The Big 4 - Die letzten 30 Beiträge

eröffnet am 14.01.20 22:21:12 von

neuester Beitrag 02.02.24 13:19:17 von

neuester Beitrag 02.02.24 13:19:17 von

Beiträge: 51

ID: 1.318.601

ID: 1.318.601

Aufrufe heute: 0

Gesamt: 3.183

Gesamt: 3.183

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 21:59 | 7488 | |

| vor 1 Stunde | 6283 | |

| gestern 19:29 | 5523 | |

| vor 1 Stunde | 5042 | |

| vor 1 Stunde | 4947 | |

| vor 1 Stunde | 3533 | |

| vor 1 Stunde | 2501 | |

| vor 1 Stunde | 2010 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.772,85 | +0,46 | 131 | |||

| 2. | 3. | 0,2170 | +3,33 | 125 | |||

| 3. | Neu! | 8,9100 | +57,98 | 108 | |||

| 4. | 4. | 167,80 | -2,42 | 103 | |||

| 5. | 14. | 5,7540 | -2,18 | 56 | |||

| 6. | 2. | 0,2980 | -3,87 | 50 | |||

| 7. | 5. | 2,6000 | -5,45 | 49 | |||

| 8. | 7. | 6,7880 | +1,97 | 38 |

Beitrag zu dieser Diskussion schreiben

...

Ähnlich argumentieren daher Abgeordnete um die liberale Neos-Politikerin Stephanie Krisper, die auch Fraktionsführerin im ÖVP-Korruptions-Untersuchungsausschuss ist, in einer Anfrage an das Justizministerium. Sie fragen, ob zu einer Insolvenzverschleppung ermittelt werde, und kritisieren, dass Wirtschaftsprüfer die hohen Immobilienwerte der Signa-Gruppe durchwinkten.

...

2.2.

Verdacht auf Straftaten: Politiker nehmen René Benko ins Visier

https://www.spiegel.de/wirtschaft/unternehmen/signa-oesterre…

Ähnlich argumentieren daher Abgeordnete um die liberale Neos-Politikerin Stephanie Krisper, die auch Fraktionsführerin im ÖVP-Korruptions-Untersuchungsausschuss ist, in einer Anfrage an das Justizministerium. Sie fragen, ob zu einer Insolvenzverschleppung ermittelt werde, und kritisieren, dass Wirtschaftsprüfer die hohen Immobilienwerte der Signa-Gruppe durchwinkten.

...

2.2.

Verdacht auf Straftaten: Politiker nehmen René Benko ins Visier

https://www.spiegel.de/wirtschaft/unternehmen/signa-oesterre…

25.10.

Adani Auditor EY Faces Inquiry by India’s Accounting Regulator

https://finance.yahoo.com/news/adani-auditor-ey-faces-inquir…

...

One of the Adani Group’s longtime auditors is being scrutinized by India’s accounting regulator, according to people familiar with the matter.

The National Financial Reporting Authority, or NFRA, has in recent weeks started an inquiry into one of the member firms of EY in India, S.R. Batliboi, said the people, who asked not to be identified discussing confidential information. The regulator has requested files and communications related to its audits on some of the companies controlled by billionaire Gautam Adani going as far back as 2014, the people said.

It’s unclear how long NFRA’s inquiry may take or what repercussions, if any, may be faced by the auditor and Adani’s companies. Representatives for NFRA and the Adani Group didn’t respond to an emailed request for comments. A representative for EY and S.R. Batliboi declined to comment.

...

Adani Auditor EY Faces Inquiry by India’s Accounting Regulator

https://finance.yahoo.com/news/adani-auditor-ey-faces-inquir…

...

One of the Adani Group’s longtime auditors is being scrutinized by India’s accounting regulator, according to people familiar with the matter.

The National Financial Reporting Authority, or NFRA, has in recent weeks started an inquiry into one of the member firms of EY in India, S.R. Batliboi, said the people, who asked not to be identified discussing confidential information. The regulator has requested files and communications related to its audits on some of the companies controlled by billionaire Gautam Adani going as far back as 2014, the people said.

It’s unclear how long NFRA’s inquiry may take or what repercussions, if any, may be faced by the auditor and Adani’s companies. Representatives for NFRA and the Adani Group didn’t respond to an emailed request for comments. A representative for EY and S.R. Batliboi declined to comment.

...

12.10.

KPMG Hit with Record £21M Fine Over Carillion Audit Failures

https://www.msn.com/en-gb/money/other/kpmg-hit-with-record-2…

...

Global auditing giant KPMG has been slapped with a monumental fine by the Financial Reporting Council (FRC), a watchdog for the UK’s auditing industry. The council has fined KPMG a record £21 million over its audit failings related to the construction behemoth Carillion, which collapsed in 2018.

...

The FRC’s decision to impose the highest fine ever in its history is reflective of the sheer magnitude of KPMG’s audit failings. Carillion’s sudden collapse in 2018 left thousands of jobs hanging in the balance and a slew of building projects unfinished. KPMG, which had consistently audited Carillion’s accounts over the years, failed to detect the company’s mounting financial issues.

The FRC’s investigation discovered an unusually high number of breaches in KPMG’s audits. The auditing firm was found to have failed in gathering sufficient evidence and exercising necessary professional skepticism during its audit work.

...

Considering the number, range, and severity of the issues detected in KPMG’s audits, the firm’s UK chief executive has described the findings as ‘damning’. The executive has also issued an apology for the firm’s shortcomings, assuring that significant improvements have been made to prevent such failures from recurring in the future.

...

Tag: It's not a bug, it's a feature.

KPMG Hit with Record £21M Fine Over Carillion Audit Failures

https://www.msn.com/en-gb/money/other/kpmg-hit-with-record-2…

...

Global auditing giant KPMG has been slapped with a monumental fine by the Financial Reporting Council (FRC), a watchdog for the UK’s auditing industry. The council has fined KPMG a record £21 million over its audit failings related to the construction behemoth Carillion, which collapsed in 2018.

...

The FRC’s decision to impose the highest fine ever in its history is reflective of the sheer magnitude of KPMG’s audit failings. Carillion’s sudden collapse in 2018 left thousands of jobs hanging in the balance and a slew of building projects unfinished. KPMG, which had consistently audited Carillion’s accounts over the years, failed to detect the company’s mounting financial issues.

The FRC’s investigation discovered an unusually high number of breaches in KPMG’s audits. The auditing firm was found to have failed in gathering sufficient evidence and exercising necessary professional skepticism during its audit work.

...

Considering the number, range, and severity of the issues detected in KPMG’s audits, the firm’s UK chief executive has described the findings as ‘damning’. The executive has also issued an apology for the firm’s shortcomings, assuring that significant improvements have been made to prevent such failures from recurring in the future.

...

Tag: It's not a bug, it's a feature.

6.6.

PwC Woes Grow as $159 Billion Australian Fund Joins Boycott

https://hk.finance.yahoo.com/news/pwc-woes-worsen-159-billio…

...

Australia’s second largest pension fund has joined the boycott of PricewaterhouseCoopers as the fallout of the embattled accounting firm’s tax evasion scandal spreads.

Australian Retirement Trust, which manages A$240 billion ($159 billion) for 2.2 million members, “will not be undertaking any new contracts with PwC at this time,” a spokeswoman told Bloomberg in an emailed statement.

The action, following similar moves by industry giant AustralianSuper and a slew of government entities since last week, is the latest sign of the costly fallout caused by revelations that PwC’s Australia unit used confidential government tax policy information to advise its global clients.

PwC stands to lose millions of dollars in revenue as clients review their relationship with the accounting agency. The firm describes itself as an “active participant” in Australia’s A$3.4 trillion pension industry, known locally as superannuation, according to its website.

...

PwC said this week it had identified 76 current and former partners associated with the scandal, and names have been handed to Australian lawmakers.

Nine senior partners were put on leave last week and the firm appointed independent directors to its board. A review is being conducted into its governance and culture, which is due in September.

...

PwC Woes Grow as $159 Billion Australian Fund Joins Boycott

https://hk.finance.yahoo.com/news/pwc-woes-worsen-159-billio…

...

Australia’s second largest pension fund has joined the boycott of PricewaterhouseCoopers as the fallout of the embattled accounting firm’s tax evasion scandal spreads.

Australian Retirement Trust, which manages A$240 billion ($159 billion) for 2.2 million members, “will not be undertaking any new contracts with PwC at this time,” a spokeswoman told Bloomberg in an emailed statement.

The action, following similar moves by industry giant AustralianSuper and a slew of government entities since last week, is the latest sign of the costly fallout caused by revelations that PwC’s Australia unit used confidential government tax policy information to advise its global clients.

PwC stands to lose millions of dollars in revenue as clients review their relationship with the accounting agency. The firm describes itself as an “active participant” in Australia’s A$3.4 trillion pension industry, known locally as superannuation, according to its website.

...

PwC said this week it had identified 76 current and former partners associated with the scandal, and names have been handed to Australian lawmakers.

Nine senior partners were put on leave last week and the firm appointed independent directors to its board. A review is being conducted into its governance and culture, which is due in September.

...

19.4.

PwC paid €53m to settle €900m claim over Quinn Insurance collapse

Insurance Compensation Fund to benefit from between €20m and €30m once fees have been deducted from settlement sum

https://www.irishtimes.com/business/financial-services/2023/…

...

The settlement was one of the biggest of its kind in Irish corporate history. But the State fund that pays the liabilities of the failed insurer received considerably less than €53 million because of large legal fees incurred in the case against PwC.

...

The insolvent insurer has been run for 13 years by administrators Michael McAteer and Paul McCann of accountants Grant Thornton. They took charge in 2010 as Co Cavan entrepreneur Seán Quinn, once considered to be the wealthiest Irish businessman, lost control of an empire that included cement, manufacturing, hospitality and banking interests.

...

Quinn’s administrators sued PwC for negligent auditing of the insurance underwriter in 2005-2008. The firm denied such claims but settled last June on terms not disclosed then.

When PwC legal fees of some €25 million were paid, the cost to the firm was €78 million. That sum is considered virtually certain to have been covered by PwC’s professional indemnity insurers.

...

PwC paid €53m to settle €900m claim over Quinn Insurance collapse

Insurance Compensation Fund to benefit from between €20m and €30m once fees have been deducted from settlement sum

https://www.irishtimes.com/business/financial-services/2023/…

...

The settlement was one of the biggest of its kind in Irish corporate history. But the State fund that pays the liabilities of the failed insurer received considerably less than €53 million because of large legal fees incurred in the case against PwC.

...

The insolvent insurer has been run for 13 years by administrators Michael McAteer and Paul McCann of accountants Grant Thornton. They took charge in 2010 as Co Cavan entrepreneur Seán Quinn, once considered to be the wealthiest Irish businessman, lost control of an empire that included cement, manufacturing, hospitality and banking interests.

...

Quinn’s administrators sued PwC for negligent auditing of the insurance underwriter in 2005-2008. The firm denied such claims but settled last June on terms not disclosed then.

When PwC legal fees of some €25 million were paid, the cost to the firm was €78 million. That sum is considered virtually certain to have been covered by PwC’s professional indemnity insurers.

...

15.3.

Signature Bank Executive Used to Audit Firm

https://www.wsj.com/livecoverage/stock-market-news-today-03-…

...

Keisha Hutchinson signed off on KPMG’s clean audit of Signature Bank in March 2021, public records show. That June, she was appointed chief risk officer for the New York lender.

Her rapid transition from a senior KPMG auditor to a senior executive at a KPMG client adds to the list of questions facing the accounting firm over its audits of Signature and Silicon Valley Bank.

...

Antwort auf Beitrag Nr.: 73.466.128 von faultcode am 13.03.23 19:44:53

...

https://twitter.com/EmmaCFA1/status/1635542393008136192

"make it work"

Credit Suisse und PwC:

...

https://twitter.com/EmmaCFA1/status/1635542393008136192

Antwort auf Beitrag Nr.: 73.465.942 von faultcode am 13.03.23 19:27:31

ein "Trick", der dann gerne nach einer Zeit lang im Job (man lernt ja auch von den Alten) angewendet wird, ist es eigentlich Larifari-Fragen vor Ort zu stellen (weil man gar nicht weiß, wie die richtigen Fragen in der jeweiligen, oftmals spontanen Situation lauten könnten).

Das aber dann richtig tough und vor Zeugen, so daß man später - im Falle eines Falles - besser behaupten kann, man hätte wirklich geprüft und wenn dann doch was übersehen wurde, dann war the Client halt kriminell und dagegen kann sich sowieso keiner richtig schützen.

Oder die Jungen merken nach einer Weile, daß den Alten im eigenen Haus richtiges Prüfen gar nicht so wichtig ist.

Zum Beispiel weil the Client richtig viel Geld einbringt ("Wenn wir nicht prüfen, prüfen die anderen und die prüfen genauso wie wir!") oder den Alten im eigenen Haus mehr oder weniger mit Auftragsentzug oder dem Entzug von anvisierten Beratungsverträgen drohte.

Ein ewiges Katz-und-Maus-Spiel.

Zitat von faultcode: ...

Oft sind diese Jungs und Mädels vor Ort auch in der - wie sie gerne sagen - kurzen Zeit vollkommen überfordert, zumal sie auch mitunter Leuten gegenstehen, die von der von der Pike auf gelernt haben, wie man mit Zahlen mehr verschleiert als aufdeckt (*).

...

ein "Trick", der dann gerne nach einer Zeit lang im Job (man lernt ja auch von den Alten) angewendet wird, ist es eigentlich Larifari-Fragen vor Ort zu stellen (weil man gar nicht weiß, wie die richtigen Fragen in der jeweiligen, oftmals spontanen Situation lauten könnten).

Das aber dann richtig tough und vor Zeugen, so daß man später - im Falle eines Falles - besser behaupten kann, man hätte wirklich geprüft und wenn dann doch was übersehen wurde, dann war the Client halt kriminell und dagegen kann sich sowieso keiner richtig schützen.

Oder die Jungen merken nach einer Weile, daß den Alten im eigenen Haus richtiges Prüfen gar nicht so wichtig ist.

Zum Beispiel weil the Client richtig viel Geld einbringt ("Wenn wir nicht prüfen, prüfen die anderen und die prüfen genauso wie wir!") oder den Alten im eigenen Haus mehr oder weniger mit Auftragsentzug oder dem Entzug von anvisierten Beratungsverträgen drohte.

Ein ewiges Katz-und-Maus-Spiel.

13.3.

KPMG Gave SVB, Signature Bank Clean Bill of Health Weeks Before Collapse

Accounting firm faces scrutiny for audits of failed banks

https://www.wsj.com/articles/kpmg-faces-scrutiny-for-audits-…

...

Silicon Valley Bank failed just 14 days after KPMG LLP gave the lender a clean bill of health. Signature Bank went down 11 days after the accounting firm signed off on its audit.

What KPMG knew about the two banks’ financial situation and what it missed will likely be the subject of regulatory scrutiny and lawsuits.

...

10.3.

Silicon Valley Bank had no official chief risk officer for 8 months while the VC market was spiraling

https://fortune.com/2023/03/10/silicon-valley-bank-chief-ris…

___

wer noch immer glaubt, daß Wirtschaftsprüfer tatsächlich was belastbar prüfen würden, dem ist leider nicht mehr zu helfen.

Die gucken halt auch nur, daß nach außen hin alles formal OK aussieht.

Oft sind diese Jungs und Mädels vor Ort auch in der - wie sie gerne sagen - kurzen Zeit vollkommen überfordert, zumal sie auch mitunter Leuten gegenstehen, die von der von der Pike auf gelernt haben, wie man mit Zahlen mehr verschleiert als aufdeckt (*).

Und die Alten im Hintergrund (Partners) kassieren

(*)

13.3.

Top Silicon Valley Bank execs worked at notoriously troubled Lehman Brothers, Deutsche Bank

https://nypost.com/2023/03/13/silicon-valley-bank-execs-work…

...

Two executives at doomed Silicon Valley Bank had previously worked at a pair of notoriously troubled financial giants — the now-shuttered Lehman Brothers and the scandal-scarred Deutsche Bank.

The employment records of SVB executives Joseph Gentile and Kim Olson raised eyebrows on social media after the tech lender’s rapid meltdown prompted fears of a systemic economic crisis. The feds were forced to bail out SVB on Sunday to restore public confidence in the banking sector.

Gentile serves as chief administrative officer of SVB Securities, a standalone investment bank wholly owned by parent company SVB Financial. But prior to taking that role in 2007, Gentile had a short stint as the chief financial officer for the fixed income division of Lehman Brothers’ Global Investment Bank.

...

KPMG Gave SVB, Signature Bank Clean Bill of Health Weeks Before Collapse

Accounting firm faces scrutiny for audits of failed banks

https://www.wsj.com/articles/kpmg-faces-scrutiny-for-audits-…

...

Silicon Valley Bank failed just 14 days after KPMG LLP gave the lender a clean bill of health. Signature Bank went down 11 days after the accounting firm signed off on its audit.

What KPMG knew about the two banks’ financial situation and what it missed will likely be the subject of regulatory scrutiny and lawsuits.

...

10.3.

Silicon Valley Bank had no official chief risk officer for 8 months while the VC market was spiraling

https://fortune.com/2023/03/10/silicon-valley-bank-chief-ris…

___

wer noch immer glaubt, daß Wirtschaftsprüfer tatsächlich was belastbar prüfen würden, dem ist leider nicht mehr zu helfen.

Die gucken halt auch nur, daß nach außen hin alles formal OK aussieht.

Oft sind diese Jungs und Mädels vor Ort auch in der - wie sie gerne sagen - kurzen Zeit vollkommen überfordert, zumal sie auch mitunter Leuten gegenstehen, die von der von der Pike auf gelernt haben, wie man mit Zahlen mehr verschleiert als aufdeckt (*).

Und die Alten im Hintergrund (Partners) kassieren

(*)

13.3.

Top Silicon Valley Bank execs worked at notoriously troubled Lehman Brothers, Deutsche Bank

https://nypost.com/2023/03/13/silicon-valley-bank-execs-work…

...

Two executives at doomed Silicon Valley Bank had previously worked at a pair of notoriously troubled financial giants — the now-shuttered Lehman Brothers and the scandal-scarred Deutsche Bank.

The employment records of SVB executives Joseph Gentile and Kim Olson raised eyebrows on social media after the tech lender’s rapid meltdown prompted fears of a systemic economic crisis. The feds were forced to bail out SVB on Sunday to restore public confidence in the banking sector.

Gentile serves as chief administrative officer of SVB Securities, a standalone investment bank wholly owned by parent company SVB Financial. But prior to taking that role in 2007, Gentile had a short stint as the chief financial officer for the fixed income division of Lehman Brothers’ Global Investment Bank.

...

8.3.

UK watchdog fines PwC for failings in Babcock audits

Financial Reporting Councl issues €6.3m penalty after finding serious breaches over two years

https://www.irishtimes.com/business/financial-services/2023/…

...

The UK accounting regulator has fined PwC £5.6 million (€6.28 million) for failings in its audits of defence group Babcock over two years.

The investigation covered a number of areas of the audits, including seven long-term contracts, which made up about a quarter of Babcock’s revenue in the financial year ended March 2018.

The Financial Reporting Council said on Wednesday it found serious breaches during audits of accounts for the 2017 and 2018 financial years, including repeated failures by PwC to challenge Babcock’s management and obtain sufficient appropriate evidence during its work.

The FRC reprimanded two former PwC audit partners. Nicholas Campbell Lambert, who led the Babcock audit, was fined £150,000, while Heather Ancient, who headed the audit of a Babcock subsidiary, was ordered to pay £48,750.

The FRC is still investigating PwC’s audits of accounts for the 2019 and 2020 financial years.

...

UK watchdog fines PwC for failings in Babcock audits

Financial Reporting Councl issues €6.3m penalty after finding serious breaches over two years

https://www.irishtimes.com/business/financial-services/2023/…

...

The UK accounting regulator has fined PwC £5.6 million (€6.28 million) for failings in its audits of defence group Babcock over two years.

The investigation covered a number of areas of the audits, including seven long-term contracts, which made up about a quarter of Babcock’s revenue in the financial year ended March 2018.

The Financial Reporting Council said on Wednesday it found serious breaches during audits of accounts for the 2017 and 2018 financial years, including repeated failures by PwC to challenge Babcock’s management and obtain sufficient appropriate evidence during its work.

The FRC reprimanded two former PwC audit partners. Nicholas Campbell Lambert, who led the Babcock audit, was fined £150,000, while Heather Ancient, who headed the audit of a Babcock subsidiary, was ordered to pay £48,750.

The FRC is still investigating PwC’s audits of accounts for the 2019 and 2020 financial years.

...

5.9.

WSJ: Ernst & Young Leaders Expected to Approve Plan to Split Accounting Company

Decision to push ahead with proposal to spin off consulting arm could lead to firm splitting in late 2023

https://www.wsj.com/articles/ernst-young-leaders-expected-to…

...

EY is facing multibillion-dollar legal claims in Germany and the U.K. over its allegedly failed audits of two corporate blowups, fintech company Wirecard AG and hospital operator NMC Health PLC. EY has said it stands by its audit work.

...

=> offenbar will man so auch mMn die Wirecard-Katastrophe in den Griff bekommen

WSJ: Ernst & Young Leaders Expected to Approve Plan to Split Accounting Company

Decision to push ahead with proposal to spin off consulting arm could lead to firm splitting in late 2023

https://www.wsj.com/articles/ernst-young-leaders-expected-to…

...

EY is facing multibillion-dollar legal claims in Germany and the U.K. over its allegedly failed audits of two corporate blowups, fintech company Wirecard AG and hospital operator NMC Health PLC. EY has said it stands by its audit work.

...

=> offenbar will man so auch mMn die Wirecard-Katastrophe in den Griff bekommen

28.6.

EY Pays $100 Million SEC Fine Over CPA Ethics Exam Cheaters

https://finance.yahoo.com/news/ey-pays-100-million-sec-10220…

...

Ernst & Young LLP admitted that dozens of its audit personnel cheated on the ethics portion of the Certified Public Accountant exam and that the firm misled US regulators probing the misconduct, according to the Securities and Exchange Commission.

The SEC announced on Tuesday that EY would pay a $100 million fine -- the largest ever penalty for an audit firm. In addition to violating accounting rules, EY didn’t cooperate with a key part of the regulator’s probe, the agency said.

Almost 50 EY audit employees improperly shared answer keys to the ethics portion of the CPA exam between 2017 and 2021 and hundreds more cheated on continuing professional education courses, the SEC said.

The firm didn’t immediately respond to a request for comment sent outside of normal business hours on Tuesday.

Despite having been informed of possibly dishonest behavior, the firm conveyed to the agency that it didn’t have a problem with cheating. The auditor then failed to promptly correct those statements when it later launched an internal investigation.

Many EY employees knew that their behavior violated the company’s code of conduct, but some still did it because they couldn’t pass on their own, according to the SEC. The firm ultimately disciplined and, in some cases, fired individuals for their actions, according to the SEC, which said it’s investigation is ongoing.

...

EY Pays $100 Million SEC Fine Over CPA Ethics Exam Cheaters

https://finance.yahoo.com/news/ey-pays-100-million-sec-10220…

...

Ernst & Young LLP admitted that dozens of its audit personnel cheated on the ethics portion of the Certified Public Accountant exam and that the firm misled US regulators probing the misconduct, according to the Securities and Exchange Commission.

The SEC announced on Tuesday that EY would pay a $100 million fine -- the largest ever penalty for an audit firm. In addition to violating accounting rules, EY didn’t cooperate with a key part of the regulator’s probe, the agency said.

Almost 50 EY audit employees improperly shared answer keys to the ethics portion of the CPA exam between 2017 and 2021 and hundreds more cheated on continuing professional education courses, the SEC said.

The firm didn’t immediately respond to a request for comment sent outside of normal business hours on Tuesday.

Despite having been informed of possibly dishonest behavior, the firm conveyed to the agency that it didn’t have a problem with cheating. The auditor then failed to promptly correct those statements when it later launched an internal investigation.

Many EY employees knew that their behavior violated the company’s code of conduct, but some still did it because they couldn’t pass on their own, according to the SEC. The firm ultimately disciplined and, in some cases, fired individuals for their actions, according to the SEC, which said it’s investigation is ongoing.

...

PwC: "We are sorry"

...PricewaterhouseCoopers was fined almost £5 million pounds ($6.22 million) for a series of poor audits of two UK construction companies, as the regulator continued to crack down on audit failings by the Big Four.

PwC will pay £3 million in relation to its audits of Galliford Try Plc, and £1.96 million over a review of Kier Group Plc, the Financial Reporting Council said Tuesday. It was also ordered to report on its most modern audits that considered long-term contracts, the FRC said.

The UK is bringing in sweeping audit reforms aimed at reining in the dominance of the largest accountancy firms and cleaning up the industry following a string of high-profile scandals.

The breaches “concern failures to properly audit revenue recognised under specific complex long-term contracts,” said Claudia Mortimore, the FRC’s deputy executive counsel.

“We are sorry that aspects of our work were not of the required standard,” PwC said in a statement. The auditor said it’s “invested heavily” in a program to strengthen audit quality, including those on long term contracts and has “seen the positive impact of the actions we’ve taken.”

...

7.6.

PwC Fined £5 Million for Shoddy Audits at Two Construction Firms

https://www.bnnbloomberg.ca/pwc-fined-5-million-for-shoddy-a…

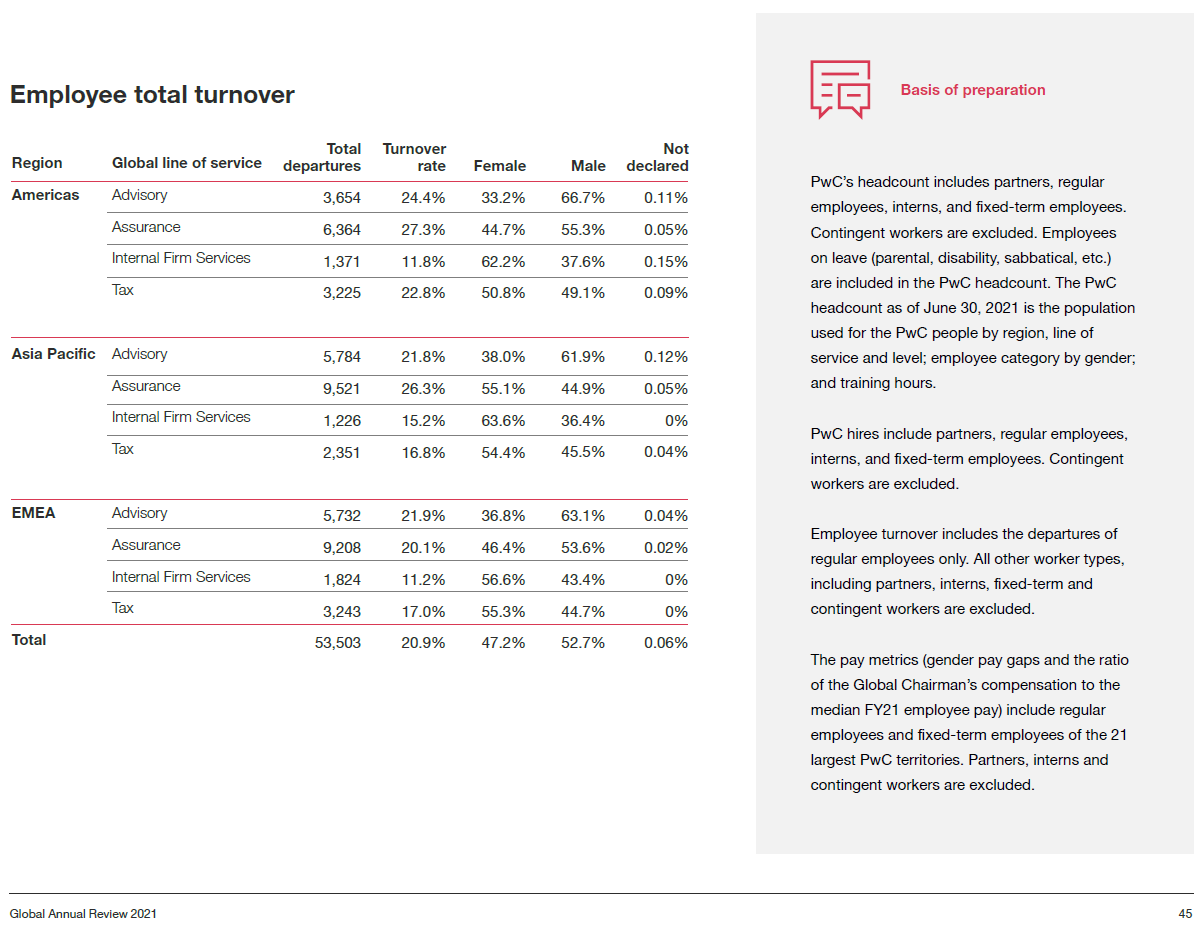

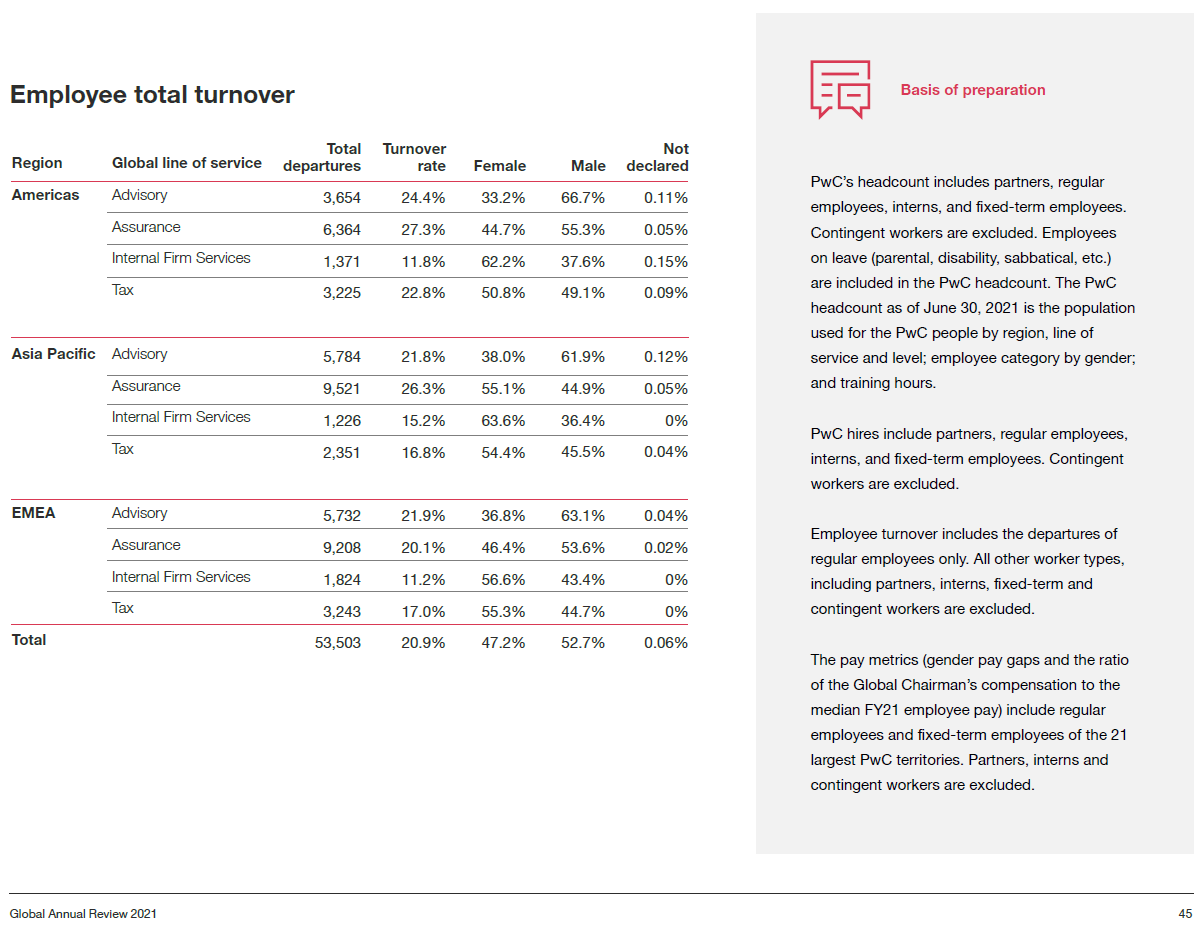

bekanntermaßen ist es nicht sehr lustig für die Big 4 zu arbeiten. Entsprechend schlägt sich das auch in den hohen Zahlen zum Employee total turnover nieder.

Global und so wie definiert bei PwC in 2020/2021 (Juni zu Juni) bei satten 20.9%

28.10.2021

<Global Annual Review 2021>

https://www.pwc.com/gx/en/about/global-annual-review-2021/go…

“Consistent high standards across everything we do are fundamental to the success of PwC. Our global governance board plays a key role in overseeing the rigorous standards that every PwC member firm agrees to comply with and the monitoring of compliance”

Lisa Sawicki

Governance Chair of PwCIL

Global und so wie definiert bei PwC in 2020/2021 (Juni zu Juni) bei satten 20.9%

28.10.2021

<Global Annual Review 2021>

https://www.pwc.com/gx/en/about/global-annual-review-2021/go…

“Consistent high standards across everything we do are fundamental to the success of PwC. Our global governance board plays a key role in overseeing the rigorous standards that every PwC member firm agrees to comply with and the monitoring of compliance”

Lisa Sawicki

Governance Chair of PwCIL

PwC war der langjährige Wirtschaftsprüfer von Evergrande, China:

11.10.2021

Evergrande crisis puts PwC role in spotlight

https://www.ft.com/content/b60bc8d6-611b-41f9-b755-064054e27…

...

The quality of Evergrande’s assets is also likely be one of the main issues picked over if the lid is lifted by its creditors.

In 2016, Hong Kong-based accounting research firm GMT Research visited 40 Evergrande development sites and concluded that Rmb150bn of asset writedowns were needed — then three times shareholders’ equity. It claimed that for years Evergrande had allowed failed projects such as abandoned hotels to accumulate on its balance sheet without writedowns.

GMT also took issue with how Evergrande classified the car parking spaces and commercial properties in its residential developments in its accounts. It said the company had “persuaded” PwC to accept the classification of these as investment properties, rather than as inventory of assets to be sold.

“Are its auditors asleep?” GMT wrote. “The company is insolvent by our reckoning and its equity worth nothing.”

...

11.10.2021

Evergrande crisis puts PwC role in spotlight

https://www.ft.com/content/b60bc8d6-611b-41f9-b755-064054e27…

...

The quality of Evergrande’s assets is also likely be one of the main issues picked over if the lid is lifted by its creditors.

In 2016, Hong Kong-based accounting research firm GMT Research visited 40 Evergrande development sites and concluded that Rmb150bn of asset writedowns were needed — then three times shareholders’ equity. It claimed that for years Evergrande had allowed failed projects such as abandoned hotels to accumulate on its balance sheet without writedowns.

GMT also took issue with how Evergrande classified the car parking spaces and commercial properties in its residential developments in its accounts. It said the company had “persuaded” PwC to accept the classification of these as investment properties, rather than as inventory of assets to be sold.

“Are its auditors asleep?” GMT wrote. “The company is insolvent by our reckoning and its equity worth nothing.”

...

27.9.

U.K.’s FRC Fines Grant Thornton $3.1 Million for Audit Work

https://www.bnnbloomberg.ca/u-k-watchdog-fines-grant-thornto…

...

The U.K.’s accounting watchdog has imposed sanctions against Grant Thornton Ltd. and a partner at the business, for its role in the alleged accounting fraud at the Patisserie Valerie bakery chain.

The Financial Reporting Council fined Grant Thornton 2.3 million pounds ($3.1 million), for its auditing work on the company between 2015 and 2017, the regulator said Monday. It also ordered non-financial sanctions including a review of the audit practice’s culture and reporting to the FRC annually for four years.

The cafe group collapsed in 2019 after more than 90 years in business following an investigation that revealed thousands of false entries in its accounts and resulted in 920 employees losing their jobs. The company was ultimately rescued by Irish private-equity firm Causeway Capital Partners.

David Newstead, Grant Thornton’s audit engagement partner, was fined 87,750 pounds, and given a three-year prohibition from carrying out statutory audits, for missing the red flags in the audit of Patisserie Holdings Plc, the bakery’s holding company.

“The audit of Patisserie Holdings Plc’s revenue and cash in particular involved missed red flags, a failure to obtain sufficient audit evidence and a failure to stand back and question information provided by management,” Claudia Mortimore, deputy executive counsel to the FRC, said.

The FRC said both Grant Thornton and Newstead have accepted the failures in the audit work.

...

U.K.’s FRC Fines Grant Thornton $3.1 Million for Audit Work

https://www.bnnbloomberg.ca/u-k-watchdog-fines-grant-thornto…

...

The U.K.’s accounting watchdog has imposed sanctions against Grant Thornton Ltd. and a partner at the business, for its role in the alleged accounting fraud at the Patisserie Valerie bakery chain.

The Financial Reporting Council fined Grant Thornton 2.3 million pounds ($3.1 million), for its auditing work on the company between 2015 and 2017, the regulator said Monday. It also ordered non-financial sanctions including a review of the audit practice’s culture and reporting to the FRC annually for four years.

The cafe group collapsed in 2019 after more than 90 years in business following an investigation that revealed thousands of false entries in its accounts and resulted in 920 employees losing their jobs. The company was ultimately rescued by Irish private-equity firm Causeway Capital Partners.

David Newstead, Grant Thornton’s audit engagement partner, was fined 87,750 pounds, and given a three-year prohibition from carrying out statutory audits, for missing the red flags in the audit of Patisserie Holdings Plc, the bakery’s holding company.

“The audit of Patisserie Holdings Plc’s revenue and cash in particular involved missed red flags, a failure to obtain sufficient audit evidence and a failure to stand back and question information provided by management,” Claudia Mortimore, deputy executive counsel to the FRC, said.

The FRC said both Grant Thornton and Newstead have accepted the failures in the audit work.

...

24.9.

WSJ: China Evergrande Auditor Gave Clean Bill of Health Despite Debt

PwC didn’t include a going-concern warning in its annual report for the ailing property developer

https://www.wsj.com/articles/china-evergrande-never-got-audi…

...

=> das machen die fast nie. Würde ja nur zu unschöner Hektik und Fragen führen

Die Big 4 sind bis heute vielfach nicht dazu da, um aufzuklären, sondern um Schummel-Bilanzen einen vermeintlich sauberen Anstrich zu geben.

Sad but true.

WSJ: China Evergrande Auditor Gave Clean Bill of Health Despite Debt

PwC didn’t include a going-concern warning in its annual report for the ailing property developer

https://www.wsj.com/articles/china-evergrande-never-got-audi…

...

=> das machen die fast nie. Würde ja nur zu unschöner Hektik und Fragen führen

Die Big 4 sind bis heute vielfach nicht dazu da, um aufzuklären, sondern um Schummel-Bilanzen einen vermeintlich sauberen Anstrich zu geben.

Sad but true.

Antwort auf Beitrag Nr.: 63.787.892 von faultcode am 24.05.20 23:14:32

22.7.

EY Accused of Actively Concealing NMC Health Audit Fraud From Investors

https://www.bnnbloomberg.ca/ey-accused-of-actively-concealin…

...

Ernst & Young faces accusations it “actively concealed” a six-year fraud from investors in a fresh lawsuit over its auditing work for the troubled NMC Health.

The hospital operator’s founder, Bavaguthu Raghuram Shetty, said the accounting giant enjoyed a “deep and cozy” relationship with executives at the troubled firm, alleging that the auditors turned a blind eye to thousands of suspicious transactions. Shetty is seeking $7 billion from the lawsuit.

The Indian entrepreneur filed a suit in New York last week, naming Ernst & Young as a co-conspirator in the fraud alongside former executives, and said investors lost more than $10 billion.

“EY’s misconduct was not one of professional negligence, but rather EY actively and intentionally conspired with the defendants to conceal their fraudulent conduct,” Shetty’s lawyer said in the court filings.

The allegations of fictitious invoices and inflated financial health between 2013 and 2019 are the most detailed yet from Shetty, who’s separately fighting claims from creditors following NMC’s collapse in April last year.

...

Zitat von faultcode: ...

• 2020: Klient NMC Health geht in die Insolvenz, nachdem sie mit dem Segen von EY allzu sehr Schulden kleingerechnet haben

...

22.7.

EY Accused of Actively Concealing NMC Health Audit Fraud From Investors

https://www.bnnbloomberg.ca/ey-accused-of-actively-concealin…

...

Ernst & Young faces accusations it “actively concealed” a six-year fraud from investors in a fresh lawsuit over its auditing work for the troubled NMC Health.

The hospital operator’s founder, Bavaguthu Raghuram Shetty, said the accounting giant enjoyed a “deep and cozy” relationship with executives at the troubled firm, alleging that the auditors turned a blind eye to thousands of suspicious transactions. Shetty is seeking $7 billion from the lawsuit.

The Indian entrepreneur filed a suit in New York last week, naming Ernst & Young as a co-conspirator in the fraud alongside former executives, and said investors lost more than $10 billion.

“EY’s misconduct was not one of professional negligence, but rather EY actively and intentionally conspired with the defendants to conceal their fraudulent conduct,” Shetty’s lawyer said in the court filings.

The allegations of fictitious invoices and inflated financial health between 2013 and 2019 are the most detailed yet from Shetty, who’s separately fighting claims from creditors following NMC’s collapse in April last year.

...

9.7.

Malaysia, 1MDB File Suit Against KPMG Partners for $5.64B: Report

https://www.bloomberg.com/news/articles/2021-07-09/malaysia-…

The Malaysian government, 1MDB and their units filed a lawsuit seeking more than $5.6 billion from 44 KPMG Malaysia partners for their role in auditing the state investment fund.

The lawsuit filed on Tuesday alleges that KPMG committed breaches of contract and negligence in its audit and certification of 1MDB’s financial statements for the financial years 2010 to 2012.

The lawsuit was first reported by the Edge newspaper. KPMG Malaysia as well as spokespeople for the Finance Ministry and the Prime Minister’s Office did not immediately respond to a request for comment.

The 1MDB scam set off investigations in Asia, the U.S. and Europe, and led to a historic change in government in 2018. Goldman Sachs Group Inc. last year admitted its role in the biggest foreign bribery case in U.S. enforcement history, reaching multiple international settlements in the billions of dollars to end probes into its fund-raising for 1MDB

The statement of claim alleged that more than $5.6 billion had been misappropriated from 1MDB and its subsidiaries to benefit former Prime Minister Najib Razak and his associates between 2009 and 2014. Of that sum, about $3.20 billion was misappropriated during the three financial years that KPMG was its auditor.

The claimants said that KPMG’s audited financial statements between 2010 to 2012 “did not give a true and fair view” of the state investment fund’s financial affairs. Had KPMG not been negligent, it would have prevented further misappropriations in the following years, they said.

As of May 6 this year, interest of at least $1.43 billion has accrued from the $5.6 billion sum, it added.

KPMG was terminated as 1MDB’s auditor in December 2013 during the audit of that year’s financial statements, the accounting firm had previously said in a statement on its website.

The firm in 2018 retracted its 1MDB audit reports as it didn’t have access to relevant documents that were declassified by the Mahathir Mohamad administration, 1MDB said in a statement that year.

Malaysia last month received $80 million from Deloitte PLT in a settlement over the firm’s audit of 1MDB and its former unit SRC International between 2011 to 2014. Malaysia received the first payment of 1.8 billion ringgit ($432 million) from AMMB Holdings Bhd. in settlement over the local lender’s involvement in the 1MDB scandal, according to the finance ministry.

Malaysia, 1MDB File Suit Against KPMG Partners for $5.64B: Report

https://www.bloomberg.com/news/articles/2021-07-09/malaysia-…

The Malaysian government, 1MDB and their units filed a lawsuit seeking more than $5.6 billion from 44 KPMG Malaysia partners for their role in auditing the state investment fund.

The lawsuit filed on Tuesday alleges that KPMG committed breaches of contract and negligence in its audit and certification of 1MDB’s financial statements for the financial years 2010 to 2012.

The lawsuit was first reported by the Edge newspaper. KPMG Malaysia as well as spokespeople for the Finance Ministry and the Prime Minister’s Office did not immediately respond to a request for comment.

The 1MDB scam set off investigations in Asia, the U.S. and Europe, and led to a historic change in government in 2018. Goldman Sachs Group Inc. last year admitted its role in the biggest foreign bribery case in U.S. enforcement history, reaching multiple international settlements in the billions of dollars to end probes into its fund-raising for 1MDB

The statement of claim alleged that more than $5.6 billion had been misappropriated from 1MDB and its subsidiaries to benefit former Prime Minister Najib Razak and his associates between 2009 and 2014. Of that sum, about $3.20 billion was misappropriated during the three financial years that KPMG was its auditor.

The claimants said that KPMG’s audited financial statements between 2010 to 2012 “did not give a true and fair view” of the state investment fund’s financial affairs. Had KPMG not been negligent, it would have prevented further misappropriations in the following years, they said.

As of May 6 this year, interest of at least $1.43 billion has accrued from the $5.6 billion sum, it added.

KPMG was terminated as 1MDB’s auditor in December 2013 during the audit of that year’s financial statements, the accounting firm had previously said in a statement on its website.

The firm in 2018 retracted its 1MDB audit reports as it didn’t have access to relevant documents that were declassified by the Mahathir Mohamad administration, 1MDB said in a statement that year.

Malaysia last month received $80 million from Deloitte PLT in a settlement over the firm’s audit of 1MDB and its former unit SRC International between 2011 to 2014. Malaysia received the first payment of 1.8 billion ringgit ($432 million) from AMMB Holdings Bhd. in settlement over the local lender’s involvement in the 1MDB scandal, according to the finance ministry.

10.6.

Deloitte Sued Over Alleged Role in Collapse of Singapore Trader

https://finance.yahoo.com/news/deloitte-sued-over-alleged-ro…

...

A failed oil trader in Singapore that owes creditors more than $3.5 billion is suing Deloitte & Touche LLP, alleging the auditing firm failed to detect “serious irregularities” in its financial statements for more than a decade.

Deloitte audited the books of Hin Leong Trading Ltd. for at least 16 years before the firm collapsed last year when founding tycoon Lim Oon Kuin admitted trading losses of $808 million weren’t reflected in the firm’s financial statements, according to a court filing.

“Deloitte failed to detect the irregularities and the material misstatements” in Hin Leong’s financial affairs, a March 5 lawsuit filed with the High Court of Singapore alleges. “Deloitte acted in breach of the terms of its engagement with the plaintiff.”

...

In a statement last year, Deloitte said its audit of Hin Leong’s accounts “was performed with the highest standards of audit and compliance with the information made known to us at the time.”

“We stand behind the quality of our work,” a Deloitte spokesperson said in the April 2020 statement

A hearing is set for next week in the case.

Wrong-Way Bets

The oil trading firm began to unravel last year following wrong-way energy bets that eventually led to one of the biggest collapses ever in the Asian city-state. The trading losses triggered demands for loan repayments by more than 20 banks, including London-based HSBC Holdings Plc and Singapore’s DBS Group Holdings Ltd. The case also prompted several major banks to review their exposure to commodities trading.

According to the suit, Deloitte audited and issued “unqualified opinions” for Hin Leong’s financial statements for each of the fiscal years from 2014 through 2019. The firm had in fact been insolvent since at least 2012, and the assets were overstated, the suit claims.

“The material misstatements in the plaintiff’s audited financial statements led to various banks and financial institutions being grossly misled as to the financial health and state of affairs,” Hin Leong claimed in the suit. “Deloitte knew or ought to have known that these banks and financial institutions were intended users of the plaintiff’s audited financial statements and would have relied on the same to extend financing.”

Few Assets

The New York-based auditing firm signed off on Hin Leong’s 2019 financial statements, which reported a 69% profit increase from the previous year, to $78.2 million. The report dated March 12, 2020, showed assets of $4.6 billion. A month later, Hin Leong was placed in interim judicial management, claiming liabilities of $3.5 billion and assets of just $257 million, according to the suit.

“Had Deloitte carried out the audits of the plaintiff’s financial statements properly, Deloitte would have detected the material misstatements,” and would not have issued unqualified audit opinions, the lawsuit alleges. As a result, “the fraudulent trading and unlawful actions by the directors and former managing director” of Hin Leong would have been discovered much earlier.

Lim, 79, has been charged with forgery. Assets, which include bank accounts, properties and club memberships -- and those of his two children -- have been frozen by the court. Lim has denied the forgery claim.

Hin Leong was run by court-appointed managers Goh Thien Phong and Chan Kheng Tek since April 2020, and was put into liquidation in March this year.

...

Deloitte Sued Over Alleged Role in Collapse of Singapore Trader

https://finance.yahoo.com/news/deloitte-sued-over-alleged-ro…

...

A failed oil trader in Singapore that owes creditors more than $3.5 billion is suing Deloitte & Touche LLP, alleging the auditing firm failed to detect “serious irregularities” in its financial statements for more than a decade.

Deloitte audited the books of Hin Leong Trading Ltd. for at least 16 years before the firm collapsed last year when founding tycoon Lim Oon Kuin admitted trading losses of $808 million weren’t reflected in the firm’s financial statements, according to a court filing.

“Deloitte failed to detect the irregularities and the material misstatements” in Hin Leong’s financial affairs, a March 5 lawsuit filed with the High Court of Singapore alleges. “Deloitte acted in breach of the terms of its engagement with the plaintiff.”

...

In a statement last year, Deloitte said its audit of Hin Leong’s accounts “was performed with the highest standards of audit and compliance with the information made known to us at the time.”

“We stand behind the quality of our work,” a Deloitte spokesperson said in the April 2020 statement

A hearing is set for next week in the case.

Wrong-Way Bets

The oil trading firm began to unravel last year following wrong-way energy bets that eventually led to one of the biggest collapses ever in the Asian city-state. The trading losses triggered demands for loan repayments by more than 20 banks, including London-based HSBC Holdings Plc and Singapore’s DBS Group Holdings Ltd. The case also prompted several major banks to review their exposure to commodities trading.

According to the suit, Deloitte audited and issued “unqualified opinions” for Hin Leong’s financial statements for each of the fiscal years from 2014 through 2019. The firm had in fact been insolvent since at least 2012, and the assets were overstated, the suit claims.

“The material misstatements in the plaintiff’s audited financial statements led to various banks and financial institutions being grossly misled as to the financial health and state of affairs,” Hin Leong claimed in the suit. “Deloitte knew or ought to have known that these banks and financial institutions were intended users of the plaintiff’s audited financial statements and would have relied on the same to extend financing.”

Few Assets

The New York-based auditing firm signed off on Hin Leong’s 2019 financial statements, which reported a 69% profit increase from the previous year, to $78.2 million. The report dated March 12, 2020, showed assets of $4.6 billion. A month later, Hin Leong was placed in interim judicial management, claiming liabilities of $3.5 billion and assets of just $257 million, according to the suit.

“Had Deloitte carried out the audits of the plaintiff’s financial statements properly, Deloitte would have detected the material misstatements,” and would not have issued unqualified audit opinions, the lawsuit alleges. As a result, “the fraudulent trading and unlawful actions by the directors and former managing director” of Hin Leong would have been discovered much earlier.

Lim, 79, has been charged with forgery. Assets, which include bank accounts, properties and club memberships -- and those of his two children -- have been frozen by the court. Lim has denied the forgery claim.

Hin Leong was run by court-appointed managers Goh Thien Phong and Chan Kheng Tek since April 2020, and was put into liquidation in March this year.

...

Antwort auf Beitrag Nr.: 67.013.427 von faultcode am 15.02.21 12:52:42

https://twitter.com/retheauditors/status/1375791570100879365

=>

Botta v. PricewaterhouseCoopers LLP

Federal Civil Lawsuit

California Northern District Court, Case No. 3:18-cv-02615-AGT

District Judge Alex G. Tse, presiding

https://www.plainsite.org/dockets/3afke51ng/california-north…

...

siehe auch:

23.2.2021

PwC US to head to trial over whether it rightly fired a whistleblower

https://www.msn.com/en-gb/money/other/pwc-us-to-head-to-tria…

...

PwC in the US will go to trial next Monday, in which it will have to defend its audits of two tech companies and that it rightly fired a whistleblower.

Former PwC senior manager Mauro Botta has accused audit giant of firing him because he submitted complaints to the Securities and Exchange Commission (SEC) and other accounting and audit regulators, saying the firm had too cosy a relationship with its clients and so allowed weak internal controls to slide, Bloomberg Tax first reported.

PwC US called the allegations false, and said it stands behind its audits of Cavium and Harmonic, which it has been working with for more than six years.

According to Bloomberg Tax, in court filings PwC US claimed that Botta signed off on the audits despite his concerns.

The giant also said Botta “fabricated an internal control and falsified audit documentation,” and then lied about doing so during an internal investigation. As a result, PwC said, he was fired.

Botta’s lawyers said that the case is about the inherent conflict between auditors role serving the interests of investors and the need to retain paying clients.

The whistleblower’s lawyers alledged the firm moved Botta off assignments when his “honest questions jeopardised a profitable relationship.”

They said Botta submitted his complaint to the SEC in 2016 because he believed there was a violation of SEC rules or regulations, giving him protection as a whistleblower under the Sarbanes-Oxley Act.

But according to PwC filings, the SEC investigated Botta’s claims and closed its inquiry without bringing any enforcement cases....

Tag:

• SOX

"inherent conflict between auditors role serving the interests of investors and the need to retain paying clients"

https://twitter.com/retheauditors/status/1375791570100879365

=>

Botta v. PricewaterhouseCoopers LLP

Federal Civil Lawsuit

California Northern District Court, Case No. 3:18-cv-02615-AGT

District Judge Alex G. Tse, presiding

https://www.plainsite.org/dockets/3afke51ng/california-north…

...

siehe auch:

23.2.2021

PwC US to head to trial over whether it rightly fired a whistleblower

https://www.msn.com/en-gb/money/other/pwc-us-to-head-to-tria…

...

PwC in the US will go to trial next Monday, in which it will have to defend its audits of two tech companies and that it rightly fired a whistleblower.

Former PwC senior manager Mauro Botta has accused audit giant of firing him because he submitted complaints to the Securities and Exchange Commission (SEC) and other accounting and audit regulators, saying the firm had too cosy a relationship with its clients and so allowed weak internal controls to slide, Bloomberg Tax first reported.

PwC US called the allegations false, and said it stands behind its audits of Cavium and Harmonic, which it has been working with for more than six years.

According to Bloomberg Tax, in court filings PwC US claimed that Botta signed off on the audits despite his concerns.

The giant also said Botta “fabricated an internal control and falsified audit documentation,” and then lied about doing so during an internal investigation. As a result, PwC said, he was fired.

Botta’s lawyers said that the case is about the inherent conflict between auditors role serving the interests of investors and the need to retain paying clients.

The whistleblower’s lawyers alledged the firm moved Botta off assignments when his “honest questions jeopardised a profitable relationship.”

They said Botta submitted his complaint to the SEC in 2016 because he believed there was a violation of SEC rules or regulations, giving him protection as a whistleblower under the Sarbanes-Oxley Act.

But according to PwC filings, the SEC investigated Botta’s claims and closed its inquiry without bringing any enforcement cases....

Zitat von faultcode: ...=> was für den einen ein Beweis ist (nach welchen Kriterien?), ist es für den anderen nicht

Kommt eine "Beweis" zu einem Staatsanwalt (oder Abschlussprüfer) und der Staatsanwalt sagt: "Du bist kein Beweis."

Kommt eine "Beweis" zu einem Gericht und das Gericht sagt: "Du bist kein Beweis."

...

Tag:

• SOX

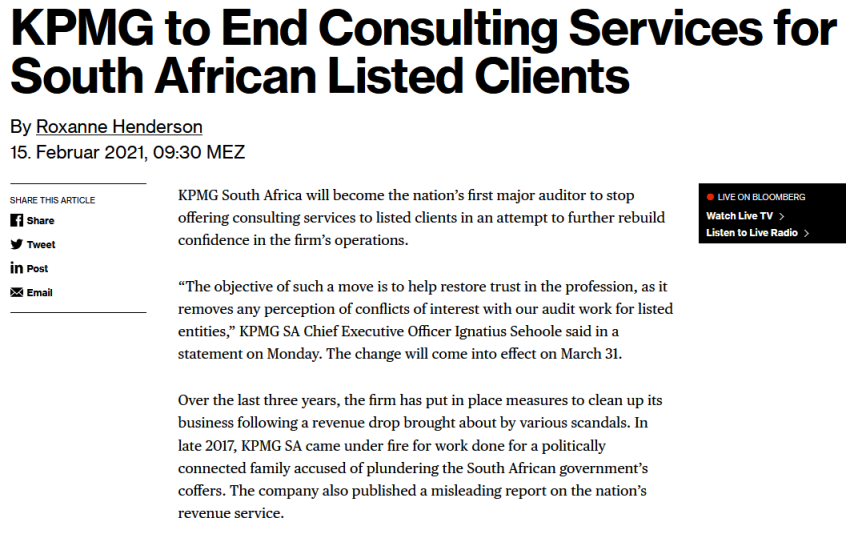

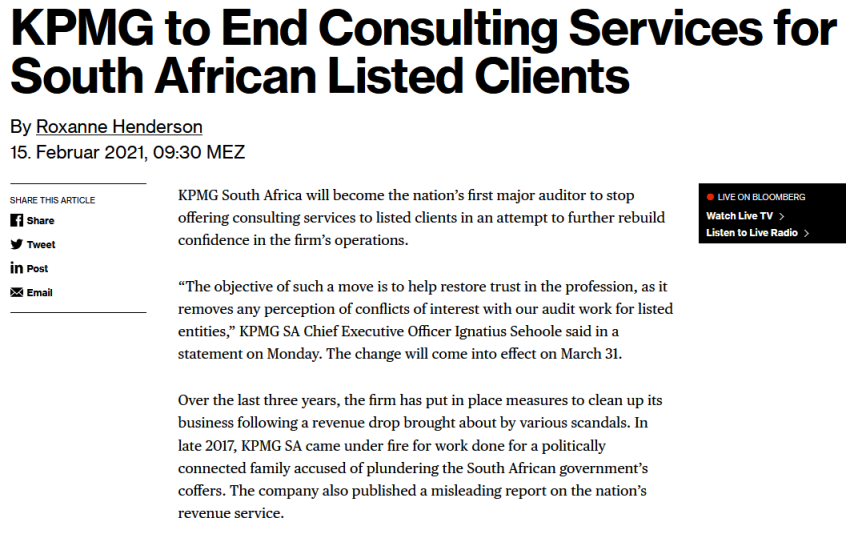

Antwort auf Beitrag Nr.: 62.376.794 von faultcode am 14.01.20 22:25:55https://www.bloomberg.com/news/articles/2021-02-15/kpmg-to-e…

...

...

Antwort auf Beitrag Nr.: 66.871.514 von faultcode am 08.02.21 01:25:28

https://twitter.com/Junheng_Li/status/1357813837693550592

https://twitter.com/Junheng_Li/status/1357813837693550592

Antwort auf Beitrag Nr.: 65.574.554 von faultcode am 02.11.20 21:18:49https://www.globaltimes.cn/page/202102/1215067.shtml

...

Tag:

• Deloitte

...

Tag:

• Deloitte

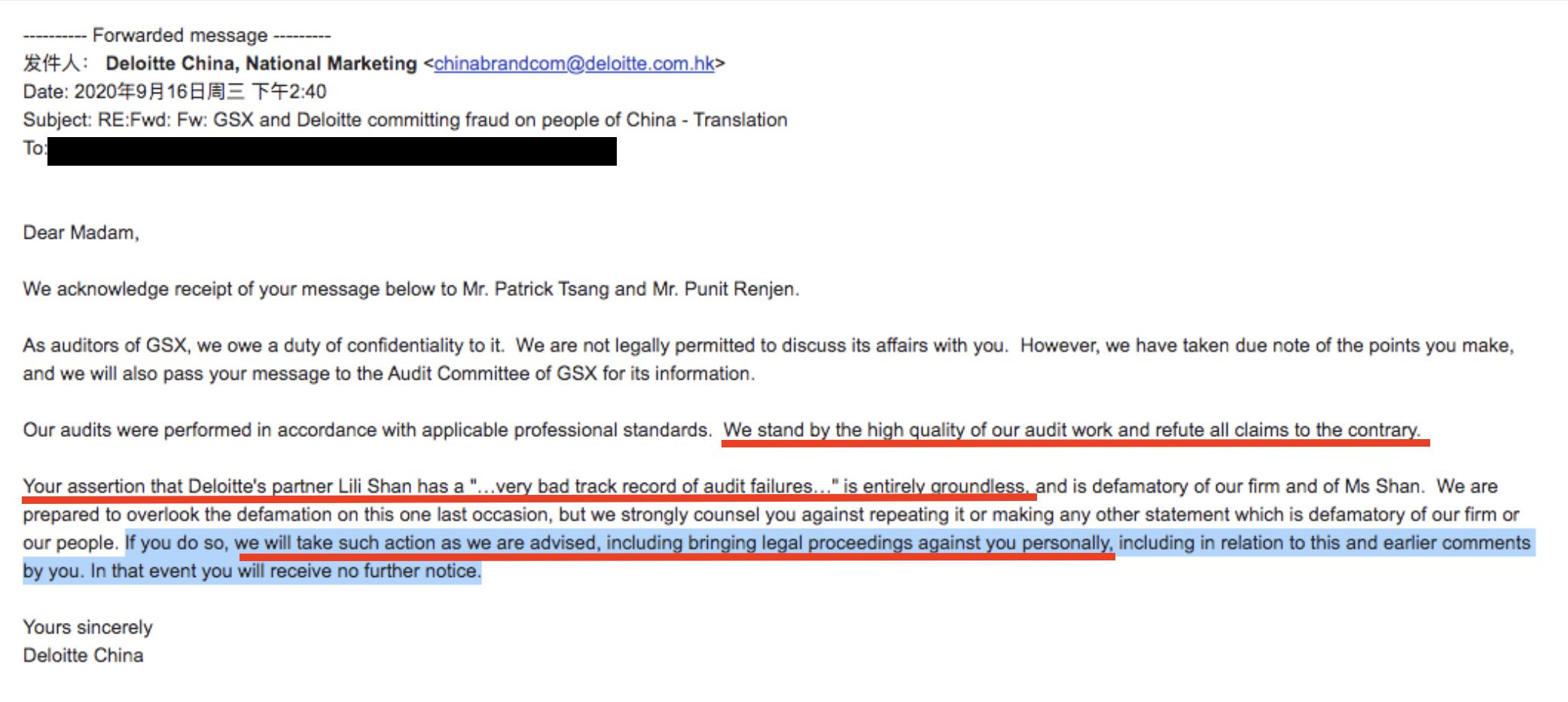

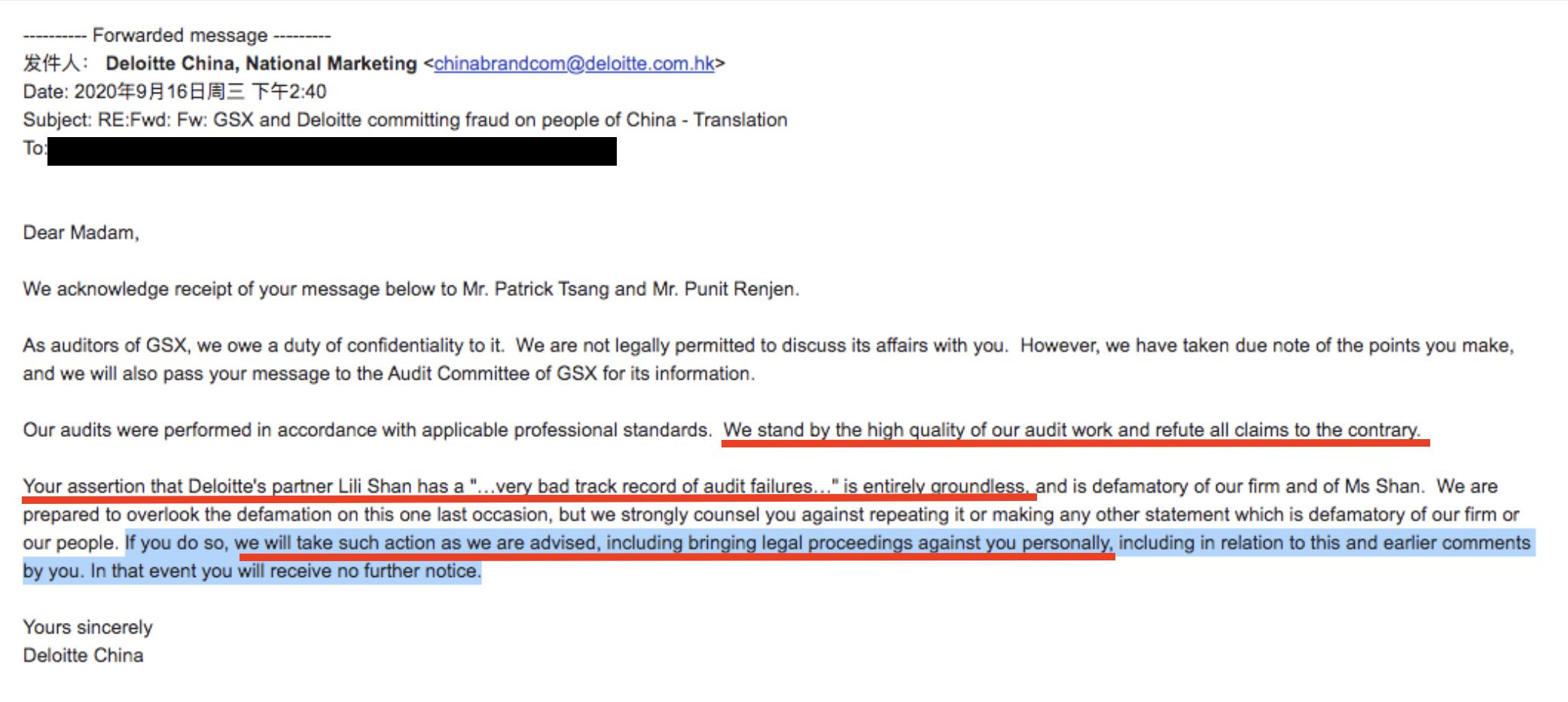

Antwort auf Beitrag Nr.: 65.322.065 von faultcode am 08.10.20 13:45:01da wird auch schon mal gedroht:

https://twitter.com/StockJabber/status/1323091165466529792

https://www.deloittefraud.com/

Tag:

• GSX Techedu

https://twitter.com/StockJabber/status/1323091165466529792

https://www.deloittefraud.com/

Tag:

• GSX Techedu

Antwort auf Beitrag Nr.: 65.316.122 von faultcode am 07.10.20 23:37:29

...

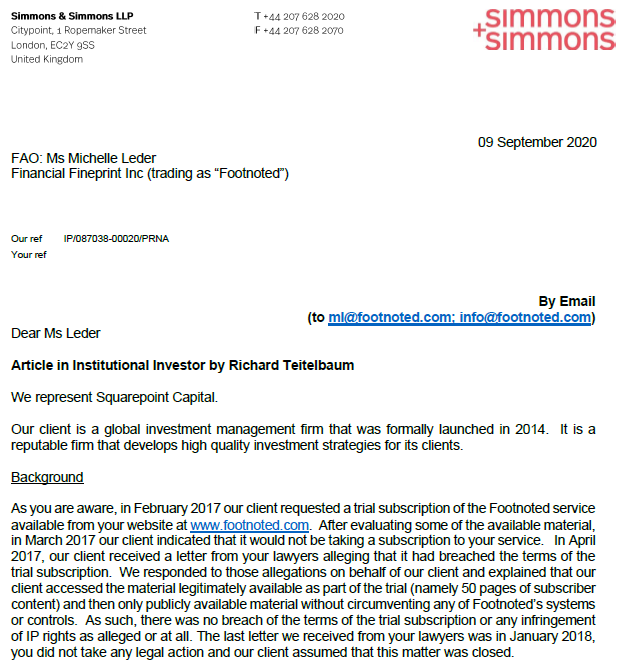

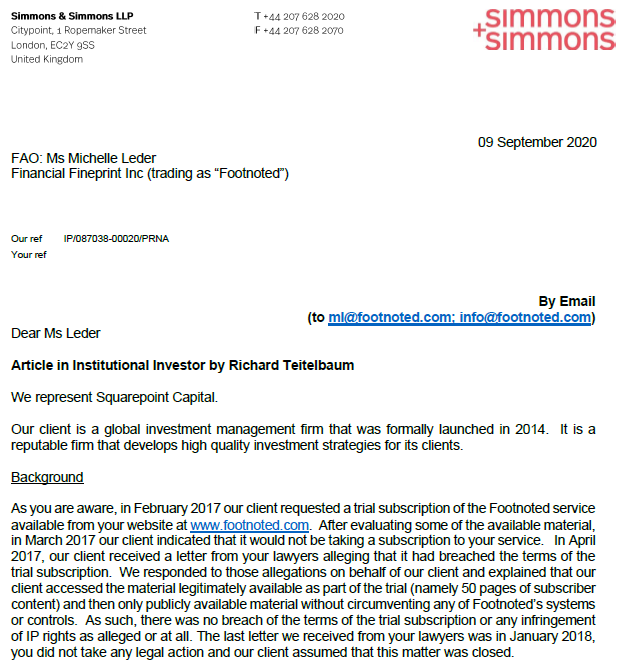

aus: https://www.footnoted.com/simpson-simpson-letter/

da steht nun Aussage gegen Aussage: https://twitter.com/footnoted/status/1313942873746755584

Wobei: was will ein HFT bzw. Quant mit kurzen Zeithorizonten mit solchen Auswertungen von SEC filings?

Mmn eignen sich diese Auswertungen, die sicherlich ihre Berechtung haben, nicht, um damit als so ein Quant Geld zu verdienen.

Diese Idee muss Squarepoint Capital dann irgendwie auch gekommen sein. Aber da war der (Praktikanten-?)Schaden schon angerichtet.

Es geht ihnen mMn auch eigentlich nur um einen möglichen Reputationsschaden, der bei der harten Konkurrenz möglicherweise Negativ-Folgen langfristig haben könnte.

__

nebenbei: die Squarepoint Ops LLC in NYC ist eine Tochter von Squarepoint Capital und tritt auch ab und zu als Leerverkäufer in Deutschland auf, aktuell z.B. bei K+S oder ProSiebenSat1.

https://www.bloomberg.com/profile/company/1293962D:US

https://www.hfobserver.com/directory/squarepoint-capital/

...

aus: https://www.footnoted.com/simpson-simpson-letter/

da steht nun Aussage gegen Aussage: https://twitter.com/footnoted/status/1313942873746755584

Wobei: was will ein HFT bzw. Quant mit kurzen Zeithorizonten mit solchen Auswertungen von SEC filings?

Mmn eignen sich diese Auswertungen, die sicherlich ihre Berechtung haben, nicht, um damit als so ein Quant Geld zu verdienen.

Diese Idee muss Squarepoint Capital dann irgendwie auch gekommen sein. Aber da war der (Praktikanten-?)Schaden schon angerichtet.

Es geht ihnen mMn auch eigentlich nur um einen möglichen Reputationsschaden, der bei der harten Konkurrenz möglicherweise Negativ-Folgen langfristig haben könnte.

__

nebenbei: die Squarepoint Ops LLC in NYC ist eine Tochter von Squarepoint Capital und tritt auch ab und zu als Leerverkäufer in Deutschland auf, aktuell z.B. bei K+S oder ProSiebenSat1.

https://www.bloomberg.com/profile/company/1293962D:US

https://www.hfobserver.com/directory/squarepoint-capital/

Leder had a motto, a version of which she would repeat endlessly to her staff: “There are no accidents in SEC filings. Everything is there for a reason, even when we’re not exactly sure what the reason is at the time.”

7.10.2020

A Corporate Sleuth Claims Squarepoint Capital Took Her Content. The Hedge Fund Is Threatening Action. What Actually Happened?

Why the beloved financial data website Footnoted went dark.

https://www.institutionalinvestor.com/article/b1nq0fmzdh9h51…

...

Tag:

• Michelle Leder

7.10.2020

A Corporate Sleuth Claims Squarepoint Capital Took Her Content. The Hedge Fund Is Threatening Action. What Actually Happened?

Why the beloved financial data website Footnoted went dark.

https://www.institutionalinvestor.com/article/b1nq0fmzdh9h51…

...

Tag:

• Michelle Leder

Kaloti Jewellery International, Dubai

EY passt(e) eigentlich gut zu Wirecard, herrschte auch dort offenbar eine Kultur, scharf gegen Whistleblower vorzugehen:17 Apr 2020

EY ordered to pay whistleblower $11m in Dubai gold audit case

Court rules accountancy firm breached code of ethics in its dealings with a refiner

https://www.theguardian.com/business/2020/apr/17/ey-ordered-…

A former partner at the accounting firm EY has been awarded $10.8m (£8.6m) in damages after being forced out of his job when he exposed professional misconduct during an audit of a Dubai gold refiner.

The high court in London ruled on Friday that EY had repeatedly breached the code of ethics for professional accountants in its dealings with one of its clients, Kaloti Jewellery International.

The claim was brought by Amjad Rihan, who revealed that silver-coated gold had been shipped from Morocco to avoid export restrictions and precious metal obtained from other countries such as Sudan, the Democratic Republic of the Congo and Iran without due diligence.

After telling EY about his concerns, Rihan was ordered back to Dubai but feared for his and his family’s safety. He resigned and subsequently made whistleblowing disclosures in 2014.

Mr Justice Kerr found EY had breached its duty to Rihan through failing to perform the Kaloti audit in an ethical and professional manner.

The court awarded Rihan a total of $10,843,941 and £117,950 in sterling for damages for past and future loss of earnings, and loss of employment benefits.

After the ruling, Rihan said: “Almost seven years of agony for me and my family has come to an end with a total vindication by the court. My life was turned upside down as I was cruelly and harshly punished for insisting on doing my job ethically, professionally and lawfully in relation to the gold audits in Dubai.

“The court ruled in my favour and found that EY breached its duties towards me, for which I am very grateful. I hope that EY uses this judgment as an opportunity to improve and take the necessary measures to avoid anything like this ever happening again.”

Paul Dowling, a solicitor from law firm Leigh Day who represented Rihan, said: “For years EY has refused to admit any wrongdoing in relation to the Kaloti audit. Instead it accused Mr Rihan of being a liar and a fantasist. Our client’s character and actions have now been completely vindicated by the court.

“By contrast it is EY which has been found to have committed serious professional misconduct at the highest echelons of the organisation. This important judgment sends a clear message to would-be whistleblowers that they do not have to tolerate unethical conduct within their organisation, no matter how high up the chain it goes.

In his judgment, Kerr said: “Gold is used in the banking industry, for investment purposes; in the jewellery industry; and in the electronics industry, for manufacturing. It is recognised internationally as being among the ‘conflict minerals’ attractive to criminals and terrorists because it is relatively easy to move and holds its value well.

“For these reasons, the importance of good due diligence and regulation in the gold refining industry and other ‘conflict minerals’ trading is emphasised in guidance published by the Organisation for Economic Cooperation and Development (OECD) and in US legislation known as the Dodd-Frank Act. The claimant and his colleagues at EY Dubai and EY MENA saw this as an opportunity to acquire fruitful work producing assurance reporting to gold refiners in Dubai and elsewhere in the region. Kaloti was the most substantial of the Dubai refiners, with the largest market share.”

Commenting on the Morocco transactions, Kerr said: “I accept as a fact that the defendants were responsible for suggesting to Kaloti that it should draft its compliance report in a manner that masked the reality of the Morocco gold issue, removing the reference to Morocco and changing the coating of gold bars with silver to documentary irregularities. I regard this as professional misconduct.”

An EY spokesperson said: “We are surprised and disappointed by the judge’s decision, its introduction of an unprecedented legal duty and its financial award to a former EY Dubai partner. We will appeal and, therefore, not comment in detail. It was the work of an EY Dubai assurance team that uncovered serious irregularities and reported them to the proper authorities. Their work ultimately resulted in sanctions against the refiner and contributed to significant changes in the sourcing of precious metals and the regulation of refiners in Dubai.”

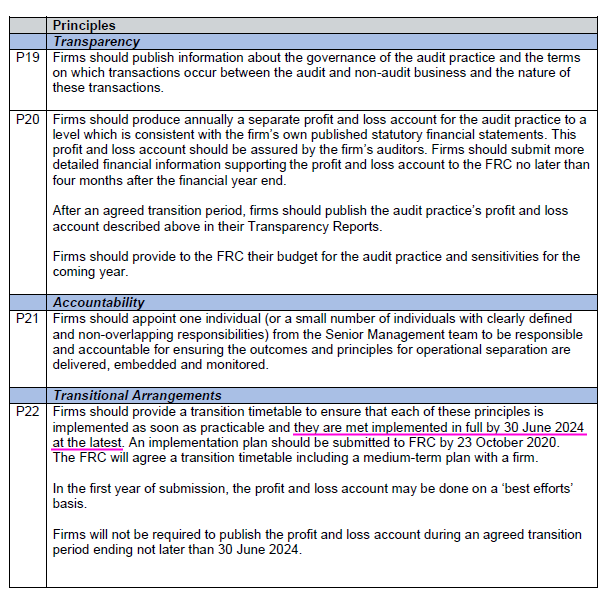

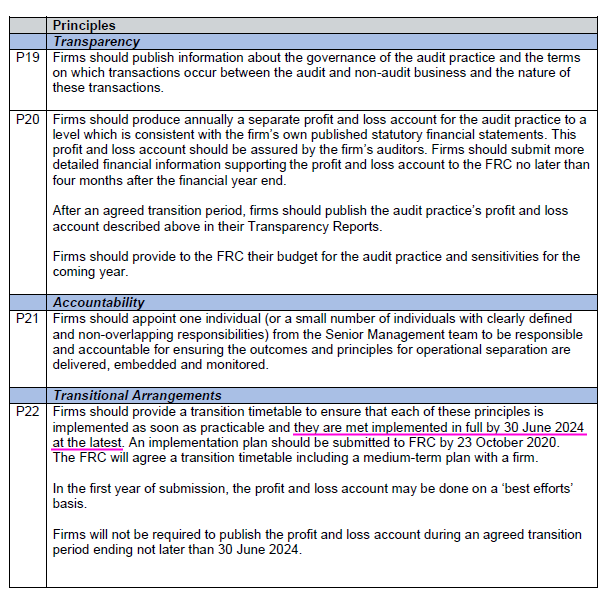

in UK liegen schon Vorschläge zur Big 4-Reform bis spätestens Mitte 2024 vor:

2.7.2020

https://t.co/jJn8mZQBBO?amp=1

=>

...

FRC = Financial Reporting Council

2.7.2020

https://t.co/jJn8mZQBBO?amp=1

=>

...

FRC = Financial Reporting Council