Prodigy Gold ehem. Kodiak Exploration der Gold- und Uranwert 2007 - 500 Beiträge pro Seite

eröffnet am 11.02.07 12:22:49 von

neuester Beitrag 01.11.12 11:15:43 von

neuester Beitrag 01.11.12 11:15:43 von

Beiträge: 452

ID: 1.111.213

ID: 1.111.213

Aufrufe heute: 0

Gesamt: 82.374

Gesamt: 82.374

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 18:41 | 268 | |

| heute 00:26 | 171 | |

| 22.06.20, 20:50 | 149 | |

| gestern 23:55 | 128 | |

| gestern 22:49 | 111 | |

| heute 02:54 | 104 | |

| gestern 23:37 | 93 | |

| gestern 23:07 | 84 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.002,02 | -1,44 | 264 | |||

| 2. | 2. | 26,58 | -0,63 | 137 | |||

| 3. | 3. | 178,01 | -2,44 | 77 | |||

| 4. | Neu! | 479,00 | -5,71 | 69 | |||

| 5. | 6. | 0,1855 | -1,85 | 67 | |||

| 6. | 15. | 17,550 | -4,10 | 63 | |||

| 7. | 5. | 131,88 | +1,75 | 48 | |||

| 8. | 18. | 5,2900 | -1,89 | 43 |

Hallo @all,

ich möchte den ersten Thread für den Wert Kodiak Exploration öffnen. Fundamental wirklich gut, cash von 7 Mio. Besitzt sehr interessante Basis- und Edelmetall Properties in Nordamerika hauptsächlich. Vor allem deren Uran Properties in Otish Basin in Quebec sticht hier eindeutig hervor. Es beinhaltet 6 234 Hektar Gebiet im Nordosten von Otish Basin mit wirklich guten (with more than 100 radioactive boulders discovered by Uranerz.Thirty of these historic samples returned values higher than 0.1% uranium, including six which assayed 3.50, 2.64, 2.54, 1.73, 1.45 and 1.13% U.)

Also macht euch einfach euer eigenes Bild auf der homepage von kodiak exploration, dort sind gute Präsentation enthalten zu den zahlreichen Properties von Kodiak.

http://www.kodiakexp.com

Gruss,

Hoschie

ich möchte den ersten Thread für den Wert Kodiak Exploration öffnen. Fundamental wirklich gut, cash von 7 Mio. Besitzt sehr interessante Basis- und Edelmetall Properties in Nordamerika hauptsächlich. Vor allem deren Uran Properties in Otish Basin in Quebec sticht hier eindeutig hervor. Es beinhaltet 6 234 Hektar Gebiet im Nordosten von Otish Basin mit wirklich guten (with more than 100 radioactive boulders discovered by Uranerz.Thirty of these historic samples returned values higher than 0.1% uranium, including six which assayed 3.50, 2.64, 2.54, 1.73, 1.45 and 1.13% U.)

Also macht euch einfach euer eigenes Bild auf der homepage von kodiak exploration, dort sind gute Präsentation enthalten zu den zahlreichen Properties von Kodiak.

http://www.kodiakexp.com

Gruss,

Hoschie

Danke für den Thread.

Es waren - glaube ich - die eher guten - nicht excellenten - Uranwerte, die mich abgehalten hatten, der Wert zu kaufen.

Damals.

Vor langer Zeit.

Sehr langer Zeit.

Es waren - glaube ich - die eher guten - nicht excellenten - Uranwerte, die mich abgehalten hatten, der Wert zu kaufen.

Damals.

Vor langer Zeit.

Sehr langer Zeit.

Hallo,

so jetzt komme ich ins grübeln soll ich nun am Montag

Aldershot oder Kodiak mir zu legen oder splitten und beide schwere Eintscheidung.

Monte

so jetzt komme ich ins grübeln soll ich nun am Montag

Aldershot oder Kodiak mir zu legen oder splitten und beide schwere Eintscheidung.

Monte

Antwort auf Beitrag Nr.: 27.620.476 von Montekaolino am 11.02.07 15:27:26Hallo Montekaolino,

also aus fundamentaler Sicht und auch aufgrund der Diversifizierung auf verschiedene Projekte in Nordamerika, spricht vieles für Kodiak. Es ist keine Frage Aldershot ist etwas spekulativer, aber deren Uran-Properties in AUS scheinen aussichtsreicher zu sein als die von Kodiak. Wenn die ein Treffer landen, dann wird der share-price eine gute Performance hinlegen.

Daher wäre es jetzt falsch von mir zu sagen, kauf jetzt Kodiak und nicht Aldershot, die Entscheidung muss du fällen, ob du dich für beide Werte entscheidest oder ob du dich nur für ein Wert entscheidest.

Ich werde versuchen in der nächsten Woche etwas mehr Fakten zu Kodiak zu posten und auch parallel zu Aldershot Resources.

Gruss,

Hoschie

also aus fundamentaler Sicht und auch aufgrund der Diversifizierung auf verschiedene Projekte in Nordamerika, spricht vieles für Kodiak. Es ist keine Frage Aldershot ist etwas spekulativer, aber deren Uran-Properties in AUS scheinen aussichtsreicher zu sein als die von Kodiak. Wenn die ein Treffer landen, dann wird der share-price eine gute Performance hinlegen.

Daher wäre es jetzt falsch von mir zu sagen, kauf jetzt Kodiak und nicht Aldershot, die Entscheidung muss du fällen, ob du dich für beide Werte entscheidest oder ob du dich nur für ein Wert entscheidest.

Ich werde versuchen in der nächsten Woche etwas mehr Fakten zu Kodiak zu posten und auch parallel zu Aldershot Resources.

Gruss,

Hoschie

Antwort auf Beitrag Nr.: 27.624.972 von Hoschie am 11.02.07 16:54:13Danke für diese Info werde mich am Montag entscheiden.

onte

onte

Antwort auf Beitrag Nr.: 27.624.972 von Hoschie am 11.02.07 16:54:13Habe in Kanada geordert und Auftrag wurde ausgeführt.

Monte

Monte

Hallo,

einige Fakten zu den Kodiak-Properties:

Zu der Nickel-Property von Kodiak:

Also was sehr interessant ist folgendes im Stockhouse:

What I found really interesting was statement from Bill Chornobay saying 1% Nickel is equivelant to 1oz/ton of gold (depending on gold prices etc). So basically 28g/t - that's phenominal! I never really thought of it that way but it puts our potential into perspective.

They have already pulled a 70m intersection of .21% Ni in phase 1; that's equivelant to 70m of approx. 6 g/t of gold. That intersect was only 27m down so we should be doing great when they dig deeper.

Also schaut euch mal die Drillings von Phase 1 genau mal an:

http://www.kodiakexp.com/projects/caribou_lake/

Hole 1,3 und Hole 5 weisen nickel mit mehr als 1% aus.

Jetzt zu den Goldproperties:

Hercules liegt zwischen Timmings-Abitibi und Red Lake (also im Norden von Ontario). Die letzten Assays aus der Phase 1 Drilling-Programm haben mehr als 15,59 g/t over 9,7 m nachgewiesen, was wirtschaftlich auf jeden Fall abbaubar ist. Das Ergebnis ist ziemlich gut.

Knucklethumb Gold Property:

Also ich habe auf der homepage nichts dergleichen über ein Drilling-Programm gefunden. Ich habe nur mal die Map analysiert.

Also ich vermute mal aufgrund der geringen Tiefe, das es sich hierbei nur um Samples handelt:

18,00 g/t Au over 2,00 m

10,82 g/t over 2,15 m

...

Das ist auf den ersten Blick erstmal ziemlich gut.

Schließlich zum Uranium Property:

Ich muss ehrlich gestehen, dass ich mich mit Uranium nicht so gut auskenne, wie mit Gold und anderen Metallen.

Ich würde Panem bitten, hier eine erste Analyse zu machen.

Folgendes kann ich nur sagen:

Lt Kodiak weisen einige historische Samples Ergebnisse von mehr als 0,1 % Uranium, einschließlich sechs mit mehr als 1 % ( 3.50, 2.64, 2.54, 1.73, 1.45 and 1.13 ) aus.

Gruss und einen schönen Sonntag,

Hoschie

einige Fakten zu den Kodiak-Properties:

Zu der Nickel-Property von Kodiak:

Also was sehr interessant ist folgendes im Stockhouse:

What I found really interesting was statement from Bill Chornobay saying 1% Nickel is equivelant to 1oz/ton of gold (depending on gold prices etc). So basically 28g/t - that's phenominal! I never really thought of it that way but it puts our potential into perspective.

They have already pulled a 70m intersection of .21% Ni in phase 1; that's equivelant to 70m of approx. 6 g/t of gold. That intersect was only 27m down so we should be doing great when they dig deeper.

Also schaut euch mal die Drillings von Phase 1 genau mal an:

http://www.kodiakexp.com/projects/caribou_lake/

Hole 1,3 und Hole 5 weisen nickel mit mehr als 1% aus.

Jetzt zu den Goldproperties:

Hercules liegt zwischen Timmings-Abitibi und Red Lake (also im Norden von Ontario). Die letzten Assays aus der Phase 1 Drilling-Programm haben mehr als 15,59 g/t over 9,7 m nachgewiesen, was wirtschaftlich auf jeden Fall abbaubar ist. Das Ergebnis ist ziemlich gut.

Knucklethumb Gold Property:

Also ich habe auf der homepage nichts dergleichen über ein Drilling-Programm gefunden. Ich habe nur mal die Map analysiert.

Also ich vermute mal aufgrund der geringen Tiefe, das es sich hierbei nur um Samples handelt:

18,00 g/t Au over 2,00 m

10,82 g/t over 2,15 m

...

Das ist auf den ersten Blick erstmal ziemlich gut.

Schließlich zum Uranium Property:

Ich muss ehrlich gestehen, dass ich mich mit Uranium nicht so gut auskenne, wie mit Gold und anderen Metallen.

Ich würde Panem bitten, hier eine erste Analyse zu machen.

Folgendes kann ich nur sagen:

Lt Kodiak weisen einige historische Samples Ergebnisse von mehr als 0,1 % Uranium, einschließlich sechs mit mehr als 1 % ( 3.50, 2.64, 2.54, 1.73, 1.45 and 1.13 ) aus.

Gruss und einen schönen Sonntag,

Hoschie

Antwort auf Beitrag Nr.: 27.805.975 von Hoschie am 18.02.07 20:14:31Danke für diese Info. Bin jetzt bei Kodiak als auch bei Aldershot drinn. Vielleich hast Du ja Fakten zu Aldershot. Danke

Monte

Monte

Antwort auf Beitrag Nr.: 27.874.008 von Montekaolino am 21.02.07 13:04:11Nachgang.

Habe mir auch Aktien von Beneton Res. zugelegt (BTC) kennst Du dies Aktie. Macht mir einen sehr guten Eindruck. Bitte um Info.

Monte

Habe mir auch Aktien von Beneton Res. zugelegt (BTC) kennst Du dies Aktie. Macht mir einen sehr guten Eindruck. Bitte um Info.

Monte

Antwort auf Beitrag Nr.: 27.874.081 von Montekaolino am 21.02.07 13:07:45Hi Monte,

das ist wirklich ein Zufall. Ich meine ich kenne den Wert nicht sehr gut, aber ich wusste, das Ewan Downie im Management sitzt. Ewan Downie ist CEO von Wolfden Res. wo ich auch investiert bin. Er ist auch im Management in Halo Res und Sabina Res.

Benton:

Der Wert sieht auf den ersten Blick ziemlich interessant aus. Die haben zahlreiche Projekte rund um Ontario. Decken fast alles ab:

Gold, Uranium, Platinum, Palladium, Nickel and Copper.

Die letzten Assays aus dem Saganaga Gold property sind gut.

Im gesamten kann ich nur sagen: Für ein kleines Investment ist es nicht schlecht.

Gruss,

Hoschie

das ist wirklich ein Zufall. Ich meine ich kenne den Wert nicht sehr gut, aber ich wusste, das Ewan Downie im Management sitzt. Ewan Downie ist CEO von Wolfden Res. wo ich auch investiert bin. Er ist auch im Management in Halo Res und Sabina Res.

Benton:

Der Wert sieht auf den ersten Blick ziemlich interessant aus. Die haben zahlreiche Projekte rund um Ontario. Decken fast alles ab:

Gold, Uranium, Platinum, Palladium, Nickel and Copper.

Die letzten Assays aus dem Saganaga Gold property sind gut.

Im gesamten kann ich nur sagen: Für ein kleines Investment ist es nicht schlecht.

Gruss,

Hoschie

Hallo,

danke für Deine Info bin jetzt in Benton, Kodiak und in Aldershot investiert.

Aldershot läuft noch nicht so richtig wird aber bestimmt noch kommen da sie ja sehr gute Urangebiete besitzen wenn Du was neueres hierüber in Erfahrung bringst bitte um Info.Danke

Monte

danke für Deine Info bin jetzt in Benton, Kodiak und in Aldershot investiert.

Aldershot läuft noch nicht so richtig wird aber bestimmt noch kommen da sie ja sehr gute Urangebiete besitzen wenn Du was neueres hierüber in Erfahrung bringst bitte um Info.Danke

Monte

Hallo zusammen

Weiss jemand, wann Kodiak was produziert?

Weiss jemand, wann Kodiak was produziert?

Antwort auf Beitrag Nr.: 27.929.733 von seppmaier22 am 23.02.07 17:58:51Kann ich Dir leider auch nicht sagen.

Aber auf die letzten Umsätze zu schließen und der letzten News zu beurteilen steht hier in Kürze eine Übernahme an.

Ist meine Meinung. Warten wir mal die nächsten Wochen ab.

Monte

Aber auf die letzten Umsätze zu schließen und der letzten News zu beurteilen steht hier in Kürze eine Übernahme an.

Ist meine Meinung. Warten wir mal die nächsten Wochen ab.

Monte

da sie so schön steigen (in Cad) hab ich kleine Position zugelegt !

hier noch eine kleine Meinung aus Stockhousboard

My BullBoards

Jump to KXL Forum

SUBJECT: Poison Pill is Bullish Posted By: ivanyee1948

Post Time: 2/23/2007 12:38

« Previous Message Next Message »

KXL roars like a Lion. They have issued an immediate poision pill because something very HUGE has been discovered, maybe another Voiseys Bay Diamond Fields multi billion dollar Platinum, Nickel, Copper deposit. God Bless Canada. We are #1.

My BullBoards

Jump to KXL Forum

SUBJECT: Poison Pill is Bullish Posted By: ivanyee1948

Post Time: 2/23/2007 12:38

« Previous Message Next Message »

KXL roars like a Lion. They have issued an immediate poision pill because something very HUGE has been discovered, maybe another Voiseys Bay Diamond Fields multi billion dollar Platinum, Nickel, Copper deposit. God Bless Canada. We are #1.

Antwort auf Beitrag Nr.: 27.929.733 von seppmaier22 am 23.02.07 17:58:51Hi @all

Kodiak Expl. ist wieder name sagt ein Exploration Unternehmen. Sie haben wirklich sehr gute Properties, wo noch einiges an Exploration-Arbeit notwendig sein wird. Bis irgendetwas in Produktion gehen kann, dauert es noch Jahre.

Bevor man an Produktion denken kann, müssen Feasibiltiy-Studies für die entsprechenden Projekte erstellt werden.

Was die produzieren könnten, habe ich in meinem letzten Posting schon erwähnt. Bitte einfachmal zurückblättern.

Nichtsdestotrotz finde ich diesen Wert fundamental wirklich sehr interessant. Die heutige news release zeigt auf, das eine mögliche Übernahme-Angebot ins Haus flattern kann und das man aber auch gewillt ist, alle shareholder hier miteinzubeziehen, mit dem Ziel: Increase of shareholder value.

In diesem Sinne, wünsche ich euch ein schönes WE

Gruss,

Hoschie

Kodiak Expl. ist wieder name sagt ein Exploration Unternehmen. Sie haben wirklich sehr gute Properties, wo noch einiges an Exploration-Arbeit notwendig sein wird. Bis irgendetwas in Produktion gehen kann, dauert es noch Jahre.

Bevor man an Produktion denken kann, müssen Feasibiltiy-Studies für die entsprechenden Projekte erstellt werden.

Was die produzieren könnten, habe ich in meinem letzten Posting schon erwähnt. Bitte einfachmal zurückblättern.

Nichtsdestotrotz finde ich diesen Wert fundamental wirklich sehr interessant. Die heutige news release zeigt auf, das eine mögliche Übernahme-Angebot ins Haus flattern kann und das man aber auch gewillt ist, alle shareholder hier miteinzubeziehen, mit dem Ziel: Increase of shareholder value.

In diesem Sinne, wünsche ich euch ein schönes WE

Gruss,

Hoschie

Antwort auf Beitrag Nr.: 27.874.081 von Montekaolino am 21.02.07 13:07:45Hi Monte,

habe einen Thread für Benton Res erstellt.

Gruss,

Hoschie

habe einen Thread für Benton Res erstellt.

Gruss,

Hoschie

Antwort auf Beitrag Nr.: 27.992.011 von Hoschie am 26.02.07 22:47:16Hallo Hoschie,

habs gelesen Danke.

Aldershot und Kodiak entwickeln sich langsam aber sicher.

Monte

habs gelesen Danke.

Aldershot und Kodiak entwickeln sich langsam aber sicher.

Monte

bin auch mal mit ner kleinen position dabei

gruß

nufan

gruß

nufan

tritt nun den Wende nach den Abgaben der vergangenen Tage ein

KODIAK EXPL ORD (KXL)

Börsenplatz Währung Letzter Preis 12:23:33 Veränderung

Venture CAD 1.05 +0.08 (+8.2%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

7'000 1.03 1.09 8'000

Real time prices

KODIAK EXPL ORD (KXL)

Börsenplatz Währung Letzter Preis 12:23:33 Veränderung

Venture CAD 1.05 +0.08 (+8.2%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

7'000 1.03 1.09 8'000

Real time prices

übrigens ist man der Meinung, dass schon bald erste Zwischenresultate kommen sollten.

SUBJECT: RE: Wager on Release of Results Posted By: northerntour

Post Time: 3/12/2007 12:34

« Previous Message Next Message »

Hi beaver65,

Even with the delays created by weather and machinery, I think managment will pop us some info regarding the first two - three drill holes between March 27th - 28th.

SUBJECT: RE: Wager on Release of Results Posted By: northerntour

Post Time: 3/12/2007 12:34

« Previous Message Next Message »

Hi beaver65,

Even with the delays created by weather and machinery, I think managment will pop us some info regarding the first two - three drill holes between March 27th - 28th.

sehr schöner Schluss

Börsenplatz Währung Letzter Preis 15:42:27 Veränderung

Venture CAD 1.07 +0.1 (+10.3%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

19'000 1.04 1.07 10'000

Market closed.

Intressante Meldung, hoffentlich hält ihr keine Ranger !!!

KXL Company Snapshot

BullBoards Member Forums My BullBoards

Jump to KXL Forum

SUBJECT: Another major uranium producer is flooded. Posted By: stargazer1

Post Time: 3/12/2007 13:34

« Previous Message Next Message »

Ranger Uranium Mine Pit 3 Flooded

World’s Third Largest Uranium Producer Underwater

A Loss of Up to 4 Million Pounds U3O8 in 2007?

Water entering Pit 3 from Retention Pond 2 spillway, Ranger Mine Pit 3, Ranger Mine on March 2nd showing evidence of flooding

U.S. and other utilities dependent upon newly mined uranium to power their nuclear reactors can add yet another supply headache to their plate. Energy Resources of Australia declared ‘force majeure’ on its uranium sales contracts to utilities the company supplies in North America, Europe and Asia. No specifics were provided on the company’s website. Information coming from ERA has been on the quiet side.

However, TradeTech chief executive Gene Clark told StockInterview, “ERA or their customers or both will have to be in the market either buying or borrowing.” Dr. Clark calculated ERA’s contract sales in 2006 averaged about US$20.55/pound and were probably expecting $22/pound this year. TradeTech’s Nuclear Market Review reports weekly changes in the spot uranium price in the Friday edition of their trade magazine, and post the update price indicator on the consulting service’s website at http://www.uranium.info

Börsenplatz Währung Letzter Preis 15:42:27 Veränderung

Venture CAD 1.07 +0.1 (+10.3%)

Geldkurs-Volumen Geldkurs - Briefkurs - Briefkurs-Volumen

19'000 1.04 1.07 10'000

Market closed.

Intressante Meldung, hoffentlich hält ihr keine Ranger !!!

KXL Company Snapshot

BullBoards Member Forums My BullBoards

Jump to KXL Forum

SUBJECT: Another major uranium producer is flooded. Posted By: stargazer1

Post Time: 3/12/2007 13:34

« Previous Message Next Message »

Ranger Uranium Mine Pit 3 Flooded

World’s Third Largest Uranium Producer Underwater

A Loss of Up to 4 Million Pounds U3O8 in 2007?

Water entering Pit 3 from Retention Pond 2 spillway, Ranger Mine Pit 3, Ranger Mine on March 2nd showing evidence of flooding

U.S. and other utilities dependent upon newly mined uranium to power their nuclear reactors can add yet another supply headache to their plate. Energy Resources of Australia declared ‘force majeure’ on its uranium sales contracts to utilities the company supplies in North America, Europe and Asia. No specifics were provided on the company’s website. Information coming from ERA has been on the quiet side.

However, TradeTech chief executive Gene Clark told StockInterview, “ERA or their customers or both will have to be in the market either buying or borrowing.” Dr. Clark calculated ERA’s contract sales in 2006 averaged about US$20.55/pound and were probably expecting $22/pound this year. TradeTech’s Nuclear Market Review reports weekly changes in the spot uranium price in the Friday edition of their trade magazine, and post the update price indicator on the consulting service’s website at http://www.uranium.info

so die 1 Can $ Grenze dürfte nach oben durch sein - potential ist da (man siehe den alltime chart )

)

intraday:

langfristchart:

gruß

nufan

)

)intraday:

langfristchart:

gruß

nufan

For Immediate Release Kodiak Acquires Uranium Properties in Otish BasinVancouver, British Columbia, March 14, 2007-

Kodiak Exploration is pleased to announce the acquisition of additional ground in Québec’s Otish Basin. Kodiak has expanded its 100% controlled land holdings from 22,350 to 58,278 acres. An additional 53,587 acres have been staked and confirmed by online notification from the Ministère des Ressources Naturelles et de la Faune du Québec. Once these latest claims are confirmed in writing, Kodiak’s position will total 111,865 acres in the highly prospective Otish Basin where the exploration for unconformity-type uranium deposits is currently underway. Kodiak plans to commence its exploration of these uranium properties with an airborne radiometric, gradiometer magnetic and EM survey in the spring of 2007, to be followed up by surface exploration and drilling to test theeconomic potential of these prospects. The Otish Basin is geologically similar and frequently compared to the Athabasca Basin in Saskatchewan, which accounts for approximately one third of global uranium production and 15% of global uranium reserves. Exploration in the Otish Basin during the 1970s by Uranerz, SOQUEM, Phelps Dodge, PanContinental-Cominco, Atlantic Richfield, Shell, Cogema and others resulted in the discovery of uranium deposits, numerous showings and large areas ofanomalous geochemistry that were never followed up as exploration in the area ceased after uranium prices collapsed in the early 1980s. The Otish Basin attracted attention again recently when Strateco reported a series of drill resultsfrom the original Uranerz Matoush uranium discovery, where high-grade uranium isconcentrated in a fault zone cutting Proterozoic-age sandstone. The uranium-mineralized fault zone is marked by altered gabbro dyke remnants and is traceable by geophysics. Strateco intersected 2.13% U3O8over 15.2 metres, including 3.20% U3O8over 8.4 metres. Two other drill holes intersected better than 1% U3O8over lengths of 14.1 metres and 10.5 metres. The mineralization at Matoush lies well above the Archean unconformity and resembles the “perched bodies” found above the McArthur River and Cigar Lake uranium deposits of the AthabascaBasin. The Matoush area also has potential for unconformity-related mineralization at depth. As a result of Strateco’s discovery, many companies are now active in the area, including Cameco and Areva.

--------------------------------------------------------------------------------

Page 2

Kodiak Acquires Uranium Properties in Otish Basin/Page 2 of 3 Kodiak’s UR and 308 prospects cover high-grade radioactive float, areas of anomalousgeochemistry, and uranium-bearing veins near the basin margins. On the UR property, a wedge-shaped radioactive boulder train measuring 3 kilometres long by 2 kilometres wide points up-ice to a fault in Archean bedrock, which is inferred to be the source. More than 100 angular granite boulders assayed by Uranerz contained over 0.1% U, with six ranging from 1.13 to 3.50% U. Similar indicators led Uranerz to the Matoush discovery. This prospect has not been drill-tested. Targets on Kodiak’s 308 West and 308 East properties include both deep unconformity sources in bedrock, and classic unconformity-style mineralization in the overlying sediments. At the Yvon showing on the 308 West claims, Uranerz traced a pitchblende vein for 15 metres. Historic lake sediment samples taken immediately northeast of the area contained from 405 to 1,920 ppm U. The 308 East prospect covers a cluster of historic uranium anomalies and radioactive boulders along the west side of a gabbro dyke, in a similar setting to the Matoush prospect. A historic hole drilled on the same structure south of Kodiak’s claims intersected uranium mineralization over3.5 metres. Kodiak’s Mat I claim block lies on the western rim of the basin, adjoining the northern edge of Strateco’s claims. This area is most prospective for shallow unconformity-style uranium mineralization. The Mat II block is located between Strateco’s ground and Cameco’s claims tothe south. The Mat III block is located to the west of Strateco’s Matoush discovery. The Mat II and Mat III claims are both prospective for perched and unconformity-style uraniummineralization. Kodiak’s new UR East claims (33,728 acres) are located 5 kilometres northeast of the UR claim block, an outlier where basinal sediments and gabbro are cut by altered and mineralized shear zones containing sulfides, including chalcopyrite. Historic lake sediment anomalies up to 159 ppm U, with elevated uranium to thorium ratios, were also recorded within the claim block. The UR East property is prospective for both unconformity and deep-unconformity style uraniummineralization. Kodiak has received online confirmation from the Ministère des Ressources Naturelles et de la Faune du Québec regarding its notice of map staking of the Mat I-III and UR East claims. Kodiak acquired the RIM 1 through 3 properties by way of online staking in the Otish Basin,totaling approximately 53,587 acres. This ground is located along the east rim of the Basin, in an area containing the highest concentrations of uranium showings and anomalies. Many of these showings are located within or near cross-cutting structures. Multiple faults crosscut the basinal sediments within the RIM claim blocks, and an historic uranium showing and several anomalies are contained within the claim boundaries. These properties are highly prospective for unconformity and perched-style uranium mineralization. Once Kodiak has received final confirmation by mail for this online staking, Kodiak will officially have 100% control of approximately 111,865 acres in the Otish Basin.

--------------------------------------------------------------------------------

Page 3

Kodiak Acquires Uranium Properties in Otish Basin/Page 3 of 3 Further information, including maps, drill sections and photographs, is available on Kodiak’s website at www.kodiakexp.comThe information contained in this news release has been reviewed and approved by Trevor Bremner, P. Geo., who is a qualified person for these projects under the definitions established by National Instrument 43-101. Mr. Bremner is an independent consultant to Kodiak. -30- On behalf of the Board of DirectorsKODIAK EXPLORATION LIMITED William S. Chornobay, Director, President For further information contact: (604) 688-9006 or by email at info@kodiakexp.comThis release has been prepared by management – TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release. This document contains certain forward lookingstatements which involve known and unknown risks, delays, and uncertainties not under the Company’s controlwhich may cause actual results, performance or achievements of the Company to be materially different from the results, performance or expectation implied by these forward

Kodiak Exploration is pleased to announce the acquisition of additional ground in Québec’s Otish Basin. Kodiak has expanded its 100% controlled land holdings from 22,350 to 58,278 acres. An additional 53,587 acres have been staked and confirmed by online notification from the Ministère des Ressources Naturelles et de la Faune du Québec. Once these latest claims are confirmed in writing, Kodiak’s position will total 111,865 acres in the highly prospective Otish Basin where the exploration for unconformity-type uranium deposits is currently underway. Kodiak plans to commence its exploration of these uranium properties with an airborne radiometric, gradiometer magnetic and EM survey in the spring of 2007, to be followed up by surface exploration and drilling to test theeconomic potential of these prospects. The Otish Basin is geologically similar and frequently compared to the Athabasca Basin in Saskatchewan, which accounts for approximately one third of global uranium production and 15% of global uranium reserves. Exploration in the Otish Basin during the 1970s by Uranerz, SOQUEM, Phelps Dodge, PanContinental-Cominco, Atlantic Richfield, Shell, Cogema and others resulted in the discovery of uranium deposits, numerous showings and large areas ofanomalous geochemistry that were never followed up as exploration in the area ceased after uranium prices collapsed in the early 1980s. The Otish Basin attracted attention again recently when Strateco reported a series of drill resultsfrom the original Uranerz Matoush uranium discovery, where high-grade uranium isconcentrated in a fault zone cutting Proterozoic-age sandstone. The uranium-mineralized fault zone is marked by altered gabbro dyke remnants and is traceable by geophysics. Strateco intersected 2.13% U3O8over 15.2 metres, including 3.20% U3O8over 8.4 metres. Two other drill holes intersected better than 1% U3O8over lengths of 14.1 metres and 10.5 metres. The mineralization at Matoush lies well above the Archean unconformity and resembles the “perched bodies” found above the McArthur River and Cigar Lake uranium deposits of the AthabascaBasin. The Matoush area also has potential for unconformity-related mineralization at depth. As a result of Strateco’s discovery, many companies are now active in the area, including Cameco and Areva.

--------------------------------------------------------------------------------

Page 2

Kodiak Acquires Uranium Properties in Otish Basin/Page 2 of 3 Kodiak’s UR and 308 prospects cover high-grade radioactive float, areas of anomalousgeochemistry, and uranium-bearing veins near the basin margins. On the UR property, a wedge-shaped radioactive boulder train measuring 3 kilometres long by 2 kilometres wide points up-ice to a fault in Archean bedrock, which is inferred to be the source. More than 100 angular granite boulders assayed by Uranerz contained over 0.1% U, with six ranging from 1.13 to 3.50% U. Similar indicators led Uranerz to the Matoush discovery. This prospect has not been drill-tested. Targets on Kodiak’s 308 West and 308 East properties include both deep unconformity sources in bedrock, and classic unconformity-style mineralization in the overlying sediments. At the Yvon showing on the 308 West claims, Uranerz traced a pitchblende vein for 15 metres. Historic lake sediment samples taken immediately northeast of the area contained from 405 to 1,920 ppm U. The 308 East prospect covers a cluster of historic uranium anomalies and radioactive boulders along the west side of a gabbro dyke, in a similar setting to the Matoush prospect. A historic hole drilled on the same structure south of Kodiak’s claims intersected uranium mineralization over3.5 metres. Kodiak’s Mat I claim block lies on the western rim of the basin, adjoining the northern edge of Strateco’s claims. This area is most prospective for shallow unconformity-style uranium mineralization. The Mat II block is located between Strateco’s ground and Cameco’s claims tothe south. The Mat III block is located to the west of Strateco’s Matoush discovery. The Mat II and Mat III claims are both prospective for perched and unconformity-style uraniummineralization. Kodiak’s new UR East claims (33,728 acres) are located 5 kilometres northeast of the UR claim block, an outlier where basinal sediments and gabbro are cut by altered and mineralized shear zones containing sulfides, including chalcopyrite. Historic lake sediment anomalies up to 159 ppm U, with elevated uranium to thorium ratios, were also recorded within the claim block. The UR East property is prospective for both unconformity and deep-unconformity style uraniummineralization. Kodiak has received online confirmation from the Ministère des Ressources Naturelles et de la Faune du Québec regarding its notice of map staking of the Mat I-III and UR East claims. Kodiak acquired the RIM 1 through 3 properties by way of online staking in the Otish Basin,totaling approximately 53,587 acres. This ground is located along the east rim of the Basin, in an area containing the highest concentrations of uranium showings and anomalies. Many of these showings are located within or near cross-cutting structures. Multiple faults crosscut the basinal sediments within the RIM claim blocks, and an historic uranium showing and several anomalies are contained within the claim boundaries. These properties are highly prospective for unconformity and perched-style uranium mineralization. Once Kodiak has received final confirmation by mail for this online staking, Kodiak will officially have 100% control of approximately 111,865 acres in the Otish Basin.

--------------------------------------------------------------------------------

Page 3

Kodiak Acquires Uranium Properties in Otish Basin/Page 3 of 3 Further information, including maps, drill sections and photographs, is available on Kodiak’s website at www.kodiakexp.comThe information contained in this news release has been reviewed and approved by Trevor Bremner, P. Geo., who is a qualified person for these projects under the definitions established by National Instrument 43-101. Mr. Bremner is an independent consultant to Kodiak. -30- On behalf of the Board of DirectorsKODIAK EXPLORATION LIMITED William S. Chornobay, Director, President For further information contact: (604) 688-9006 or by email at info@kodiakexp.comThis release has been prepared by management – TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release. This document contains certain forward lookingstatements which involve known and unknown risks, delays, and uncertainties not under the Company’s controlwhich may cause actual results, performance or achievements of the Company to be materially different from the results, performance or expectation implied by these forward

Antwort auf Beitrag Nr.: 28.320.206 von Panem am 16.03.07 02:23:52Danke Panem,

wollte gerade auch posten.

Gruss,

Hoschie

wollte gerade auch posten.

Gruss,

Hoschie

Charttechnisch muss die 1,20 CAD durchbrochen werden, damit es weiter aufwärts geht.

Gruss,

Hoschie

Gruss,

Hoschie

Press Release - Kodiak Exploration Limited(TSX-V : KXL)

Kodiak Commences Phase III Program on Hercules Gold Prospect

March 29, 2007 7:05:00 AM

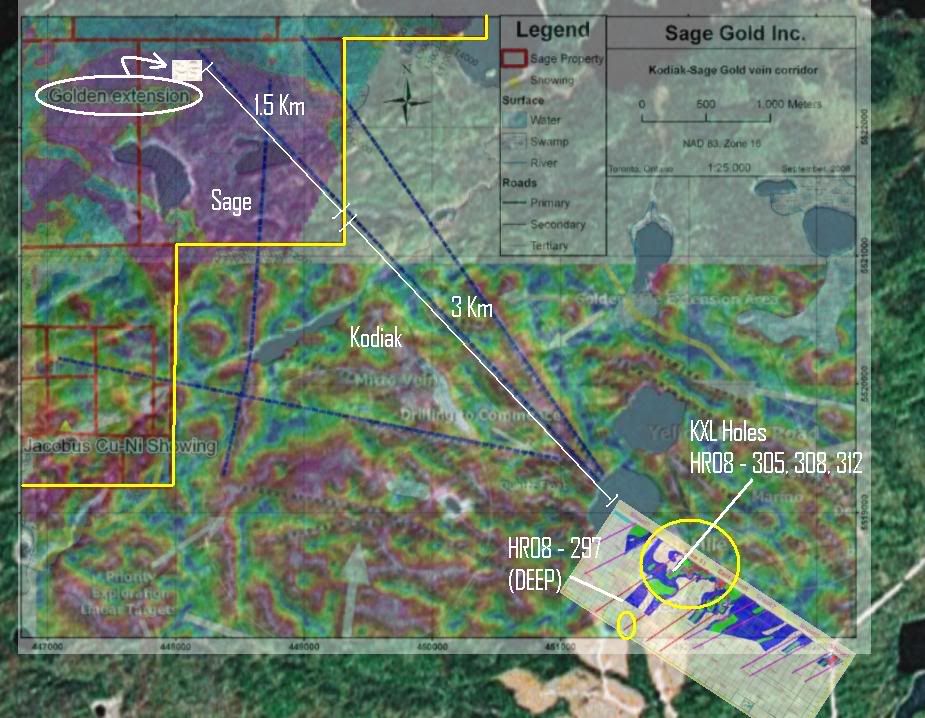

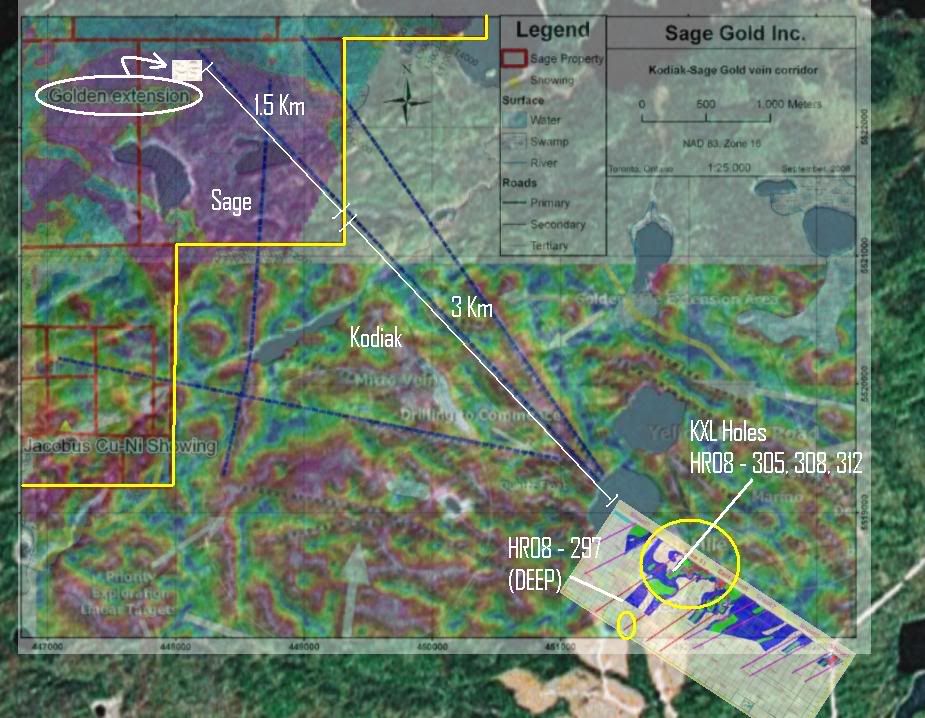

Kodiak Exploration Limited (TSX VENTURE: KXL) is pleased to announce commencement of its Phase III exploration program on its 100% controlled Hercules gold prospect in Ontario. The property covers a gold-mineralized shear zone that Kodiak has traced by stripping and diamond drilling over a strike length of 1.2 kilometres, and that remains open in all directions.

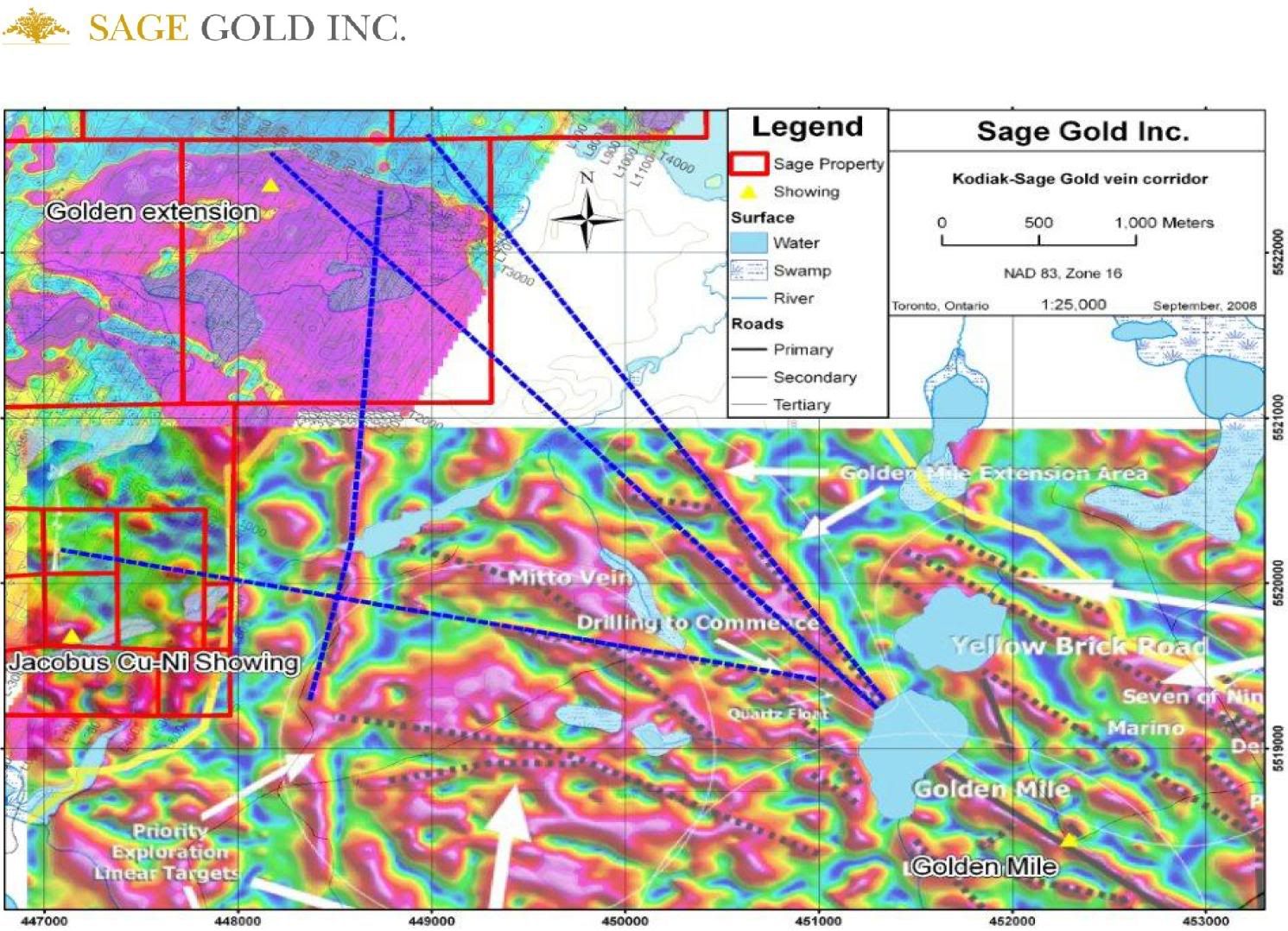

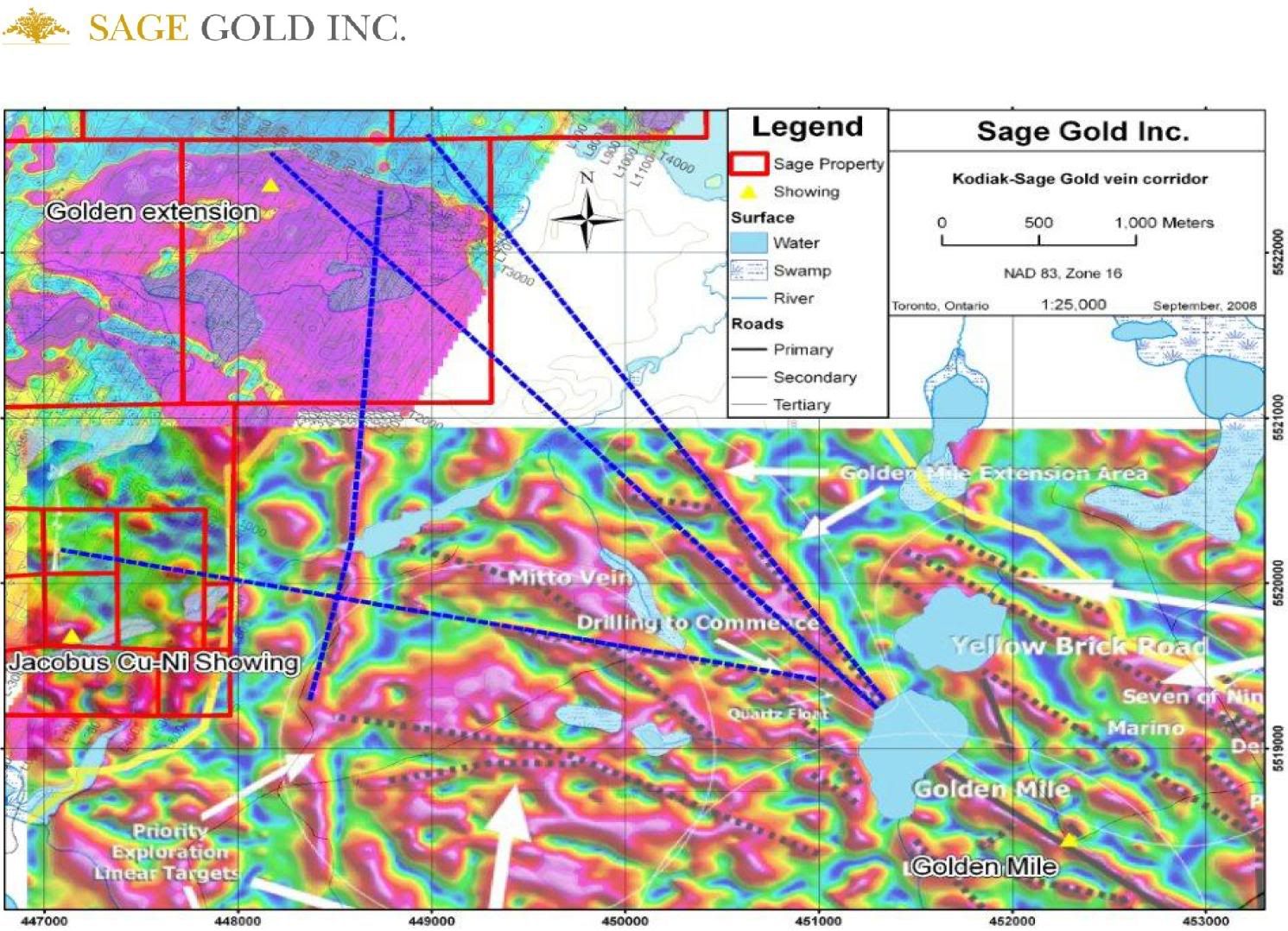

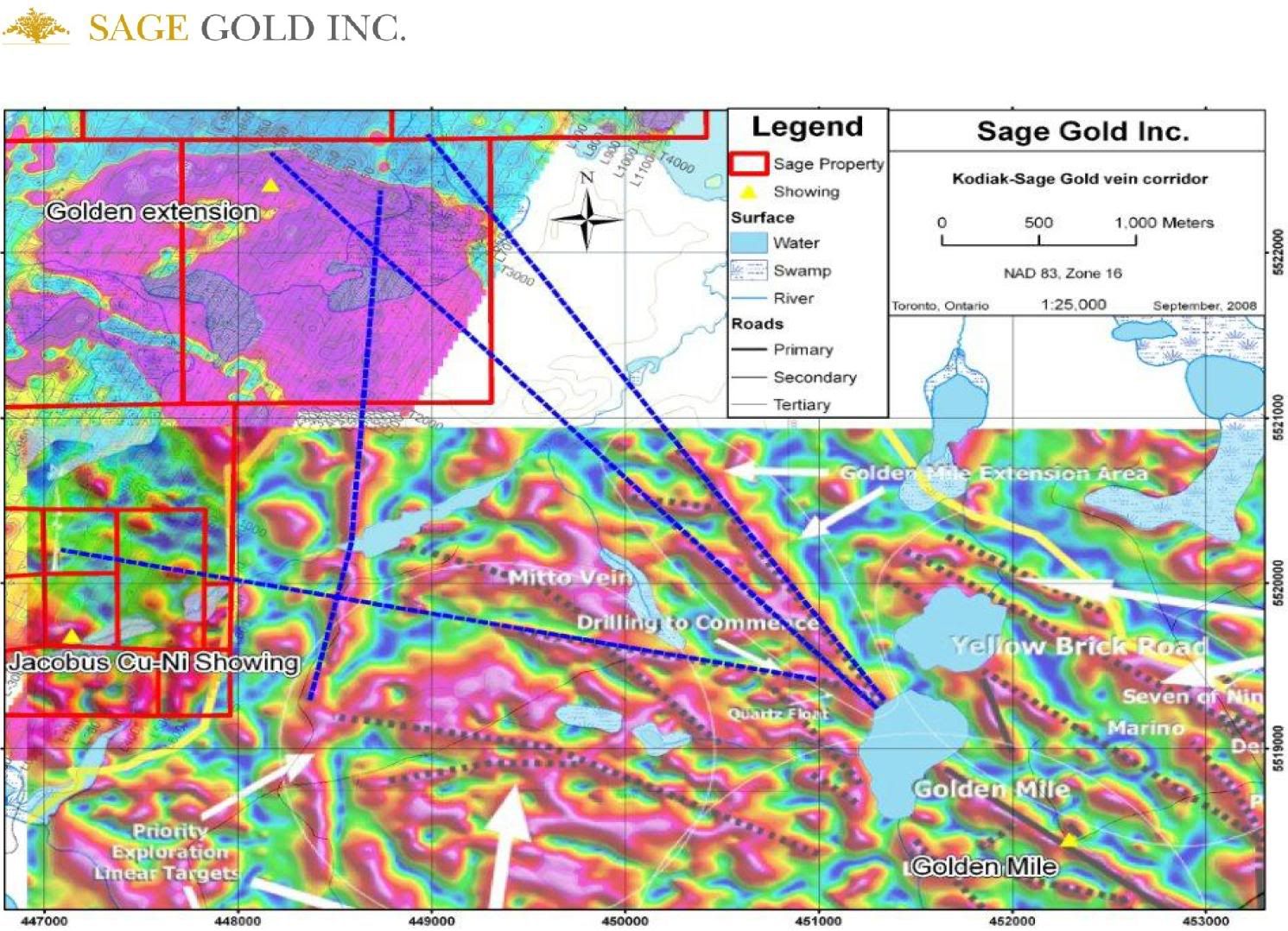

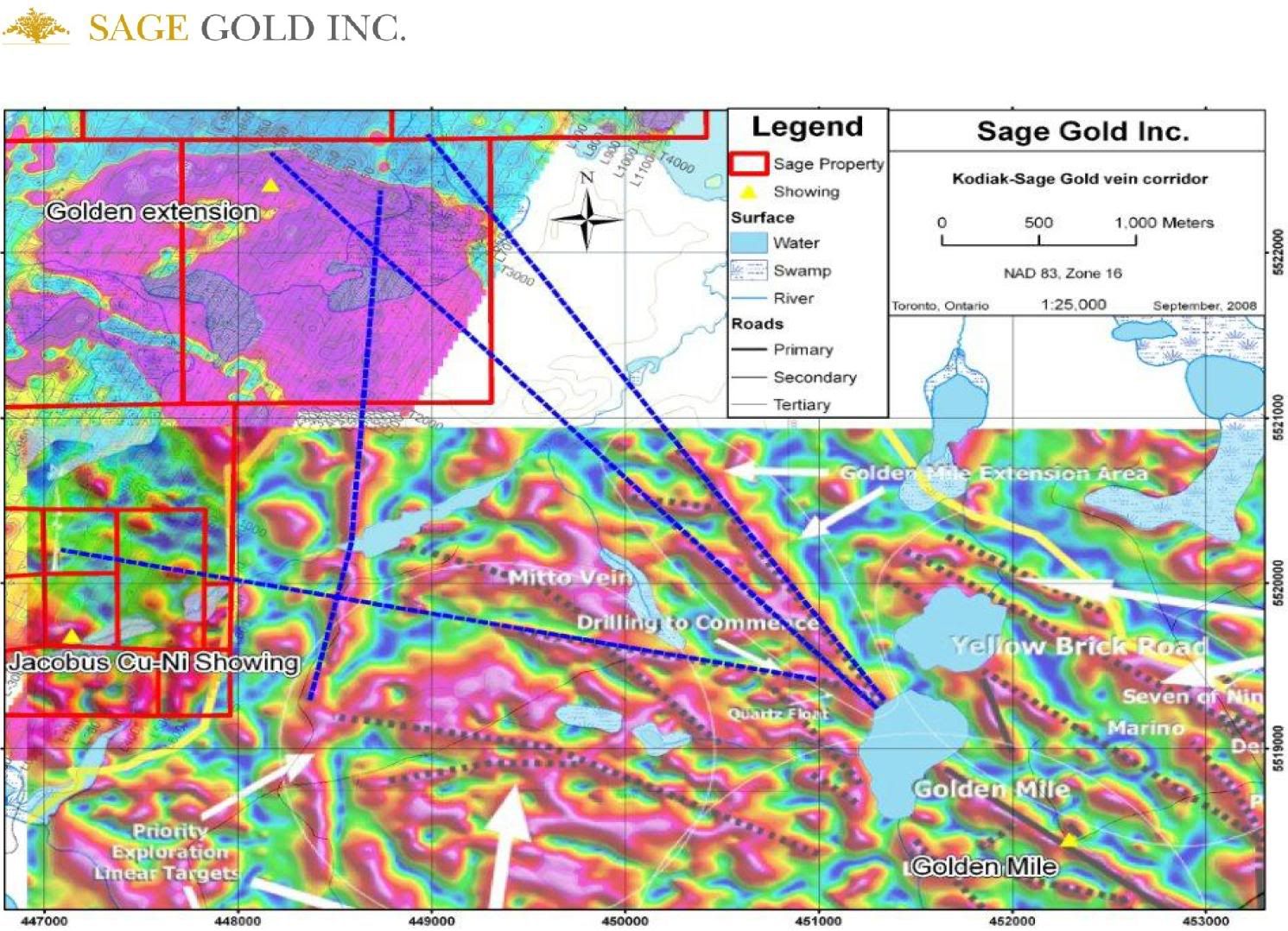

Drilling on the WL Gold Zone in 2006 encountered high-grade gold mineralization in several drill holes, including 15.59 g/t Au over 9.7 metres true thickness, including 51.65 g/t Au over 2.8 metres, in Hole HR-06-03. Two other holes also assayed better than 10 g/t Au over multi-metre intervals. These holes outline a high-grade gold-mineralized shoot plunging to the west/northwest that remains open, demonstrating the potential for the system to host a significant new gold discovery. A total of 17 out of 20 Phase I and II drill holes contain gold mineralization, outlining a broad mineralized halo 1 kilometre long and up to 75 metres wide that surrounds high-grade mineralization in the WL, Penelton and Yellow Brick Road zones.

Preliminary mapping of the WL, Penelton and Yellow Brick Road gold zones indicates that a series of thick, S-shaped pyritic gold-bearing quartz veins approximately 80 metres long are repeated along the shear zone every 100 to 150 metres. Both the veins and the intensely sheared wall rocks are gold-bearing. Petrographic analysis has confirmed the presence of electrum (a gold-silver alloy) in one of the channel cuts. A strong correlation between gold and silver values in the shear suggests it is widespread. Metallics assays were performed to mitigate any sampling errors which could be caused by uneven distribution of gold in the veins. The results indicate that both fine and coarse gold are present in the system.

Intense alteration of the metavolcanic and porphyry wall rocks indicates that large volumes of hydrothermal fluid have passed through the Hercules shear, which is steeply dipping to vertical and up to 400 metres wide. In the WL Gold Zone, sericite, chlorite and carbonate alteration are dominant, while the Penelton and Yellow Brick Road zones are characterized by feldspar and hematite alteration, along with silica and sericite. Ribbon fractures within the veins, associated with pyrite and sericite, suggest multiple episodes of mineralization.

The host rocks, geometry and structure along the Hercules shear system have many of the characteristics of well known gold deposits in the Archean, such as those found in the Abitibi and Timmins gold camps. Thirteen kilometres of the newly discovered Hercules shear system remain relatively unexplored. There are several gold showings along the system that have returned assays up to 40.32 g/t Au from grab samples, confirming the potential for additional high-grade gold shoots.

Kodiak's Phase III exploration program will focus on expanding the known extent of the gold-bearing zone on surface along strike for eight kilometres. It is also planned to include IP and magnetic surveys, trenching and prospecting, along with detailed geological mapping and sampling, to define the plunge direction and angle of the known mineralized shoots. This will be followed by diamond drilling to test economic potential.

Further information, including maps, drill sections and photographs, is available on Kodiak's website at www.kodiakexp.com.

The information contained in this news release has been reviewed and approved by Trevor Bremner, P. Geo., who is a qualified person for these projects under the definitions established by National Instrument 43-101. Mr. Bremner is an independent consultant to Kodiak.

On behalf of the Board of Directors

KODIAK EXPLORATION LIMITED

William S. Chornobay, Director, President

Contacts: Kodiak Exploration Limited

William S. Chornobay Director, President

Tel: (604) 688-9006

Fax: (604) 688-9029

Kodiak Commences Phase III Program on Hercules Gold Prospect

March 29, 2007 7:05:00 AM

Kodiak Exploration Limited (TSX VENTURE: KXL) is pleased to announce commencement of its Phase III exploration program on its 100% controlled Hercules gold prospect in Ontario. The property covers a gold-mineralized shear zone that Kodiak has traced by stripping and diamond drilling over a strike length of 1.2 kilometres, and that remains open in all directions.

Drilling on the WL Gold Zone in 2006 encountered high-grade gold mineralization in several drill holes, including 15.59 g/t Au over 9.7 metres true thickness, including 51.65 g/t Au over 2.8 metres, in Hole HR-06-03. Two other holes also assayed better than 10 g/t Au over multi-metre intervals. These holes outline a high-grade gold-mineralized shoot plunging to the west/northwest that remains open, demonstrating the potential for the system to host a significant new gold discovery. A total of 17 out of 20 Phase I and II drill holes contain gold mineralization, outlining a broad mineralized halo 1 kilometre long and up to 75 metres wide that surrounds high-grade mineralization in the WL, Penelton and Yellow Brick Road zones.

Preliminary mapping of the WL, Penelton and Yellow Brick Road gold zones indicates that a series of thick, S-shaped pyritic gold-bearing quartz veins approximately 80 metres long are repeated along the shear zone every 100 to 150 metres. Both the veins and the intensely sheared wall rocks are gold-bearing. Petrographic analysis has confirmed the presence of electrum (a gold-silver alloy) in one of the channel cuts. A strong correlation between gold and silver values in the shear suggests it is widespread. Metallics assays were performed to mitigate any sampling errors which could be caused by uneven distribution of gold in the veins. The results indicate that both fine and coarse gold are present in the system.

Intense alteration of the metavolcanic and porphyry wall rocks indicates that large volumes of hydrothermal fluid have passed through the Hercules shear, which is steeply dipping to vertical and up to 400 metres wide. In the WL Gold Zone, sericite, chlorite and carbonate alteration are dominant, while the Penelton and Yellow Brick Road zones are characterized by feldspar and hematite alteration, along with silica and sericite. Ribbon fractures within the veins, associated with pyrite and sericite, suggest multiple episodes of mineralization.

The host rocks, geometry and structure along the Hercules shear system have many of the characteristics of well known gold deposits in the Archean, such as those found in the Abitibi and Timmins gold camps. Thirteen kilometres of the newly discovered Hercules shear system remain relatively unexplored. There are several gold showings along the system that have returned assays up to 40.32 g/t Au from grab samples, confirming the potential for additional high-grade gold shoots.

Kodiak's Phase III exploration program will focus on expanding the known extent of the gold-bearing zone on surface along strike for eight kilometres. It is also planned to include IP and magnetic surveys, trenching and prospecting, along with detailed geological mapping and sampling, to define the plunge direction and angle of the known mineralized shoots. This will be followed by diamond drilling to test economic potential.

Further information, including maps, drill sections and photographs, is available on Kodiak's website at www.kodiakexp.com.

The information contained in this news release has been reviewed and approved by Trevor Bremner, P. Geo., who is a qualified person for these projects under the definitions established by National Instrument 43-101. Mr. Bremner is an independent consultant to Kodiak.

On behalf of the Board of Directors

KODIAK EXPLORATION LIMITED

William S. Chornobay, Director, President

Contacts: Kodiak Exploration Limited

William S. Chornobay Director, President

Tel: (604) 688-9006

Fax: (604) 688-9029

4/10/2007

Vancouver, BC April 10, 2007

FSC / Press Release

Kodiak Appoints Vice-President, Exploration

Vancouver, British Columbia CANADA, April 10, 2007 /FSC/ - Kodiak Exploration Limited (TSX - VX: KXL), is pleased to announce that Brian Maher has joined the Company as its Vice-President, Exploration.

Mr. Brian Maher is an economic geologist with over 27 years of experience in the international mining and exploration industry, during which time he has been part of several successful discoveries. He received his B.A. (Geology) from California State University in 1980 and his M.Sc. (Economic Geology) from Colorado State University in 1983. Mr. Maher is a member of the Society of Economic Geologists and the author of numerous publications on economic geology.

In 1982, Mr. Maher began a 16-year career with ASARCO Inc., where he initiated, designed and supervised exploration programs for gold and copper deposits in a variety of geologic environments throughout North and South America, resulting in the discovery of significant gold and base metal resources.

From 1998 through 2002, Mr. Maher operated a successful geologic consulting business with an emphasis on geologic modeling, resource estimation and business planning. Between 2002 and 2004 Mr. Maher was Project Manager at an underground gold mine in Nevada, supervising underground and surface exploration. In the course of that project he came to the attention of Hochschild Mining PLC, a Peruvian based mining company which was privately owned when Brian was asked to join it in 2005, but recently went public on the Main Market of the London Stock Exchange.

Brian's responsibilities at Hochschild, where he served as Exploration Manager for the US, Canada and Mexico prior to joining Kodiak, included supervision of exploration and mine development programs, economic analysis of acquisition candidates and development of new corporate strategies.

Mr Maher will assume overall responsibility for management, supervision and direction of Kodiak's exploration activities and geological team on a full-time basis. In addition, he will be actively involved in identifying advanced exploration projects and evaluating their economic potential as possible acquisition targets for Kodiak. As part of his compensation package, Brian will be granted incentive stock options to purchase up to 500,000 shares of the Company at the price of 0.93 per share.

"Kodiak is extremely pleased that an economic geologist of Brian's calibre has joined its team" said the company's President, Bill Chornobay. "His confidence in the potential of our current nickel, gold and uranium projects, and his belief in our strategy of growth through the acquisition of undervalued mineral assets will further our plans to build Kodiak into a major player in the mineral exploration business."

Further information, including maps, drill sections and photographs, is available on Kodiak's website at www.kodiakexp.com.

Vancouver, BC April 10, 2007

FSC / Press Release

Kodiak Appoints Vice-President, Exploration

Vancouver, British Columbia CANADA, April 10, 2007 /FSC/ - Kodiak Exploration Limited (TSX - VX: KXL), is pleased to announce that Brian Maher has joined the Company as its Vice-President, Exploration.

Mr. Brian Maher is an economic geologist with over 27 years of experience in the international mining and exploration industry, during which time he has been part of several successful discoveries. He received his B.A. (Geology) from California State University in 1980 and his M.Sc. (Economic Geology) from Colorado State University in 1983. Mr. Maher is a member of the Society of Economic Geologists and the author of numerous publications on economic geology.

In 1982, Mr. Maher began a 16-year career with ASARCO Inc., where he initiated, designed and supervised exploration programs for gold and copper deposits in a variety of geologic environments throughout North and South America, resulting in the discovery of significant gold and base metal resources.

From 1998 through 2002, Mr. Maher operated a successful geologic consulting business with an emphasis on geologic modeling, resource estimation and business planning. Between 2002 and 2004 Mr. Maher was Project Manager at an underground gold mine in Nevada, supervising underground and surface exploration. In the course of that project he came to the attention of Hochschild Mining PLC, a Peruvian based mining company which was privately owned when Brian was asked to join it in 2005, but recently went public on the Main Market of the London Stock Exchange.

Brian's responsibilities at Hochschild, where he served as Exploration Manager for the US, Canada and Mexico prior to joining Kodiak, included supervision of exploration and mine development programs, economic analysis of acquisition candidates and development of new corporate strategies.

Mr Maher will assume overall responsibility for management, supervision and direction of Kodiak's exploration activities and geological team on a full-time basis. In addition, he will be actively involved in identifying advanced exploration projects and evaluating their economic potential as possible acquisition targets for Kodiak. As part of his compensation package, Brian will be granted incentive stock options to purchase up to 500,000 shares of the Company at the price of 0.93 per share.

"Kodiak is extremely pleased that an economic geologist of Brian's calibre has joined its team" said the company's President, Bill Chornobay. "His confidence in the potential of our current nickel, gold and uranium projects, and his belief in our strategy of growth through the acquisition of undervalued mineral assets will further our plans to build Kodiak into a major player in the mineral exploration business."

Further information, including maps, drill sections and photographs, is available on Kodiak's website at www.kodiakexp.com.

Press Release - Kodiak Exploration Limited (TSX-V : KXL)

Kodiak Announces $800,000 Exploration Program for Ten Otish Uranium Properties

June 21, 2007 9:02:00 AM

--------------------------------------------------------------------------------

Kodiak Exploration Limited (TSX VENTURE: KXL) is pleased to report that it has contracted to have 11,000 line kilometres of airborne surveys flown over ten uranium prospects staked by it in the Otish Basin of Quebec during 2006. The airborne survey and follow-up ground exploration will be used to identify radioactive targets for a drilling program.

The Otish Basin has been considered prospective for uranium for many years. It is frequently compared to the Athabasca Basin of Saskatchewan, which accounts for approximately one third of global uranium supply. It made headlines recently after Strateco Resources Inc. intersected 2.13% U3O8 over 15.2 metres in a 2006 drill hole on its Matoush property, which is contiguous with Kodiak's Matoush north and south properties and 1.3 km east of Kodiak's Matoush west claim block. Kodiak's other seven prospects are known as the UR, UR East, 308 West, 308 East, and RIM 1, 2 and 3. Kodiak holds a 100% interest in all ten claim blocks, which collectively cover approximately 105,000 acres.

Exploration conducted on Kodiak's UR claim block during the 1970's by Uranerz, a large European uranium company, identified more than 100 radioactive boulders within a 3 km x 2 km area. Those boulders returned uranium values ranging from 0.12% U308 to 4.13% U308. Kodiak's exploration programs will be directed at locating the source of those mineralized boulders. Since the boulders were deposited at their current locations by glacial ice flows, they form a pattern which allows the company to follow them "up-ice" to a potential source. The particular pattern of the radioactive boulders discovered by Uranez indicates that a regional fault located 3 km up-ice may be the source of those boulders and, therefore, prospective for a uranium deposit. That fault is covered by mineral claims which are 100% owned by Kodiak.

Kodiak will fly radiometric, magnetic and electromagnetic surveys, all of which are designed to identify radioactive targets within the basinal sediments and radioactive fault zones which cut the bedrock up-ice from the boulder trains, which are near the basin margin. Kodiak has budgeted $800,000 for the airborne program and follow-up surface exploration. The airborne survey is scheduled to begin in early August, 2007.

Kodiak's ten uranium prospects include a wide range of geological settings, with potential to host a variety of deposit types. These include perched deposits within the basinal sediments (like Matoush), classic unconformity-style deposits at the bedrock interface (like Key Lake), and deep unconformity deposits within the crystalline bedrock (like Rabbit Lake).

Kodiak's properties were acquired to cover specific target areas identified by Uranerz in the late 1970s, but relinquished after the uranium price collapsed in the early 1980s. These prospects were developed by Kodiak's geologic team in collaboration with Roscoe Postle Associates, and Charles Beaudry, P. Geo. This summer's exploration program is to be conducted under the direct supervision of Kodiak consulting geologist Chris Marmont, P.Geo. Mr. Marmont has considerable past uranium exploration experience, including a position as manager of Urangesellschaft Canada Limited's Baker Lake program in the late seventies. That program included the initial drilling of the Kiggavik uranium deposit.

The information contained in this news release has been reviewed and approved by Chris Marmont, P.Geo who is the qualified person for the Otish project under the definitions established by National Instrument 43-101.

Kodiak is a mineral exploration company with properties located in Canada. Maps, photographs, geological details and additional information may be reviewed on its web site at www.kodiakexp.com.

On behalf of the Board of Directors

KODIAK EXPLORATION LIMITED

William S. Chornobay, Director, President

This document contains certain forward looking statements which involve known and unknown risks, delays, and uncertainties not under the Company's control which may cause actual results, performance or achievements of the Company to be materially different from the results, performance or expectation implied by these forward looking statements.

Contacts:

Kodiak Exploration Limited

William S. Chornobay Director, President

(604) 688-9006

Fax 604) 688-9029

604) 688-9029

Email: info@kodiakexp.com

Website: www.kodiakexp.com

Kodiak Announces $800,000 Exploration Program for Ten Otish Uranium Properties

June 21, 2007 9:02:00 AM

--------------------------------------------------------------------------------

Kodiak Exploration Limited (TSX VENTURE: KXL) is pleased to report that it has contracted to have 11,000 line kilometres of airborne surveys flown over ten uranium prospects staked by it in the Otish Basin of Quebec during 2006. The airborne survey and follow-up ground exploration will be used to identify radioactive targets for a drilling program.

The Otish Basin has been considered prospective for uranium for many years. It is frequently compared to the Athabasca Basin of Saskatchewan, which accounts for approximately one third of global uranium supply. It made headlines recently after Strateco Resources Inc. intersected 2.13% U3O8 over 15.2 metres in a 2006 drill hole on its Matoush property, which is contiguous with Kodiak's Matoush north and south properties and 1.3 km east of Kodiak's Matoush west claim block. Kodiak's other seven prospects are known as the UR, UR East, 308 West, 308 East, and RIM 1, 2 and 3. Kodiak holds a 100% interest in all ten claim blocks, which collectively cover approximately 105,000 acres.

Exploration conducted on Kodiak's UR claim block during the 1970's by Uranerz, a large European uranium company, identified more than 100 radioactive boulders within a 3 km x 2 km area. Those boulders returned uranium values ranging from 0.12% U308 to 4.13% U308. Kodiak's exploration programs will be directed at locating the source of those mineralized boulders. Since the boulders were deposited at their current locations by glacial ice flows, they form a pattern which allows the company to follow them "up-ice" to a potential source. The particular pattern of the radioactive boulders discovered by Uranez indicates that a regional fault located 3 km up-ice may be the source of those boulders and, therefore, prospective for a uranium deposit. That fault is covered by mineral claims which are 100% owned by Kodiak.

Kodiak will fly radiometric, magnetic and electromagnetic surveys, all of which are designed to identify radioactive targets within the basinal sediments and radioactive fault zones which cut the bedrock up-ice from the boulder trains, which are near the basin margin. Kodiak has budgeted $800,000 for the airborne program and follow-up surface exploration. The airborne survey is scheduled to begin in early August, 2007.

Kodiak's ten uranium prospects include a wide range of geological settings, with potential to host a variety of deposit types. These include perched deposits within the basinal sediments (like Matoush), classic unconformity-style deposits at the bedrock interface (like Key Lake), and deep unconformity deposits within the crystalline bedrock (like Rabbit Lake).

Kodiak's properties were acquired to cover specific target areas identified by Uranerz in the late 1970s, but relinquished after the uranium price collapsed in the early 1980s. These prospects were developed by Kodiak's geologic team in collaboration with Roscoe Postle Associates, and Charles Beaudry, P. Geo. This summer's exploration program is to be conducted under the direct supervision of Kodiak consulting geologist Chris Marmont, P.Geo. Mr. Marmont has considerable past uranium exploration experience, including a position as manager of Urangesellschaft Canada Limited's Baker Lake program in the late seventies. That program included the initial drilling of the Kiggavik uranium deposit.

The information contained in this news release has been reviewed and approved by Chris Marmont, P.Geo who is the qualified person for the Otish project under the definitions established by National Instrument 43-101.

Kodiak is a mineral exploration company with properties located in Canada. Maps, photographs, geological details and additional information may be reviewed on its web site at www.kodiakexp.com.

On behalf of the Board of Directors

KODIAK EXPLORATION LIMITED

William S. Chornobay, Director, President

This document contains certain forward looking statements which involve known and unknown risks, delays, and uncertainties not under the Company's control which may cause actual results, performance or achievements of the Company to be materially different from the results, performance or expectation implied by these forward looking statements.

Contacts:

Kodiak Exploration Limited

William S. Chornobay Director, President

(604) 688-9006

Fax

604) 688-9029

604) 688-9029 Email: info@kodiakexp.com

Website: www.kodiakexp.com

da hat man tatsächlich was nettes gefunden

... und daher geht der kurs auch über 1,8 cad

das wird bei VG GOLD und HY LAKE dieses jahr auch noch kommen, wenn die drilling results draussen sind.

gruß,

dosco

das wird bei VG GOLD und HY LAKE dieses jahr auch noch kommen, wenn die drilling results draussen sind.

gruß,

dosco

bin ich der einzige im lande der in dem titel drinnen ist ?

Nope.

wie eloquent... aber wenigstens sind wir 2!

Antwort auf Beitrag Nr.: 31.925.805 von dosco12 am 10.10.07 15:26:18Nein du bist nicht der einzige

Antwort auf Beitrag Nr.: 31.939.396 von Hoschie am 11.10.07 14:51:06I got back home late this evening from the Hercules Property. We landed in a snowstorm at Geraldton, and then hopped in a truck with the project geo to spend the day swinging rock hammers at outcrops. I plan to write a full trip report tomorrow but I am too dozy to concentrate right now. I hate to leave that sort of thing for a Friday, so I will just post a couple of notes:

The system is massive, with several nested veins including two that run for about 2 kms so far and remain open lateraly and to depth. They have issues with swamps and lakes that interupt the stripping of the veins so they have to wait for winter, but they have identified drill targets up the yin-yang from the surface sampling so far. I walked the length of one of the more productive veins and saw that the sampling was done in a straight line across the vein, in 20m intervals. So it was not a question of just high grade sampling that was reported.

The visible gold in this system is the best I have ever seen. I brought home 4 samples and I look forward to the next Toronto goldbugs meeting to show them around. Absolutely off the charts! There were so many gold spots just along the surface of the veins I lost count, and some were about the size of my thumbnail. I did not want to take home the samples from the vein that were exposed, so I spent about half an hour with a geo and a prospector, breaking rock and I only took the more interesting samples, but we found VG all over the place.

There are numerous samples and 10 more drill core assays still pending, and KXL has paid a higher lab fee to get priority testing done. So I expect more news will be released very soon. I think the market is going to like it too, based on what I witnessed for myself.

I will post more tomorrow. For personal disclosure, I bought more shares this week, and have not sold a share since last winter, but I do have plans to take some profits later in this run and ride the zero cost average shares. So I do not want to overly hype this story and sell into it, but be advised I plan to take about a quarter of my shares off the table, somewhere above $2. KXL paid my airfare to the project today, but I do not receive any form of compensation for my time or for posting my reports.

cheers!

The system is massive, with several nested veins including two that run for about 2 kms so far and remain open lateraly and to depth. They have issues with swamps and lakes that interupt the stripping of the veins so they have to wait for winter, but they have identified drill targets up the yin-yang from the surface sampling so far. I walked the length of one of the more productive veins and saw that the sampling was done in a straight line across the vein, in 20m intervals. So it was not a question of just high grade sampling that was reported.

The visible gold in this system is the best I have ever seen. I brought home 4 samples and I look forward to the next Toronto goldbugs meeting to show them around. Absolutely off the charts! There were so many gold spots just along the surface of the veins I lost count, and some were about the size of my thumbnail. I did not want to take home the samples from the vein that were exposed, so I spent about half an hour with a geo and a prospector, breaking rock and I only took the more interesting samples, but we found VG all over the place.

There are numerous samples and 10 more drill core assays still pending, and KXL has paid a higher lab fee to get priority testing done. So I expect more news will be released very soon. I think the market is going to like it too, based on what I witnessed for myself.

I will post more tomorrow. For personal disclosure, I bought more shares this week, and have not sold a share since last winter, but I do have plans to take some profits later in this run and ride the zero cost average shares. So I do not want to overly hype this story and sell into it, but be advised I plan to take about a quarter of my shares off the table, somewhere above $2. KXL paid my airfare to the project today, but I do not receive any form of compensation for my time or for posting my reports.

cheers!

Das hört sich super an, wenn das stimmt, was dieser Stockhouse user schreibt.

der ist bekannt wie ein bunter hund: coach247

mexicomike ja der ist sehr bekannt

news von kodiak:

habe ich ja noch nie gelesen, aber klingt lustig:

AGORACOM Launches "Investor Controlled Discussion Forum" for Kodiak Exploration Investors in Response to Epidemic Bashing and Spam

Friday October 12, 3:55 pm ET

TORONTO, ONTARIO--(Marketwire - Oct. 12, 2007) - AGORACOM (http://www.agoracom.com) is pleased to announce the launch of an "Investor Controlled Discussion Forum" for investors of Kodiak Exploration (TSX VENTURE:KXL - News) at http://www.agoracom.com/ir/Kodiak , as well as, the appointment of "Crowlee" as HUB Leader.

ADVERTISEMENT

WHAT ARE INVESTOR CONTROLLED DISCUSSION FORUMS?

In response to epidemic levels of spam, stock bashing and profanity on stock forums around the web, AGORACOM launched Investor Controlled Discussion Forums for the purpose of handing control back to small-cap investors. Specifically, control over offending posts, offending members and company information.

Based on a democratic voting and activity system, investors of every small-cap stock are able to appoint HUB Leaders to exercise the following controls with just one-click:

- Delete offending posts containing spam, profanity and stock bashing

- Delete offending members that continue to post offending messages

- Update company information such as corporate profiles, management bio's, company photos and videos, logos, outstanding shares and more.

As a result, investors are able to amalgamate, communicate, share market intelligence and exchange investment opinions in a clean and constructive environment, leading to the best investment decision possible. Testimonials from newly registered members can be seen at http://del.icio.us/AGORACOM/AgoracomTestimonials.

AGORACOM launched its paradigm shifting model on October 5th, 2007 and reports that over 100 HUBS have already been launched. Investors of companies not yet on AGORACOM can request a HUB at: http://www.agoracom.com/hub_requests/new.

About AGORACOM

AGORACOM (http://www.Agoracom.com) is North America's largest official online community for public companies. Unlike stock communities that provide investors with unmonitored discussion forums plagued by profanity, spam and bashing, AGORACOM was built to serve the interests of public companies and investors by creating monitored communities focusing on quality over quantity.

habe ich ja noch nie gelesen, aber klingt lustig:

AGORACOM Launches "Investor Controlled Discussion Forum" for Kodiak Exploration Investors in Response to Epidemic Bashing and Spam

Friday October 12, 3:55 pm ET

TORONTO, ONTARIO--(Marketwire - Oct. 12, 2007) - AGORACOM (http://www.agoracom.com) is pleased to announce the launch of an "Investor Controlled Discussion Forum" for investors of Kodiak Exploration (TSX VENTURE:KXL - News) at http://www.agoracom.com/ir/Kodiak , as well as, the appointment of "Crowlee" as HUB Leader.

ADVERTISEMENT

WHAT ARE INVESTOR CONTROLLED DISCUSSION FORUMS?

In response to epidemic levels of spam, stock bashing and profanity on stock forums around the web, AGORACOM launched Investor Controlled Discussion Forums for the purpose of handing control back to small-cap investors. Specifically, control over offending posts, offending members and company information.

Based on a democratic voting and activity system, investors of every small-cap stock are able to appoint HUB Leaders to exercise the following controls with just one-click:

- Delete offending posts containing spam, profanity and stock bashing

- Delete offending members that continue to post offending messages

- Update company information such as corporate profiles, management bio's, company photos and videos, logos, outstanding shares and more.

As a result, investors are able to amalgamate, communicate, share market intelligence and exchange investment opinions in a clean and constructive environment, leading to the best investment decision possible. Testimonials from newly registered members can be seen at http://del.icio.us/AGORACOM/AgoracomTestimonials.

AGORACOM launched its paradigm shifting model on October 5th, 2007 and reports that over 100 HUBS have already been launched. Investors of companies not yet on AGORACOM can request a HUB at: http://www.agoracom.com/hub_requests/new.

About AGORACOM

AGORACOM (http://www.Agoracom.com) is North America's largest official online community for public companies. Unlike stock communities that provide investors with unmonitored discussion forums plagued by profanity, spam and bashing, AGORACOM was built to serve the interests of public companies and investors by creating monitored communities focusing on quality over quantity.

Antwort auf Beitrag Nr.: 31.969.466 von fwinter61 am 13.10.07 16:46:09Willkommen hier im Kodiak Expl. Thread. Wenn du mehr Fakten zu Kodiak wissen willst, dann geh zur Homepage www.kodiakexp.com oder geh an den Anfang des Threads wo ich einiges zu Kodiak geschrieben habe.

Gruss und ein schönes WE,

Hoschie

Gruss und ein schönes WE,

Hoschie

Antwort auf Beitrag Nr.: 31.972.164 von Hoschie am 13.10.07 19:22:49Thanks f+r die Begrüúng!

Kam über Bayswater hier her

http://www.stockhouse.com/bullboards/forum.asp?symbol=BAY&ta…

mal sehen, ob da ein Zusammenhang entsteht.

Kam über Bayswater hier her

http://www.stockhouse.com/bullboards/forum.asp?symbol=BAY&ta…

mal sehen, ob da ein Zusammenhang entsteht.

Na?

Wer ist hier bereits dabei?

Wer ist hier bereits dabei?

Antwort auf Beitrag Nr.: 31.992.456 von Panem am 15.10.07 08:31:58ich noch immer...

leider dumm genug gewesen bei noront zu 2,6 raus zu gehen... das passiert mir hier nicht...

leider dumm genug gewesen bei noront zu 2,6 raus zu gehen... das passiert mir hier nicht...

wieso steigen die bloss immer noch ?

hätte mehr kaufen sollen...

hätte mehr kaufen sollen...

Antwort auf Beitrag Nr.: 32.051.161 von dosco12 am 17.10.07 17:33:062,37 ?

Antwort auf Beitrag Nr.: 32.051.161 von dosco12 am 17.10.07 17:33:062.49 ?

soll das jetzt jede minute 5 % nach oben gehen ?

soll das jetzt jede minute 5 % nach oben gehen ?

Antwort auf Beitrag Nr.: 32.071.521 von dosco12 am 18.10.07 20:02:362,55...

oehm

oehm

Antwort auf Beitrag Nr.: 32.071.660 von dosco12 am 18.10.07 20:09:092,6. .. das gibts doch nicht...

2,65 ... ääää?

Antwort auf Beitrag Nr.: 32.071.660 von dosco12 am 18.10.07 20:09:092,7 iiiiii

Antwort auf Beitrag Nr.: 32.071.736 von dosco12 am 18.10.07 20:12:322,75!

ok, auf die erklärende news bin ich aber gespannt...

ok, auf die erklärende news bin ich aber gespannt...

Antwort auf Beitrag Nr.: 32.071.838 von dosco12 am 18.10.07 20:17:512,8 cad!

Antwort auf Beitrag Nr.: 32.073.382 von dosco12 am 18.10.07 21:37:232,95!

halted ?!

Antwort auf Beitrag Nr.: 32.084.543 von dosco12 am 19.10.07 15:09:22Market Regulation Services - Trading Halt - Kodiak Exploration Limited - KXL

Friday October 19, 9:12 am ET

VANCOUVER, Oct. 19 /CNW/ - The following issues have been halted by Market Regulation Services (RS):

Issuer Name: Kodiak Exploration Limited

TSX-V Ticker Symbol: KXL

Time of Halt: at the open

Reason for Halt: Pending News

For further information

Market Regulation Services Inc., (416) 646-7299

Friday October 19, 9:12 am ET

VANCOUVER, Oct. 19 /CNW/ - The following issues have been halted by Market Regulation Services (RS):

Issuer Name: Kodiak Exploration Limited

TSX-V Ticker Symbol: KXL

Time of Halt: at the open

Reason for Halt: Pending News

For further information

Market Regulation Services Inc., (416) 646-7299

Antwort auf Beitrag Nr.: 32.084.611 von dosco12 am 19.10.07 15:15:06Hui... ich bin mit Dir gespannt.

Vielen Dank für das Heraussuchen und die schöne Reportage gestern abend; hab das gestern leider nicht mitverfolgt, kann Deinen Kommentaren aber soweit folgen.

Vielen Dank für das Heraussuchen und die schöne Reportage gestern abend; hab das gestern leider nicht mitverfolgt, kann Deinen Kommentaren aber soweit folgen.

Antwort auf Beitrag Nr.: 32.084.947 von Peter_B am 19.10.07 15:37:29Ich weiß es schon, ich weiß es schon!

(aber schon seit Montag)

Gelobt sein die Insider!

(aber schon seit Montag)

Gelobt sein die Insider!

Antwort auf Beitrag Nr.: 32.085.653 von Panem am 19.10.07 16:17:32Ach komm. Was denn das für ein Spruch?

Hercules?

Hercules?

Antwort auf Beitrag Nr.: 32.085.895 von Peter_B am 19.10.07 16:32:53Ich weiß, der Spruch ist doof.

Nein, es war einfach der Bericht von Coach247 vom Fieldtrip, der durchgesickert ist.

Zumindest hat mir Kodiak nach Lage der Dinge den Sieg beim WO-Börsenspiel gebracht.

Daher mein Jubel.

Privat war ich zu vorsichtig, denn aufgrund von Gerüchten zu kaufen ist so eine Sache - und meine nicht.

Nein, es war einfach der Bericht von Coach247 vom Fieldtrip, der durchgesickert ist.

Zumindest hat mir Kodiak nach Lage der Dinge den Sieg beim WO-Börsenspiel gebracht.

Daher mein Jubel.

Privat war ich zu vorsichtig, denn aufgrund von Gerüchten zu kaufen ist so eine Sache - und meine nicht.

Antwort auf Beitrag Nr.: 32.085.963 von Panem am 19.10.07 16:36:33Den hab ich auch gelesen; hm. Naja. Wie ist dieser Coach denn einzuschätzen bzw. warum leitest Du hiervon was ab?

A propos - von heute:

http://www.agoracom.com/ir/Kodiak/messages/600577#message

A propos - von heute:

http://www.agoracom.com/ir/Kodiak/messages/600577#message

However...

... ich stell mal was rein, damit man in diesem schönen Board auch ein wenig dabei ist

... ich stell mal was rein, damit man in diesem schönen Board auch ein wenig dabei ist

Antwort auf Beitrag Nr.: 32.086.177 von Peter_B am 19.10.07 16:49:27der bericht war gut... aber die infos wusste ich schon vor ihm...

stand auf der homepage seit wochen, dass es vg gibt!

aber wie immer nur ein paar k gekauft...

stand auf der homepage seit wochen, dass es vg gibt!

aber wie immer nur ein paar k gekauft...

Antwort auf Beitrag Nr.: 32.086.496 von dosco12 am 19.10.07 17:07:25Ja, aber seine Sätze auf seiner Homepage waren extrem beeindruckend.

So etwas habe ich von Mike noch nie gehört.

So etwas habe ich von Mike noch nie gehört.

Map aller Area Plays:

Ich sage nur: Hallo Noront!

http://www.mndm.gov.on.ca/mndm/mines/resgeol/northwest/tbn/r…

Ich sage nur: Hallo Noront!

http://www.mndm.gov.on.ca/mndm/mines/resgeol/northwest/tbn/r…

aber wer sitzt tatsächlich auf der ader.

das düften nur wenige...wenn überhaupt einer sein.

wer von denen hatte den visible gold auf dem claim ?

gruß,

dosco

das düften nur wenige...wenn überhaupt einer sein.

wer von denen hatte den visible gold auf dem claim ?

gruß,

dosco

Antwort auf Beitrag Nr.: 32.085.963 von Panem am 19.10.07 16:36:33Hallo Panem

Wir wollen doch bitteschön korrekt bleiben. Ich bitte dich deshalb, dein Posting

->

#61 von Panem Benutzerinfo Nachricht an Benutzer Beiträge des Benutzers ausblenden 19.10.07 16:36:33 Beitrag Nr.: 32.085.963

Ich weiß, der Spruch ist doof.

Nein, es war einfach der Bericht von Coach247 vom Fieldtrip, der durchgesickert ist.

Zumindest hat mir Kodiak nach Lage der Dinge den Sieg beim WO-Börsenspiel gebracht.

Daher mein Jubel.

Privat war ich zu vorsichtig, denn aufgrund von Gerüchten zu kaufen ist so eine Sache - und meine nicht.

->

richtig zu stellen.

Mit freundlichsten Grüßen - deine Börsenspielhosteß

Wir wollen doch bitteschön korrekt bleiben. Ich bitte dich deshalb, dein Posting

->

#61 von Panem Benutzerinfo Nachricht an Benutzer Beiträge des Benutzers ausblenden 19.10.07 16:36:33 Beitrag Nr.: 32.085.963

Ich weiß, der Spruch ist doof.

Nein, es war einfach der Bericht von Coach247 vom Fieldtrip, der durchgesickert ist.

Zumindest hat mir Kodiak nach Lage der Dinge den Sieg beim WO-Börsenspiel gebracht.

Daher mein Jubel.

Privat war ich zu vorsichtig, denn aufgrund von Gerüchten zu kaufen ist so eine Sache - und meine nicht.

->

richtig zu stellen.

Mit freundlichsten Grüßen - deine Börsenspielhosteß

Antwort auf Beitrag Nr.: 32.095.456 von Boersenspiele am 20.10.07 23:16:33Nach Lage der Dinge NICHT den auch gar nicht verdienten Sieg im Börsenspiel...

Besser?

Besser?

Antwort auf Beitrag Nr.: 31.961.699 von dosco12 am 12.10.07 19:51:01Im Übrigen hatte hier jeder die Info zur Verfügung - ohne eventuell die Werthaltigkeit der Quelle einschätzen zu können.

Ich sehe das Problem deshalb nicht:

"I got back home late this evening from the Hercules Property. We landed in a snowstorm at Geraldton, and then hopped in a truck with the project geo to spend the day swinging rock hammers at outcrops. I plan to write a full trip report tomorrow but I am too dozy to concentrate right now. I hate to leave that sort of thing for a Friday, so I will just post a couple of notes:

The system is massive, with several nested veins including two that run for about 2 kms so far and remain open lateraly and to depth. They have issues with swamps and lakes that interupt the stripping of the veins so they have to wait for winter, but they have identified drill targets up the yin-yang from the surface sampling so far. I walked the length of one of the more productive veins and saw that the sampling was done in a straight line across the vein, in 20m intervals. So it was not a question of just high grade sampling that was reported.

The visible gold in this system is the best I have ever seen. I brought home 4 samples and I look forward to the next Toronto goldbugs meeting to show them around. Absolutely off the charts! There were so many gold spots just along the surface of the veins I lost count, and some were about the size of my thumbnail. I did not want to take home the samples from the vein that were exposed, so I spent about half an hour with a geo and a prospector, breaking rock and I only took the more interesting samples, but we found VG all over the place.

There are numerous samples and 10 more drill core assays still pending, and KXL has paid a higher lab fee to get priority testing done. So I expect more news will be released very soon. I think the market is going to like it too, based on what I witnessed for myself.

I will post more tomorrow. For personal disclosure, I bought more shares this week, and have not sold a share since last winter, but I do have plans to take some profits later in this run and ride the zero cost average shares. So I do not want to overly hype this story and sell into it, but be advised I plan to take about a quarter of my shares off the table, somewhere above $2. KXL paid my airfare to the project today, but I do not receive any form of compensation for my time or for posting my reports.

cheers!"

Ich sehe das Problem deshalb nicht:

"I got back home late this evening from the Hercules Property. We landed in a snowstorm at Geraldton, and then hopped in a truck with the project geo to spend the day swinging rock hammers at outcrops. I plan to write a full trip report tomorrow but I am too dozy to concentrate right now. I hate to leave that sort of thing for a Friday, so I will just post a couple of notes: