Gewinnerbranchen der Jahre 2006 bis 2040 (Seite 910)

eröffnet am 10.12.06 16:57:17 von

neuester Beitrag 16.02.24 09:33:08 von

neuester Beitrag 16.02.24 09:33:08 von

Beiträge: 94.068

ID: 1.099.361

ID: 1.099.361

Aufrufe heute: 10

Gesamt: 3.535.966

Gesamt: 3.535.966

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| heute 18:36 | 8022 | |

| vor 39 Minuten | 5998 | |

| heute 17:09 | 5413 | |

| vor 27 Minuten | 4016 | |

| vor 18 Minuten | 3402 | |

| vor 23 Minuten | 3287 | |

| vor 1 Stunde | 3079 | |

| vor 39 Minuten | 3019 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 3. | 18.159,50 | -0,16 | 204 | |||

| 2. | 5. | 193,89 | +15,21 | 116 | |||

| 3. | 4. | 2.341,21 | +0,15 | 61 | |||

| 4. | 6. | 7,9000 | +7,48 | 47 | |||

| 5. | 19. | 64,80 | -4,35 | 45 | |||

| 6. | 2. | 0,8700 | -26,27 | 42 | |||

| 7. | 39. | 15,128 | -5,66 | 35 | |||

| 8. | 33. | 0,1785 | -7,03 | 30 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 59.711.448 von Oberkassel am 25.01.19 15:04:38ad Yext

https://www.handelsblatt.com/unternehmen/mittelstand/familie…

https://www.handelsblatt.com/unternehmen/mittelstand/familie…

VCEL

Weltweiter Knieknorpelreparaturmarkt wächst bis 2023 aufgrund der Zunahme der fettleibigen Bevölkerung, Sportverletzungen, Arthrose und Chondrodystrophie. Technologische Fortschritte, die Zunahme von Unfällen und verwandten Verletzungen sowie die steigende Nachfrage nach minimalinvasiven chirurgischen Produkten sind die Schlüsselfaktoren für das Wachstum des Knieknorpelreparaturmarktes.

Zu den großen Akteuren auf dem Markt für Knieknorpelreparaturen zählen Medtronic (USA), Biomet Inc. (Zimmer Biomet Inc.) (USA), ConMed Corporation (USA), Depuy Synthes (Johnson und Johnson Services, Inc.) (USA). Arthrex, Inc. (USA), Smith & Nephew PLC (UK), LifeNet Health, Inc. (USA), Anika Therapeutics, Inc. (USA), Stryker Corporation (USA) und Vericel Corporation (USA).

https://fashionjournal24.com/global-knee-cartilage-repairing…

+++++

Das medizinische Zentrum von "Hackensack University" gab bekannt, dass es eines der ersten Krankenhäuser in New Jersey ist, das eine hochmoderne Behandlung anbietet, um die Knorpelzellen des Patienten nachwachsen und implantieren zu können. Es werden MACI-Implantate verwendet, um Knieknorpel zu regenerieren.

https://www.hackensackumc.org/2019/01/24/hackensack-universi…

Weltweiter Knieknorpelreparaturmarkt wächst bis 2023 aufgrund der Zunahme der fettleibigen Bevölkerung, Sportverletzungen, Arthrose und Chondrodystrophie. Technologische Fortschritte, die Zunahme von Unfällen und verwandten Verletzungen sowie die steigende Nachfrage nach minimalinvasiven chirurgischen Produkten sind die Schlüsselfaktoren für das Wachstum des Knieknorpelreparaturmarktes.

Zu den großen Akteuren auf dem Markt für Knieknorpelreparaturen zählen Medtronic (USA), Biomet Inc. (Zimmer Biomet Inc.) (USA), ConMed Corporation (USA), Depuy Synthes (Johnson und Johnson Services, Inc.) (USA). Arthrex, Inc. (USA), Smith & Nephew PLC (UK), LifeNet Health, Inc. (USA), Anika Therapeutics, Inc. (USA), Stryker Corporation (USA) und Vericel Corporation (USA).

https://fashionjournal24.com/global-knee-cartilage-repairing…

+++++

Das medizinische Zentrum von "Hackensack University" gab bekannt, dass es eines der ersten Krankenhäuser in New Jersey ist, das eine hochmoderne Behandlung anbietet, um die Knorpelzellen des Patienten nachwachsen und implantieren zu können. Es werden MACI-Implantate verwendet, um Knieknorpel zu regenerieren.

https://www.hackensackumc.org/2019/01/24/hackensack-universi…

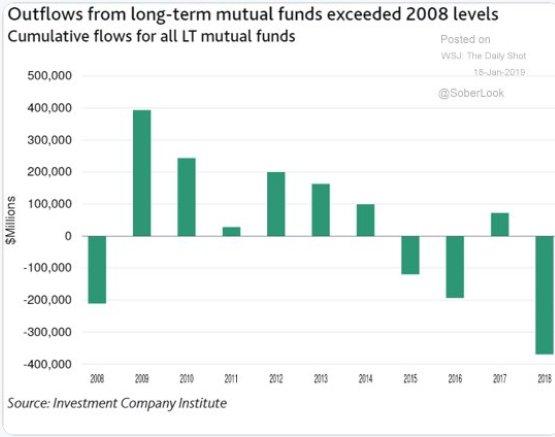

+++ This typically occurs at market "bottoms”. After the 2008 outflows, it's interesting to view what happened next in 2009.

+++ Bullish sentiment ticked back up this week to 37.7% after falling to 33.5% last week. The weekly investor sentiment survey conducted by AAII has come off of extremely low levels from the late 2018 sell-off and has maintained above 30% readings for all of 2019 so far. This jump in bullish sentiment is still slightly lower than the historical average and where we were only a couple weeks ago (38.5%).

https://seekingalpha.com/article/4235761-s-and-p-500-weekly-…" target="_blank" rel="nofollow ugc noopener">

https://seekingalpha.com/article/4235761-s-and-p-500-weekly-…

+++ There is surely a time to be out of stocks. The difficult part is knowing when. I’m not here to tell anyone they should be overweight stocks for the duration of a bear market and sit through 40-50% declines. It is always better to be in control of the situation. Far too many let the market force their hand. Instead, successful investors all share a trait. They assess the situation to avoid making premature decisions when it comes to major portfolio changes.

Antwort auf Beitrag Nr.: 59.713.944 von anyway am 25.01.19 18:57:51@anyway - danke für deine Meinung - habe Positionen in NEL und Powercell eröffnet.

Gerade auch Powercell mit Kooperation Bosch/Siemens/Nikola finde ich zu diesen Preisen/ MK knapp über 100 mio sehr interessant.

https://www.powercell.se/en/technology/

Interssanterweise sind die Norweger-Aktien dynamisch unterwegs, Ballard power läuft nicht mit, Air Liquide mit Beteiligung an HYGS, die auch erwacht.

Wir reden von revolutionärem Potential bei LKW, PKW, Bussen, Baufahrzuigen, Schiffahrt - Kreuzfahrten, Fähren, Container.

Ein TAM, der nicht gerade klein ist.

Gerade auch Powercell mit Kooperation Bosch/Siemens/Nikola finde ich zu diesen Preisen/ MK knapp über 100 mio sehr interessant.

https://www.powercell.se/en/technology/

Interssanterweise sind die Norweger-Aktien dynamisch unterwegs, Ballard power läuft nicht mit, Air Liquide mit Beteiligung an HYGS, die auch erwacht.

Wir reden von revolutionärem Potential bei LKW, PKW, Bussen, Baufahrzuigen, Schiffahrt - Kreuzfahrten, Fähren, Container.

Ein TAM, der nicht gerade klein ist.

ad Nel ASA

Da ich nicht glauben mag, dass die Batterie-Technologie die H2-Technologie schon besiegt hat, habe ich hier im Mai 2018 mal einen Fuß in die Tür gestellt.

Solche Wetten auf die Zukunft gehe ich seit meinem Desaster mit Ballard Power um das Jahr 2000 jedoch nur noch mit sehr kleinen Beträgen ein.

Da ich nicht glauben mag, dass die Batterie-Technologie die H2-Technologie schon besiegt hat, habe ich hier im Mai 2018 mal einen Fuß in die Tür gestellt.

Solche Wetten auf die Zukunft gehe ich seit meinem Desaster mit Ballard Power um das Jahr 2000 jedoch nur noch mit sehr kleinen Beträgen ein.

Antwort auf Beitrag Nr.: 59.711.448 von Oberkassel am 25.01.19 15:04:38

Target 120 US Dollar von Trade auf Long gesetzt.

Oberkassel

Xilinx Emerges As A Semiconductor Unicorn And Shivs The Shorts

https://seekingalpha.com/article/4235602-xilinx-emerges-semi…Target 120 US Dollar von Trade auf Long gesetzt.

Oberkassel

Antwort auf Beitrag Nr.: 59.710.722 von clearasil am 25.01.19 13:45:53

Auf der Trade Watch:Yext

Oberkassel

Yext (YEXT) To Present At 21st Annual Needham Growth Conference - Slideshow

https://seekingalpha.com/article/4233751-yext-yext-present-2…Auf der Trade Watch:Yext

Oberkassel

Antwort auf Beitrag Nr.: 59.710.704 von clearasil am 25.01.19 13:43:40braucht jemand einen Job?

https://nikolamotor.com/careers/jobs

https://nikolamotor.com/careers/jobs

zu Nikola:

“Now that we are funded and oversubscribed, we are kicking it into high gear and preparing for Nikola World 2019,” said Nikola founder and Chief Executive Trevor Milton in a statement.

Competition

Nikola is racing against several competitors to produce road-worthy electric semi-trucks. In June, the 4-year-old company said it expects to begin fleet testing its trucks in 2019.

Tesla Inc. also is working on its all-electric, long-distance Semi truck and has said it will put it into production next year.

This summer, Daimler AG said its all-electric Freightliner eCascadia for regional runs will be in production in three years.

Navistar International, with Traton, formerly Volkswagen Truck & Bus, also has electric truck plans in the works. And Toyota Motor Corp. recently announced a second-generation Class 8 fuel cell truck for testing in drayage operations at the ports of Los Angeles and Long Beach in Southern California.

The push for electric trucks is driven in large part by the increased demand by regulators for zero-emission or low-emission vehicles. For now, most heavy trucks still run on diesel.

Some companies are beginning to take steps to change that. In May, Anheuser-Busch placed an order for up to 800 hydrogen-electric-powered semi-trucks from Nikola. Nikola said the trucks, which will make regional runs between breweries and distribution centers, will enter service in two years.

In December 2017, the brewing giant ordered 40 electric semi-trucks from Tesla. Unlike Nikola, Tesla typically requires a deposit and partial payment upfront.

The two companies have split the name of inventor and electrical engineer Nikola Tesla, who invented the alternating current electric system still in use today. That didn’t stop Nikola from suing Tesla in May, alleging the company stole its truck design. Tesla has said the suit has no merit.

Hydrogen Fueling Stations

In June, Nikola also said it plans to build the first two hydrogen-fuel stations in Arizona, where it is headquartered, and California. An additional 28 stations are planned on key routes serving Anheuser-Busch breweries and distribution centers.

The stations will be able to refuel both Class 8 heavy trucks and consumer cars, according to Nikola.

It’s unknown whether the company plans an additional round of financing anytime soon.

“It looks like they are not hurting for money,” said IHS principal analyst Antti Lindstrom. “It’s just a matter of them executing on the promise.”

https://www.trucks.com/2018/11/15/nikola-tops-200-million-fu…

On Wednesday, Nikola Corporation announced it had completed an oversubscribed Series C funding round that began in August. Wednesday’s announcement was of $105 million, bringing the two-stage round to $205 million total. CEO and founder Trevor Milton said the goal was to raise $150 million. Investors have not been identified.

“It’s primarily for prepping the truck for full production,” he told FreightWaves. “We’re going to start a $1B round in the first quarter of next year. It usually takes around 4-5 months to complete a round that big and that will go to the factory and everything else.”

Ground should be broken for the factory next year, Milton said. Both the North American models, the hydrogen-electric powered Nikola One and Nikola Two (day cab), will be produced at the Arizona manufacturing plant once they enter full production. The company is spending more than $1 billion over the next six years to develop the facility on the west side of Phoenix.

As good as 2018 has been, 2019 looks to be even better for Nikola. The $1B funding round should kick the company’s work into high gear, and drivers should start to see the trucks on the road.

https://www.freightwaves.com/news/equipment/nikola-motor-sec…" target="_blank" rel="nofollow ugc noopener">https://www.trucks.com/2018/11/15/nikola-tops-200-million-fu…

On Wednesday, Nikola Corporation announced it had completed an oversubscribed Series C funding round that began in August. Wednesday’s announcement was of $105 million, bringing the two-stage round to $205 million total. CEO and founder Trevor Milton said the goal was to raise $150 million. Investors have not been identified.

“It’s primarily for prepping the truck for full production,” he told FreightWaves. “We’re going to start a $1B round in the first quarter of next year. It usually takes around 4-5 months to complete a round that big and that will go to the factory and everything else.”

Ground should be broken for the factory next year, Milton said. Both the North American models, the hydrogen-electric powered Nikola One and Nikola Two (day cab), will be produced at the Arizona manufacturing plant once they enter full production. The company is spending more than $1 billion over the next six years to develop the facility on the west side of Phoenix.

As good as 2018 has been, 2019 looks to be even better for Nikola. The $1B funding round should kick the company’s work into high gear, and drivers should start to see the trucks on the road.

https://www.freightwaves.com/news/equipment/nikola-motor-sec…

“Now that we are funded and oversubscribed, we are kicking it into high gear and preparing for Nikola World 2019,” said Nikola founder and Chief Executive Trevor Milton in a statement.

Competition

Nikola is racing against several competitors to produce road-worthy electric semi-trucks. In June, the 4-year-old company said it expects to begin fleet testing its trucks in 2019.

Tesla Inc. also is working on its all-electric, long-distance Semi truck and has said it will put it into production next year.

This summer, Daimler AG said its all-electric Freightliner eCascadia for regional runs will be in production in three years.

Navistar International, with Traton, formerly Volkswagen Truck & Bus, also has electric truck plans in the works. And Toyota Motor Corp. recently announced a second-generation Class 8 fuel cell truck for testing in drayage operations at the ports of Los Angeles and Long Beach in Southern California.

The push for electric trucks is driven in large part by the increased demand by regulators for zero-emission or low-emission vehicles. For now, most heavy trucks still run on diesel.

Some companies are beginning to take steps to change that. In May, Anheuser-Busch placed an order for up to 800 hydrogen-electric-powered semi-trucks from Nikola. Nikola said the trucks, which will make regional runs between breweries and distribution centers, will enter service in two years.

In December 2017, the brewing giant ordered 40 electric semi-trucks from Tesla. Unlike Nikola, Tesla typically requires a deposit and partial payment upfront.

The two companies have split the name of inventor and electrical engineer Nikola Tesla, who invented the alternating current electric system still in use today. That didn’t stop Nikola from suing Tesla in May, alleging the company stole its truck design. Tesla has said the suit has no merit.

Hydrogen Fueling Stations

In June, Nikola also said it plans to build the first two hydrogen-fuel stations in Arizona, where it is headquartered, and California. An additional 28 stations are planned on key routes serving Anheuser-Busch breweries and distribution centers.

The stations will be able to refuel both Class 8 heavy trucks and consumer cars, according to Nikola.

It’s unknown whether the company plans an additional round of financing anytime soon.

“It looks like they are not hurting for money,” said IHS principal analyst Antti Lindstrom. “It’s just a matter of them executing on the promise.”

https://www.trucks.com/2018/11/15/nikola-tops-200-million-fu…

On Wednesday, Nikola Corporation announced it had completed an oversubscribed Series C funding round that began in August. Wednesday’s announcement was of $105 million, bringing the two-stage round to $205 million total. CEO and founder Trevor Milton said the goal was to raise $150 million. Investors have not been identified.

“It’s primarily for prepping the truck for full production,” he told FreightWaves. “We’re going to start a $1B round in the first quarter of next year. It usually takes around 4-5 months to complete a round that big and that will go to the factory and everything else.”

Ground should be broken for the factory next year, Milton said. Both the North American models, the hydrogen-electric powered Nikola One and Nikola Two (day cab), will be produced at the Arizona manufacturing plant once they enter full production. The company is spending more than $1 billion over the next six years to develop the facility on the west side of Phoenix.

As good as 2018 has been, 2019 looks to be even better for Nikola. The $1B funding round should kick the company’s work into high gear, and drivers should start to see the trucks on the road.

https://www.freightwaves.com/news/equipment/nikola-motor-sec…" target="_blank" rel="nofollow ugc noopener">https://www.trucks.com/2018/11/15/nikola-tops-200-million-fu…

On Wednesday, Nikola Corporation announced it had completed an oversubscribed Series C funding round that began in August. Wednesday’s announcement was of $105 million, bringing the two-stage round to $205 million total. CEO and founder Trevor Milton said the goal was to raise $150 million. Investors have not been identified.

“It’s primarily for prepping the truck for full production,” he told FreightWaves. “We’re going to start a $1B round in the first quarter of next year. It usually takes around 4-5 months to complete a round that big and that will go to the factory and everything else.”

Ground should be broken for the factory next year, Milton said. Both the North American models, the hydrogen-electric powered Nikola One and Nikola Two (day cab), will be produced at the Arizona manufacturing plant once they enter full production. The company is spending more than $1 billion over the next six years to develop the facility on the west side of Phoenix.

As good as 2018 has been, 2019 looks to be even better for Nikola. The $1B funding round should kick the company’s work into high gear, and drivers should start to see the trucks on the road.

https://www.freightwaves.com/news/equipment/nikola-motor-sec…

Antwort auf Beitrag Nr.: 59.702.880 von Tamakoschy am 24.01.19 16:04:42billig gib's erst, wenn der simon wieder da is ...