Credit Suisse (CSGN) WKN: 876800 (Seite 186)

eröffnet am 24.01.08 12:41:06 von

neuester Beitrag 24.04.23 12:01:15 von

neuester Beitrag 24.04.23 12:01:15 von

Beiträge: 2.096

ID: 1.137.693

ID: 1.137.693

Aufrufe heute: 2

Gesamt: 143.501

Gesamt: 143.501

Aktive User: 0

ISIN: CH0012138530 · WKN: 876800

0,8900

USD

+0,56 %

+0,0050 USD

Letzter Kurs 10.06.23 Nasdaq OTC

Neuigkeiten

| TitelBeiträge |

|---|

23.04.24 · BörsenNEWS.de |

26.11.23 · Dr. Marc-Oliver Lux |

01.09.23 · Aktien.news – Aktiennews für Sie |

31.08.23 · wallstreetONLINE Redaktion |

Werte aus der Branche Banken

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 64,55 | +37,22 | |

| 13,290 | +22,15 | |

| 130,00 | +12,07 | |

| 30,00 | +11,11 | |

| 26,62 | +10,00 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 10,300 | -16,60 | |

| 11,160 | -21,96 | |

| 21,000 | -27,59 | |

| 8,7100 | -47,67 | |

| 175,00 | -65,00 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 68.523.318 von faultcode am 16.06.21 13:38:19

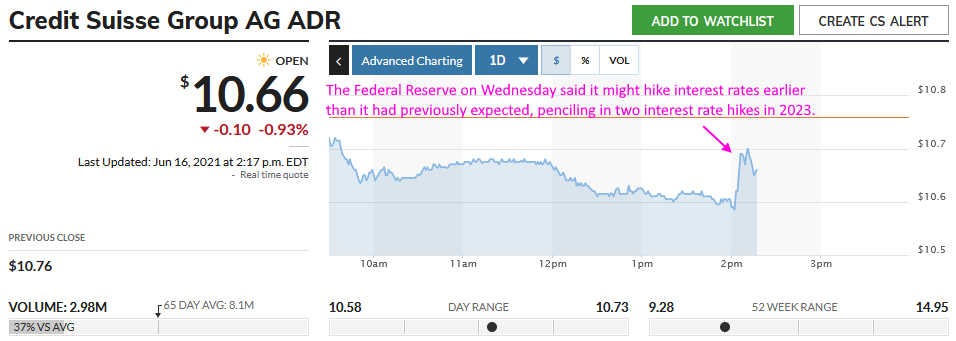

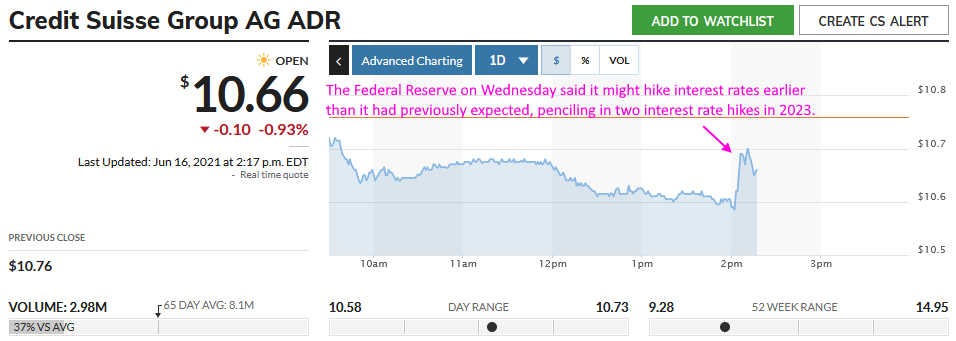

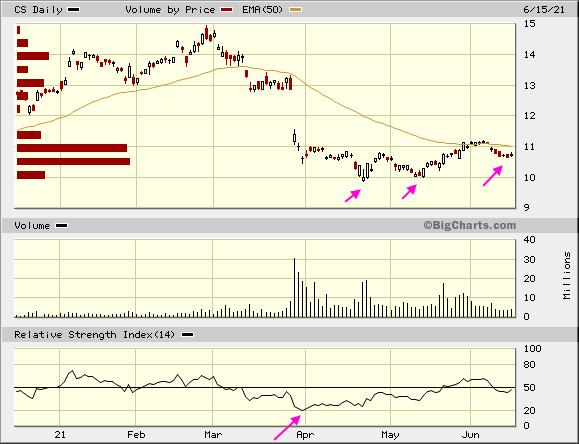

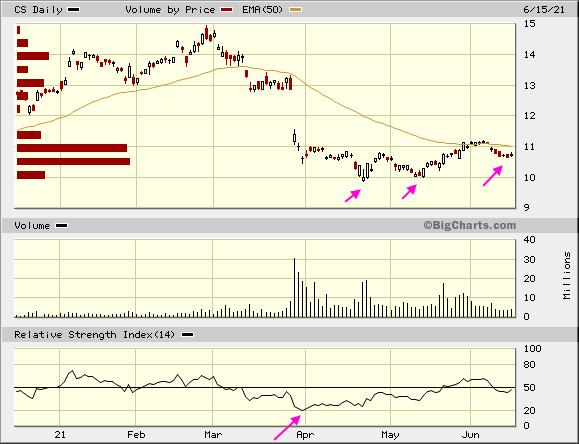

Antwort auf Beitrag Nr.: 68.344.217 von faultcode am 29.05.21 12:27:22nichtsdestotrotz, die Aktie will nicht mehr fallen:

=> kleine Long-Position

=> kleine Long-Position

Europa hat eine neue "Deutsche Bank" -- Credit Suisse:

28.5.

A Credit Suisse Unit Blacklisted Gupta as Another Bankrolled Him

https://www.bloomberg.com/news/articles/2021-05-28/a-credit-…

...

Credit Suisse Group AG executives ignored warnings from colleagues about troubled steel tycoon Sanjeev Gupta as they channeled $1.2 billion of client funds to his businesses, according to people familiar with the matter.

Bankers in Credit Suisse’s commodity trade-finance unit blacklisted Gupta’s Liberty Commodities Ltd. in 2016 because they suspected some of its deals weren’t legitimate, the people said. When they learned about two years later that the bank was lending to his companies through a suite of investment funds, which eventually grew to $10 billion, they flagged their worries to leaders in compliance and the division that housed the loans, one of the people said.

The disclosure that Credit Suisse may have put clients at risk despite internal concerns over Gupta’s businesses adds a new twist to the debacle stemming from the March implosion of Greensill Capital, the finance firm at the center of the three-way relationship.

Investigations, Lawsuits

The U.K. Serious Fraud Office is now investigating Gupta’s group of companies for suspected fraud, including in its financing deals with Greensill, according to a May 14 statement. Credit Suisse has sued to force Gupta’s Liberty Commodities into insolvency and has since shut the funds that made the loans and launched an internal investigation. Investors are staring at losses as the bank confronts embarrassing lawsuits.

“We are currently focusing our efforts on recovering our investors’ money,” Will Bowen, a spokesman for Credit Suisse in London, said in an emailed statement, adding that the bank’s internal probe will focus on “all of the issues” linked to the funds. “We are committed to learning the lessons and will share the relevant lessons learnt at the appropriate time.”

Andrew Mitchell, a spokesman for the Gupta Family Group Alliance, or GFG Alliance, a collective of businesses linked to Gupta including Liberty Commodities, denied any wrongdoing.The Greensill saga represents just one of the two disasters that rocked Credit Suisse in the first half of 2021. Since Greensill began unraveling, the bank has announced a $5.5 billion hit from the blowup at Archegos Capital Management.

Apologies

Former Chairman Urs Rohner apologized to shareholders and his successor, Antonio Horta-Osorio, who arrived at the end of April, has promised a sweeping strategy review.

Chief Executive Officer Thomas Gottstein, who was head of the division that oversaw trade finance, wasn’t aware of the internal concerns about Gupta that had prompted the bank to cut him off, according to a person familiar with the matter.

Employees at the trade-finance unit, which lends money for the buying and selling of commodities, cut ties with Gupta in 2016 after becoming skeptical toward his Liberty Commodities, the people said. They distrusted the documents the company provided, triggering doubts about its transactions, they said. In one example reported by Bloomberg, the company had presented another bank with what seemed to be duplicate shipping receipts. Credit Suisse’s commodity team had stopped working with Gupta after identifying suspicious shipments while the bank’s credit-structuring team lobbied against the Greensill funds, the Wall Street Journal reported in April.

A spokesman for Gupta has denied any wrongdoing.

Banking Ties

Liberty Commodities pledged assets to Credit Suisse as security for borrowings in 2013 but by early 2016, all such commitments had been extinguished, indicating that the financing relationship had ceased, U.K. Companies House filings show. And while Gupta’s company listed the Swiss bank as one of its lenders in its 2014 annual report, it didn’t in the following year’s report, which is dated May 2016, according to the filings.

Their counterparts at other banks, including Macquarie Group Ltd. and Sberbank PJSC, halted trading with Liberty Commodities around the same time because of similar concerns; Goldman Sachs Group Inc. also stopped in 2016, Bloomberg has reported.

Nevertheless, executives at Credit Suisse’s asset-management division -- which creates investment products for clients and charges a fee for overseeing them -- began arranging a suite of funds focused on supply-chain finance in 2017. The entities bought securitized loans packaged by Greensill, a firm created by Australian businessman Lex Greensill. Much of the debts were linked to Gupta’s businesses.

Warnings

Officials at the commodity trade-finance unit were concerned when they found out about the funds’ links to Gupta and took their fears to Thomas Grotzer, general counsel for the bank’s Swiss division. They also warned Luc Mathys and Lukas Haas, the bankers who helped oversee the trades at the asset-management unit.

Grotzer was promoted last month to interim global head of compliance at Credit Suisse. He didn’t respond to requests for comment. Mathys, head of fixed-income at the asset-management division, and Haas, a portfolio manager, were put on temporary leave in March. Neither responded to requests for comment.

The bank pushed ahead with the funds and marketed them to investors as being made up of short-term debt secured on invoices, assets considered so safe that Credit Suisse gave the largest vehicle its lowest rating for risk. Yet part of the loans were linked to mere possible future revenues.

Other parts of the bank continued working with Gupta as well. Credit Suisse’s investment bankers were due to lead an initial public offering for Liberty’s U.S. steel arm, which was ultimately pulled, according to a statement from the company. Gupta also announced that the Swiss bank would finance his planned acquisition of Thyssenkrupp AG’s steel unit, which fell apart earlier this year.

Credit Suisse has so far recouped about $5.9 billion of the $10 billion in these supply-chain funds, but it remains unclear how much will be returned ultimately to investors. Loans to Gupta’s businesses are among a batch of debts that are the “principal sources of valuation uncertainty,” the bank said earlier this month.

Liberty Commodities’s external legal advisors investigated “alleged rumors concerning the paperwork” it used in 2019, according to Mitchell, the spokesman for GFG Alliance. They found no evidence to substantiate the rumors, nor was the company “ever subject to further complaints or proceedings,” he said.

“LCL has ongoing banking relationships with separate financial institutions,” Mitchell said, referring to Liberty Commodities. “The trade-finance market has been hugely challenging for all but the very largest commodities traders in recent years. Nevertheless, no financial institution has been left out of pocket as a result of lending money to LCL. On the contrary, they have received substantial commercial returns.”

...

28.5.

A Credit Suisse Unit Blacklisted Gupta as Another Bankrolled Him

https://www.bloomberg.com/news/articles/2021-05-28/a-credit-…

...

Credit Suisse Group AG executives ignored warnings from colleagues about troubled steel tycoon Sanjeev Gupta as they channeled $1.2 billion of client funds to his businesses, according to people familiar with the matter.

Bankers in Credit Suisse’s commodity trade-finance unit blacklisted Gupta’s Liberty Commodities Ltd. in 2016 because they suspected some of its deals weren’t legitimate, the people said. When they learned about two years later that the bank was lending to his companies through a suite of investment funds, which eventually grew to $10 billion, they flagged their worries to leaders in compliance and the division that housed the loans, one of the people said.

The disclosure that Credit Suisse may have put clients at risk despite internal concerns over Gupta’s businesses adds a new twist to the debacle stemming from the March implosion of Greensill Capital, the finance firm at the center of the three-way relationship.

Investigations, Lawsuits

The U.K. Serious Fraud Office is now investigating Gupta’s group of companies for suspected fraud, including in its financing deals with Greensill, according to a May 14 statement. Credit Suisse has sued to force Gupta’s Liberty Commodities into insolvency and has since shut the funds that made the loans and launched an internal investigation. Investors are staring at losses as the bank confronts embarrassing lawsuits.

“We are currently focusing our efforts on recovering our investors’ money,” Will Bowen, a spokesman for Credit Suisse in London, said in an emailed statement, adding that the bank’s internal probe will focus on “all of the issues” linked to the funds. “We are committed to learning the lessons and will share the relevant lessons learnt at the appropriate time.”

Andrew Mitchell, a spokesman for the Gupta Family Group Alliance, or GFG Alliance, a collective of businesses linked to Gupta including Liberty Commodities, denied any wrongdoing.The Greensill saga represents just one of the two disasters that rocked Credit Suisse in the first half of 2021. Since Greensill began unraveling, the bank has announced a $5.5 billion hit from the blowup at Archegos Capital Management.

Apologies

Former Chairman Urs Rohner apologized to shareholders and his successor, Antonio Horta-Osorio, who arrived at the end of April, has promised a sweeping strategy review.

Chief Executive Officer Thomas Gottstein, who was head of the division that oversaw trade finance, wasn’t aware of the internal concerns about Gupta that had prompted the bank to cut him off, according to a person familiar with the matter.

Employees at the trade-finance unit, which lends money for the buying and selling of commodities, cut ties with Gupta in 2016 after becoming skeptical toward his Liberty Commodities, the people said. They distrusted the documents the company provided, triggering doubts about its transactions, they said. In one example reported by Bloomberg, the company had presented another bank with what seemed to be duplicate shipping receipts. Credit Suisse’s commodity team had stopped working with Gupta after identifying suspicious shipments while the bank’s credit-structuring team lobbied against the Greensill funds, the Wall Street Journal reported in April.

A spokesman for Gupta has denied any wrongdoing.

Banking Ties

Liberty Commodities pledged assets to Credit Suisse as security for borrowings in 2013 but by early 2016, all such commitments had been extinguished, indicating that the financing relationship had ceased, U.K. Companies House filings show. And while Gupta’s company listed the Swiss bank as one of its lenders in its 2014 annual report, it didn’t in the following year’s report, which is dated May 2016, according to the filings.

Their counterparts at other banks, including Macquarie Group Ltd. and Sberbank PJSC, halted trading with Liberty Commodities around the same time because of similar concerns; Goldman Sachs Group Inc. also stopped in 2016, Bloomberg has reported.

Nevertheless, executives at Credit Suisse’s asset-management division -- which creates investment products for clients and charges a fee for overseeing them -- began arranging a suite of funds focused on supply-chain finance in 2017. The entities bought securitized loans packaged by Greensill, a firm created by Australian businessman Lex Greensill. Much of the debts were linked to Gupta’s businesses.

Warnings

Officials at the commodity trade-finance unit were concerned when they found out about the funds’ links to Gupta and took their fears to Thomas Grotzer, general counsel for the bank’s Swiss division. They also warned Luc Mathys and Lukas Haas, the bankers who helped oversee the trades at the asset-management unit.

Grotzer was promoted last month to interim global head of compliance at Credit Suisse. He didn’t respond to requests for comment. Mathys, head of fixed-income at the asset-management division, and Haas, a portfolio manager, were put on temporary leave in March. Neither responded to requests for comment.

The bank pushed ahead with the funds and marketed them to investors as being made up of short-term debt secured on invoices, assets considered so safe that Credit Suisse gave the largest vehicle its lowest rating for risk. Yet part of the loans were linked to mere possible future revenues.

Other parts of the bank continued working with Gupta as well. Credit Suisse’s investment bankers were due to lead an initial public offering for Liberty’s U.S. steel arm, which was ultimately pulled, according to a statement from the company. Gupta also announced that the Swiss bank would finance his planned acquisition of Thyssenkrupp AG’s steel unit, which fell apart earlier this year.

Credit Suisse has so far recouped about $5.9 billion of the $10 billion in these supply-chain funds, but it remains unclear how much will be returned ultimately to investors. Loans to Gupta’s businesses are among a batch of debts that are the “principal sources of valuation uncertainty,” the bank said earlier this month.

Liberty Commodities’s external legal advisors investigated “alleged rumors concerning the paperwork” it used in 2019, according to Mitchell, the spokesman for GFG Alliance. They found no evidence to substantiate the rumors, nor was the company “ever subject to further complaints or proceedings,” he said.

“LCL has ongoing banking relationships with separate financial institutions,” Mitchell said, referring to Liberty Commodities. “The trade-finance market has been hugely challenging for all but the very largest commodities traders in recent years. Nevertheless, no financial institution has been left out of pocket as a result of lending money to LCL. On the contrary, they have received substantial commercial returns.”

...

Antwort auf Beitrag Nr.: 67.911.932 von faultcode am 22.04.21 13:30:29https://www.bloomberg.com/news/articles/2021-05-03/credit-su…

...

...

Antwort auf Beitrag Nr.: 67.906.136 von faultcode am 22.04.21 01:49:4122.4.

Credit Suisse braucht frisches Kapital - Weitere Hedgefonds-Belastung

https://www.wallstreet-online.de/nachricht/13809380-roundup-…

...

Die Credit Suisse muss sich wegen der Probleme bei Lieferketten-Finanzierungsfonds frisches Kapital besorgen. Zudem rechnet die Schweizer Großbank wegen des Ausfalls des Hedgefonds Archegos im zweiten Quartal mit einer weiteren Belastung von 600 Millionen Franken.

In den ersten drei Monaten des Jahres hatte das Debakel bei dem Fonds - wie bereits bekannt - mit 4,4 Milliarden Franken (rund 4 Mrd Euro) belastet. Die Bank rutschte deswegen in die roten Zahlen; allerdings nicht so stark wie Anfang April angekündigt und von Analysten befürchtet. Die Aktie fiel zum Handelsstart um bis zu sechs Prozent. Neben den Problemen bei Archegos ringt die Credit Suisse mit den Folgen der Pleite des britisch-australischen Finanzkonglomerats Greensill.

Derzeit versucht die Bank, möglichst viel Geld zugunsten der Anleger mehrerer sogenannter Lieferketten-Finanzierungsfonds (Supply Chain Finance Fund) zu retten, die sie gemeinsam mit Greensill aufgelegt hatte. Aus diesem Grund muss die Bank auf Druck der Schweizer Finanzaufsicht ihr Kapital um 1,9 Milliarden Franken aufstocken, wie die Bank am Donnerstag in Zürich mitteilte.

Aus diesem Grund kündigte die Bank die Ausgabe von Pflichtwandelanleihen an - also eine Kapitalerhöhung mit Zeitverzögerung. Die beiden Anleihen sollen am oder um den 12. Mai herum platziert sein und werden später in 100 Millionen beziehungsweise 103 Millionen Aktien gewandelt. Das Volumen bezifferte die Credit Suisse auf rund 1,8 Milliarden Franken. Durch die Wandlung steigt die Aktienzahl um rund acht Prozent auf rund 2,65 Milliarden.

Die beiden Fehlschläge bei Greensill und Archegos überschatteten bei der Credit Suisse die zum Teil in anderen Sparten erzielten operativen Erfolge. Alles in allem stand in den ersten drei Monaten ein Vorsteuerverlust von 757 Millionen Franken in den Büchern nach einem Gewinn von 1,2 Milliarden ein Jahr zuvor. Der Vorsteuerverlust fiel allerdings etwas geringer aus, als die Bank Anfang April angekündigt hatte. Unter dem Strich stand ein Verlust von 252 Millionen Franken - nach einem Plus von 1,3 Milliarden Franken im Vorjahresquartal. Bei den Erträgen profitiere die Bank wie die Konkurrenz von einem regen Handel an den Kapitalmärkten und einer hohen Nachfrage unter anderem nach Anleihen.

Getrieben von einem starken Geschäft im Investmentbanking legten die Erträge um fast ein Drittel auf 7,6 Milliarden Franken zu - im Investmenbanking betrug das Plus 80 Prozent. Credit-Suisse-Chef Thomas Gottstein geht davon aus, dass die Dynamik im Investmentbanking nicht so anhält. Die Entwicklung in diesem Bereich werde einen Rückgang der Marktaktivität widerspiegeln. Zudem werde der deutliche Abbau von Risiken im Geschäft mit Hedgefonds auf die Erträge drücken.

Besser sieht es in der anderen Sparte aus. "Im Vermögensverwaltungsgeschäft erwarten wir einen weitgehend stabilen Zinserfolg und einen Anstieg der wiederkehrenden Kommissions- und Gebührenerträge, die von höheren verwalteten Vermögen profitieren dürften." Gottstein nannte die Belastung aus dem Hedgefonds-Debakel einmal mehr "inakzeptabel". "Gemeinsam mit dem Verwaltungsrat haben wir wichtige Schritte unternommen, um diese Situation sowie die Supply-Chain-Finance-Funds-Angelegenheit anzugehen", sagte er laut Mitteilung.

Personelle Konsequenzen hatte es bereits Anfang April gegeben. So mussten etwa Investment-Bank-Chef Brian Chin und Risikochefin Lara Werner ihren Job abgeben. Die Konzernleitung um Bankchef Gottstein verzichtet auf Boni.

...

Credit Suisse braucht frisches Kapital - Weitere Hedgefonds-Belastung

https://www.wallstreet-online.de/nachricht/13809380-roundup-…

...

Die Credit Suisse muss sich wegen der Probleme bei Lieferketten-Finanzierungsfonds frisches Kapital besorgen. Zudem rechnet die Schweizer Großbank wegen des Ausfalls des Hedgefonds Archegos im zweiten Quartal mit einer weiteren Belastung von 600 Millionen Franken.

In den ersten drei Monaten des Jahres hatte das Debakel bei dem Fonds - wie bereits bekannt - mit 4,4 Milliarden Franken (rund 4 Mrd Euro) belastet. Die Bank rutschte deswegen in die roten Zahlen; allerdings nicht so stark wie Anfang April angekündigt und von Analysten befürchtet. Die Aktie fiel zum Handelsstart um bis zu sechs Prozent. Neben den Problemen bei Archegos ringt die Credit Suisse mit den Folgen der Pleite des britisch-australischen Finanzkonglomerats Greensill.

Derzeit versucht die Bank, möglichst viel Geld zugunsten der Anleger mehrerer sogenannter Lieferketten-Finanzierungsfonds (Supply Chain Finance Fund) zu retten, die sie gemeinsam mit Greensill aufgelegt hatte. Aus diesem Grund muss die Bank auf Druck der Schweizer Finanzaufsicht ihr Kapital um 1,9 Milliarden Franken aufstocken, wie die Bank am Donnerstag in Zürich mitteilte.

Aus diesem Grund kündigte die Bank die Ausgabe von Pflichtwandelanleihen an - also eine Kapitalerhöhung mit Zeitverzögerung. Die beiden Anleihen sollen am oder um den 12. Mai herum platziert sein und werden später in 100 Millionen beziehungsweise 103 Millionen Aktien gewandelt. Das Volumen bezifferte die Credit Suisse auf rund 1,8 Milliarden Franken. Durch die Wandlung steigt die Aktienzahl um rund acht Prozent auf rund 2,65 Milliarden.

Die beiden Fehlschläge bei Greensill und Archegos überschatteten bei der Credit Suisse die zum Teil in anderen Sparten erzielten operativen Erfolge. Alles in allem stand in den ersten drei Monaten ein Vorsteuerverlust von 757 Millionen Franken in den Büchern nach einem Gewinn von 1,2 Milliarden ein Jahr zuvor. Der Vorsteuerverlust fiel allerdings etwas geringer aus, als die Bank Anfang April angekündigt hatte. Unter dem Strich stand ein Verlust von 252 Millionen Franken - nach einem Plus von 1,3 Milliarden Franken im Vorjahresquartal. Bei den Erträgen profitiere die Bank wie die Konkurrenz von einem regen Handel an den Kapitalmärkten und einer hohen Nachfrage unter anderem nach Anleihen.

Getrieben von einem starken Geschäft im Investmentbanking legten die Erträge um fast ein Drittel auf 7,6 Milliarden Franken zu - im Investmenbanking betrug das Plus 80 Prozent. Credit-Suisse-Chef Thomas Gottstein geht davon aus, dass die Dynamik im Investmentbanking nicht so anhält. Die Entwicklung in diesem Bereich werde einen Rückgang der Marktaktivität widerspiegeln. Zudem werde der deutliche Abbau von Risiken im Geschäft mit Hedgefonds auf die Erträge drücken.

Besser sieht es in der anderen Sparte aus. "Im Vermögensverwaltungsgeschäft erwarten wir einen weitgehend stabilen Zinserfolg und einen Anstieg der wiederkehrenden Kommissions- und Gebührenerträge, die von höheren verwalteten Vermögen profitieren dürften." Gottstein nannte die Belastung aus dem Hedgefonds-Debakel einmal mehr "inakzeptabel". "Gemeinsam mit dem Verwaltungsrat haben wir wichtige Schritte unternommen, um diese Situation sowie die Supply-Chain-Finance-Funds-Angelegenheit anzugehen", sagte er laut Mitteilung.

Personelle Konsequenzen hatte es bereits Anfang April gegeben. So mussten etwa Investment-Bank-Chef Brian Chin und Risikochefin Lara Werner ihren Job abgeben. Die Konzernleitung um Bankchef Gottstein verzichtet auf Boni.

...

Antwort auf Beitrag Nr.: 67.905.851 von faultcode am 21.04.21 23:48:37https://www.wsj.com/articles/credit-suisses-exposure-to-arch…

...

...

https://www.bloomberg.com/news/articles/2021-04-21/credit-su…

...

In recent years, Credit Suisse Chief Executive Officer Thomas Gottstein and his predecessor Tidjane Thiam gave the task of resetting the bank’s risk appetite to Lara Warner, head of risk and compliance, who is stepping down as well. She challenged managers in her division to stop thinking only about defending the bank’s capital and also look at strategic business priorities, Bloomberg reported earlier.

...

Shah, who has been with the bank for more than 20 years, was one of the people at the firm who helped nurture the relationship with Archegos as the fund began growing in size.

...

In 2016, under then-CEO Thiam, Credit Suisse underwent a significant restructuring of its risk functions that led to many people leaving. The risk-control center was shifted to Zurich, Credit Suisse’s headquarters, from New York, where the majority of the bank’s investment-banking and trading activities sit.

Since the restructuring, efforts to cut costs have damped the bank’s ability to add talent and replenish the defense lines, a person familiar with the matter said.

...

In recent years, Credit Suisse Chief Executive Officer Thomas Gottstein and his predecessor Tidjane Thiam gave the task of resetting the bank’s risk appetite to Lara Warner, head of risk and compliance, who is stepping down as well. She challenged managers in her division to stop thinking only about defending the bank’s capital and also look at strategic business priorities, Bloomberg reported earlier.

...

Shah, who has been with the bank for more than 20 years, was one of the people at the firm who helped nurture the relationship with Archegos as the fund began growing in size.

...

In 2016, under then-CEO Thiam, Credit Suisse underwent a significant restructuring of its risk functions that led to many people leaving. The risk-control center was shifted to Zurich, Credit Suisse’s headquarters, from New York, where the majority of the bank’s investment-banking and trading activities sit.

Since the restructuring, efforts to cut costs have damped the bank’s ability to add talent and replenish the defense lines, a person familiar with the matter said.

Investoren zittern dem Quartalsresultat der Credit Suisse entgegen

Der Aktienkurs der Credit Suisse sackt im Vorfeld der Quartalsresultate am Donnerstag weiter ab. Kommen weitere böse Überraschungen ans Licht? Die Investoren wollen Klarheit.

https://www.cash.ch/news/top-news/banken-investoren-zittern-…

Der Aktienkurs der Credit Suisse sackt im Vorfeld der Quartalsresultate am Donnerstag weiter ab. Kommen weitere böse Überraschungen ans Licht? Die Investoren wollen Klarheit.

https://www.cash.ch/news/top-news/banken-investoren-zittern-…

CREDIT SUISSE STOCK SALES COULD RESULT IN ADDITIONAL LOSSES BEYOND $4.7 BILLION ALREADY DISCLOSED, SOURCE SAYS

Quelle: https://twitter.com/Fxhedgers/status/1384539547065720838?s=2…

Quelle: https://twitter.com/Fxhedgers/status/1384539547065720838?s=2…

Schweizer Aktienfavoriten: Das Spekulieren um Archegos-Kosten bei Credit Suisse geht weiter

...

Darf man dem für J.P. Morgan tätigen Bankenanalysten Kian Abouhossein Glauben schenken, dann könnte die Grossbank auf den jüngst bekannt gewordenen Paketverkäufen mit einem Gesamterlös in Höhe von gut 4 Milliarden Dollar gleich nochmals umgerechnet 360 Millionen Franken in den Sand gesetzt haben.

...

https://www.cash.ch/insider/ausserplanmaessige-anpassung-sch…

...

Darf man dem für J.P. Morgan tätigen Bankenanalysten Kian Abouhossein Glauben schenken, dann könnte die Grossbank auf den jüngst bekannt gewordenen Paketverkäufen mit einem Gesamterlös in Höhe von gut 4 Milliarden Dollar gleich nochmals umgerechnet 360 Millionen Franken in den Sand gesetzt haben.

...

https://www.cash.ch/insider/ausserplanmaessige-anpassung-sch…

23.04.24 · BörsenNEWS.de · Air Liquide |

26.11.23 · Dr. Marc-Oliver Lux · Credit Suisse Group |

01.09.23 · Aktien.news – Aktiennews für Sie · Credit Suisse Group |

31.08.23 · wallstreetONLINE Redaktion · Credit Suisse Group |

18.06.23 · dpa-AFX · Credit Suisse Group |