Diskussion zu Signal Gold [Anaconda Gold] (Seite 140)

eröffnet am 20.09.06 16:45:25 von

neuester Beitrag 18.05.24 13:58:19 von

neuester Beitrag 18.05.24 13:58:19 von

Beiträge: 36.205

ID: 1.083.231

ID: 1.083.231

Aufrufe heute: 8

Gesamt: 2.161.682

Gesamt: 2.161.682

Aktive User: 0

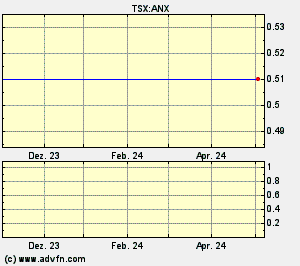

ISIN: CA82664T1012 · WKN: A3DK3Q · Symbol: Y8B

0,0710

EUR

+4,41 %

+0,0030 EUR

Letzter Kurs 21.05.24 Tradegate

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 221,00 | +20,70 | |

| 0,7750 | +20,16 | |

| 742,05 | +19,92 | |

| 16,270 | +16,71 | |

| 1,2800 | +15,32 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8000 | -11,11 | |

| 10,770 | -13,65 | |

| 8.650,00 | -16,93 | |

| 11.000,00 | -31,83 | |

| 48,50 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Anaconda Mining drills four m of 6.7 g/t Au at Stog'er

2016-06-02 08:28 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING EXTENDS THE STRIKE OF STOG'ER TIGHT TO 500 METRES AND INTERSECTS 6.70 G/T GOLD OVER 4 METRES

Anaconda Mining Inc. has released the results of a 751-metre, 16-hole, diamond drill program conducted at the Stog'er Tight project. The drill program focused on shallow areas, no more than 40 metres from surface, west and southwest of the Stog'er Tight deposit. The goals of the program were to test the hypothesis that the gabbro and west zones joined together below surface and to determine if surface mineralization at the west zone continued downdip and is an extension of the deposit.

Highlights of the drill program include:

Hole BN-16-235 returned 6.70 grams per tonne gold over four metres from 16 metres to 20 metres, including 8.85 g/t Au over three metres.

Hole BN-16-227 returned 1.81 g/t Au over six metres from 22 metres to 28 metres.

Hole BN-16-236 returned 3.72 g/t Au over four metres from six metres to 10 metres and 2.27 g/t Au over three metres from 18 metres to 21 metres.

The west and gabbro zones were determined to be two separate zones of mineralization and both zones continue at depth. The gabbro zone dips shallowly to the north beneath the west zone and is within 20 metres of surface. Both the west and gabbro zones are the folded extensions of Stog'er Tight, which extended the strike length 100 metres for a total of 500 metres. Equally important, the company's interpretation of these drill results indicate that numerous other showings throughout the Stog'er Tight project area may represent fold repetition of the Stog'er Tight deposit.

Dustin Angelo, chief executive officer of Anaconda, stated: "The drill program around the gabbro and west zones was successful in that it extended the Stog'er Tight deposit 100 metres westward, to a total strike length of 500 metres, and identified multiple zones of shallow mineralization. We also learned about the repetitious folding that is occurring around Stog'er Tight, which is a very good predictive tool as we step out farther from the main deposit area. It has given us more confidence in the potential to expand the resources around Stog'er Tight."

SIGNIFICANT GOLD INTERSECTIONS

Drill hole From To Interval Au

(m) (m) (m) (g/t)

BN-16-225 21.8 24 2.2 1.76

BN-16-226 6 7 1 1.99

and 14 19 5 1.42

BN-16-227 17 19 2 1.08

and 22 28 6 1.81

including 23 26 3 3.04

BN-16-228 9 13 4 2.28

BN-16-229 18.5 22 3.5 0.63

BN-16-230 35.5 38.5 3 2.46

BN-16-231 14 15 1 0.69

BN-16-232 14 15 1 0.67

BN-16-233 20 21 1 1.10

BN-16-234 26 30 4 2.04

BN-16-235 16 20 4 6.70

including 16 19 3 8.85

BN-16-236 6 10 4 3.72

and 18 21 3 2.27

BN-16-238 43 44 1 0.54

BN-16-242 38 39 1 1.17

A summary of significant composited assays (core length) from the western and gabbro zones at Stog'er Tight. True widths are estimated to be between 70 per cent and 95 per cent of the core length.

The company has geologically modelled the results of the drill program and will use the information to determine the best approach to test the further continuity of the Stog'er Tight deposit.

The Stog'er Tight deposit

The Stog'er Tight deposit is located 3.5 kilometres from the Pine Cove mill along the existing mine road. The deposit contains a National Instrument 43-101-compliant resource, including an indicated resource of 204,100 tonnes with a grade of 3.59 g/t Au (23,540 ounces Au) and an inferred resource of 252,000 tonnes with a grade of 3.27 g/t Au (26,460 ounces Au) using a cut-off grade of 0.8 g/t Au (see company's news release dated Oct. 22, 2015). The deposit is characterized by intense carbonate, albite and pyrite alteration of gabbroic rocks with gold, strongly associated with pyrite, which is similar to the Pine Cove deposit. The geological characteristics of Stog'er Tight are found in a much larger area around the deposit that is approximately 1.5 km long by 0.5 km wide. Besides the east, west and gabbro zones, several other zones of alteration and mineralization have been identified throughout the greater Stog'er Tight area, indicating the potential for further discovery.

This news release has been reviewed and approved by Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining Inc., a qualified person, under National Instrument 43-101 standard for disclosure for mineral projects.

All samples are collected using quality assurance/quality control protocols including the regular insertion of duplicates, standards and blanks within the sample batch for analysis. All samples quoted in this release are analyzed at Eastern Analytical Ltd. in Springdale, Nfld., for Au by fire assay (30 grams) with an atomic absorption finish.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-06-02 08:28 ET - News Release

Mr. Dustin Angelo reports

ANACONDA MINING EXTENDS THE STRIKE OF STOG'ER TIGHT TO 500 METRES AND INTERSECTS 6.70 G/T GOLD OVER 4 METRES

Anaconda Mining Inc. has released the results of a 751-metre, 16-hole, diamond drill program conducted at the Stog'er Tight project. The drill program focused on shallow areas, no more than 40 metres from surface, west and southwest of the Stog'er Tight deposit. The goals of the program were to test the hypothesis that the gabbro and west zones joined together below surface and to determine if surface mineralization at the west zone continued downdip and is an extension of the deposit.

Highlights of the drill program include:

Hole BN-16-235 returned 6.70 grams per tonne gold over four metres from 16 metres to 20 metres, including 8.85 g/t Au over three metres.

Hole BN-16-227 returned 1.81 g/t Au over six metres from 22 metres to 28 metres.

Hole BN-16-236 returned 3.72 g/t Au over four metres from six metres to 10 metres and 2.27 g/t Au over three metres from 18 metres to 21 metres.

The west and gabbro zones were determined to be two separate zones of mineralization and both zones continue at depth. The gabbro zone dips shallowly to the north beneath the west zone and is within 20 metres of surface. Both the west and gabbro zones are the folded extensions of Stog'er Tight, which extended the strike length 100 metres for a total of 500 metres. Equally important, the company's interpretation of these drill results indicate that numerous other showings throughout the Stog'er Tight project area may represent fold repetition of the Stog'er Tight deposit.

Dustin Angelo, chief executive officer of Anaconda, stated: "The drill program around the gabbro and west zones was successful in that it extended the Stog'er Tight deposit 100 metres westward, to a total strike length of 500 metres, and identified multiple zones of shallow mineralization. We also learned about the repetitious folding that is occurring around Stog'er Tight, which is a very good predictive tool as we step out farther from the main deposit area. It has given us more confidence in the potential to expand the resources around Stog'er Tight."

SIGNIFICANT GOLD INTERSECTIONS

Drill hole From To Interval Au

(m) (m) (m) (g/t)

BN-16-225 21.8 24 2.2 1.76

BN-16-226 6 7 1 1.99

and 14 19 5 1.42

BN-16-227 17 19 2 1.08

and 22 28 6 1.81

including 23 26 3 3.04

BN-16-228 9 13 4 2.28

BN-16-229 18.5 22 3.5 0.63

BN-16-230 35.5 38.5 3 2.46

BN-16-231 14 15 1 0.69

BN-16-232 14 15 1 0.67

BN-16-233 20 21 1 1.10

BN-16-234 26 30 4 2.04

BN-16-235 16 20 4 6.70

including 16 19 3 8.85

BN-16-236 6 10 4 3.72

and 18 21 3 2.27

BN-16-238 43 44 1 0.54

BN-16-242 38 39 1 1.17

A summary of significant composited assays (core length) from the western and gabbro zones at Stog'er Tight. True widths are estimated to be between 70 per cent and 95 per cent of the core length.

The company has geologically modelled the results of the drill program and will use the information to determine the best approach to test the further continuity of the Stog'er Tight deposit.

The Stog'er Tight deposit

The Stog'er Tight deposit is located 3.5 kilometres from the Pine Cove mill along the existing mine road. The deposit contains a National Instrument 43-101-compliant resource, including an indicated resource of 204,100 tonnes with a grade of 3.59 g/t Au (23,540 ounces Au) and an inferred resource of 252,000 tonnes with a grade of 3.27 g/t Au (26,460 ounces Au) using a cut-off grade of 0.8 g/t Au (see company's news release dated Oct. 22, 2015). The deposit is characterized by intense carbonate, albite and pyrite alteration of gabbroic rocks with gold, strongly associated with pyrite, which is similar to the Pine Cove deposit. The geological characteristics of Stog'er Tight are found in a much larger area around the deposit that is approximately 1.5 km long by 0.5 km wide. Besides the east, west and gabbro zones, several other zones of alteration and mineralization have been identified throughout the greater Stog'er Tight area, indicating the potential for further discovery.

This news release has been reviewed and approved by Paul McNeill, PGeo, vice-president, exploration, with Anaconda Mining Inc., a qualified person, under National Instrument 43-101 standard for disclosure for mineral projects.

All samples are collected using quality assurance/quality control protocols including the regular insertion of duplicates, standards and blanks within the sample batch for analysis. All samples quoted in this release are analyzed at Eastern Analytical Ltd. in Springdale, Nfld., for Au by fire assay (30 grams) with an atomic absorption finish.

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Antwort auf Beitrag Nr.: 52.393.782 von bigyawn am 12.05.16 15:30:24So langsam könnte die Aktie ja auch mal aus ihrem Dornröschenschlaf erwachen und es den anderen Minenwerten nachmachen und dem Goldpreis folgen...

Disclaimer:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Es besteht die Möglichkeit eines Interessenkonfliktes, da ich selber Aktien/Finanzinstrumente an dem Unternehmen bzw. zu dem Rohstoff halte.

Disclaimer:

Die gemachten Angaben dienen lediglich zu Informationszwecken und stellen keine Anlageberatung oder Aufforderung zum Kauf oder Verkauf von Finanzinstrumenten dar. In Vermögensanlagen fragen sie ihren Vermögens- oder Bankberater. Aktieninvestments und Finanzanlagen beherbergen stets auch das Risiko des Totalverlustes. Daher wird eine Haftung für Vermögensschäden kategorisch ausgeschlossen. Es besteht die Möglichkeit eines Interessenkonfliktes, da ich selber Aktien/Finanzinstrumente an dem Unternehmen bzw. zu dem Rohstoff halte.

Anaconda cheers test work results for Thor deposit ore

2016-05-12 09:25 ET - News Release

Mr. Dustin Angelo reports

METALLURGICAL TEST WORK DEMONSTRATES PINE COVE MILL PROCESSING POTENTIAL FOR THE THOR DEPOSIT

The results of preliminary metallurgical test work indicates that ore from the Thor deposit of Anaconda Mining Inc.'s Viking project could be processed at the Pine Cove mill using current flotation and leach circuit configuration. The results of the study are based on a homogenized sample collected from two diamond drill holes. Bench-scale test work, conducted by NB Research and Productivity Council, primarily focused on flotation, cyanide leaching and grinding to evaluate the response of the Thor deposit material to the current plant flow sheet for the Pine Cove mill.

In a flotation test, using a grind of (80 per cent passing) 150 microm, currently used for Pine Cove ore, the Thor deposit sample attained 96-per-cent gold recovery in 4.4 per cent of the mass at a grade of 35.12 grams per tonne Au in the rougher stage. In a bottle roll cyanidation test, the current Pine Cove mill regrind size of (80 per cent passing) 20 microm obtained 94.1-per-cent Au extraction without requiring accelerating reagents and consumed 1.1 kilograms per tonne NaCN compared with 3.6 kilograms per tonne for Pine Cove ore. A bond ball mill grindability test was performed utilizing a limiting screen size of 150 microm and indicated that the sample has a Bond Ball Work Index (BWI) value of 18.5 kWh/t.

President and CEO, Dustin Angelo, stated, "Our primary thesis in expanding Anaconda's reach to new deposits is that the Pine Cove mill and related infrastructure can be leveraged to expedite development of satellite deposits that would otherwise not be mined, given their size. The preliminary metallurgical results on flotation and leaching from the Thor Deposit supports our thesis and allows the company to move forward with plans to expand the historical resource base at the Viking Project with the initial goal of doubling the size of the resource while optimizing a path to development."

The Company will conduct follow up metallurgical testing and/or bulk sampling for processing at the Pine Cove mill when it is appropriate for feasibility studies.

The Metallurgical Sample and Analysis

The sample for the metallurgical test work on the Thor Deposit was collected by Anaconda staff from diamond drill holes VK09-20 and VK10-46 located at the northern portion of the deposit and sent to RPC in Fredericton, New Brunswick. The 59.8 kg sample was homogenized and analyzed by ICP-OES, whole rock analysis and Au fire assay and was found to have a head grade of 1.86 g/t Au, 1.4 g/t Ag, 0.003% Cu and 2.1% Fe, and found to contain 67.26% SiO2.

The Thor Deposit

Anaconda acquired the Thor Deposit as part of an option agreement announced on February 10, 2016 (see Press Release, available on SEDAR and the Company's website). The Thor Deposit hosts a Historical Mineral Resource Estimate as defined by the National Instrument 43-101 Standards for Disclosure for Mineral Projects and is not considered by the Company to be a Current Mineral Resource, since Anaconda Qualified Persons have not independently completed work to classify it as a Current Mineral Resource. The Historical Resource includes an Indicated Resource of 63,000 ounces at a grade of 2.09 g/t Au and an Inferred Resource of 20,000 ounces at a grade of 1.79 g/t Au, using a 1.00 g/t cut off, as documented in a Technical Report filed on SEDAR, titled "MINERAL RESOURCE ESTIMATE UPDATE FOR THE THOR TREND GOLD DEPOSIT, NORTHERN ABITIBI MINING CORP., White Bay Area, Newfoundland and Labrador, Canada, Latitude 49o 42' N Longitude 57o 00' W." prepared for Northern Abitibi Mining Corp. by Dr. Shane Ebert, P. Geo. and Gary Giroux, P. Eng. MASc., December 30, 2011.

RPC is an accredited metallurgical testing facility located in New Brunswick, Canada, that has been in the industry for over 50 years and serves both local and global clients in all areas of extractive metallurgy. Metallurgical work on the Thor Deposit outlined in this release was conducted by Neri Botha P. Eng. and Leo Cheung P. Eng. of RPC, both Qualified Persons under the National Instrument 43-101 Standard for Disclosure for Mineral Projects

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects .

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

2016-05-12 09:25 ET - News Release

Mr. Dustin Angelo reports

METALLURGICAL TEST WORK DEMONSTRATES PINE COVE MILL PROCESSING POTENTIAL FOR THE THOR DEPOSIT

The results of preliminary metallurgical test work indicates that ore from the Thor deposit of Anaconda Mining Inc.'s Viking project could be processed at the Pine Cove mill using current flotation and leach circuit configuration. The results of the study are based on a homogenized sample collected from two diamond drill holes. Bench-scale test work, conducted by NB Research and Productivity Council, primarily focused on flotation, cyanide leaching and grinding to evaluate the response of the Thor deposit material to the current plant flow sheet for the Pine Cove mill.

In a flotation test, using a grind of (80 per cent passing) 150 microm, currently used for Pine Cove ore, the Thor deposit sample attained 96-per-cent gold recovery in 4.4 per cent of the mass at a grade of 35.12 grams per tonne Au in the rougher stage. In a bottle roll cyanidation test, the current Pine Cove mill regrind size of (80 per cent passing) 20 microm obtained 94.1-per-cent Au extraction without requiring accelerating reagents and consumed 1.1 kilograms per tonne NaCN compared with 3.6 kilograms per tonne for Pine Cove ore. A bond ball mill grindability test was performed utilizing a limiting screen size of 150 microm and indicated that the sample has a Bond Ball Work Index (BWI) value of 18.5 kWh/t.

President and CEO, Dustin Angelo, stated, "Our primary thesis in expanding Anaconda's reach to new deposits is that the Pine Cove mill and related infrastructure can be leveraged to expedite development of satellite deposits that would otherwise not be mined, given their size. The preliminary metallurgical results on flotation and leaching from the Thor Deposit supports our thesis and allows the company to move forward with plans to expand the historical resource base at the Viking Project with the initial goal of doubling the size of the resource while optimizing a path to development."

The Company will conduct follow up metallurgical testing and/or bulk sampling for processing at the Pine Cove mill when it is appropriate for feasibility studies.

The Metallurgical Sample and Analysis

The sample for the metallurgical test work on the Thor Deposit was collected by Anaconda staff from diamond drill holes VK09-20 and VK10-46 located at the northern portion of the deposit and sent to RPC in Fredericton, New Brunswick. The 59.8 kg sample was homogenized and analyzed by ICP-OES, whole rock analysis and Au fire assay and was found to have a head grade of 1.86 g/t Au, 1.4 g/t Ag, 0.003% Cu and 2.1% Fe, and found to contain 67.26% SiO2.

The Thor Deposit

Anaconda acquired the Thor Deposit as part of an option agreement announced on February 10, 2016 (see Press Release, available on SEDAR and the Company's website). The Thor Deposit hosts a Historical Mineral Resource Estimate as defined by the National Instrument 43-101 Standards for Disclosure for Mineral Projects and is not considered by the Company to be a Current Mineral Resource, since Anaconda Qualified Persons have not independently completed work to classify it as a Current Mineral Resource. The Historical Resource includes an Indicated Resource of 63,000 ounces at a grade of 2.09 g/t Au and an Inferred Resource of 20,000 ounces at a grade of 1.79 g/t Au, using a 1.00 g/t cut off, as documented in a Technical Report filed on SEDAR, titled "MINERAL RESOURCE ESTIMATE UPDATE FOR THE THOR TREND GOLD DEPOSIT, NORTHERN ABITIBI MINING CORP., White Bay Area, Newfoundland and Labrador, Canada, Latitude 49o 42' N Longitude 57o 00' W." prepared for Northern Abitibi Mining Corp. by Dr. Shane Ebert, P. Geo. and Gary Giroux, P. Eng. MASc., December 30, 2011.

RPC is an accredited metallurgical testing facility located in New Brunswick, Canada, that has been in the industry for over 50 years and serves both local and global clients in all areas of extractive metallurgy. Metallurgical work on the Thor Deposit outlined in this release was conducted by Neri Botha P. Eng. and Leo Cheung P. Eng. of RPC, both Qualified Persons under the National Instrument 43-101 Standard for Disclosure for Mineral Projects

This news release has been reviewed and approved by Paul McNeill, P. Geo., VP Exploration with Anaconda Mining Inc., a "Qualified Person", under National Instrument 43-101 Standard for Disclosure for Mineral Projects .

We seek Safe Harbor.

© 2016 Canjex Publishing Ltd. All rights reserved.

Wenn der innere Wert des Papiergeldes immer weiter den Bach runter geht, dann muss zwangsläufig der Wert unserer Schlange weiter steigen...

Weshalb würden die Zentralbanken denn sonst ihre Goldvorräte steigern, wenn sie es nicht in Zukunft brauchen werden...?

Weshalb würden die Zentralbanken denn sonst ihre Goldvorräte steigern, wenn sie es nicht in Zukunft brauchen werden...?

Insiderkäufe: Dustin Angelo hat weitere 259.000 Anaconda Aktien im April gekauft!

Er wird schon wissen weshalb...

Aus dem Kanadischen Board:

User avatar

160k

May 02, 2016 - 06:10 PM

RE: Baystock1: Gold tops 1,302.00$/oz in pre-opening trade:

This morning, gold topped $1,300.00/oz/U.S. and then slipped back a bit to close at 1,292.00/oz.USD$. Baystock1: I think that you have misunderstood what I have been saying. It is only Lew Lawrick that I find dislikeable. I have the greatest respect for Dustin Angelo. As far as writing about ANX only, I am not sure what you mean? Do you mean other gold stocks or all stocks in general? I hold other securities but they would have no relationship whatsoever to what we discuss on this Bullboard. They are mostly financial and hospitality-related securities. As far as my favourite stock other than ANX is concerned, I find McEwan Mining (MUX-T) a Company that is doing everything right. A model worth emulating by ANX. It is aggressive; held tightly by insiders, especially by McEwan himself who holds over 25% of all of the outstanding and issued stock. The stock is interlisted on both the TSX and on the NYSE. When I first mentioned it here on this Bullboard many months ago, the stock was trading in the mid-ninety cent range and has since spiked up to the $3.30/share range. McEwan himself has singularly built this Company up from almost nothing. He is not afraid to go where the money is and does not limit himself by geography alone. Remember, he founded and built Goldcorp (G-T) into the major gold producer that it is today. Then when he left Goldcorp, he felt that he could do the same again, on his own, with a start-up and in a very short time, he has built MUX into a mid-range producer with terrific production metrics. In other news: DUSTIN ANGELO is reporting the following stock purchases of Anaconda Mining: 1) on April 27, 2016: he BOUGHT 122,000 ANX shares at .06cents each and all; and 2) on April 28, 2016: he BOUGHT 137,000 ANX shares at .06cents each and all. If Dustin were more aggressive, he would have nabbed Coastal Gold which had 2 bidders competing for its flagship property in southern Newfoundland. This deposit is very deep; higher in grade than what we are getting out of Point Rousse, and has the potential for a very long-lived production profile. At the time it was near financial bankruptcy and trading at .01-.02cents/share. First Mining (FF-VX) won out. But all in all, Dustin is running the Company as prudently and as financially risk-free as he possibly can. Remember, he took over ANX under terrible financial conditions and today, it is debt-free and cash-rich. ANX will eventually break through and turn the corner. Patience is one of our greatest virtues. Finally, someone mentioned here that Dustin does not answer or call back on phone calls. That is not true. I have never been denied the opportunity of speaking with him when he is free to talk nor have I been turned away when simply popping in at his office, without an appointment, to have a short chat with him. I hope this clears up any misunderstandings.

Quelle: http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Er wird schon wissen weshalb...

Aus dem Kanadischen Board:

User avatar

160k

May 02, 2016 - 06:10 PM

RE: Baystock1: Gold tops 1,302.00$/oz in pre-opening trade:

This morning, gold topped $1,300.00/oz/U.S. and then slipped back a bit to close at 1,292.00/oz.USD$. Baystock1: I think that you have misunderstood what I have been saying. It is only Lew Lawrick that I find dislikeable. I have the greatest respect for Dustin Angelo. As far as writing about ANX only, I am not sure what you mean? Do you mean other gold stocks or all stocks in general? I hold other securities but they would have no relationship whatsoever to what we discuss on this Bullboard. They are mostly financial and hospitality-related securities. As far as my favourite stock other than ANX is concerned, I find McEwan Mining (MUX-T) a Company that is doing everything right. A model worth emulating by ANX. It is aggressive; held tightly by insiders, especially by McEwan himself who holds over 25% of all of the outstanding and issued stock. The stock is interlisted on both the TSX and on the NYSE. When I first mentioned it here on this Bullboard many months ago, the stock was trading in the mid-ninety cent range and has since spiked up to the $3.30/share range. McEwan himself has singularly built this Company up from almost nothing. He is not afraid to go where the money is and does not limit himself by geography alone. Remember, he founded and built Goldcorp (G-T) into the major gold producer that it is today. Then when he left Goldcorp, he felt that he could do the same again, on his own, with a start-up and in a very short time, he has built MUX into a mid-range producer with terrific production metrics. In other news: DUSTIN ANGELO is reporting the following stock purchases of Anaconda Mining: 1) on April 27, 2016: he BOUGHT 122,000 ANX shares at .06cents each and all; and 2) on April 28, 2016: he BOUGHT 137,000 ANX shares at .06cents each and all. If Dustin were more aggressive, he would have nabbed Coastal Gold which had 2 bidders competing for its flagship property in southern Newfoundland. This deposit is very deep; higher in grade than what we are getting out of Point Rousse, and has the potential for a very long-lived production profile. At the time it was near financial bankruptcy and trading at .01-.02cents/share. First Mining (FF-VX) won out. But all in all, Dustin is running the Company as prudently and as financially risk-free as he possibly can. Remember, he took over ANX under terrible financial conditions and today, it is debt-free and cash-rich. ANX will eventually break through and turn the corner. Patience is one of our greatest virtues. Finally, someone mentioned here that Dustin does not answer or call back on phone calls. That is not true. I have never been denied the opportunity of speaking with him when he is free to talk nor have I been turned away when simply popping in at his office, without an appointment, to have a short chat with him. I hope this clears up any misunderstandings.

Quelle: http://www.stockhouse.com/companies/bullboard/t.anx/anaconda…

Auch bei unserer Schlange wäre es an der Zeit, dass sich der hartnäckige Widerstand im Bereich der 0,07 CAD überwinden lässt.

Im Siebenjahreschart sieht man gut, dass dies seit 2011 eine gute Unterstützung war.

Und was einmal als Unterstützung gut gehalten hat ist eben dann auch erst mal ein hartnäckiger Widerstand - normalerweise...

Nun sollte aber ein weiter Schub im Goldpreis helfen diesen Widerstandsbereich zu überwinden.

Wenn der Deckel weg geflogen ist, dann sollte erst mal Potential bis zu 0,14-0,17 CAD vorhanden sein.

Alles nur meine Vermutung und keine Handelsempfehlung!

Im Siebenjahreschart sieht man gut, dass dies seit 2011 eine gute Unterstützung war.

Und was einmal als Unterstützung gut gehalten hat ist eben dann auch erst mal ein hartnäckiger Widerstand - normalerweise...

Nun sollte aber ein weiter Schub im Goldpreis helfen diesen Widerstandsbereich zu überwinden.

Wenn der Deckel weg geflogen ist, dann sollte erst mal Potential bis zu 0,14-0,17 CAD vorhanden sein.

Alles nur meine Vermutung und keine Handelsempfehlung!

Wenn er die 1.300 USD knackt, dann sollte laut Aussage verschiedener Charttechniker erst mal Potential bis 1.400-1.500 USD vorhanden sein...

We will see...

We will see...

Jetzt gespannt darauf achten was der Goldpreis macht!

| Zeit | Titel |

|---|---|

| 10.04.24 | |

| 10.04.24 | |

| 10.04.24 | |

| 10.04.24 |