Baidu.com - NASDAQ: BIDU crashed - dieses Jahr noch unter 30 US Dollar? - 500 Beiträge pro Seite (Seite 2)

eröffnet am 10.03.06 10:23:51 von

neuester Beitrag 26.03.24 10:24:03 von

neuester Beitrag 26.03.24 10:24:03 von

Beiträge: 1.961

ID: 1.046.404

ID: 1.046.404

Aufrufe heute: 0

Gesamt: 230.689

Gesamt: 230.689

Aktive User: 0

ISIN: US0567521085 · WKN: A0F5DE · Symbol: BIDU

100,52

USD

+0,62 %

+0,62 USD

Letzter Kurs 02:00:00 Nasdaq

Neuigkeiten

26.04.24 · wallstreetONLINE Redaktion |

17.04.24 · BNP Paribas Anzeige |

16.04.24 · Der Aktionär TV |

09.04.24 · LYNX Analysen Anzeige |

08.04.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,6800 | +18,31 | |

| 20,200 | +12,85 | |

| 2,9200 | +12,31 | |

| 0,6050 | +12,04 | |

| 0,8820 | +10,94 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 3,5300 | -8,73 | |

| 28,26 | -9,57 | |

| 10,870 | -10,61 | |

| 2,7500 | -15,95 | |

| 1,2400 | -51,56 |

China's Baidu to invest 5 billion yuan in browser business, says report

Lisa Tsai, Taipei; Adam Hwang, DIGITIMES [Friday 2 July 2010]

China's online search web portal Baidu plans to invest five billion yuan (US$735 million) over the next three years to develop browser business, according to China-based a report on cnsoftnews.com.

Baidu may acquire China-based companies engaged in R&D of browser software, such as Maxthon Browser, the report said.

Lisa Tsai, Taipei; Adam Hwang, DIGITIMES [Friday 2 July 2010]

China's online search web portal Baidu plans to invest five billion yuan (US$735 million) over the next three years to develop browser business, according to China-based a report on cnsoftnews.com.

Baidu may acquire China-based companies engaged in R&D of browser software, such as Maxthon Browser, the report said.

11:15 Uhr

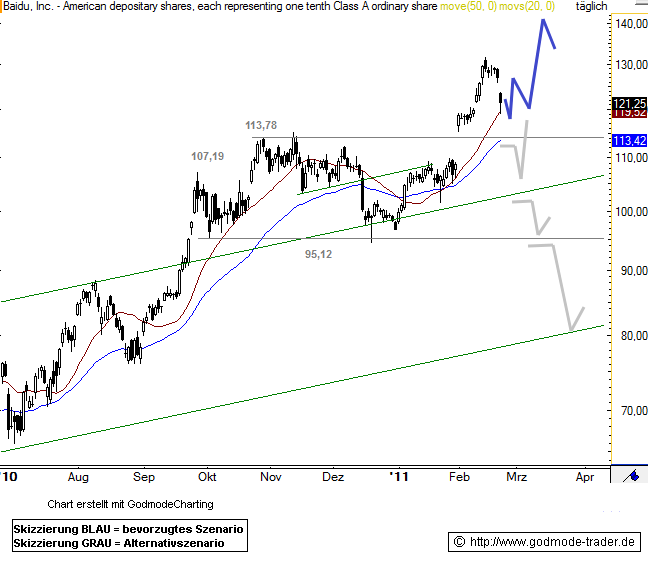

Baidu: Aktie vor Absturz

Martin Weiß

Baidu bleibt eines der besten Internetunternehmen in China - und eines der am höchsten bewerteten. Bislang hielten die Bullen der Aktie die Treue, aber nach dem Bruch des Aufwärtstrends sind die Bären am Drücker. Mit dem richtigen Put-Optionsschein können Anleger jetzt auf den Absturz spekulieren. Und zweistellige Gewinne einfahren.

Um es vorweg zu nehmen: DER AKTIONÄR hält Baidu unter langfrisitigen Aspekten für eines der aussichtsreichsten Investments in China. Die mit Abstand größte Suchmaschine in der Volksrepublik hält sich seit Jahren die Konkurrenten vom Leib (zugegebenermaßen mit Hilfe der Regierung) und wächst rasant. Bis Ende Juni glänzte die Aktie zudem mit relativer Stärke, der Aufwärtstrend schien allen Turbulenzen an den internationalen Börsen trotzen zu können. Seit wenigen Tagen hat sich das Setup aber komplett geändert.

Zeit für den Seitenwechsel

Eine erste Short-Empfehlung auf Baidu am 9. Juni ist, salopp ausgedrückt, gründlich in die Hose gegangen. Zwar wurde der Aufwärtstrend wie erwartet nach unten gebrochen, jedoch stellte sich das Ganze letztlich als Fehlsignal heraus. Der empfohlene Put-Optionsschein (CG8 YBL) wurde bei 0,45 Euro mit einem Verlust von 21 Prozent ausgestoppt. Zumindest hielt sich der Verlust in Grenzen.

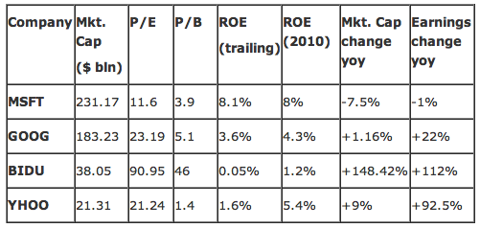

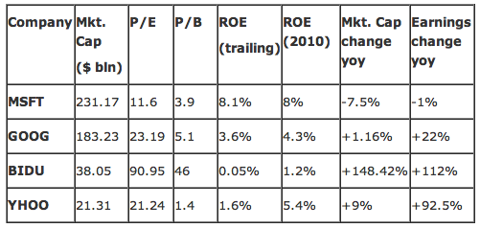

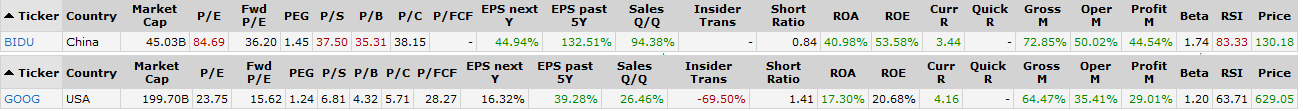

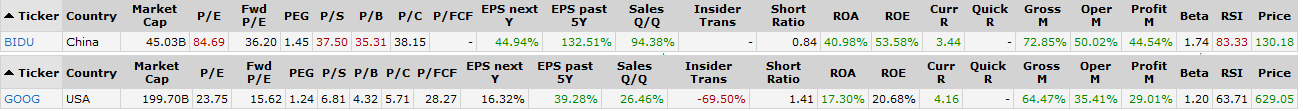

Die Argumentation für die Positionierung auf der Short-Seite hier noch einmal zusammengefasst: "Trotz dieser Aussichten ist Baidu nach der Kursrallye der letzten Monate generös bewertet: Das KGV auf Basis der für 2010 erwarteten Gewinne beträgt 57, das für 2011 noch immer 37. Zum Vergleich: Google ist mit KGVs von 17 und 15 geradezu ein Schnäppchen. Die Volatilität in dem Titel hat zuletzt kräftig zugenommen, ein Zeichen, dass die Anleger nervös werden.

In den vergangenen Tagen hat Baidu in einem uneinheitlichen Marktumfeld überraschend stark Federn gelassen, der Abwärtstrend wurde endgültig gebrochen. Die sich anschließende Erholung fiel deutlich schwächer aus, als bei den vorausgegangenen Korrekturen, aktuell notiert die Aktie bei 67,55 Dollar in der Nähe des Break-Tiefs.

Fazit: Aufwärtstrend gebrochen, schwache Erholung und die fundamental hohe Bewertung der Titel sprechen eher für eine Fortsetzung des Trends, als für eine Trendwende. Risikofreudige Anleger probieren es noch einmal mit dem Citi-Put mit Laufzeit bis September und einem Basispreis von 65 Dollar. Setzt sich die Korrektur fort, könnte Baidu schnell bis in den Bereich um 60 Dollar einbrechen. Für diesen Fall verspricht der OS Kursgewinne von bis zu 50 Prozent.

Baidu: Aktie vor Absturz

Martin Weiß

Baidu bleibt eines der besten Internetunternehmen in China - und eines der am höchsten bewerteten. Bislang hielten die Bullen der Aktie die Treue, aber nach dem Bruch des Aufwärtstrends sind die Bären am Drücker. Mit dem richtigen Put-Optionsschein können Anleger jetzt auf den Absturz spekulieren. Und zweistellige Gewinne einfahren.

Um es vorweg zu nehmen: DER AKTIONÄR hält Baidu unter langfrisitigen Aspekten für eines der aussichtsreichsten Investments in China. Die mit Abstand größte Suchmaschine in der Volksrepublik hält sich seit Jahren die Konkurrenten vom Leib (zugegebenermaßen mit Hilfe der Regierung) und wächst rasant. Bis Ende Juni glänzte die Aktie zudem mit relativer Stärke, der Aufwärtstrend schien allen Turbulenzen an den internationalen Börsen trotzen zu können. Seit wenigen Tagen hat sich das Setup aber komplett geändert.

Zeit für den Seitenwechsel

Eine erste Short-Empfehlung auf Baidu am 9. Juni ist, salopp ausgedrückt, gründlich in die Hose gegangen. Zwar wurde der Aufwärtstrend wie erwartet nach unten gebrochen, jedoch stellte sich das Ganze letztlich als Fehlsignal heraus. Der empfohlene Put-Optionsschein (CG8 YBL) wurde bei 0,45 Euro mit einem Verlust von 21 Prozent ausgestoppt. Zumindest hielt sich der Verlust in Grenzen.

Die Argumentation für die Positionierung auf der Short-Seite hier noch einmal zusammengefasst: "Trotz dieser Aussichten ist Baidu nach der Kursrallye der letzten Monate generös bewertet: Das KGV auf Basis der für 2010 erwarteten Gewinne beträgt 57, das für 2011 noch immer 37. Zum Vergleich: Google ist mit KGVs von 17 und 15 geradezu ein Schnäppchen. Die Volatilität in dem Titel hat zuletzt kräftig zugenommen, ein Zeichen, dass die Anleger nervös werden.

In den vergangenen Tagen hat Baidu in einem uneinheitlichen Marktumfeld überraschend stark Federn gelassen, der Abwärtstrend wurde endgültig gebrochen. Die sich anschließende Erholung fiel deutlich schwächer aus, als bei den vorausgegangenen Korrekturen, aktuell notiert die Aktie bei 67,55 Dollar in der Nähe des Break-Tiefs.

Fazit: Aufwärtstrend gebrochen, schwache Erholung und die fundamental hohe Bewertung der Titel sprechen eher für eine Fortsetzung des Trends, als für eine Trendwende. Risikofreudige Anleger probieren es noch einmal mit dem Citi-Put mit Laufzeit bis September und einem Basispreis von 65 Dollar. Setzt sich die Korrektur fort, könnte Baidu schnell bis in den Bereich um 60 Dollar einbrechen. Für diesen Fall verspricht der OS Kursgewinne von bis zu 50 Prozent.

Bloomberg

Baidu Emerges as Winner After Google Ends Conflict With China

July 11, 2010, 4:15 PM EDT

By Mark Lee and Brian Womack

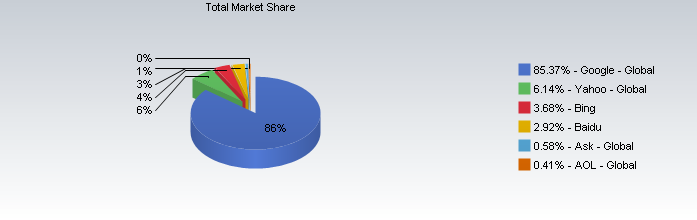

July 12 (Bloomberg) -- After winning permission from China’s government to continue to operate in the country, Google Inc. must now fight for relevance as Baidu Inc. extends its dominance in the world’s largest internet market.

Uncertainty over whether Google would be forced out of China, prompted some advertisers to switch to Beijing-based Baidu. Google had its license renewed last week after it stopped automatically sending Chinese users offshore.

“There is a big gap between Baidu and Google, and that gap has got bigger,” said Vincent Kobler, managing director of Emporio Leo Burnett, a Shanghai advertising agency that specializes in online marketing. “It’s going to be tough for Google, even with the renewed license, to gain market share.”

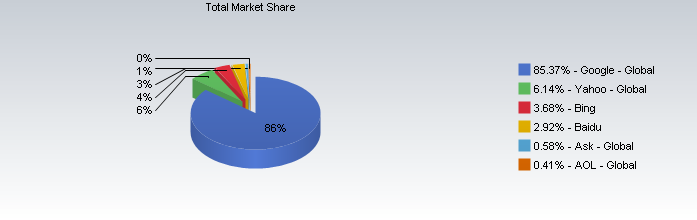

Google’s market share in China fell to 30.9 percent in the first quarter from 35.6 percent three months earlier, according to data from research firm Analysys International. Baidu’s share increased to a record 64 percent from 58.4 percent, according to Analysys.

“It won’t be easy for Google because its service has been diminished in the past few months,” said Jake Li, an Internet analyst at Guotai Junan Securities in Shenzhen. “Baidu is likely to stay ahead.”

Extra Step

Last month, to remain in compliance with China’s laws while also ending self-censorship, Google added an extra step for Chinese Web surfers, directing them to a landing page that in turn pointed them to the Hong Kong site. It then submitted a revised application to renew its license.

Adding another complication for Chinese Web surfers will cost Google, Gene Munster, an analyst at Piper Jaffray Cos., said in a July 9 research note. Every extra step added to the search process will lose users, he said.

Google always seeks to improve the quality of its service to users, spokeswoman Marsha Wang said. She declined to comment on the company’s sales and market share in China.

“Our position has always been the uncertainties surrounding Google have had no more than a marginal impact on our revenue, and I don’t see any reason why this changes things,” said Kaiser Kuo, Baidu’s spokesman in Beijing.

Google rose 2.4 percent to $467.49 on the Nasdaq Stock Market on July 9. The shares declined 25 percent this year, compared to a 73 percent gain by Baidu’s stock.

Largest Market

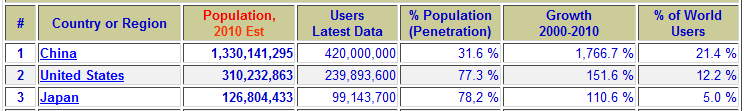

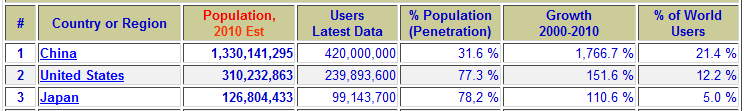

China had 384 million Internet users at the end of 2009, the government estimates, more than the U.S. population. That may grow to 840 million by 2013, according to EMarketer Inc.

Google began redirecting users in China to an unfiltered site in Hong Kong in March, a practice the country’s government disapproved of. The U.S. company, based in Mountain View, California, said in January it would no longer comply with Chinese government requirements that websites self-censor content.

Baidu in April said it benefited from Google’s “semi- exit.” The Chinese company expects “healthy” growth in customers and average spending by clients will continue, Baidu CEO Robin Li said in a conference call in April.

“Baidu is willing to do whatever the government wants, to play by the rules. That’s to Baidu’s benefit,” said Jason Helfstein, an analyst at Oppenheimer & Co. in New York. “Google is trying to do things that they think are the right thing to do, even if it has negative business implications, naturally that has been shareholders’ gripe.”

Lost Partnerships

Ending self-censorship also cost Google partnerships with mobile phone service provider China Unicom (Hong Kong) Ltd. and Web portal Tom Online Inc.

Google had said in January it would stop censoring content and threatened to exit the Chinese market after cyber attacks originating from the nation targeted its systems.

The “highly sophisticated” attacks were aimed at obtaining proprietary information and personal data belonging to human-rights activists who use the company’s Gmail e-mail service, it said.

Bank of America Corp.’s Merrill Lynch estimated in April Google would generate $160 million in sales this year from China. That’s less than 1 percent of the company’s projected revenue this year, according to the average of 29 analyst estimates compiled by Bloomberg. It earned sales of about $335 million from China in 2009, according to Analysys.

Since it began redirecting Chinese users, Google’s search results have been screened by China’s so-called Great Firewall, a government monitoring system that blocks overseas services such as Facebook Inc. and Google’s YouTube.

The firewall limits Chinese Web users’ access to information on topics ranging from Tibet’s independence movement to the 1989 crackdown on protesters in Tiananmen Square.

“Until Google develops a deeper understanding with regulators in China, Google’s China business remains at risk,” said Sandeep Aggarwal, an analyst at Caris & Co. in San Francisco.

Baidu Emerges as Winner After Google Ends Conflict With China

July 11, 2010, 4:15 PM EDT

By Mark Lee and Brian Womack

July 12 (Bloomberg) -- After winning permission from China’s government to continue to operate in the country, Google Inc. must now fight for relevance as Baidu Inc. extends its dominance in the world’s largest internet market.

Uncertainty over whether Google would be forced out of China, prompted some advertisers to switch to Beijing-based Baidu. Google had its license renewed last week after it stopped automatically sending Chinese users offshore.

“There is a big gap between Baidu and Google, and that gap has got bigger,” said Vincent Kobler, managing director of Emporio Leo Burnett, a Shanghai advertising agency that specializes in online marketing. “It’s going to be tough for Google, even with the renewed license, to gain market share.”

Google’s market share in China fell to 30.9 percent in the first quarter from 35.6 percent three months earlier, according to data from research firm Analysys International. Baidu’s share increased to a record 64 percent from 58.4 percent, according to Analysys.

“It won’t be easy for Google because its service has been diminished in the past few months,” said Jake Li, an Internet analyst at Guotai Junan Securities in Shenzhen. “Baidu is likely to stay ahead.”

Extra Step

Last month, to remain in compliance with China’s laws while also ending self-censorship, Google added an extra step for Chinese Web surfers, directing them to a landing page that in turn pointed them to the Hong Kong site. It then submitted a revised application to renew its license.

Adding another complication for Chinese Web surfers will cost Google, Gene Munster, an analyst at Piper Jaffray Cos., said in a July 9 research note. Every extra step added to the search process will lose users, he said.

Google always seeks to improve the quality of its service to users, spokeswoman Marsha Wang said. She declined to comment on the company’s sales and market share in China.

“Our position has always been the uncertainties surrounding Google have had no more than a marginal impact on our revenue, and I don’t see any reason why this changes things,” said Kaiser Kuo, Baidu’s spokesman in Beijing.

Google rose 2.4 percent to $467.49 on the Nasdaq Stock Market on July 9. The shares declined 25 percent this year, compared to a 73 percent gain by Baidu’s stock.

Largest Market

China had 384 million Internet users at the end of 2009, the government estimates, more than the U.S. population. That may grow to 840 million by 2013, according to EMarketer Inc.

Google began redirecting users in China to an unfiltered site in Hong Kong in March, a practice the country’s government disapproved of. The U.S. company, based in Mountain View, California, said in January it would no longer comply with Chinese government requirements that websites self-censor content.

Baidu in April said it benefited from Google’s “semi- exit.” The Chinese company expects “healthy” growth in customers and average spending by clients will continue, Baidu CEO Robin Li said in a conference call in April.

“Baidu is willing to do whatever the government wants, to play by the rules. That’s to Baidu’s benefit,” said Jason Helfstein, an analyst at Oppenheimer & Co. in New York. “Google is trying to do things that they think are the right thing to do, even if it has negative business implications, naturally that has been shareholders’ gripe.”

Lost Partnerships

Ending self-censorship also cost Google partnerships with mobile phone service provider China Unicom (Hong Kong) Ltd. and Web portal Tom Online Inc.

Google had said in January it would stop censoring content and threatened to exit the Chinese market after cyber attacks originating from the nation targeted its systems.

The “highly sophisticated” attacks were aimed at obtaining proprietary information and personal data belonging to human-rights activists who use the company’s Gmail e-mail service, it said.

Bank of America Corp.’s Merrill Lynch estimated in April Google would generate $160 million in sales this year from China. That’s less than 1 percent of the company’s projected revenue this year, according to the average of 29 analyst estimates compiled by Bloomberg. It earned sales of about $335 million from China in 2009, according to Analysys.

Since it began redirecting Chinese users, Google’s search results have been screened by China’s so-called Great Firewall, a government monitoring system that blocks overseas services such as Facebook Inc. and Google’s YouTube.

The firewall limits Chinese Web users’ access to information on topics ranging from Tibet’s independence movement to the 1989 crackdown on protesters in Tiananmen Square.

“Until Google develops a deeper understanding with regulators in China, Google’s China business remains at risk,” said Sandeep Aggarwal, an analyst at Caris & Co. in San Francisco.

Trotz neuer Lizenz hat Google in China zu kämpfen

12.07.2010

Google steht auch nach der Erteilung der Lizenz für seine Geschäfte in China vor großen Herausforderungen.

Der amerikanische Suchmaschinengigant hat im Zuge der Streitigkeiten mit der chinesischen Regierung an Boden gegenüber Marktführer Baidu verloren. Wegen der drohenden Schließung der Google-Dienste sind Anzeigenkunden vermehrt zum chinesischen Konkurrenten abgewandert, berichtete die Finanznachrichtenagentur Bloomberg am Sonntag in San Francisco.

"Es wird nicht einfach für Google werden, weil der Marktanteil in den vergangenen Monaten weiter zurückging", sagte Jake Li, ein Internet-Analyst aus dem chinesischen Shenzen. "Baidu wird wahrscheinlich weiter vorne bleiben." Am Freitag hatte Google die Erneuerung seiner Lizenz für das Betreiben seiner Suchmaschine in China von der Regierung erhalten. Die Erlaubnis muss allerdings jedes Jahr erneuert werden.

Um die Auflagen der chinesischen Regierung zu erfüllen, hatte Google zuletzt die automatische Umleitung seiner Suchseite auf die unzensierten Google-Server in Hongkong aufgehoben und den Zugang durch einen Link ersetzt, den Nutzer anklicken können. Diese Umleitung dürfte nach Einschätzung von Gene Munster, Analyst bei der Investmentbank Piper Jaffray, Google weiter schaden. Jeder Schritt, der bei der Internet-Suche nun dazu komme, werde Nutzer kosten, so Munster.

Im Juni verzeichnete Google nach Angaben der Marktforscher von StatCounter mit einem Marktanteil von 33 Prozent in China ein neues Rekordtief. Baidu lag mit 65 Prozent weit in Führung. Für den Juli ermittelten die Internet-Beobachter nur eine leichte Annäherung: Google rangiert bei 35 Prozent Marktanteil, Baidu verlor geringfügig auf 64 Prozent. (dpa/tc)

12.07.2010

Google steht auch nach der Erteilung der Lizenz für seine Geschäfte in China vor großen Herausforderungen.

Der amerikanische Suchmaschinengigant hat im Zuge der Streitigkeiten mit der chinesischen Regierung an Boden gegenüber Marktführer Baidu verloren. Wegen der drohenden Schließung der Google-Dienste sind Anzeigenkunden vermehrt zum chinesischen Konkurrenten abgewandert, berichtete die Finanznachrichtenagentur Bloomberg am Sonntag in San Francisco.

"Es wird nicht einfach für Google werden, weil der Marktanteil in den vergangenen Monaten weiter zurückging", sagte Jake Li, ein Internet-Analyst aus dem chinesischen Shenzen. "Baidu wird wahrscheinlich weiter vorne bleiben." Am Freitag hatte Google die Erneuerung seiner Lizenz für das Betreiben seiner Suchmaschine in China von der Regierung erhalten. Die Erlaubnis muss allerdings jedes Jahr erneuert werden.

Um die Auflagen der chinesischen Regierung zu erfüllen, hatte Google zuletzt die automatische Umleitung seiner Suchseite auf die unzensierten Google-Server in Hongkong aufgehoben und den Zugang durch einen Link ersetzt, den Nutzer anklicken können. Diese Umleitung dürfte nach Einschätzung von Gene Munster, Analyst bei der Investmentbank Piper Jaffray, Google weiter schaden. Jeder Schritt, der bei der Internet-Suche nun dazu komme, werde Nutzer kosten, so Munster.

Im Juni verzeichnete Google nach Angaben der Marktforscher von StatCounter mit einem Marktanteil von 33 Prozent in China ein neues Rekordtief. Baidu lag mit 65 Prozent weit in Führung. Für den Juli ermittelten die Internet-Beobachter nur eine leichte Annäherung: Google rangiert bei 35 Prozent Marktanteil, Baidu verlor geringfügig auf 64 Prozent. (dpa/tc)

Die E/PS-Vorgabe für das 2. Quartal lautet: 0,30 US-$. Ich bin gespannt, ob das zu

schaffen ist. Immerhin eine Erhöhung von 50% gegenüber dem 1. Quartal.

Eine geringfügige Verfehlung - und Baidu wird sicher böse abgestraft.

Hier nochmal die vorangegangenen Ergebnisse:

Archived Results

Earnings Calendar

Date Fiscal

End Fiscal

Qtr Time Actual FC Yr-ago Rev.

Yr-Yr Rev. $

mln Yr-ago $

14-Feb-07 200612 4 After 0.48 0.36 0.09 143.4 % 14.3

31-Oct-06 200609 3 After 0.37 0.27 0.07 170.1 % 11.22

26-Jul-06 200606 2 After 0.25 0.21 n/a

09-May-06 200603 1 After 0.16 0.12 n/a 1590.0 % 1

21-Feb-06 200512 4 After 0.13 0.08 n/a 167.9 % 5.3

26-Oct-05 200509 3 After 0.03 0.06 n/a

schaffen ist. Immerhin eine Erhöhung von 50% gegenüber dem 1. Quartal.

Eine geringfügige Verfehlung - und Baidu wird sicher böse abgestraft.

Hier nochmal die vorangegangenen Ergebnisse:

Archived Results

Earnings Calendar

Date Fiscal

End Fiscal

Qtr Time Actual FC Yr-ago Rev.

Yr-Yr Rev. $

mln Yr-ago $

Date Fisc End Qtr Time Actual FC Yr-ago

28-Apr-10 201003 1 After 2.02 1.50 0.86 59.9 % 118.6

09-Feb-10 200912 4 After 1.80 1.68 1.31 39.8 % 132.11

26-Oct-09 200909 3 After 2.16 1.81 1.47 38.7 % 135.0

23-Jul-09 200906 2 After 1.61 1.44 1.11 37.4 % 117.0

27-Apr-09 200903 1 After 0.86 0.76 0.60 41.5 % 83.8

18-Feb-09 200812 4 After 1.31 1.32 0.87

22-Oct-08 200809 3 After 1.47 1.28 0.72 104.2 % 66.3

23-Jul-08 200806 2 After 1.11 0.98 0.54 124.2 % 52.19

24-Apr-08 200803 1 After 0.60 0.60 0.32 108.4 % 39.3

13-Feb-08 200712 4 After 0.87 0.71 0.45 125.0 % 34.8

25-Oct-07 200709 3 After 0.72 0.70 0.31 118.1 % 30.4

25-Jul-07 200706 2 After 0.54 0.44 0.25 119.6 % 24

26-Apr-07 200703 1 After 0.37 0.36 n/a 111.2 % 16.9

14-Feb-07 200612 4 After 0.48 0.36 0.09 143.4 % 14.3

31-Oct-06 200609 3 After 0.37 0.27 0.07 170.1 % 11.22

26-Jul-06 200606 2 After 0.25 0.21 n/a

09-May-06 200603 1 After 0.16 0.12 n/a 1590.0 % 1

21-Feb-06 200512 4 After 0.13 0.08 n/a 167.9 % 5.3

26-Oct-05 200509 3 After 0.03 0.06 n/a

Antwort auf Beitrag Nr.: 39.814.169 von Karlll am 13.07.10 16:45:41Sorry, das war Murks, daher besser der Link, dann steht alles in der richtigen Spalte:

http://www.briefing.com/GeneralContent/Active/Investor/Ticke…

Gruß Karlll

http://www.briefing.com/GeneralContent/Active/Investor/Ticke…

Gruß Karlll

Baidus und Rakutens B2C Mall geht im Herbst online

Autor: EMFIS.COM | 30.06.2010 | 09:24

Hongkong 30.06.2010 (www.emfis.com) Die Internethandelsplattform von dem chinesischen Suchmaschinengiganten Baidu und dem japanischen Internetauktionshaus Rakuten, B2C Mall soll voraussichtlich ab Herbst diesen Jahres online gehen. Ab 10. August soll mit der internen Testphase begonnen werden.

Verkäufer welche auf B2C aktiv werden wollen haben eine Kaution von 15000 Yuan (2210 USD) zu hinterlegen. Etwas höher als bei Alibabas Taobao Mall welche 10000 Yuan Kaution verlangt. Auch die Service Kosten sollen etwas höher liegen als bei dem Konkurrenten von Alibaba. Als Bezahlformen werden Baidus BaiFuBao, Alibabas Alipay, das Bankkarten Netzwerk von China Unionpay und Kreditkarten zur Verfügung stehen. Rakuten teilte mit, ausserdem bereits mit mit 10 verschiedenen Paketzustelldiensten Kooperationsverträge geschlossen zu haben.

Autor: EMFIS.COM | 30.06.2010 | 09:24

Hongkong 30.06.2010 (www.emfis.com) Die Internethandelsplattform von dem chinesischen Suchmaschinengiganten Baidu und dem japanischen Internetauktionshaus Rakuten, B2C Mall soll voraussichtlich ab Herbst diesen Jahres online gehen. Ab 10. August soll mit der internen Testphase begonnen werden.

Verkäufer welche auf B2C aktiv werden wollen haben eine Kaution von 15000 Yuan (2210 USD) zu hinterlegen. Etwas höher als bei Alibabas Taobao Mall welche 10000 Yuan Kaution verlangt. Auch die Service Kosten sollen etwas höher liegen als bei dem Konkurrenten von Alibaba. Als Bezahlformen werden Baidus BaiFuBao, Alibabas Alipay, das Bankkarten Netzwerk von China Unionpay und Kreditkarten zur Verfügung stehen. Rakuten teilte mit, ausserdem bereits mit mit 10 verschiedenen Paketzustelldiensten Kooperationsverträge geschlossen zu haben.

Und hier der Grund für den heutigen Anstieg:

Baidu Shares Climb to Two-Week High on First Global's `Outperform' Rating

By Boris Korby - Jul 13, 2010

Baidu Inc., the operator of China’s most-used Internet search engine, rose to the highest price in two weeks after First Global rated the shares “outperform” in new coverage.

Baidu climbed 4.4 percent to $73.86 at 1:27 p.m. New York time. Earlier, the shares rose as much as 5.8 percent to $74.80, the highest since June 28. The company has climbed 80 percent this year.

“The expected growth momentum in online advertising, increased penetration of Internet and broadband connectivity, Baidu’s market leadership in Chinese Internet search, and its high return ratios” are all “great positives,” Devina Mehra, First Global chief strategist, wrote in a report today. “Baidu is expected to benefit the most if Google makes an exit from China.”

Google Inc. won the renewal of its Web-service license in China last week, defusing a six-month standoff with the government over censorship.

Baidu’s market share in the first quarter increased to a record 64 percent from 58.4 percent, according to data from research firm Analysys International. Uncertainty over whether Google would be forced out of the world’s largest Internet market prompted some advertisers to switch to Beijing-based Baidu.

First Global said it expects Baidu to generate revenue of $1 billion and earnings per share of $1.11 in 2010, with revenue of $1.6 billion and earnings per share of $1.71 in 2011.

ThinkEquity LLC analyst Aaron Kessler maintained a “buy” rating for Baidu today, without indicating a target price.

To contact the reporter on this story: Boris Korby in New York at Bkorby1@bloomberg.net

Baidu Shares Climb to Two-Week High on First Global's `Outperform' Rating

By Boris Korby - Jul 13, 2010

Baidu Inc., the operator of China’s most-used Internet search engine, rose to the highest price in two weeks after First Global rated the shares “outperform” in new coverage.

Baidu climbed 4.4 percent to $73.86 at 1:27 p.m. New York time. Earlier, the shares rose as much as 5.8 percent to $74.80, the highest since June 28. The company has climbed 80 percent this year.

“The expected growth momentum in online advertising, increased penetration of Internet and broadband connectivity, Baidu’s market leadership in Chinese Internet search, and its high return ratios” are all “great positives,” Devina Mehra, First Global chief strategist, wrote in a report today. “Baidu is expected to benefit the most if Google makes an exit from China.”

Google Inc. won the renewal of its Web-service license in China last week, defusing a six-month standoff with the government over censorship.

Baidu’s market share in the first quarter increased to a record 64 percent from 58.4 percent, according to data from research firm Analysys International. Uncertainty over whether Google would be forced out of the world’s largest Internet market prompted some advertisers to switch to Beijing-based Baidu.

First Global said it expects Baidu to generate revenue of $1 billion and earnings per share of $1.11 in 2010, with revenue of $1.6 billion and earnings per share of $1.71 in 2011.

ThinkEquity LLC analyst Aaron Kessler maintained a “buy” rating for Baidu today, without indicating a target price.

To contact the reporter on this story: Boris Korby in New York at Bkorby1@bloomberg.net

15.07.2010 12:32

Baidu to Report Second Quarter 2010 Financial Results on July 21, 2010

BEIJING, July 15 /PRNewswire-Asia/ -- Baidu, Inc. , the leading Chinese language Internet search provider, today announced that it will report its financial results for the second quarter ended June 30, 2010, after the U.S. market closes on July 21, 2010. Baidu's management will hold an earnings conference call at 8:00 PM on July 21, 2010 U.S. Eastern Time (8:00 AM on July 22, 2010 Beijing/Hong Kong time).

(Logo: http://photos.prnewswire.com/prnh/20081103/BAIDULOGO ) (Logo: http://www.newscom.com/cgi-bin/prnh/20081103/BAIDULOGO ) Dial-in details for the earnings conference call are as follows: US: +1.857.350.1676 UK: +44.207.365.8426 Hong Kong: +852.3002.1672 Passcode for all regions: 91851178

A replay of the conference call may be accessed by phone at the following number until July 28, 2010:

International: +1.617.801.6888 Passcode: 25736168

Baidu to Report Second Quarter 2010 Financial Results on July 21, 2010

BEIJING, July 15 /PRNewswire-Asia/ -- Baidu, Inc. , the leading Chinese language Internet search provider, today announced that it will report its financial results for the second quarter ended June 30, 2010, after the U.S. market closes on July 21, 2010. Baidu's management will hold an earnings conference call at 8:00 PM on July 21, 2010 U.S. Eastern Time (8:00 AM on July 22, 2010 Beijing/Hong Kong time).

(Logo: http://photos.prnewswire.com/prnh/20081103/BAIDULOGO ) (Logo: http://www.newscom.com/cgi-bin/prnh/20081103/BAIDULOGO ) Dial-in details for the earnings conference call are as follows: US: +1.857.350.1676 UK: +44.207.365.8426 Hong Kong: +852.3002.1672 Passcode for all regions: 91851178

A replay of the conference call may be accessed by phone at the following number until July 28, 2010:

International: +1.617.801.6888 Passcode: 25736168

Booming Demand for TV on the Internet in China

By DAVID BARBOZA

Published: July 18, 2010

SHANGHAI — Internet TV has arrived in China.

Every month, about 300 million people in China are using a computer to watch Chinese TV dramas, Japanese and Korean sitcoms, and even American films and television series like “Twilight” and “Gossip Girl.” Live streaming of the recent World Cup also drew a huge online audience.

Analysts say young people in China are even starting to favor free laptop-viewing over TV sets, in part as a way to make an end run around regulators, who often bar state-run TV networks from broadcasting shows that do not meet the approval of the Communist Party.

It is a momentous shift in viewing habits that has not gone unnoticed by the authorities in Beijing. They are tightening oversight of online video sites and also pushing state-run television networks to form their own Internet TV sites in an effort to retain control over what viewers can watch online.

In addition, the country’s big Web portals and search engines — including Baidu — are scrambling to form competing video sites, many of which plan to license content from the United States and elsewhere.

“Everyone wants to get in on this market now,” says Li Yifei, chairwoman of VivaKi, the digital media division of the advertising giant the Publicis Groupe. “Suddenly there’s a change of attitude because people are watching a lot of online video.”

While Internet TV in the United States is in a nascent state, in China, it is already drawing a huge share of the world’s biggest Internet market, where an estimated 400 million people are on the Web. A market research firm based in Shanghai, iResearch, says advertising on Internet TV and Web video sites is expected to reach $346 million this year, up from $83 million in 2008.

Big video sites like Youku, Tudou, KU6 and PPTV are spending aggressively to license content, produce original programming and buy the bandwidth necessary to store and broadcast content.

On Thursday, when many of the industry’s leaders gathered at the China Digital Media Summit in Shanghai, the future of video Web sites was one of the hottest topics.

A similar discussion is playing out in the United States, where YouTube is searching for ways to make money from traffic on a site largely devoted to user-generated content and where Hulu.com — the free online video hub created by NBC Universal, the News Corporation and Disney — is also trying to grow.

Advertisers are warming to the idea of Internet TV.

“There used to be a joke about the Internet in the advertising community. They said, ‘We’ll advertise when it starts to look like TV,’ ” says Michael Galgon, former global chief advertising strategist at Microsoft. “Well, now it’s starting to look like TV.”

In China, though, Internet TV occupies a unique position largely because it serves as an alternative to what many consider bland state-run programming.

Global media companies like Disney are often restricted from winning television programming slots and are allowed to show only a limited number of films in China. Piracy is rampant in China, and TV viewership among young people is in decline.

That may explain why Internet TV is booming in China. While most early video sites here focused on user-generated content — or amateur videos posted by users — many of those sites have recently evolved by offering licensed content, in-house productions, and loads of pirated films and television series that are uploaded to the sites by users.

For instance, some of America’s most popular shows, including “CSI,” appear on Youku.com and Tudou.com just hours after being broadcast in the United States, usually with Chinese subtitles.

Analysts say they do not know how much of the Internet TV content is pirated, but the fact that many of the sites continue to broadcast pirated television shows and films is a complicating factor. Most executives for the video sites say they are licensing a growing share of content and trying to stop users from uploading pirated content to their sites.

“Through various agents, we have purchased and are going to purchase more copyrighted content from foreign countries,” Victor Koo, the founder and chief executive at Youku, said in an e-mail message. On the issue of pirated foreign movies uploaded by users, he added that the site had been working with the Motion Picture Association of America to improve its monitoring.

But some analysts say illegal content is a major factor driving traffic to Internet TV and video sites and a taboo topic for the industry. Still, the analysts concede that Internet TV and video sites are gradually moving toward more original and licensed content, with some companies competing fiercely to buy popular Chinese and Korean television series.

Anita Huang, a spokeswoman for Tudou, based in Shanghai, says the company is positioning itself as a Chinese version of HBO.

Vincent Tao, chief executive of PPTV, which provides licensed content, said his company was streaming N.B.A. games and producing original TV dramas. “We are going to spend more to acquire foreign content,” he said. “We now have a deal with Warner Brothers.”

Strong challenges from newcomers to Internet TV could create a messy battle over the next few years. For instance, Baidu.com recently formed Qiyi, and if Baidu begins directing most video searches to its own site, that could harm other sites, since Baidu is China’s dominant search engine.

“Advertising agencies really want to transfer their advertising budgets to online video sites, there’s no question about it,” Alan Yan, founder and chief executive at AdChina, said. “But first, the video sites need to solve some of the copyright issues on the content.”

Bao Beibei contributed research.

By DAVID BARBOZA

Published: July 18, 2010

SHANGHAI — Internet TV has arrived in China.

Every month, about 300 million people in China are using a computer to watch Chinese TV dramas, Japanese and Korean sitcoms, and even American films and television series like “Twilight” and “Gossip Girl.” Live streaming of the recent World Cup also drew a huge online audience.

Analysts say young people in China are even starting to favor free laptop-viewing over TV sets, in part as a way to make an end run around regulators, who often bar state-run TV networks from broadcasting shows that do not meet the approval of the Communist Party.

It is a momentous shift in viewing habits that has not gone unnoticed by the authorities in Beijing. They are tightening oversight of online video sites and also pushing state-run television networks to form their own Internet TV sites in an effort to retain control over what viewers can watch online.

In addition, the country’s big Web portals and search engines — including Baidu — are scrambling to form competing video sites, many of which plan to license content from the United States and elsewhere.

“Everyone wants to get in on this market now,” says Li Yifei, chairwoman of VivaKi, the digital media division of the advertising giant the Publicis Groupe. “Suddenly there’s a change of attitude because people are watching a lot of online video.”

While Internet TV in the United States is in a nascent state, in China, it is already drawing a huge share of the world’s biggest Internet market, where an estimated 400 million people are on the Web. A market research firm based in Shanghai, iResearch, says advertising on Internet TV and Web video sites is expected to reach $346 million this year, up from $83 million in 2008.

Big video sites like Youku, Tudou, KU6 and PPTV are spending aggressively to license content, produce original programming and buy the bandwidth necessary to store and broadcast content.

On Thursday, when many of the industry’s leaders gathered at the China Digital Media Summit in Shanghai, the future of video Web sites was one of the hottest topics.

A similar discussion is playing out in the United States, where YouTube is searching for ways to make money from traffic on a site largely devoted to user-generated content and where Hulu.com — the free online video hub created by NBC Universal, the News Corporation and Disney — is also trying to grow.

Advertisers are warming to the idea of Internet TV.

“There used to be a joke about the Internet in the advertising community. They said, ‘We’ll advertise when it starts to look like TV,’ ” says Michael Galgon, former global chief advertising strategist at Microsoft. “Well, now it’s starting to look like TV.”

In China, though, Internet TV occupies a unique position largely because it serves as an alternative to what many consider bland state-run programming.

Global media companies like Disney are often restricted from winning television programming slots and are allowed to show only a limited number of films in China. Piracy is rampant in China, and TV viewership among young people is in decline.

That may explain why Internet TV is booming in China. While most early video sites here focused on user-generated content — or amateur videos posted by users — many of those sites have recently evolved by offering licensed content, in-house productions, and loads of pirated films and television series that are uploaded to the sites by users.

For instance, some of America’s most popular shows, including “CSI,” appear on Youku.com and Tudou.com just hours after being broadcast in the United States, usually with Chinese subtitles.

Analysts say they do not know how much of the Internet TV content is pirated, but the fact that many of the sites continue to broadcast pirated television shows and films is a complicating factor. Most executives for the video sites say they are licensing a growing share of content and trying to stop users from uploading pirated content to their sites.

“Through various agents, we have purchased and are going to purchase more copyrighted content from foreign countries,” Victor Koo, the founder and chief executive at Youku, said in an e-mail message. On the issue of pirated foreign movies uploaded by users, he added that the site had been working with the Motion Picture Association of America to improve its monitoring.

But some analysts say illegal content is a major factor driving traffic to Internet TV and video sites and a taboo topic for the industry. Still, the analysts concede that Internet TV and video sites are gradually moving toward more original and licensed content, with some companies competing fiercely to buy popular Chinese and Korean television series.

Anita Huang, a spokeswoman for Tudou, based in Shanghai, says the company is positioning itself as a Chinese version of HBO.

Vincent Tao, chief executive of PPTV, which provides licensed content, said his company was streaming N.B.A. games and producing original TV dramas. “We are going to spend more to acquire foreign content,” he said. “We now have a deal with Warner Brothers.”

Strong challenges from newcomers to Internet TV could create a messy battle over the next few years. For instance, Baidu.com recently formed Qiyi, and if Baidu begins directing most video searches to its own site, that could harm other sites, since Baidu is China’s dominant search engine.

“Advertising agencies really want to transfer their advertising budgets to online video sites, there’s no question about it,” Alan Yan, founder and chief executive at AdChina, said. “But first, the video sites need to solve some of the copyright issues on the content.”

Bao Beibei contributed research.

Baidu to Launch Mobile Phone Operating System

Posted on: Mon, 19 Jul 2010 07:15:38 EDT

Baidu Inc. (Nasdaq: BIDU | PowerRating) plans to launch its own operating system for mobile phones, instead of Internet browser as guessed by insiders. The top executives recruited by Baidu from Google Inc. (Nasdaq: GOOG | PowerRating) will take charge of the R&D of the product.

Actually, Baidu intended to foray into the operating system field long ago. Last year, when Robin Li received an interview by Wall Street Journal, he revealed that the company would promote operating system like Chrome OS of Google. Li pointed out that Baidu would provide value-added service and customized contents for users through the operating system.

The China Internet Network Information Center (CNNIC) discloses that China's Internet users surfing online through mobile phones have reached 277 million. Baidu's development of operating system is likely to be one step of its wireless Internet strategy.

Meanwhile, Baidu is kicking off recruitment with the largest scale in history. In the half year ended July 16, the company has announced recruitment for 500 posts on its official Web site. Dozens of talents have been attracted from Google.

Source: www.sina.com.cn (July 19, 2010)

Posted on: Mon, 19 Jul 2010 07:15:38 EDT

Baidu Inc. (Nasdaq: BIDU | PowerRating) plans to launch its own operating system for mobile phones, instead of Internet browser as guessed by insiders. The top executives recruited by Baidu from Google Inc. (Nasdaq: GOOG | PowerRating) will take charge of the R&D of the product.

Actually, Baidu intended to foray into the operating system field long ago. Last year, when Robin Li received an interview by Wall Street Journal, he revealed that the company would promote operating system like Chrome OS of Google. Li pointed out that Baidu would provide value-added service and customized contents for users through the operating system.

The China Internet Network Information Center (CNNIC) discloses that China's Internet users surfing online through mobile phones have reached 277 million. Baidu's development of operating system is likely to be one step of its wireless Internet strategy.

Meanwhile, Baidu is kicking off recruitment with the largest scale in history. In the half year ended July 16, the company has announced recruitment for 500 posts on its official Web site. Dozens of talents have been attracted from Google.

Source: www.sina.com.cn (July 19, 2010)

State media accuses Baidu of promoting fake drug sites-report

SHANGHAI | Mon Jul 19, 2010 5:24am EDT

SHANGHAI July 19 (Reuters) - China's main state-run television station has accused the country's top internet search engine Baidu Inc (BIDU.O) of directing users to websites that sell counterfeit drugs, the People's Daily reported on Monday.

CCTV reported on Sunday that Baidu and other search engines had profited from promoting three websites offering counterfeit drugs that had duped more than 3,000 people in China, said the newspaper, the mouthpiece of the ruling Communist Party.

Baidu declined comment on the report. In the second quarter, Baidu had a 70.8 percent share of China's search market, according to iResearch data.

A source familiar with the situation told Reuters on Monday that the sites exploited a loophole in the system, piggybacking on legitimate websites to gain access to buy keywords. The source could not be identified due to the sensitivity of the matter.

In 2008, CCTV aired a similar expose on Baidu selling links to unlicensed medical sites with unproven claims for their products. The company's Nasdaq-listed shares subsequently fell more than 20 percent and its fourth-quarter earnings were hit, prompting Baidu Chief Executive Robin Li to publicly apologise.

As a result of the scandal, Baidu had overhauled its operations and sacked staff involved.

In the last few years, China has been beset by a series of product safety scandals ranging from tainted milk to fake pharmaceuticals.

The government has announced several crackdowns but the problems persist, aided by a lack of surveillance, generally poor quality standards and corruption. (Reporting by Melanie Lee; Editing by Chris Lewis and Anshuman Daga)

http://www.reuters.com/article/idCNTOE66I04E20100719?rpc=44

SHANGHAI | Mon Jul 19, 2010 5:24am EDT

SHANGHAI July 19 (Reuters) - China's main state-run television station has accused the country's top internet search engine Baidu Inc (BIDU.O) of directing users to websites that sell counterfeit drugs, the People's Daily reported on Monday.

CCTV reported on Sunday that Baidu and other search engines had profited from promoting three websites offering counterfeit drugs that had duped more than 3,000 people in China, said the newspaper, the mouthpiece of the ruling Communist Party.

Baidu declined comment on the report. In the second quarter, Baidu had a 70.8 percent share of China's search market, according to iResearch data.

A source familiar with the situation told Reuters on Monday that the sites exploited a loophole in the system, piggybacking on legitimate websites to gain access to buy keywords. The source could not be identified due to the sensitivity of the matter.

In 2008, CCTV aired a similar expose on Baidu selling links to unlicensed medical sites with unproven claims for their products. The company's Nasdaq-listed shares subsequently fell more than 20 percent and its fourth-quarter earnings were hit, prompting Baidu Chief Executive Robin Li to publicly apologise.

As a result of the scandal, Baidu had overhauled its operations and sacked staff involved.

In the last few years, China has been beset by a series of product safety scandals ranging from tainted milk to fake pharmaceuticals.

The government has announced several crackdowns but the problems persist, aided by a lack of surveillance, generally poor quality standards and corruption. (Reporting by Melanie Lee; Editing by Chris Lewis and Anshuman Daga)

http://www.reuters.com/article/idCNTOE66I04E20100719?rpc=44

15:40 Uhr

Baidu: Betrugsvorwürfe drücken Aktienkurs

Martin Weiß

Die Aktie von Chinas führender Suchmaschine verliert im vorbörslichen Geschäft in New York mehr als drei Prozent an Wert. Anleger reagieren mit den massiven Verkäufen auf Medienberichte, wonach der Konzern bei der Verbreitung von gefäschten Medikamenten geholfen habe.

Wie die Nachrichtenagentur Reuters unter Berufung auf chinesische Medien schreibt, habe Baidu die Nutzer seiner Suchmaschine auf Internetseiten verwiesen, auf denen gefälschte Medikamente verkaufen werden. Insgesamt seien mehr als 3.000 Kunden auf den Schwindel hereingefallen. An der Börse reagieren die Anleger verunsichert. Die Baidu-Aktie fällt vorbörslich um 2,34 Dollar ider 3,2 Prozent auf 71,19 Dollar.

Sicherheitslücken genutzt

Die Vorwürfe wiegen umso schwerer, da sie vom chinesischen Staatsfernsehen erhoben wurden, das als Sprachrohr der chinesischen Führung gilt. Wie es heißt, sollen die Betreiber der betrügerischen Seiten eine Sicherheitslücke genutzt haben, um für entsprechende Keywords bei Baidu zu bieten.

Die nun gegen Baidu erhobenen Anschuldigungen klingen nicht ganz neu. Der Konzern war bereits vor zwei Jahren scharf dafür kritisiert worden, illegalen Medikamentenhändlern eine Plattform zu bieten. Das Unternehmen hatte daraufhin umfangreiche Maßnahmen zur Umstrukturierung eingeleitet und die verantwortlichen Mitarbeiter entlassen.

Baidu: Betrugsvorwürfe drücken Aktienkurs

Martin Weiß

Die Aktie von Chinas führender Suchmaschine verliert im vorbörslichen Geschäft in New York mehr als drei Prozent an Wert. Anleger reagieren mit den massiven Verkäufen auf Medienberichte, wonach der Konzern bei der Verbreitung von gefäschten Medikamenten geholfen habe.

Wie die Nachrichtenagentur Reuters unter Berufung auf chinesische Medien schreibt, habe Baidu die Nutzer seiner Suchmaschine auf Internetseiten verwiesen, auf denen gefälschte Medikamente verkaufen werden. Insgesamt seien mehr als 3.000 Kunden auf den Schwindel hereingefallen. An der Börse reagieren die Anleger verunsichert. Die Baidu-Aktie fällt vorbörslich um 2,34 Dollar ider 3,2 Prozent auf 71,19 Dollar.

Sicherheitslücken genutzt

Die Vorwürfe wiegen umso schwerer, da sie vom chinesischen Staatsfernsehen erhoben wurden, das als Sprachrohr der chinesischen Führung gilt. Wie es heißt, sollen die Betreiber der betrügerischen Seiten eine Sicherheitslücke genutzt haben, um für entsprechende Keywords bei Baidu zu bieten.

Die nun gegen Baidu erhobenen Anschuldigungen klingen nicht ganz neu. Der Konzern war bereits vor zwei Jahren scharf dafür kritisiert worden, illegalen Medikamentenhändlern eine Plattform zu bieten. Das Unternehmen hatte daraufhin umfangreiche Maßnahmen zur Umstrukturierung eingeleitet und die verantwortlichen Mitarbeiter entlassen.

Baidu to create a Google Android Competitor?

Can you please name out the mobile OS platforms we have today? Ah! iOS 4, … Android, … WebOS, … Windows Phone 7, … BlackBerry OS, … Symbian, … MeeGo … others I can’t remember or possibly don’t no. That’s not a bad list too… but there might soon be a possible addition to the list.

According to some news sources, Baidu is planning to develop a mobile platform OS on its own. But it being done by Googlers… ‘er former Chinese Googlers is what is interesting. Reportedly its the Google’s Chinese employees who have left the company during its struggle to exist in China, who have been set to the task. The project being, for an OpenSource OS is another twist, which will bring it directly into contention with Google’s Android in China.

Tough time for Google, I guess?

Can you please name out the mobile OS platforms we have today? Ah! iOS 4, … Android, … WebOS, … Windows Phone 7, … BlackBerry OS, … Symbian, … MeeGo … others I can’t remember or possibly don’t no. That’s not a bad list too… but there might soon be a possible addition to the list.

According to some news sources, Baidu is planning to develop a mobile platform OS on its own. But it being done by Googlers… ‘er former Chinese Googlers is what is interesting. Reportedly its the Google’s Chinese employees who have left the company during its struggle to exist in China, who have been set to the task. The project being, for an OpenSource OS is another twist, which will bring it directly into contention with Google’s Android in China.

Tough time for Google, I guess?

Baidu: Expecting Strong Q2 Results, Slower Q3 Growth

by: Xiaofan Zhang July 20, 2010 |

Expecting strong Q2 results. Chinese search engine operator Baidu (BIDU) will report 2Q10 results on July 21 after market close. For the quarter, I estimate Baidu generated $280 million revenue (up 48% Q/Q) and $0.33 GAAP EPS, significantly above management guidance of $268.1-274.0 million and consensus of $271.4 million. I attribute the strong growth in Q2 to three factors: advertisers ramping up spending after Chinese New Year, Baidu gaining market share after Google (GOOG) exited China mainland in late March, Phoenix Nest system achieving higher penetration among Baidu's advertising clients.

Sequential growth to slow down in Q3. For 3Q10, I forecast Baidu will grow revenue by 18%-25% quarter-over-quarter, representing slower sequential growth than in Q2, mainly due to the tougher comparison against a great Q2. I believe the Q/Q growth in Q3 will mainly come from three sources: the secular and spontaneous growth of search volume in China, continued market share gain against Google, and further penetration of Phoenix Nest into Baidu's client base. As a reference, Table 1 shows Baidu's historical 3Q sequential growth was in the range of 15%-28%, with an average of 21%.

xzhang.07.20.2010.b

by: Xiaofan Zhang July 20, 2010 |

Expecting strong Q2 results. Chinese search engine operator Baidu (BIDU) will report 2Q10 results on July 21 after market close. For the quarter, I estimate Baidu generated $280 million revenue (up 48% Q/Q) and $0.33 GAAP EPS, significantly above management guidance of $268.1-274.0 million and consensus of $271.4 million. I attribute the strong growth in Q2 to three factors: advertisers ramping up spending after Chinese New Year, Baidu gaining market share after Google (GOOG) exited China mainland in late March, Phoenix Nest system achieving higher penetration among Baidu's advertising clients.

Sequential growth to slow down in Q3. For 3Q10, I forecast Baidu will grow revenue by 18%-25% quarter-over-quarter, representing slower sequential growth than in Q2, mainly due to the tougher comparison against a great Q2. I believe the Q/Q growth in Q3 will mainly come from three sources: the secular and spontaneous growth of search volume in China, continued market share gain against Google, and further penetration of Phoenix Nest into Baidu's client base. As a reference, Table 1 shows Baidu's historical 3Q sequential growth was in the range of 15%-28%, with an average of 21%.

xzhang.07.20.2010.b

Google's China rival to create Android-like OS

21 July, 2010

Google's biggest search rival in China - homegrown market leader Baidu, is to develop a Linux-based smartphone to rival the Californian search giant's Android-based devices.

Chinese state-run news agency Xinhua today reported a deal between Baidu and developers Tencent and TekMobile to create an "Android-like operating system". Tencent is the company behind Asia's most popular instant messaging software, QQ.

According to reports in the Chinese media, the move is being led by former Google employees who were poached by Baidu after Google ended the self-censorship of its search results. Baidu has wooed Google China's former vice-president of engineering, and the technical director of the Google academy of engineering, to head the project.

Baidu CEO Robin Li has long harboured ambitions of getting a foothold the mobile market. Li revealed plans to launch a Linux-based mobile OS in an interview with the Wall Street Journal last year.

Blogging sites in China have suggested that the only way the deal could succeed is with state investment aimed at knocking Google's Android out of the market.

Google's recent wrangles with China's Government over censorship have seen it falling further behind in the Chinese search market. Its market share has dropped from 32.8 per cent at the end of last year, and currently stands at 27.8 per cent.

Now the company will have to fight for its mobile OS business - and the rewards for the winner of the contest will be huge.

According to a Government statement yesterday, China's mobile phone market reached 800 million users by the end of June this year. The country is set to invest more than $17 billion in its 3G infrastructure this year

21 July, 2010

Google's biggest search rival in China - homegrown market leader Baidu, is to develop a Linux-based smartphone to rival the Californian search giant's Android-based devices.

Chinese state-run news agency Xinhua today reported a deal between Baidu and developers Tencent and TekMobile to create an "Android-like operating system". Tencent is the company behind Asia's most popular instant messaging software, QQ.

According to reports in the Chinese media, the move is being led by former Google employees who were poached by Baidu after Google ended the self-censorship of its search results. Baidu has wooed Google China's former vice-president of engineering, and the technical director of the Google academy of engineering, to head the project.

Baidu CEO Robin Li has long harboured ambitions of getting a foothold the mobile market. Li revealed plans to launch a Linux-based mobile OS in an interview with the Wall Street Journal last year.

Blogging sites in China have suggested that the only way the deal could succeed is with state investment aimed at knocking Google's Android out of the market.

Google's recent wrangles with China's Government over censorship have seen it falling further behind in the Chinese search market. Its market share has dropped from 32.8 per cent at the end of last year, and currently stands at 27.8 per cent.

Now the company will have to fight for its mobile OS business - and the rewards for the winner of the contest will be huge.

According to a Government statement yesterday, China's mobile phone market reached 800 million users by the end of June this year. The country is set to invest more than $17 billion in its 3G infrastructure this year

Baidu.com nachbörslich +4,6% nach besseren Zahlen

Datum: 21.07. 23:27

New York (BoerseGo.de) – Der größte chinesische Suchmaschinenbetreiber Baidu.com berichtet für das zweite Quartal einen Gewinn von 0,35 Dollar pro Aktie und übertrifft damit die Erwartungen von Wall Street um 4 Cent. Der Umsatz klettert gegenüber dem entsprechenden Vorjahresquartal um 74,4 Prozent auf 282,3 Millionen Dollar, was ebenfalls über den Konsensschätzungen der Analysten von 276,7 Millionen Dollar liegt.

Für das aktuelle dritte Quartal rechnet das Unternehmen mit einem Umsatz von 324,4 bis 333,3 Millionen Dollar, was über den aktuellen Erwartungen von Wall Street von 321,55 Millionen Dollar liegt.

Die Aktie klettert nachbörslich aktuell 4,6 Prozent auf 76,55 Dollar.

Datum: 21.07. 23:27

New York (BoerseGo.de) – Der größte chinesische Suchmaschinenbetreiber Baidu.com berichtet für das zweite Quartal einen Gewinn von 0,35 Dollar pro Aktie und übertrifft damit die Erwartungen von Wall Street um 4 Cent. Der Umsatz klettert gegenüber dem entsprechenden Vorjahresquartal um 74,4 Prozent auf 282,3 Millionen Dollar, was ebenfalls über den Konsensschätzungen der Analysten von 276,7 Millionen Dollar liegt.

Für das aktuelle dritte Quartal rechnet das Unternehmen mit einem Umsatz von 324,4 bis 333,3 Millionen Dollar, was über den aktuellen Erwartungen von Wall Street von 321,55 Millionen Dollar liegt.

Die Aktie klettert nachbörslich aktuell 4,6 Prozent auf 76,55 Dollar.

22.07.2010 09:20

Chinas Suchmaschine Baidu mit 118% Gewinnanstieg

EMFIS.COM - Peking / New York 22.07.2010 (www.emfis.com) Chinas größter Suchmaschinenbetreiber Baidu brillierte mit seinen veröffentlichten Quartalszahlen.

Der Google- Rivale, welcher inzwischen in China über 70 Prozent an Marktanteilen hält, konnte im abgelaufenen Quartal seinen Gewinn mehr als verdoppeln.

Laut dem Marktuntersuchungsunternehmen iResearch, gelang es Baidu seinen Marktanteil gegenüber dem ersten Quartal um 3 Prozent zu erhöhen. Dagegen hatte Google einen Rückgang von 2,2 Prozent auf 27,3 Prozent hinnehmen müssen.

Wie das Unternehmen bekannt gab, stieg der Nettogewinn Dank eines kräftigen Zuwachses bei den Anzeigenkunden um 118 Prozent auf 123,50 Mio. US Dollar, bzw. 35 US Cent pro Aktie. Der Umsatz legte um 74,4 Prozent auf 282,3 Mio. US Dollar zu.

Mit diesen Zahlen lag Baidu über den Erwartungen von 31 US Cent Gewinnanstieg. Auch beim Umsatz lag man um etwa 25 Mio. US Dollar über den Prognosen.

Weiter teilte das Unternehmen mit, dass man im zweiten Quartal mit 254.000 aktiven Online- Marketingkunden 25 Prozent mehr wie im Vorjahreszeitraum verzeichnen konnte.

Auch die Aussichten sind sehr gut. So geht Baidu für das dritte Quartal von einem Umsatz zwischen 324 Mio. und 333 Mio. US Dollar aus, was über den Prognosen von Analysten liegt.

An der US- Börse hatte die Aktie nachbörslich um 5,6 Prozent auf 77,38 US Dollar zulegen können. Seit Jahresbeginn beträgt das Plus inzwischen 78 Prozent.

Chinas Suchmaschine Baidu mit 118% Gewinnanstieg

EMFIS.COM - Peking / New York 22.07.2010 (www.emfis.com) Chinas größter Suchmaschinenbetreiber Baidu brillierte mit seinen veröffentlichten Quartalszahlen.

Der Google- Rivale, welcher inzwischen in China über 70 Prozent an Marktanteilen hält, konnte im abgelaufenen Quartal seinen Gewinn mehr als verdoppeln.

Laut dem Marktuntersuchungsunternehmen iResearch, gelang es Baidu seinen Marktanteil gegenüber dem ersten Quartal um 3 Prozent zu erhöhen. Dagegen hatte Google einen Rückgang von 2,2 Prozent auf 27,3 Prozent hinnehmen müssen.

Wie das Unternehmen bekannt gab, stieg der Nettogewinn Dank eines kräftigen Zuwachses bei den Anzeigenkunden um 118 Prozent auf 123,50 Mio. US Dollar, bzw. 35 US Cent pro Aktie. Der Umsatz legte um 74,4 Prozent auf 282,3 Mio. US Dollar zu.

Mit diesen Zahlen lag Baidu über den Erwartungen von 31 US Cent Gewinnanstieg. Auch beim Umsatz lag man um etwa 25 Mio. US Dollar über den Prognosen.

Weiter teilte das Unternehmen mit, dass man im zweiten Quartal mit 254.000 aktiven Online- Marketingkunden 25 Prozent mehr wie im Vorjahreszeitraum verzeichnen konnte.

Auch die Aussichten sind sehr gut. So geht Baidu für das dritte Quartal von einem Umsatz zwischen 324 Mio. und 333 Mio. US Dollar aus, was über den Prognosen von Analysten liegt.

An der US- Börse hatte die Aktie nachbörslich um 5,6 Prozent auf 77,38 US Dollar zulegen können. Seit Jahresbeginn beträgt das Plus inzwischen 78 Prozent.

Baidu Chinesischer Konzern plant eigenes mobiles OS

Autor: Stefan Schomberg | 22.07.2010 - 09:40 | (13)

Der chinesische Suchmaschinenbetreiber Baidu will nach Presseinformationen ein eigenes mobiles Betriebssystem entwickeln. Es soll ähnlich offen sein wie Android, berichtet das Nachrichtenmagazin Information Week. Die Offenheit dürfte nicht die einzige Ähnlichkeit zum OS von Google sein, denn angeblich sind zahlreiche ehemalige Mitarbeiter des weltweit führenden Suchmaschinenbetreibers an der Entwicklung beteiligt.

Im Streit zwischen Google und der chinesischen Regierung hatten etliche Mitarbeiter des amerikanischen Konzerns den Arbeitsplatz gewechselt und fanden unter anderem bei Baidu Anstellung. China hatte damals verlangt, dass Google bestimmte Suchanfragen aus dem Reich der Mitte blockt.

Der Vorstoß von Baidu könnte der Versuch sein, mehr Marktanteile zu erreichen und Google auf Abstand zu halten. Obwohl der chinesische Suchmaschinenbetreiber im eigenen Land bei Suchanfragen von Computern aus mit einem Anteil von etwa 70 Prozent beinahe Monopolstellung hat, kommt er bei mobilen Anfragen nur auf etwa 26 Prozent, wie Google.

Autor: Stefan Schomberg | 22.07.2010 - 09:40 | (13)

Der chinesische Suchmaschinenbetreiber Baidu will nach Presseinformationen ein eigenes mobiles Betriebssystem entwickeln. Es soll ähnlich offen sein wie Android, berichtet das Nachrichtenmagazin Information Week. Die Offenheit dürfte nicht die einzige Ähnlichkeit zum OS von Google sein, denn angeblich sind zahlreiche ehemalige Mitarbeiter des weltweit führenden Suchmaschinenbetreibers an der Entwicklung beteiligt.

Im Streit zwischen Google und der chinesischen Regierung hatten etliche Mitarbeiter des amerikanischen Konzerns den Arbeitsplatz gewechselt und fanden unter anderem bei Baidu Anstellung. China hatte damals verlangt, dass Google bestimmte Suchanfragen aus dem Reich der Mitte blockt.

Der Vorstoß von Baidu könnte der Versuch sein, mehr Marktanteile zu erreichen und Google auf Abstand zu halten. Obwohl der chinesische Suchmaschinenbetreiber im eigenen Land bei Suchanfragen von Computern aus mit einem Anteil von etwa 70 Prozent beinahe Monopolstellung hat, kommt er bei mobilen Anfragen nur auf etwa 26 Prozent, wie Google.

Thursday, July 22, 2010 ET

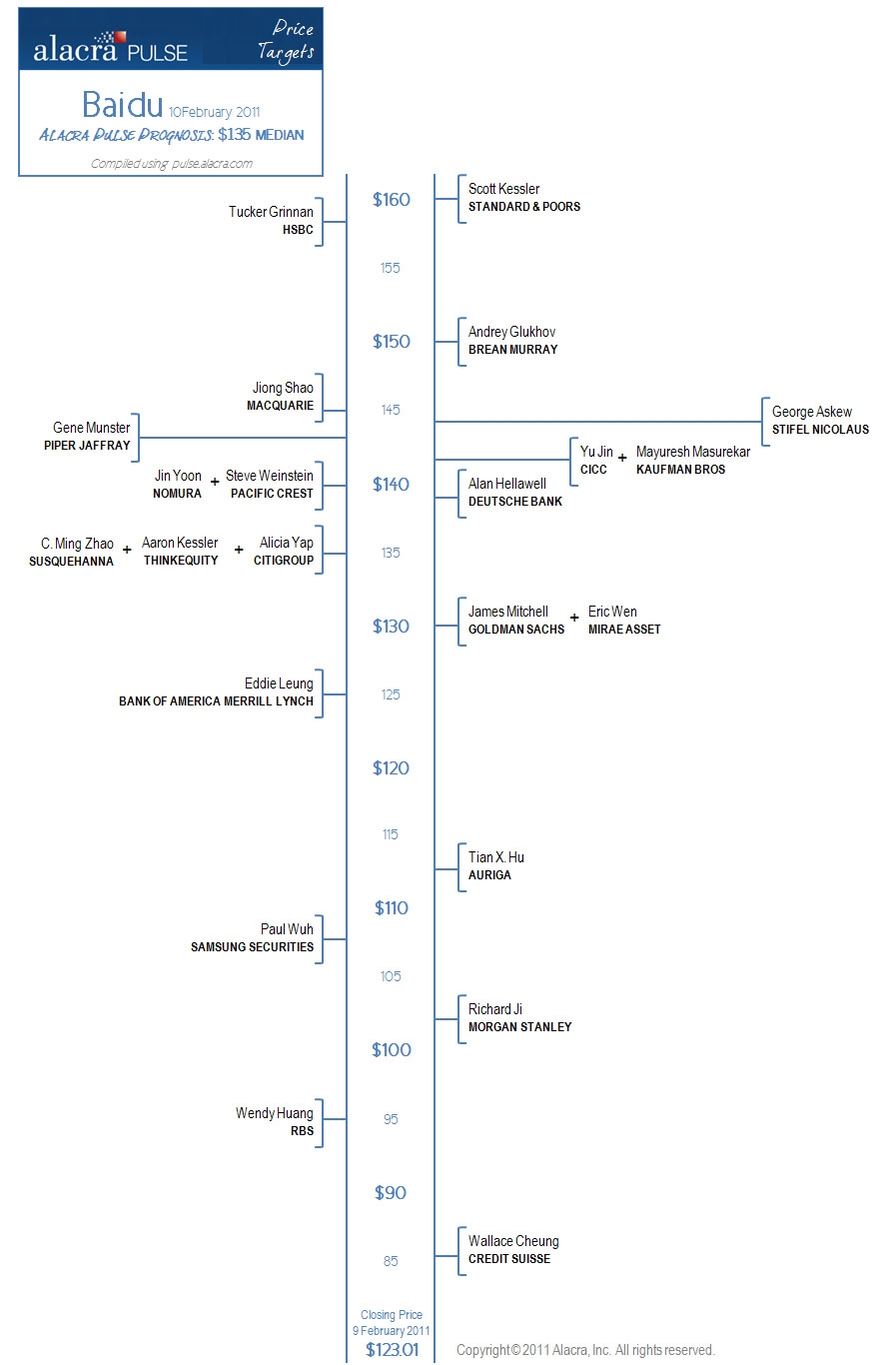

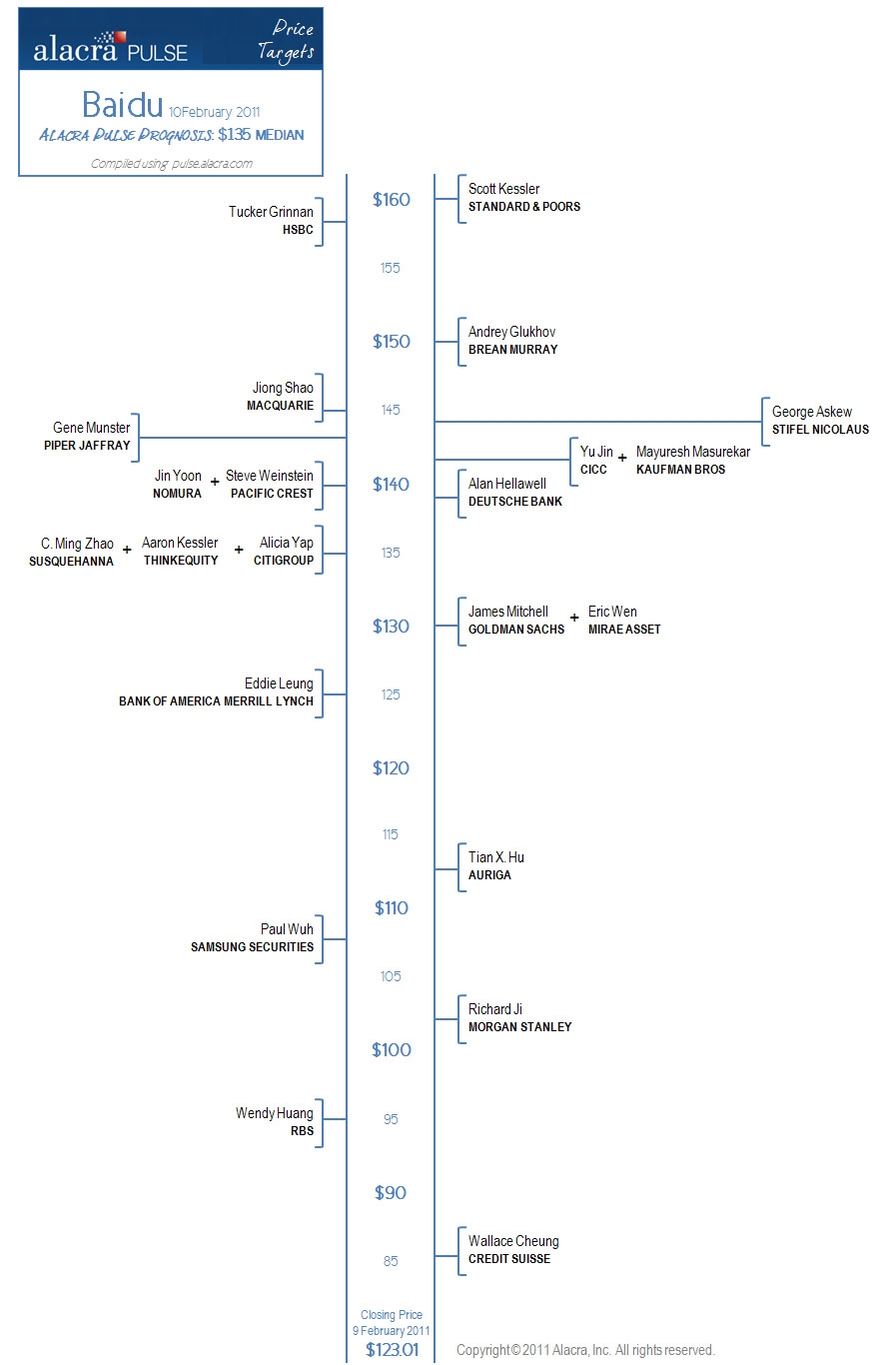

Baidu: Street Boosts Price Targets After Q2 Tops Estimates

By Eric Savitz

The Street is ratcheting up its price targets for Baidu (BIDU) this morning after the China-based Internet search engine late yesterday posted better-than-expected Q2 results.

* Goldman Sachs analyst James Mitchell repeated his Buy rating on the stock, and raised his target to $90 from $76, “to reflect higher margin estimates and more confidence in the quality of growth given faster customer adds.”

* Brean Murray analyst Andrey Gluknov likewise reiterated his Buy rating, while lifting his target to $90, from $80. “We would remain aggressive buyers of BIDU,” he writes, adding that the company “should continue to benefit from the disruptions in the competitive landscape and the overall acceleration in the search advertising market in China.”

* Citigroup analyst Alicia Yap repeated her Buy rating on the stock, lifting her target to $93, from $87; among other things, she sees the company benefiting from “the distraction of a major competitor,” i.e., Google (GOOG), which continues to grapple with how to operate in China.

* Piper Jaffray analyst Gene Munster keeps his Neutral rating on the stock, but boosts his target to $81, from $70. “While the company’s trajectory seems unstoppable, we believe that some tailwinds that had driven BIDU’s performance are lessening as we near closer to annualizing the new bidding system and the situation with Google in China appears to have reached a stable point.”

BIDU is up $1.19, or 1.6%, to $74.50.

Baidu: Street Boosts Price Targets After Q2 Tops Estimates

By Eric Savitz

The Street is ratcheting up its price targets for Baidu (BIDU) this morning after the China-based Internet search engine late yesterday posted better-than-expected Q2 results.

* Goldman Sachs analyst James Mitchell repeated his Buy rating on the stock, and raised his target to $90 from $76, “to reflect higher margin estimates and more confidence in the quality of growth given faster customer adds.”

* Brean Murray analyst Andrey Gluknov likewise reiterated his Buy rating, while lifting his target to $90, from $80. “We would remain aggressive buyers of BIDU,” he writes, adding that the company “should continue to benefit from the disruptions in the competitive landscape and the overall acceleration in the search advertising market in China.”

* Citigroup analyst Alicia Yap repeated her Buy rating on the stock, lifting her target to $93, from $87; among other things, she sees the company benefiting from “the distraction of a major competitor,” i.e., Google (GOOG), which continues to grapple with how to operate in China.

* Piper Jaffray analyst Gene Munster keeps his Neutral rating on the stock, but boosts his target to $81, from $70. “While the company’s trajectory seems unstoppable, we believe that some tailwinds that had driven BIDU’s performance are lessening as we near closer to annualizing the new bidding system and the situation with Google in China appears to have reached a stable point.”

BIDU is up $1.19, or 1.6%, to $74.50.

China: Baidu will seine Suche in Android-Geräte integrieren

Montag, 26. Juli 2010

Konzern-Chef Robin Li wünscht sich eine "sehr prominent platzierte Suchbox" auf den Handydisplays. Android-Geräte machen nur 0,4 Prozent des chinesischen Mobile-Markts aus. Die Symbian Foundation arbeitet bereits mit Baidu zusammen.

Baidu will mit Geräteherstellern von Smartphones kooperieren.

Baidu[1] möchte seine Suche künftig in die Benutzeroberfläche aller Android-Handys integrieren, die in China verkauft werden. Der größte Suchmaschinenanbieter des Landes führt Gespräche mit Herstellern, die auf Googles[2] Betriebssystem zurückgreifen, wie das Wall Street Journal[3] berichtet.

Damit versucht Baidu einmal mehr, seinem größten Konkurrenten - Google - zuvorzukommen. Der chinesische Mobile-Suchmarkt ist klein, wächst aber rasch. Ziel sei es, ein Baidu-Suchfeld "sehr prominent auf dem Handydisplay zu platzieren", sagte CEO Robin Li.

Android-Smartphones machten nur 0,4 Prozent 7,25 Millionen Smartphones aus, die im vierten Quartal 2009 verkauft wurden. Auch mit Herstellern, die andere mobile OS nutzen, werde bereits verhandelt. "Wir sind mit ein paar großen Namen im Gespräch", sagte Li.

Vergangenen Monat hatte die Symbian Foundation[4] eine Zusammenarbeit mit Baidu[5] angekündigt. Symbian-Geräte machten im vierten Quartal 2009 72,1 Prozent der verkauften Smartphones aus.

Obwohl außerhalb des eigenen Landes weitgehend unbekannt, ist Baidu die größte Suchmaschine Chinas. Vor allem nachdem Google im März seine chinesische Suchseite gesperrt und später seine Nutzer nach Hongkong umgeleitet[6] hatte, verzeichnete Baidu steigende Nutzerzahlen. Sein Anteil am chinesischen Suchmarkt stieg im zweiten Quartal 2010 um sechs Punkte auf derzeit 70 Prozent; Google kommt auf 24 Prozent.

Montag, 26. Juli 2010

Konzern-Chef Robin Li wünscht sich eine "sehr prominent platzierte Suchbox" auf den Handydisplays. Android-Geräte machen nur 0,4 Prozent des chinesischen Mobile-Markts aus. Die Symbian Foundation arbeitet bereits mit Baidu zusammen.

Baidu will mit Geräteherstellern von Smartphones kooperieren.

Baidu[1] möchte seine Suche künftig in die Benutzeroberfläche aller Android-Handys integrieren, die in China verkauft werden. Der größte Suchmaschinenanbieter des Landes führt Gespräche mit Herstellern, die auf Googles[2] Betriebssystem zurückgreifen, wie das Wall Street Journal[3] berichtet.

Damit versucht Baidu einmal mehr, seinem größten Konkurrenten - Google - zuvorzukommen. Der chinesische Mobile-Suchmarkt ist klein, wächst aber rasch. Ziel sei es, ein Baidu-Suchfeld "sehr prominent auf dem Handydisplay zu platzieren", sagte CEO Robin Li.

Android-Smartphones machten nur 0,4 Prozent 7,25 Millionen Smartphones aus, die im vierten Quartal 2009 verkauft wurden. Auch mit Herstellern, die andere mobile OS nutzen, werde bereits verhandelt. "Wir sind mit ein paar großen Namen im Gespräch", sagte Li.

Vergangenen Monat hatte die Symbian Foundation[4] eine Zusammenarbeit mit Baidu[5] angekündigt. Symbian-Geräte machten im vierten Quartal 2009 72,1 Prozent der verkauften Smartphones aus.

Obwohl außerhalb des eigenen Landes weitgehend unbekannt, ist Baidu die größte Suchmaschine Chinas. Vor allem nachdem Google im März seine chinesische Suchseite gesperrt und später seine Nutzer nach Hongkong umgeleitet[6] hatte, verzeichnete Baidu steigende Nutzerzahlen. Sein Anteil am chinesischen Suchmarkt stieg im zweiten Quartal 2010 um sechs Punkte auf derzeit 70 Prozent; Google kommt auf 24 Prozent.

Baidu Takes Mobile Search Battle to Google in China

Paul Denlinger, The China Vortex | Jul. 27, 2010, 7:49 AM |

When it comes to Google in China, there is no rest for the weary.

Just after winning its content license in China, and getting praise from the Chinese government, Baidu, China's leading domestic search engine, leaks out word that it intends to dominate the mobile search market, and is using a group of former Google engineers to develop a new mobile platform based on Android, which Google helped to develop.

During Google's censorship dispute with the Chinese government, Baidu's management showed the presence of mind to keep quiet. As I have previously mentioned, mobile search in a green field opportunity.

Steve Jobs, Apple's CEO, has cheerfully proclaimed that mobile users don't use search, they use apps. ("Take that, Eric!") Compared to Apple's iPhone platform, where there are more than 100,000 apps fighting for attention and downloads, Chinese language apps for both the Android and iPhone platforms are at an early stage of development. A few VCs, such as Kai-Fu Lee, former president of Google China, have started new VC funds to fund development of the nascent mobile apps market.

Obviously, Baidu wants to stake out the mobile search market and become the default before too many apps flood the market, so that Baidu's search becomes a habit for most Chinese mobile users. Because Baidu has been relatively unsuccessful in expanding outside China, it has no choice except to deepen China market penetration.

The growth of the Android platform will be helped by the fact that MediaTek, one of Taiwan's leading low-cost chip makers for wireless, has committed to launching a low-cost chipset for Android later this year. This will dramatically lower the price point for Android smartphones in the China market.

In addition, Baidu has leaked out word that it intends to seek a mainland China listing for the company. It will be very interesting how the Chinese government handles this, since most companies which are approved for listing need to have strategic government ties, and mainland listings are not readily handed out. In fact, this has become a point of concern for private-sector Chinese companies, which have complained that they have been treated as second-rate citizens when it comes to listings in China.

The Chinese government has reacted defensively to these charges, insisting that there is no discrimination. While Baidu is generally treated as China's native son, an image which the company deliberately fosters in its communications and advertising, it is by no means a certain thing that Baidu will get everything it wants. Baidu is considered to be a private-sector company.

If the Chinese government gives Baidu everything it wants, the Chinese government could come under criticism from western companies and governments for showing favoritism to a native Chinese company, and small Chinese companies would criticize the government for showing favoritism for an industry giant, at the expense of smaller companies. As I mentioned in a previous article, the Chinese government, more often than not, seeks to find a balance.

For this reason, Baidu's land grab is by no means a sure thing. Conceivably, the Chinese government could hand out more mobile service licenses to Google China to prevent Baidu from becoming the sole player, reversing its former position to Google.

If this happened, it would mark a dramatic change of fortune for Google in China. But stranger things have happened.

Paul Denlinger, The China Vortex | Jul. 27, 2010, 7:49 AM |

When it comes to Google in China, there is no rest for the weary.

Just after winning its content license in China, and getting praise from the Chinese government, Baidu, China's leading domestic search engine, leaks out word that it intends to dominate the mobile search market, and is using a group of former Google engineers to develop a new mobile platform based on Android, which Google helped to develop.

During Google's censorship dispute with the Chinese government, Baidu's management showed the presence of mind to keep quiet. As I have previously mentioned, mobile search in a green field opportunity.

Steve Jobs, Apple's CEO, has cheerfully proclaimed that mobile users don't use search, they use apps. ("Take that, Eric!") Compared to Apple's iPhone platform, where there are more than 100,000 apps fighting for attention and downloads, Chinese language apps for both the Android and iPhone platforms are at an early stage of development. A few VCs, such as Kai-Fu Lee, former president of Google China, have started new VC funds to fund development of the nascent mobile apps market.

Obviously, Baidu wants to stake out the mobile search market and become the default before too many apps flood the market, so that Baidu's search becomes a habit for most Chinese mobile users. Because Baidu has been relatively unsuccessful in expanding outside China, it has no choice except to deepen China market penetration.

The growth of the Android platform will be helped by the fact that MediaTek, one of Taiwan's leading low-cost chip makers for wireless, has committed to launching a low-cost chipset for Android later this year. This will dramatically lower the price point for Android smartphones in the China market.

In addition, Baidu has leaked out word that it intends to seek a mainland China listing for the company. It will be very interesting how the Chinese government handles this, since most companies which are approved for listing need to have strategic government ties, and mainland listings are not readily handed out. In fact, this has become a point of concern for private-sector Chinese companies, which have complained that they have been treated as second-rate citizens when it comes to listings in China.

The Chinese government has reacted defensively to these charges, insisting that there is no discrimination. While Baidu is generally treated as China's native son, an image which the company deliberately fosters in its communications and advertising, it is by no means a certain thing that Baidu will get everything it wants. Baidu is considered to be a private-sector company.

If the Chinese government gives Baidu everything it wants, the Chinese government could come under criticism from western companies and governments for showing favoritism to a native Chinese company, and small Chinese companies would criticize the government for showing favoritism for an industry giant, at the expense of smaller companies. As I mentioned in a previous article, the Chinese government, more often than not, seeks to find a balance.