Globex Mining- Startschuss ??? (Seite 940)

eröffnet am 15.11.05 13:07:13 von

neuester Beitrag 14.06.24 13:31:49 von

neuester Beitrag 14.06.24 13:31:49 von

Beiträge: 32.867

ID: 1.020.143

ID: 1.020.143

Aufrufe heute: 5

Gesamt: 2.349.614

Gesamt: 2.349.614

Aktive User: 0

ISIN: CA3799005093 · WKN: A1H735 · Symbol: G1MN

0,6340

EUR

-1,86 %

-0,0120 EUR

Letzter Kurs 14.06.24 Tradegate

Neuigkeiten

| TitelBeiträge |

|---|

13.06.24 · globenewswire |

12.06.24 · kapitalerhoehungen.de |

04.06.24 · globenewswire |

03.06.24 · globenewswire |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8250 | +25,00 | |

| 0,8906 | +20,35 | |

| 0,7650 | +15,91 | |

| 5,6500 | +12,55 | |

| 14,500 | +6,62 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 9,3500 | -8,33 | |

| 0,7246 | -9,22 | |

| 0,5050 | -15,13 | |

| 12,460 | -16,06 | |

| 0,8300 | -20,38 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 54.199.846 von WilliamTell am 30.01.17 23:26:03

Auszug aus Report OPAWICA:

Gruss William

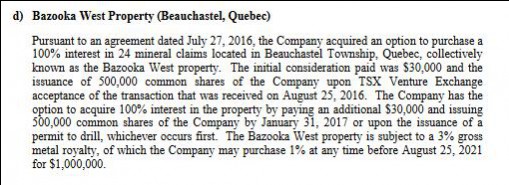

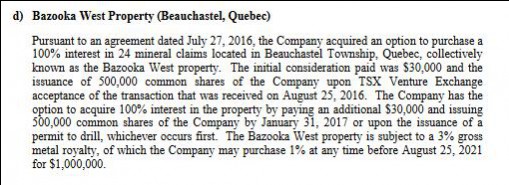

Bazooka West Property (Beauchastel Cadillac Fault) - Optionsbedingungen

Globex erhält also aus diesem Deal gesamthaft 65'000 CAD Cash und 1'250'000 Aktien plus 3% GMR, davon 1% rückkaufbar bis 25.8.2021 für 1 Mio CAD.Auszug aus Report OPAWICA:

Gruss William

Antwort auf Beitrag Nr.: 54.199.270 von crystalsonic am 30.01.17 21:43:06Die Bazooka-West Property heisst bei Globex Beauchastel Cadillac Fault.

Gruss William

Gruss William

Antwort auf Beitrag Nr.: 54.198.493 von crystalsonic am 30.01.17 20:01:11

Gruss William

Probe auc Montalembert

Hier noch eine Probe von Montalembert......echt hochgradige Sache!!Gruss William

Antwort auf Beitrag Nr.: 54.198.493 von crystalsonic am 30.01.17 20:01:11

Opawica Explorations Inc. Update on Drill Mobilization at Bazooka Property and Option Extension of Bazooka West Property, Quebec

Vancouver, British Columbia--(Newsfile Corp. - January 30, 2017) - Opawica Explorations Inc. (TSXV: OPW) (the "Company" / "Opawica") announces that further to the Company's news release of October 27, 2016 that announced the initialization of drill mobilization in November 2016, a delay in obtaining access permits has required the Company to amend mobilization arrangements with the drill contractor. Drilling at the Company's 100% owned Bazooka Property will now commence in mid February 2017.

The Company has also obtained a three month extension on its Option to acquire 100% interest, subject to a 3% gross metal royalty, of the Bazooka West property from Globex Mining Enterprises Inc. (TSX: GMX) that was first announced on August 2, 2016. The final option payment of $30,000 and 500,000 common shares of the Company has been extended to April 30, 2017, for consideration of $5,000 and 250,000 common shares of the Company payable upon receipt of TSX Venture Exchange acceptance of the extension.

The gold mineralization on the Company's 100% owned Bazooka property, where past drilling has intersected world class gold intercepts, appears to be the extension of the mineralized zones and gold resources known to exist on the western end on the Yorbeau Resources Inc. ("Yorbeau") Rouyn property. The Yorbeau property has been optioned by Kinross Gold Corporation ("Kinross"), whereby Kinross has the option to acquire a 100% interest in Yorbeau's Rouyn property for consideration that includes exploration expenditures of C$12 million; cash payments of USD $25,000,000, plus 2% of the prevailing gold price multiplied by the number of ounces of gold in measured, indicated and inferred resources identified in a resource estimate, yet to be completed; as well as other considerations (see Yorbeau press release dated October 25, 2016).

Opawica is mobilizing a drill program that is designed to test the depth extension of the mineralized zone of the underground workings. In 1951-52, Eldona Gold Mines Ltd. sank a shaft to a depth of 125 metres, and at the depth of 114 metres, 634 metres of drifts were developed and the company had reached the fold nose feature of the Cadillac Larder Lake Break ("CLLB"). Four mineralized gold zones were outlined as follows: "Average of back panel samples grading 0.31 oz over 15.0 feet, average of back panel samples grading 0.55 oz over 3.5 feet by 69 feet long, average of back panel samples grading 0.06 oz over 5.3 feet by 60 feet long and channel samples grading 0.21 oz (over a drift section of 10 feet)", (extract from NI 43-101 technical report dated March 20, 2016 filed by the Company on www.sedar.com on April 28, 2016). The Opawica drill program of up to three holes totalling 1,500 metres is designed to reach the depth extension of the underground mineralized zone at the depth from 200 to 400 metres.

Significant gold mineralization has been established on the Bazooka property from near surface to approximately 250 metres vertical depth from past drilling by previous owners such as Siscoe (1944) interval of 5.79 metres of 77.18 g/t Au (true width unknown); with more recent drill intercepts ranging from narrow and intermittent anomalous gold values up to Soquem (1981) interval of 7.50 metres of 25.77 g/t Au; Lake Shore Gold Corp. (2003) intercept of 1.25 metres of 94.11 g/t Au; and RT Minerals Corp. values of up to 17 metres of core length at 7.86 g/t Au, including 7.20 metres interval of 16.77 g/t Au (RT Minerals Corp. June 21, 2011 press release). These recent intervals are estimated at approximately 85% to 93% true widths. This gold mineralization is known to exist within 50 metres on strike to the gold mineralization on the Yorbeau property and for a current strike length on Opawica's Bazooka property and optioned Bazooka West property for approximately seven kilometres.

Mr. Yvan Bussieres, P.Eng., is the Qualified Person who has prepared or supervised the preparation of the information that forms the basis for the scientific and technical disclosure in this news release.

FOR FURTHER INFORMATION CONTACT:

Fred Kiernicki

President and Chief Executive Officer

Opawica Explorations Inc.

Verlängerung des OPW Option deals mit 250k Aktien compensation

Globex Mining Enterprises Inc. (GMX - TSX)Opawica Explorations Inc. Update on Drill Mobilization at Bazooka Property and Option Extension of Bazooka West Property, Quebec

Vancouver, British Columbia--(Newsfile Corp. - January 30, 2017) - Opawica Explorations Inc. (TSXV: OPW) (the "Company" / "Opawica") announces that further to the Company's news release of October 27, 2016 that announced the initialization of drill mobilization in November 2016, a delay in obtaining access permits has required the Company to amend mobilization arrangements with the drill contractor. Drilling at the Company's 100% owned Bazooka Property will now commence in mid February 2017.

The Company has also obtained a three month extension on its Option to acquire 100% interest, subject to a 3% gross metal royalty, of the Bazooka West property from Globex Mining Enterprises Inc. (TSX: GMX) that was first announced on August 2, 2016. The final option payment of $30,000 and 500,000 common shares of the Company has been extended to April 30, 2017, for consideration of $5,000 and 250,000 common shares of the Company payable upon receipt of TSX Venture Exchange acceptance of the extension.

The gold mineralization on the Company's 100% owned Bazooka property, where past drilling has intersected world class gold intercepts, appears to be the extension of the mineralized zones and gold resources known to exist on the western end on the Yorbeau Resources Inc. ("Yorbeau") Rouyn property. The Yorbeau property has been optioned by Kinross Gold Corporation ("Kinross"), whereby Kinross has the option to acquire a 100% interest in Yorbeau's Rouyn property for consideration that includes exploration expenditures of C$12 million; cash payments of USD $25,000,000, plus 2% of the prevailing gold price multiplied by the number of ounces of gold in measured, indicated and inferred resources identified in a resource estimate, yet to be completed; as well as other considerations (see Yorbeau press release dated October 25, 2016).

Opawica is mobilizing a drill program that is designed to test the depth extension of the mineralized zone of the underground workings. In 1951-52, Eldona Gold Mines Ltd. sank a shaft to a depth of 125 metres, and at the depth of 114 metres, 634 metres of drifts were developed and the company had reached the fold nose feature of the Cadillac Larder Lake Break ("CLLB"). Four mineralized gold zones were outlined as follows: "Average of back panel samples grading 0.31 oz over 15.0 feet, average of back panel samples grading 0.55 oz over 3.5 feet by 69 feet long, average of back panel samples grading 0.06 oz over 5.3 feet by 60 feet long and channel samples grading 0.21 oz (over a drift section of 10 feet)", (extract from NI 43-101 technical report dated March 20, 2016 filed by the Company on www.sedar.com on April 28, 2016). The Opawica drill program of up to three holes totalling 1,500 metres is designed to reach the depth extension of the underground mineralized zone at the depth from 200 to 400 metres.

Significant gold mineralization has been established on the Bazooka property from near surface to approximately 250 metres vertical depth from past drilling by previous owners such as Siscoe (1944) interval of 5.79 metres of 77.18 g/t Au (true width unknown); with more recent drill intercepts ranging from narrow and intermittent anomalous gold values up to Soquem (1981) interval of 7.50 metres of 25.77 g/t Au; Lake Shore Gold Corp. (2003) intercept of 1.25 metres of 94.11 g/t Au; and RT Minerals Corp. values of up to 17 metres of core length at 7.86 g/t Au, including 7.20 metres interval of 16.77 g/t Au (RT Minerals Corp. June 21, 2011 press release). These recent intervals are estimated at approximately 85% to 93% true widths. This gold mineralization is known to exist within 50 metres on strike to the gold mineralization on the Yorbeau property and for a current strike length on Opawica's Bazooka property and optioned Bazooka West property for approximately seven kilometres.

Mr. Yvan Bussieres, P.Eng., is the Qualified Person who has prepared or supervised the preparation of the information that forms the basis for the scientific and technical disclosure in this news release.

FOR FURTHER INFORMATION CONTACT:

Fred Kiernicki

President and Chief Executive Officer

Opawica Explorations Inc.

Antwort auf Beitrag Nr.: 54.197.695 von crystalsonic am 30.01.17 18:23:50

Bob Moriarty

Archives

Jan 30, 2017

Over the years I have discovered that the very best indicator mineral for gold, is gold. Someone contacted me recently and told me that he wanted to advertise a company that had just found a grab sample on surface with a big blob of gold smack dab in the middle. I liked that a lot and said, “Send me a picture.” And was told that pictures of the rock came in the “burn before reading category” and I was going to have to wait to see it like everyone else. Rats!

Eventually, in what seemed like eons later, the company announced closing the deal and put out the assays. They were barn burning especially given they were mostly channel samples taken at the surface.

The agreement was between Natan Resources (NRL-V) and Globex Mining (GMX-T) on the Montalembert property in Quebec where gold was first discovered in 1949. The project consists of a 5,516 square ha bit of ground. Prior work by another operator in 1973 showed an average grade of 20.8 g/t gold over 78 samples taken on a 123-meter strike length at surface.

Globex staked the ground in 2015 and owns 100% of the project. During 2015 and 2016 Globex sampled two veins, the primary Galena vein and the Number 2 vein and came up with results of 84.0 g/t, 64.5 g/t, 36.3 g/t and 17.3 g/t gold.

The agreement calls for Natan to pay Globex a total of $2.7 million over five years, to issue 8.5 million shares and to spend $15 million on exploration to get a 100% interest. That sounds expensive but the deal is rear end loaded, over half the money to be paid to Globex takes place in 2019 and the serious exploration expenses are due starting in 2019.

It’s a great deal for both companies. Natan just did a major financing and has $4 million in the bank. If the CEO and President of Natan, Steve Roebuck, can pick up a 438 g/t piece of rock just by wandering around I’d like to suggest that if a team of geologists can’t find a resource worthy of the name with $4 million to spend they should be drawn and quartered on the YouTube for everyone to view.

In addition to the cash, shares and exploration commitment, Natan will also pay a 6% Gross Metal Royalty on the first 150,000 ounces of both gold and silver and 3.5% GMR after 150,000 ounces.

I really like the ability to gain 100% of a project and while the terms of the agreement are highly favorable to Globex given that they just staked the property, Natan has a deposit they can get serious numbers from right at the surface and a lot of money to play with. The placement was for a unit consisting of a share and a half warrant at $.40 for two years. That would bring in another $4 million in cash and with high grade gold at surface; the company should be well on the way to production with $8 million to work with. I see the company being worth a lot more than a $6 million dollar market cap very soon.

Naturally I needed to go to both web sites to verify my information. The webmasters of both sites need smacking on the bum. In the news section of Natan resources, the press releases talking about the private placement were broken and on the Globex site looking at the Montalembert page, the map at the bottom of the page had an invalid link and couldn’t be viewed.

I wasn’t willing to wade through all the information on the Globex site since they claim over 140 land packages. I suspect the company is very cheap but when you have that many projects going, it’s very hard for an investor to actually put a value on more than one or two properties.

Natan on the other hand is simple to understand. They have one major project with high-grade gold veins on the surface in Quebec, which is one of the best jurisdictions in the world for gold mining. The company is both very cheap and well cashed up with a project that a properly trained monkey could spot drill locations for.

Natan is an advertiser. I have bought shares in both the open market and in a private placement. Naturally I am biased. I am as biased about Globex but I do not own shares. You are responsible for your own due diligence.

Natan Resources

NRL-V $.205 (Jan 27, 2017)

29.5 million shares

Natan Resources website

Globex Mining Enterprises

GMX-T $.53 (Jan 27, 2017)

GLBXF-OTCQX 48.8 million shares

Globex Mining website

http://www.321gold.com/editorials/moriarty/moriarty013017.html

Natan Grabs a Sample of 438 g/t Gold and Globex updateBob Moriarty

Archives

Jan 30, 2017

Over the years I have discovered that the very best indicator mineral for gold, is gold. Someone contacted me recently and told me that he wanted to advertise a company that had just found a grab sample on surface with a big blob of gold smack dab in the middle. I liked that a lot and said, “Send me a picture.” And was told that pictures of the rock came in the “burn before reading category” and I was going to have to wait to see it like everyone else. Rats!

Eventually, in what seemed like eons later, the company announced closing the deal and put out the assays. They were barn burning especially given they were mostly channel samples taken at the surface.

The agreement was between Natan Resources (NRL-V) and Globex Mining (GMX-T) on the Montalembert property in Quebec where gold was first discovered in 1949. The project consists of a 5,516 square ha bit of ground. Prior work by another operator in 1973 showed an average grade of 20.8 g/t gold over 78 samples taken on a 123-meter strike length at surface.

Globex staked the ground in 2015 and owns 100% of the project. During 2015 and 2016 Globex sampled two veins, the primary Galena vein and the Number 2 vein and came up with results of 84.0 g/t, 64.5 g/t, 36.3 g/t and 17.3 g/t gold.

The agreement calls for Natan to pay Globex a total of $2.7 million over five years, to issue 8.5 million shares and to spend $15 million on exploration to get a 100% interest. That sounds expensive but the deal is rear end loaded, over half the money to be paid to Globex takes place in 2019 and the serious exploration expenses are due starting in 2019.

It’s a great deal for both companies. Natan just did a major financing and has $4 million in the bank. If the CEO and President of Natan, Steve Roebuck, can pick up a 438 g/t piece of rock just by wandering around I’d like to suggest that if a team of geologists can’t find a resource worthy of the name with $4 million to spend they should be drawn and quartered on the YouTube for everyone to view.

In addition to the cash, shares and exploration commitment, Natan will also pay a 6% Gross Metal Royalty on the first 150,000 ounces of both gold and silver and 3.5% GMR after 150,000 ounces.

I really like the ability to gain 100% of a project and while the terms of the agreement are highly favorable to Globex given that they just staked the property, Natan has a deposit they can get serious numbers from right at the surface and a lot of money to play with. The placement was for a unit consisting of a share and a half warrant at $.40 for two years. That would bring in another $4 million in cash and with high grade gold at surface; the company should be well on the way to production with $8 million to work with. I see the company being worth a lot more than a $6 million dollar market cap very soon.

Naturally I needed to go to both web sites to verify my information. The webmasters of both sites need smacking on the bum. In the news section of Natan resources, the press releases talking about the private placement were broken and on the Globex site looking at the Montalembert page, the map at the bottom of the page had an invalid link and couldn’t be viewed.

I wasn’t willing to wade through all the information on the Globex site since they claim over 140 land packages. I suspect the company is very cheap but when you have that many projects going, it’s very hard for an investor to actually put a value on more than one or two properties.

Natan on the other hand is simple to understand. They have one major project with high-grade gold veins on the surface in Quebec, which is one of the best jurisdictions in the world for gold mining. The company is both very cheap and well cashed up with a project that a properly trained monkey could spot drill locations for.

Natan is an advertiser. I have bought shares in both the open market and in a private placement. Naturally I am biased. I am as biased about Globex but I do not own shares. You are responsible for your own due diligence.

Natan Resources

NRL-V $.205 (Jan 27, 2017)

29.5 million shares

Natan Resources website

Globex Mining Enterprises

GMX-T $.53 (Jan 27, 2017)

GLBXF-OTCQX 48.8 million shares

Globex Mining website

Antwort auf Beitrag Nr.: 54.197.545 von crystalsonic am 30.01.17 18:10:59

NR von FM:

The second agreement is with a private individual (the "Duparquet Vendor"), and pursuant to this agreement, First Mining has agreed to acquire eighteen mining claims located in the Township of Duparquet, Québec (the "Central Duparquet Transaction") in exchange for $250,000 and 2,500,000 common shares of First Mining (the "Central Duparquet Transaction Shares").

Keith Neumeyer, Chairman of First Mining, stated "We are excited about the drilling campaign that we have launched at our Goldlund project, and the prospects that it holds for resource expansion. We believe our Goldlund project has the potential to be one of our core projects. This initial drill campaign is expected to be a phase one of several campaigns in the coming years to further advance this project to a PEA level. We are also very pleased to have acquired the additional Pickle Lake and Central Duparquet claims as we believe the consolidation of regions we are active in should be a continued process that benefits each of our projects."

The parties to the GoldON Transaction and the Central Duparquet Transaction are at arm's length, and pricing for each transaction was based on the 5-day VWAP of First Mining's shares as of today's date, being $0.84. The deemed value of the GoldON Transaction is approximately $168,000, and the deemed value of the Central Duparquet Transaction is approximately $2,350,000.

Globex Inhalt:

Property Description and Location

The Duquesne West (and Ottoman) Property is comprised of 60 claims totalling 929 ha located 32 km northwest of the mining town of Rouyn-Noranda and 10 km east of the town of Duparquet in Duparquet Township, northwestern Quebec. The property is readily accessed by vehicle along gravel roads originating from Highway 393 roughly 4.5 km west of Highway 101. A series of ATV trails and various drill roads provide further access throughout most of the property. The Property is held 100% by Duparquet Assets Ltd. (‘DAL’), a company owned 50% by Globex and 50% by Jack Stoch Geoconsultant Services Limited (‘GJSL’) a company owned by Jack Stoch, President & CEO and Director of Globex.

FM kauft 18 claims neben unseren Duquesne für 2.3m CAD

NR von First Mining die haben für 2.5m 18 claims in Duparquet gekauft. Die schreiben nichts über einen NI43-101 Report oder irgendwas einfach ein weiterer strategischer Kauf um ihr riesiges Portfolio dort zu erweitern und mittendrin sitzen wir mit unseren 60 claims UND einer 800k Unzen NI43-101 Resource. Ich hänge unten noch den Globex Duquesne West Part rein. Wenn wir jetzt unsere Claims bewerten möchten sage ich mal mindestens dreimal soviel als 2.5m da es mehr als dreimal soviele Claims sind UND wir bereits 800k Unzen Gold dort nachgewiesen haben :-) ich werfe mal mindestens 20 CAD pro Unze in den Raum wo wir bei 16m CAD wären davon 50% also alleine das Projekt jederzeit an FM zu verkaufen wir haben ja deren großes Interesse auf der Messe in München mitbekommen :-)NR von FM:

The second agreement is with a private individual (the "Duparquet Vendor"), and pursuant to this agreement, First Mining has agreed to acquire eighteen mining claims located in the Township of Duparquet, Québec (the "Central Duparquet Transaction") in exchange for $250,000 and 2,500,000 common shares of First Mining (the "Central Duparquet Transaction Shares").

Keith Neumeyer, Chairman of First Mining, stated "We are excited about the drilling campaign that we have launched at our Goldlund project, and the prospects that it holds for resource expansion. We believe our Goldlund project has the potential to be one of our core projects. This initial drill campaign is expected to be a phase one of several campaigns in the coming years to further advance this project to a PEA level. We are also very pleased to have acquired the additional Pickle Lake and Central Duparquet claims as we believe the consolidation of regions we are active in should be a continued process that benefits each of our projects."

The parties to the GoldON Transaction and the Central Duparquet Transaction are at arm's length, and pricing for each transaction was based on the 5-day VWAP of First Mining's shares as of today's date, being $0.84. The deemed value of the GoldON Transaction is approximately $168,000, and the deemed value of the Central Duparquet Transaction is approximately $2,350,000.

Globex Inhalt:

Property Description and Location

The Duquesne West (and Ottoman) Property is comprised of 60 claims totalling 929 ha located 32 km northwest of the mining town of Rouyn-Noranda and 10 km east of the town of Duparquet in Duparquet Township, northwestern Quebec. The property is readily accessed by vehicle along gravel roads originating from Highway 393 roughly 4.5 km west of Highway 101. A series of ATV trails and various drill roads provide further access throughout most of the property. The Property is held 100% by Duparquet Assets Ltd. (‘DAL’), a company owned 50% by Globex and 50% by Jack Stoch Geoconsultant Services Limited (‘GJSL’) a company owned by Jack Stoch, President & CEO and Director of Globex.

Antwort auf Beitrag Nr.: 54.193.231 von WilliamTell am 30.01.17 09:58:32

Chalice's Dec. 31 cash position at $40.4M (Australian)

2017-01-30 11:39 ET - News Release

CHALICE GOLD MINES LIMITED -- DECEMBER 2016 QUARTERLY ACTIVITY & CASH FLOW REPORTS

Chalice Gold Mines Ltd. has issued its quarterly activity and cash flow reports for the quarter ended Dec. 31, 2016. The full texts of these reports are available at the company's website and under the company's SEDAR profile.

Quarterly highlights:

Binding option and farm-in term sheet executed with Richmont Mines Inc. (TSX: RIC; NYSE: RIC) to acquire a 70% interest in the Chimo Gold Project, located in the highly endowed Abitibi region of Quebec, Canada, a premier gold district hosting several multi-million ounce deposits.

The Chimo Gold Project is located adjacent to the Nordeau Gold Project (together now named the East Cadillac Gold Project), which Chalice also secured recently under an option agreement {A –} allowing it to consolidate a contiguous ~16km strike length along the Larder Lake-Cadillac fault, ~35km east of the >20Moz Val d'Or gold camp.

Recent drilling by TSX-V-listed gold explorer Cartier Resources close to the boundary of the East Cadillac Gold Project has returned impressive intercepts.

Approvals received for drilling at Warrego North Project in the Northern Territory with drilling to commence as soon as possible (weather permitting) targeting high-grade copper-gold Tennant-Creek-style mineralisation.

Planning and approvals continue in preparation for an active drilling campaign at four projects in Canada, the Northern Territory and WA within the next 6 months.

During the Quarter Chalice sold 14.1 million shares in First Mining Finance for gross revenue of A$11.5 million.

As at December 31, 2016, Chalice remains well-funded with cash of A$40.4 million and 18.2 million shares held in First Mining Finance Corp (TSX-V: FF).

Chalice continues to target additional high-potential opportunities globally

AeM und dort wird das Geld vor allem auf deren Chimo Claims verbohrt::

VAL-D'OR, QUEBEC -- (Marketwired) -- 12/22/16 -- Cartier Resources Inc. (TSX VENTURE: ECR) ("Cartier") has closed the strategic investment by Agnico Eagle Mines Limited ("Agnico") previously announced on December 19, 2016 (the "Strategic Placement"). Pursuant to the Strategic Placement, Agnico purchased 22,500,000 common shares (the "Common Shares") of Cartier at a price of $0.20 per Common Share for proceeds of $4,500,000. As a result of the Strategic Placement, Agnico now owns 19.97% of the issued and outstanding Common Shares of Cartier.

The proceeds from the Offering shall be primarily used for exploration at the Cartier's five main projects located in Quebec: Chimo, Benoist, Wilson, Fenton and Cadillac Extension, as well as for working capital and general corporate purposes.

Chalice hat 40m cash und 18.2m FM Aktien

Das primäre Projekt von Chalice wird das East Cadillac Gold Projekt das ist unser Nordeau und die Chimo Claims von Richmont. So und jetzt wird es interessant bin da am Wochenende darauf gestoßen direkt nebenan liegt Cartier Resources die bohrten wie verrückt mit top Ergebnissen und an denen hat sich Agnico Eagle beteiligt die im Cadillac Break ja ihre zwei Minen haben - Lapa und Ronde und es wird sich an allem hoch interessanten beteiligt. Naja und unser Ironwood liegt da ja auch nicht soweit weg vor allem direkt bei den zwei Minen. Erst Chalice NR danach AEM NR:Chalice's Dec. 31 cash position at $40.4M (Australian)

2017-01-30 11:39 ET - News Release

CHALICE GOLD MINES LIMITED -- DECEMBER 2016 QUARTERLY ACTIVITY & CASH FLOW REPORTS

Chalice Gold Mines Ltd. has issued its quarterly activity and cash flow reports for the quarter ended Dec. 31, 2016. The full texts of these reports are available at the company's website and under the company's SEDAR profile.

Quarterly highlights:

Binding option and farm-in term sheet executed with Richmont Mines Inc. (TSX: RIC; NYSE: RIC) to acquire a 70% interest in the Chimo Gold Project, located in the highly endowed Abitibi region of Quebec, Canada, a premier gold district hosting several multi-million ounce deposits.

The Chimo Gold Project is located adjacent to the Nordeau Gold Project (together now named the East Cadillac Gold Project), which Chalice also secured recently under an option agreement {A –} allowing it to consolidate a contiguous ~16km strike length along the Larder Lake-Cadillac fault, ~35km east of the >20Moz Val d'Or gold camp.

Recent drilling by TSX-V-listed gold explorer Cartier Resources close to the boundary of the East Cadillac Gold Project has returned impressive intercepts.

Approvals received for drilling at Warrego North Project in the Northern Territory with drilling to commence as soon as possible (weather permitting) targeting high-grade copper-gold Tennant-Creek-style mineralisation.

Planning and approvals continue in preparation for an active drilling campaign at four projects in Canada, the Northern Territory and WA within the next 6 months.

During the Quarter Chalice sold 14.1 million shares in First Mining Finance for gross revenue of A$11.5 million.

As at December 31, 2016, Chalice remains well-funded with cash of A$40.4 million and 18.2 million shares held in First Mining Finance Corp (TSX-V: FF).

Chalice continues to target additional high-potential opportunities globally

AeM und dort wird das Geld vor allem auf deren Chimo Claims verbohrt::

VAL-D'OR, QUEBEC -- (Marketwired) -- 12/22/16 -- Cartier Resources Inc. (TSX VENTURE: ECR) ("Cartier") has closed the strategic investment by Agnico Eagle Mines Limited ("Agnico") previously announced on December 19, 2016 (the "Strategic Placement"). Pursuant to the Strategic Placement, Agnico purchased 22,500,000 common shares (the "Common Shares") of Cartier at a price of $0.20 per Common Share for proceeds of $4,500,000. As a result of the Strategic Placement, Agnico now owns 19.97% of the issued and outstanding Common Shares of Cartier.

The proceeds from the Offering shall be primarily used for exploration at the Cartier's five main projects located in Quebec: Chimo, Benoist, Wilson, Fenton and Cadillac Extension, as well as for working capital and general corporate purposes.

Zu obigem Beitrag gehört noch der Chart der letzten 2 Wochen am Heimmarkt.

Gruss William

Gruss William

Umsätze der letzten Woche vom 23. - 27. Januar 2017

Schon in der Vorwoche hatten wir gute Umsätze bei steigenden Kursen. Gute Nachrichten vom 18.1. und 20.1.2017 betreffend Francoeur und Montalembert waren die Grundlage.Aufgrund der Teilnahme an der Messe von Vancouver konnte Jack das Interesse vieler Investoren wecken und der Kurs stieg am Montag nochals heftig an. Am Dienstag konnte der Kurs auf dem Niveau von 0.58-0.61 CAD gehalten werden. Ab Mittwoch ging es dann wieder nach unten und der Kurs endete immerhin noch auf dem gleichen Niveau wie der Schlusskurs der Vorwoche. Bei sinkendem Kurs gab es am Donnerstag und Freitag nur wenige Transaktionen was als gutes Zeichen gewertet werden kann.

Umsätze am Heimmarkt der letzten 2 Wochen

Wochen-Umsätze aller Handelsplätze der Wochen 1-4

Der durchschnittliche Kurs ist in der letzten Woche von 0.456 auf 0.56.9 CAD angestiegen (USD und EUR umgerechnet zu Tageskursen in CAD).

Wir warten gespannt, was die nächste Woche bringt.

Gruss William

Antwort auf Beitrag Nr.: 54.185.740 von WilliamTell am 28.01.17 16:44:18Am Widerstand gescheitert und diese Woche eigentlich am Stand verharrt.

Am Goldwert braucht man sich bei Globex nicht orientieren.

Auch bei einer Korrektur bleib ich dabei.

mfg

geri

Am Goldwert braucht man sich bei Globex nicht orientieren.

Auch bei einer Korrektur bleib ich dabei.

mfg

geri

12.06.24 · kapitalerhoehungen.de · Mercedes-Benz Group |

03.06.24 · Der Finanzinvestor · Shell |

21.05.24 · kapitalerhoehungen.de · Barrick Gold Corporation |