after patients experienced retina damage, which hasn’t been a problem for the more than 350 patients treated to date with ganetespib.

Dr. Bahcall says Synta is targeting lung cancer, because “we have seen convincing evidence of clinical activity in lung cancer.” He adds, “We have seen a number of patients who failed to respond to standard therapies, show definitive responses after receiving ganetespib.”

In addition to Synta’s focus on NSCLC, ganetespib is currently being evaluated in a broad range of investigator-sponsored cancer clinical studies, including NSCLC, breast, prostrate, pancreatic, colorectal, gastric, small cell lung, ocular melanoma, liver, gastrointestinal stromal tumors and hematologic cancers. “While these other trials are still quite early stage, we are seeing interesting signs of activity in gastric and breast cancer,” he adds.

Synta plans to begin a pivotal two-stage Phase 2b/3 clinical trial in the current quarter, treating second-line advanced NSCLC patients with ganetespib in combination with the chemotherapy, docetaxel. Preliminary results from the Phase 2b portion are expected either at the end of 2011 or the first quarter of 2012.

The Phase 2b portion of the trial, which will enroll about 240 patients, is designed to assess progression-free survival and safety and identify if there are any special subpopulations of patients that get the most benefit from the drug.

The Phase 3 portion of the trial will enroll some 500 patients, with overall survival as the likely primary endpoint. It will start in the early part of next year, with interim data available by the end of 2012 and final data the following year.

Dr. Bahcall says Synta also has seen encouraging data that radiation therapy can be more effective with ganetespib. He says, “Ganetespib inhibits some of the known repair mechanisms that are activated when cancer cells are irradiated. By suppressing these repair mechanism, ganetespib appears to enhance the activity of this type of treatment.” He adds that the company is considering another trial this year to examine the drug’s benefit with radiation therapy.

“The partnering interest we’re seeing for the ganetespib program is based on three things: the clear evidence that the compound is clinically active; that it has an unusually well tolerated safety profile for an active systemic therapy; and of course, the very large potential markets being addressed – multiple cancer indications, with very high unmet needs,” Dr. Bahcall says.

He is confident the company will conclude one or more partnerships this year. “We have four promising programs, each of which are in active partnering discussions. The discussions around ganetespib are moving along well, but we’ve seen good interest in each of these programs. The number of independent programs increases our confidence that we’ll identify one or more partnerships that we will want to enter into by the end of the year, whether it is for ganetespib or one of the others.”

Last month, at the American Association for Cancer Research (AACR) annual meeting, Synta outlined additional research findings for ganetespib and updated the mechanism that its elesclomol drug uses to target cancer cell metabolism.

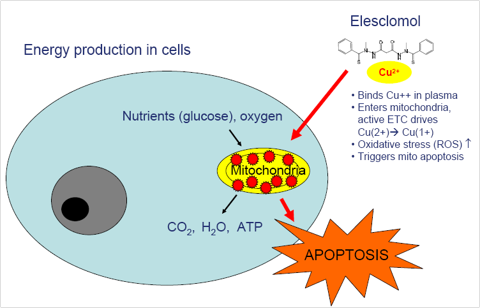

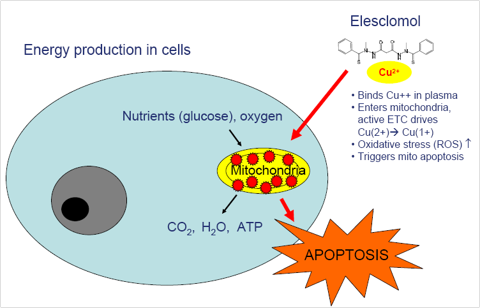

“Elesclomol works very differently than conventional chemotherapies or ‘targeted’ therapies which inhibit various cell signaling factors. Elesclomol targets the energy source – the power plant – of cancer cells: the mitochondria,” Dr. Bahcall says.

Citing the drug’s novel approach, he acknowledges that it has taken some time to understand why the drug worked in certain patients and not in others.

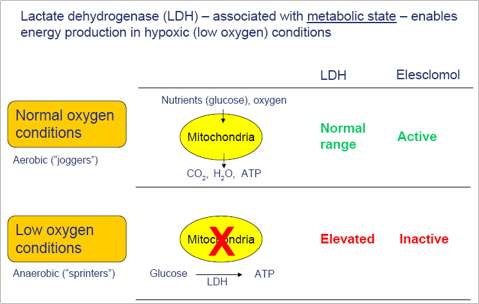

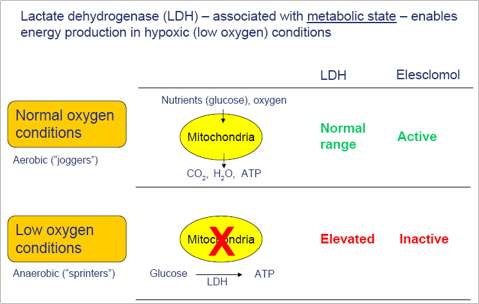

“Over the past year, our scientists have discovered that there is a marker that can differentiate between patients in which elesclomol is likely to be active and those in which it is not. That marker ties to the mechanism of action – the marker is a reflection of just how much a cancer cell is relying on the mitochondria for energy,” he explains. “Essentially, our drug targets active mitochondria, which requires oxygen. When cells have active mitochondria burning oxygen, treatment with elesclomol kills the cell; when cells do not have enough oxygen for active mitochondria, elesclomol doesn’t work. The marker our scientists identified is a way to measure, in the blood, to what extent cancer cells have active mitochondria.”

Using a running analogy, he points out that there are two types of running state: the aerobic, or jogging state, in which there is enough oxygen available for normal energy production in muscle cells; and the anaerobic, or sprinting state, in which cells rapidly exhaust available oxygen supply. There is a marker in the blood of the anaerobic sprinting state – the lactic acid buildup, which you feel as muscle burn. That’s analogous to what happens in cancer cells, he says. “Cancer cells in the jogging regime are killed by elesclomol, and the cancer cells in the anaerobic or sprinting regime are not killed. The biomarker we use to distinguish between the two is the analog of lactic acid build-up in runners.”

Dr. Bahcall says Synta has looked at the randomized trials that it ran with elesclomol and found clinical activity in patients who were in an aerobic state, the “joggers”. There was no clinical activity in the anaerobic state, the “sprinters”.

“This finding is exciting to all of us, because it represents a new type of drug and a new way of identifying just those patients who are likely to benefit,” he adds. “Targeting cancer cell metabolism in this way is an entirely novel approach to treating cancer, distinct from chemotherapy or cell signaling inhibition. Cancer metabolism is emerging now as one of the most exciting areas in cancer research.”

Investigator-sponsored clinical trials of elesclomol in acute myeloid leukemia and ovarian cancer are currently underway, and Synta expects to initiate a Phase 2 trial of elesclomol in non-small cell lung cancer by mid-year, he says, adding that research is continuing on several other cancer types, because the compound applies to many different cancers. “And that becomes very significant,” Dr. Bahcall adds.

While Synta’s inflammation program is still in the research stage, it includes drug candidates designed to inhibit the production of cytokines interleukin-12 and interleukin-23 and compounds that modulate the calcium-signaling pathway in immune cells that drive inflammatory responses in rheumatoid arthritis, psoriasis and inflammatory bowel disease.

“Essentially, what we’re developing are oral drugs that can suppress key proteins that drive inflammation,” Dr. Bahcall says. That compares with anti-inflammatory drugs like Remicade and Embrel, which are injected. “Our goal is to improve the activity and reduce the toxicities compared to currently available treatments. Most currently available therapies are either too toxic to be broadly used, or not sufficiently targeted to modify any more than just the symptoms of serious inflammatory or autoimmune disorders – for example, the aspirin class. While the injectable biologics are potent, pills which could achieve the same activity would be much more convenient for patients and might be able to avoid some of the other side effects associated with treatment with injectable biologics.” Synta hopes its compounds will move into the clinic sometime next year to begin Phase 1 human studies.

Pointing out that Synta has cash to finance its operations into 2012, he contends the company is in a “nice position, because we have significant investor interest, as seen by the quality and numbers of investors that participated in our most recent financing, as well as significant interest from partners, all of which create additional sources of capital that can extend our cash runway, as needed.”

http://seekingalpha.com/article/264442-synta-readying-2-key-…

Hier mal ein guter Artikel, der die Sache übersichtlich, umfangreich und aktuell darstellt:

(und auch Elesclomol ist noch nicht tot!)

Synta Pharmaceuticals (NASDAQ:SNTA) is gearing up to begin two key clinical trials in non-small cell lung cancer (NSCLC) with its two novel compounds – ganetespib and elesclomol – that are being closely watched by potential Big Pharma partners.

“Both are differentiated from anything else that’s out there,” CEO Dr. Safi Bahcall says in an exclusive interview with BioTuesdays.com.

Ganetespib is a potent, second-generation inhibitor of heat shock protein 90 (Hsp90), a well known cancer target. Hsp90 is a molecular chaperone required for the proper activation of many cancer-promoting proteins and is recognized as a key facilitator of cancer cell growth and survival. “It is one of the highest priority cancer targets because of its critical role across multiple cancer indications and in promoting resistance to chemotherapy as well targeted therapies,” he adds.

At a meeting of the International Association for the Study of Lung Cancer in February, Synta presented positive preliminary Phase 2 clinical data for ganetespib in treating NSCLC. In 33 patients with stage 3b/4 lung cancer, three had durable objective responses, ten had lesion tumor shrinkage, and 22 achieved lesion stabilization.

In a recent report, Roth Capital Partners analyst Andrew Vaino said ganetespib is the “most promising current Hsp90 inhibitor” in development and is poised to be the first second-generation Hsp90 inhibitor to make it to a Phase 3 clinical study. “While the preliminary data presented are early-stage … that 66% of patients experienced lesion stabilization shows, to us, a strong sign of activity.”

Ganetespib’s “safety appears remarkable,” Mr. Vaino added, with diarrhea, fatigue and nausea being the most common adverse events. Several multinational drug companies have stopped work on their second-generation Hsp90 inhibitors after patients experienced retina damage, which hasn’t been a problem for the more than 350 patients treated to date with ganetespib.

Dr. Bahcall says Synta is targeting lung cancer, because “we have seen convincing evidence of clinical activity in lung cancer.” He adds, “We have seen a number of patients who failed to respond to standard therapies, show definitive responses after receiving ganetespib.”

In addition to Synta’s focus on NSCLC, ganetespib is currently being evaluated in a broad range of investigator-sponsored cancer clinical studies, including NSCLC, breast, prostrate, pancreatic, colorectal, gastric, small cell lung, ocular melanoma, liver, gastrointestinal stromal tumors and hematologic cancers. “While these other trials are still quite early stage, we are seeing interesting signs of activity in gastric and breast cancer,” he adds.

Synta plans to begin a pivotal two-stage Phase 2b/3 clinical trial in the current quarter, treating second-line advanced NSCLC patients with ganetespib in combination with the chemotherapy, docetaxel. Preliminary results from the Phase 2b portion are expected either at the end of 2011 or the first quarter of 2012.

The Phase 2b portion of the trial, which will enroll about 240 patients, is designed to assess progression-free survival and safety and identify if there are any special subpopulations of patients that get the most benefit from the drug.

The Phase 3 portion of the trial will enroll some 500 patients, with overall survival as the likely primary endpoint. It will start in the early part of next year, with interim data available by the end of 2012 and final data the following year.

Dr. Bahcall says Synta also has seen encouraging data that radiation therapy can be more effective with ganetespib. He says, “Ganetespib inhibits some of the known repair mechanisms that are activated when cancer cells are irradiated. By suppressing these repair mechanism, ganetespib appears to enhance the activity of this type of treatment.” He adds that the company is considering another trial this year to examine the drug’s benefit with radiation therapy.

“The partnering interest we’re seeing for the ganetespib program is based on three things: the clear evidence that the compound is clinically active; that it has an unusually well tolerated safety profile for an active systemic therapy; and of course, the very large potential markets being addressed – multiple cancer indications, with very high unmet needs,” Dr. Bahcall says.

He is confident the company will conclude one or more partnerships this year. “We have four promising programs, each of which are in active partnering discussions. The discussions around ganetespib are moving along well, but we’ve seen good interest in each of these programs. The number of independent programs increases our confidence that we’ll identify one or more partnerships that we will want to enter into by the end of the year, whether it is for ganetespib or one of the others.”

Last month, at the American Association for Cancer Research (AACR) annual meeting, Synta outlined additional research findings for ganetespib and updated the mechanism that its elesclomol drug uses to target cancer cell metabolism.

“Elesclomol works very differently than conventional chemotherapies or ‘targeted’ therapies which inhibit various cell signaling factors. Elesclomol targets the energy source – the power plant – of cancer cells: the mitochondria,” Dr. Bahcall says.

Citing the drug’s novel approach, he acknowledges that it has taken some time to understand why the drug worked in certain patients and not in others.

“Over the past year, our scientists have discovered that there is a marker that can differentiate between patients in which elesclomol is likely to be active and those in which it is not. That marker ties to the mechanism of action – the marker is a reflection of just how much a cancer cell is relying on the mitochondria for energy,” he explains. “Essentially, our drug targets active mitochondria, which requires oxygen. When cells have active mitochondria burning oxygen, treatment with elesclomol kills the cell; when cells do not have enough oxygen for active mitochondria, elesclomol doesn’t work. The marker our scientists identified is a way to measure, in the blood, to what extent cancer cells have active mitochondria.”

Using a running analogy, he points out that there are two types of running state: the aerobic, or jogging state, in which there is enough oxygen available for normal energy production in muscle cells; and the anaerobic, or sprinting state, in which cells rapidly exhaust available oxygen supply. There is a marker in the blood of the anaerobic sprinting state – the lactic acid buildup, which you feel as muscle burn. That’s analogous to what happens in cancer cells, he says. “Cancer cells in the jogging regime are killed by elesclomol, and the cancer cells in the anaerobic or sprinting regime are not killed. The biomarker we use to distinguish between the two is the analog of lactic acid build-up in runners.”

Dr. Bahcall says Synta has looked at the randomized trials that it ran with elesclomol and found clinical activity in patients who were in an aerobic state, the “joggers”. There was no clinical activity in the anaerobic state, the “sprinters”.

“This finding is exciting to all of us, because it represents a new type of drug and a new way of identifying just those patients who are likely to benefit,” he adds. “Targeting cancer cell metabolism in this way is an entirely novel approach to treating cancer, distinct from chemotherapy or cell signaling inhibition. Cancer metabolism is emerging now as one of the most exciting areas in cancer research.”

Investigator-sponsored clinical trials of elesclomol in acute myeloid leukemia and ovarian cancer are currently underway, and Synta expects to initiate a Phase 2 trial of elesclomol in non-small cell lung cancer by mid-year, he says, adding that research is continuing on several other cancer types, because the compound applies to many different cancers. “And that becomes very significant,” Dr. Bahcall adds.

While Synta’s inflammation program is still in the research stage, it includes drug candidates designed to inhibit the production of cytokines interleukin-12 and interleukin-23 and compounds that modulate the calcium-signaling pathway in immune cells that drive inflammatory responses in rheumatoid arthritis, psoriasis and inflammatory bowel disease.

“Essentially, what we’re developing are oral drugs that can suppress key proteins that drive inflammation,” Dr. Bahcall says. That compares with anti-inflammatory drugs like Remicade and Embrel, which are injected. “Our goal is to improve the activity and reduce the toxicities compared to currently available treatments. Most currently available therapies are either too toxic to be broadly used, or not sufficiently targeted to modify any more than just the symptoms of serious inflammatory or autoimmune disorders – for example, the aspirin class. While the injectable biologics are potent, pills which could achieve the same activity would be much more convenient for patients and might be able to avoid some of the other side effects associated with treatment with injectable biologics.” Synta hopes its compounds will move into the clinic sometime next year to begin Phase 1 human studies.

Pointing out that Synta has cash to finance its operations into 2012, he contends the company is in a “nice position, because we have significant investor interest, as seen by the quality and numbers of investors that participated in our most recent financing, as well as significant interest from partners, all of which create additional sources of capital that can extend our cash runway, as needed.”

http://seekingalpha.com/article/264442-synta-readying-2-key-…

Und eine weitere Einordnung zu Ganetespib. Gut möglich, dass der Asiendeal (oder gleich mehr) wirklich bald kommt. Der Autor lag in der Vergangenheit mit solchen Prognosen recht gut:

2011 is shaping up as a transformational year for Synta (SNTA), who is making progress on multiple fronts with its lead agent ganetespib (formerly known as STA-9090). Ganetespib is an Hsp90 inhibitor, a protein with a well recognized role in cancer. The concept of inhibiting Hsp90 to fight cancer goes back two decades, but all attempts have been beset by failures so far. As Synta’s ganetespib appears to be the first active and safe Hsp90 inhibitor, it is poised to make a big dent in the multibillion dollar oncology market. I discussed the history of Hsp90 inhibitors and Synta’s unique positioning in a previous write up.)

Synta started off the year with good data in non-small cell lung cancer (NSCLC) and expects to accelerate ganetespib’s development towards a registration trial early next year. In the meantime, ganetespib is being evaluated in a broad and aggressive clinical development program, which could generate a lot of clinical data in 2011. Lastly, Synta is expected to partner Asian rights for the drug in the coming months. This deal should be very lucrative, as ganetespib represents everything the pharma industry is looking for: Clear signs of activity, established safety profile, broad potential utility and biomarkers for patient selection.

Promising clinical data

Last month, Synta published results from a phase II trial in NSCLC. The long anticipated data included results for 33 patients whose tumors did not harbor EGFR and KRAS mutations. These patients represent about two thirds of the overall population with NSCLC, the leading cause of cancer-related death in the western world. There were 3 cases of partial responses as well as 7 additional cases of tumor shrinkage. These results are in line with previous experience with Infinity’s (INFI) 1st generation Hsp90 inhibitor in NSCLC. The problem with Infinity’s drug, which is based on a natural antibiotic, was its problematic safety profile, primarily liver toxicities.

Based on these results, it is now safe to say that ganetespib is definitely an active drug as a single agent. This is further supported by responses in a variety of other indications, for which ganetespib is currently being evaluated. According to the company, they are seeing responses in breast, gastric, melanoma and colorectal cancer, some were in very heavily pretreated patients. This demonstrates the broad potential utility ganetespib possesses, which is not surprising given the central and ubiquitous role Hsp90 has in cancer biology.

Still, ganetespib did not have a meaningful effect in the majority of NSCLC patients and this is probably the case in other tumor types. This activity profile is typical of targeted therapies, which do not shrink tumors but curb their growth in the majority of patients. Some targeted agents, such as Tarceva and Nexavar lead to a survival benefit as single agents in unselected patient populations despite their mild activity profile. Nevertheless, in order to prove this for ganetespib, Synta will have to run a long, expensive and risky study.

Two additional alternatives for developing targeted agents are identifying patients who are more likely to respond using biomarkers or combining targeted agents with approved regimens. Synta is pursuing both directions in its recently announced registration program in lung cancer.

Registration strategy

Last month, Synta announced plans to initiate a phase 2b/3 study in NSCLC in combination with Taxotere, a commonly used chemotherapy drug. This trial, planned to start in the next quarter, will include a phase 2b portion that will generate a go/no go decision for the phase III portion and will inform the company on the optimal trial design. The phase III portion, which will involve the regimen and medical centers from the phase II portion, will start only based on good phase II data. The uniqueness in Synta’s approach is in coupling the phase II with the phase III from operational and regulatory aspects. This will save the company time and money as well facilitate a smooth transition between the two phases. Needless to say, if the phase 2b fails, this design has no apparent advantage.

There are basically two important questions the phase II portion should address. First, it will serve as an indication for the benefit in combing ganetespib with Taxotere. Another important aspect of the phase 2b trial will be identifying biomarkers in order to better define the patient population most likely to benefit from ganetespib. This is a crucial point as it will enable Synta to pursue approval of ganetespib as a highly effective treatment for niche populations, not necessarily in combination with Taxotere. This may represent a fast and cheap route to market on top of the long and standard phase III evaluation, assuming both are viable options.

The issue of biomarkers for patient selection has been touted by the company for a while but no specifics were provided. It appears that the company has already identified genetic markers in the patients who had dramatic responses with ganetespib but this data is still preliminary. There are probably multiple mutations that render cancer cells “Hsp90 addicted”. Even when assuming that these mutations occur in a small precentage (~10%) of the population, the cumulative market size across the different tumor types could be substantial. One marker that is already out in the open is ALK mutations in lung cancer patients, which I discussed in my recent post on Synta.

Synta is using PFS as a primary endpoint in the phase II portion, which is typically short in 2nd line NSCLC (3-4 months with Taxotere alone). Consequently, initial results from the phase 2b trial are expected late 2011 or early 2012, less than a year from study initiation.

The trial is not blinded, which somewhat compromises the robustness of the data. The advantage in not being blinded to the data is the ability to monitor in real time the trends and adjust the clinical strategy accordingly. Another potential issue might stem from using PFS as a basis for decision making given the relative fluid nature of this endpoint, as opposed to overall survival. In addition, given the short PFS expected in the control arm, it might be challenging to show a meaningful numerical difference.

Monetizing ganetespib

With the available data set which proves ganetespib is both safe and active as a single agent, the time is right for a partnership deal. Management did not provide specific guidance but insinuated that the preferable scenario will be a deal for marketing rights in Asia at this point followed by an additional deal down the road when the program is more advanced.

Based on licensing deals in the past years, ganetespib could be the subject of a massive licensing deal. The table below lists 7 licensing deals of targeted agents for cancer between biotech companies and large pharmas. What all these drugs have in common is the fact they target hot pathways, have broad potential utility as well as potential synergism with other targeted agents. In some cases, these agents have demonstrated activity in the form of objective responses.

Ganetespib has some unique properties over all of these agents at the time of their respective licensing deals. Its clinical data package includes hundreds of patients with clinical activity in over 5 tumor types. Moreover, all of the drugs below were experiencing fierce competition whereas ganetespib is the only Hsp90 inhibitor in advanced clinical development. Lastly, in contrast to the agents below, there are already good biomarkers for patient selection for ganetespib.

For a risk-averse partner, ganetespib’s unique situation creates an attractive and de-risked licensing opportunity. Consequently, investors could expect an upfront payment of ~$40M for the rights in Asia. A worldwide deal should bring upfront payment to over $100M.

With respect to sales potential, Pfizer’s crizotinib could be a good benchmark, as a highly effective drug in a niche patient population (ALK fusion mutations, accounting for ~4% of NSCLC cases). According to Bloomberg, crizotinib is forecasted to generate $755M annually in 2015. Hsp90 inhibitors are also believed to be very effective in ALK mutated patients, but there appear to be several additional mutations that make tumors sensitive to Hsp90 inhibition. For example, the patient with the strongest and most durable response in ganetespib’s NSCLC trial, appears to have a different mutation (not ALK). Unlike crizotinib, which has so far demonstrated activity in lung and a rare subtype lymphoma, ganetespib already has activity in a wide range of tumors with potentially additional genetic markers for patient selection. Therefore, ganetespib could easily become a $1B drug just in genetically defined patient populations.

Future Catalysts in 2011

Synta is looking at an eventful 2011. Events should include a licensing deal in Asia as well as a large body of clinical data at ASCO 2011 this June. The company is also expected to launch the phase 2b in NSCLC during the quarter, with initial data expected late 2011 or early 2012.

Another important event is first clinical data for CUDC-305, Curis’ (CRIS) Hsp90 inhibitor, partnered with Debiopharm. This could be the first real competitor to ganetespib based on remarks by Curis’ CEO at the recent RBC healthcare conference, who stated that this drug has a clean safety profile and there are multiple signs of clinical activity. One clear advantage CUDC-305 could have is the fact it can be given orally, in contrast to ganetespib. Nevertheless, it is hard to evaluate CUDC-305 as there is no published data for this compound.

In summary, ganetespib has the right ingredients to push Synta’s shares higher during 2011. The drug hits a hot target, it has early signs of clinical activity with an established safety profile and is currently in a broad clinical program. Adding good biomarker data for patient selection and the lack of other advanced stage Hsp90 inhibitors makes ganetespib one of the most attractive unpartnered assets in the industry.

http://www.hammerstockblog.com/putting-a-price-tag-on-synta%…

2011 is shaping up as a transformational year for Synta (SNTA), who is making progress on multiple fronts with its lead agent ganetespib (formerly known as STA-9090). Ganetespib is an Hsp90 inhibitor, a protein with a well recognized role in cancer. The concept of inhibiting Hsp90 to fight cancer goes back two decades, but all attempts have been beset by failures so far. As Synta’s ganetespib appears to be the first active and safe Hsp90 inhibitor, it is poised to make a big dent in the multibillion dollar oncology market. I discussed the history of Hsp90 inhibitors and Synta’s unique positioning in a previous write up.)

Synta started off the year with good data in non-small cell lung cancer (NSCLC) and expects to accelerate ganetespib’s development towards a registration trial early next year. In the meantime, ganetespib is being evaluated in a broad and aggressive clinical development program, which could generate a lot of clinical data in 2011. Lastly, Synta is expected to partner Asian rights for the drug in the coming months. This deal should be very lucrative, as ganetespib represents everything the pharma industry is looking for: Clear signs of activity, established safety profile, broad potential utility and biomarkers for patient selection.

Promising clinical data

Last month, Synta published results from a phase II trial in NSCLC. The long anticipated data included results for 33 patients whose tumors did not harbor EGFR and KRAS mutations. These patients represent about two thirds of the overall population with NSCLC, the leading cause of cancer-related death in the western world. There were 3 cases of partial responses as well as 7 additional cases of tumor shrinkage. These results are in line with previous experience with Infinity’s (INFI) 1st generation Hsp90 inhibitor in NSCLC. The problem with Infinity’s drug, which is based on a natural antibiotic, was its problematic safety profile, primarily liver toxicities.

Based on these results, it is now safe to say that ganetespib is definitely an active drug as a single agent. This is further supported by responses in a variety of other indications, for which ganetespib is currently being evaluated. According to the company, they are seeing responses in breast, gastric, melanoma and colorectal cancer, some were in very heavily pretreated patients. This demonstrates the broad potential utility ganetespib possesses, which is not surprising given the central and ubiquitous role Hsp90 has in cancer biology.

Still, ganetespib did not have a meaningful effect in the majority of NSCLC patients and this is probably the case in other tumor types. This activity profile is typical of targeted therapies, which do not shrink tumors but curb their growth in the majority of patients. Some targeted agents, such as Tarceva and Nexavar lead to a survival benefit as single agents in unselected patient populations despite their mild activity profile. Nevertheless, in order to prove this for ganetespib, Synta will have to run a long, expensive and risky study.

Two additional alternatives for developing targeted agents are identifying patients who are more likely to respond using biomarkers or combining targeted agents with approved regimens. Synta is pursuing both directions in its recently announced registration program in lung cancer.

Registration strategy

Last month, Synta announced plans to initiate a phase 2b/3 study in NSCLC in combination with Taxotere, a commonly used chemotherapy drug. This trial, planned to start in the next quarter, will include a phase 2b portion that will generate a go/no go decision for the phase III portion and will inform the company on the optimal trial design. The phase III portion, which will involve the regimen and medical centers from the phase II portion, will start only based on good phase II data. The uniqueness in Synta’s approach is in coupling the phase II with the phase III from operational and regulatory aspects. This will save the company time and money as well facilitate a smooth transition between the two phases. Needless to say, if the phase 2b fails, this design has no apparent advantage.

There are basically two important questions the phase II portion should address. First, it will serve as an indication for the benefit in combing ganetespib with Taxotere. Another important aspect of the phase 2b trial will be identifying biomarkers in order to better define the patient population most likely to benefit from ganetespib. This is a crucial point as it will enable Synta to pursue approval of ganetespib as a highly effective treatment for niche populations, not necessarily in combination with Taxotere. This may represent a fast and cheap route to market on top of the long and standard phase III evaluation, assuming both are viable options.

The issue of biomarkers for patient selection has been touted by the company for a while but no specifics were provided. It appears that the company has already identified genetic markers in the patients who had dramatic responses with ganetespib but this data is still preliminary. There are probably multiple mutations that render cancer cells “Hsp90 addicted”. Even when assuming that these mutations occur in a small precentage (~10%) of the population, the cumulative market size across the different tumor types could be substantial. One marker that is already out in the open is ALK mutations in lung cancer patients, which I discussed in my recent post on Synta.

Synta is using PFS as a primary endpoint in the phase II portion, which is typically short in 2nd line NSCLC (3-4 months with Taxotere alone). Consequently, initial results from the phase 2b trial are expected late 2011 or early 2012, less than a year from study initiation.

The trial is not blinded, which somewhat compromises the robustness of the data. The advantage in not being blinded to the data is the ability to monitor in real time the trends and adjust the clinical strategy accordingly. Another potential issue might stem from using PFS as a basis for decision making given the relative fluid nature of this endpoint, as opposed to overall survival. In addition, given the short PFS expected in the control arm, it might be challenging to show a meaningful numerical difference.

Monetizing ganetespib

With the available data set which proves ganetespib is both safe and active as a single agent, the time is right for a partnership deal. Management did not provide specific guidance but insinuated that the preferable scenario will be a deal for marketing rights in Asia at this point followed by an additional deal down the road when the program is more advanced.

Based on licensing deals in the past years, ganetespib could be the subject of a massive licensing deal. The table below lists 7 licensing deals of targeted agents for cancer between biotech companies and large pharmas. What all these drugs have in common is the fact they target hot pathways, have broad potential utility as well as potential synergism with other targeted agents. In some cases, these agents have demonstrated activity in the form of objective responses.

Ganetespib has some unique properties over all of these agents at the time of their respective licensing deals. Its clinical data package includes hundreds of patients with clinical activity in over 5 tumor types. Moreover, all of the drugs below were experiencing fierce competition whereas ganetespib is the only Hsp90 inhibitor in advanced clinical development. Lastly, in contrast to the agents below, there are already good biomarkers for patient selection for ganetespib.

For a risk-averse partner, ganetespib’s unique situation creates an attractive and de-risked licensing opportunity. Consequently, investors could expect an upfront payment of ~$40M for the rights in Asia. A worldwide deal should bring upfront payment to over $100M.

With respect to sales potential, Pfizer’s crizotinib could be a good benchmark, as a highly effective drug in a niche patient population (ALK fusion mutations, accounting for ~4% of NSCLC cases). According to Bloomberg, crizotinib is forecasted to generate $755M annually in 2015. Hsp90 inhibitors are also believed to be very effective in ALK mutated patients, but there appear to be several additional mutations that make tumors sensitive to Hsp90 inhibition. For example, the patient with the strongest and most durable response in ganetespib’s NSCLC trial, appears to have a different mutation (not ALK). Unlike crizotinib, which has so far demonstrated activity in lung and a rare subtype lymphoma, ganetespib already has activity in a wide range of tumors with potentially additional genetic markers for patient selection. Therefore, ganetespib could easily become a $1B drug just in genetically defined patient populations.

Future Catalysts in 2011

Synta is looking at an eventful 2011. Events should include a licensing deal in Asia as well as a large body of clinical data at ASCO 2011 this June. The company is also expected to launch the phase 2b in NSCLC during the quarter, with initial data expected late 2011 or early 2012.

Another important event is first clinical data for CUDC-305, Curis’ (CRIS) Hsp90 inhibitor, partnered with Debiopharm. This could be the first real competitor to ganetespib based on remarks by Curis’ CEO at the recent RBC healthcare conference, who stated that this drug has a clean safety profile and there are multiple signs of clinical activity. One clear advantage CUDC-305 could have is the fact it can be given orally, in contrast to ganetespib. Nevertheless, it is hard to evaluate CUDC-305 as there is no published data for this compound.

In summary, ganetespib has the right ingredients to push Synta’s shares higher during 2011. The drug hits a hot target, it has early signs of clinical activity with an established safety profile and is currently in a broad clinical program. Adding good biomarker data for patient selection and the lack of other advanced stage Hsp90 inhibitors makes ganetespib one of the most attractive unpartnered assets in the industry.

http://www.hammerstockblog.com/putting-a-price-tag-on-synta%…

Ganetespib wird derzeit in einer breiten Palette von klinischen Studien sowohl als Monotherapie und in Kombination mit anderen Anti-Krebs-Wirkstoffe untersucht. Bald tritt Phase III in Kraft. Aktie bekommt langsam Flügel.

Hier war ja lange Sendepause...

Also, Ganetespib ist noch immer nicht verpartnert, aber der P IIb-Trial hat erste Daten geliefert, die gar nicht so schlecht aussehen. Bis Ende des Jahres, wahrscheinlich schon im September, werden wir hier Klarheit haben.

Ohad Hammer hat die jüngsten Entwicklungen umfassend beschrieben:

Synta- The Signal Looks Real

So what does the market really think about Synta’s (SNTA) lung cancer data? 2 weeks ago, the stock lost 33% in 1 trading session following interim results from the phase II trial for the company’s lead agent, ganetespib. Since then, Synta regained most of the fall, as the market digested the data with the help of supporting analysts from Jefferies and Roth Capital.

Looking at the clinical results, it is easy to understand the market’s bi-polar reaction. One the one hand, there are multiple promising efficacy signals and a good safety profile. On the other, the data set was less mature than what investors had expected.

The GALAXY trial design

Synta evaluated ganetespib in combination with chemotherapy (docetaxel) for 2nd line NSCLC (non-small cell lung cancer). The trial is a large (240 patients) randomized phase II study designed as a “signal searching” trial for identifying specific patient populations that are more responsive to the drug. The trial is big enough to detect a signal even in a subset of 20% based on progression-free survival (PFS). Based on the signal in the phase II portion, Synta plans to take ganetespib to phase III in the relevant patient populations.

Originally, there were 2 subsets in which ganetespib had already shown an efficacy signal: ALK mutants and KRAS mutants. As the drug is already being studies in dedicated trials for ALK mutated tumors, the GALAXY trial focused on other subsets, primarily KRAS mutants (based on early clinical experience) and high LDH (based on preclinical evidence and scientific rationale).

Initial signs of activity

At the interim analysis, the database included 183 patients, with an efficacy signal across three subsets:

1. Adenocarcinoma subtype (114 patients, 62% of overall population)

2. Adenocarcinoma subtype with high LDH (31 patients, 17% of overall population)

3. Adenocarcinoma subtype KRAS mutants (20 patients, 11% of overall population)

In the adeno subset, ganetespib generated a signal in PFS and overall survival. Patients who received chemo+ganetespib had a median PFS of 4.2 months vs. 2.9 months in the control arm. Response rate was also higher in the ganetespib arm (15% vs. 8%). The most striking signal was in the preliminary overall survival analysis, which showed a clear separation between the two arms, which started from day 100. This analysis should be treated with cautious given the low number of events but the trend looks very promising.

In the high LDH and KRAS mutant subsets, adding ganetespib led to an impressive signal in progression-free survival (PFS). LDH-high and KRAS mutant patients in the control arm had a median PFS of 1.4 and 1.6 months respectively. Patients in these subsets who received chemo+ganetespib had a PFS of 4.2 months, representing a 3 and 2.6-fold increase, respectively. Responses were also more common in the combination arm for both subsets.

Are the signals real?

Subset analysis relies on several factors including sample size, numerical difference, prospective definition of subset and type of endpoint. The 3 different subset analyses presented by Synta look compelling although they vary in terms of data maturity and reliability.

The adeno subset included a large sample size (114 patients, half of whom experienced progression) but the PFS difference was modest and was not pre-defined as a co-primary endpoint. The overall survival signal in adeno patients is early but the separation of the curves looks very promising.

The extent of PFS difference in the adeno group (1.3 months, 45% improvement) might not look impressive at first glance. However, PFS often under-represents the survival benefit of targeted agents like ganetespib. Two examples in lung cancer are Tarceva and Avastin, both of which are approved based a survival advantage. Avastin led to 1.7 month (38%) improvement in PFS with Tarceva adding only 0.4 months (25% improvement).

The LDH and KRAS subsets were small but the magnitude of PFS was impressive (2.5-3 fold increase) and they were prospectively defined. One encouraging sign is the fact that effect size was maintained as the data matured during the past 3 months, according to Synta’s CEO. Although the KRAS subset is the smallest, it is the only one relying on a molecular characteristic of the tumor with a clear rationale and clinical activity for ganetespib in an earlier trial as monotherapy.

No statistical measures were provided by the company, due to the early stage of the data set. Nevertheless, Synta’s decision to proceed to phase III implies that there are at least statistical trends.

Synta vs. Array

In KRAS mutated lung cancer, the most relevant comparator for ganetespib is AstraZeneca’s (AZN)selumetinib, which I wrote about in my ASCO 2012 summary. Originally licensed from Array Biopharma (ARRY), selumetinib was also added to docetaxel for NSCLC patients with KRAS mutants.

An indirect comparison between the two agents shows a similar PFS benefit over docetaxel, with a ~2.5-fold improvement. Response rate for selumetinib appears higher, but it is unclear whether responses were defined in the same way (confirmed vs. unconfirmed).

Selumetinib’s data set is larger and more mature, automatically making it more reliable. The difference in PFS and response rate were also statistically significant with selumetinib, whereas there was simply not enough data to evaluate statistical significance for ganetespib. Lastly, the selumetinib trial was a double blind study in contrast to the ganetespib trial, where physicians knew which patients were receiving the drug or placebo. This could have created an investigator bias in evaluating PFS and response rate. Needless to say, updated results for ganetespib could change this comparison to either direction.

Both drugs are expected to enter phase III in KRAS mutants later this year. Since they have distinct modes of action, they could be synergistic in combination. It is unlikely that evaluating the two drugs in combination will occur before they reach the market, as they are running neck and neck towards approval. The only company with an Hsp90 inhibitor and a MEK inhibitor in clinical testing is Novartis.

Summary

The PFS benefit across the 3 different subsets looks reliable thanks to the large sample size for the adeno subgroup and the fact that KRAS and LDH sub-analysis was prospectively defined by the company. The biggest surprise was the preliminary survival trend in the adeno group, which represent a large commercial opportunity ($1.5B in the US alone). Even if only one of the smaller subgroup analysis is corroborated by larger studies (LDH or KRAS), ganetespib is still looking at a $0.5B opportunity, excluding the ALK opportunity.

Still, one cannot help wondering if Synta should have waited 2-3 more months to provide the investment community with the complete picture. The next update is expected at the ESMO meeting (starts Sep 28th), which is expected to include more patients and longer follow up.

http://www.hammerstockblog.com/synta-the-signal-looks-real/

Also, Ganetespib ist noch immer nicht verpartnert, aber der P IIb-Trial hat erste Daten geliefert, die gar nicht so schlecht aussehen. Bis Ende des Jahres, wahrscheinlich schon im September, werden wir hier Klarheit haben.

Ohad Hammer hat die jüngsten Entwicklungen umfassend beschrieben:

Synta- The Signal Looks Real

So what does the market really think about Synta’s (SNTA) lung cancer data? 2 weeks ago, the stock lost 33% in 1 trading session following interim results from the phase II trial for the company’s lead agent, ganetespib. Since then, Synta regained most of the fall, as the market digested the data with the help of supporting analysts from Jefferies and Roth Capital.

Looking at the clinical results, it is easy to understand the market’s bi-polar reaction. One the one hand, there are multiple promising efficacy signals and a good safety profile. On the other, the data set was less mature than what investors had expected.

The GALAXY trial design

Synta evaluated ganetespib in combination with chemotherapy (docetaxel) for 2nd line NSCLC (non-small cell lung cancer). The trial is a large (240 patients) randomized phase II study designed as a “signal searching” trial for identifying specific patient populations that are more responsive to the drug. The trial is big enough to detect a signal even in a subset of 20% based on progression-free survival (PFS). Based on the signal in the phase II portion, Synta plans to take ganetespib to phase III in the relevant patient populations.

Originally, there were 2 subsets in which ganetespib had already shown an efficacy signal: ALK mutants and KRAS mutants. As the drug is already being studies in dedicated trials for ALK mutated tumors, the GALAXY trial focused on other subsets, primarily KRAS mutants (based on early clinical experience) and high LDH (based on preclinical evidence and scientific rationale).

Initial signs of activity

At the interim analysis, the database included 183 patients, with an efficacy signal across three subsets:

1. Adenocarcinoma subtype (114 patients, 62% of overall population)

2. Adenocarcinoma subtype with high LDH (31 patients, 17% of overall population)

3. Adenocarcinoma subtype KRAS mutants (20 patients, 11% of overall population)

In the adeno subset, ganetespib generated a signal in PFS and overall survival. Patients who received chemo+ganetespib had a median PFS of 4.2 months vs. 2.9 months in the control arm. Response rate was also higher in the ganetespib arm (15% vs. 8%). The most striking signal was in the preliminary overall survival analysis, which showed a clear separation between the two arms, which started from day 100. This analysis should be treated with cautious given the low number of events but the trend looks very promising.

In the high LDH and KRAS mutant subsets, adding ganetespib led to an impressive signal in progression-free survival (PFS). LDH-high and KRAS mutant patients in the control arm had a median PFS of 1.4 and 1.6 months respectively. Patients in these subsets who received chemo+ganetespib had a PFS of 4.2 months, representing a 3 and 2.6-fold increase, respectively. Responses were also more common in the combination arm for both subsets.

Are the signals real?

Subset analysis relies on several factors including sample size, numerical difference, prospective definition of subset and type of endpoint. The 3 different subset analyses presented by Synta look compelling although they vary in terms of data maturity and reliability.

The adeno subset included a large sample size (114 patients, half of whom experienced progression) but the PFS difference was modest and was not pre-defined as a co-primary endpoint. The overall survival signal in adeno patients is early but the separation of the curves looks very promising.

The extent of PFS difference in the adeno group (1.3 months, 45% improvement) might not look impressive at first glance. However, PFS often under-represents the survival benefit of targeted agents like ganetespib. Two examples in lung cancer are Tarceva and Avastin, both of which are approved based a survival advantage. Avastin led to 1.7 month (38%) improvement in PFS with Tarceva adding only 0.4 months (25% improvement).

The LDH and KRAS subsets were small but the magnitude of PFS was impressive (2.5-3 fold increase) and they were prospectively defined. One encouraging sign is the fact that effect size was maintained as the data matured during the past 3 months, according to Synta’s CEO. Although the KRAS subset is the smallest, it is the only one relying on a molecular characteristic of the tumor with a clear rationale and clinical activity for ganetespib in an earlier trial as monotherapy.

No statistical measures were provided by the company, due to the early stage of the data set. Nevertheless, Synta’s decision to proceed to phase III implies that there are at least statistical trends.

Synta vs. Array

In KRAS mutated lung cancer, the most relevant comparator for ganetespib is AstraZeneca’s (AZN)selumetinib, which I wrote about in my ASCO 2012 summary. Originally licensed from Array Biopharma (ARRY), selumetinib was also added to docetaxel for NSCLC patients with KRAS mutants.

An indirect comparison between the two agents shows a similar PFS benefit over docetaxel, with a ~2.5-fold improvement. Response rate for selumetinib appears higher, but it is unclear whether responses were defined in the same way (confirmed vs. unconfirmed).

Selumetinib’s data set is larger and more mature, automatically making it more reliable. The difference in PFS and response rate were also statistically significant with selumetinib, whereas there was simply not enough data to evaluate statistical significance for ganetespib. Lastly, the selumetinib trial was a double blind study in contrast to the ganetespib trial, where physicians knew which patients were receiving the drug or placebo. This could have created an investigator bias in evaluating PFS and response rate. Needless to say, updated results for ganetespib could change this comparison to either direction.

Both drugs are expected to enter phase III in KRAS mutants later this year. Since they have distinct modes of action, they could be synergistic in combination. It is unlikely that evaluating the two drugs in combination will occur before they reach the market, as they are running neck and neck towards approval. The only company with an Hsp90 inhibitor and a MEK inhibitor in clinical testing is Novartis.

Summary

The PFS benefit across the 3 different subsets looks reliable thanks to the large sample size for the adeno subgroup and the fact that KRAS and LDH sub-analysis was prospectively defined by the company. The biggest surprise was the preliminary survival trend in the adeno group, which represent a large commercial opportunity ($1.5B in the US alone). Even if only one of the smaller subgroup analysis is corroborated by larger studies (LDH or KRAS), ganetespib is still looking at a $0.5B opportunity, excluding the ALK opportunity.

Still, one cannot help wondering if Synta should have waited 2-3 more months to provide the investment community with the complete picture. The next update is expected at the ESMO meeting (starts Sep 28th), which is expected to include more patients and longer follow up.

http://www.hammerstockblog.com/synta-the-signal-looks-real/

In den letzten Wochen gab es übrigens auch relativ große Insiderkäufe. Der Kauf von Kovner war ca. 5 Mio. Dollar schwer.

Synta on stock run after insider buys

Boston Business Journal by Julie M. Donnelly, Reporter

Date: Tuesday, July 3, 2012, 12:05pm EDT

Julie M. Donnelly

Reporter- Boston Business Journal

Synta Pharmaceuticals’ (Nasdaq: SNTA) stock rose more than 10 percent Tuesday, and has jumped more than 32 percent since a rash of insider buys June 29. The Lexington, Mass-based biotechnology company has no approved drugs but has six mid-to-late stage clinical trials ongoing for potential cancer therapies.

Board director Bruce Kovner purchased 910,000 shares on June 29 and currently controls more than 10 percent of the company. Board chairman Keith Gollust purchased 150,000 shares on June 29 and currently controls 2,015,348 shares of the company.

CEO Safi Bahcall purchased 10,000 shares on June 29 and currently holds 2,343,135 shares of the company. Vice President of Clinical Research Vojo Vukovic purchased 3,000 shares on June 29 and currently holds 25,249 shares of the company.

Synta on stock run after insider buys

Boston Business Journal by Julie M. Donnelly, Reporter

Date: Tuesday, July 3, 2012, 12:05pm EDT

Julie M. Donnelly

Reporter- Boston Business Journal

Synta Pharmaceuticals’ (Nasdaq: SNTA) stock rose more than 10 percent Tuesday, and has jumped more than 32 percent since a rash of insider buys June 29. The Lexington, Mass-based biotechnology company has no approved drugs but has six mid-to-late stage clinical trials ongoing for potential cancer therapies.

Board director Bruce Kovner purchased 910,000 shares on June 29 and currently controls more than 10 percent of the company. Board chairman Keith Gollust purchased 150,000 shares on June 29 and currently controls 2,015,348 shares of the company.

CEO Safi Bahcall purchased 10,000 shares on June 29 and currently holds 2,343,135 shares of the company. Vice President of Clinical Research Vojo Vukovic purchased 3,000 shares on June 29 and currently holds 25,249 shares of the company.

Beitrag zu dieser Diskussion schreiben

Zu dieser Diskussion können keine Beiträge mehr verfasst werden, da der letzte Beitrag vor mehr als zwei Jahren verfasst wurde und die Diskussion daraufhin archiviert wurde.

Bitte wenden Sie sich an feedback@wallstreet-online.de und erfragen Sie die Reaktivierung der Diskussion oder starten Sie eine neue Diskussion.

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 189 | ||

| 125 | ||

| 94 | ||

| 76 | ||

| 76 | ||

| 51 | ||

| 45 | ||

| 43 | ||

| 39 | ||

| 35 |

| Wertpapier | Beiträge | |

|---|---|---|

| 30 | ||

| 26 | ||

| 26 | ||

| 18 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 17 | ||

| 16 | ||

| 15 |