The gold mining stock as a Tenbagger (Seite 4)

eröffnet am 14.06.17 02:30:00 von

neuester Beitrag 22.12.23 12:50:05 von

neuester Beitrag 22.12.23 12:50:05 von

Beiträge: 84

ID: 1.255.112

ID: 1.255.112

Aufrufe heute: 0

Gesamt: 4.120

Gesamt: 4.120

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 11:52 | 3384 | |

| heute 14:48 | 2367 | |

| gestern 22:26 | 1662 | |

| vor 37 Minuten | 1560 | |

| vor 20 Minuten | 1453 | |

| 08.05.24, 11:56 | 1442 | |

| heute 13:44 | 1291 | |

| vor 12 Minuten | 1056 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.772,85 | +0,46 | 131 | |||

| 2. | 3. | 0,2170 | +3,33 | 125 | |||

| 3. | Neu! | 8,2570 | +96,67 | 108 | |||

| 4. | 4. | 156,46 | -2,31 | 103 | |||

| 5. | 14. | 5,7540 | -2,18 | 56 | |||

| 6. | 2. | 0,2980 | -3,87 | 50 | |||

| 7. | 5. | 2,3720 | -7,54 | 49 | |||

| 8. | 7. | 6,8000 | +2,38 | 38 |

Beitrag zu dieser Diskussion schreiben

biggest gold miners:

https://www.kitco.com/news/2020-12-31/Polyus-is-the-top-2020…

Zu Sibanye: ...und Platin kommt erst so langsam ins Laufen

https://www.kitco.com/news/2020-12-31/Polyus-is-the-top-2020…

Zu Sibanye: ...und Platin kommt erst so langsam ins Laufen

nur Beispiele: Forward P/E's nach Thomson Reuters, 28.12.2020:

• Barrick Gold: 16.86

• Newmont: 15.97

• Newcrest Mining: 14.71

• AngloGold Ashanti: 5.30 (!)

Forward P/E S&P 500: alles schon gleichmäßig über 20:

https://twitter.com/ISABELNET_SA/status/1343521086093320193

nebenbei: ich halte New Gold (NGD) für kein so wahrscheinliches Übernahmeziel; zumindest nicht 2021.

Ja, der strebsame CEO Renaud Adams hat Erfahrung darin, siehe Verkauf von Richmont Mines an Alamos (neben anderen Faktoren), aber der Umbau auch unter ihm ist doch schon so gut wie abgeschlossen.

Vor allem mit dem Verkauf der (großen) Blackwater-Liegenschaft in BC.

Obacht in Yukon..

“We are extremely disappointed with, and surprised by this decision”, said President and CEO Graham Downs. “This was an application for a private, single-lane, gravel and controlled-access road in an area with existing winter trail access. If this road can’t be permitted following a positive environmental and socio-economic assessment decision and years of governmental encouragement to invest in the project, then you have to wonder if Yukon is in fact open for business.”

30.11.

Yukon Government rejects ATAC's tote road permit

https://www.kitco.com/news/2020-11-30/Yukon-Government-rejec…

..und auch in BC:

• ich habe da manchmal den Eindruck, daß man Explorer und Developer erstmal kommen und Arbeitsplätze, auch ein paar vor Ort, schafffen lässt (mit dem Geld fremder Leute), und dann wenn's richtig losgehen soll: nö

Ich habe nichts gegen Naturschutz (65Km mining road through the Beaver River Watershed) und den Schutz der Interessen von angestammten Einwohnern, aber dann soll man halt von vornherein ehrlich sein und sagen: eine Mine kommt da niemals hin solange wir hier leben

<keine Position>

“We are extremely disappointed with, and surprised by this decision”, said President and CEO Graham Downs. “This was an application for a private, single-lane, gravel and controlled-access road in an area with existing winter trail access. If this road can’t be permitted following a positive environmental and socio-economic assessment decision and years of governmental encouragement to invest in the project, then you have to wonder if Yukon is in fact open for business.”

30.11.

Yukon Government rejects ATAC's tote road permit

https://www.kitco.com/news/2020-11-30/Yukon-Government-rejec…

..und auch in BC:

• ich habe da manchmal den Eindruck, daß man Explorer und Developer erstmal kommen und Arbeitsplätze, auch ein paar vor Ort, schafffen lässt (mit dem Geld fremder Leute), und dann wenn's richtig losgehen soll: nö

Ich habe nichts gegen Naturschutz (65Km mining road through the Beaver River Watershed) und den Schutz der Interessen von angestammten Einwohnern, aber dann soll man halt von vornherein ehrlich sein und sagen: eine Mine kommt da niemals hin solange wir hier leben

<keine Position>

Forecast: Top 30 Gold Producers in 2021

aus: Investor Presentation September 2020, Turquoise Hill Resources

=> es gibt auf der Welt ziemlich viele und mMn auch überraschend viele Goldminen, die im Jahr ~500k Unzen Gold produzieren

Die Top-Mine, immer noch und mit Abstand, ist die Muruntau Mine in Usbekistan, die als Staatsunternehmen betrieben wird (Navoi Mining and Metallurgy Combinat).

aus: Investor Presentation September 2020, Turquoise Hill Resources

=> es gibt auf der Welt ziemlich viele und mMn auch überraschend viele Goldminen, die im Jahr ~500k Unzen Gold produzieren

Die Top-Mine, immer noch und mit Abstand, ist die Muruntau Mine in Usbekistan, die als Staatsunternehmen betrieben wird (Navoi Mining and Metallurgy Combinat).

The Precious FANGs:

$FNV

$AEM

$NEM

$GOLD

https://twitter.com/stebottaioli/status/1324379393821757445

Antwort auf Beitrag Nr.: 65.160.775 von faultcode am 22.09.20 22:01:59Shareholders’ Gold Council

https://www.goldcouncil.net/press-release

September 20, 2020

Open Letter to Global Gold Company CEOs & Boards

As long-term investors in the gold mining sector, we evaluate the success of our investment decisions by looking at a number of factors, including stock price performance, strategic vision & execution, environmental & social records, proper governance, and alignment of incentives.

Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision & communication with investors. Admittedly, some companies have made significant improvements in these areas recently, but there is still ample room for improvement.

Our aim in sending this letter out is not to focus on criticism-but rather, to offer some solutions that we think would provide for greater alignment of interests between management teams, board members and shareholders.

We believe greater alignment is necessary for Boards to effectively manage the best interests of companies. We have provided below some ideas that we think would improve the perception of the industry, to make the sector more attractive to investors:

Corporate Governance

Establish strict term limits for directors who do not have meaningful stock ownership;

Broaden board representation from outside a narrow geographic and industrial background and ensure diversity of membership;

Have a clear disclosed process for selecting directors that includes meaningful dialog with shareholders;

Disclose the nature of any material current and past professional and personal relationships amongst board members;

Limit the number of fully-operational corporate boards that directors can sit on with an absolute maximum which is at or below how ISS and Glass Lewis define “overboarded”.

Shareholder Alignment & Compensation

Include per-share value metrics in calculating compensation for management teams and incorporate those metrics in presentations to investors;

Define what metrics company management teams will be assessed upon for annual compensation at the beginning of the year (rather than retroactively when circulars are released one year later);

Ensure a material component of non-equity bonus grants are tied to long-term shareholder returns;

Implement a balance in the granting of stock grants and options to reward long-term stock price appreciation appropriately;

Impose strict maximum quantity and minimum time thresholds for how much stock insiders can sell when exercising options;

Institute progressive levels of minimum insider stock ownership levels that are also proportional to seniority and tenure of each director;

Ensure that change of control fees are tied to long-term shareholder returns.

Strategy & Execution

Maintain active data rooms without onerous entry conditions, such as open-ended time and scope-limited standstills, which preclude potential acquirers from taking offers directly to shareholders;

Articulate a capital return framework which balances the allocation of free cash flow towards dividends, share buybacks, and manageable growth initiatives (for companies in production);

Delineate and disclose how budgets are allocated between exploration & development activities, general & administrative expenses, and management compensation (for companies in exploration and development);

Maintain an ongoing dialogue with shareholders regarding future equity capital needs for the business and carefully consider the pros and cons of various equity raising options, while noting that “bought deals” are often considered problematic and shareholder unfriendly by market participants.

Despite the strong performance of precious metals mining equities in 2020, investor flows into active and passive fund strategies have been lackluster. In contrast, flows into physical metals and related ETFs have been record breaking. The contrast suggests that the appeal of mining equities remains limited to specialist funds and has escaped the attention of generalist investors.

Despite strong performance, mining shares are still episodically inexpensive. We believe that adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders.

Respectfully submitted,

Walter M. Cabot Jr., President, Apogee Global Advisors Inc.

Jon Case, Portfolio Manager, CI Investments

William R Church, Managing Member, TGRA Capital Management LLC

Sean Fieler, President & CIO, Equinox Partners

Joe Foster, Portfolio Manager, VanEck Funds

Benoit Gervais, Senior VP/Portfolio Manager, Mackenzie Investments

Christian Godin, Executive Director, Shareholders’ Gold Council

Bernhard Graf, Portfolio Manager, AMG Fondsverwaltung AG

John Hathaway, Senior Portfolio Manager, Sprott

Jon Hartsel, Co-Chief Investment Officer and Director of Research, Donald Smith & Company

Dave Iben, Chief Investment Officer and Lead Portfolio Manager, Kopernik Global Investors, LLC

Marcelo Kim, Partner, Paulson & Co. Inc.

Stephen Land, VP/Portfolio Manager, Franklin Templeton

Georges Lequime, Senior Fund Advisor, Earth Resource Investment Group

Shanquan Li, Senior Portfolio Manager, Invesco

Daniel McConvey, Managing Member, Rossport Investments LLC

Karim Nasr, Group CEO, La Mancha Holding

David Neuhauser, Managing Director, Livermore Partners

Daniel Oliver Jr., Managing Member, Myrmikan Capital, LLC

Peter Palmedo, President, Sun Valley Gold LLC

Rick Rule, Senior Managing Director, Sprott Inc.

Onno Rutten, VP/Portfolio Manager, Mackenzie Investments

Ranjan Tandon, Managing Member, Libra Advisors LLC

Matthew Zabloski, Managing Director, Delbrook Capital

https://www.goldcouncil.net/press-release

September 20, 2020

Open Letter to Global Gold Company CEOs & Boards

As long-term investors in the gold mining sector, we evaluate the success of our investment decisions by looking at a number of factors, including stock price performance, strategic vision & execution, environmental & social records, proper governance, and alignment of incentives.

Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision & communication with investors. Admittedly, some companies have made significant improvements in these areas recently, but there is still ample room for improvement.

Our aim in sending this letter out is not to focus on criticism-but rather, to offer some solutions that we think would provide for greater alignment of interests between management teams, board members and shareholders.

We believe greater alignment is necessary for Boards to effectively manage the best interests of companies. We have provided below some ideas that we think would improve the perception of the industry, to make the sector more attractive to investors:

Corporate Governance

Establish strict term limits for directors who do not have meaningful stock ownership;

Broaden board representation from outside a narrow geographic and industrial background and ensure diversity of membership;

Have a clear disclosed process for selecting directors that includes meaningful dialog with shareholders;

Disclose the nature of any material current and past professional and personal relationships amongst board members;

Limit the number of fully-operational corporate boards that directors can sit on with an absolute maximum which is at or below how ISS and Glass Lewis define “overboarded”.

Shareholder Alignment & Compensation

Include per-share value metrics in calculating compensation for management teams and incorporate those metrics in presentations to investors;

Define what metrics company management teams will be assessed upon for annual compensation at the beginning of the year (rather than retroactively when circulars are released one year later);

Ensure a material component of non-equity bonus grants are tied to long-term shareholder returns;

Implement a balance in the granting of stock grants and options to reward long-term stock price appreciation appropriately;

Impose strict maximum quantity and minimum time thresholds for how much stock insiders can sell when exercising options;

Institute progressive levels of minimum insider stock ownership levels that are also proportional to seniority and tenure of each director;

Ensure that change of control fees are tied to long-term shareholder returns.

Strategy & Execution

Maintain active data rooms without onerous entry conditions, such as open-ended time and scope-limited standstills, which preclude potential acquirers from taking offers directly to shareholders;

Articulate a capital return framework which balances the allocation of free cash flow towards dividends, share buybacks, and manageable growth initiatives (for companies in production);

Delineate and disclose how budgets are allocated between exploration & development activities, general & administrative expenses, and management compensation (for companies in exploration and development);

Maintain an ongoing dialogue with shareholders regarding future equity capital needs for the business and carefully consider the pros and cons of various equity raising options, while noting that “bought deals” are often considered problematic and shareholder unfriendly by market participants.

Despite the strong performance of precious metals mining equities in 2020, investor flows into active and passive fund strategies have been lackluster. In contrast, flows into physical metals and related ETFs have been record breaking. The contrast suggests that the appeal of mining equities remains limited to specialist funds and has escaped the attention of generalist investors.

Despite strong performance, mining shares are still episodically inexpensive. We believe that adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders.

Respectfully submitted,

Walter M. Cabot Jr., President, Apogee Global Advisors Inc.

Jon Case, Portfolio Manager, CI Investments

William R Church, Managing Member, TGRA Capital Management LLC

Sean Fieler, President & CIO, Equinox Partners

Joe Foster, Portfolio Manager, VanEck Funds

Benoit Gervais, Senior VP/Portfolio Manager, Mackenzie Investments

Christian Godin, Executive Director, Shareholders’ Gold Council

Bernhard Graf, Portfolio Manager, AMG Fondsverwaltung AG

John Hathaway, Senior Portfolio Manager, Sprott

Jon Hartsel, Co-Chief Investment Officer and Director of Research, Donald Smith & Company

Dave Iben, Chief Investment Officer and Lead Portfolio Manager, Kopernik Global Investors, LLC

Marcelo Kim, Partner, Paulson & Co. Inc.

Stephen Land, VP/Portfolio Manager, Franklin Templeton

Georges Lequime, Senior Fund Advisor, Earth Resource Investment Group

Shanquan Li, Senior Portfolio Manager, Invesco

Daniel McConvey, Managing Member, Rossport Investments LLC

Karim Nasr, Group CEO, La Mancha Holding

David Neuhauser, Managing Director, Livermore Partners

Daniel Oliver Jr., Managing Member, Myrmikan Capital, LLC

Peter Palmedo, President, Sun Valley Gold LLC

Rick Rule, Senior Managing Director, Sprott Inc.

Onno Rutten, VP/Portfolio Manager, Mackenzie Investments

Ranjan Tandon, Managing Member, Libra Advisors LLC

Matthew Zabloski, Managing Director, Delbrook Capital

21.9.

Gold Investors Take New Aim at Miners With Returns Falling Short

https://finance.yahoo.com/news/gold-investors-aim-miners-ret…

...

In an open letter to the mining industry, prominent gold investors including money managers at Franklin Templeton, VanEck Funds and members of the Shareholders’ Gold Council are targeting issues including executive compensation and directors who don’t have enough skin in the game because they don’t hold a meaningful amount of shares in the firms they represent. The signatories offered 16 suggestions to better align the interest of managers, boards and shareholders.

...

Gold has been on a record-setting tear as the pandemic threatens to derail global economic growth, sending investors on a flight to safe havens. That comes at a time when real yields are falling as governments unleash massive stimulus programs. Precious-metal miners have seen their shares skyrocket with a gauge of senior gold producers climbing almost 80% in the past year.

“Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision & communication with investors,” the group said in the letter released Sunday. That was the first day of the Denver Gold Group’s Americas conference, a key annual event for the industry.

Shareholder payouts will be a key topic for gold miners this year as higher prices leave companies with large piles of cash. Historically, bullion producers have focused on growth rather than cash returns, were overoptimistic about projects and had poor capital discipline, which were “key drivers of value destruction by the gold miners,” UBS Group AG analysts including Daniel Major said in a Sept. 15 report.

The Shareholders’ Gold Council -- spearheaded by Paulson & Co. at the Denver conference in 2017 and formally launched a year later -- has agitated for change using the clout of a membership that includes influential investors and fund managers. The open letter, which also includes investors outside the Council, didn’t name particular companies and instead argued the group was not focused on criticism but wanted to offer solutions instead.

“Despite strong performance, mining shares are still episodically inexpensive,” the group said. “We believe that adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders.”

Among this year’s suggestions were calls for board-level changes such as setting up “a clear disclosed process for selecting directors that includes meaningful dialog with shareholders.” It also wants companies to establish “strict term limits for directors who do not have meaningful stock ownership,” an issue that the Shareholders’ Gold Council had addressed in the past.

On the management level, the coalition is asking companies to include and disclose to investors “per-share value metrics in calculating compensation,” and define -- at the beginning of the year rather than retroactively -- how teams’ annual compensation will be assessed.

📢📢📢

In terms of general strategy, the investors want gold miners to maintain active data rooms “without onerous entry conditions,” some of which they say prevent potential buyers from taking offers directly to shareholders. 📢📢📢

They also want gold producers to set out “a capital return framework which balances the allocation of free cash flow towards dividends, share buybacks, and manageable growth initiatives.”

“Adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders,” the group says in its letter.

In a 2018 report, the Council took aim at mining executives who had a low ownership-to-pay ratio in a comparison of executives and chairmen at 17 gold companies. Last year, a second report said “significantly mismanaged” gold companies could unlock $13 billion in value through mergers and cost cuts.

Interest in environmental, social and governance topics has moved to the forefront in conversations with stakeholders in the past year, industry executives say. Rising gold prices will only increase that pressure, with Newmont Corp. Chief Executive Officer Tom Palmer saying ESG is sometimes the only topic of discussion when talking to shareholders in Europe.

There are 24 signatories in the letter including Karim Nasr, group CEO of the Sawiris family’s La Mancha Holding S.a.r.l; David Neuhauser, managing director at Livermore Partners; and John Hathaway, a senior portfolio manager at Sprott Asset Management LP. Other signatories included money managers from Invesco Ltd., Mackenzie Investments, CI Investments and Kopernik Global Investors LLC.

Gold Investors Take New Aim at Miners With Returns Falling Short

https://finance.yahoo.com/news/gold-investors-aim-miners-ret…

...

In an open letter to the mining industry, prominent gold investors including money managers at Franklin Templeton, VanEck Funds and members of the Shareholders’ Gold Council are targeting issues including executive compensation and directors who don’t have enough skin in the game because they don’t hold a meaningful amount of shares in the firms they represent. The signatories offered 16 suggestions to better align the interest of managers, boards and shareholders.

...

Gold has been on a record-setting tear as the pandemic threatens to derail global economic growth, sending investors on a flight to safe havens. That comes at a time when real yields are falling as governments unleash massive stimulus programs. Precious-metal miners have seen their shares skyrocket with a gauge of senior gold producers climbing almost 80% in the past year.

“Though the performance of gold mining stocks has been noteworthy recently, we believe that performance continues to fall short in the areas of corporate governance, alignment of incentives and strategic vision & communication with investors,” the group said in the letter released Sunday. That was the first day of the Denver Gold Group’s Americas conference, a key annual event for the industry.

Shareholder payouts will be a key topic for gold miners this year as higher prices leave companies with large piles of cash. Historically, bullion producers have focused on growth rather than cash returns, were overoptimistic about projects and had poor capital discipline, which were “key drivers of value destruction by the gold miners,” UBS Group AG analysts including Daniel Major said in a Sept. 15 report.

The Shareholders’ Gold Council -- spearheaded by Paulson & Co. at the Denver conference in 2017 and formally launched a year later -- has agitated for change using the clout of a membership that includes influential investors and fund managers. The open letter, which also includes investors outside the Council, didn’t name particular companies and instead argued the group was not focused on criticism but wanted to offer solutions instead.

“Despite strong performance, mining shares are still episodically inexpensive,” the group said. “We believe that adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders.”

Among this year’s suggestions were calls for board-level changes such as setting up “a clear disclosed process for selecting directors that includes meaningful dialog with shareholders.” It also wants companies to establish “strict term limits for directors who do not have meaningful stock ownership,” an issue that the Shareholders’ Gold Council had addressed in the past.

On the management level, the coalition is asking companies to include and disclose to investors “per-share value metrics in calculating compensation,” and define -- at the beginning of the year rather than retroactively -- how teams’ annual compensation will be assessed.

📢📢📢

In terms of general strategy, the investors want gold miners to maintain active data rooms “without onerous entry conditions,” some of which they say prevent potential buyers from taking offers directly to shareholders. 📢📢📢

They also want gold producers to set out “a capital return framework which balances the allocation of free cash flow towards dividends, share buybacks, and manageable growth initiatives.”

“Adoption of these suggested measures will improve current low equity valuations by attracting a wider audience of generalist investors and thereby lower the industry’s cost of capital to the benefit of all stakeholders,” the group says in its letter.

In a 2018 report, the Council took aim at mining executives who had a low ownership-to-pay ratio in a comparison of executives and chairmen at 17 gold companies. Last year, a second report said “significantly mismanaged” gold companies could unlock $13 billion in value through mergers and cost cuts.

Interest in environmental, social and governance topics has moved to the forefront in conversations with stakeholders in the past year, industry executives say. Rising gold prices will only increase that pressure, with Newmont Corp. Chief Executive Officer Tom Palmer saying ESG is sometimes the only topic of discussion when talking to shareholders in Europe.

There are 24 signatories in the letter including Karim Nasr, group CEO of the Sawiris family’s La Mancha Holding S.a.r.l; David Neuhauser, managing director at Livermore Partners; and John Hathaway, a senior portfolio manager at Sprott Asset Management LP. Other signatories included money managers from Invesco Ltd., Mackenzie Investments, CI Investments and Kopernik Global Investors LLC.

25.6.

...

“Wait until the Robinhood traders learn about the gold and silver penny stocks, that’s where we’re long,” Costa told MarketWatch. He was referring to a low-cost trading app that has lured a flood of new investors, who have lately won some bets on beaten-down stocks.

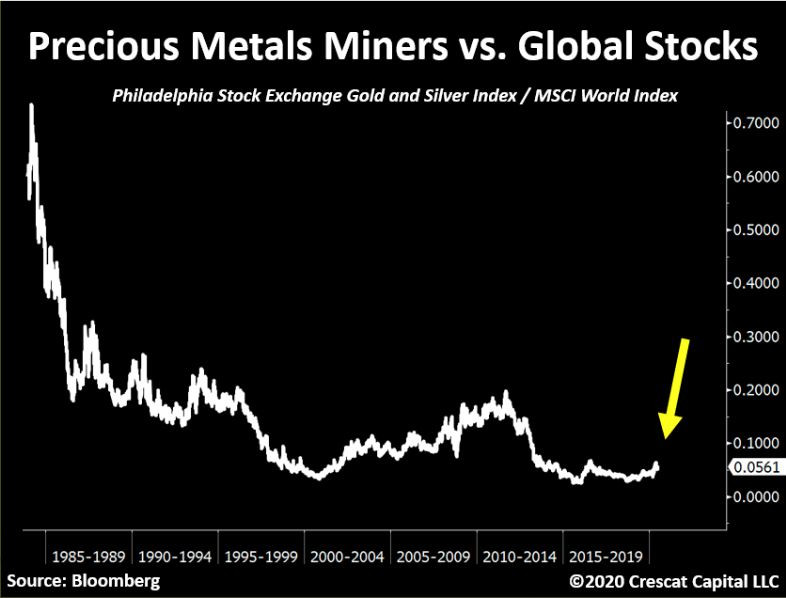

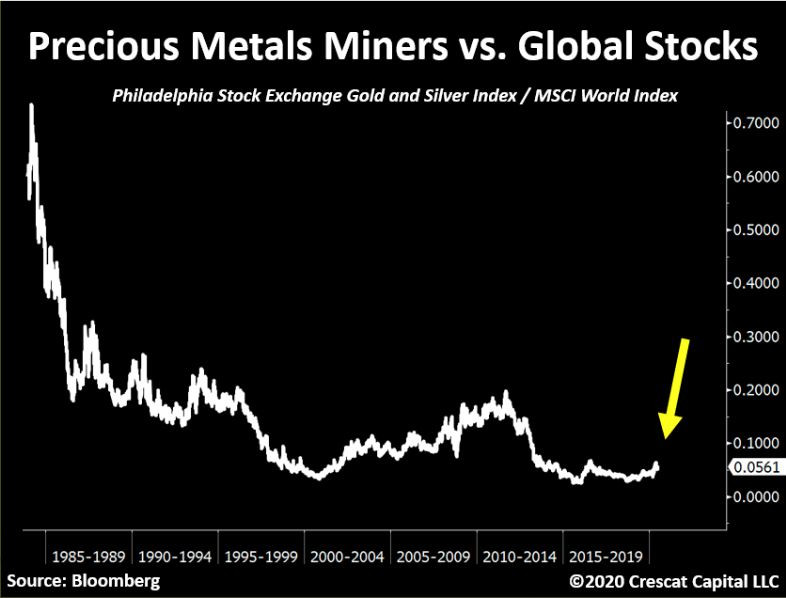

“The mining space has been in sort of a recession since the 2011 peak of gold and silver prices. The capital in the space has dried up significantly. I think that now with the macro and fundamentals aligning with technicals on the long-term side, I’ve never seen such a good setup for an industry like precious metals,” said Costa.

Costa says they have been taking friendly activist stakes in some “junior explorer” miners with prolific projects.” Crescat created a fund devoted to mining companies a year ago because the sector was so beaten-down.

...

Gold and silver penny stocks could be the next Robinhood trader obsession, says this portfolio manager

https://www.marketwatch.com/story/gold-and-silver-penny-stoc…

--> Original-Quelle:

17.6.

Crescat Turns Activist on Gold

https://www.crescat.net/crescat-turns-activist-on-gold/

...

“Wait until the Robinhood traders learn about the gold and silver penny stocks, that’s where we’re long,” Costa told MarketWatch. He was referring to a low-cost trading app that has lured a flood of new investors, who have lately won some bets on beaten-down stocks.

“The mining space has been in sort of a recession since the 2011 peak of gold and silver prices. The capital in the space has dried up significantly. I think that now with the macro and fundamentals aligning with technicals on the long-term side, I’ve never seen such a good setup for an industry like precious metals,” said Costa.

Costa says they have been taking friendly activist stakes in some “junior explorer” miners with prolific projects.” Crescat created a fund devoted to mining companies a year ago because the sector was so beaten-down.

...

Gold and silver penny stocks could be the next Robinhood trader obsession, says this portfolio manager

https://www.marketwatch.com/story/gold-and-silver-penny-stoc…

--> Original-Quelle:

17.6.

Crescat Turns Activist on Gold

https://www.crescat.net/crescat-turns-activist-on-gold/

...

Argo said he expects generalist interest to come to the sector because high gold prices make the margins too tempting, but the action to date has been timid by North American miners.

"These [factors] are the sorts of things that are the starting point for taking bigger steps into this space, more risky steps into the space," said Agro.

"Let's not forget even at $1,700-$1,740 ounce gold--if your all-in-sustaining-cost of production is $1,000 or $1,100 an ounce, you're making big margins. You're making the kind of margins that software companies or technology companies can make."

According to Motley Fool, Apple has a 38% gross profit margin. Barrick's most recent Q1 had gross margin at 34.73%, up 6% from a year ago.

...

19.6.

Technology-like margins come to the mining sector

https://www.kitco.com/news/2020-06-19/Technology-like-margin…

Argo said he expects generalist interest to come to the sector because high gold prices make the margins too tempting, but the action to date has been timid by North American miners.

"These [factors] are the sorts of things that are the starting point for taking bigger steps into this space, more risky steps into the space," said Agro.

"Let's not forget even at $1,700-$1,740 ounce gold--if your all-in-sustaining-cost of production is $1,000 or $1,100 an ounce, you're making big margins. You're making the kind of margins that software companies or technology companies can make."

According to Motley Fool, Apple has a 38% gross profit margin. Barrick's most recent Q1 had gross margin at 34.73%, up 6% from a year ago.

...

19.6.

Technology-like margins come to the mining sector

https://www.kitco.com/news/2020-06-19/Technology-like-margin…