starke, interessante, bombenstarke "Machbarkeitsstudien" - 500 Beiträge pro Seite (Seite 13)

eröffnet am 12.06.14 14:12:18 von

neuester Beitrag 31.05.21 14:26:18 von

neuester Beitrag 31.05.21 14:26:18 von

Beiträge: 10.349

ID: 1.195.350

ID: 1.195.350

Aufrufe heute: 2

Gesamt: 279.116

Gesamt: 279.116

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 52 Minuten | 3339 | |

| 01.05.24, 18:36 | 2275 | |

| vor 1 Stunde | 2110 | |

| gestern 19:24 | 1735 | |

| vor 54 Minuten | 1366 | |

| vor 1 Stunde | 1339 | |

| gestern 18:35 | 1304 | |

| vor 41 Minuten | 1072 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.001,60 | +0,59 | 240 | |||

| 2. | 2. | 168,20 | +0,08 | 87 | |||

| 3. | 3. | 9,7000 | +12,27 | 75 | |||

| 4. | 14. | 6,1400 | -1,35 | 69 | |||

| 5. | 11. | 0,1865 | 0,00 | 52 | |||

| 6. | 7. | 0,8750 | -12,50 | 47 | |||

| 7. | 12. | 0,1561 | +2,97 | 38 | |||

| 8. | 6. | 2.302,50 | 0,00 | 36 |

Antwort auf Beitrag Nr.: 56.709.937 von Popeye82 am 14.01.18 05:15:00B2Gold(/(ex) Papillon Resources)

www.b2gold.com/news/index.php?content_id=695

www.b2gold.com/news/index.php?content_id=695

Antwort auf Beitrag Nr.: 58.909.488 von Popeye82 am 09.10.18 19:41:46Tharisa/Prospect Resources/Premier African Minerals/Zulu Lithium

www.newzimbabwe.com/zims-mining-sector-to-inject-12-billion-…

http://www.mines.gov.zw/

http://www.bloomberg.com/news/articles/2018-11-05/zimbabwe-t…

http://www.moneyweb.co.za/news-fast-news/zimbabwe-targets-12…

www.newzimbabwe.com/zims-mining-sector-to-inject-12-billion-…

http://www.mines.gov.zw/

http://www.bloomberg.com/news/articles/2018-11-05/zimbabwe-t…

http://www.moneyweb.co.za/news-fast-news/zimbabwe-targets-12…

Antwort auf Beitrag Nr.: 58.996.197 von Popeye82 am 18.10.18 19:06:42Sirius Minerals

https://otp.tools.investis.com/clients/uk/sirius_minerals/rn…

https://beta.companieshouse.gov.uk/company/08270855

http://www.mclh.co.uk/

http://www.strabag.de/

www.worldconstructionnetwork.com/news/mclaughlin-wins-contra…

www.worldfertilizer.com/potash/06112018/york-potash-processi…

www.miningglobal.com/sustainability/sirius-minerals-signs-ep…

www.theconstructionindex.co.uk/news/view/sirius-signs-mclaug…

www.proactiveinvestors.co.uk/companies/news/208477/sirius-mi…

https://otp.tools.investis.com/clients/uk/sirius_minerals/rn…

https://beta.companieshouse.gov.uk/company/08270855

http://www.mclh.co.uk/

http://www.strabag.de/

www.worldconstructionnetwork.com/news/mclaughlin-wins-contra…

www.worldfertilizer.com/potash/06112018/york-potash-processi…

www.miningglobal.com/sustainability/sirius-minerals-signs-ep…

www.theconstructionindex.co.uk/news/view/sirius-signs-mclaug…

www.proactiveinvestors.co.uk/companies/news/208477/sirius-mi…

Antwort auf Beitrag Nr.: 59.181.873 von Popeye82 am 09.11.18 19:03:14don´t forget Caledonia Mining

double five.... 5% divi, KGV 5

einer meiner werte seit jahren ohne "fremde hilfe"

....im übrigen mir extrem aufgefallen, daß sich die werte die ich alleine gefunden und analysiert habe, auch am allerbesten entwickelt haben unterm strich.

auch Tharisa hält sich vergleichsweise vorzüglich, Central Asia dieses jahr nicht aber seit jahren solide. Highland gold ebenso.... usw... lukoil mein einziger ölwert vorgestern mit 10-jahre-hoch.

von daher werde ich vermutlich hier auch wieder mehr zum einzelgänger werden und neue stories selber suchen... inspiration ist manchmal nicht allzu gut.

entwickler/explorer die ich favorisiere sind hier auch nirgends im gespräch...

(werde aber vermutlich auch keine mehr nennen)

Do it ALONE

eigentlich war´s im leben auch immer mein weg....

double five.... 5% divi, KGV 5

einer meiner werte seit jahren ohne "fremde hilfe"

....im übrigen mir extrem aufgefallen, daß sich die werte die ich alleine gefunden und analysiert habe, auch am allerbesten entwickelt haben unterm strich.

auch Tharisa hält sich vergleichsweise vorzüglich, Central Asia dieses jahr nicht aber seit jahren solide. Highland gold ebenso.... usw... lukoil mein einziger ölwert vorgestern mit 10-jahre-hoch.

von daher werde ich vermutlich hier auch wieder mehr zum einzelgänger werden und neue stories selber suchen... inspiration ist manchmal nicht allzu gut.

entwickler/explorer die ich favorisiere sind hier auch nirgends im gespräch...

(werde aber vermutlich auch keine mehr nennen)

Do it ALONE

eigentlich war´s im leben auch immer mein weg....

Antwort auf Beitrag Nr.: 59.182.032 von Popeye82 am 09.11.18 19:23:37Sirius Minerals Plc

https://siriusminerals.com/our-project/materials-handling-an…

www.proactiveinvestors.co.uk/companies/news/208507/sirius-mi…

https://siriusminerals.com/our-project/materials-handling-an…

www.proactiveinvestors.co.uk/companies/news/208507/sirius-mi…

Antwort auf Beitrag Nr.: 59.180.946 von Popeye82 am 09.11.18 17:36:45Stillstand is Rückschritt

Antwort auf Beitrag Nr.: 58.577.927 von Popeye82 am 31.08.18 03:20:24Aquila Resources

https://aquilaresources.com/release/?id=122561

https://aquilaresources.com/release/?id=122560

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

https://aquilaresources.com/release/?id=122561

https://aquilaresources.com/release/?id=122560

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

Antwort auf Beitrag Nr.: 59.182.104 von Boersiback am 09.11.18 19:32:08ALLright.

Good luck,

and BYE!

Good luck,

and BYE!

Antwort auf Beitrag Nr.: 59.182.836 von Popeye82 am 09.11.18 20:58:44das heißt NICHT "bye"

gesamtmarkt und ideen gibt es auch noch...

aber einzelwerte nur noch für mich allein und

keine angaben welche und keine diskussion darüber

vernebelt mir zu sehr die birne und hatte zu viele fehlentscheidungen zur folge.

es werden im allgemeinen hier zu viele falsche schlüsse gezogen,

auch von den paar guten.

popeye machts doch eigentlich auch so...

(in dem fall kein vorwurf, sondern vielleicht eben der richtige pfad)

gesamtmarkt und ideen gibt es auch noch...

aber einzelwerte nur noch für mich allein und

keine angaben welche und keine diskussion darüber

vernebelt mir zu sehr die birne und hatte zu viele fehlentscheidungen zur folge.

es werden im allgemeinen hier zu viele falsche schlüsse gezogen,

auch von den paar guten.

popeye machts doch eigentlich auch so...

(in dem fall kein vorwurf, sondern vielleicht eben der richtige pfad)

Antwort auf Beitrag Nr.: 58.948.374 von Popeye82 am 12.10.18 23:28:24Myanmar Metals

https://assets.ctfassets.net/hnlfgsjzg6je/6B4tyVu1FuqQ4iM86e…

https://assets.ctfassets.net/hnlfgsjzg6je/5Fa4J8SaOc8k44u2sO…

https://assets.ctfassets.net/hnlfgsjzg6je/6B4tyVu1FuqQ4iM86e…

https://assets.ctfassets.net/hnlfgsjzg6je/5Fa4J8SaOc8k44u2sO…

Antwort auf Beitrag Nr.: 58.555.283 von Popeye82 am 28.08.18 21:44:33Sovereign Metals

www.investi.com.au/api/announcements/svm/a1603862-e13.pdf

www.investi.com.au/api/announcements/svm/a1603862-e13.pdf

Antwort auf Beitrag Nr.: 59.036.728 von Popeye82 am 24.10.18 01:17:58Deep South Resources

www.deepsouthresources.com/investors/news-releases/deep-sout…

http://ukwazi.com/

www.deepsouthresources.com/investors/news-releases/deep-sout…

http://ukwazi.com/

Antwort auf Beitrag Nr.: 59.173.038 von Popeye82 am 08.11.18 22:11:33Cypress Development

http://aheadoftheherd.com/Newsletter/2018html/1Exploding-Dem…

http://aheadoftheherd.com/Newsletter/2018html/1Exploding-Dem…

Antwort auf Beitrag Nr.: 58.265.942 von Popeye82 am 20.07.18 21:00:01AgriMin

https://agrimin.com.au/wp-content/uploads/20181025-Mackay-SO…

https://agrimin.com.au/wp-content/uploads/Discussions-with-N…

https://naif.gov.au/

https://agrimin.com.au/wp-content/uploads/20181025-Mackay-SO…

https://agrimin.com.au/wp-content/uploads/Discussions-with-N…

https://naif.gov.au/

Antwort auf Beitrag Nr.: 59.144.556 von Popeye82 am 06.11.18 01:59:46Core Exploration

https://wcsecure.weblink.com.au/pdf/CXO/02046531.pdf

https://wcsecure.weblink.com.au/pdf/CXO/02046531.pdf

Antwort auf Beitrag Nr.: 59.136.477 von Popeye82 am 05.11.18 01:12:06Allegiance Coal

www.allegiancecoal.com.au/irm/PDF/1476_0/ItochuCorporationIn…

www.allegiancecoal.com.au/irm/PDF/1476_0/ItochuCorporationIn…

Antwort auf Beitrag Nr.: 59.118.221 von Popeye82 am 01.11.18 20:40:15Liontown Resources

www.ltresources.com.au/sites/default/files/asx-announcements…

http://www.lycopodium.com.au/

www.ltresources.com.au/sites/default/files/asx-announcements…

http://www.lycopodium.com.au/

Antwort auf Beitrag Nr.: 59.151.366 von Popeye82 am 06.11.18 18:59:12LSC Lithium

www.lsclithium.com/news-and-media/news-releases/press-releas…

http://www.pluspetrol.net/

www.lsclithium.com/news-and-media/news-releases/press-releas…

http://www.pluspetrol.net/

Antwort auf Beitrag Nr.: 59.173.839 von Popeye82 am 09.11.18 01:05:09TNG

https://mastermines.global/articles/is-vanadium-the-perfect-…

https://mastermines.global/articles/is-vanadium-the-perfect-…

Antwort auf Beitrag Nr.: 59.136.543 von Popeye82 am 05.11.18 03:07:19Continental Gold

www.continentalgold.com/en/continental-gold-drills-broad-int…

www.continentalgold.com/en/continental-gold-drills-broad-int…

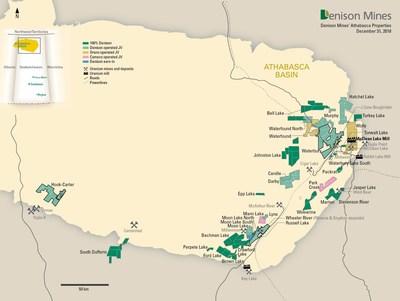

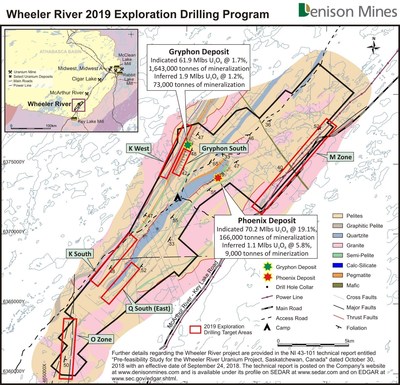

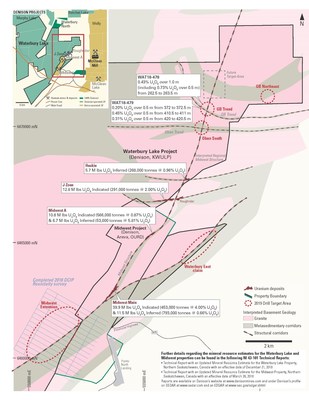

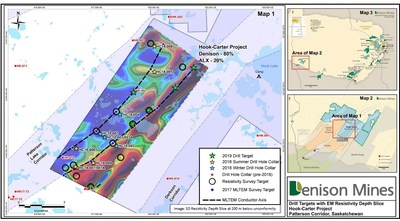

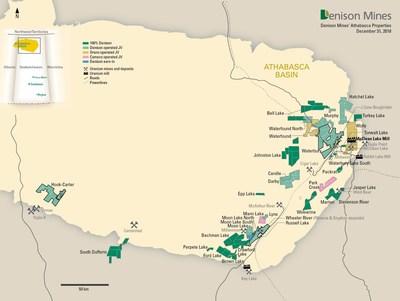

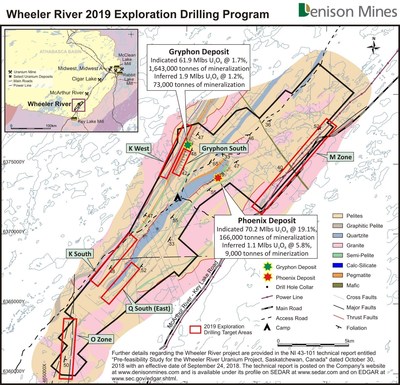

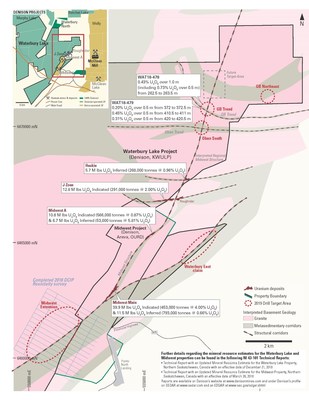

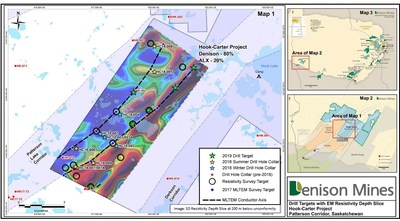

Antwort auf Beitrag Nr.: 59.161.506 von Popeye82 am 07.11.18 19:15:43Denison Mines

www.denisonmines.com/news/2018/denison-reports-results-from-…

www.denisonmines.com/news/2018/denison-annouces-cad-5-millio…

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

www.denisonmines.com/news/2018/denison-reports-results-from-…

www.denisonmines.com/news/2018/denison-annouces-cad-5-millio…

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

Antwort auf Beitrag Nr.: 59.140.497 von Popeye82 am 05.11.18 15:57:50Emmerson Plc

- Total budgeted cost for construction of port upgrades is approximately US$7.5 million, including a 30% contingency

- Initial discussions with local authorities indicate that the Port of Mohammedia (150km from proposed mine site) has capacity for exports from Khemisset

- Port of Casablanca and proposed Port of Kenitra expected to present feasible alternative options

- Estimated capital cost saving of approximately 95% for capex cost for port upgrade, or over US$190 million, relative to cost of a recently constructed potash handling port facility in Canada[1]

- Design and estimate completed according to AusIMM guidelines for capital cost estimates

- Further enhances Management's strong belief in potential for Khemisset to be a low capital cost potash mine development, following the announcements of low capex mine access, low capex logistics solution, and low capex electrical and gas supply which combined have the potential to save Emmerson over US$1.2 billion when compared to benchmark projects (refer RNS's dated 18 September, 08 October, and 23 October 2018)

- Scoping Study to be delivered in Q4 2018, well ahead of previous schedule

www.rns-pdf.londonstockexchange.com/rns/9748G_1-2018-11-11.p…

- Total budgeted cost for construction of port upgrades is approximately US$7.5 million, including a 30% contingency

- Initial discussions with local authorities indicate that the Port of Mohammedia (150km from proposed mine site) has capacity for exports from Khemisset

- Port of Casablanca and proposed Port of Kenitra expected to present feasible alternative options

- Estimated capital cost saving of approximately 95% for capex cost for port upgrade, or over US$190 million, relative to cost of a recently constructed potash handling port facility in Canada[1]

- Design and estimate completed according to AusIMM guidelines for capital cost estimates

- Further enhances Management's strong belief in potential for Khemisset to be a low capital cost potash mine development, following the announcements of low capex mine access, low capex logistics solution, and low capex electrical and gas supply which combined have the potential to save Emmerson over US$1.2 billion when compared to benchmark projects (refer RNS's dated 18 September, 08 October, and 23 October 2018)

- Scoping Study to be delivered in Q4 2018, well ahead of previous schedule

www.rns-pdf.londonstockexchange.com/rns/9748G_1-2018-11-11.p…

Antwort auf Beitrag Nr.: 59.099.804 von Popeye82 am 31.10.18 03:44:43Giyani Metals

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

Antwort auf Beitrag Nr.: 58.764.037 von Popeye82 am 21.09.18 17:23:24Euro Sun Mining

http://eurosunmining.com/news/index.php?content_id=283

http://gov.ro/ro/guvernul/sedinte-guvern/informatie-de-presa…

http://gov.ro/en

http://www.dreptonline.ro/en_resourses/en_official_gazette_r…

http://www.namr.ro/home-page/

http://eurosunmining.com/rovina-valley-project/project-overv…

"Euro Sun Announces Mining License for the Rovina Valley Project Fully Approved by Romanian Government

TORONTO, Nov. 12, 2018 (GLOBE NEWSWIRE) -- Euro Sun Mining Inc. (TSX: ESM) (“Euro Sun” or the “Company”) is pleased to announce the completion of the ratification process of its exploitation permit and mining license for the Rovina Valley Project in Romania. Euro Sun’s mining license was signed by the Prime Minister of Romania at the weekly meeting of the Romanian government on November 9, 2018, as press released through the Government of Romania website.1

The fully approved mining license for the Rovina Valley Project will now be published in the Official Monitor of the Romanian Government.

Stan Bharti, Chairman of Euro Sun stated; “The importance of this ratification cannot be overstated. Romania has now demonstrated an open and willing embrace for mining investment, one that is sure to attract significant interest not only in the Rovina Valley project but for mining investment globally in Romania. I would like to thank all the Government of Romania officials involved for approving this important milestone.”

G. Scott Moore, President and CEO stated; “We are very pleased to see the process to ratify our mining license come to a successful conclusion. We would like to thank the National Agency for Mineral Resources for their support of this important project for Euro Sun and for Romania. As the first non-state-owned entity to have a ratified mining license, we are committed to developing the Rovina Valley Project as an example of responsible mining to the highest environmental standards, and in the process, provide meaningful economic impact to our local community partners and to the Romanian state.”

The Company will now undertake the Environmental and Social Impact Assessment (ESIA) and will also continue the Feasibility Study accelerating the Rovina Valley Project towards a construction decision.

The Preliminary Economic Assessment (PEA) in 2010 outlined a robust project with an average annual gold production of 196,000 ounces over 19 years with the first five years of production averaging 238,000 oz annually. In addition, the PEA indicated that the Rovina Valley Project would produce 49.4 million pounds annually. Production was based on a production rate of approximately 45,000 tonnes per day.

The Feasibility Study will evaluate a scalable, phased approach targeting higher grade zones of the deposit. The phases will begin with the exploitation of the Colnic deposit, with the other deposits to follow, at an initial throughput of approximately 15,000 - 25,000 tonnes per day. The Company believes this phased approach better manages upfront capital costs, better mitigates project risk and is anticipated to deliver improved economics over the 2010 PEA.

The Company also announces that Guy Charette has resigned from the Company’s board of directors effective immediately. Mr. Charette has been a director since 2003. The Company thanks Mr. Charette for his contributions.

http://gov.ro/ro/guvernul/sedinte-guvern/informatie-de-presa…

About Rovina Valley

The Rovina Valley Project is one of the largest mineral deposits in the European Union and consists of three porphyry deposits: Colnic and Rovina, two at surface deposits and Ciresta, an underground deposit. The Rovina Valley Project hosts measured and indicated mineral resources of 7.2 million ounces of gold and 1.4 billion pounds of copper in 406 million tonnes at 0.55 gold grams per tonne and 0.16% of contained copper.

Qualified Person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Randall Ruff, Vice President Exploration for Euro Sun, who is a Qualified Persons as defined by National Instrument 43-101.

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange listed mining company focused on the exploration and development of its 100%-owned Rovina Valley gold and copper project located in west-central Romania, which hosts the second largest gold deposit in Europe.

Further information:

Investor Relations at info@eurosunmining.com or +1 416.309.4299."

http://eurosunmining.com/news/index.php?content_id=283

http://gov.ro/ro/guvernul/sedinte-guvern/informatie-de-presa…

http://gov.ro/en

http://www.dreptonline.ro/en_resourses/en_official_gazette_r…

http://www.namr.ro/home-page/

http://eurosunmining.com/rovina-valley-project/project-overv…

"Euro Sun Announces Mining License for the Rovina Valley Project Fully Approved by Romanian Government

TORONTO, Nov. 12, 2018 (GLOBE NEWSWIRE) -- Euro Sun Mining Inc. (TSX: ESM) (“Euro Sun” or the “Company”) is pleased to announce the completion of the ratification process of its exploitation permit and mining license for the Rovina Valley Project in Romania. Euro Sun’s mining license was signed by the Prime Minister of Romania at the weekly meeting of the Romanian government on November 9, 2018, as press released through the Government of Romania website.1

The fully approved mining license for the Rovina Valley Project will now be published in the Official Monitor of the Romanian Government.

Stan Bharti, Chairman of Euro Sun stated; “The importance of this ratification cannot be overstated. Romania has now demonstrated an open and willing embrace for mining investment, one that is sure to attract significant interest not only in the Rovina Valley project but for mining investment globally in Romania. I would like to thank all the Government of Romania officials involved for approving this important milestone.”

G. Scott Moore, President and CEO stated; “We are very pleased to see the process to ratify our mining license come to a successful conclusion. We would like to thank the National Agency for Mineral Resources for their support of this important project for Euro Sun and for Romania. As the first non-state-owned entity to have a ratified mining license, we are committed to developing the Rovina Valley Project as an example of responsible mining to the highest environmental standards, and in the process, provide meaningful economic impact to our local community partners and to the Romanian state.”

The Company will now undertake the Environmental and Social Impact Assessment (ESIA) and will also continue the Feasibility Study accelerating the Rovina Valley Project towards a construction decision.

The Preliminary Economic Assessment (PEA) in 2010 outlined a robust project with an average annual gold production of 196,000 ounces over 19 years with the first five years of production averaging 238,000 oz annually. In addition, the PEA indicated that the Rovina Valley Project would produce 49.4 million pounds annually. Production was based on a production rate of approximately 45,000 tonnes per day.

The Feasibility Study will evaluate a scalable, phased approach targeting higher grade zones of the deposit. The phases will begin with the exploitation of the Colnic deposit, with the other deposits to follow, at an initial throughput of approximately 15,000 - 25,000 tonnes per day. The Company believes this phased approach better manages upfront capital costs, better mitigates project risk and is anticipated to deliver improved economics over the 2010 PEA.

The Company also announces that Guy Charette has resigned from the Company’s board of directors effective immediately. Mr. Charette has been a director since 2003. The Company thanks Mr. Charette for his contributions.

http://gov.ro/ro/guvernul/sedinte-guvern/informatie-de-presa…

About Rovina Valley

The Rovina Valley Project is one of the largest mineral deposits in the European Union and consists of three porphyry deposits: Colnic and Rovina, two at surface deposits and Ciresta, an underground deposit. The Rovina Valley Project hosts measured and indicated mineral resources of 7.2 million ounces of gold and 1.4 billion pounds of copper in 406 million tonnes at 0.55 gold grams per tonne and 0.16% of contained copper.

Qualified Person

The scientific and technical information pertaining to the metallurgical studies presented in this press release has been reviewed and approved by Randall Ruff, Vice President Exploration for Euro Sun, who is a Qualified Persons as defined by National Instrument 43-101.

About Euro Sun Mining Inc.

Euro Sun is a Toronto Stock Exchange listed mining company focused on the exploration and development of its 100%-owned Rovina Valley gold and copper project located in west-central Romania, which hosts the second largest gold deposit in Europe.

Further information:

Investor Relations at info@eurosunmining.com or +1 416.309.4299."

Antwort auf Beitrag Nr.: 58.922.730 von Popeye82 am 10.10.18 21:47:51Canada Carbon

www.canadacarbon.com/newsdetail?&newsfile=ccb_20181112.htm

http://www.tribunaux.qc.ca/mjq_en/c-superieure/index-cs.html

http://gslr.ca/en/reglements-br-municipaux/

http://courdappelduquebec.ca/en/

www.canadacarbon.com/newsdetail?&newsfile=ccb_20181112.htm

http://www.tribunaux.qc.ca/mjq_en/c-superieure/index-cs.html

http://gslr.ca/en/reglements-br-municipaux/

http://courdappelduquebec.ca/en/

Antwort auf Beitrag Nr.: 59.136.423 von Popeye82 am 05.11.18 00:20:46Aurania Resources

www.aurania.com/otcqb-podcast-series-with-ceo-keith-barron/

www.aurania.com/otcqb-podcast-series-with-ceo-keith-barron/

Antwort auf Beitrag Nr.: 59.180.172 von Popeye82 am 09.11.18 16:18:001,2,3,4(drop Your Clothes on the Floor)

Greenland Minerals

www.nzz.ch/wirtschaft/groenland-will-mehr-als-bloss-vom-fisc…

Greenland Minerals

www.nzz.ch/wirtschaft/groenland-will-mehr-als-bloss-vom-fisc…

Antwort auf Beitrag Nr.: 59.182.167 von Popeye82 am 09.11.18 19:39:13Sirius Minerals Plc

- Mineral transport system fit-out agreed and finalised with STRABAG

- Fit-out price in line with capital re-estimate announced on 6 September 2018

- Procurement now complete for the major construction packages for stage 2 financing, a significant milestone

- The Company is working towards financial close of stage 2 financing in Q1 2019

https://otp.tools.investis.com/clients/uk/sirius_minerals/rn…

https://tunnel.strabag.com/

"Procurement complete for the major construction packages

§ Mineral transport system fit-out agreed and finalised with STRABAG

§ Fit-out price in line with capital re-estimate announced on 6 September 2018

§ Procurement now complete for the major construction packages for stage 2 financing, a significant milestone

§ The Company is working towards financial close of stage 2 financing in Q1 2019

Sirius Minerals Plc ("Sirius" or the "Company") announces that it has varied its existing mineral transport system ("MTS") tunnelling contract with STRABAG AG ("STRABAG") to include the engineering, procurement and construction of the fit-out of the Company's MTS.

The MTS fit-out scope includes the fit-out of; the MTS conveyor, the maintenance railway, electrical and communications infrastructure, and all other services in the tunnel essential to the operation of the MTS.

The price of the MTS fit-out, which will be incurred in GBP, is in line with the Company's capital re-estimate announced on 6 September 2018. More than 50 per cent of the MTS fit-out price is on a fixed rates or lump sum basis. The remainder of the MTS fit-out price is based upon estimated prices that will be converted into fixed prices prior to completion of stage 2 financing. The proposed schedule for the MTS fit-out is in line with the Company's overall Project schedule.

The Company has now completed its procurement for the major construction packages related to the stage 2 senior debt financing process, which represents a significant milestone for the Project.

Chris Fraser, Managing Director and CEO of Sirius, comments:

"Procurement of the mineral transport system fit-out marks the completion of our major construction procurement programme to support our stage 2 senior debt financing process and is a significant milestone for the Company. Our efforts are now focussed on the successful execution of our financing plan to fully finance the construction of our world-class, long-life polyhalite project."

Stage 2 financing

The varied MTS contract, which is the final procurement contract for our stage 2 senior debt financing process, will now be provided to the stage 2 lenders for review by the lenders' independent technical consultant. Following completion of the procurement contract review, the Company and its lenders will assess the required capital contingency levels for the Project and will determine the overall capital funding requirement of the Project. As previously announced, the Company expects the capital funding requirement of the Project to be US$3.4bn - US$3.6bn (previously US$3bn). The Company believes that a US$3bn senior debt financing is the appropriate level of debt and will not seek to increase this amount.

Given the timing of completion of the final procurement contracts, final lender commitment letters are expected to be received in December 2018 and January 2019. As previously announced, the Company is targeting financial close of stage 2 financing in Q1 2019.

Mineral transport system

The MTS will carry the Company's mined polyhalite from 360 meters underground at the Woodsmith mine site to the materials handling facility at Wilton, Teesside, on a 37km underground conveyor system. The tunnel will be constructed by three tunnel boring machines. The conveyor system in the MTS will be designed to handle 20 Mtpa of throughput. The tunnel will also contain maintenance rail and services, including a 66kV power feeder from Wilton International industrial complex.

For further information, please contact:

Sirius Minerals Plc

Investor Relations

Jennifer Wyllie, Tristan Pottas

Email: ir@siriusminerals.com

Tel: +44 845 524 0247

Media enquiries

Edelman

Alex Simmons, Ed Brown

Email: Siriusminerals@edelman.com

Tel: +44 7970 174 353

Tel: +44 7540 412 298

About STRABAG SE

STRABAG SE is a publicly listed European-based technology group for construction services and a leading international transportation infrastructure, building construction and civil engineering contractor. STRABAG SE is a global leader in tunnelling technologies and a specialist in providing technically optimised end-to-end tunnelling solutions worldwide. Their extensive experience and track record on some of the world's largest and most technically challenging projects includes the excavation of tunnels and caverns, tunnel boring machine operations of all kinds including soft ground and hard rock, and long, deep tunnels. Further information can be found at https://tunnel.strabag.com.

About Sirius Minerals Plc

Sirius Minerals Plc is focussed on the development of the Woodsmith Mine, which will access the world's largest and highest grade polyhalite deposit located in North Yorkshire, United Kingdom. Polyhalite is a unique multi-nutrient fertilizer, which can be used to increase balanced fertilization around the world. Sirius Minerals' shares are traded on the Premium List of the London Stock Exchange. Its shares are also traded in the United States on the OTCQX through a sponsored ADR facility. Further information on the Company can be found at www.siriusminerals.com. "

- Mineral transport system fit-out agreed and finalised with STRABAG

- Fit-out price in line with capital re-estimate announced on 6 September 2018

- Procurement now complete for the major construction packages for stage 2 financing, a significant milestone

- The Company is working towards financial close of stage 2 financing in Q1 2019

https://otp.tools.investis.com/clients/uk/sirius_minerals/rn…

https://tunnel.strabag.com/

"Procurement complete for the major construction packages

§ Mineral transport system fit-out agreed and finalised with STRABAG

§ Fit-out price in line with capital re-estimate announced on 6 September 2018

§ Procurement now complete for the major construction packages for stage 2 financing, a significant milestone

§ The Company is working towards financial close of stage 2 financing in Q1 2019

Sirius Minerals Plc ("Sirius" or the "Company") announces that it has varied its existing mineral transport system ("MTS") tunnelling contract with STRABAG AG ("STRABAG") to include the engineering, procurement and construction of the fit-out of the Company's MTS.

The MTS fit-out scope includes the fit-out of; the MTS conveyor, the maintenance railway, electrical and communications infrastructure, and all other services in the tunnel essential to the operation of the MTS.

The price of the MTS fit-out, which will be incurred in GBP, is in line with the Company's capital re-estimate announced on 6 September 2018. More than 50 per cent of the MTS fit-out price is on a fixed rates or lump sum basis. The remainder of the MTS fit-out price is based upon estimated prices that will be converted into fixed prices prior to completion of stage 2 financing. The proposed schedule for the MTS fit-out is in line with the Company's overall Project schedule.

The Company has now completed its procurement for the major construction packages related to the stage 2 senior debt financing process, which represents a significant milestone for the Project.

Chris Fraser, Managing Director and CEO of Sirius, comments:

"Procurement of the mineral transport system fit-out marks the completion of our major construction procurement programme to support our stage 2 senior debt financing process and is a significant milestone for the Company. Our efforts are now focussed on the successful execution of our financing plan to fully finance the construction of our world-class, long-life polyhalite project."

Stage 2 financing

The varied MTS contract, which is the final procurement contract for our stage 2 senior debt financing process, will now be provided to the stage 2 lenders for review by the lenders' independent technical consultant. Following completion of the procurement contract review, the Company and its lenders will assess the required capital contingency levels for the Project and will determine the overall capital funding requirement of the Project. As previously announced, the Company expects the capital funding requirement of the Project to be US$3.4bn - US$3.6bn (previously US$3bn). The Company believes that a US$3bn senior debt financing is the appropriate level of debt and will not seek to increase this amount.

Given the timing of completion of the final procurement contracts, final lender commitment letters are expected to be received in December 2018 and January 2019. As previously announced, the Company is targeting financial close of stage 2 financing in Q1 2019.

Mineral transport system

The MTS will carry the Company's mined polyhalite from 360 meters underground at the Woodsmith mine site to the materials handling facility at Wilton, Teesside, on a 37km underground conveyor system. The tunnel will be constructed by three tunnel boring machines. The conveyor system in the MTS will be designed to handle 20 Mtpa of throughput. The tunnel will also contain maintenance rail and services, including a 66kV power feeder from Wilton International industrial complex.

For further information, please contact:

Sirius Minerals Plc

Investor Relations

Jennifer Wyllie, Tristan Pottas

Email: ir@siriusminerals.com

Tel: +44 845 524 0247

Media enquiries

Edelman

Alex Simmons, Ed Brown

Email: Siriusminerals@edelman.com

Tel: +44 7970 174 353

Tel: +44 7540 412 298

About STRABAG SE

STRABAG SE is a publicly listed European-based technology group for construction services and a leading international transportation infrastructure, building construction and civil engineering contractor. STRABAG SE is a global leader in tunnelling technologies and a specialist in providing technically optimised end-to-end tunnelling solutions worldwide. Their extensive experience and track record on some of the world's largest and most technically challenging projects includes the excavation of tunnels and caverns, tunnel boring machine operations of all kinds including soft ground and hard rock, and long, deep tunnels. Further information can be found at https://tunnel.strabag.com.

About Sirius Minerals Plc

Sirius Minerals Plc is focussed on the development of the Woodsmith Mine, which will access the world's largest and highest grade polyhalite deposit located in North Yorkshire, United Kingdom. Polyhalite is a unique multi-nutrient fertilizer, which can be used to increase balanced fertilization around the world. Sirius Minerals' shares are traded on the Premium List of the London Stock Exchange. Its shares are also traded in the United States on the OTCQX through a sponsored ADR facility. Further information on the Company can be found at www.siriusminerals.com. "

Antwort auf Beitrag Nr.: 59.118.353 von Popeye82 am 01.11.18 21:06:14as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3122_0/ExecutionofEPCC…

http://www.gres.com.au/

http://www.taurusfunds.com.au/

https://privatefunddata.com/private-funds/taurus-mining-fina…

https://naif.gov.au/

http://www.metifex.com.au/

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3122_0/ExecutionofEPCC…

http://www.gres.com.au/

http://www.taurusfunds.com.au/

https://privatefunddata.com/private-funds/taurus-mining-fina…

https://naif.gov.au/

http://www.metifex.com.au/

Antwort auf Beitrag Nr.: 59.163.477 von Popeye82 am 07.11.18 23:16:37Jangada Mines

www.rns-pdf.londonstockexchange.com/rns/9597G_1-2018-11-9.pd…

www.stockmarketwire.com/article/6203004/Jangada-Mines-reveal…

http://www.consulmet.com/

www.mining-journal.com/feasibility/news/1350860/jangada-redu…

www.share-talk.com/jangada-mines-plc-aimjan-32-reduction-in-…

"Jangada Mines reveals signifcant reduction in total capital expenditure

12 November 2018 | 09:41am

StockMarketWire.com - Natural resources company Jangada Mines said preliminary capital expenditure had been significantly reduced following the creation of an updated process flowsheet in partnership with Consulmet for its Pedra Branca project.

The company said projected plant capex costs were reduced by 8% to US$33.8m, while upfront capex costs were reduced by 32% to US$43.9m.

'Today's refinement and optimisation of the process flowsheet has delivered an impressive 32% and 38% reduction in plant capex and overall capex, respectively, further enhancing the Project's potential to provide lucrative returns, said Brian McMaster, Chairman of Jangada.

'As such, we are delighted with today's result, which is primarily a result of Consulmet's highly specialist experience in building PGM plants.'

At 9:41am: [LON:JAN] Jangada Mines Plc Ord Gbp0.0004 share price was +0.11p at 2.43p

Story provided by StockMarketWire.com"

www.rns-pdf.londonstockexchange.com/rns/9597G_1-2018-11-9.pd…

www.stockmarketwire.com/article/6203004/Jangada-Mines-reveal…

http://www.consulmet.com/

www.mining-journal.com/feasibility/news/1350860/jangada-redu…

www.share-talk.com/jangada-mines-plc-aimjan-32-reduction-in-…

"Jangada Mines reveals signifcant reduction in total capital expenditure

12 November 2018 | 09:41am

StockMarketWire.com - Natural resources company Jangada Mines said preliminary capital expenditure had been significantly reduced following the creation of an updated process flowsheet in partnership with Consulmet for its Pedra Branca project.

The company said projected plant capex costs were reduced by 8% to US$33.8m, while upfront capex costs were reduced by 32% to US$43.9m.

'Today's refinement and optimisation of the process flowsheet has delivered an impressive 32% and 38% reduction in plant capex and overall capex, respectively, further enhancing the Project's potential to provide lucrative returns, said Brian McMaster, Chairman of Jangada.

'As such, we are delighted with today's result, which is primarily a result of Consulmet's highly specialist experience in building PGM plants.'

At 9:41am: [LON:JAN] Jangada Mines Plc Ord Gbp0.0004 share price was +0.11p at 2.43p

Story provided by StockMarketWire.com"

Antwort auf Beitrag Nr.: 59.192.062 von Popeye82 am 12.11.18 01:23:14Liontown Resources

www.ltresources.com.au/sites/default/files/asx-announcements…

http://www.westgold.com.au/

www.ltresources.com.au/sites/default/files/asx-announcements…

http://www.westgold.com.au/

Antwort auf Beitrag Nr.: 59.152.539 von Popeye82 am 06.11.18 21:29:24Iconic Minerals

https://docs.wixstatic.com/ugd/6718b0_767fc4e20aa14018881d8a…

https://docs.wixstatic.com/ugd/6718b0_767fc4e20aa14018881d8a…

Antwort auf Beitrag Nr.: 59.200.984 von Popeye82 am 12.11.18 23:43:30160km long Trend, Opens up new 60km long prospective corridor, south of Thunderbird

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3127_0/NewLargeHighGra…

Sheffield Resources

www.sheffieldresources.com.au/irm/PDF/3127_0/NewLargeHighGra…

Antwort auf Beitrag Nr.: 59.144.655 von Popeye82 am 06.11.18 04:30:10as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3151_0/SanJorgeminingupdate

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Axiom Mining

www.axiom-mining.com/irm/PDF/3151_0/SanJorgeminingupdate

Antwort auf Beitrag Nr.: 59.136.555 von Popeye82 am 05.11.18 03:53:15können sich Keine Richtigen Kochtöpfe leisten ---->LOW cost Exploration

Pensana Metals

www.pensanametals.com/index.php/investors/asx-announcements/…

https://stockhead.com.au/resources/pensana-aims-to-have-the-…

Pensana Metals

www.pensanametals.com/index.php/investors/asx-announcements/…

https://stockhead.com.au/resources/pensana-aims-to-have-the-…

Antwort auf Beitrag Nr.: 59.199.268 von Popeye82 am 12.11.18 19:30:32as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Euro Sun MIning

www.mining.com/euro-sun-gets-mining-license-rovina-romania/?…

www.mining-journal.com/politics/news/1350918/euro-sun-rises-…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Euro Sun MIning

www.mining.com/euro-sun-gets-mining-license-rovina-romania/?…

www.mining-journal.com/politics/news/1350918/euro-sun-rises-…

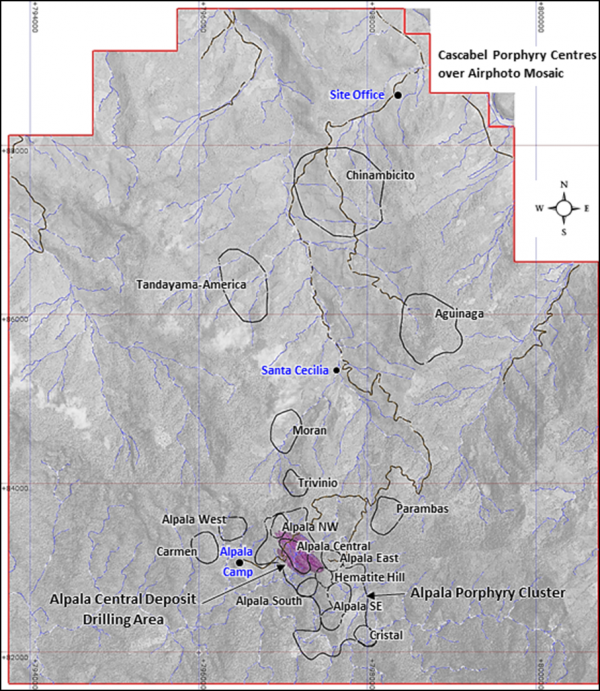

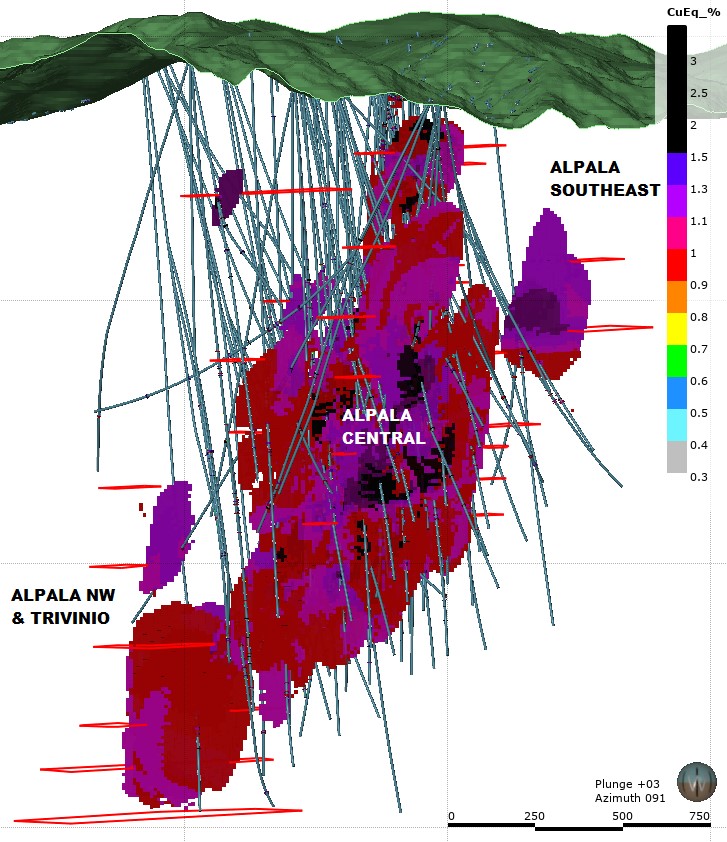

Antwort auf Beitrag Nr.: 58.975.665 von Popeye82 am 16.10.18 20:43:07updated Mineral Resource Estimate(MRE) projected for release in December 2018

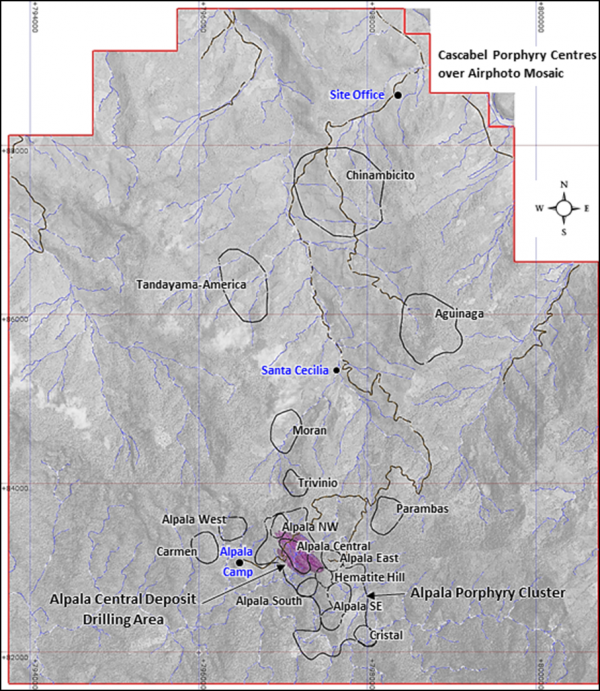

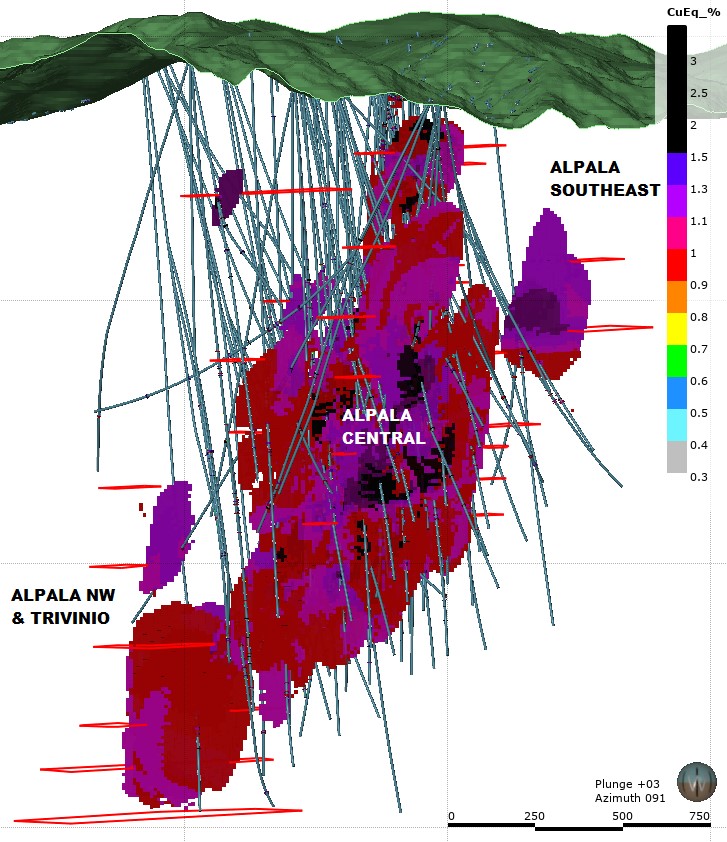

SolGold

www.rns-pdf.londonstockexchange.com/rns/0759H_1-2018-11-12.p…

www.mining-journal.com/resource-definition/news/1350945/solg…

www.rns-pdf.londonstockexchange.com/rns/8277G_1-2018-11-8.pd…

SolGold

www.rns-pdf.londonstockexchange.com/rns/0759H_1-2018-11-12.p…

www.mining-journal.com/resource-definition/news/1350945/solg…

www.rns-pdf.londonstockexchange.com/rns/8277G_1-2018-11-8.pd…

Antwort auf Beitrag Nr.: 58.794.899 von Popeye82 am 25.09.18 17:15:44VERY decisive event

D'Arianne Phosphate

www.arianne-inc.com/en/pressroom/press-releases/port-of-sagu…

http://www.canada.ca/en/environment-climate-change.html

http://www.canada.ca/en/government/ministers/catherine-mcken…

http://www.portsaguenay.ca/

http://www.canada.ca/en/environmental-assessment-agency.html

www.arianne-inc.com/en/pressroom/press-releases/arianne-phos…

https://news.un.org/en/tags/02-economic-development-and-deve…

D'Arianne Phosphate

www.arianne-inc.com/en/pressroom/press-releases/port-of-sagu…

http://www.canada.ca/en/environment-climate-change.html

http://www.canada.ca/en/government/ministers/catherine-mcken…

http://www.portsaguenay.ca/

http://www.canada.ca/en/environmental-assessment-agency.html

www.arianne-inc.com/en/pressroom/press-releases/arianne-phos…

https://news.un.org/en/tags/02-economic-development-and-deve…

Antwort auf Beitrag Nr.: 59.117.669 von Popeye82 am 01.11.18 19:39:27as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Excelsior Mining

www.excelsiormining.com/news/news-2018/Excelsior%20Provides%…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

______________________________________________

Excelsior Mining

www.excelsiormining.com/news/news-2018/Excelsior%20Provides%…

Antwort auf Beitrag Nr.: 58.854.336 von Popeye82 am 02.10.18 17:07:49Rock Tech Lithium

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

http://www.dmt-group.com/de.html

http://rocktechlithium.com/rock-tech-mobilizes-trenching-cre…

http://www.sedar.com/GetFile.do?lang=EN&docClass=24&issuerNo…

http://www.dmt-group.com/de.html

http://rocktechlithium.com/rock-tech-mobilizes-trenching-cre…

Antwort auf Beitrag Nr.: 59.153.127 von Popeye82 am 06.11.18 22:42:29FireWeed Zinc

TS18-012 228.80 278.00 49.20 28.22 8.43 3.23 35

Including 264.00 277.00 13.00 7.46 13.51 6.26 110

TS18-013 Exploration hole on geophysical target. No zone intersected.

TS18-014 142.30 158.50 16.20 12.41 7.99 13.26 166

Including 146.50 157.60 11.10 8.50 9.75 17.41 222

Including 146.50 149.50 3.00 2.30 23.76 8.38 150

Including 151.50 155.50 4.00 3.06 2.78 27.59 311

www.nasdaq.com/press-release/fireweed-drills-799-zinc-1326-l…

TS18-012 228.80 278.00 49.20 28.22 8.43 3.23 35

Including 264.00 277.00 13.00 7.46 13.51 6.26 110

TS18-013 Exploration hole on geophysical target. No zone intersected.

TS18-014 142.30 158.50 16.20 12.41 7.99 13.26 166

Including 146.50 157.60 11.10 8.50 9.75 17.41 222

Including 146.50 149.50 3.00 2.30 23.76 8.38 150

Including 151.50 155.50 4.00 3.06 2.78 27.59 311

www.nasdaq.com/press-release/fireweed-drills-799-zinc-1326-l…

Antwort auf Beitrag Nr.: 58.744.327 von Popeye82 am 20.09.18 01:45:32as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

NQ Minerals

www.nqminerals.com/first-concentrate-sale-at-nqs-hellyer-pro…

http://www.traxys.com/

www.nqminerals.com/issue-of-equity-5/

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

NQ Minerals

www.nqminerals.com/first-concentrate-sale-at-nqs-hellyer-pro…

http://www.traxys.com/

www.nqminerals.com/issue-of-equity-5/

Antwort auf Beitrag Nr.: 59.159.538 von Popeye82 am 07.11.18 16:17:02European Electric Metals

www.europeanelectricmetals.com/news/display/index.php?conten…

http://www.alsglobal.com/

www.europeanelectricmetals.com/news/display/index.php?conten…

http://www.alsglobal.com/

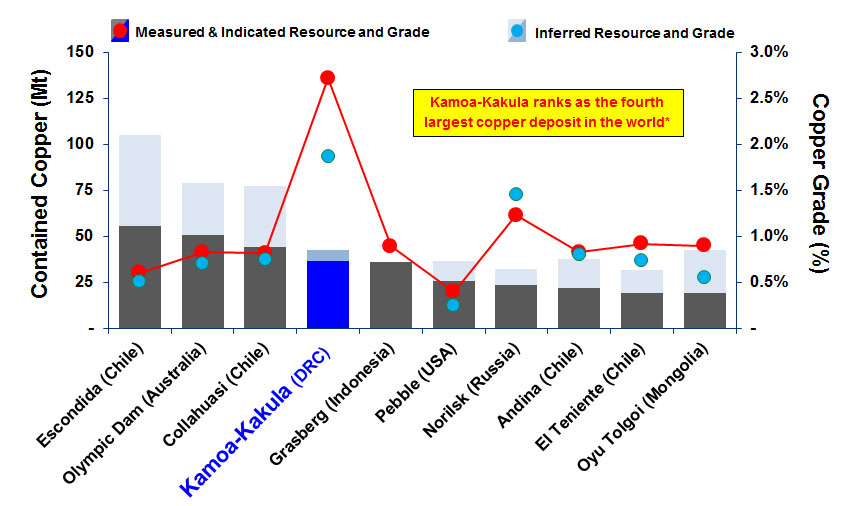

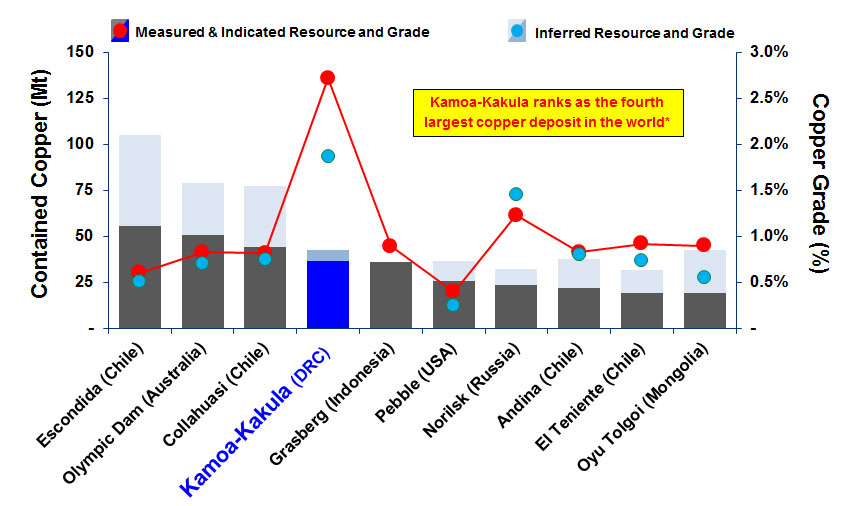

Antwort auf Beitrag Nr.: 59.171.046 von Popeye82 am 08.11.18 18:36:08Ivanhoe Mines

www.miningreview.com/ivanhoe-ore-inspiring/

http://www.draglobal.com/

www.miningreview.com/ivanhoe-ore-inspiring/

http://www.draglobal.com/

Antwort auf Beitrag Nr.: 59.175.339 von Popeye82 am 09.11.18 09:05:24as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

___________________________________________

Argosys Minerals

www.asx.com.au/asxpdf/20181113/pdf/44075h205314lb.pdf

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

___________________________________________

Argosys Minerals

www.asx.com.au/asxpdf/20181113/pdf/44075h205314lb.pdf

Antwort auf Beitrag Nr.: 59.075.374 von Popeye82 am 28.10.18 00:57:59Australian Potash

www.australianpotash.com.au/site/PDF/1682_0/SuccessfulInfill…

www.australianpotash.com.au/site/PDF/1659_0/AnnualReport2018

www.australianpotash.com.au/site/PDF/1682_0/SuccessfulInfill…

www.australianpotash.com.au/site/PDF/1659_0/AnnualReport2018

Antwort auf Beitrag Nr.: 59.144.985 von Popeye82 am 06.11.18 07:38:33Amur Minerals

https://amurminerals.com/content/wp-content/uploads/20181112…

https://amurminerals.com/content/wp-content/uploads/20181112…

Antwort auf Beitrag Nr.: 59.195.743 von Popeye82 am 12.11.18 13:50:00TNG

www.businessnews.com.au/article/TNG-signs-titanium-offtake-d…

www.businessnews.com.au/article/TNG-signs-titanium-offtake-d…

Antwort auf Beitrag Nr.: 59.191.993 von Popeye82 am 12.11.18 00:31:36Allegiance Coal

www.allegiancecoal.com.au/irm/PDF/1478_0/Section10OrderRecei…

http://www2.gov.bc.ca/gov/content/environment/natural-resour…

www.allegiancecoal.com.au/irm/PDF/1478_0/Section10OrderRecei…

http://www2.gov.bc.ca/gov/content/environment/natural-resour…

Antwort auf Beitrag Nr.: 59.153.769 von Popeye82 am 07.11.18 01:05:58UNdeniably WORLD scale Inventory

Strandline Resources

www.strandline.com.au/irm/PDF/2708_0/CoburnMineralResourceEs…

www.strandline.com.au/irm/PDF/2707_0/PatersonsResearchReport…

Strandline Resources

www.strandline.com.au/irm/PDF/2708_0/CoburnMineralResourceEs…

www.strandline.com.au/irm/PDF/2707_0/PatersonsResearchReport…

Antwort auf Beitrag Nr.: 59.145.393 von Popeye82 am 06.11.18 08:32:25Bluestone Resources

www.bluestoneresources.ca/news/index.php?content_id=100

www.bluestoneresources.ca/_resources/images/20181113-NR-Imag…

www.bluestoneresources.ca/news/index.php?content_id=100

www.bluestoneresources.ca/_resources/images/20181113-NR-Imag…

Antwort auf Beitrag Nr.: 59.200.819 von Popeye82 am 12.11.18 22:49:31Sirius Minerals

www.proactiveinvestors.co.uk/companies/news/208980/sirius-mi…

www.proactiveinvestors.co.uk/companies/news/208980/sirius-mi…

Antwort auf Beitrag Nr.: 58.933.629 von Popeye82 am 11.10.18 18:14:50Venturex Resources

https://wcsecure.weblink.com.au/pdf/VXR/02047667.pdf

http://www.epa.wa.gov.au/

http://burnvoir.com.au/

https://wcsecure.weblink.com.au/pdf/VXR/02040597.pdf

https://wcsecure.weblink.com.au/pdf/VXR/02047667.pdf

http://www.epa.wa.gov.au/

http://burnvoir.com.au/

https://wcsecure.weblink.com.au/pdf/VXR/02040597.pdf

Antwort auf Beitrag Nr.: 59.195.623 von Popeye82 am 12.11.18 13:37:22LSC Lithium

www.lsclithium.com/news-and-media/news-releases/press-releas…

www.lsclithium.com/news-and-media/news-releases/press-releas…

Antwort auf Beitrag Nr.: 59.119.607 von Popeye82 am 02.11.18 02:14:52as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Lithium Americas

www.lithiumamericas.com/news/lithium-americas-reports-third-…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Lithium Americas

www.lithiumamericas.com/news/lithium-americas-reports-third-…

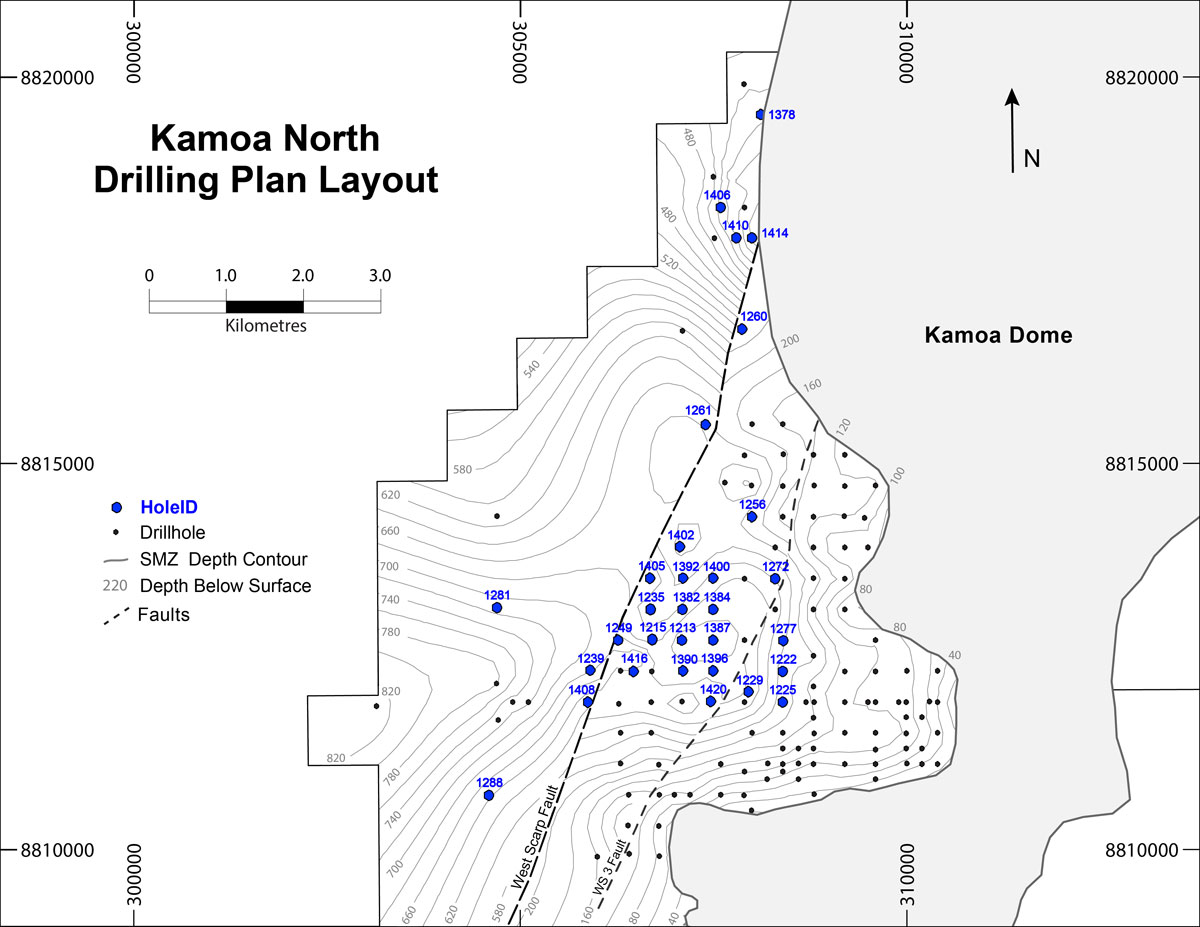

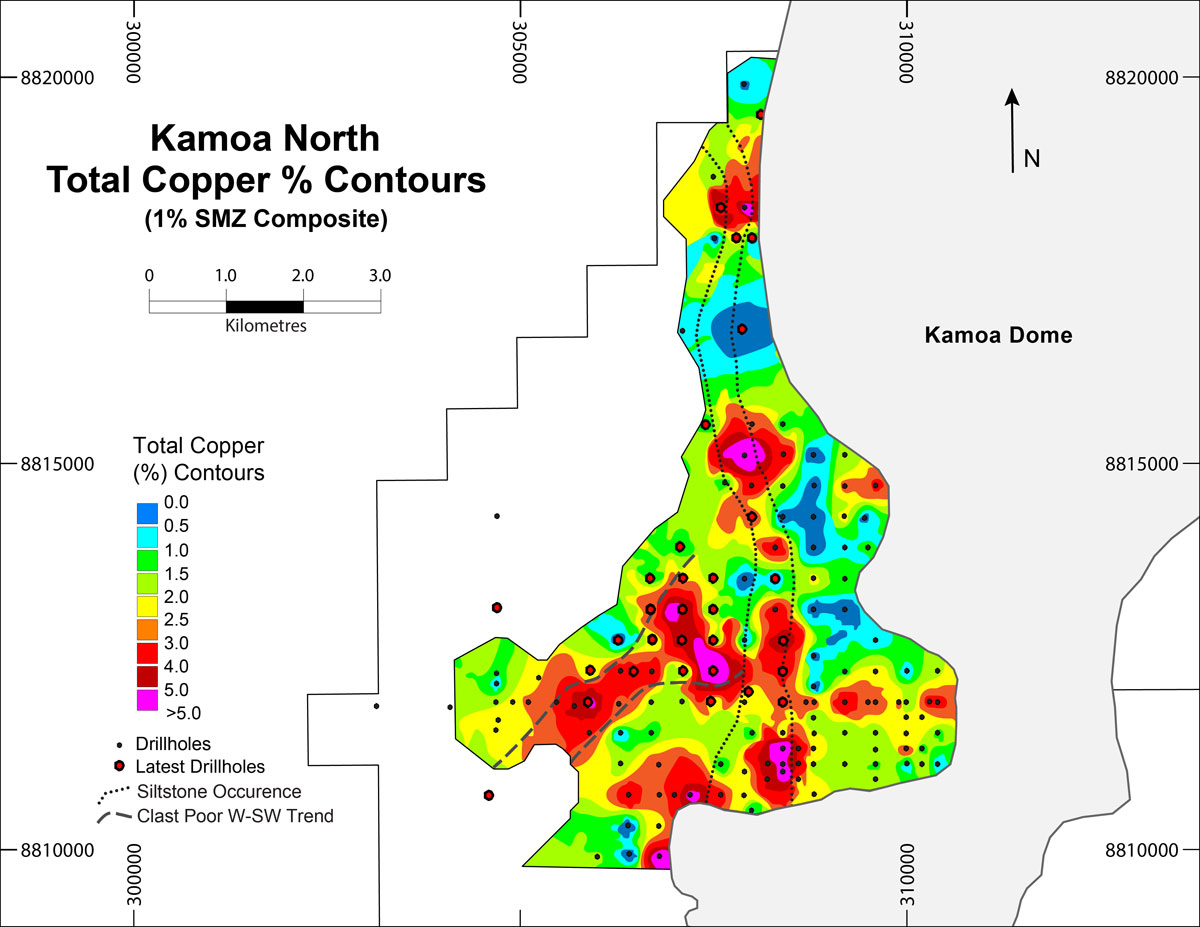

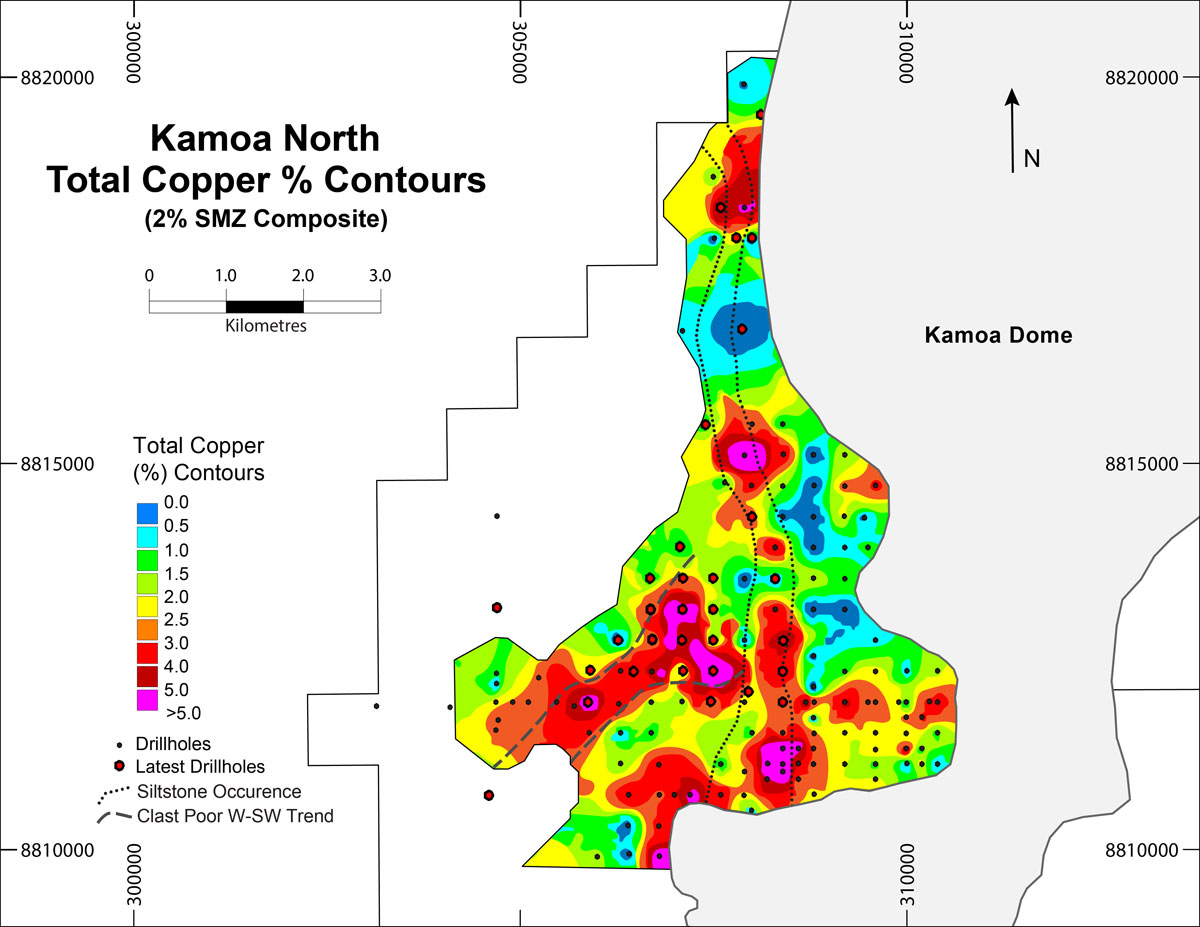

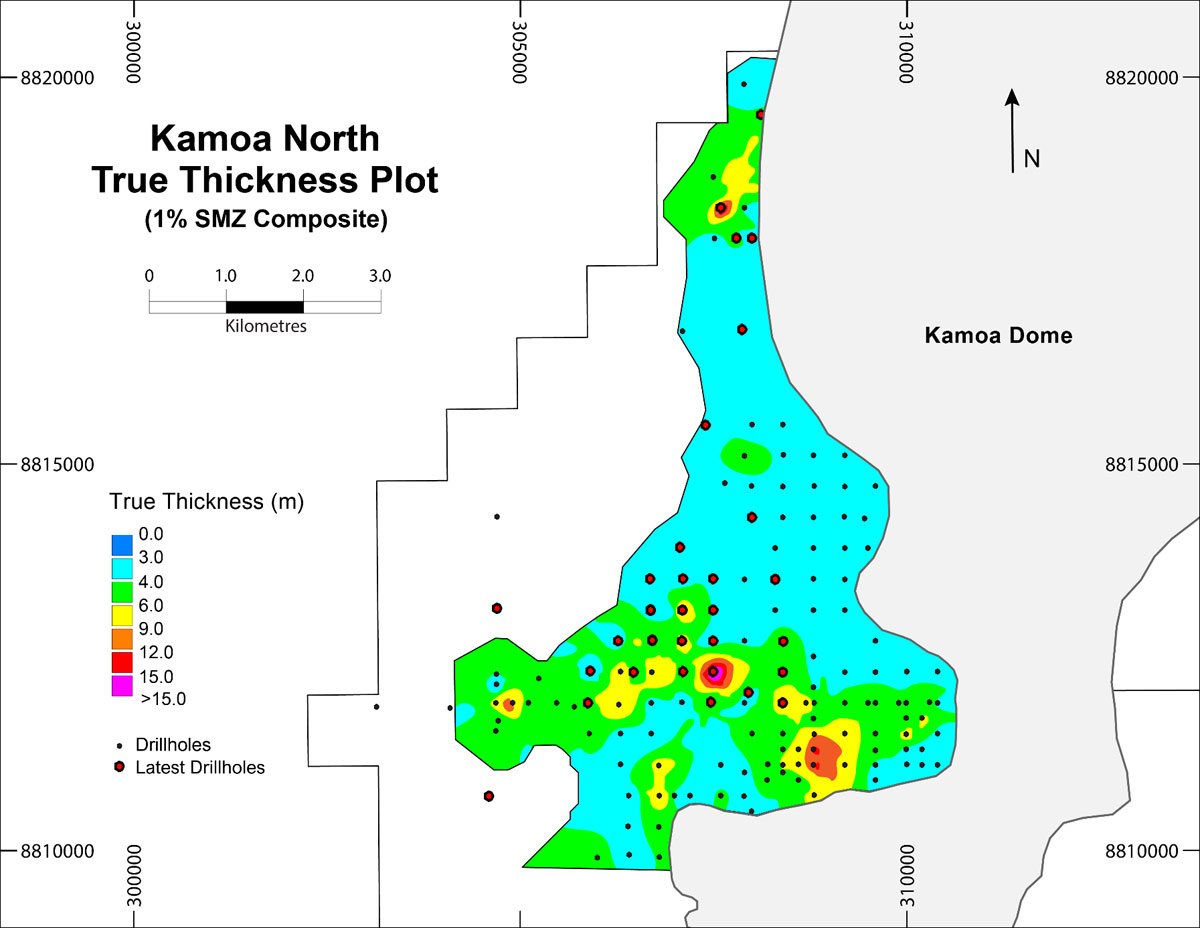

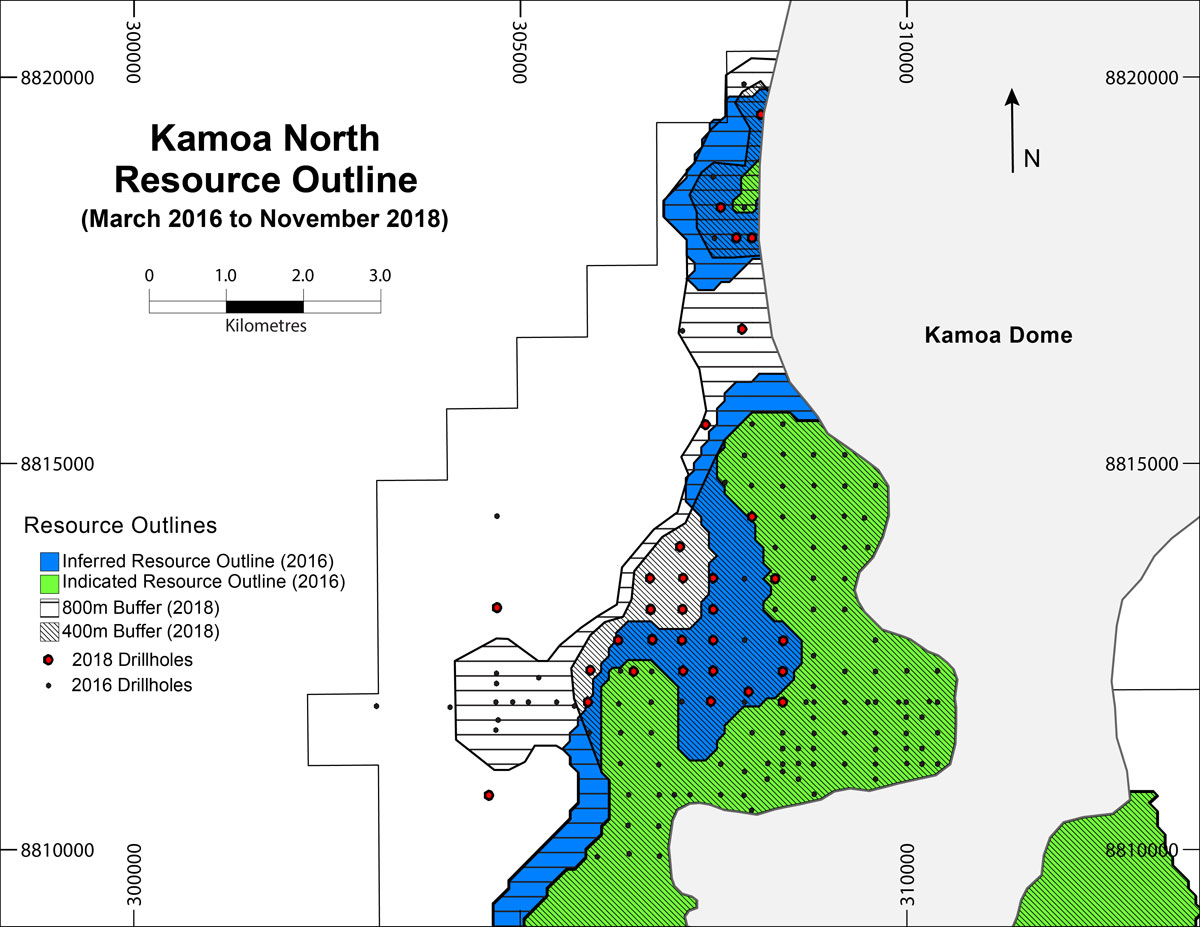

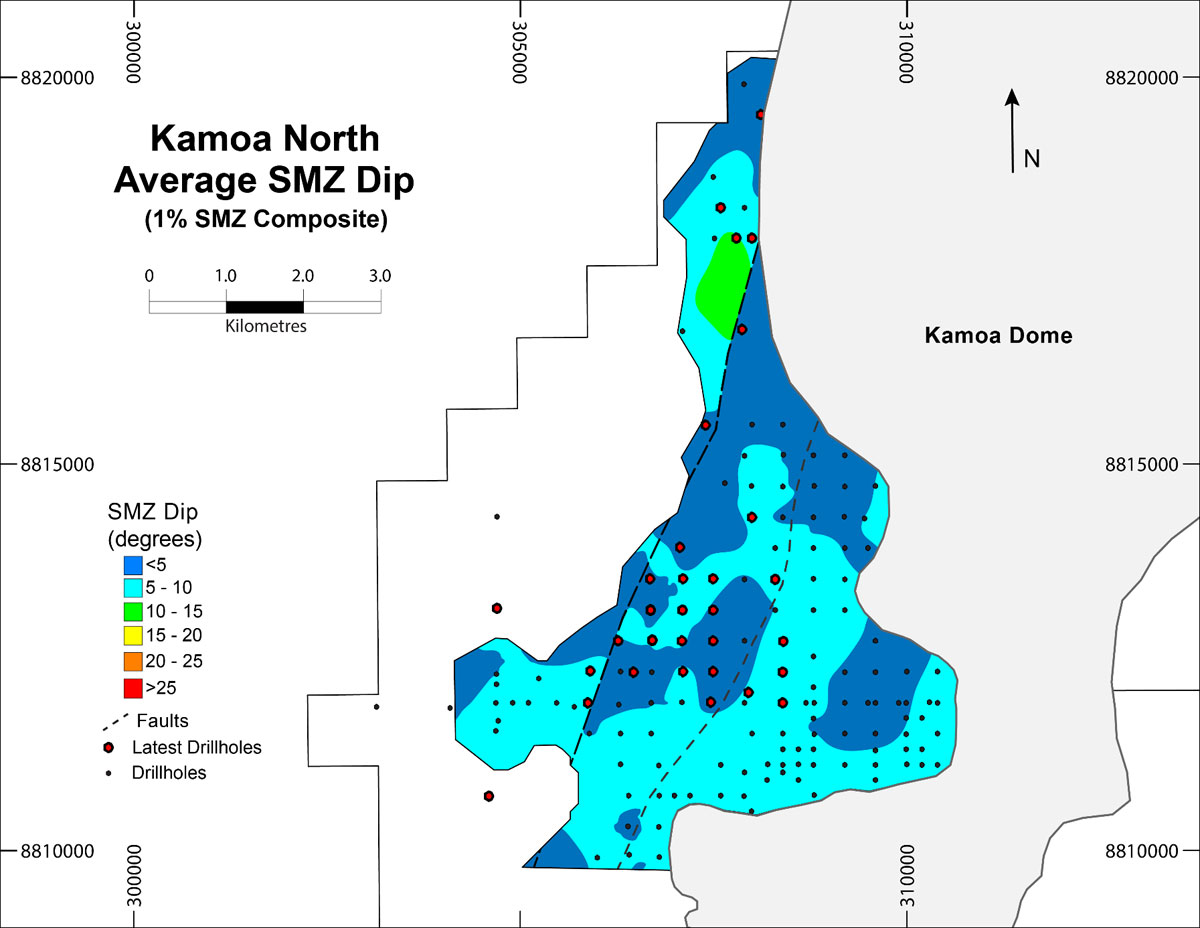

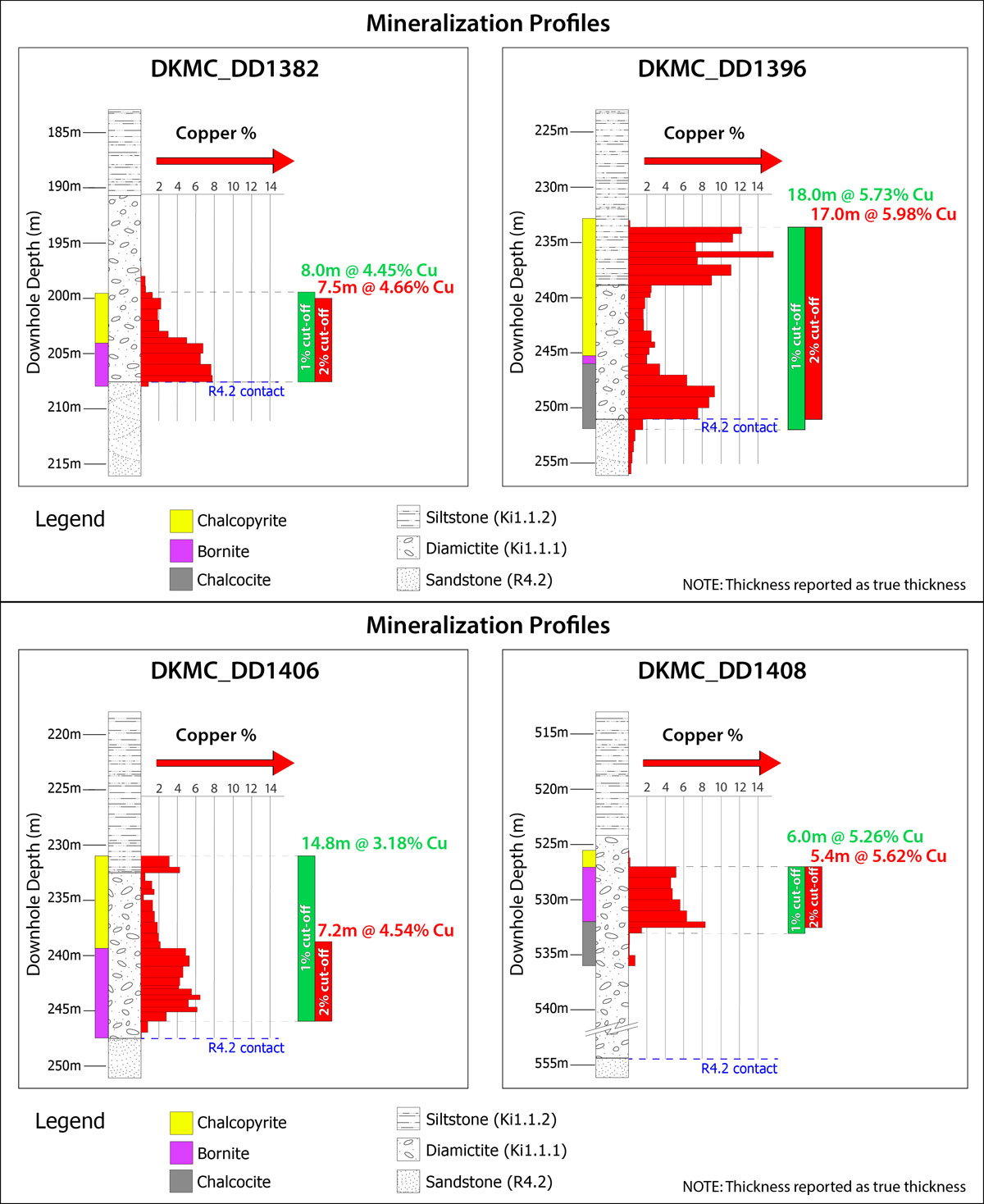

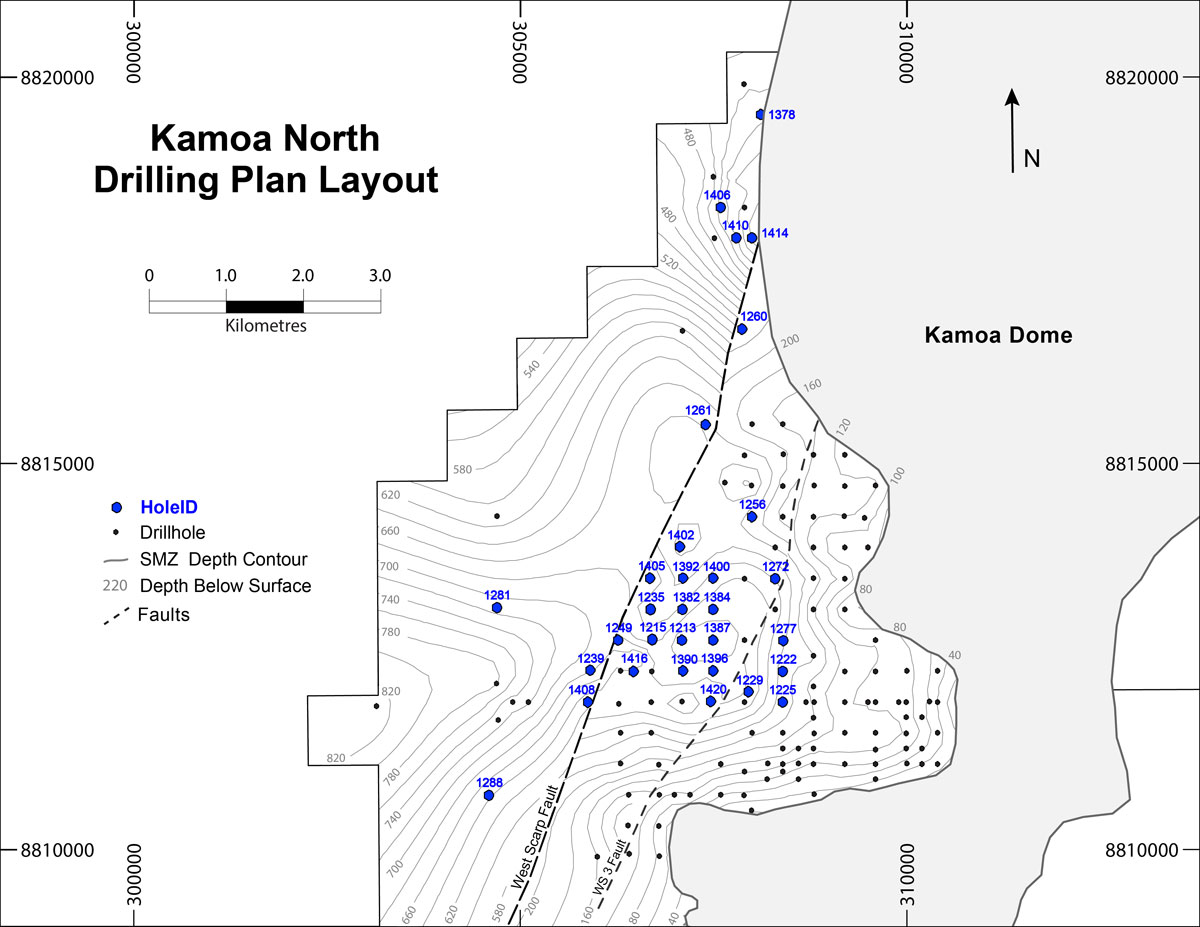

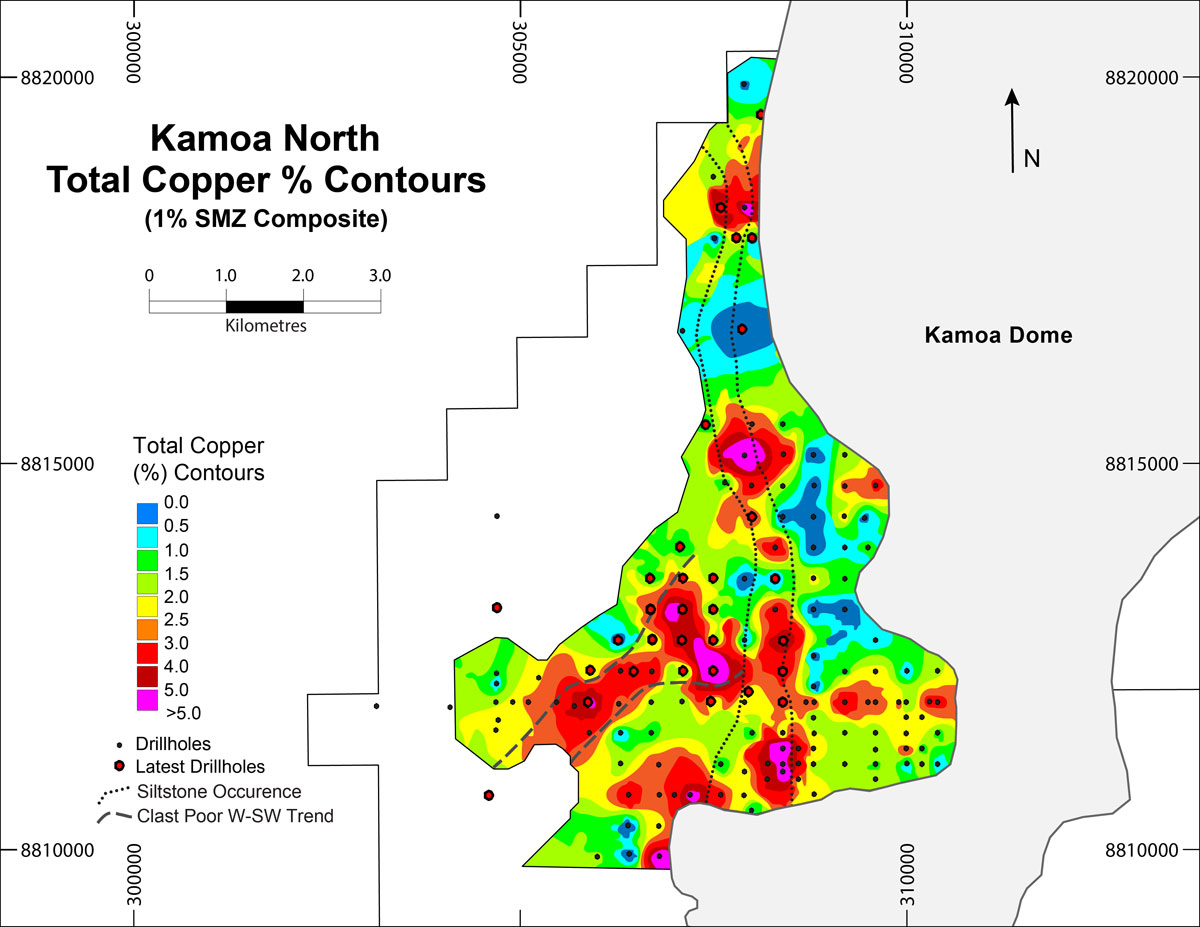

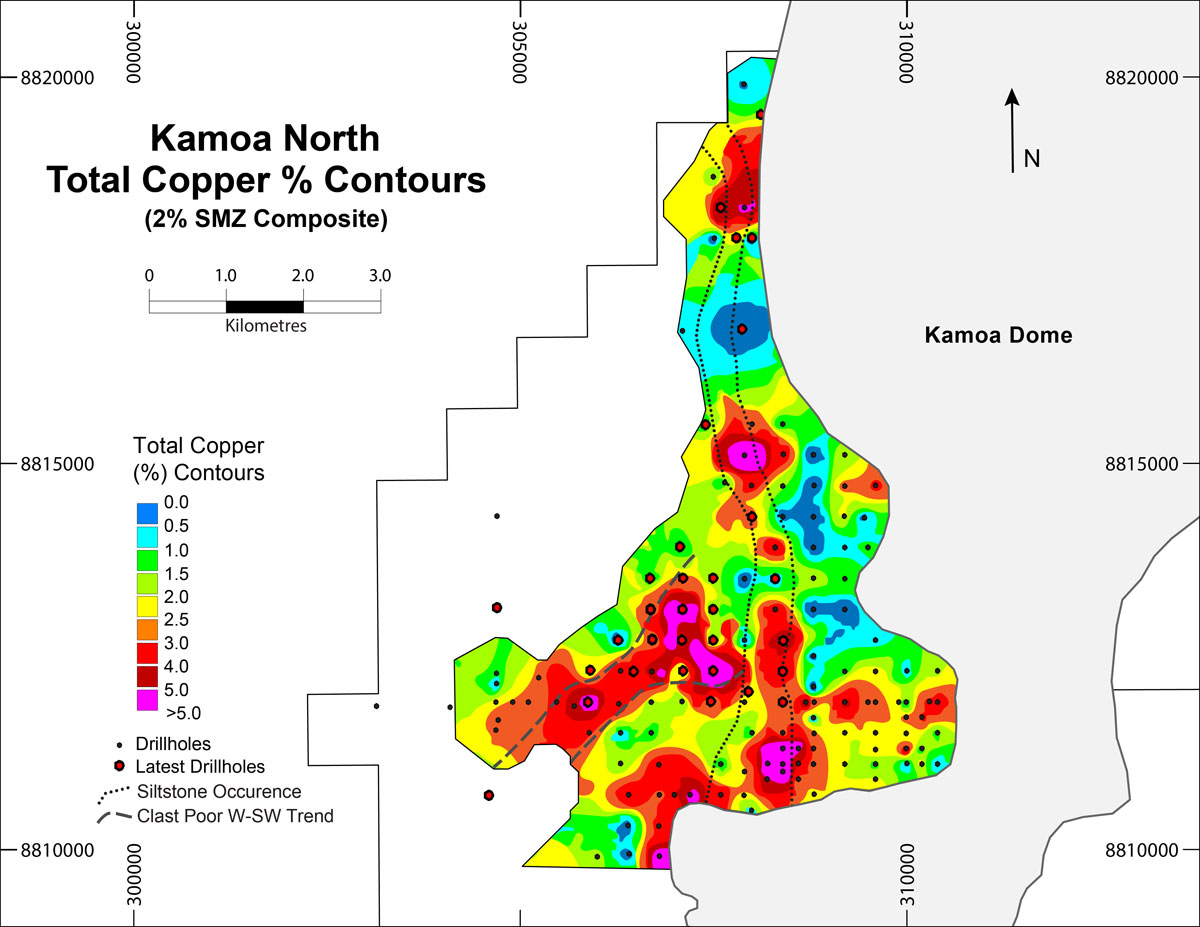

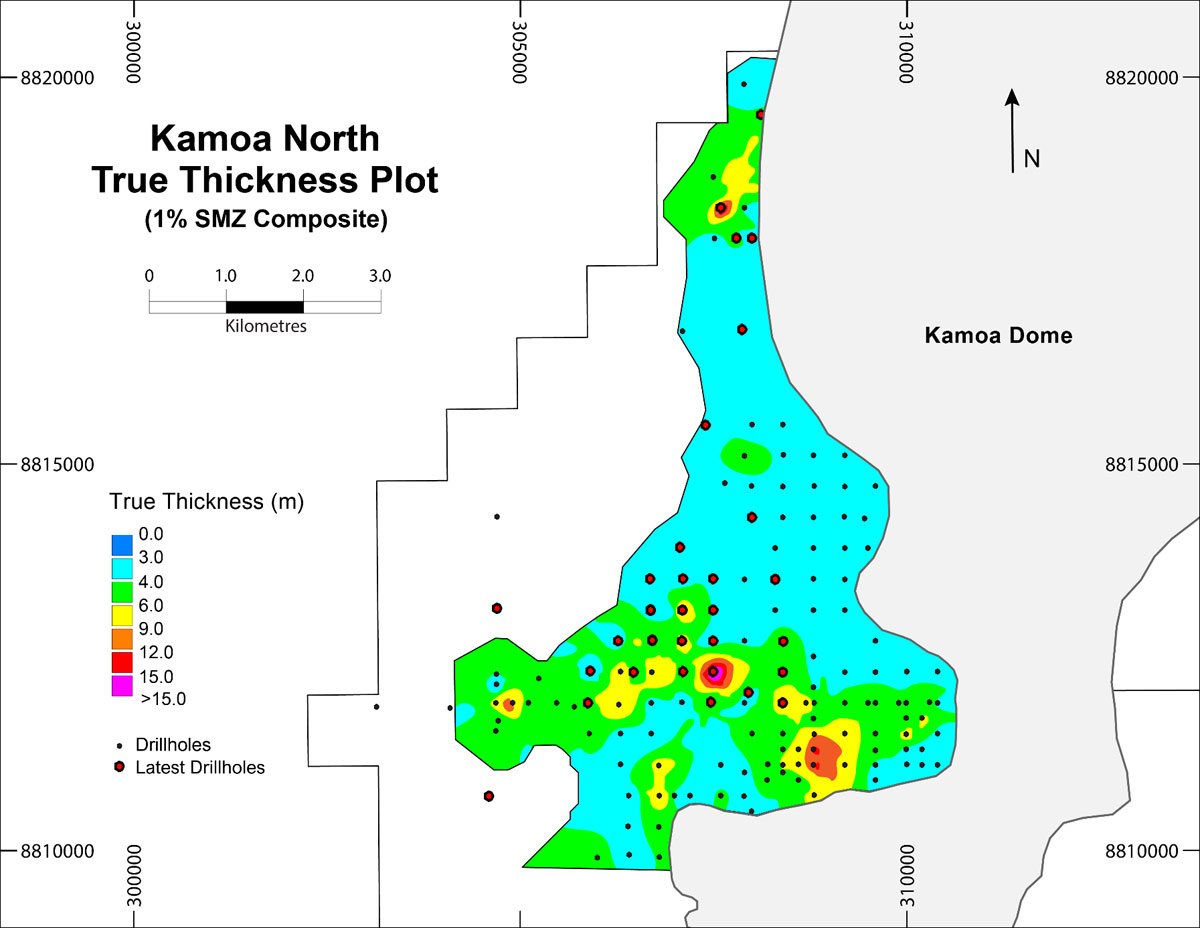

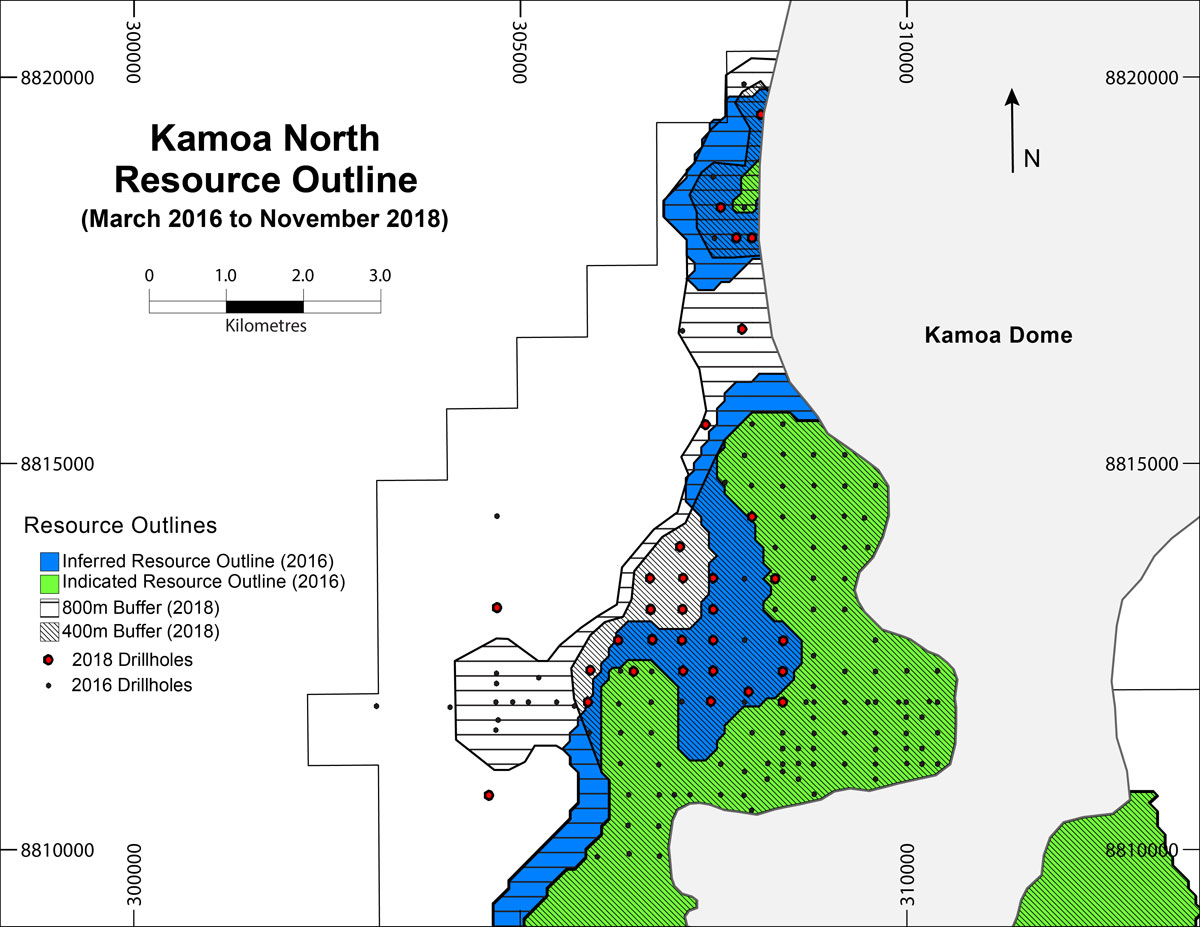

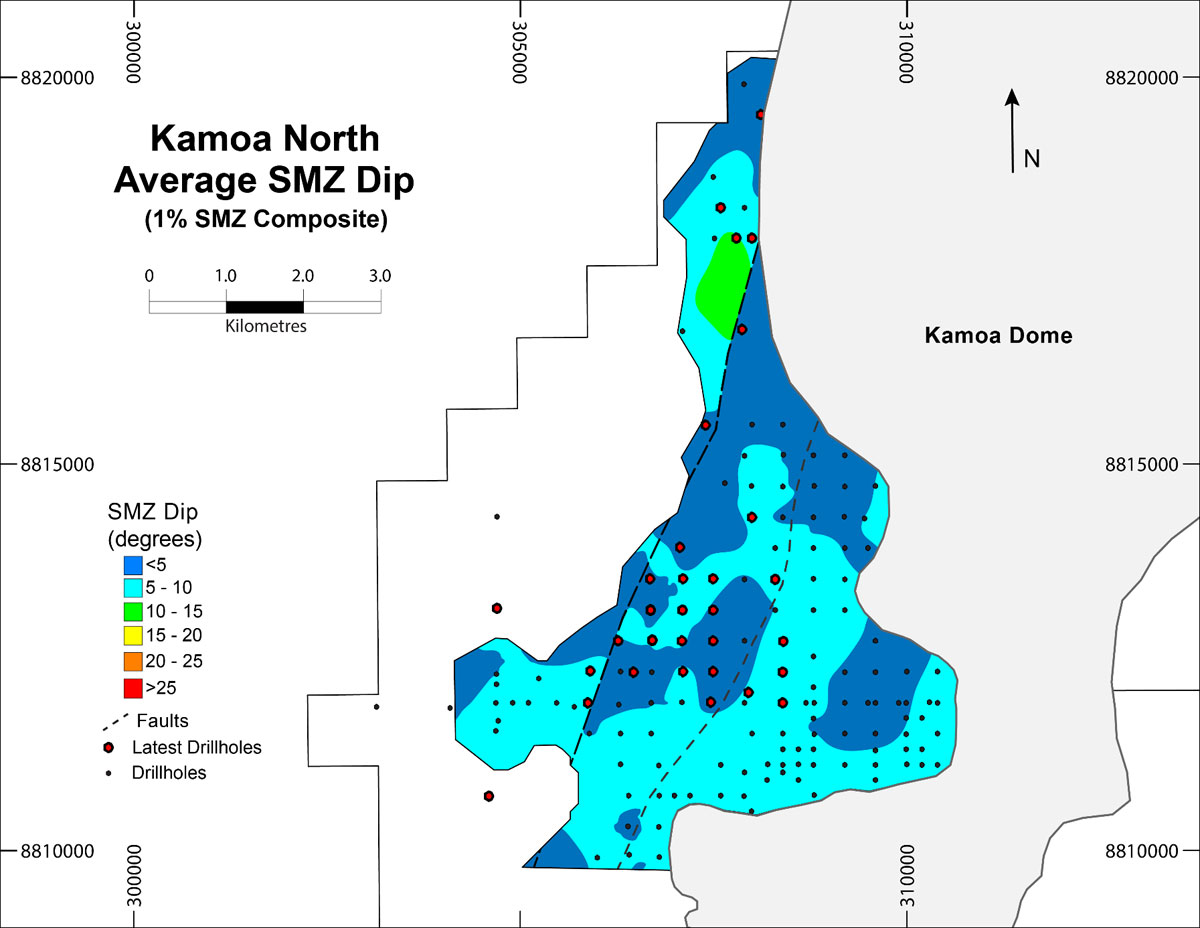

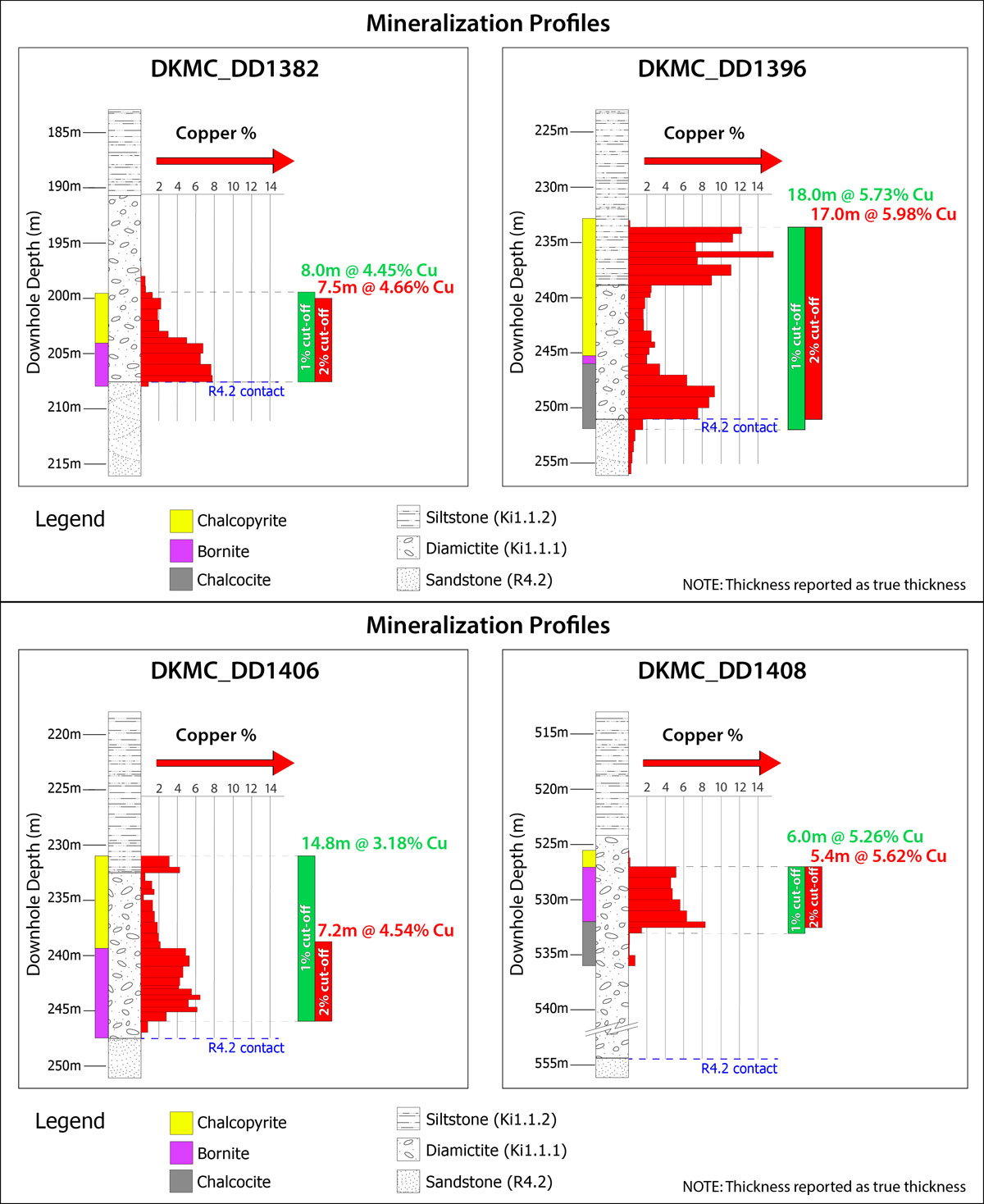

Antwort auf Beitrag Nr.: 59.207.196 von Popeye82 am 13.11.18 20:35:15Ivanhoe Mines

www.ivanhoemines.com/news/2018/latest-drilling-expands-kamoa…

www.ivanhoemines.com/news/2018/latest-drilling-expands-kamoa…

Antwort auf Beitrag Nr.: 49.499.354 von Szween am 05.04.15 22:06:51Teenbaggers

Ja man muss halt das richtige Projekt auch haben im Portfolio ...

Sicher gibt es Übernahmen .. Aber die sind einfach weniger geworden , weil früher für jede kleine Klitsche viel Geld ausgegeben wurde und nun das Geld nicht mehr soo locker sitzt . Klare Zeiten für einen Vervielfacher scheinen vorbei zu sein ,da es von einem auf den anderen Tag irgendwo immer eine Katastrophe passieren kann .

Sicherlich sind Juniors reizvolle Unternehmen. Aber man möchte ja in einem gewissen Zeithorizont etwas verdienen .. und der ist meiner Meinung nach derzeit sehr lange bei Rohstoffen . Dann kommt das Risiko hinzu , das irgendein Parameter auf einmal nicht mehr bestimmt bei der Berechnung und die gut gerechnete Planung ist dahin...

Vielleicht bin ich auch einfach nur zu ungeduldig....

___________________________________________________________________________________

Welches ist nun der nächste 10-bagger .. Das ist die große Frage..

____________________________________________________

Wie kann man es besser machen ?? Nachdem der Markt am Boden liegt seit Jahren , muss man ja auch mal Glück oder Geschick haben mit einem Investment. Was nützt das ganze Cash im Depot , wenn man nicht weiss was man wann kaufen soll ....

__________________________________________________________________________________

Mit dem Tenbagger war wohl ein schlechtes Beispiel von mir ... Das ist nen Traum , den man hat aber nur wenige Male , wenn überhaupt vorkommt.

Ich frage mich welche der vielen Firmen mit Potential man besitzen muss , um eine gute Performance (mehr als auf einem Sparbuch also 10%-15% aufwärts) zu erzielen auf 1 Jahr gesehen. Es gibt so viele vorgestellte Werte , nur kann man die ja schwer alle besitzen mit einer ansprechenden Gewichtung.

Wie differenziert ihr da weiter ?? Ich schließe zumeist schon mal Australische Werte aus , da ich sie selber schlecht handeln kann über meinen Hauptbroker und ich mit Werten aus Australien schlechte Erfahrungen bisher gemacht habe leider. Dazu noch das Länderrisiko abwägen aber ansonsten bin ich nach allen Seiten offen.

_________________________________________________________________________________

Szween

Du hattest Hier ein paar Gute Punkte angesprochen.

Sehe gerade nochmal Schreiben "von ganz von Anfang" an.

Weil Ein Bezugsschreiben suchen.

Will da vielleicht nochmal darauf Bezug nehmen.

Mit Einigem "Grundlegendem" blablabla.

Also ich haltes für nicht falsch Da "mal drüber zu quatschen".

Aber Dafür muss man sich, auch, in Meinen Augen, EIne "Menge, Menge Allgemeinzeug", erstmal, fragen. (Und zwar in Diese Richtung: WAAAAAS braucht es denn für Eine Resource Firma, dass Die EInen Wert schafft?????"(Und Das ist Alles gar nicht so einfach.)) Da gehts dann eher nicht um "WKN XYZ, buy NOOOOOW".

Darf man fragen Welche Aktien Du im Moment hältst?

Ja man muss halt das richtige Projekt auch haben im Portfolio ...

Sicher gibt es Übernahmen .. Aber die sind einfach weniger geworden , weil früher für jede kleine Klitsche viel Geld ausgegeben wurde und nun das Geld nicht mehr soo locker sitzt . Klare Zeiten für einen Vervielfacher scheinen vorbei zu sein ,da es von einem auf den anderen Tag irgendwo immer eine Katastrophe passieren kann .

Sicherlich sind Juniors reizvolle Unternehmen. Aber man möchte ja in einem gewissen Zeithorizont etwas verdienen .. und der ist meiner Meinung nach derzeit sehr lange bei Rohstoffen . Dann kommt das Risiko hinzu , das irgendein Parameter auf einmal nicht mehr bestimmt bei der Berechnung und die gut gerechnete Planung ist dahin...

Vielleicht bin ich auch einfach nur zu ungeduldig....

___________________________________________________________________________________

Welches ist nun der nächste 10-bagger .. Das ist die große Frage..

____________________________________________________

Wie kann man es besser machen ?? Nachdem der Markt am Boden liegt seit Jahren , muss man ja auch mal Glück oder Geschick haben mit einem Investment. Was nützt das ganze Cash im Depot , wenn man nicht weiss was man wann kaufen soll ....

__________________________________________________________________________________

Mit dem Tenbagger war wohl ein schlechtes Beispiel von mir ... Das ist nen Traum , den man hat aber nur wenige Male , wenn überhaupt vorkommt.

Ich frage mich welche der vielen Firmen mit Potential man besitzen muss , um eine gute Performance (mehr als auf einem Sparbuch also 10%-15% aufwärts) zu erzielen auf 1 Jahr gesehen. Es gibt so viele vorgestellte Werte , nur kann man die ja schwer alle besitzen mit einer ansprechenden Gewichtung.

Wie differenziert ihr da weiter ?? Ich schließe zumeist schon mal Australische Werte aus , da ich sie selber schlecht handeln kann über meinen Hauptbroker und ich mit Werten aus Australien schlechte Erfahrungen bisher gemacht habe leider. Dazu noch das Länderrisiko abwägen aber ansonsten bin ich nach allen Seiten offen.

_________________________________________________________________________________

Szween

Du hattest Hier ein paar Gute Punkte angesprochen.

Sehe gerade nochmal Schreiben "von ganz von Anfang" an.

Weil Ein Bezugsschreiben suchen.

Will da vielleicht nochmal darauf Bezug nehmen.

Mit Einigem "Grundlegendem" blablabla.

Also ich haltes für nicht falsch Da "mal drüber zu quatschen".

Aber Dafür muss man sich, auch, in Meinen Augen, EIne "Menge, Menge Allgemeinzeug", erstmal, fragen. (Und zwar in Diese Richtung: WAAAAAS braucht es denn für Eine Resource Firma, dass Die EInen Wert schafft?????"(Und Das ist Alles gar nicht so einfach.)) Da gehts dann eher nicht um "WKN XYZ, buy NOOOOOW".

Darf man fragen Welche Aktien Du im Moment hältst?

Antwort auf Beitrag Nr.: 49.911.087 von Reiners am 04.06.15 12:23:16as said, bin mit Der Richtung Hier SEHR, SEHR zufrieden.

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Zu Dem Projekt.

Sie haben es jedenfalls jetzt zum Produzenten geschafft.

Aber, abgesehen davon dass Die gar nicht quotiert sind(??), habe Mich spekulativ für CAY entschieden.

Alufer Mining

www.alufermining.com/wp-content/uploads/Alufer-Mining-Ltd-Fi…

www.alufermining.com/wp-content/uploads/Alufer-Mining-Ltd-Of…

http://www.spic.com.cn/overview.htm

www.alufermining.com/wp-content/uploads/MOL-Signs-Bauxite-Tr…

www.molgroup.com

http://www.presidence.gov.gn/

http://www.alufermining.com/wp-content/uploads/Alufer-Mining…

http://www.ifc.org/

http://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_ex…

www.alufermining.com/wp-content/uploads/BelAir-Construction-…

http://www.resourcecapitalfunds.com/

http://www.africafc.org/

http://www.orionresourcepartners.com/about.html

http://mines.gov.gn/en/

http://www.presidence.gov.gn/

www.alufermining.com/wp-content/uploads/Alufer-presentation-…

langsam mehren sich Die (Voraussichtlichen) Produzenten Hier.

and it's JUST a Start.

_____________________________________________

Zu Dem Projekt.

Sie haben es jedenfalls jetzt zum Produzenten geschafft.

Aber, abgesehen davon dass Die gar nicht quotiert sind(??), habe Mich spekulativ für CAY entschieden.

Alufer Mining

www.alufermining.com/wp-content/uploads/Alufer-Mining-Ltd-Fi…

www.alufermining.com/wp-content/uploads/Alufer-Mining-Ltd-Of…

http://www.spic.com.cn/overview.htm

www.alufermining.com/wp-content/uploads/MOL-Signs-Bauxite-Tr…

www.molgroup.com

http://www.presidence.gov.gn/

http://www.alufermining.com/wp-content/uploads/Alufer-Mining…

http://www.ifc.org/

http://www.ifc.org/wps/wcm/connect/topics_ext_content/ifc_ex…

www.alufermining.com/wp-content/uploads/BelAir-Construction-…

http://www.resourcecapitalfunds.com/

http://www.africafc.org/

http://www.orionresourcepartners.com/about.html

http://mines.gov.gn/en/

http://www.presidence.gov.gn/

www.alufermining.com/wp-content/uploads/Alufer-presentation-…

Antwort auf Beitrag Nr.: 54.496.440 von Popeye82 am 08.03.17 21:16:20Azarga Uranium

http://azargauranium.com/azarga-uranium-increases-measured-i…

http://azargauranium.com/azarga-uranium-provides-update-on-p…

http://www.nrc.gov/

http://www.nrc.gov/about-nrc/organization/aslbpfuncdesc.html

http://www.epa.gov/laws-regulations/summary-national-environ…

http://azargauranium.com/wp-content/uploads/post/AZZ_IP_2018…

http://azargauranium.com/azarga-uranium-increases-measured-i…

http://azargauranium.com/azarga-uranium-provides-update-on-p…

http://www.nrc.gov/

http://www.nrc.gov/about-nrc/organization/aslbpfuncdesc.html

http://www.epa.gov/laws-regulations/summary-national-environ…

http://azargauranium.com/wp-content/uploads/post/AZZ_IP_2018…

Antwort auf Beitrag Nr.: 51.211.890 von eblu am 01.12.15 11:40:29

_____________________________________________________________

Kommt wahrscheinlich noch,

at SOME point,

aber Das wird nicht ganz einfach.

Zitat von eblu: gibts zum Jahresende mal eine Zusammenfassung.

Vor allen Dingen die Companys nach Sparten.

Also: Uran-Gold-Pothash etc.

Das würde uns glatt helfen, ansonsten wird uns das zu aufwendig hier.

_____________________________________________________________

Kommt wahrscheinlich noch,

at SOME point,

aber Das wird nicht ganz einfach.

Antwort auf Beitrag Nr.: 59.205.664 von Popeye82 am 13.11.18 14:54:35Euro Sun MIning

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

https://gmpsecurities.bluematrix.com/sellside/EmailDocViewer…

Antwort auf Beitrag Nr.: 58.705.164 von Popeye82 am 14.09.18 22:39:46Goldsource Mines

www.goldsourcemines.com/news_releases/2018/index.php?content…

www.goldsourcemines.com/_resources/news/GXS-NR-2018-10-25-Fi…

http://www.actlabs.com/page.aspx?menu=40&app=220&cat1=664&tp…

www.goldsourcemines.com/news_releases/2018/index.php?content…

www.goldsourcemines.com/_resources/news/GXS-NR-2018-10-25-Fi…

http://www.actlabs.com/page.aspx?menu=40&app=220&cat1=664&tp…

Antwort auf Beitrag Nr.: 59.191.147 von Popeye82 am 11.11.18 19:57:15AgriMin

https://agrimin.com.au/wp-content/uploads/20181112-Definitiv…

http://www.transport.wa.gov.au/imarine/port-of-wyndham.asp

http://www.stantec.com/en

http://www.novopro.ca/

http://globalpotashsolutions.com/

http://www.knightpiesold.com/en/

http://www.centraldesert.org.au/native-title-item/kiwirrkurr…

http://www.centraldesert.org.au/native-title-item/ngururrpa/

http://www.nativetitle.org.au/find/pbc/3890

http://www.nativetitle.org.au/find/pbc/3937

https://naif.gov.au/

http://cgltd.com.au/

https://agrimin.com.au/wp-content/uploads/20181025-Mackay-SO…

https://agrimin.com.au/wp-content/uploads/20181112-Definitiv…

http://www.transport.wa.gov.au/imarine/port-of-wyndham.asp

http://www.stantec.com/en

http://www.novopro.ca/

http://globalpotashsolutions.com/

http://www.knightpiesold.com/en/

http://www.centraldesert.org.au/native-title-item/kiwirrkurr…

http://www.centraldesert.org.au/native-title-item/ngururrpa/

http://www.nativetitle.org.au/find/pbc/3890

http://www.nativetitle.org.au/find/pbc/3937

https://naif.gov.au/

http://cgltd.com.au/

https://agrimin.com.au/wp-content/uploads/20181025-Mackay-SO…

Antwort auf Beitrag Nr.: 58.974.267 von Popeye82 am 16.10.18 18:50:01Peel Mining

18,2m @40,3% Zn, 15,21% Pb, 0,97% Cu, 356g/t Ag+2,77 g/t Au, from 182m

https://gallery.mailchimp.com/951e77c8e0a283427bbef579b/file…

18,2m @40,3% Zn, 15,21% Pb, 0,97% Cu, 356g/t Ag+2,77 g/t Au, from 182m

https://gallery.mailchimp.com/951e77c8e0a283427bbef579b/file…

Antwort auf Beitrag Nr.: 59.074.648 von Popeye82 am 27.10.18 20:52:00MOD Resources

www.modresources.com.au/sites/default/files/asx-announcement…

www.modresources.com.au/sites/default/files/asx-announcement…

Antwort auf Beitrag Nr.: 59.218.006 von Popeye82 am 15.11.18 01:39:29Peel Mining

https://stockhead.com.au/resources/awe-inspiring-zinc-explor…

https://stockhead.com.au/resources/awe-inspiring-zinc-explor…

Antwort auf Beitrag Nr.: 59.144.217 von Popeye82 am 05.11.18 23:08:04ONE of the MOST interesting emerging lithium brine projects, GLOBALLY, breakTHROUGH (rapid) lithium extraction process reduces the recovery time, of extracting lithium from brine, from the current industry method, that takes YEARS, to as little as SEVERAL HOURS

NEXT Bumsbude.

Eine Weitere, Die ich Hier 1mal PRE "Feasibility" hinzufügen möchte.

Ein SaureGurkenEXPLORER,

in Deutschland.

Mission: Dem Untergang VERSPROCHEN.

Auch mehr so Resource"Tech"firma.

Standard Lithium

https://standardlithium.com/standard-lithium-announces-maide…

https://standardlithium.com/lithium-arkansas-smackover/

https://standardlithium.com/bristol-lake/

https://standardlithium.com/wp-content/uploads/2018/11/Novem…

https://standardlithium.com/news/

https://standardlithium.com/contact/

https://standardlithium.com/

- RICH TV LIVE

Am 14.11.2018 veröffentlicht

Standard Lithium Ltd. (OTCQX: STLHF) (TSXV: SLL) is a Game Changer 100% Proof - RICH TV LIVE - NOVEMBER 14, 2018 - Standard Lithium Ltd. (“Standard Lithium” or the “Company”) (SLL.V) (OTC-NASDAQ INTL DESIGNATION: STLHF) (S5L.F), announces that it has signed a term sheet (the “Term Sheet”) with global specialty chemical company LANXESS Corporation (“LANXESS”) for a contemplated joint venture in the commercial production of battery grade lithium from brine extracted from the Smackover Formation in South Arkansas.

Standard Lithium is working with LANXESS in a phased approach as per terms of a binding memorandum of understanding, to develop commercial opportunities related to the production, marketing and sale of battery grade lithium products extracted from brine produced from the Smackover Formation.

Under the proposed terms of the joint venture, LANXESS would contribute lithium extraction rights and grant access to its existing infrastructure to the joint venture, and Standard Lithium would contribute existing rights and leases held in the Smackover Formation and the pilot plant being developed on the Property, as well as its proprietary extraction processes including all relevant intellectual property rights. Upon proof of concept, LANXESS is prepared to provide funding to the joint venture to allow for commercial development of the future commercial project, and it is anticipated that the joint venture will include options for Standard Lithium to participate in project funding on similar terms. The final terms of the joint venture and any funding arrangement remain subject to completion of due diligence, technical proof of concept, normal economic viability studies (e.g. Preliminary Feasibility Study etc.) to confirm the technical feasibility and economic viability of the project, and the negotiation of definitive agreements between the parties.

About Standard Lithium Ltd.

The Company’s flagship LANXESS Project is located in southern Arkansas, where it is engaged in the testing and proving of the commercial viability of lithium extraction from over 150,000 acres of permitted brine operations utilising the Company’s proprietary selective extraction technology. The Company is also pursuing the resource development of over 30,000 acres of separate brine leases located in southwestern Arkansas and approximately 45,000 acres of mineral leases located in the Mojave Desert in San Bernardino County, California.

Investors are cautioned that without a Pre-Feasibility or Feasibility study prepared in accordance with NI 43-101 there can be no assurance that the Term Sheet will result in an actual producing lithium mine.

Standard Lithium is listed on the TSX Venture Exchange under the trading symbol “SLL”; quoted on the OTC-NASDAQ INTL DESIGNATION under the symbol “STLHF”; and on the Frankfurt Stock Exchange under the symbol “S5L”.

Subscribe - https://www.youtube.com/c/RICHTVLIVE

Visit - http://www.richtvlive.com/ a one-stop shop for cryptocurrency, stocks, sports, travel and trending topics. #richtvlive #breakingnews #money

Join the RICH TV LIVE FREE Social Media Community - Download the Amino app on your phone or computer and follow the link - https://aminoapps.com/c/RICHTVLIVE/home/

Join the Conversation get the RICH TV LIVE app at Google Play - https://play.google.com/store/apps/de...

iPhone App Store - https://itunes.apple.com/us/app/richt...

DISCLAIMER

Rich TV's company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in Rich TV reports company profiles or other investor relations materials and presentations are subject to change. Rich TV and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. Richard De Sousa was compensated $400 by 10397610 Canada Inc. for digital advertising (Standard Lithium Ltd.).

Investing is inherently risky. Rich TV is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov. -

- RICH TV LIVE

Am 25.09.2018 veröffentlicht

Stocks to watch: Standard Lithium (TSXV: SLL.VN) (OTCQX: STLHF) (FRA: S5L) - RICH TV LIVE - September 25, 2018 - Standard Lithium Ltd. ("Standard Lithium" or the "Company") (TSXV:SLL.VN) (OTCQX:STLHF) (FRA:S5L), is pleased to provide an update regarding the Company's rapid progress in developing and building a large-scale Pilot Plant for deployment at the Arkansas project site. The Company and its Scientific Advisory Team have been developing, testing and optimising proprietary lithium extraction and crystallisation technologies on Smackover brines for over a year, and are now at the stage where the process flowsheet is sufficiently tested and proven to allow procurement and fabrication to commence on the full-scale Pilot Plant.

A lithium extraction Mini-Pilot Plant has been operated continuously for long durations, and has demonstrated that lithium can be selectively extracted from raw Smackover brine (i.e. with no pre-treatment other than pH adjustment); can be converted into a concentrated and substantially purified (compared to the feed brine) lithium chloride solution; that the lithium-loaded sorbent material can be continuously regenerated and recycled to the extraction stage; and that overall lithium extraction efficiencies of over 90% can be achieved. Completion of this work has allowed design of the large-scale lithium extraction Pilot Plant to be sufficiently completed, such that procurement of long lead-time equipment has commenced. The procurement and fabrication of the lithium extraction Pilot Plant is being performed by Zeton Inc. at their design and fabrication facility in Burlington, Ontario. Once fabrication of the modular Pilot Plant is complete, it will be shipped to the Project site in southern Arkansas for installation, commissioning and operation. Initial site investigation and civil/mechanical engineering design work have commenced at the Project site, and it is expected that all site preparation and brine/utility interconnections will be completed well in advance of deployment of the Pilot Plant modules to the Project site.

Subscribe - https://www.youtube.com/c/RICHTVLIVE

Visit - http://www.richtvlive.com/ a one-stop shop for cryptocurrency, stocks, sports, travel and trending topics. #richtvlive #stocks #news

Join the Conversation get the RICH TV LIVE app at Google Play - https://play.google.com/store/apps/de...

iPhone App Store - https://itunes.apple.com/us/app/richt...

Popular Uploads - https://goo.gl/tbvXGg

Most Recent Upload - https://goo.gl/unKXBy

YouTube Channel Page - https://goo.gl/yUdG7w

Subscribe - https://goo.gl/q2tLnn

Rich TV Live Playlist - https://goo.gl/e116JF

YouTube support Tubebuddy - https://www.tubebuddy.com/RICHTVLIVE

DISCLAIMER

Rich TV's company profiles and other investor relations materials, publications or presentations, including web content, are based on data obtained from sources we believe to be reliable but are not guaranteed as to accuracy and are not purported to be complete. As such, the information should not be construed as advice designed to meet the particular investment needs of any investor. Any opinions expressed in Rich TV reports company profiles or other investor relations materials and presentations are subject to change. Rich TV and its affiliates may buy and sell shares of securities or options of the issuers mentioned on this website at any time. Richard De Sousa was compensated $400 by 10397610 Canada Inc. for digital advertising services (Standard Lithium).

Investing is inherently risky. Rich TV is not responsible for any gains or losses that result from the opinions expressed on this website, in its research reports, company profiles or in other investor relations materials or presentations that it publishes electronically or in print.

We strongly encourage all investors to conduct their own research before making any investment decision. For more information on stock market investing, visit the Securities and Exchange Commission ("SEC") at www.sec.gov. -

- RICH TV LIVE

Am 08.11.2018 veröffentlicht

Standard Lithium Ltd. (OTCQX:STLHF) (TSXV:SLL) (FRA:S5L) Receives Nasdaq International Designation - RICH TV LIVE - November 8, 2018 - Standard Lithium Ltd. ("Standard Lithium" or the "Company") (TSXV:SLL.VN) (OTC-Nasdaq Intl. Designation: STLHF) (FRA:S5L), is pleased to announce that Standard Lithium has been admitted into the Nasdaq International Designation program under the symbol OTC - Nasdaq International Designation: STLHF. This is an over-the-counter (OTC) platform designed for non-U.S. companies. The program provides member companies with Nasdaq's visibility offering, allowing for greater access to U.S.-based investors.

"Our project development focus is on U.S. based assets and with the Nasdaq Intl. Designation we hope to expand the Company's visibility across U.S. capital markets and increase shareholder confidence and liquidity," said Standard Lithium CEO, Robert Mintak. -

- goldstocktrades

Am 27.07.2018 veröffentlicht

http://goldstocktrades.com/blog

I’ve been following a lithium junior for several months as a possible near term US producer who unlike so many junior lithium developers may have a faster track to production and the sponsorship and treasury to accomplish it with over $20 million greenbacks in the bank. They took a few minutes out of their day to speak to us while on the world famous Benchmark Minerals tour to discuss a recent announcement which at the time was ignored by the market but may be interesting to my subscribers. I immediately got off my fishing boat to call the management team to discuss the execution of a binding contract with a global specialty minerals company with billions in revenue and thousands of employees. The agreement will allow this little junior to pursue commercial development of lithium produced from brines in Arkansas. This company already recovers bromine from these brines which are used in making flame retardant plastics. This bromine brines are also rich in lithium. This is just another deal out of many this little lithium developer has signed over the past year with existing chemical companies. Whats so important to look at with these deals with existing chemical producers is that they are already in operation and permitted. So now this little junior miner who has raised a over $20 million dollars at a significant premium to where it is now.

DISCLOSURE:

I own shares in this company and they are a website sponsor. Author (Jeb Handwerger) owns shares in Standard Lithium and the company is a website advertiser so that means I have been compensated and have a conflict of interest to help boost awareness of this story. The content of this article is for information only. -

- Market One Media Group Inc.

Am 06.07.2018 veröffentlicht

Standard Lithium Ltd. (TSX.V: SLL) is leading the next generation of lithium producers. They are focused on unlocking the value of existing large-scale US based lithium bearing brine resources that can be brought into production quickly. The company believes new lithium production can be brought on stream rapidly by minimizing project risks at selection stage; resource, political & geographic, regulatory & permitting, and by leveraging advances in lithium extraction technologies and processes.

Learn more about Standard Lithium on their website: http://standardlithium.com/ -

- BTV Business Television

Am 26.04.2018 veröffentlicht

The increased demand for lithium spells opportunity to this company’s novel lithium extraction methods.

To see more videos like this one go to www.b-tv.com. -

- Ellis Martin

Am 19.03.2018 veröffentlicht

In this segment Ellis Martin speaks with Robert Mintak, CEO of Standard Lithium (OTCQX:STLHF/TSX-V:SLL)The Company is currently focused on the immediate exploration and development of the Bristol Dry Lake Lithium Project located in the Mojave region of San Bernardino County, California; the location has significant infrastructure in-place, with easy road and rail access, abundant electricity and water sources, and is already permitted for extensive brine extraction and processing activities. The Company is also commencing due diligence and resource evaluation on 30,000+ acres of brine leases located in the Smackover Formation in southern Arkansas.

http://www.standardlithium.com

http;??www.ellismartinreport.com

Standard Lithium is a paid sponsor of The Ellis Martin Report -

- Cult Studio

Am 23.02.2018 veröffentlicht -

- Swiss Resource Capital AG

Am 18.03.2018 veröffentlicht

Standard Lithium: Exploring Two US Projects In California & Arkansas. Interview With CEO Robert Mintak.

Get our free Newsletter (English) ►: http://eepurl.com/bScRBX

Get our free Newsletter (German) ►: http://eepurl.com/08pAn

Subscribe to our YouTube channel ►: https://www.youtube.com/user/Resource...

*Stay ahead of the investment-crowd*

Commodity-TV and Rohstoff-TV offer you free interviews and company presentations across the Metals-, Mining- and Commodity sector. -

- motherlodetv.net

Am 26.02.2018 veröffentlicht

Standard Lithium (V.SSL) motherlodetv.net Video Signature

Moving quickly towards lithium production with Standard Lithium CEO Robert Mintak -

NEXT Bumsbude.

Eine Weitere, Die ich Hier 1mal PRE "Feasibility" hinzufügen möchte.

Ein SaureGurkenEXPLORER,

in Deutschland.

Mission: Dem Untergang VERSPROCHEN.

Auch mehr so Resource"Tech"firma.

Standard Lithium

https://standardlithium.com/standard-lithium-announces-maide…

https://standardlithium.com/lithium-arkansas-smackover/

https://standardlithium.com/bristol-lake/

https://standardlithium.com/wp-content/uploads/2018/11/Novem…

https://standardlithium.com/news/

https://standardlithium.com/contact/

https://standardlithium.com/

- RICH TV LIVE

Am 14.11.2018 veröffentlicht