China Crash (Seite 4)

eröffnet am 26.10.18 15:59:51 von

neuester Beitrag 08.02.24 12:18:20 von

neuester Beitrag 08.02.24 12:18:20 von

Beiträge: 314

ID: 1.291.324

ID: 1.291.324

Aufrufe heute: 0

Gesamt: 40.185

Gesamt: 40.185

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 1 Stunde | 5008 | |

| vor 45 Minuten | 4074 | |

| vor 44 Minuten | 3221 | |

| vor 1 Stunde | 2732 | |

| vor 51 Minuten | 2111 | |

| heute 08:50 | 1879 | |

| vor 1 Stunde | 1463 | |

| heute 13:07 | 1292 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.070,40 | +0,78 | 240 | |||

| 2. | 3. | 0,1905 | +0,79 | 113 | |||

| 3. | 2. | 1,1800 | -14,49 | 107 | |||

| 4. | 5. | 9,2550 | +0,11 | 73 | |||

| 5. | 4. | 157,58 | -0,69 | 57 | |||

| 6. | 12. | 2.341,86 | +0,42 | 39 | |||

| 7. | Neu! | 11,905 | +14,97 | 37 | |||

| 8. | Neu! | 4,8750 | +8,70 | 36 |

Beitrag zu dieser Diskussion schreiben

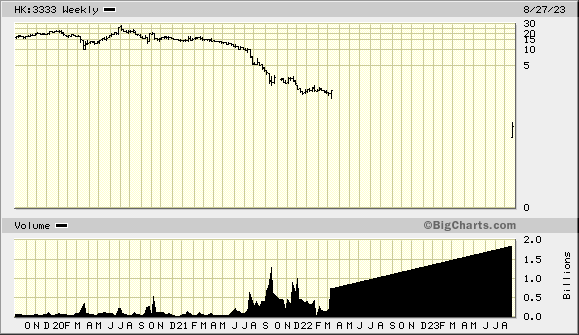

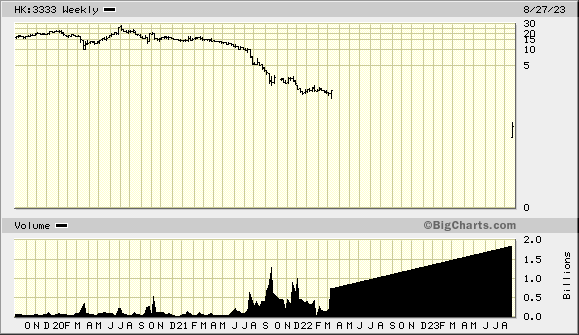

Evergrande: "trading resumed":

HK:3333 = China Evergrande Group

HK:3333 = China Evergrande Group

26.8.

China’s Economy Is Worse Now Than in the 1970s, This Analyst Says

https://www.marketwatch.com/articles/chinas-economy-is-worse…

Charlene Chu, Autonomous Research: https://www.autonomous.com/#our_partners

...

Where’s the biggest disconnect you see in the market?

People keep looking at this as a cyclical short-term problem and [think] China will get back to the growth path it was on, and everything will be fine. Those days are over. China is never going back to prepandemic growth levels. There are just too many structural issues. Then, layer on the demographics and it’s going to be impossible to get close to the growth rates of the past. People don’t understand that. It’s not clear China’s authorities fully understand that either as they keep emphasizing that it’s taken every other country time to rebound after reopening so people just need to be patient.

How bad will it get?

The growth picture has changed dramatically. There will be cyclical ups and downs when you can make money, but it’s absolutely in a structural decline in growth and at some point there’s a real risk where it hovers at barely positive levels of growth. The investment case has gotten much weaker for China, particularly with all the risks people are taking on when they are investing there.

China’s Economy Is Worse Now Than in the 1970s, This Analyst Says

https://www.marketwatch.com/articles/chinas-economy-is-worse…

Charlene Chu, Autonomous Research: https://www.autonomous.com/#our_partners

...

Where’s the biggest disconnect you see in the market?

People keep looking at this as a cyclical short-term problem and [think] China will get back to the growth path it was on, and everything will be fine. Those days are over. China is never going back to prepandemic growth levels. There are just too many structural issues. Then, layer on the demographics and it’s going to be impossible to get close to the growth rates of the past. People don’t understand that. It’s not clear China’s authorities fully understand that either as they keep emphasizing that it’s taken every other country time to rebound after reopening so people just need to be patient.

How bad will it get?

The growth picture has changed dramatically. There will be cyclical ups and downs when you can make money, but it’s absolutely in a structural decline in growth and at some point there’s a real risk where it hovers at barely positive levels of growth. The investment case has gotten much weaker for China, particularly with all the risks people are taking on when they are investing there.

16.8.

China Markets Approach Grim Milestones as Selloff Spirals

https://uk.news.yahoo.com/msci-china-index-set-erase-0130454…

...

The MSCI China Index dropped as much as 1.3% amid mounting concerns over economic growth, set to close below where it was before policy vows at the July political gathering triggered a rally. The Hang Seng China Enterprises Index is within a whisker of wiping out its gains, while the Hang Seng Index slid 1.4% to inch closer to a technical bear market.

Pressure is building across China’s financial markets given a slew of disappointing economic data, renewed concerns about the property sector and an unfolding crisis in the nation’s shadow banking system. All of this is creating deflationary pressure that threatens to undermine corporate profits. Investors are calling for more aggressive easing by Beijing as the incremental policies have so far failed to revive confidence.

“China’s current recession-like conditions, characterized by deflationary pressures, have significant implications for both its domestic economy and its global interaction,” said Manish Bhargava, a fund manager at Straits Investment Holdings in Singapore. “Investors might become wary of allocating funds to China due to concerns about the economic downturn and reduced potential returns.”

...

11.8.

China Loans Plunge to 14-Year Low, Adding to Deflation Risk

https://finance.yahoo.com/news/china-loans-plunge-2009-low-0…

...

New loans reached 345.9 billion yuan in July, the People’s Bank of China said Friday, less than half the 780 billion yuan economists had forecast in a Bloomberg survey. Aggregate financing, a broad measure of credit, was 528.2 billion yuan last month, also well below estimates.

“It is a big disappointment, proving the fragile status of the recovery in China,” said Kiyong Seong, lead Asia macro strategist at Societe Generale. The probability of further PBOC easing in the near term is notably rising, he said.

...

9.8.

Jetzt wird’s für Chinas Wirtschaft wirklich gefährlich

Chinas Wirtschaft scheint verwundbarer, als viele Ökonomen lange Zeit angenommen haben. Die Verbraucher sparen, wo sie können – es droht eine verhängnisvolle Preisspirale nach unten.

https://www.spiegel.de/wirtschaft/konjunktur-in-china-jetzt-…

...

Die chinesische Wirtschaft ist in die Deflation gerutscht: Wie das Statistikamt in Peking am Mittwoch mitteilte, sanken Verbraucherpreise im Juli im Vergleich zum Vorjahr um 0,3 Prozent. Bereits im Juni hatten die Preise nur noch stagniert, nachdem sie im Mai noch leicht um 0,2 Prozent gestiegen waren.

...

Zwar profitieren die Verbraucher auf den ersten Blick, weil sie weniger für Waren und Dienstleistungen bezahlen müssen. Doch die Folgen können gravierend sein. Zum einen droht die Nachfrage zu erstarren, wenn die Aussicht besteht, dass die Waren umso billiger werden, je später man sie kauft. Zum anderen drückt eine Deflation in der Regel auch auf die Gewinne der Unternehmen und birgt damit die Gefahr von Lohnkürzungen oder Entlassungen.

Experten führen den Preisverfall in China unter anderem auf den anhaltend schwachen Konsum und Probleme am Immobilienmarkt zurück. Nach dem Ende der Coronapandemie erholt sich die chinesische Wirtschaft langsamer als von den meisten Ökonomen erwartet.

...

Jetzt wird’s für Chinas Wirtschaft wirklich gefährlich

Chinas Wirtschaft scheint verwundbarer, als viele Ökonomen lange Zeit angenommen haben. Die Verbraucher sparen, wo sie können – es droht eine verhängnisvolle Preisspirale nach unten.

https://www.spiegel.de/wirtschaft/konjunktur-in-china-jetzt-…

...

Die chinesische Wirtschaft ist in die Deflation gerutscht: Wie das Statistikamt in Peking am Mittwoch mitteilte, sanken Verbraucherpreise im Juli im Vergleich zum Vorjahr um 0,3 Prozent. Bereits im Juni hatten die Preise nur noch stagniert, nachdem sie im Mai noch leicht um 0,2 Prozent gestiegen waren.

...

Zwar profitieren die Verbraucher auf den ersten Blick, weil sie weniger für Waren und Dienstleistungen bezahlen müssen. Doch die Folgen können gravierend sein. Zum einen droht die Nachfrage zu erstarren, wenn die Aussicht besteht, dass die Waren umso billiger werden, je später man sie kauft. Zum anderen drückt eine Deflation in der Regel auch auf die Gewinne der Unternehmen und birgt damit die Gefahr von Lohnkürzungen oder Entlassungen.

Experten führen den Preisverfall in China unter anderem auf den anhaltend schwachen Konsum und Probleme am Immobilienmarkt zurück. Nach dem Ende der Coronapandemie erholt sich die chinesische Wirtschaft langsamer als von den meisten Ökonomen erwartet.

...

7.7.

China Stock Delistings Set to Beat Record as Weak Firms Culled

https://finance.yahoo.com/news/china-stock-delistings-set-be…

...

China is on course to see a record number of stocks being delisted from its exchanges this year as new rules introduced to improve the quality of listed companies snare an ever greater number of victims.

...

Chinese regulators revamped delisting guidelines in 2021 as part of their efforts to clean up the stock market and bolster investor confidence. The number of delistings jumped the following year, and has risen further in 2023 as the economic recovery from the pandemic has faltered.

...

30.6.

China’s Economic Woes Are Multiplying — and Xi Jinping Has No Easy Fix

https://finance.yahoo.com/news/china-economic-woes-multiplyi…

...

..halfway through 2023, it’s facing a confluence of problems: Sluggish consumer spending, a crisis-ridden property market, flagging exports, record youth unemployment and towering local government debt. The impact of these strains is starting to reverberate around the globe, impacting everything from commodity prices to equity markets. The risk of Fed hikes tipping the US into recession has also heightened the prospect of a simultaneous slump in the world's two economic powerhouses.

...

“A few years ago, it was difficult to imagine China not rapidly overtaking the US as the world's biggest economy,” said Tom Orlik, chief economist for Bloomberg Economics. “Now, that geopolitical moment will almost certainly be delayed, and it's possible to imagine scenarios where it doesn't happen at all.”

In a downside scenario — with a sharper property slump, slow pace of reforms and more dramatic US-China decoupling — Bloomberg Economics sees China’s growth decelerating to 3% by 2030.

...

China’s Economic Woes Are Multiplying — and Xi Jinping Has No Easy Fix

https://finance.yahoo.com/news/china-economic-woes-multiplyi…

...

..halfway through 2023, it’s facing a confluence of problems: Sluggish consumer spending, a crisis-ridden property market, flagging exports, record youth unemployment and towering local government debt. The impact of these strains is starting to reverberate around the globe, impacting everything from commodity prices to equity markets. The risk of Fed hikes tipping the US into recession has also heightened the prospect of a simultaneous slump in the world's two economic powerhouses.

...

“A few years ago, it was difficult to imagine China not rapidly overtaking the US as the world's biggest economy,” said Tom Orlik, chief economist for Bloomberg Economics. “Now, that geopolitical moment will almost certainly be delayed, and it's possible to imagine scenarios where it doesn't happen at all.”

In a downside scenario — with a sharper property slump, slow pace of reforms and more dramatic US-China decoupling — Bloomberg Economics sees China’s growth decelerating to 3% by 2030.

...

16.9.

5G-Mobilfunknetz in Deutschland -- Behörden nehmen Huawei-Software ins Visier

Das Bundesinnenministerium könnte nach SPIEGEL-Informationen eine wichtige Softwarekomponente des chinesischen Herstellers Huawei untersagen – und damit deutsche Netzbetreiber zum Rückbau einiger Sendeanlagen zwingen.

https://www.spiegel.de/panorama/5g-mobilfunknetz-in-deutschl…

...

Unterdessen steigt auch der Druck der Europäischen Union auf den chinesischen Technologiekonzern. Am Donnerstag stufte die EU-Kommission sowohl Huawei als auch die chinesische Firma ZTE als Sicherheitsrisiko ein, die Kommission werde keine Produkte der Hersteller mehr nutzen.

Binnenkommissar Thierry Breton rief die Mitgliedsländer dazu auf, die chinesischen Ausrüster künftig ebenfalls zu meiden: »Wir können es uns nicht leisten, Abhängigkeiten aufrechtzuerhalten, die als Waffen gegen unsere gemeinsamen Interessen eingesetzt werden können«, sagte er.

Länder wie Schweden, Portugal, Italien und Großbritannien haben Huawei bereits aus ihren Netzen verbannt – teils wie im Vereinigten Königreich allerdings mit jahrelangen Übergangsfristen.

5G-Mobilfunknetz in Deutschland -- Behörden nehmen Huawei-Software ins Visier

Das Bundesinnenministerium könnte nach SPIEGEL-Informationen eine wichtige Softwarekomponente des chinesischen Herstellers Huawei untersagen – und damit deutsche Netzbetreiber zum Rückbau einiger Sendeanlagen zwingen.

https://www.spiegel.de/panorama/5g-mobilfunknetz-in-deutschl…

...

Unterdessen steigt auch der Druck der Europäischen Union auf den chinesischen Technologiekonzern. Am Donnerstag stufte die EU-Kommission sowohl Huawei als auch die chinesische Firma ZTE als Sicherheitsrisiko ein, die Kommission werde keine Produkte der Hersteller mehr nutzen.

Binnenkommissar Thierry Breton rief die Mitgliedsländer dazu auf, die chinesischen Ausrüster künftig ebenfalls zu meiden: »Wir können es uns nicht leisten, Abhängigkeiten aufrechtzuerhalten, die als Waffen gegen unsere gemeinsamen Interessen eingesetzt werden können«, sagte er.

Länder wie Schweden, Portugal, Italien und Großbritannien haben Huawei bereits aus ihren Netzen verbannt – teils wie im Vereinigten Königreich allerdings mit jahrelangen Übergangsfristen.

12.6.

Media row: China tells last Indian reporter to leave, according to reports

https://www.msn.com/en-in/news/other/media-row-china-tells-l…

...

In a tit-for-tat move amid an intensifying media row, China has asked the last Indian journalist operating in the country to leave by the end of the month.

India had four reporters based in China this year. Two were barred from returning in April after their visas were "frozen", and another journalist left Beijing last week.

The last Indian reporter in China, from the Press Trust of India news agency, will leave this month when his visa expires, as per a Bloomberg report.

This will leave India without a media presence in the world's second largest economy.

'No limitations on journalists in India'Refuting Beijing's allegations that Chinese journalists had been accorded "unfair arrangements" in India, foreign ministry spokesperson Arindam Bagchi recently said that "all foreign journalists, including Chinese journalists, have been pursuing journalistic activities in India without any limitations or difficulties in reporting or doing media coverage".

Bagchi said Indian journalists in China, however, had been operating with certain difficulties "such as not being permitted to hire locals as correspondents or journalists".

"As you know, foreign media can, and do, freely hire local journalists to work for their bureaus in India but China has not allowed this. In addition, Indian journalists also face several restrictions while getting access and travelling locally," he added.

What triggered the row?

According to media reports, the row was triggered after Beijing barred Indian journalists operating in China from hiring local correspondents or even travelling locally.

Beijing imposed measures limiting employment to three individuals at a time who must come from a pool provided by the Chinese authorities, said the Bloomberg report. India doesn’t have a cap on hiring.

...

Media row: China tells last Indian reporter to leave, according to reports

https://www.msn.com/en-in/news/other/media-row-china-tells-l…

...

In a tit-for-tat move amid an intensifying media row, China has asked the last Indian journalist operating in the country to leave by the end of the month.

India had four reporters based in China this year. Two were barred from returning in April after their visas were "frozen", and another journalist left Beijing last week.

The last Indian reporter in China, from the Press Trust of India news agency, will leave this month when his visa expires, as per a Bloomberg report.

This will leave India without a media presence in the world's second largest economy.

'No limitations on journalists in India'Refuting Beijing's allegations that Chinese journalists had been accorded "unfair arrangements" in India, foreign ministry spokesperson Arindam Bagchi recently said that "all foreign journalists, including Chinese journalists, have been pursuing journalistic activities in India without any limitations or difficulties in reporting or doing media coverage".

Bagchi said Indian journalists in China, however, had been operating with certain difficulties "such as not being permitted to hire locals as correspondents or journalists".

"As you know, foreign media can, and do, freely hire local journalists to work for their bureaus in India but China has not allowed this. In addition, Indian journalists also face several restrictions while getting access and travelling locally," he added.

What triggered the row?

According to media reports, the row was triggered after Beijing barred Indian journalists operating in China from hiring local correspondents or even travelling locally.

Beijing imposed measures limiting employment to three individuals at a time who must come from a pool provided by the Chinese authorities, said the Bloomberg report. India doesn’t have a cap on hiring.

...

6.6.

Over a Dozen Chinese Developers Face Delisting From Exchanges

https://finance.yahoo.com/news/wave-delisting-faces-chinese-…

...

Over a Dozen Chinese Developers Face Delisting From Exchanges

https://finance.yahoo.com/news/wave-delisting-faces-chinese-…

...