Gewinnerbranchen der Jahre 2006 bis 2040 (Seite 8921)

eröffnet am 10.12.06 16:57:17 von

neuester Beitrag 16.02.24 09:33:08 von

neuester Beitrag 16.02.24 09:33:08 von

Beiträge: 94.068

ID: 1.099.361

ID: 1.099.361

Aufrufe heute: 1

Gesamt: 3.536.108

Gesamt: 3.536.108

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 41 Minuten | 1511 | |

| 08.05.24, 11:56 | 1324 | |

| vor 1 Stunde | 953 | |

| vor 31 Minuten | 800 | |

| vor 1 Stunde | 776 | |

| vor 28 Minuten | 726 | |

| gestern 17:20 | 704 | |

| gestern 23:15 | 642 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.772,85 | +0,46 | 131 | |||

| 2. | 3. | 0,2170 | +3,33 | 125 | |||

| 3. | Neu! | 8,2570 | +96,67 | 108 | |||

| 4. | 4. | 156,46 | -2,31 | 103 | |||

| 5. | 14. | 5,7540 | -2,18 | 56 | |||

| 6. | 2. | 0,2980 | -3,87 | 50 | |||

| 7. | 5. | 2,3720 | -7,54 | 49 | |||

| 8. | 7. | 6,8000 | +2,38 | 38 |

Beitrag zu dieser Diskussion schreiben

so macht börse spass

nicht vergessen solang man nicht verauft sinds keine verluste. also nicht verunsichern lassen. schlimmer wäre es wenn die banken operativ verluste machen würden dies ist aber definitiv nicht der fall. ist eine reine buchwertkrise

Wall Street Poised for Another Down Day

Friday November 9, 7:53 am ET

By Joe Bel Bruno, AP Business Writer

Stock Futures Point Lower on Wachovia Warning, Ahead of Economic Data; Investors Stay on Edge

NEW YORK (AP) -- Stocks headed to a lower open Friday after Wachovia Corp. said it expects to increase quarterly loan losses, raising investor concern about the continuing credit crisis.

The nation's fourth-largest bank said in a filing with the Securities and Exchange Commission that credit market volatility could cause a $1.1 billion write-down for October alone. The problem stems from its asset-backed securities, such as collateralized debt obligations, that have lost value on sinking investor demand.

ADVERTISEMENT

Investors were also worried after Qualcomm Inc., the nation's second-biggest maker of chips that run mobile phones, predicted late Thursday after the closing bell that fiscal fourth-quarter earnings nearly doubled. But, heightened competition and legal troubles will cause 2008 results to fall 4 percent to 7 percent below Wall Street projections.

The market was also on edge after Federal Reserve Chairman Ben Bernanke said Thursday that policy makers expect the economy to "slow noticeably" this quarter. His comments caused major indexes to fall -- contributing to a slide this week on concerns about continuing credit woes, a weakening dollar and rising oil prices.

Dow Jones industrial futures fell 87, or 0.66 percent, to 13,175. Standard & Poor's 500 index futures fell 11.30, or 0.77 percent, to 1,464.20, and the Nasdaq composite index fell 16.00, or 0.76 percent, to 2,089.50.

Investors are waiting for data on the September trade balance and October import prices as well as the University of Michigan's consumer confidence survey for November.

The Commerce Department is scheduled to release its monthly report on international trade in goods and services, based on documents from U.S. Customs and Border Protection, at 8:30 am EST.

The preliminary Reuters/University of Michigan monthly index of consumer sentiment will be released Friday at 10 a.m. EST. Economists expect consumer sentiment will inch downward amid persistent worries about the housing recession and high energy prices.

Key among their worries is the escalating prices of oil, which has been trading just off of $100 a barrel. Light, sweet crude fell 40 cents to $94.06 in premarket electronic trading on the New York Mercantile Exchange.

In corporate news, wireless high-speed Internet provider Clearwire Corp. and Sprint Nextel Corp. announced before the bell they scrapped an agreement to jointly build a nationwide WiFi network. Clearwire also reported its third-quarter loss widened more than expected.

Walt Disney & Co. shares were also in focus after the entertainment company said late Thursday fiscal fourth-quarter profit rose 12 percent, driven by sports network ESPN and turnout at its U.S. theme parks. However, executives remain concerned about a Hollywood writers strike that began this week.

Overseas, Japan's Nikkei stock average closed down 1.19 percent and Hong Kong's Hang Seng index rose 0.08 percent. In afternoon trading, Britain's FTSE 100 fell 0.66 percent, Germany's DAX index rose 0.50 percent, and France's CAC-40 shed 0.96 percent.

nicht vergessen solang man nicht verauft sinds keine verluste. also nicht verunsichern lassen. schlimmer wäre es wenn die banken operativ verluste machen würden dies ist aber definitiv nicht der fall. ist eine reine buchwertkrise

Wall Street Poised for Another Down Day

Friday November 9, 7:53 am ET

By Joe Bel Bruno, AP Business Writer

Stock Futures Point Lower on Wachovia Warning, Ahead of Economic Data; Investors Stay on Edge

NEW YORK (AP) -- Stocks headed to a lower open Friday after Wachovia Corp. said it expects to increase quarterly loan losses, raising investor concern about the continuing credit crisis.

The nation's fourth-largest bank said in a filing with the Securities and Exchange Commission that credit market volatility could cause a $1.1 billion write-down for October alone. The problem stems from its asset-backed securities, such as collateralized debt obligations, that have lost value on sinking investor demand.

ADVERTISEMENT

Investors were also worried after Qualcomm Inc., the nation's second-biggest maker of chips that run mobile phones, predicted late Thursday after the closing bell that fiscal fourth-quarter earnings nearly doubled. But, heightened competition and legal troubles will cause 2008 results to fall 4 percent to 7 percent below Wall Street projections.

The market was also on edge after Federal Reserve Chairman Ben Bernanke said Thursday that policy makers expect the economy to "slow noticeably" this quarter. His comments caused major indexes to fall -- contributing to a slide this week on concerns about continuing credit woes, a weakening dollar and rising oil prices.

Dow Jones industrial futures fell 87, or 0.66 percent, to 13,175. Standard & Poor's 500 index futures fell 11.30, or 0.77 percent, to 1,464.20, and the Nasdaq composite index fell 16.00, or 0.76 percent, to 2,089.50.

Investors are waiting for data on the September trade balance and October import prices as well as the University of Michigan's consumer confidence survey for November.

The Commerce Department is scheduled to release its monthly report on international trade in goods and services, based on documents from U.S. Customs and Border Protection, at 8:30 am EST.

The preliminary Reuters/University of Michigan monthly index of consumer sentiment will be released Friday at 10 a.m. EST. Economists expect consumer sentiment will inch downward amid persistent worries about the housing recession and high energy prices.

Key among their worries is the escalating prices of oil, which has been trading just off of $100 a barrel. Light, sweet crude fell 40 cents to $94.06 in premarket electronic trading on the New York Mercantile Exchange.

In corporate news, wireless high-speed Internet provider Clearwire Corp. and Sprint Nextel Corp. announced before the bell they scrapped an agreement to jointly build a nationwide WiFi network. Clearwire also reported its third-quarter loss widened more than expected.

Walt Disney & Co. shares were also in focus after the entertainment company said late Thursday fiscal fourth-quarter profit rose 12 percent, driven by sports network ESPN and turnout at its U.S. theme parks. However, executives remain concerned about a Hollywood writers strike that began this week.

Overseas, Japan's Nikkei stock average closed down 1.19 percent and Hong Kong's Hang Seng index rose 0.08 percent. In afternoon trading, Britain's FTSE 100 fell 0.66 percent, Germany's DAX index rose 0.50 percent, and France's CAC-40 shed 0.96 percent.

Wachovia Portfolio Value Falls in Oct.

Friday November 9, 7:14 am ET

Wachovia to Set Aside Up to $600 Million for Loan Losses in 4th Quarter

NEW YORK (AP) -- Wachovia Corp. said Friday the value of its collateralized debt obligations sank in October by an estimated $1.1 billion pretax, requiring a writedown of about $1.11 per share for the month of October.

Wachovia's writedowns for its exposure to mortgage-backed securities and CDOs -- complex instruments that combine slices of different kind of risk -- totaled 35 cents per share for the entire third quarter.

In a regulatory filing with the Securities and Exchange Commission, the financial services provider said the market in November so far remains "extraordinarily volatile."

The company plans to boost its allowance for loan losses in the fourth quarter due to expected credit deterioration in the housing market in certain regions. The provision is pegged at $500 million to $600 million in excess of charge-offs in the quarter.

Friday November 9, 7:14 am ET

Wachovia to Set Aside Up to $600 Million for Loan Losses in 4th Quarter

NEW YORK (AP) -- Wachovia Corp. said Friday the value of its collateralized debt obligations sank in October by an estimated $1.1 billion pretax, requiring a writedown of about $1.11 per share for the month of October.

Wachovia's writedowns for its exposure to mortgage-backed securities and CDOs -- complex instruments that combine slices of different kind of risk -- totaled 35 cents per share for the entire third quarter.

In a regulatory filing with the Securities and Exchange Commission, the financial services provider said the market in November so far remains "extraordinarily volatile."

The company plans to boost its allowance for loan losses in the fourth quarter due to expected credit deterioration in the housing market in certain regions. The provision is pegged at $500 million to $600 million in excess of charge-offs in the quarter.

eine dividendenkürzung wurde vom neuen management bereits als absolut nicht nötig abgelehnt.

operativ läuft das geschäft. operativer gewinn weit jenseits der 20 milliarden

operativ läuft das geschäft. operativer gewinn weit jenseits der 20 milliarden

nun ja wie gesagt bin in die c rein . von mir aus können sie die 50 milliarden komplett abschreiben die sie noch in ihren büchern haben.

. von mir aus können sie die 50 milliarden komplett abschreiben die sie noch in ihren büchern haben.

die jungs sitzen auf vermögenswerten von 2,3 billionen $

der artikel von space insbesondere der folgnde auszug das dürfte alle unklarheiten beseitigen:

Is Citi in trouble of failing? Not by a country mile. Let's not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3%, is safe as Citi has a plethora of options to use to pay it. Let's not forget, aside from writing down the CDO's, the rest of the banks operations are performing very well and the international operations are going gangbusters.

.

.

.

even if they do, let's say they sell $50 billion in assets. That whopping amount comes to 2% of Citi's total asset base.... am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

. von mir aus können sie die 50 milliarden komplett abschreiben die sie noch in ihren büchern haben.

. von mir aus können sie die 50 milliarden komplett abschreiben die sie noch in ihren büchern haben.die jungs sitzen auf vermögenswerten von 2,3 billionen $

der artikel von space insbesondere der folgnde auszug das dürfte alle unklarheiten beseitigen:

Is Citi in trouble of failing? Not by a country mile. Let's not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3%, is safe as Citi has a plethora of options to use to pay it. Let's not forget, aside from writing down the CDO's, the rest of the banks operations are performing very well and the international operations are going gangbusters.

.

.

.

even if they do, let's say they sell $50 billion in assets. That whopping amount comes to 2% of Citi's total asset base.... am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

die finanzwerte werden ja entsetzlich verprügelt und branche langsam SEHR interessant!!

hier 2 nette Artikel zur C, die die Entschedungsfindung vielleicht unterstützt. Der "Vorteil" bei der C ist, dass sie schon viel ausgepackt haben. Aktuell glauben wohl viele, dass sie die Divi nicht zahlen können, um Bares zu scheffeln.

Citigroup 'Crisis': Some Perspective Is In Order

posted on: November 08, 2007 | about stocks: C

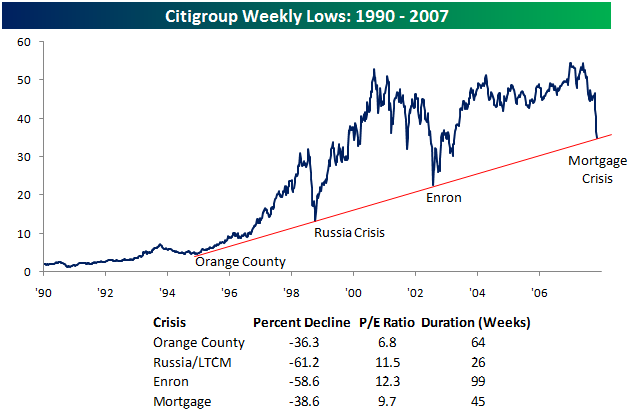

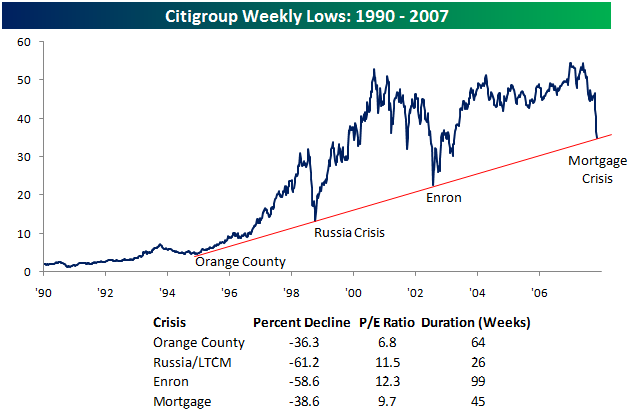

I found an very interesting chart over at Bespoke Investments. It contrasted today's "crisis" with past ones (LTCM, Orange County & Enron). The chart (below) illustrates that this sell-off in Citigroup (C) shares is in keeping with past ones and also shows the rapid accent after the "crisis" passes.

Schöne Linie,gell???

Is Citi in trouble of failing? Not by a country mile. Let's not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3%, is safe as Citi has a plethora of options to use to pay it. Let's not forget, aside from writing down the CDO's, the rest of the banks operations are performing very well and the international operations are going gangbusters.

What if Citi has to sell off assets to meet obligations? Isn't that what people want to unlock the value in it? They won't but even if they do, let's say they sell $50 billion in assets. That whopping amount comes to 2% of Citi's total asset base.... am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

Citi could issue $200 billion in debt to provide funds and even with that, its assets base would still be twice its debt level. The thing of it is, a billion dollars used to be a lot of money. It just isn't that much anymore when you are talking about institutions sitting on trillions. Some perspective is in order.

Can Citigroup Maintain the Dividend?

posted on: November 09, 2007 | about stocks: C

Citigroup's dividend yield keeps rising as the stock keeps falling. A month ago, the yield was about 4.5%. At last look, it had reached 6.8% as the stock fell below $32 per share. The initial sell-off in the stock had to do with news that the company would write-off an additional $8-11 billion in sub-prime CDOs. But the stock has continued to fall because many investors are betting that the dividend will have to be cut in order to shore up capital.

So far at least, the board has indicated that the dividend will be maintained. But suppose it is cut? Will that drive the stock price lower? It may, but I doubt it will go much lower. In fact, investors may view a dividend reduction as good news. It could signal the board's determination to get serious about the company's financial problems.

My view is that Citigroup has reached a low enough level to justify the risk of buying some shares. That's exactly what I just started doing. My investment will likely be dead money for a while, but taking a page from Warren Buffett's book, it should pay off handsomely in the years ahead.

Citigroup 'Crisis': Some Perspective Is In Order

posted on: November 08, 2007 | about stocks: C

I found an very interesting chart over at Bespoke Investments. It contrasted today's "crisis" with past ones (LTCM, Orange County & Enron). The chart (below) illustrates that this sell-off in Citigroup (C) shares is in keeping with past ones and also shows the rapid accent after the "crisis" passes.

Schöne Linie,gell???

Is Citi in trouble of failing? Not by a country mile. Let's not forget these are just paper losses. Citi made $21 billion last year and sits on $2.3 TRILLION in assets as of 9/30 which is more than 2X it current debt. The dividend, now at 6.3%, is safe as Citi has a plethora of options to use to pay it. Let's not forget, aside from writing down the CDO's, the rest of the banks operations are performing very well and the international operations are going gangbusters.

What if Citi has to sell off assets to meet obligations? Isn't that what people want to unlock the value in it? They won't but even if they do, let's say they sell $50 billion in assets. That whopping amount comes to 2% of Citi's total asset base.... am I the only one who really does not think that is a big deal? It is a bit like us selling our dishwasher.

Citi could issue $200 billion in debt to provide funds and even with that, its assets base would still be twice its debt level. The thing of it is, a billion dollars used to be a lot of money. It just isn't that much anymore when you are talking about institutions sitting on trillions. Some perspective is in order.

Can Citigroup Maintain the Dividend?

posted on: November 09, 2007 | about stocks: C

Citigroup's dividend yield keeps rising as the stock keeps falling. A month ago, the yield was about 4.5%. At last look, it had reached 6.8% as the stock fell below $32 per share. The initial sell-off in the stock had to do with news that the company would write-off an additional $8-11 billion in sub-prime CDOs. But the stock has continued to fall because many investors are betting that the dividend will have to be cut in order to shore up capital.

So far at least, the board has indicated that the dividend will be maintained. But suppose it is cut? Will that drive the stock price lower? It may, but I doubt it will go much lower. In fact, investors may view a dividend reduction as good news. It could signal the board's determination to get serious about the company's financial problems.

My view is that Citigroup has reached a low enough level to justify the risk of buying some shares. That's exactly what I just started doing. My investment will likely be dead money for a while, but taking a page from Warren Buffett's book, it should pay off handsomely in the years ahead.

ja hsbc ist auch sicher. barclays evtl zu klein für ne große krise

WOW wird bei der RBOS die halbe Bilanz abgeschrieben? breites Grinsen Wird ja immer leckerer... lecker Noch dazu UK. GBP und 0% QST.

nö die börse ist grad dabei die ganze bank abzuschreiben

nö die börse ist grad dabei die ganze bank abzuschreiben

Antwort auf Beitrag Nr.: 32.359.971 von Pontiuspilatus am 09.11.07 12:54:57potentiell insolvenzgefährdet wenns richtig ruppig an den finanzmärkten wird.

Na ich denke eine Barclays ist auch weniger gefährdet. Die haben ein extrem starkes Standbein mit ihren Fonds/ETFs. Und HSBC?

Na ich denke eine Barclays ist auch weniger gefährdet. Die haben ein extrem starkes Standbein mit ihren Fonds/ETFs. Und HSBC?

bin jetzt in die citi rein können von mir gern nich 10 oder 20 % fallen dann wird aufgestockt. nächste woche wird mein isrg geld frein