The Big 4 (Seite 3)

eröffnet am 14.01.20 22:21:12 von

neuester Beitrag 02.02.24 13:19:17 von

neuester Beitrag 02.02.24 13:19:17 von

Beiträge: 51

ID: 1.318.601

ID: 1.318.601

Aufrufe heute: 0

Gesamt: 3.182

Gesamt: 3.182

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| vor 11 Minuten | 2188 | |

| vor 40 Minuten | 1559 | |

| vor 47 Minuten | 1521 | |

| vor 1 Stunde | 1305 | |

| vor 39 Minuten | 738 | |

| vor 13 Minuten | 601 | |

| gestern 23:30 | 500 | |

| gestern 23:07 | 455 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.792,62 | +0,39 | 214 | |||

| 2. | 3. | 0,2220 | +5,71 | 112 | |||

| 3. | 2. | 0,3800 | +22,58 | 96 | |||

| 4. | 4. | 160,58 | +0,26 | 75 | |||

| 5. | 5. | 2,5555 | -0,39 | 56 | |||

| 6. | 7. | 6,7720 | +1,96 | 40 | |||

| 7. | 6. | 0,1656 | -0,30 | 39 | |||

| 8. | 9. | 10,300 | -0,77 | 37 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 67.013.427 von faultcode am 15.02.21 12:52:42

https://twitter.com/retheauditors/status/1375791570100879365

=>

Botta v. PricewaterhouseCoopers LLP

Federal Civil Lawsuit

California Northern District Court, Case No. 3:18-cv-02615-AGT

District Judge Alex G. Tse, presiding

https://www.plainsite.org/dockets/3afke51ng/california-north…

...

siehe auch:

23.2.2021

PwC US to head to trial over whether it rightly fired a whistleblower

https://www.msn.com/en-gb/money/other/pwc-us-to-head-to-tria…

...

PwC in the US will go to trial next Monday, in which it will have to defend its audits of two tech companies and that it rightly fired a whistleblower.

Former PwC senior manager Mauro Botta has accused audit giant of firing him because he submitted complaints to the Securities and Exchange Commission (SEC) and other accounting and audit regulators, saying the firm had too cosy a relationship with its clients and so allowed weak internal controls to slide, Bloomberg Tax first reported.

PwC US called the allegations false, and said it stands behind its audits of Cavium and Harmonic, which it has been working with for more than six years.

According to Bloomberg Tax, in court filings PwC US claimed that Botta signed off on the audits despite his concerns.

The giant also said Botta “fabricated an internal control and falsified audit documentation,” and then lied about doing so during an internal investigation. As a result, PwC said, he was fired.

Botta’s lawyers said that the case is about the inherent conflict between auditors role serving the interests of investors and the need to retain paying clients.

The whistleblower’s lawyers alledged the firm moved Botta off assignments when his “honest questions jeopardised a profitable relationship.”

They said Botta submitted his complaint to the SEC in 2016 because he believed there was a violation of SEC rules or regulations, giving him protection as a whistleblower under the Sarbanes-Oxley Act.

But according to PwC filings, the SEC investigated Botta’s claims and closed its inquiry without bringing any enforcement cases....

Tag:

• SOX

"inherent conflict between auditors role serving the interests of investors and the need to retain paying clients"

https://twitter.com/retheauditors/status/1375791570100879365

=>

Botta v. PricewaterhouseCoopers LLP

Federal Civil Lawsuit

California Northern District Court, Case No. 3:18-cv-02615-AGT

District Judge Alex G. Tse, presiding

https://www.plainsite.org/dockets/3afke51ng/california-north…

...

siehe auch:

23.2.2021

PwC US to head to trial over whether it rightly fired a whistleblower

https://www.msn.com/en-gb/money/other/pwc-us-to-head-to-tria…

...

PwC in the US will go to trial next Monday, in which it will have to defend its audits of two tech companies and that it rightly fired a whistleblower.

Former PwC senior manager Mauro Botta has accused audit giant of firing him because he submitted complaints to the Securities and Exchange Commission (SEC) and other accounting and audit regulators, saying the firm had too cosy a relationship with its clients and so allowed weak internal controls to slide, Bloomberg Tax first reported.

PwC US called the allegations false, and said it stands behind its audits of Cavium and Harmonic, which it has been working with for more than six years.

According to Bloomberg Tax, in court filings PwC US claimed that Botta signed off on the audits despite his concerns.

The giant also said Botta “fabricated an internal control and falsified audit documentation,” and then lied about doing so during an internal investigation. As a result, PwC said, he was fired.

Botta’s lawyers said that the case is about the inherent conflict between auditors role serving the interests of investors and the need to retain paying clients.

The whistleblower’s lawyers alledged the firm moved Botta off assignments when his “honest questions jeopardised a profitable relationship.”

They said Botta submitted his complaint to the SEC in 2016 because he believed there was a violation of SEC rules or regulations, giving him protection as a whistleblower under the Sarbanes-Oxley Act.

But according to PwC filings, the SEC investigated Botta’s claims and closed its inquiry without bringing any enforcement cases....

Zitat von faultcode: ...=> was für den einen ein Beweis ist (nach welchen Kriterien?), ist es für den anderen nicht

Kommt eine "Beweis" zu einem Staatsanwalt (oder Abschlussprüfer) und der Staatsanwalt sagt: "Du bist kein Beweis."

Kommt eine "Beweis" zu einem Gericht und das Gericht sagt: "Du bist kein Beweis."

...

Tag:

• SOX

Antwort auf Beitrag Nr.: 62.376.794 von faultcode am 14.01.20 22:25:55https://www.bloomberg.com/news/articles/2021-02-15/kpmg-to-e…

...

...

Antwort auf Beitrag Nr.: 66.871.514 von faultcode am 08.02.21 01:25:28

https://twitter.com/Junheng_Li/status/1357813837693550592

https://twitter.com/Junheng_Li/status/1357813837693550592

Antwort auf Beitrag Nr.: 65.574.554 von faultcode am 02.11.20 21:18:49https://www.globaltimes.cn/page/202102/1215067.shtml

...

Tag:

• Deloitte

...

Tag:

• Deloitte

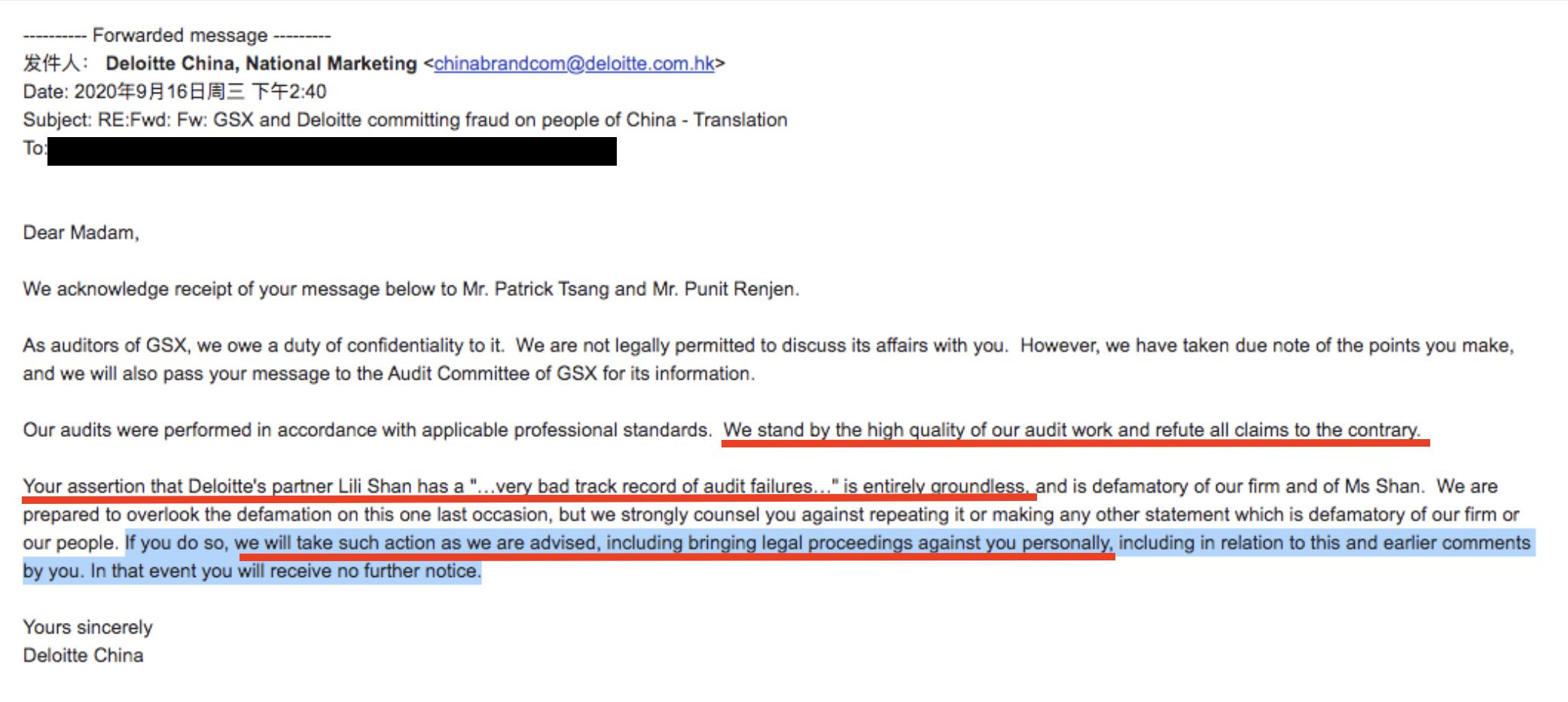

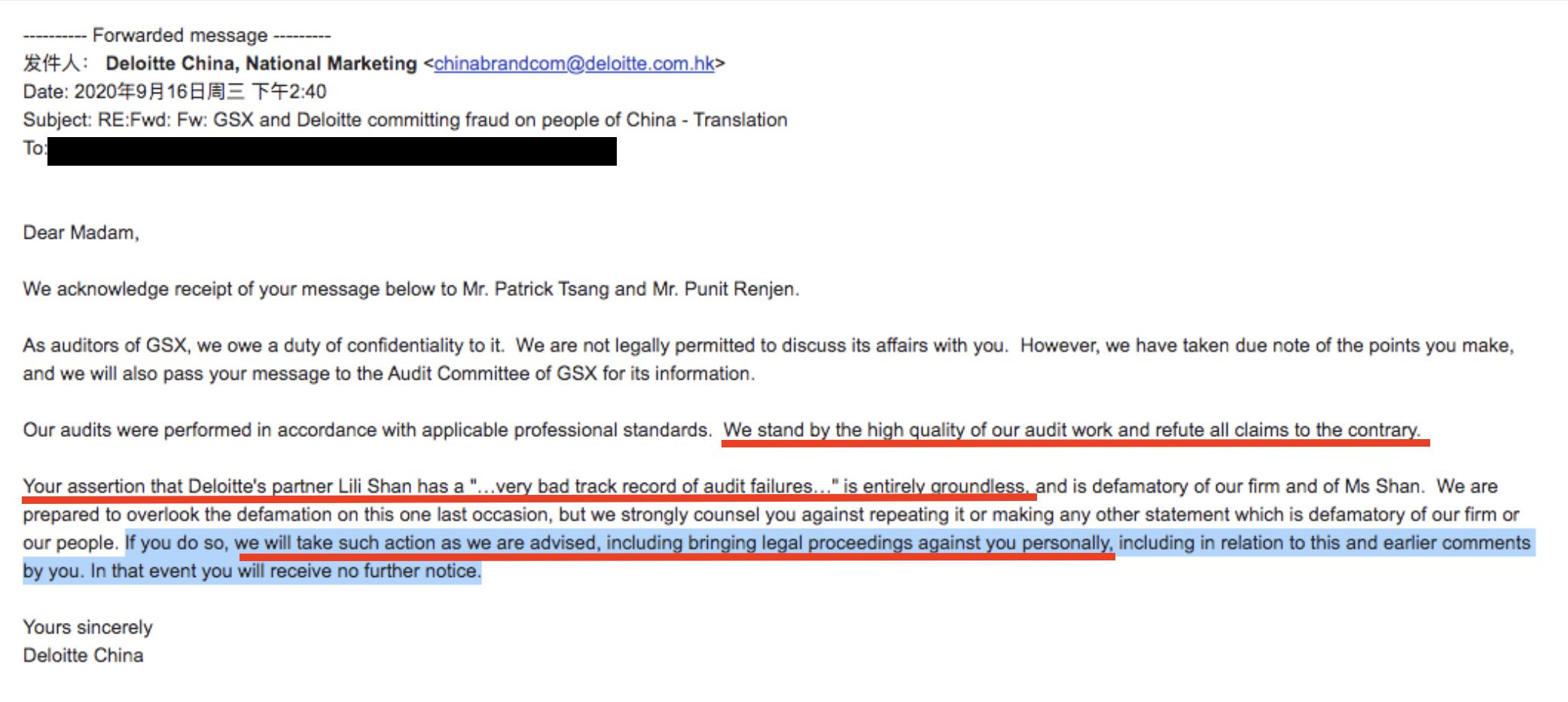

Antwort auf Beitrag Nr.: 65.322.065 von faultcode am 08.10.20 13:45:01da wird auch schon mal gedroht:

https://twitter.com/StockJabber/status/1323091165466529792

https://www.deloittefraud.com/

Tag:

• GSX Techedu

https://twitter.com/StockJabber/status/1323091165466529792

https://www.deloittefraud.com/

Tag:

• GSX Techedu

Antwort auf Beitrag Nr.: 65.316.122 von faultcode am 07.10.20 23:37:29

...

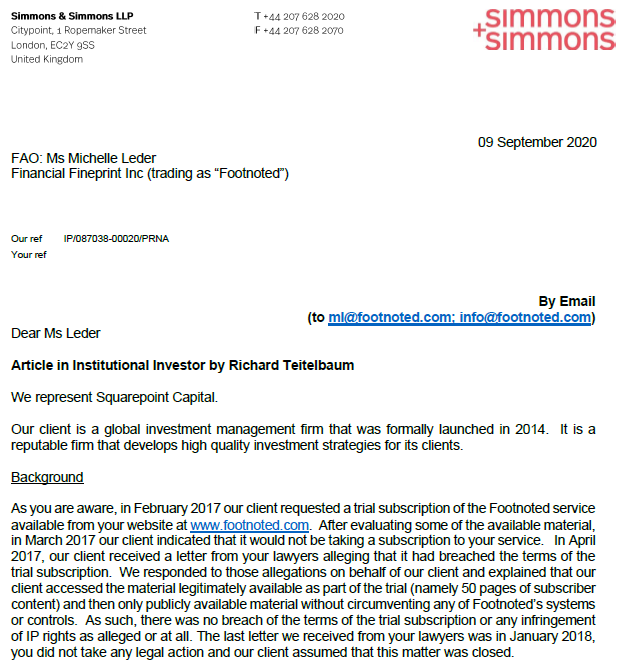

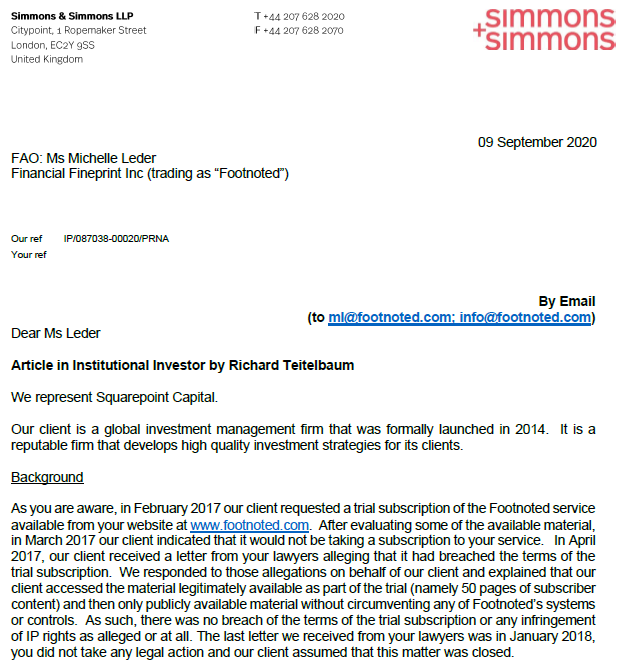

aus: https://www.footnoted.com/simpson-simpson-letter/

da steht nun Aussage gegen Aussage: https://twitter.com/footnoted/status/1313942873746755584

Wobei: was will ein HFT bzw. Quant mit kurzen Zeithorizonten mit solchen Auswertungen von SEC filings?

Mmn eignen sich diese Auswertungen, die sicherlich ihre Berechtung haben, nicht, um damit als so ein Quant Geld zu verdienen.

Diese Idee muss Squarepoint Capital dann irgendwie auch gekommen sein. Aber da war der (Praktikanten-?)Schaden schon angerichtet.

Es geht ihnen mMn auch eigentlich nur um einen möglichen Reputationsschaden, der bei der harten Konkurrenz möglicherweise Negativ-Folgen langfristig haben könnte.

__

nebenbei: die Squarepoint Ops LLC in NYC ist eine Tochter von Squarepoint Capital und tritt auch ab und zu als Leerverkäufer in Deutschland auf, aktuell z.B. bei K+S oder ProSiebenSat1.

https://www.bloomberg.com/profile/company/1293962D:US

https://www.hfobserver.com/directory/squarepoint-capital/

...

aus: https://www.footnoted.com/simpson-simpson-letter/

da steht nun Aussage gegen Aussage: https://twitter.com/footnoted/status/1313942873746755584

Wobei: was will ein HFT bzw. Quant mit kurzen Zeithorizonten mit solchen Auswertungen von SEC filings?

Mmn eignen sich diese Auswertungen, die sicherlich ihre Berechtung haben, nicht, um damit als so ein Quant Geld zu verdienen.

Diese Idee muss Squarepoint Capital dann irgendwie auch gekommen sein. Aber da war der (Praktikanten-?)Schaden schon angerichtet.

Es geht ihnen mMn auch eigentlich nur um einen möglichen Reputationsschaden, der bei der harten Konkurrenz möglicherweise Negativ-Folgen langfristig haben könnte.

__

nebenbei: die Squarepoint Ops LLC in NYC ist eine Tochter von Squarepoint Capital und tritt auch ab und zu als Leerverkäufer in Deutschland auf, aktuell z.B. bei K+S oder ProSiebenSat1.

https://www.bloomberg.com/profile/company/1293962D:US

https://www.hfobserver.com/directory/squarepoint-capital/

Leder had a motto, a version of which she would repeat endlessly to her staff: “There are no accidents in SEC filings. Everything is there for a reason, even when we’re not exactly sure what the reason is at the time.”

7.10.2020

A Corporate Sleuth Claims Squarepoint Capital Took Her Content. The Hedge Fund Is Threatening Action. What Actually Happened?

Why the beloved financial data website Footnoted went dark.

https://www.institutionalinvestor.com/article/b1nq0fmzdh9h51…

...

Tag:

• Michelle Leder

7.10.2020

A Corporate Sleuth Claims Squarepoint Capital Took Her Content. The Hedge Fund Is Threatening Action. What Actually Happened?

Why the beloved financial data website Footnoted went dark.

https://www.institutionalinvestor.com/article/b1nq0fmzdh9h51…

...

Tag:

• Michelle Leder

Kaloti Jewellery International, Dubai

EY passt(e) eigentlich gut zu Wirecard, herrschte auch dort offenbar eine Kultur, scharf gegen Whistleblower vorzugehen:17 Apr 2020

EY ordered to pay whistleblower $11m in Dubai gold audit case

Court rules accountancy firm breached code of ethics in its dealings with a refiner

https://www.theguardian.com/business/2020/apr/17/ey-ordered-…

A former partner at the accounting firm EY has been awarded $10.8m (£8.6m) in damages after being forced out of his job when he exposed professional misconduct during an audit of a Dubai gold refiner.

The high court in London ruled on Friday that EY had repeatedly breached the code of ethics for professional accountants in its dealings with one of its clients, Kaloti Jewellery International.

The claim was brought by Amjad Rihan, who revealed that silver-coated gold had been shipped from Morocco to avoid export restrictions and precious metal obtained from other countries such as Sudan, the Democratic Republic of the Congo and Iran without due diligence.

After telling EY about his concerns, Rihan was ordered back to Dubai but feared for his and his family’s safety. He resigned and subsequently made whistleblowing disclosures in 2014.

Mr Justice Kerr found EY had breached its duty to Rihan through failing to perform the Kaloti audit in an ethical and professional manner.

The court awarded Rihan a total of $10,843,941 and £117,950 in sterling for damages for past and future loss of earnings, and loss of employment benefits.

After the ruling, Rihan said: “Almost seven years of agony for me and my family has come to an end with a total vindication by the court. My life was turned upside down as I was cruelly and harshly punished for insisting on doing my job ethically, professionally and lawfully in relation to the gold audits in Dubai.

“The court ruled in my favour and found that EY breached its duties towards me, for which I am very grateful. I hope that EY uses this judgment as an opportunity to improve and take the necessary measures to avoid anything like this ever happening again.”

Paul Dowling, a solicitor from law firm Leigh Day who represented Rihan, said: “For years EY has refused to admit any wrongdoing in relation to the Kaloti audit. Instead it accused Mr Rihan of being a liar and a fantasist. Our client’s character and actions have now been completely vindicated by the court.

“By contrast it is EY which has been found to have committed serious professional misconduct at the highest echelons of the organisation. This important judgment sends a clear message to would-be whistleblowers that they do not have to tolerate unethical conduct within their organisation, no matter how high up the chain it goes.

In his judgment, Kerr said: “Gold is used in the banking industry, for investment purposes; in the jewellery industry; and in the electronics industry, for manufacturing. It is recognised internationally as being among the ‘conflict minerals’ attractive to criminals and terrorists because it is relatively easy to move and holds its value well.

“For these reasons, the importance of good due diligence and regulation in the gold refining industry and other ‘conflict minerals’ trading is emphasised in guidance published by the Organisation for Economic Cooperation and Development (OECD) and in US legislation known as the Dodd-Frank Act. The claimant and his colleagues at EY Dubai and EY MENA saw this as an opportunity to acquire fruitful work producing assurance reporting to gold refiners in Dubai and elsewhere in the region. Kaloti was the most substantial of the Dubai refiners, with the largest market share.”

Commenting on the Morocco transactions, Kerr said: “I accept as a fact that the defendants were responsible for suggesting to Kaloti that it should draft its compliance report in a manner that masked the reality of the Morocco gold issue, removing the reference to Morocco and changing the coating of gold bars with silver to documentary irregularities. I regard this as professional misconduct.”

An EY spokesperson said: “We are surprised and disappointed by the judge’s decision, its introduction of an unprecedented legal duty and its financial award to a former EY Dubai partner. We will appeal and, therefore, not comment in detail. It was the work of an EY Dubai assurance team that uncovered serious irregularities and reported them to the proper authorities. Their work ultimately resulted in sanctions against the refiner and contributed to significant changes in the sourcing of precious metals and the regulation of refiners in Dubai.”

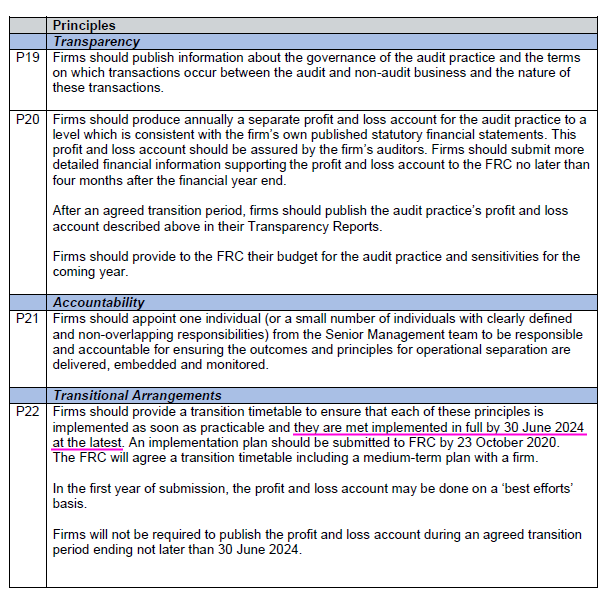

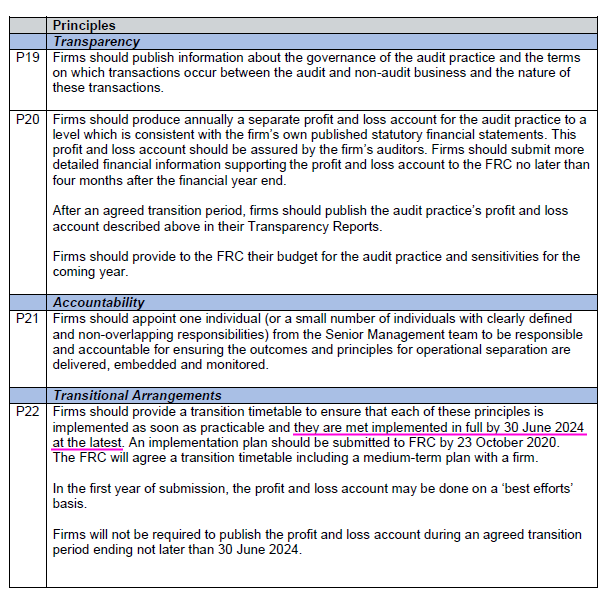

in UK liegen schon Vorschläge zur Big 4-Reform bis spätestens Mitte 2024 vor:

2.7.2020

https://t.co/jJn8mZQBBO?amp=1

=>

...

FRC = Financial Reporting Council

2.7.2020

https://t.co/jJn8mZQBBO?amp=1

=>

...

FRC = Financial Reporting Council