BHP Billiton - ein Basisinvestment im Rohstoffsektor (Seite 6)

eröffnet am 11.06.07 15:37:48 von

neuester Beitrag 14.05.24 16:43:05 von

neuester Beitrag 14.05.24 16:43:05 von

Beiträge: 736

ID: 1.128.624

ID: 1.128.624

Aufrufe heute: 0

Gesamt: 124.600

Gesamt: 124.600

Aktive User: 0

ISIN: AU000000BHP4 · WKN: 850524 · Symbol: BHP1

28,28

EUR

+2,13 %

+0,59 EUR

Letzter Kurs 17.05.24 Tradegate

Neuigkeiten

17.05.24 · wallstreetONLINE Redaktion |

17.05.24 · EQS Group AG |

16.05.24 · EQS Group AG |

16.05.24 · wallstreetONLINE Redaktion |

15.05.24 · EQS Group AG |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,6800 | +19,30 | |

| 725,25 | +18,50 | |

| 1,2800 | +14,29 | |

| 2,9000 | +13,28 | |

| 1,2000 | +13,21 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 0,8500 | -7,61 | |

| 2,6100 | -9,06 | |

| 0,5088 | -18,80 | |

| 0,5550 | -20,71 | |

| 0,5500 | -26,67 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 74.611.271 von ahe25940 am 10.10.23 08:36:41

Das ist echt seltsam. Habe vom Support nur die Info bekommen, dass es ein Problem gibt und sie dran sind. Ist aber auch schon wieder 4 Tage her

Zitat von ahe25940:Zitat von batg1999: Habt ihr die Dividende bei TradeRepublic schon erhalten?

Nein, hier kam auch noch nix.

Das ist echt seltsam. Habe vom Support nur die Info bekommen, dass es ein Problem gibt und sie dran sind. Ist aber auch schon wieder 4 Tage her

Antwort auf Beitrag Nr.: 74.581.514 von batg1999 am 03.10.23 22:34:23

Nein, hier kam auch noch nix.

Zitat von batg1999: Habt ihr die Dividende bei TradeRepublic schon erhalten?

Nein, hier kam auch noch nix.

Antwort auf Beitrag Nr.: 74.589.059 von Oginvest am 05.10.23 10:33:01Auszug:

DIVESTMENT DOWNSIDE

Van Jaarsveld said a deterrent to acquisitions was the need to later sell off assets.

For example, he said Canada's Teck Resources, whose metals business has attracted interest from a number of major miners including Glencore, arguably has some commodities that BHP would like more exposure to.

For BHP to engage in a buyout, it would need to consider price, ease of jurisdiction, and opportunity to add value, among other factors, but then would need to think about which assets it would have to divest.

"So you've just paid a 30% premium for everything," he said. "This is what makes M&A hard. You can do a great deal and then you have to sell 30% of what you just bought and you're losing all your synergy value."

BHP has been trying to sell two Queensland metallurgical coal mines since August 2020 and is assessing prospects for assets it acquired in its $6.4-billion takeover of Oz Minerals, such as the Pantera copper and gold project in Brazil.

"BHP's Oz Minerals Brazil is not on the market," van Jaarsveld said.

"The deal only closed in May. We are looking at what we have got," adding "you don't want to sell assets, potentially and then somebody else make a big discovery.

DIVESTMENT DOWNSIDE

Van Jaarsveld said a deterrent to acquisitions was the need to later sell off assets.

For example, he said Canada's Teck Resources, whose metals business has attracted interest from a number of major miners including Glencore, arguably has some commodities that BHP would like more exposure to.

For BHP to engage in a buyout, it would need to consider price, ease of jurisdiction, and opportunity to add value, among other factors, but then would need to think about which assets it would have to divest.

"So you've just paid a 30% premium for everything," he said. "This is what makes M&A hard. You can do a great deal and then you have to sell 30% of what you just bought and you're losing all your synergy value."

BHP has been trying to sell two Queensland metallurgical coal mines since August 2020 and is assessing prospects for assets it acquired in its $6.4-billion takeover of Oz Minerals, such as the Pantera copper and gold project in Brazil.

"BHP's Oz Minerals Brazil is not on the market," van Jaarsveld said.

"The deal only closed in May. We are looking at what we have got," adding "you don't want to sell assets, potentially and then somebody else make a big discovery.

Global miner BHP to focus on cost cuts, patient on M&A

MELBOURNE, Oct 5 (Reuters) - Global miner BHP Group (BHP.AX) is focused on cutting costs to drive growth while being patient on buying assets, its chief development officer Johan van Jaarsveld said on Thursday in Melbourne.

"This is a cyclical industry, and you sometimes are going to have to wait for 10 years or may be more to get the right opportunity at the right price," van Jaarsveld said.

"If we can save 10% of our cost base, that's $20 billion in value that's under our control. The last time someone created $20 billion with an M&A deal - I’d like them to tell me when it was."

While lots of money would be made in lithium over the next few years, BHP was not invested in the sector because the long-term margins were not sufficient, but in nickel, BHP expects to eventually become the world's second biggest producer.

It intends to ramp up to produce 200,000 metric tons a year of nickel, second only to Russia's Norilsk Nickel (GMKN.MM) with its Australian operations producing 120,000-130,000 tons and its Tanzanian Kabanga operations around 60,000-70,000 tons.

...

https://www.reuters.com/markets/deals/global-miner-bhp-focus…

MELBOURNE, Oct 5 (Reuters) - Global miner BHP Group (BHP.AX) is focused on cutting costs to drive growth while being patient on buying assets, its chief development officer Johan van Jaarsveld said on Thursday in Melbourne.

"This is a cyclical industry, and you sometimes are going to have to wait for 10 years or may be more to get the right opportunity at the right price," van Jaarsveld said.

"If we can save 10% of our cost base, that's $20 billion in value that's under our control. The last time someone created $20 billion with an M&A deal - I’d like them to tell me when it was."

While lots of money would be made in lithium over the next few years, BHP was not invested in the sector because the long-term margins were not sufficient, but in nickel, BHP expects to eventually become the world's second biggest producer.

It intends to ramp up to produce 200,000 metric tons a year of nickel, second only to Russia's Norilsk Nickel (GMKN.MM) with its Australian operations producing 120,000-130,000 tons and its Tanzanian Kabanga operations around 60,000-70,000 tons.

...

https://www.reuters.com/markets/deals/global-miner-bhp-focus…

Habt ihr die Dividende bei TradeRepublic schon erhalten?

China’s demand for oil and copper is ‘booming,’ says Goldman Sachs

China’s demand for many major commodities has been growing at “robust rates,” Goldman Sachs said in a recent note.

The investment bank observed that China’s demand for copper has risen 8% year on year, while appetite for iron ore and oil are up by 7% and 6%, respectively, all beating Goldman’s full-year expectations.

“This strength in demand has largely been tied to a combination of strong growth from the green economy, grid and property completions,” the Goldman report observed.

While China’s embattled property sector is still struggling to recover, the investment bank noted that China’s green economy has shown “significant strength” so far this year, resulting in a demand surge for metals related to the green transition, such as copper.

...

https://www.cnbc.com/2023/10/02/chinas-demand-for-oil-and-co…

China’s demand for many major commodities has been growing at “robust rates,” Goldman Sachs said in a recent note.

The investment bank observed that China’s demand for copper has risen 8% year on year, while appetite for iron ore and oil are up by 7% and 6%, respectively, all beating Goldman’s full-year expectations.

“This strength in demand has largely been tied to a combination of strong growth from the green economy, grid and property completions,” the Goldman report observed.

While China’s embattled property sector is still struggling to recover, the investment bank noted that China’s green economy has shown “significant strength” so far this year, resulting in a demand surge for metals related to the green transition, such as copper.

...

https://www.cnbc.com/2023/10/02/chinas-demand-for-oil-and-co…

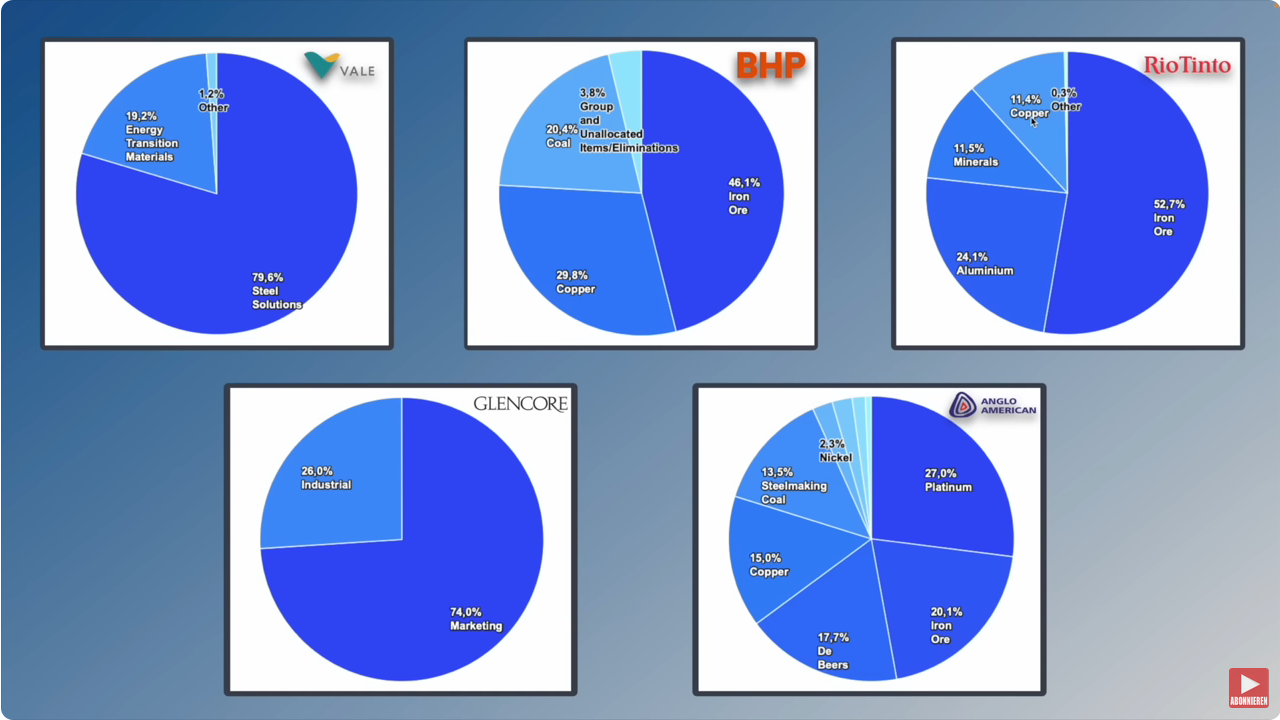

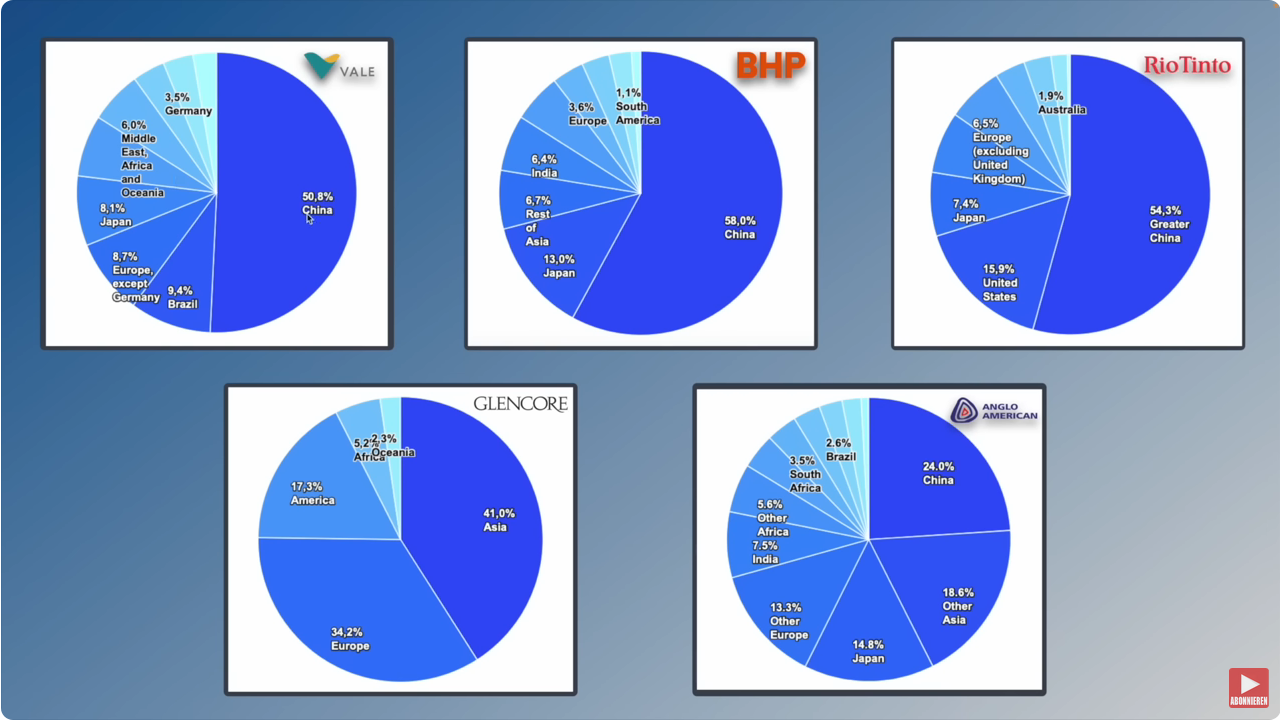

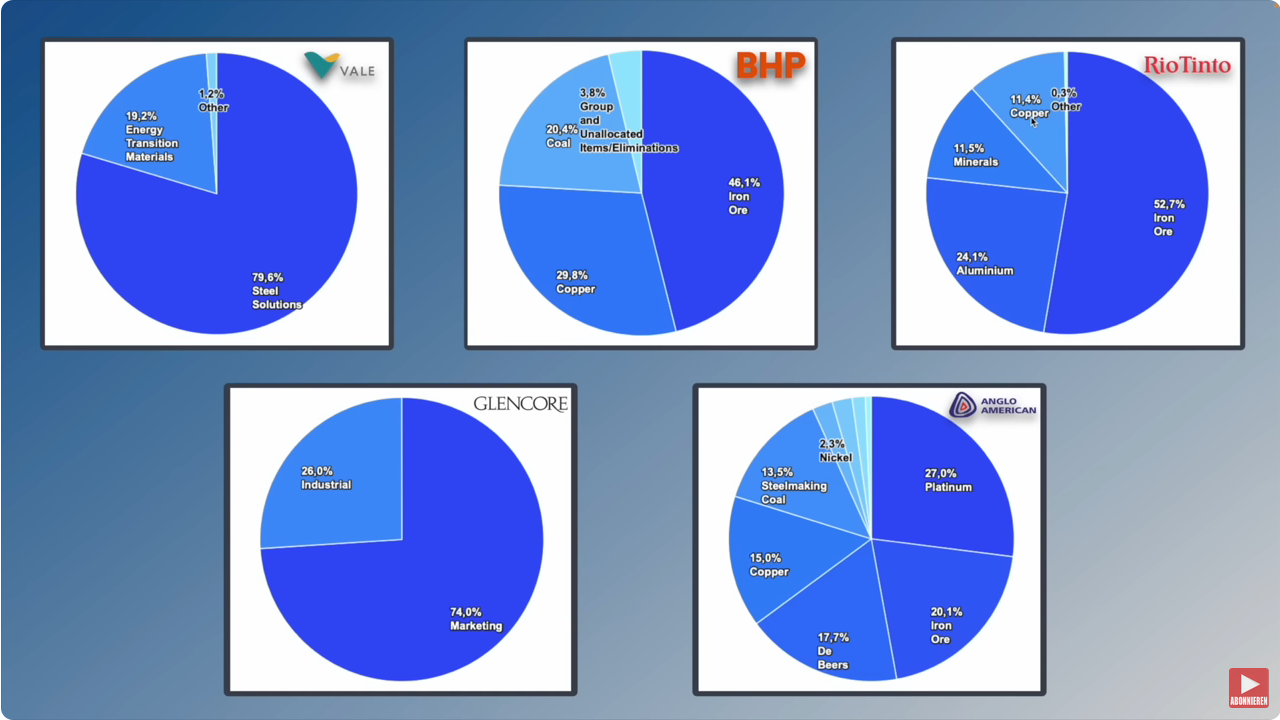

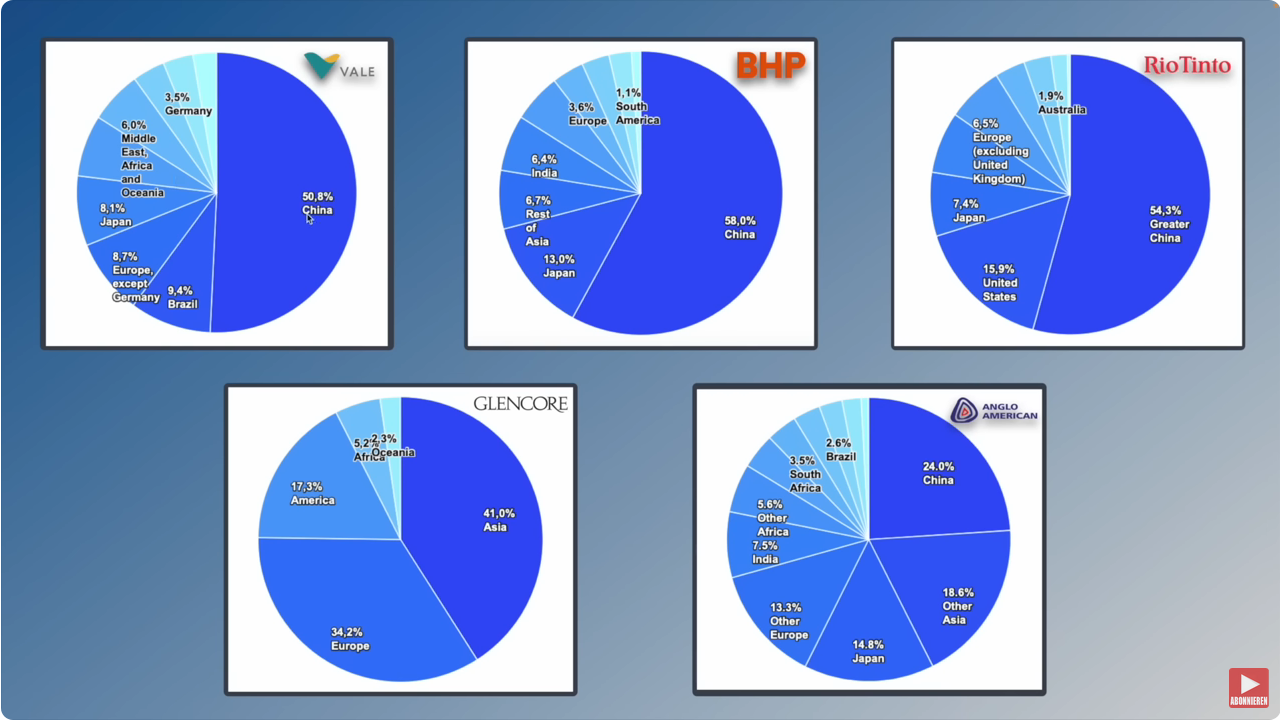

Antwort auf Beitrag Nr.: 74.565.853 von Oginvest am 30.09.23 11:24:22Folien (Produkte/Kunden) aus dem Vergleich mit Anglo, BHP, Glencore, Rio und Vale:

BHP Group's CEO calls for 'small set' of common ESG standards

Sept 28 (Reuters) - Miner BHP Group's (BHP.AX) CEO on Thursday called for the introduction of a "small set of common standards" against which the mining industry can measure performance and access capital."Opening a mine, done well, creates sustainable wealth and jobs...But of course this must be done with least possible impact to the environment," BHP CEO Mike Henry said, speaking at the IEA critical minerals & clean energy summit in Paris.

"We also have too many standards for the same ESG (Environmental, Social, and Governance) dimensions, leading to confusion and dissipated effort," he added.

The mining industry is a key focus for policymakers and investors because it provides the critical raw materials needed for electric vehicles and renewable energy infrastructure, but is also responsible for up to 7% of greenhouse-gas (GHG) global emissions.

....

https://www.reuters.com/sustainability/bhp-groups-ceo-calls-…

17.05.24 · wallstreetONLINE Redaktion · BHP Group |

16.05.24 · wallstreetONLINE Redaktion · BHP Group |

14.05.24 · wallstreetONLINE Redaktion · BHP Group |

13.05.24 · wallstreetONLINE Redaktion · BHP Group |

13.05.24 · dpa-AFX · Abertis Infraestructuras |