The gold mining stock as a Tenbagger - Die letzten 30 Beiträge

eröffnet am 14.06.17 02:30:00 von

neuester Beitrag 22.12.23 12:50:05 von

neuester Beitrag 22.12.23 12:50:05 von

Beiträge: 84

ID: 1.255.112

ID: 1.255.112

Aufrufe heute: 0

Gesamt: 4.120

Gesamt: 4.120

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 11:04 | 1754 | |

| 08.05.24, 11:56 | 1272 | |

| gestern 22:26 | 1046 | |

| vor 1 Stunde | 916 | |

| gestern 17:59 | 869 | |

| heute 09:58 | 767 | |

| vor 52 Minuten | 742 | |

| heute 10:46 | 698 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.772,85 | +0,46 | 131 | |||

| 2. | 3. | 0,2170 | +3,33 | 125 | |||

| 3. | Neu! | 8,2570 | +96,67 | 108 | |||

| 4. | 4. | 156,46 | -2,31 | 103 | |||

| 5. | 14. | 5,7540 | -2,18 | 56 | |||

| 6. | 2. | 0,2980 | -3,87 | 50 | |||

| 7. | 5. | 2,3720 | -7,54 | 49 | |||

| 8. | 7. | 6,8000 | +2,38 | 38 |

Beitrag zu dieser Diskussion schreiben

<Barrick Gold Corp vs VanEck Gold Miners ETF; beides in USD>

=> Barrick Gold als günstigerer Gold miner ETF

$GDX: Top 10 Holdings:

Company Symbol Total Net Assets

Newmont Corp. NEM 9.43%

Barrick Gold Corp. GOLD 8.91%

Franco-Nevada Corp. FNV 7.41%

Agnico Eagle Mines Ltd. AEM 7.36%

Wheaton Precious Metals Corp. WPM 6.08%

Gold Fields Ltd. ADR GFI 4.84%

Newmont Corp. CDI NEM 4.72%

Zijin Mining Group Co. Ltd. ZIJMF 4.25%

Northern Star Resources Ltd. NESRF 4.03%

AngloGold Ashanti PLC AU 3.59%

View Holdings As of 10/31/2023

https://www.marketwatch.com/investing/fund/gdx/holdings?mod=…

7.2.

Miners Face Too Many Woes in Emerging Markets, Alamos Says

https://finance.yahoo.com/news/miners-face-too-many-woes-163…

...

Panama’s tax dispute with First Quantum Minerals Ltd. over a giant copper mine underscores increasing political risks mining companies face in some regions, according to fellow Canadian metals producer Alamos Gold Inc.

“There are too many difficulties in emerging markets right now,” Chief Executive Officer John McCluskey said in a Monday interview. “Something goes wrong, and the government decides it wants to jack up your tax rate, or just make an accusation that you suddenly owe $200 million or more in back taxes, or something along those lines. I mean, companies have faced that kind of thing.”

McCluskey, 63, has firsthand experience with such political risks. Back in 2019, Turkey’s government declined to renew Alamos Gold’s permits for a project in the country, leading the CEO to shutter the company’s Turkish operations and then take the government to court for “unfair and inequitable treatment.”

Four years later, McCluskey said he’s still pursuing a $1 billion claim in an international court.

The fallout in Turkey has left the 20-year-old company with only North American assets. Alamos owns two gold mines in Canada and one in Mexico, where “you can actually go to sleep at night knowing your assets are secure,” McCluskey said. The company’s shares have risen 60% in the past year.

Panama’s feud with First Quantum has escalated in recent weeks, with the Central American government starting a negative ad campaign against the Vancouver-based company on Twitter and suspending its access to shipping on Monday.

...

Miners Face Too Many Woes in Emerging Markets, Alamos Says

https://finance.yahoo.com/news/miners-face-too-many-woes-163…

...

Panama’s tax dispute with First Quantum Minerals Ltd. over a giant copper mine underscores increasing political risks mining companies face in some regions, according to fellow Canadian metals producer Alamos Gold Inc.

“There are too many difficulties in emerging markets right now,” Chief Executive Officer John McCluskey said in a Monday interview. “Something goes wrong, and the government decides it wants to jack up your tax rate, or just make an accusation that you suddenly owe $200 million or more in back taxes, or something along those lines. I mean, companies have faced that kind of thing.”

McCluskey, 63, has firsthand experience with such political risks. Back in 2019, Turkey’s government declined to renew Alamos Gold’s permits for a project in the country, leading the CEO to shutter the company’s Turkish operations and then take the government to court for “unfair and inequitable treatment.”

Four years later, McCluskey said he’s still pursuing a $1 billion claim in an international court.

The fallout in Turkey has left the 20-year-old company with only North American assets. Alamos owns two gold mines in Canada and one in Mexico, where “you can actually go to sleep at night knowing your assets are secure,” McCluskey said. The company’s shares have risen 60% in the past year.

Panama’s feud with First Quantum has escalated in recent weeks, with the Central American government starting a negative ad campaign against the Vancouver-based company on Twitter and suspending its access to shipping on Monday.

...

23.1.

Yamana Gold Founder Says ‘Chatter’ Points to More Industry M&A

https://finance.yahoo.com/news/yamana-gold-founder-says-chat…

...

“I’m a bit jaded, because I’ve been talking about the need for consolidation for 19 years,” the executive chairman said in a Jan. 20 interview at Yamana’s Toronto headquarters. “But I do think we’ll finally begin to see some of it happening soon. I hear lots of chatter out there about other pending transactions.”

...

Marrone has advocated for consolidation in an industry that has wrestled with underinvestment and depleting reserves. Top gold miners including Newmont Corp. and Agnico have bulked up through acquisitions in recent years, catching the eye of investors. Still, a vast number of junior and mid-sized producers don’t get the same attention, and have struggled to raise capital.

“The result of all that is there’s not only less money to go around, but there’s less money that chases quality opportunities,” Marrone, 63, said.

That’s partly why Marrone plans to start a private equity venture aimed at investing in gold mines in his next career chapter. Along with Yamana Chief Executive Officer Daniel Racine, the pair want to find “hidden gems” — projects with the potential to produce higher grades at lower costs.

“There are examples of assets of companies that are trading at a fraction of what they should be trading at,” the founder said. “We’re looking at those and thinking: with some elbow grease, some smart investment and our competency, we’ll create added value.”

...

Yamana Gold Founder Says ‘Chatter’ Points to More Industry M&A

https://finance.yahoo.com/news/yamana-gold-founder-says-chat…

...

“I’m a bit jaded, because I’ve been talking about the need for consolidation for 19 years,” the executive chairman said in a Jan. 20 interview at Yamana’s Toronto headquarters. “But I do think we’ll finally begin to see some of it happening soon. I hear lots of chatter out there about other pending transactions.”

...

Marrone has advocated for consolidation in an industry that has wrestled with underinvestment and depleting reserves. Top gold miners including Newmont Corp. and Agnico have bulked up through acquisitions in recent years, catching the eye of investors. Still, a vast number of junior and mid-sized producers don’t get the same attention, and have struggled to raise capital.

“The result of all that is there’s not only less money to go around, but there’s less money that chases quality opportunities,” Marrone, 63, said.

That’s partly why Marrone plans to start a private equity venture aimed at investing in gold mines in his next career chapter. Along with Yamana Chief Executive Officer Daniel Racine, the pair want to find “hidden gems” — projects with the potential to produce higher grades at lower costs.

“There are examples of assets of companies that are trading at a fraction of what they should be trading at,” the founder said. “We’re looking at those and thinking: with some elbow grease, some smart investment and our competency, we’ll create added value.”

...

Antwort auf Beitrag Nr.: 69.113.390 von faultcode am 21.08.21 00:22:40$GDX -- VanEck Vectors Gold Miners ETF: heute man wieder Aufstand der Goldminer-Bullen:

mal schauen, wie nachhaltig. Jedensfalls lässt der RSI|14d noch Spielraum nach oben mMn.

mal schauen, wie nachhaltig. Jedensfalls lässt der RSI|14d noch Spielraum nach oben mMn.

< Tax loss selling in dieser Woche:

• Aurelius Minerals CAN): das zieht sich schier unendlich hin bis zu einer möglichen Produktion -- unter laufender Aktien-Verwässerung

• Newcore Gold (Ghana): das ist und bleibt mMn Low Grade -- auch wieder unter laufender Aktien-Verwässerung

• Pantoro (AUS): diese Story ist nun doch endgültig kaputt mMn (bei diesem Goldpreis und diesem Kosten-Niveau) -- das Konstrukt mit dem nicht-operativen Miteigentümer Tulla Resources (50%); Norseman Gold ja, aber nicht mehr in dieser Konstellation; Halls Creek (100%) ist auch nicht gerade der Burner

>

• Aurelius Minerals CAN): das zieht sich schier unendlich hin bis zu einer möglichen Produktion -- unter laufender Aktien-Verwässerung

• Newcore Gold (Ghana): das ist und bleibt mMn Low Grade -- auch wieder unter laufender Aktien-Verwässerung

• Pantoro (AUS): diese Story ist nun doch endgültig kaputt mMn (bei diesem Goldpreis und diesem Kosten-Niveau) -- das Konstrukt mit dem nicht-operativen Miteigentümer Tulla Resources (50%); Norseman Gold ja, aber nicht mehr in dieser Konstellation; Halls Creek (100%) ist auch nicht gerade der Burner

>

21.9.

Top Gold CEOs Say Soaring Costs Will Hobble Mining Industry Into 2023

https://www.bnnbloomberg.ca/top-gold-ceos-say-soaring-costs-…

...

The world’s top gold mining executives see cost pressures sticking around into next year, adding to industry headwinds fueled by economic and political uncertainty, supply-chain disruptions and surging interest rates.

...

“We find ourselves living in interesting times as the global economies and geopolitical environment hit another inflection point,” Mark Bristow, chief executive officer of Barrick Gold Corp., said at the Colorado confab. “It’s arguable that the last time we faced such uncertainty was the Second World War.”

...

The knock-on effects from the Covid-19 pandemic and impacts of Russia’s war in Ukraine are significant drivers of decades-high inflation, while a disrupted global supply chain has been adding to cost pressures for companies and consumers. Such issues are likely to linger as the Fed’s continues its aggressive monetary tightening, according to top mining executives.

“We’re in a very volatile economic environment at the moment,” Newmont Corp. CEO Tom Palmer said in an interview. “Look out the window: you see inflation, interest rates increasing, you’ve got the tragedy playing out in Ukraine. It’s a theme that’s broader than just the gold industry.”

Palmer, who leads the world’s largest gold miner, sees cost inflation in labor, fuel and energy, as well as materials and consumables “continuing into the better part of 2023.”

Rising costs are plaguing mining companies and their operations around the world. South Africa’s Gold Fields Ltd. has been dealing with high labor costs that are driving up expenses in Australia, where the company has nine operating mines, according to CEO Chris Griffith. While he has seen a cooling of fuel prices, other components key to mining, including explosives and reagents, haven’t come down yet thanks to persistent inflation.

“We’ll likely still see inflation at high levels for a significant period of time, although we’ve seen it flattening off,” Griffith said in an interview.

The Fed has been pursuing aggressive monetary tightening to bring down inflation, which has lifted bond yields and the dollar. Central banks around the world are pursuing similar hawkish measures. Such actions could make it challenging for single-asset producers and development companies that may not have the financing means to absorb costs and increase capital, according to Shaun Usmar, CEO of Triple Flag Precious Metals Corp.

“Those companies have seen stock prices come down a lot,” Usmar said in an interview. “The equity markets probably aren’t accessible -- if they are, it’s very expensive, very dilutive. Debt, if they can get it, is very expensive and is getting more expensive at the moment.”

Such an environment leaves room for mergers and consolidation, especially for miners with cash and a need to grow, said Usmar, who served as Barrick’s chief financial officer from 2014 to 2016.

“The best risk mitigator for any mining company is liquidity,” he said.

Top Gold CEOs Say Soaring Costs Will Hobble Mining Industry Into 2023

https://www.bnnbloomberg.ca/top-gold-ceos-say-soaring-costs-…

...

The world’s top gold mining executives see cost pressures sticking around into next year, adding to industry headwinds fueled by economic and political uncertainty, supply-chain disruptions and surging interest rates.

...

“We find ourselves living in interesting times as the global economies and geopolitical environment hit another inflection point,” Mark Bristow, chief executive officer of Barrick Gold Corp., said at the Colorado confab. “It’s arguable that the last time we faced such uncertainty was the Second World War.”

...

The knock-on effects from the Covid-19 pandemic and impacts of Russia’s war in Ukraine are significant drivers of decades-high inflation, while a disrupted global supply chain has been adding to cost pressures for companies and consumers. Such issues are likely to linger as the Fed’s continues its aggressive monetary tightening, according to top mining executives.

“We’re in a very volatile economic environment at the moment,” Newmont Corp. CEO Tom Palmer said in an interview. “Look out the window: you see inflation, interest rates increasing, you’ve got the tragedy playing out in Ukraine. It’s a theme that’s broader than just the gold industry.”

Palmer, who leads the world’s largest gold miner, sees cost inflation in labor, fuel and energy, as well as materials and consumables “continuing into the better part of 2023.”

Rising costs are plaguing mining companies and their operations around the world. South Africa’s Gold Fields Ltd. has been dealing with high labor costs that are driving up expenses in Australia, where the company has nine operating mines, according to CEO Chris Griffith. While he has seen a cooling of fuel prices, other components key to mining, including explosives and reagents, haven’t come down yet thanks to persistent inflation.

“We’ll likely still see inflation at high levels for a significant period of time, although we’ve seen it flattening off,” Griffith said in an interview.

The Fed has been pursuing aggressive monetary tightening to bring down inflation, which has lifted bond yields and the dollar. Central banks around the world are pursuing similar hawkish measures. Such actions could make it challenging for single-asset producers and development companies that may not have the financing means to absorb costs and increase capital, according to Shaun Usmar, CEO of Triple Flag Precious Metals Corp.

“Those companies have seen stock prices come down a lot,” Usmar said in an interview. “The equity markets probably aren’t accessible -- if they are, it’s very expensive, very dilutive. Debt, if they can get it, is very expensive and is getting more expensive at the moment.”

Such an environment leaves room for mergers and consolidation, especially for miners with cash and a need to grow, said Usmar, who served as Barrick’s chief financial officer from 2014 to 2016.

“The best risk mitigator for any mining company is liquidity,” he said.

mal wieder ein krasser Gold miner-Bärenmarkt zur Zeit:

<Gold Miners index stocks above 200 EMA index>

<PHLX Gold/Silver Index>

=> das wird mMn auch noch Tage oder sogar ein paar Wochen so weitergehen

<Gold Miners index stocks above 200 EMA index>

<PHLX Gold/Silver Index>

=> das wird mMn auch noch Tage oder sogar ein paar Wochen so weitergehen

31.5.

More Gold Deals Are in the Works If Yamana Is Any Gauge

https://www.bnnbloomberg.ca/more-gold-deals-are-in-the-works…

...

Yamana Gold Inc. considered other options before agreeing to be acquired by Gold Fields Ltd. for about US$7 billion, suggesting there are discussions for other prospective deals in the gold industry, the Canadian firm’s executive chairman said.

“We cannot be, and should not be, the only company that is considering being part of something bigger,” Peter Marrone said in an interview Tuesday after the agreement with Gold Fields was announced.

Marrone, who has been a vocal proponent of consolidation in an industry that has faced under-investment and depleting reserves, is confident that Yamana shareholders will approve the Gold Fields deal, describing investor sentiment as “very positive” on terms.

“I would be pretending if I told you that this was the only deal that we had looked at or considered,” he said. “That suggests to me that there is a willingness on the part of participants in my industry to look at consolidation.”

Yamana rose as much as 13 per cent, the most in two years, after it received the friendly bid from Gold Fields. Yamana has mines in Canada, Argentina, Chile and Brazil, and Gold Fields said the deal fits with its strategy of expanding in “mining friendly” jurisdictions across the Americas.

The tie-up is the latest in a revived shift toward consolidation in the gold industry over the past year. Newcrest Mining Ltd. agreed in November to buy Pretium Resources Inc. Rising costs are offsetting gains from elevated gold prices, while projects are getting pricier and trickier to develop, providing further impetus for companies to seek savings via deals.

Marrone said discussions in the industry seem to be taking place. “Anecdotally, they’ve been taking place with us, so that suggest they’ve been taking place more broadly as well,” he said.

=> Yamana Gold [CAD]:

<keine Position>

More Gold Deals Are in the Works If Yamana Is Any Gauge

https://www.bnnbloomberg.ca/more-gold-deals-are-in-the-works…

...

Yamana Gold Inc. considered other options before agreeing to be acquired by Gold Fields Ltd. for about US$7 billion, suggesting there are discussions for other prospective deals in the gold industry, the Canadian firm’s executive chairman said.

“We cannot be, and should not be, the only company that is considering being part of something bigger,” Peter Marrone said in an interview Tuesday after the agreement with Gold Fields was announced.

Marrone, who has been a vocal proponent of consolidation in an industry that has faced under-investment and depleting reserves, is confident that Yamana shareholders will approve the Gold Fields deal, describing investor sentiment as “very positive” on terms.

“I would be pretending if I told you that this was the only deal that we had looked at or considered,” he said. “That suggests to me that there is a willingness on the part of participants in my industry to look at consolidation.”

Yamana rose as much as 13 per cent, the most in two years, after it received the friendly bid from Gold Fields. Yamana has mines in Canada, Argentina, Chile and Brazil, and Gold Fields said the deal fits with its strategy of expanding in “mining friendly” jurisdictions across the Americas.

The tie-up is the latest in a revived shift toward consolidation in the gold industry over the past year. Newcrest Mining Ltd. agreed in November to buy Pretium Resources Inc. Rising costs are offsetting gains from elevated gold prices, while projects are getting pricier and trickier to develop, providing further impetus for companies to seek savings via deals.

Marrone said discussions in the industry seem to be taking place. “Anecdotally, they’ve been taking place with us, so that suggest they’ve been taking place more broadly as well,” he said.

=> Yamana Gold [CAD]:

<keine Position>

30.3.

Gold mining costs remain stable but could rise soon

https://www.kitco.com/news/2022-03-30/Gold-mining-costs-rema…

...

The average cost of mining gold in 2021 stood at $1,129/oz in Q4’21, almost unchanged from the previous quarter. The static nature of the cost is somewhat of a surprise as inflation had kicked into a degree at that stage in time.

Inputs such as fuel, energy, and labor played a significant role in pushing global all-in Sustaining Costs (AISC) from $972/oz in Q2 2020 to $1,131/oz in Q3 2021 (+14%).

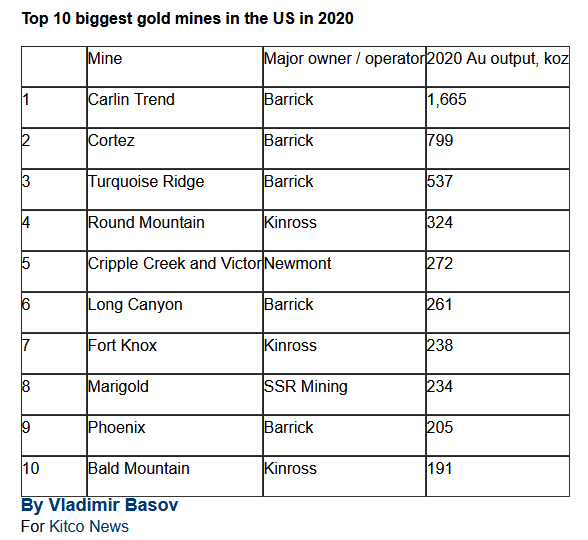

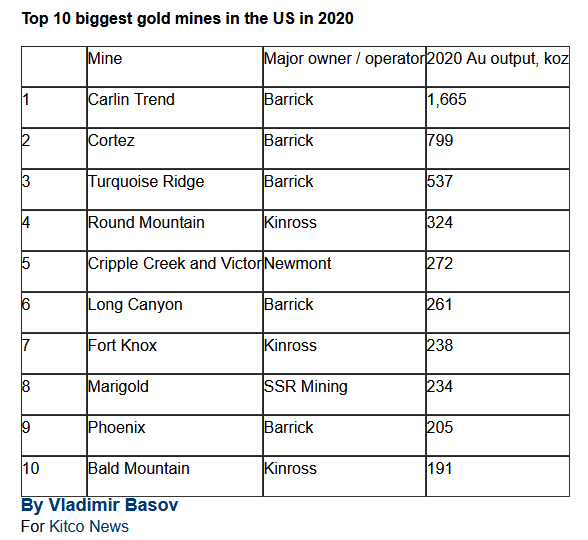

In regards to the grades mined, higher grade ore at several major gold mines, particularly at Barrick and Newmont’s JV mines in Nevada Carlin, Cortez, and Turquoise Ridge. The rise in average grades increases the amount of gold produced per tonne of rock mined and processed, thus effectively lowering costs on a unit basis, according to data acquired by Metals Focus.

Adam Webb, Director of Mine Supply at Metals Focus noted "Average margins were squeezed by these rising costs, but remain high on a historical basis. Despite a 6% y-o-y reduction, at US731/oz they remained comfortably above the peak of US$552/oz reached in 2012, during the last bull run in gold."

He also added, "Should the gold price remain strong in 2022 then gold miners should continue to generate high margins, notwithstanding further pressure from continued cost inflation."

Gold mining costs remain stable but could rise soon

https://www.kitco.com/news/2022-03-30/Gold-mining-costs-rema…

...

The average cost of mining gold in 2021 stood at $1,129/oz in Q4’21, almost unchanged from the previous quarter. The static nature of the cost is somewhat of a surprise as inflation had kicked into a degree at that stage in time.

Inputs such as fuel, energy, and labor played a significant role in pushing global all-in Sustaining Costs (AISC) from $972/oz in Q2 2020 to $1,131/oz in Q3 2021 (+14%).

In regards to the grades mined, higher grade ore at several major gold mines, particularly at Barrick and Newmont’s JV mines in Nevada Carlin, Cortez, and Turquoise Ridge. The rise in average grades increases the amount of gold produced per tonne of rock mined and processed, thus effectively lowering costs on a unit basis, according to data acquired by Metals Focus.

Adam Webb, Director of Mine Supply at Metals Focus noted "Average margins were squeezed by these rising costs, but remain high on a historical basis. Despite a 6% y-o-y reduction, at US731/oz they remained comfortably above the peak of US$552/oz reached in 2012, during the last bull run in gold."

He also added, "Should the gold price remain strong in 2022 then gold miners should continue to generate high margins, notwithstanding further pressure from continued cost inflation."

HUI (NYSE Arca Gold BUGS index) to SPX (S&P 500) ratio:

https://investmentresearchdynamics.com/financial-markets/fed…

https://investmentresearchdynamics.com/financial-markets/fed…

Antwort auf Beitrag Nr.: 69.496.662 von faultcode am 04.10.21 15:46:23M&A bei KL und PVG zeigen mMn eines ganz klar: kaufen, solange es noch günstig ist (was immer der Markt darunter versteht):

https://www.gurufocus.com/stock/PVG/summary?search=pvg

https://www.gurufocus.com/stock/PVG/summary?search=pvg

Kursrückgänge an der TSX 2021:

yellow = precious metals

https://twitter.com/GrantMBeasley/status/1443905927388835842

yellow = precious metals

https://twitter.com/GrantMBeasley/status/1443905927388835842

June 2021

Is conventional wisdom about resource taxation correct? Mining evidence from transparency reporting

https://www.sciencedirect.com/science/article/pii/S0305750X2…

...

In line with investment decision theory, our model predicts that governments should decrease their take on mining operations to compensate multinational corporate investors for increased local development costs and political and macroeconomic risk.

However, our empirical investigation shows that higher country risk is actually associated with greater government take.

Extending the model, we find that political economy variables have as much predictive power in explaining the government take as the basic investment theory model.

...

Is conventional wisdom about resource taxation correct? Mining evidence from transparency reporting

https://www.sciencedirect.com/science/article/pii/S0305750X2…

...

In line with investment decision theory, our model predicts that governments should decrease their take on mining operations to compensate multinational corporate investors for increased local development costs and political and macroeconomic risk.

However, our empirical investigation shows that higher country risk is actually associated with greater government take.

Extending the model, we find that political economy variables have as much predictive power in explaining the government take as the basic investment theory model.

...

$GDX -- VanEck Vectors Gold Miners ETF

--> leichte Erholung in Sicht?

Mir ist aufgefallen, daß einige Miner aus der zweiten und dritten Reihe (Aura Minerals z.B.) ein sattes Plus in Toronto hinlegten.

Ohne News.

--> leichte Erholung in Sicht?

Mir ist aufgefallen, daß einige Miner aus der zweiten und dritten Reihe (Aura Minerals z.B.) ein sattes Plus in Toronto hinlegten.

Ohne News.

Antwort auf Beitrag Nr.: 68.771.483 von faultcode am 14.07.21 12:47:17

https://twitter.com/goldstocktrades/status/14247490407182909…

https://twitter.com/goldstocktrades/status/14247490407182909…

Antwort auf Beitrag Nr.: 68.771.483 von faultcode am 14.07.21 12:47:17die großen Miner werden offenbar nicht mehr weiter abverkauft, während Gold so dahindümpelt.

Das kann aber auch damit zu tun haben, daß diese oft (viel) weniger Probleme haben ausreichend Personal (in CAN z.B.) zu finden.

Die kleinen tun sich hier z.Z. sehr schwer, obwohl auch Newmont letzte Woche auf (stark) gestiegene Personalkosten hinwies.

Das kann aber auch damit zu tun haben, daß diese oft (viel) weniger Probleme haben ausreichend Personal (in CAN z.B.) zu finden.

Die kleinen tun sich hier z.Z. sehr schwer, obwohl auch Newmont letzte Woche auf (stark) gestiegene Personalkosten hinwies.

https://docsend.com/view/adwmdeeyfvqwecj2

MAY 2021

On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question

Galaxy Digital Mining

Rachel Rybarczyk, Drew Armstrong & Amanda Fabiano

=>

MAY 2021

On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question

Galaxy Digital Mining

Rachel Rybarczyk, Drew Armstrong & Amanda Fabiano

=>

Antwort auf Beitrag Nr.: 67.714.075 von faultcode am 06.04.21 13:53:30

https://www.kitco.com/news/2021-04-09/The-world-s-top-10-lar…

https://www.kitco.com/news/2021-04-09/The-world-s-top-10-lar…

Antwort auf Beitrag Nr.: 67.712.005 von haowenshan am 06.04.21 11:45:30

das was in meinem Portfolio ist und Ex-Werte ab und zu. Also sehr breit gestreut.

Zuetzt kaufte ich Kinross, Kirkland, Wallbridge und Hycroft nach.

Zitat von haowenshan: ...

was für goldminenbetreiber hast du sonst noch auf dem radar?

...

das was in meinem Portfolio ist und Ex-Werte ab und zu. Also sehr breit gestreut.

Zuetzt kaufte ich Kinross, Kirkland, Wallbridge und Hycroft nach.

Antwort auf Beitrag Nr.: 67.704.031 von faultcode am 05.04.21 13:43:48

https://www.kitco.com/news/2021-04-05/Top-10-biggest-gold-mi…

https://www.kitco.com/news/2021-04-05/Top-10-biggest-gold-mi…

Antwort auf Beitrag Nr.: 67.229.817 von faultcode am 27.02.21 01:38:03

ich bin jetzt durch zufall auf der suche nach "brauchbareren" allg. goldthreads hierher gestoßen. interessante, kontroversielle anregungen (gold weniger hedge gegen krisen (?)). ich bin immer noch unschlüssig, ob ein gold etf nicht vernünftiger ist als direkt in minen zu gehen.

was für goldminenbetreiber hast du sonst noch auf dem radar?

(ich hab ein paar ansichtsstücke von centamin, klar gibt es da risiken, aber die sind doch bei den von dir genannten genauso da, zb orvana minerals, sind die nicht in bolivien tätig? kann jederzeit was passieren, zb https://www.tagesspiegel.de/politik/rohstoff-export-bolivien… )

Zitat von faultcode: Fundamental günstige (Gold) miner bzw. Explorer (ohne zu hohe Risiken in der Jurisdiktion (*)):

(keine Vollständigkeit)

KBV < 1 (B: 2020Q3 || 2020Q4; K: 26.2.2021):

• EASTERN PLATINUM: ~0.5 (Pt)

• Orvana Minerals: ~0.6

• White Gold: ~0.6 (Explorer)

(*) natürlich ist z.B. eine Centamin plc fundamental günstig und vermutlich derzeit der beste Dividendenzahler unter den Goldminern.

ich bin jetzt durch zufall auf der suche nach "brauchbareren" allg. goldthreads hierher gestoßen. interessante, kontroversielle anregungen (gold weniger hedge gegen krisen (?)). ich bin immer noch unschlüssig, ob ein gold etf nicht vernünftiger ist als direkt in minen zu gehen.

was für goldminenbetreiber hast du sonst noch auf dem radar?

(ich hab ein paar ansichtsstücke von centamin, klar gibt es da risiken, aber die sind doch bei den von dir genannten genauso da, zb orvana minerals, sind die nicht in bolivien tätig? kann jederzeit was passieren, zb https://www.tagesspiegel.de/politik/rohstoff-export-bolivien… )

5.4.

...gold miners had most profitable year ever

https://www.kitco.com/commentaries/2021-03-30/New-research-g…

ein paar mMn interessante Aussagen des CEO's von Agnico Eagle, Alden Greenhouse:

9.3.

Despite the commodity run, don't expect an exploration spending spike..

https://www.kitco.com/news/2021-03-08/Despite-the-commodity-…

...

Agnico Eagle's Alden Greenhouse does not expect a repeat of 2010 exploration spending spree.

Greenhouse was speaking at the Financing in the Junior Markets on Monday at the Prospectors & Developers Association of Canada's (PDAC). Greenhouse is VP of corporate development and business strategy at Agnico Eagles Mines (TSE:AEM).

2010 was an exuberant year. With government stimulus to help the economy recover from the 2008 financial crisis, commodity prices spiked. Globally, nonferrous exploration budgets in 2010 totaled $11.2 billion, up 45% from 2009, according to a study done by Metals Economics Group.

This time around, expect less froth.

"There is much stricter financial capital allocation," said Greenhouse during his talk.

Greenhouse said juniors are a necessary part of the mining ecosystem and fill many niches that miners are unable.

"Do we need junior companies? The answer is obviously yes. We can't do it all. Juniors are a key incubator for the start of the pipeline for a lot of the senior companies," said Greenhouse.

"One of the less obvious roles is that juniors provide a first contact point for a lot of key stakeholders," said Greenhouse who noted that communities with no knowledge of mining may first encounter juniors as their first experience close-up with the resource sector.

Juniors also provide seniors with more flexibility. For example, Greenhouse said that Agnico's focus is to search out opportunities in low-risk regions. Greenhouse said Agnico can use juniors to test out regions where Agnico chooses not to work yet.

"It allows us to dip our toes," he said.

In the investing commmunity, juniors also attract a different type of investor with a different type of risk profile. A junior can provide returns that a miner is not able.

"[Juniors] tend to attract investors with a little more risk tolerance... You can't really expect to get 10-, 20-, 30-times returns from a senior."

Asked how a junior can get a senior company's attention and potentially get a deal, Alden said Agnico already has teams in various jurisdictions and keeps tabs on the junior space.

"We probably know about you already," said Alden.

Rather, deals need to happen through communication. Even if it is a great project, there are many demands on capital and timing may not be right.

Greenhouse said juniors just need to concentrate on keeping the lines of communication open for when the time is right.

___

gut, das muss nicht für alle Senior miners (in North America) gelten; aber eine Grundstimmung meine ich hier schon zu erkennen.

Denn die Senior miners beonachten sich ja auch gegenseitig - auch wenn das natürlich oben nicht steht (und er es vermutlich auch nicht sagte...)

9.3.

Despite the commodity run, don't expect an exploration spending spike..

https://www.kitco.com/news/2021-03-08/Despite-the-commodity-…

...

Agnico Eagle's Alden Greenhouse does not expect a repeat of 2010 exploration spending spree.

Greenhouse was speaking at the Financing in the Junior Markets on Monday at the Prospectors & Developers Association of Canada's (PDAC). Greenhouse is VP of corporate development and business strategy at Agnico Eagles Mines (TSE:AEM).

2010 was an exuberant year. With government stimulus to help the economy recover from the 2008 financial crisis, commodity prices spiked. Globally, nonferrous exploration budgets in 2010 totaled $11.2 billion, up 45% from 2009, according to a study done by Metals Economics Group.

This time around, expect less froth.

"There is much stricter financial capital allocation," said Greenhouse during his talk.

Greenhouse said juniors are a necessary part of the mining ecosystem and fill many niches that miners are unable.

"Do we need junior companies? The answer is obviously yes. We can't do it all. Juniors are a key incubator for the start of the pipeline for a lot of the senior companies," said Greenhouse.

"One of the less obvious roles is that juniors provide a first contact point for a lot of key stakeholders," said Greenhouse who noted that communities with no knowledge of mining may first encounter juniors as their first experience close-up with the resource sector.

Juniors also provide seniors with more flexibility. For example, Greenhouse said that Agnico's focus is to search out opportunities in low-risk regions. Greenhouse said Agnico can use juniors to test out regions where Agnico chooses not to work yet.

"It allows us to dip our toes," he said.

In the investing commmunity, juniors also attract a different type of investor with a different type of risk profile. A junior can provide returns that a miner is not able.

"[Juniors] tend to attract investors with a little more risk tolerance... You can't really expect to get 10-, 20-, 30-times returns from a senior."

Asked how a junior can get a senior company's attention and potentially get a deal, Alden said Agnico already has teams in various jurisdictions and keeps tabs on the junior space.

"We probably know about you already," said Alden.

Rather, deals need to happen through communication. Even if it is a great project, there are many demands on capital and timing may not be right.

Greenhouse said juniors just need to concentrate on keeping the lines of communication open for when the time is right.

___

gut, das muss nicht für alle Senior miners (in North America) gelten; aber eine Grundstimmung meine ich hier schon zu erkennen.

Denn die Senior miners beonachten sich ja auch gegenseitig - auch wenn das natürlich oben nicht steht (und er es vermutlich auch nicht sagte...)

Antwort auf Beitrag Nr.: 67.229.817 von faultcode am 27.02.21 01:38:03

Fundamental günstige (Gold) miner bzw. Explorer (ohne zu hohe Risiken in der Jurisdiktion (*)):

(keine Vollständigkeit)

KBV < 1 (B: 2020Q3 || 2020Q4; K: 26.2.2021):

• EASTERN PLATINUM: ~0.5 (Pt)

• Orvana Minerals: ~0.6

• White Gold: ~0.6 (Explorer)

___

(*) natürlich ist z.B. eine Centamin plc fundamental günstig und vermutlich derzeit der beste Dividendenzahler unter den Goldminern.

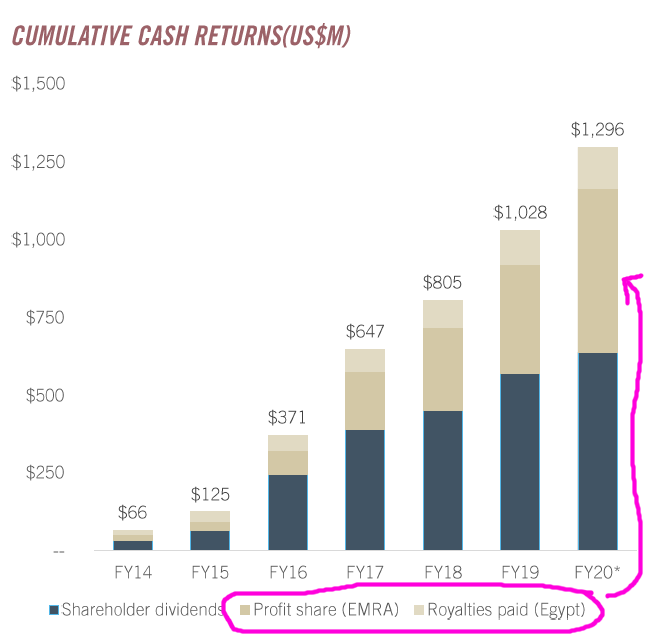

Aber schon auf Folie 5/39 vom Februar 2021 heißt es:

"COMMITMENT TO STAKEHOLDER RETURNS"

da lesen viele halt nicht mehr weiter, obwohl es eine Folie weiter heißt:

"COMMITMENT TO SHAREHOLDER RETURNS"

...denn sie erinnern sich vielleicht an das:

In October 2012 Centamin's licence for the Sukarim mine was annulled by an Egyptian court.

In solchen Jurisdiktionen weiß kein Außenstehender, was der morgige Tag bringen wird. Gerne mal "eine neue Situation". Und spätestens bei so einem Diagramm ist Schluss mit lustig:

..und man denkt sich: wieso betreibt der ägyptische Staat (=ägyptisches Militär) seine Goldmine eigentlich nicht gleich selber?

(keine Vollständigkeit)

KBV < 1 (B: 2020Q3 || 2020Q4; K: 26.2.2021):

• EASTERN PLATINUM: ~0.5 (Pt)

• Orvana Minerals: ~0.6

• White Gold: ~0.6 (Explorer)

___

(*) natürlich ist z.B. eine Centamin plc fundamental günstig und vermutlich derzeit der beste Dividendenzahler unter den Goldminern.

Aber schon auf Folie 5/39 vom Februar 2021 heißt es:

"COMMITMENT TO STAKEHOLDER RETURNS"

da lesen viele halt nicht mehr weiter, obwohl es eine Folie weiter heißt:

"COMMITMENT TO SHAREHOLDER RETURNS"

...denn sie erinnern sich vielleicht an das:

In October 2012 Centamin's licence for the Sukarim mine was annulled by an Egyptian court.

In solchen Jurisdiktionen weiß kein Außenstehender, was der morgige Tag bringen wird. Gerne mal "eine neue Situation". Und spätestens bei so einem Diagramm ist Schluss mit lustig:

..und man denkt sich: wieso betreibt der ägyptische Staat (=ägyptisches Militär) seine Goldmine eigentlich nicht gleich selber?

...

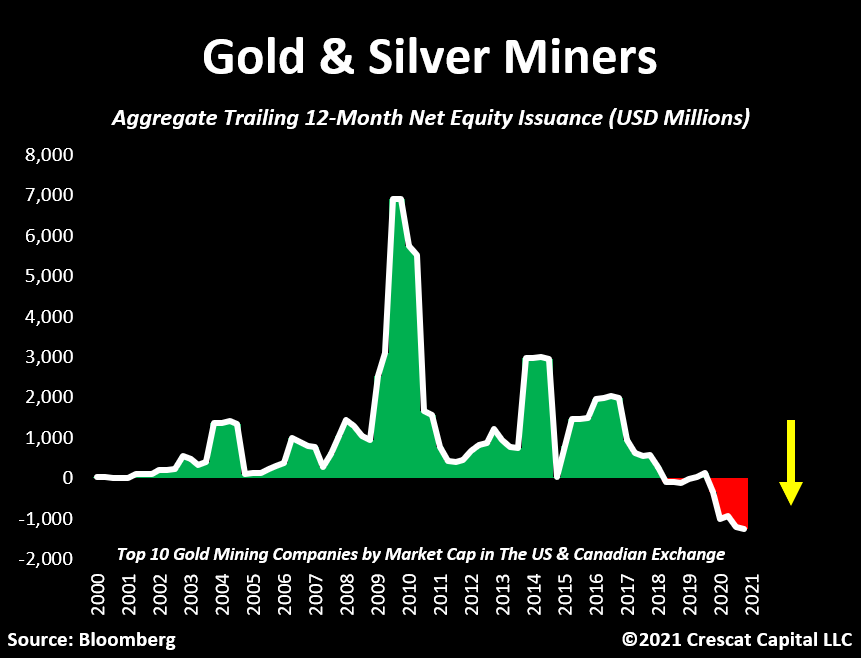

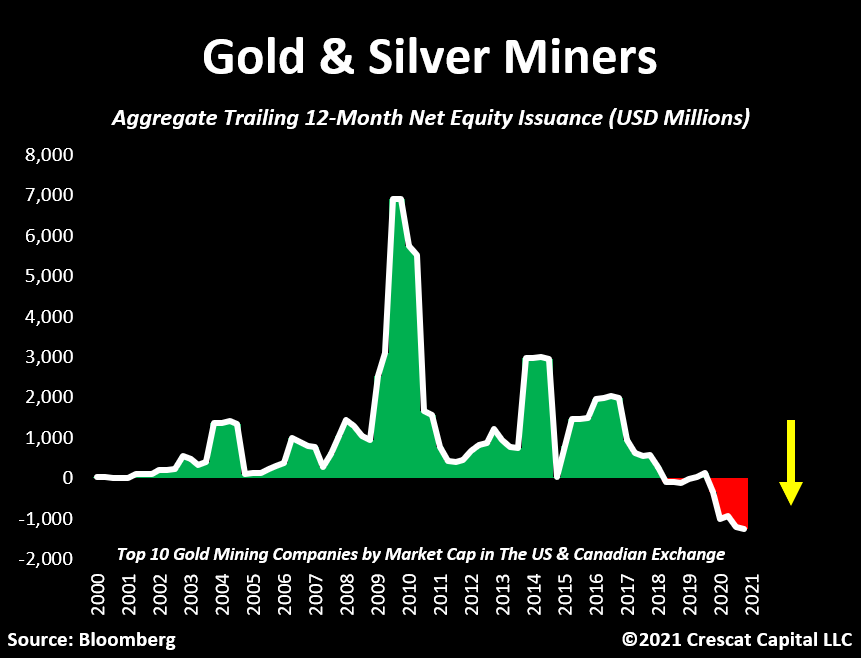

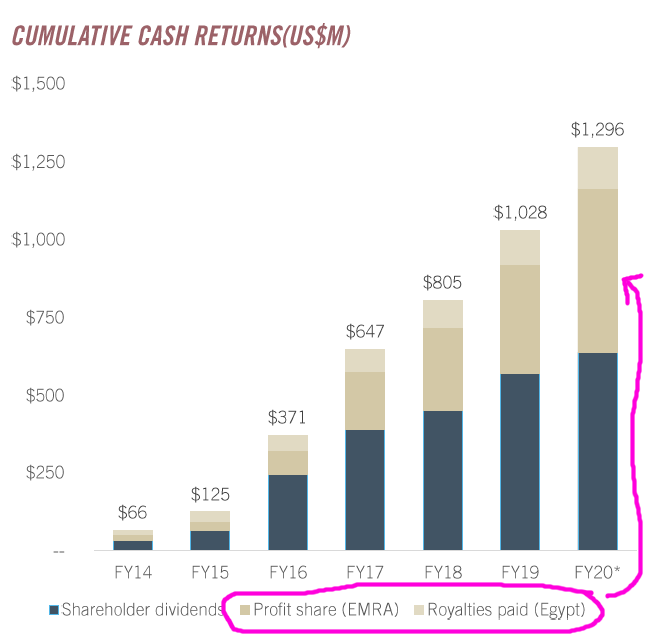

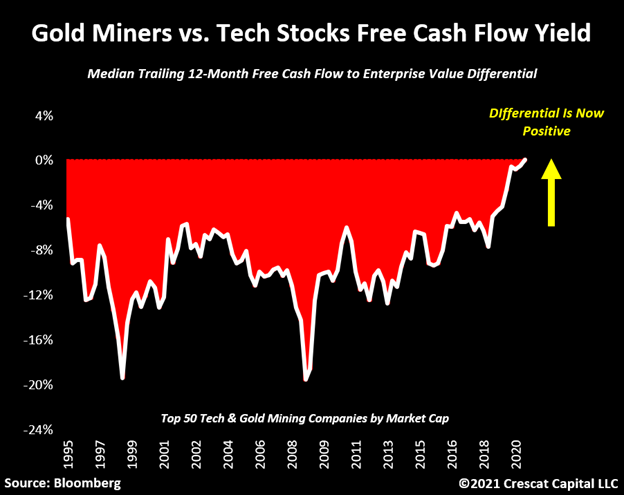

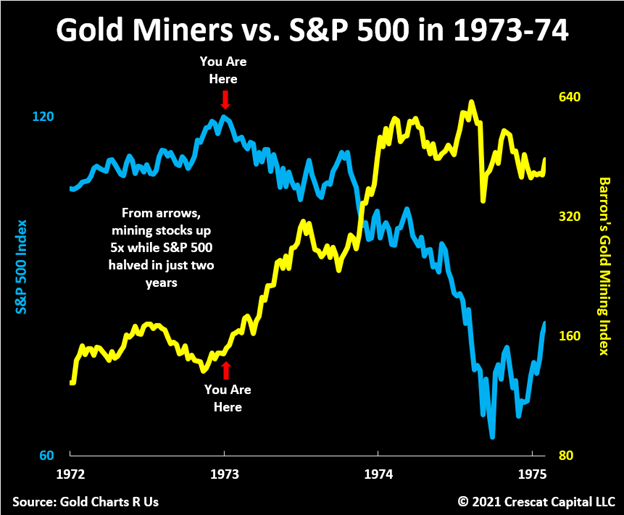

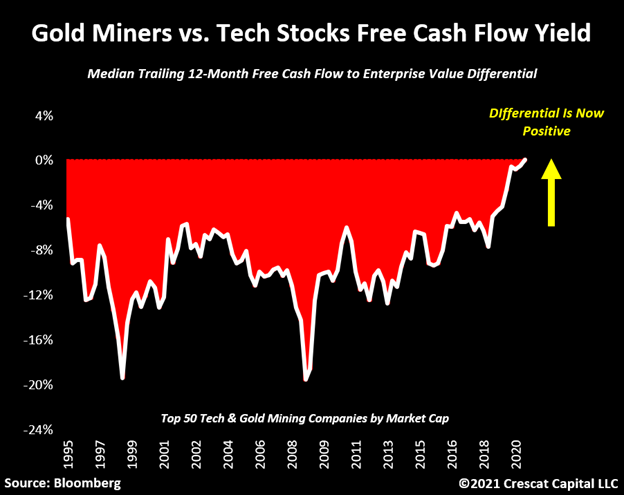

The opportunity for buying gold stocks and selling overvalued large cap growth stocks appears like 1972. In just two years in 1973-74, the S&P 500 declined 50% while gold stocks increased five-fold!

...

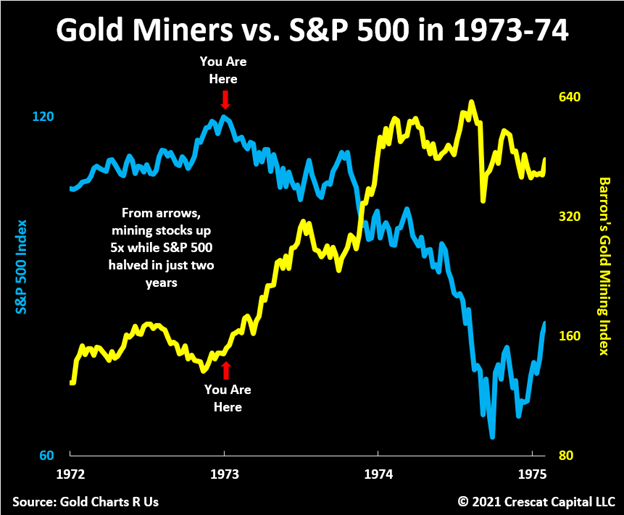

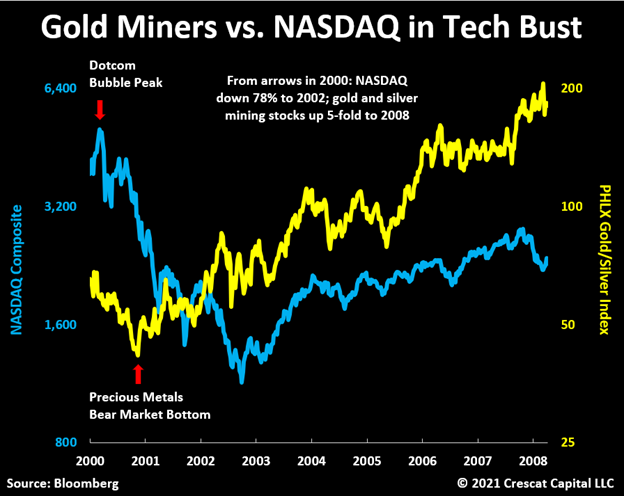

Similarly, from the peak of the tech bubble, the NASDAQ Composite declined 78% in just two and half years while gold and silver mining equites would soon begin a new secular bull market.

...

A significant part of our bullish case for precious metal miners is the valuation of the top producers relative to not only the overall equity market but especially in comparison with high-flying growth stocks. For the first time in 25 years, gold and silver mining companies now trade with a higher free cash flow yield than tech stocks. We believe this truly is a new era for precious metals’ companies that for a long time have been labeled as capital destroyers.

...

28.1.

Crescat Capital Quarterly Investor Letter Q4 2020

https://www.crescat.net/crescat-capital-quarterly-investor-l…

The opportunity for buying gold stocks and selling overvalued large cap growth stocks appears like 1972. In just two years in 1973-74, the S&P 500 declined 50% while gold stocks increased five-fold!

...

Similarly, from the peak of the tech bubble, the NASDAQ Composite declined 78% in just two and half years while gold and silver mining equites would soon begin a new secular bull market.

...

A significant part of our bullish case for precious metal miners is the valuation of the top producers relative to not only the overall equity market but especially in comparison with high-flying growth stocks. For the first time in 25 years, gold and silver mining companies now trade with a higher free cash flow yield than tech stocks. We believe this truly is a new era for precious metals’ companies that for a long time have been labeled as capital destroyers.

...

28.1.

Crescat Capital Quarterly Investor Letter Q4 2020

https://www.crescat.net/crescat-capital-quarterly-investor-l…

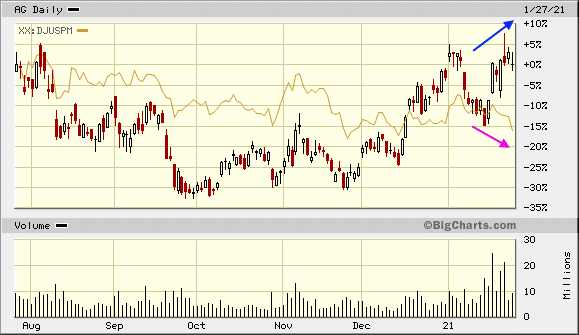

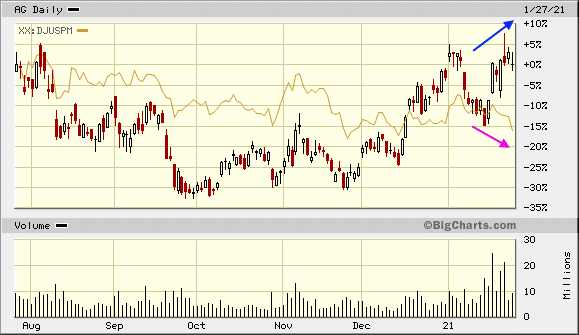

r/wallstreetbets -- WSB:

nun sollen die PM-Miner drankommen. Bei AG (First Majestic Silver) wurde wohl ein Anfang gemacht:

28.1.

Is The Reddit Rebellion About To Descend On The Precious Metals Market?

https://www.zerohedge.com/markets/reddit-rebellion-about-des…

nun sollen die PM-Miner drankommen. Bei AG (First Majestic Silver) wurde wohl ein Anfang gemacht:

28.1.

Is The Reddit Rebellion About To Descend On The Precious Metals Market?

https://www.zerohedge.com/markets/reddit-rebellion-about-des…

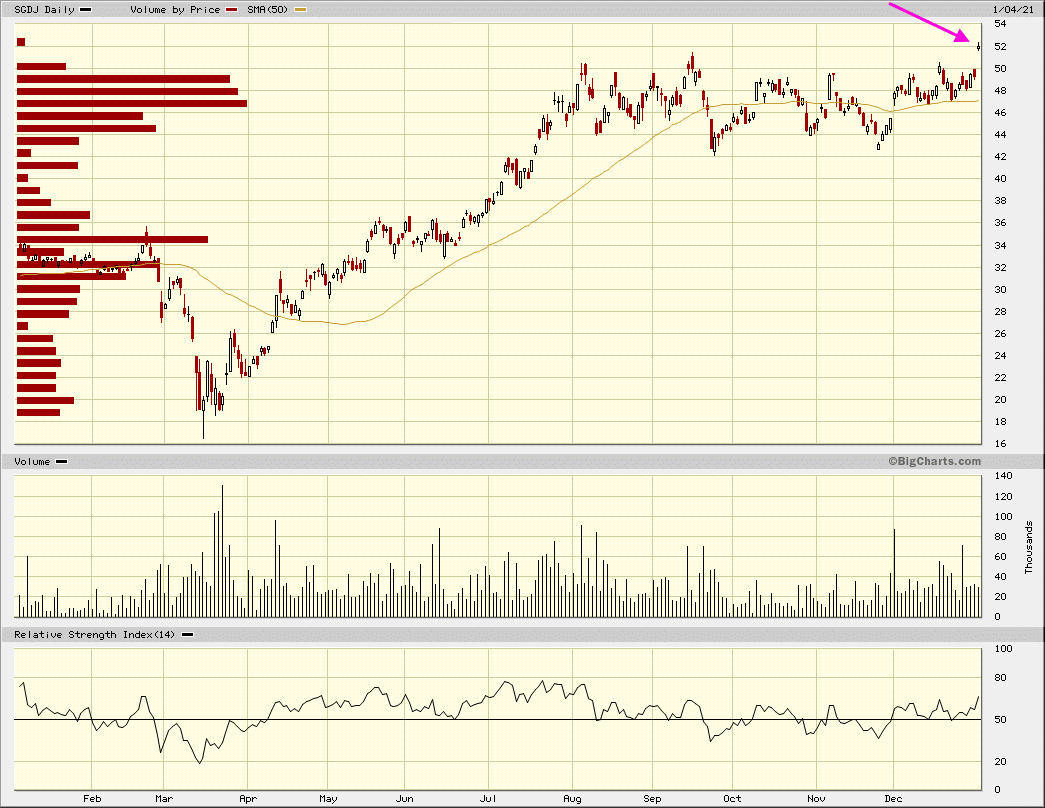

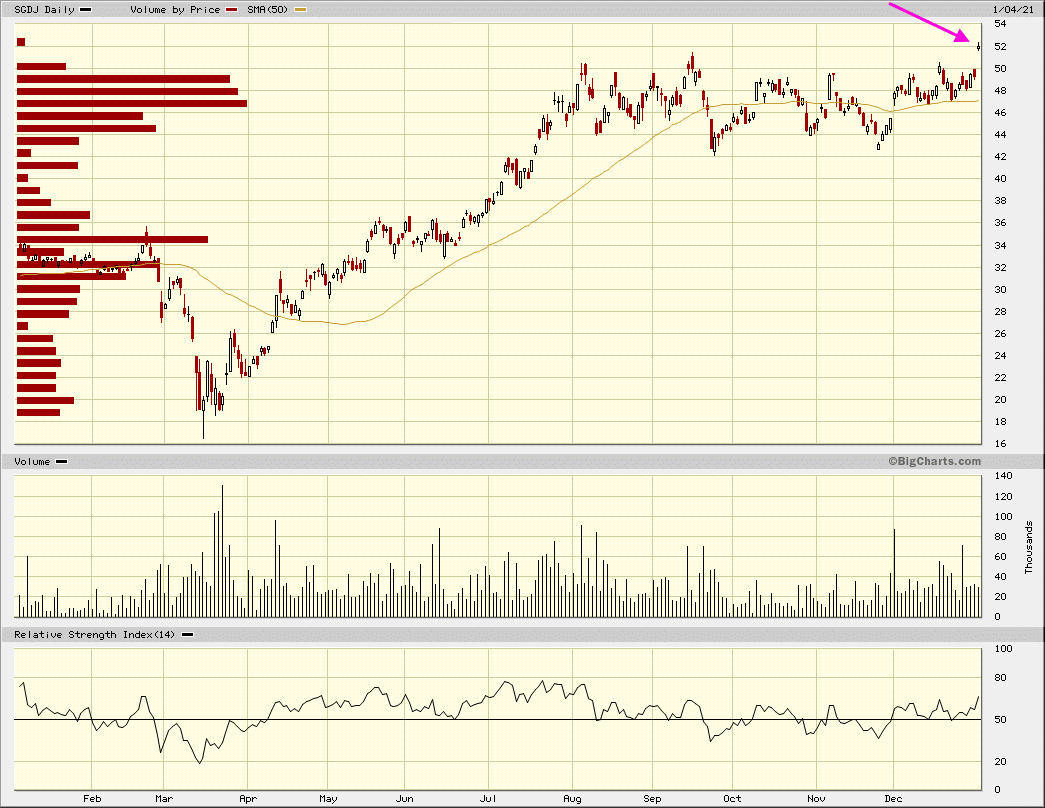

Montag, 4.1.2021 -- der Knall ist da!

SGDJ - Sprott Junior Gold Miners ETF

...

SGDJ - Sprott Junior Gold Miners ETF

...