Europa's Banken: Schicksalsjahr 2016 (Seite 3)

eröffnet am 31.07.16 19:44:34 von

neuester Beitrag 05.12.23 15:03:17 von

neuester Beitrag 05.12.23 15:03:17 von

Beiträge: 158

ID: 1.236.043

ID: 1.236.043

Aufrufe heute: 0

Gesamt: 10.244

Gesamt: 10.244

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 00:04 | 488 | |

| 20.04.24, 12:11 | 382 | |

| heute 00:14 | 345 | |

| gestern 21:21 | 248 | |

| 10.11.14, 14:54 | 207 | |

| 05.12.14, 17:15 | 202 | |

| heute 03:34 | 181 | |

| gestern 19:32 | 171 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.161,01 | +1,36 | 217 | |||

| 2. | 3. | 0,1885 | -0,26 | 90 | |||

| 3. | 2. | 1,1800 | -14,49 | 77 | |||

| 4. | 5. | 9,3500 | +1,14 | 60 | |||

| 5. | 4. | 168,29 | -1,11 | 50 | |||

| 6. | Neu! | 0,4400 | +3,53 | 36 | |||

| 7. | Neu! | 4,7950 | +6,91 | 34 | |||

| 8. | Neu! | 11,905 | +14,97 | 31 |

Beitrag zu dieser Diskussion schreiben

4.8.

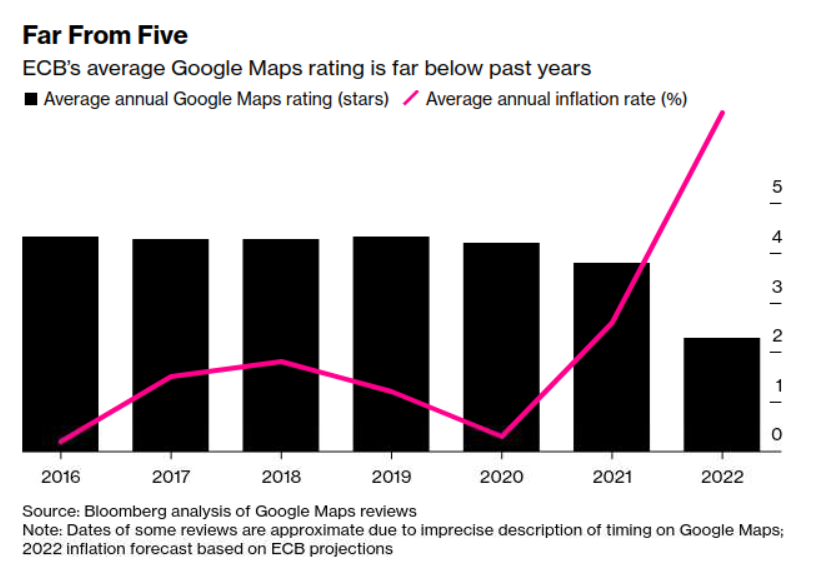

Angry Europeans Lower ECB’s Google Rating Amid Soaring Inflation

https://www.bloomberg.com/news/articles/2022-08-04/ecb-s-goo…

...

Critics of the European Central Bank have found a new way to vent their frustration, with a stream of poor ratings thrown at the Google Maps listing of its Frankfurt headquarters.

While such reviews on the search engine often focus on a building’s architecture or facilities, about half of the hundred or so left in the 10th anniversary year of its completion are complaints on the policies of President Christine Lagarde and her colleagues.

As a result, average ratings on Google Maps for the 45-story green-glass ECB tower have fallen significantly. Its entry has also attracted more reviews in the first seven months of 2022 alone than in any previous year.

Such frustration follows a surge in inflation that reached a euro-era record of 8.9% in July, the same month the ECB lifted borrowing costs for the first time in over a decade. The hesitation of officials to raise rates while global peers tightened has prompted criticism particularly in its home country of Germany.

One reviewer, Christoph H., posted a week ago that the ECB “is only focused on government financing through the back door.” A post by someone called Ludwig Berg a few days beforehand criticized politicians’ appointment of Lagarde, in view of “galloping inflation.” Reviews were posted in numerous languages, though many of the more critical ones were written in German.

...

...

Antwort auf Beitrag Nr.: 72.017.557 von faultcode am 20.07.22 12:03:55...

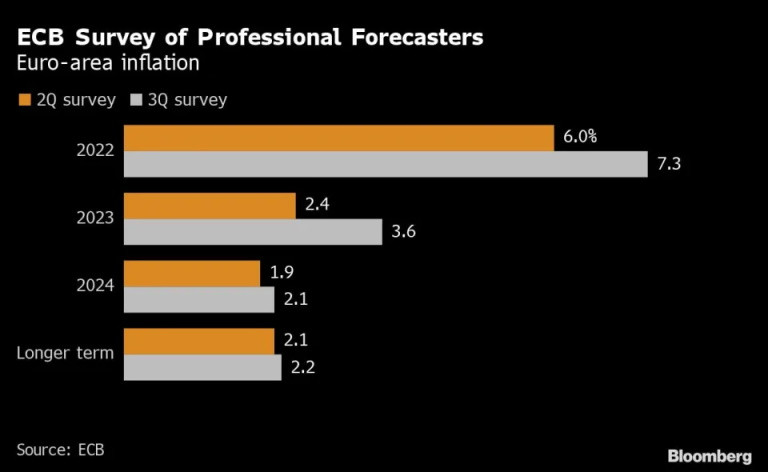

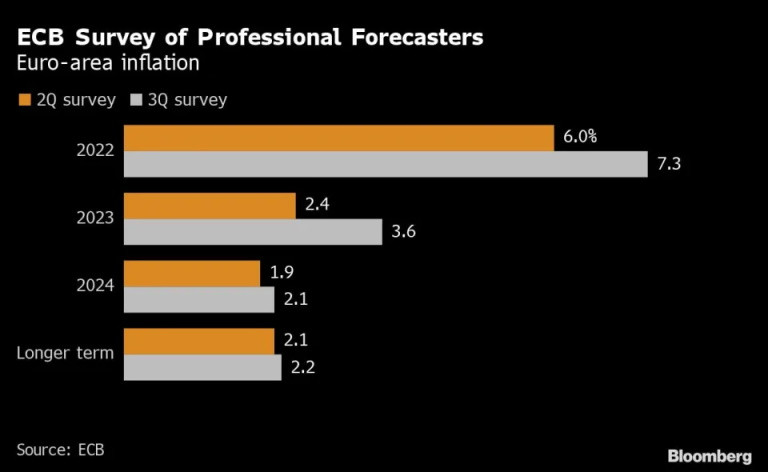

Professional forecasters surveyed by the European Central Bank raised their longer-term inflation outlook to 2.2% from 2.1% three months ago.

...

https://uk.finance.yahoo.com/news/ecb-survey-shows-inflation…

Professional forecasters surveyed by the European Central Bank raised their longer-term inflation outlook to 2.2% from 2.1% three months ago.

...

https://uk.finance.yahoo.com/news/ecb-survey-shows-inflation…

20.7.

ECB Aims for Bulletproof Crisis Tool Anticipating Legal Showdown

https://www.bnnbloomberg.ca/ecb-aims-for-bulletproof-crisis-…

...

...

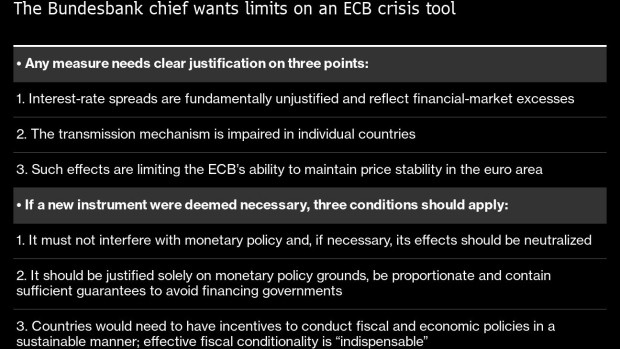

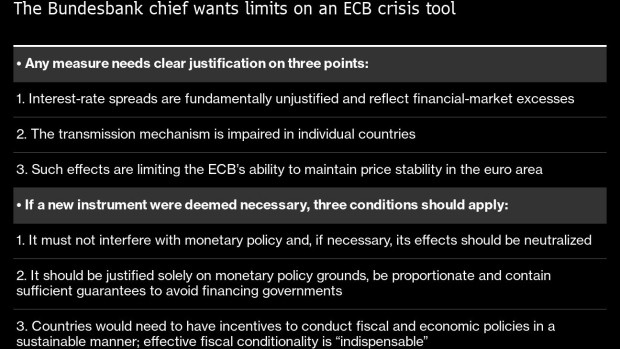

For European Central Bank officials devising a crisis tool that will be credible enough to keep the euro together, the biggest challenge may be to get it past the lawyers.

President Christine Lagarde and her colleagues know any measure they reveal on Thursday is likely to be scrutinized by Germany’s constitutional court. Every one of the ECB’s past bond-buying programs has provoked lawsuits, with each getting progressively more complicated to resolve.

Given that history, the Governing Council’s creation of a tool that can facilitate interest-rate increases while stemming subsequent market speculation on Italy’s public finances may involve more legal considerations than any monetary policy decision since the euro was founded.

The challenge is to ensure any plan conforms to the ECB’s mandate of delivering price stability and doesn’t directly finance governments. That means a decision, on when and under what circumstances it can buy bonds, needs to be matched by safeguards and conditions countries must fulfill in exchange.

“Managing spreads of individual member states is a minefield,” said Christoph Ohler, a law professor at the University of Jena in Germany.

...

ECB Aims for Bulletproof Crisis Tool Anticipating Legal Showdown

https://www.bnnbloomberg.ca/ecb-aims-for-bulletproof-crisis-…

...

...

For European Central Bank officials devising a crisis tool that will be credible enough to keep the euro together, the biggest challenge may be to get it past the lawyers.

President Christine Lagarde and her colleagues know any measure they reveal on Thursday is likely to be scrutinized by Germany’s constitutional court. Every one of the ECB’s past bond-buying programs has provoked lawsuits, with each getting progressively more complicated to resolve.

Given that history, the Governing Council’s creation of a tool that can facilitate interest-rate increases while stemming subsequent market speculation on Italy’s public finances may involve more legal considerations than any monetary policy decision since the euro was founded.

The challenge is to ensure any plan conforms to the ECB’s mandate of delivering price stability and doesn’t directly finance governments. That means a decision, on when and under what circumstances it can buy bonds, needs to be matched by safeguards and conditions countries must fulfill in exchange.

“Managing spreads of individual member states is a minefield,” said Christoph Ohler, a law professor at the University of Jena in Germany.

...

Milton Friedman Speaks: Money and Inflation, 1978:

https://twitter.com/FinanceLancelot/status/15428506777890406…

https://twitter.com/FinanceLancelot/status/15428506777890406…

30.6.

ECB to Ask Banks to Weigh Russian Gas Embargo in Dividend Plans

https://www.bnnbloomberg.ca/ecb-to-ask-banks-to-weigh-russia…

...

The European Central Bank plans to ask the region’s lenders to factor in the economic hit of a potential cut off of Russian gas when considering payouts to shareholders.

“We will propose to ask banks to recalculate their capital trajectories under a more adverse scenario including also potentially a gas embargo or a recession,” said Andrea Enria, who leads the ECB’s supervisory board. The watchdog would “use this also for the purpose of vetting their distribution plans going ahead.”

European banks have seen their prospects clouded as Russia’s invasion of Ukraine raises the possibility of a wave of soured loans given a spike in inflation and companies’ difficulty in sourcing commodities. That’s a stark difference to the beginning of the year when European banks were luring back investors with pledges to return billions of euros in capital via dividends and share buybacks.

...

ECB to Ask Banks to Weigh Russian Gas Embargo in Dividend Plans

https://www.bnnbloomberg.ca/ecb-to-ask-banks-to-weigh-russia…

...

The European Central Bank plans to ask the region’s lenders to factor in the economic hit of a potential cut off of Russian gas when considering payouts to shareholders.

“We will propose to ask banks to recalculate their capital trajectories under a more adverse scenario including also potentially a gas embargo or a recession,” said Andrea Enria, who leads the ECB’s supervisory board. The watchdog would “use this also for the purpose of vetting their distribution plans going ahead.”

European banks have seen their prospects clouded as Russia’s invasion of Ukraine raises the possibility of a wave of soured loans given a spike in inflation and companies’ difficulty in sourcing commodities. That’s a stark difference to the beginning of the year when European banks were luring back investors with pledges to return billions of euros in capital via dividends and share buybacks.

...

"Narrow Path"

Television interview on the sidelines of a conference to celebrate the 350th anniversary of the Riksbank in Stockholm, Sweden, on Friday, May 25, 2018. The central bank has embarked on an historic monetary easing program over the past years to bring back inflation, using a weaker krona to help achieve its goal. Photographer: Mikael Sjoberg/Bloomberg , Bloomberg

27.6.

Central Banks Have Narrow Path to Soft Landing, BIS Chief Says

https://www.bnnbloomberg.ca/central-banks-have-narrow-path-t…

Television interview on the sidelines of a conference to celebrate the 350th anniversary of the Riksbank in Stockholm, Sweden, on Friday, May 25, 2018. The central bank has embarked on an historic monetary easing program over the past years to bring back inflation, using a weaker krona to help achieve its goal. Photographer: Mikael Sjoberg/Bloomberg , Bloomberg

27.6.

Central Banks Have Narrow Path to Soft Landing, BIS Chief Says

https://www.bnnbloomberg.ca/central-banks-have-narrow-path-t…

so kann man das offensichtlich kompetenzbefreite Wirken von Frau Anungslos auch vornehmer umschreiben:

https://www.bloomberg.com/news/articles/2022-06-09/lagarde-s…

https://www.bloomberg.com/news/articles/2022-06-09/lagarde-s…

Antwort auf Beitrag Nr.: 71.635.473 von faultcode am 23.05.22 14:25:4711.9.2021

09.06.2022 - 13:54 Uhr

Leitzins soll im Juli steigen -- EZB leitet Zins-Wende ein

https://www.bild.de/geld/wirtschaft/wirtschaft/wirtschaft-in…

Die Europäische Zentralbank (EZB) beendet ihre milliardenschweren Netto-Anleihenkäufe zum 1. Juli und macht damit den Weg frei für die erste Zinserhöhung im Euroraum seit elf Jahren.

Das beschloss der EZB-Rat am Donnerstag bei seiner auswärtigen Sitzung in Amsterdam, wie die Notenbank in Frankfurt mitteilte.

Im Juli soll der Leitzins demnach um 0,25 Prozent steigen.

...

Zitat von faultcode: FRAU AHNUNGSLOS IN HOCHFORM:

11.9.2021

ECB’s Lagarde says a rate hike unlikely for 2022...

https://www.cnbc.com/2021/11/19/ecbs-lagarde-says-a-rate-hik…

...

09.06.2022 - 13:54 Uhr

Leitzins soll im Juli steigen -- EZB leitet Zins-Wende ein

https://www.bild.de/geld/wirtschaft/wirtschaft/wirtschaft-in…

Die Europäische Zentralbank (EZB) beendet ihre milliardenschweren Netto-Anleihenkäufe zum 1. Juli und macht damit den Weg frei für die erste Zinserhöhung im Euroraum seit elf Jahren.

Das beschloss der EZB-Rat am Donnerstag bei seiner auswärtigen Sitzung in Amsterdam, wie die Notenbank in Frankfurt mitteilte.

Im Juli soll der Leitzins demnach um 0,25 Prozent steigen.

...

8.6.

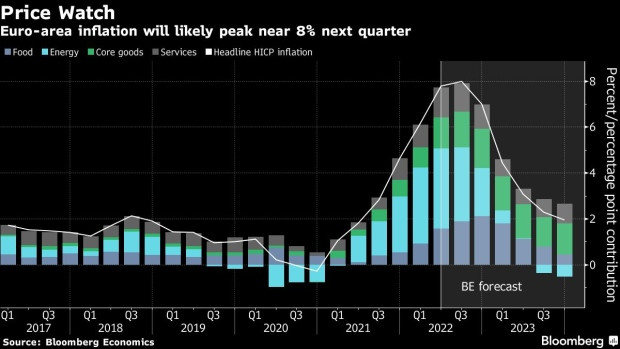

Euro-Area Inflation Is Set to Peak in Third Quarter

https://www.bnnbloomberg.ca/euro-area-inflation-is-set-to-pe…

BE = Bloomberg Economics