Africa Oil Corp. - World-Class East Africa Oil Exploration - 500 Beiträge pro Seite (Seite 5)

eröffnet am 23.06.11 21:04:25 von

neuester Beitrag 23.04.24 11:17:43 von

neuester Beitrag 23.04.24 11:17:43 von

Beiträge: 4.120

ID: 1.167.139

ID: 1.167.139

Aufrufe heute: 3

Gesamt: 628.600

Gesamt: 628.600

Aktive User: 0

ISIN: CA00829Q1019 · WKN: A0MZJC · Symbol: AOI

1,7100

EUR

+3,83 %

+0,0630 EUR

Letzter Kurs 26.04.24 Tradegate

Werte aus der Branche Öl/Gas

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 1,915 | +17,13 | |

| 7,3400 | +15,77 | |

| 9,6400 | +13,95 | |

| 7,9500 | +13,25 | |

| 13,810 | +10,39 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 325,00 | -9,97 | |

| 0,9400 | -10,48 | |

| 4,3100 | -18,98 | |

| 9,3500 | -28,02 | |

| 0,900 | -28,57 |

... Auch von mir allem AOI'ler noch eine schöne Weihnachtszeit und das uns nächstes Jahr zu Weihnachten, alle um unseren frühen Einstieg bei AOI beneiden werden...

2013 - das Jahr von Africa Oil Corp.

2013 - das Jahr von Africa Oil Corp.

So schließe ich mich meinem Vorgänger an und wünsche ebenfalls einige besinnliche Tage,

sowie viel Kraft und Nerven in 2013 bei event. Kursen unter 5 CAD. (wobei ich diese Kurse niemanden wünsche)

Vielleicht erbarmt sich in 2013 ein Major den Laden für 7 oder 8 CAD zu übernehmen,

denn ein no-brainer ist dieses Invest in keinem Fall...

Anbei nochmal ein (imo) guter Artikel, welcher vor einem Monat von vielen (auch ich habe ihn belächelt) verspottet wurde.

(siehe untere comments)

How Close is the Africa Oil Bubble to Bursting?

By Nathan Kirykos - November 23, 2012 28 Comments

Nathan is a member of The Motley Fool Blog Network -- entries represent the personal opinions of our bloggers and are not formally edited.

Introduction

The investors often propel some companies' valuation at high levels making them a bubble. I like identifying and exposing these bubbles before they implode. The greed isn't a wise investment strategy. Many people are driven by greed and they want a bubble to go higher as they have a biased perception of reality. Once the implosion occurs, they recognize their mistake but it is too late. So I'll analyze the case of Africa Oil Corporation (TSXV: AOI). Is it a result of people's greed or ignorance?

Operations Overview

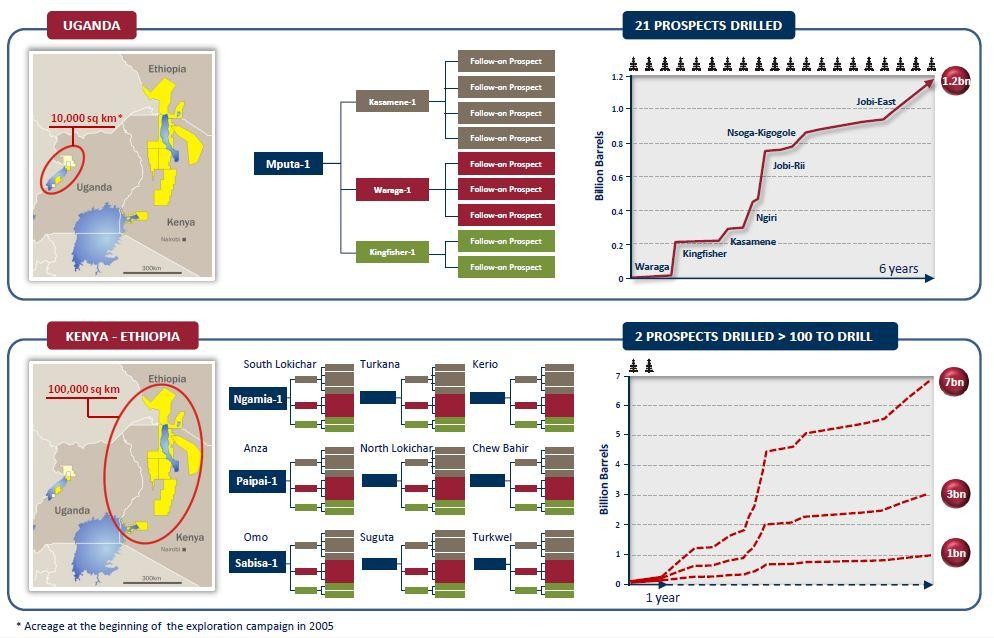

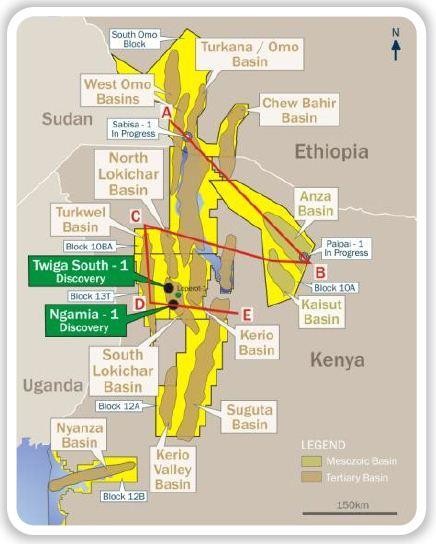

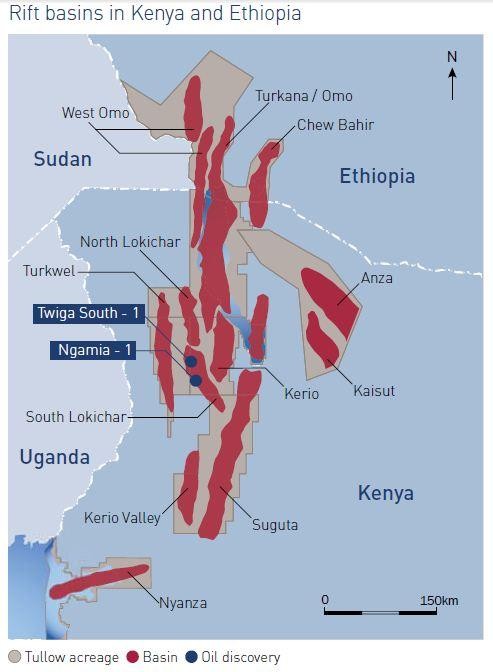

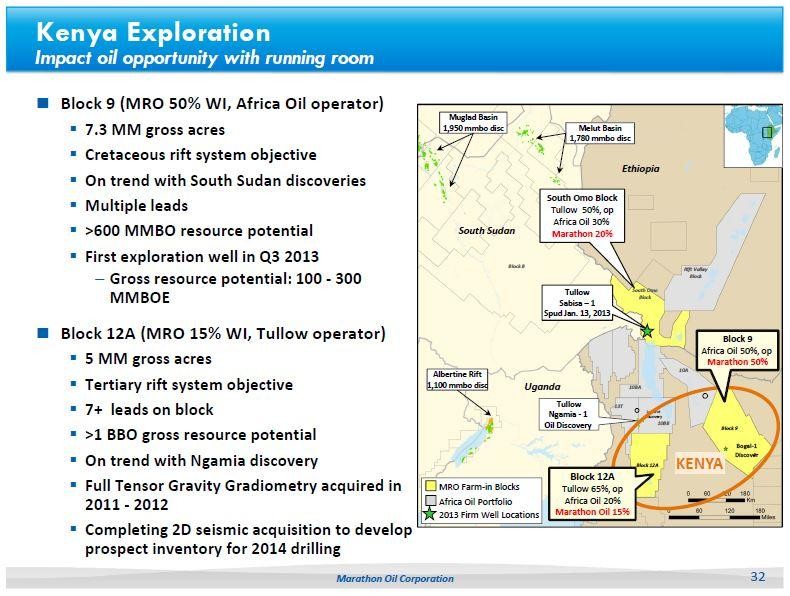

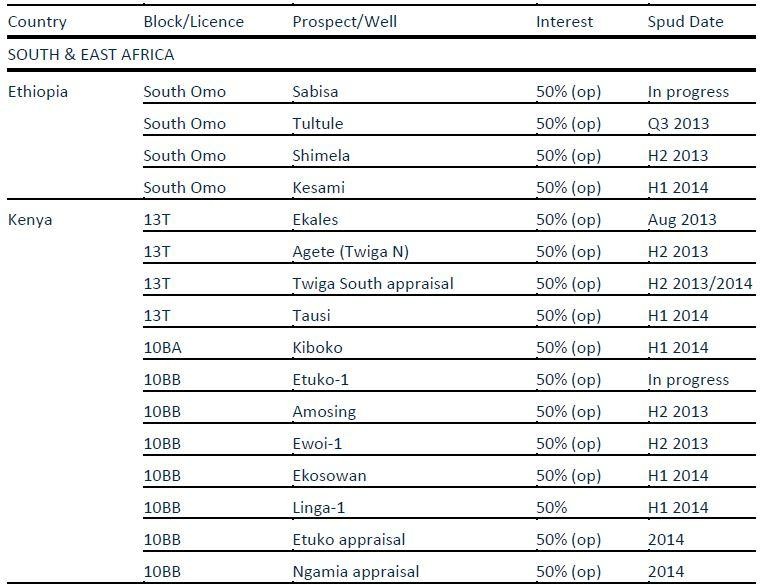

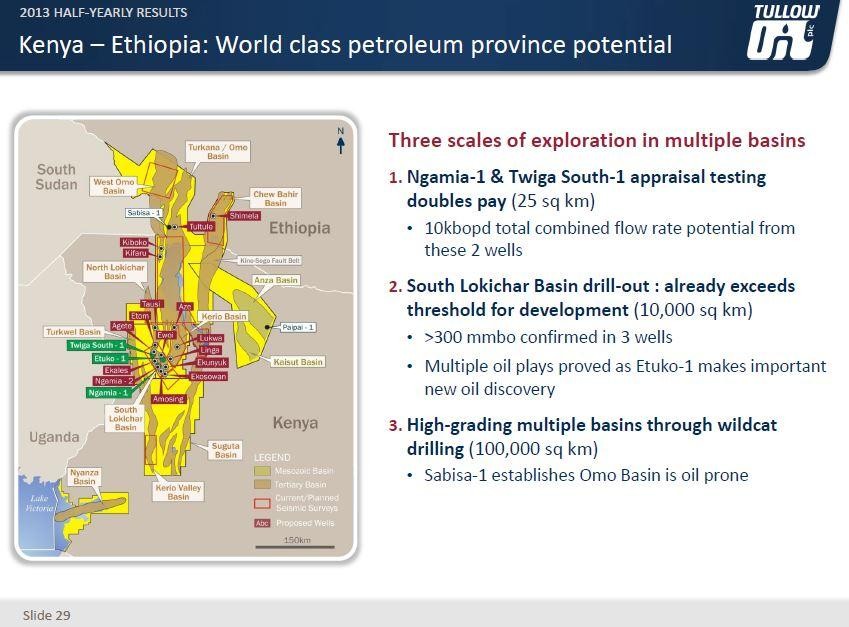

Africa Oil is a Canadian energy company with assets in Kenya, Ethiopia, Mali and Somalia through its 45% stake in Horn Petroleum Corporation. Africa Oil's East African holdings are in excess of 300,000 square kilometers. The company doesn't have any production today and it is in a multi-well drilling campaign in Kenya and Ethiopia during the last months.

Corporate Developments

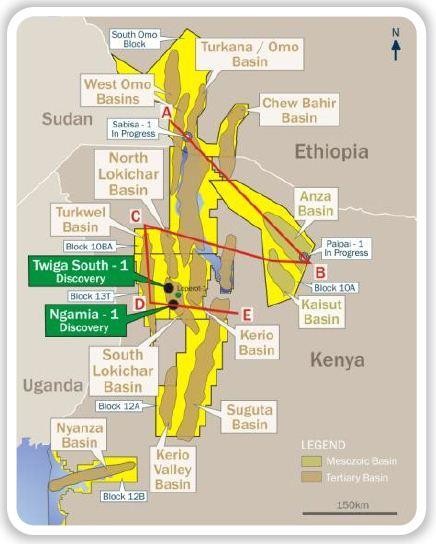

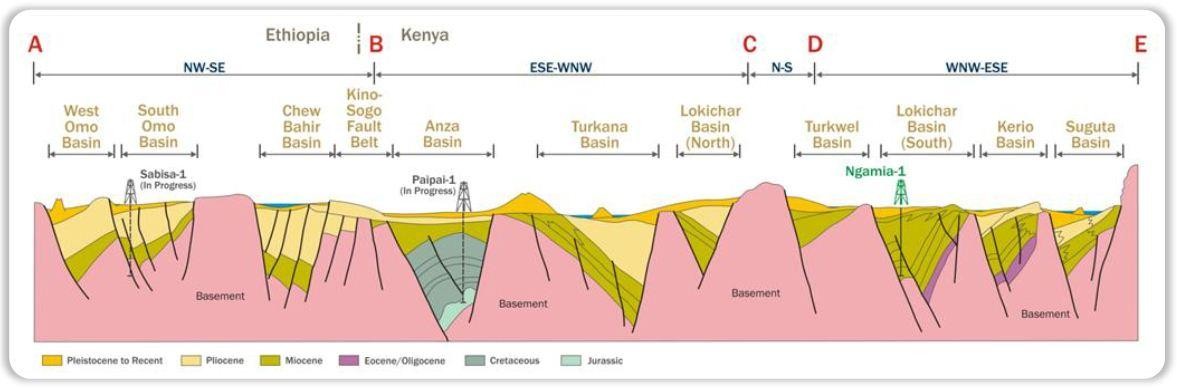

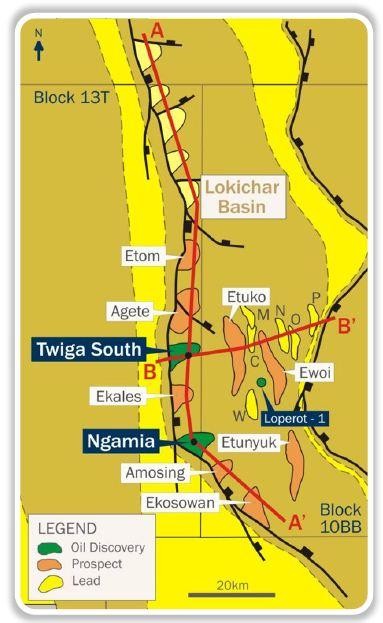

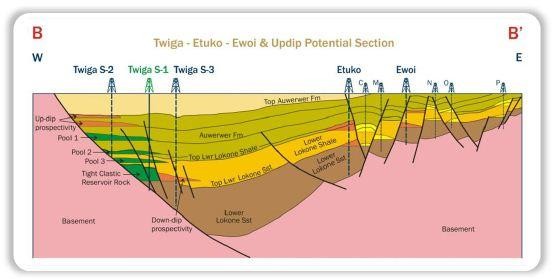

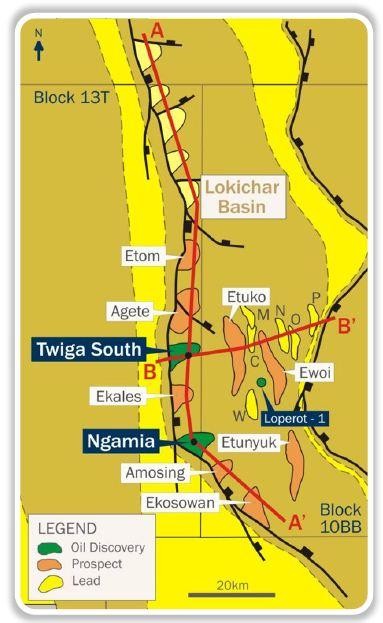

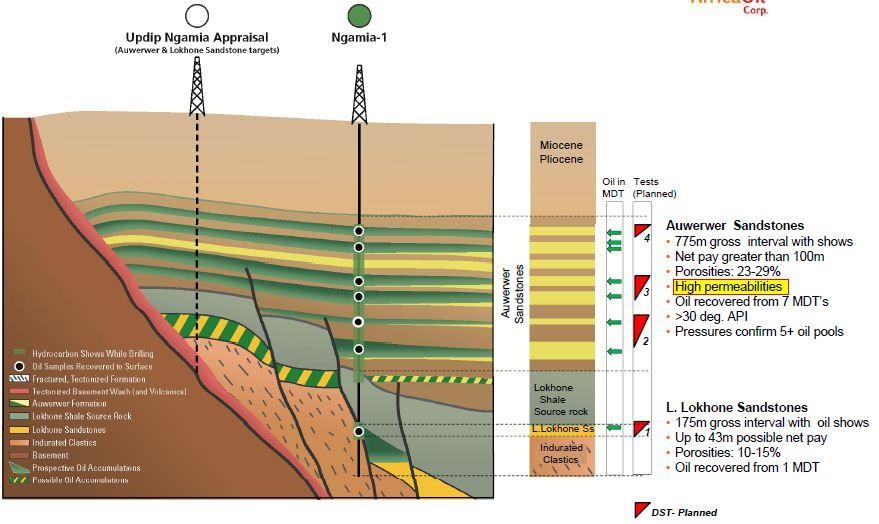

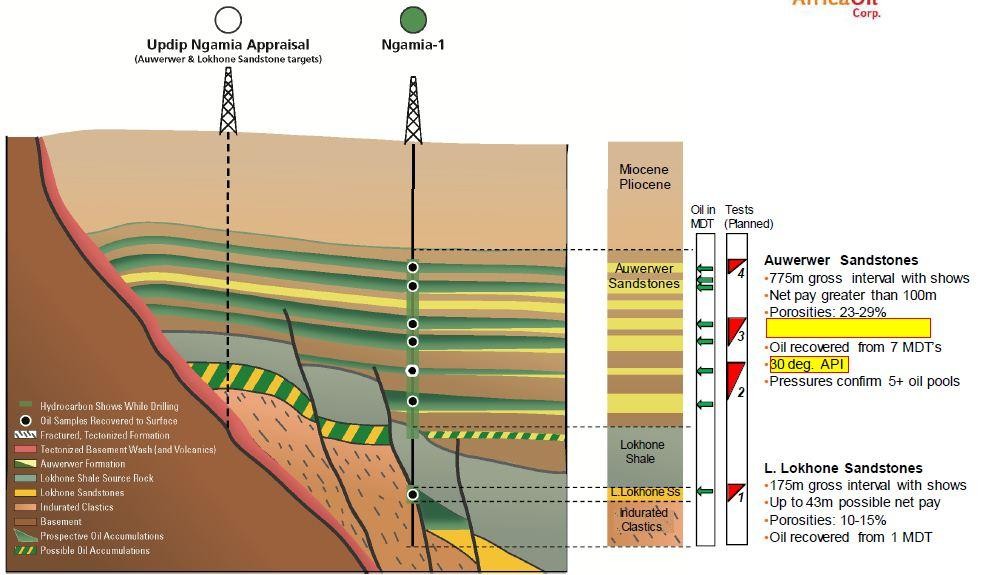

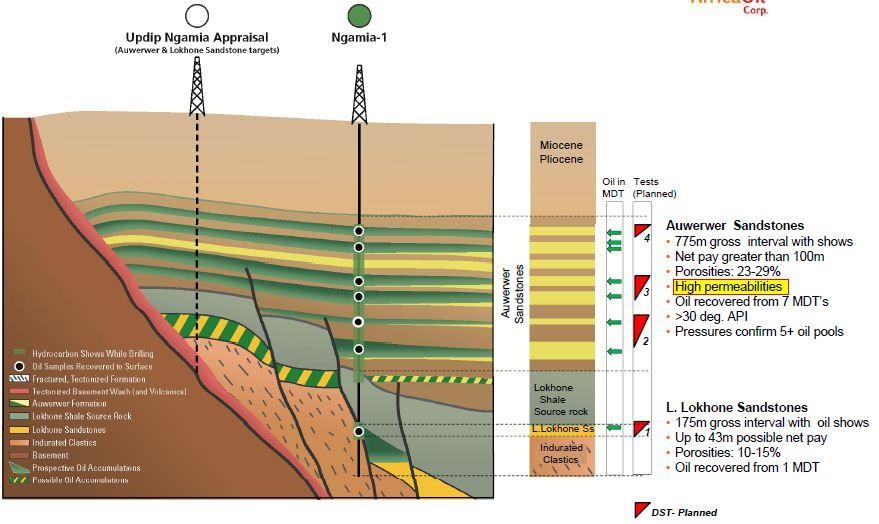

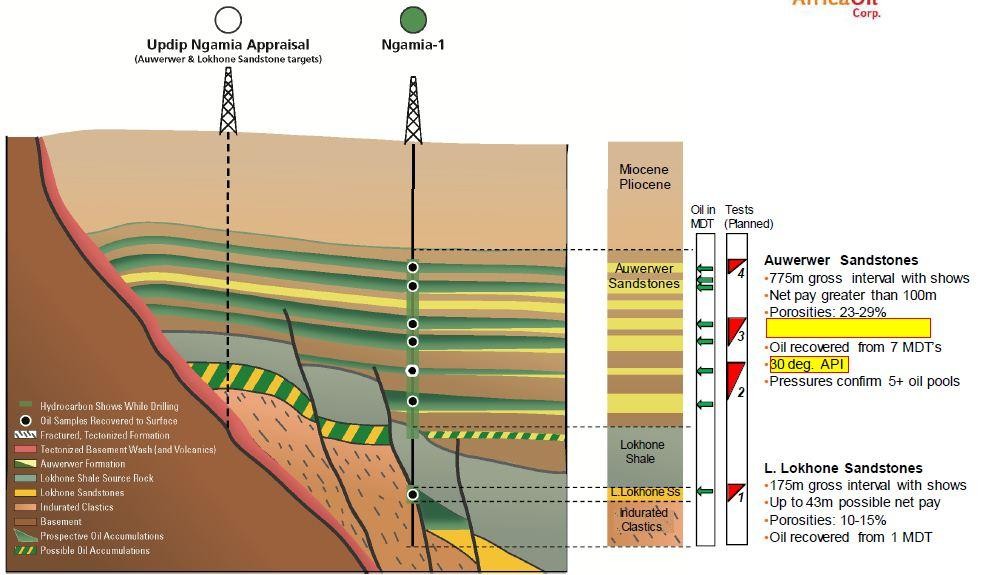

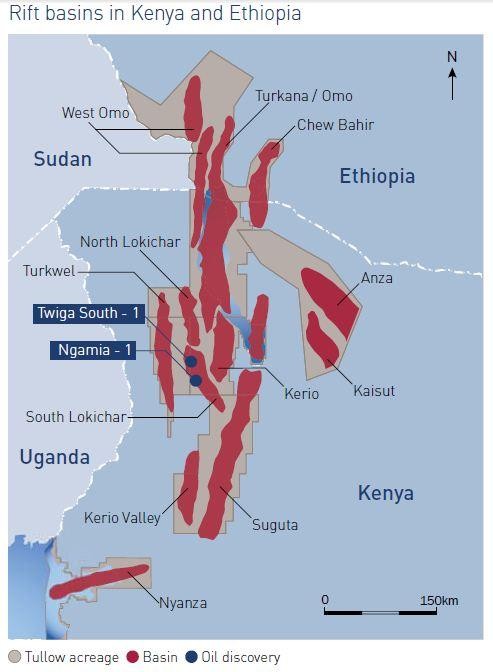

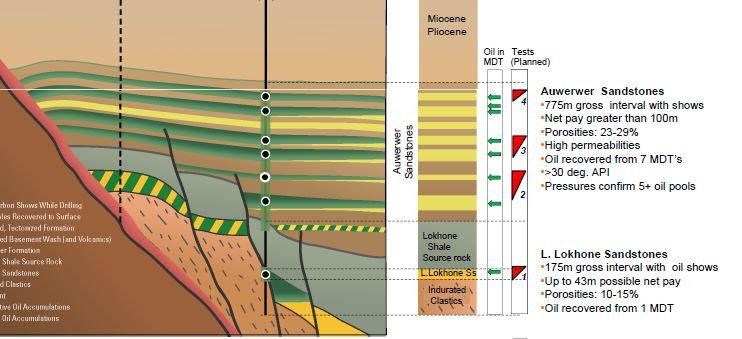

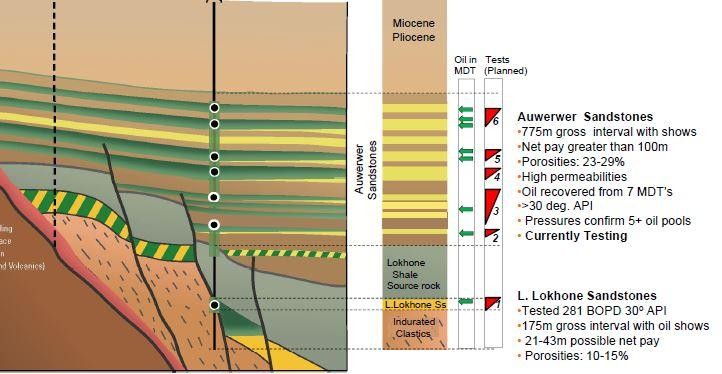

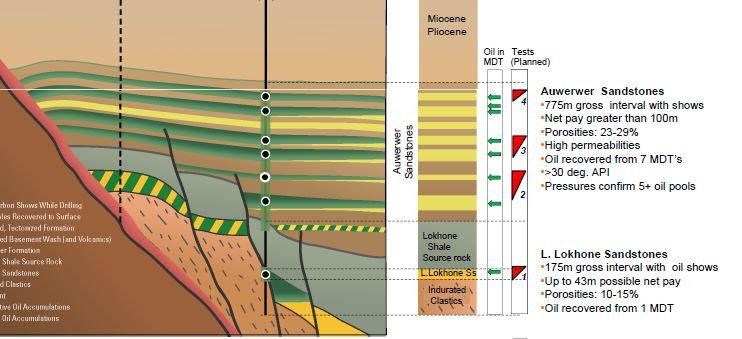

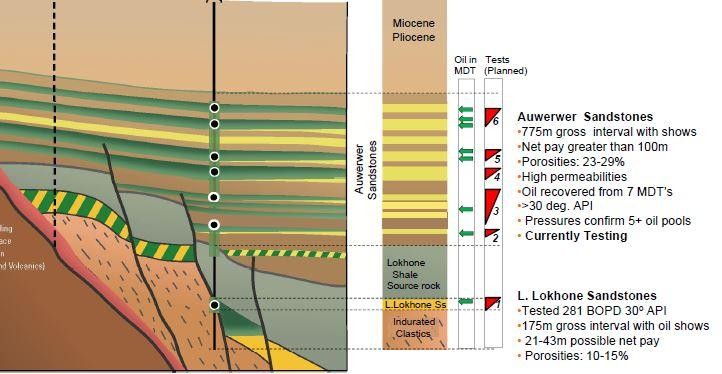

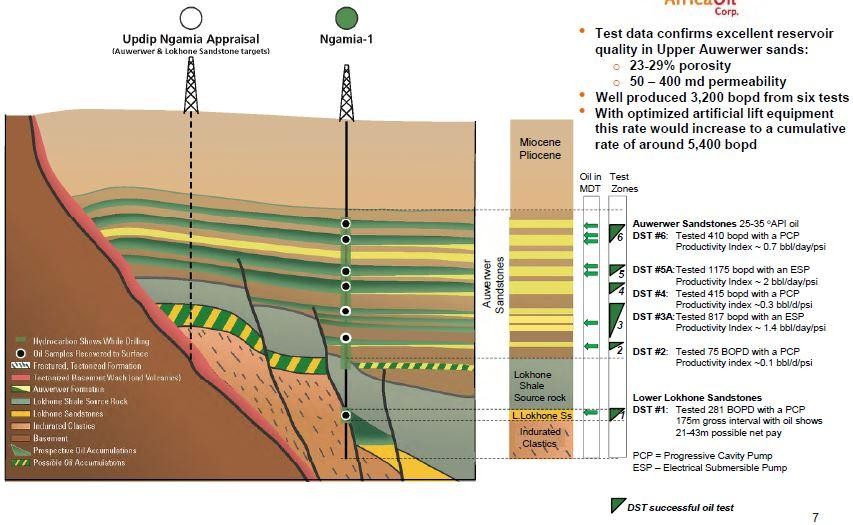

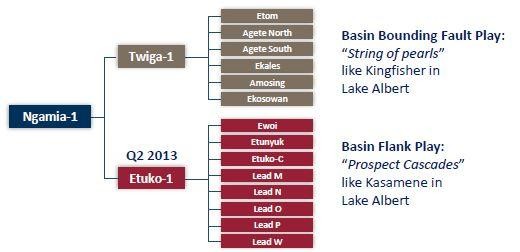

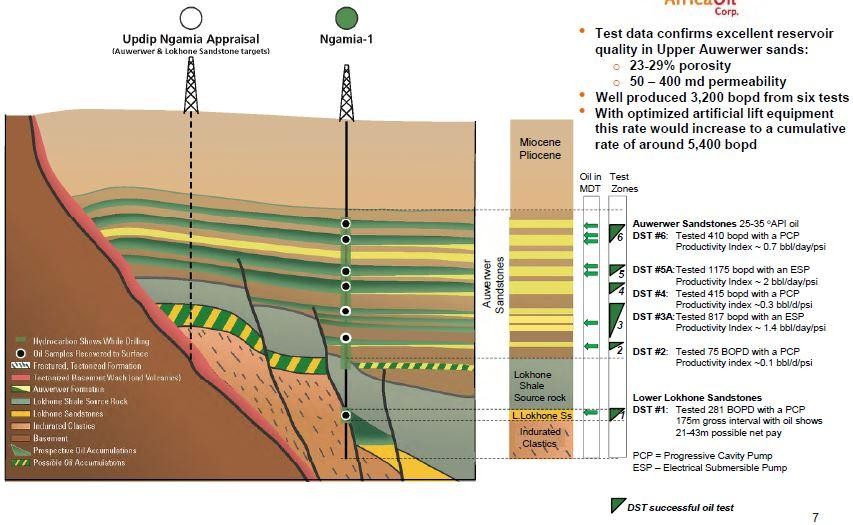

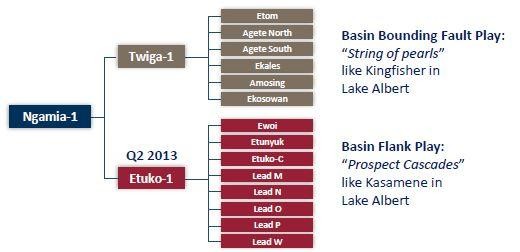

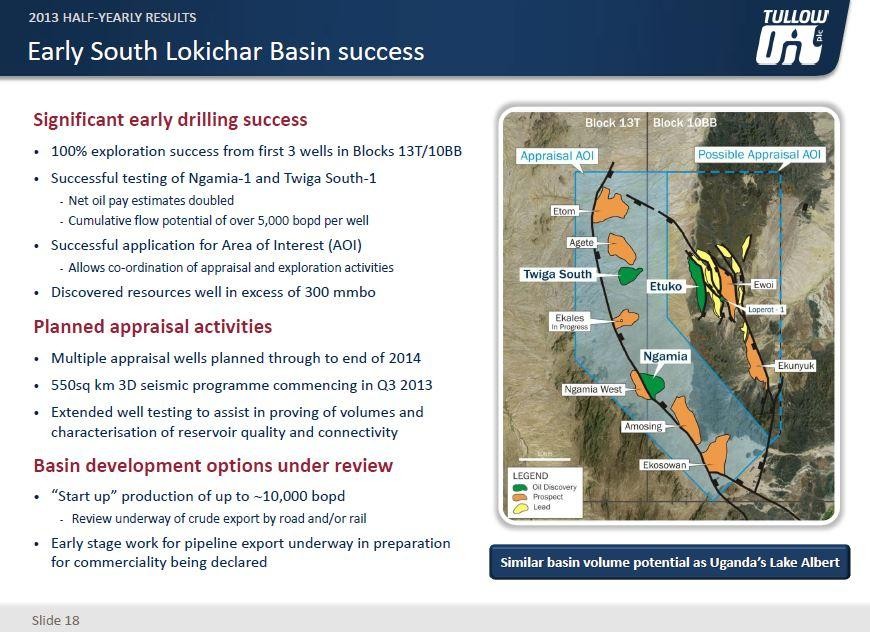

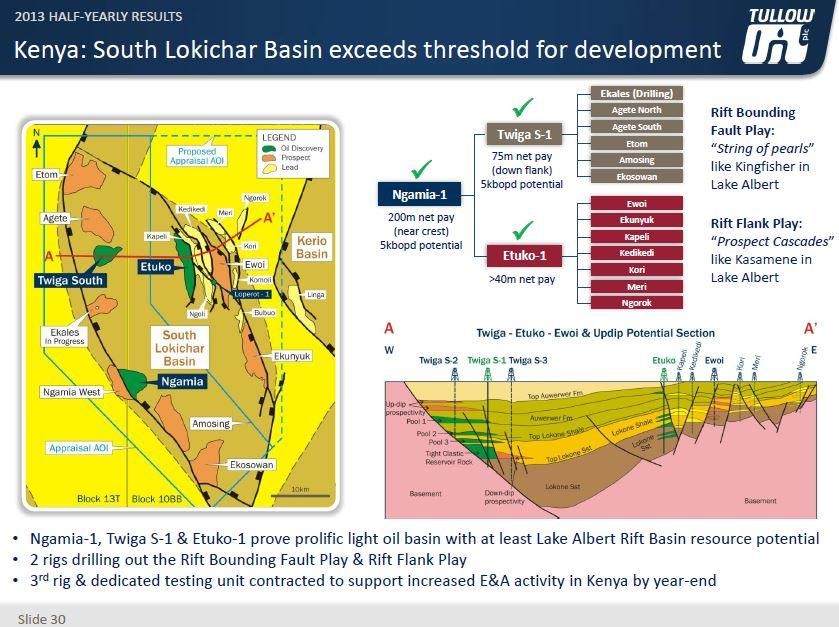

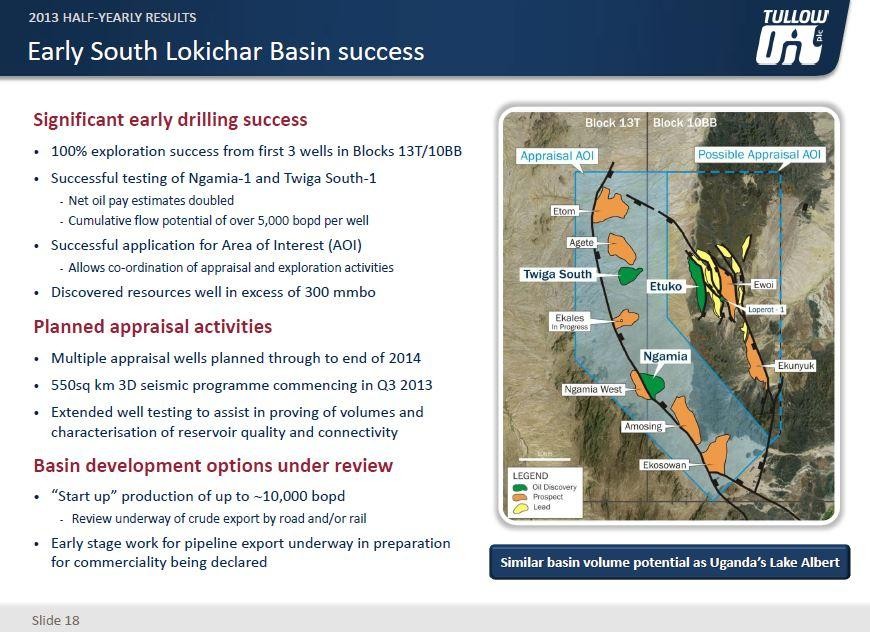

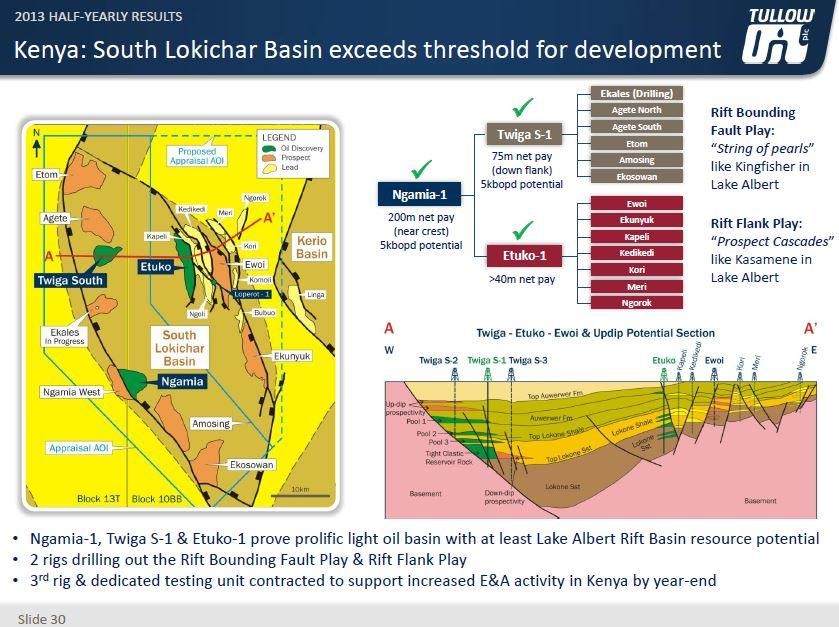

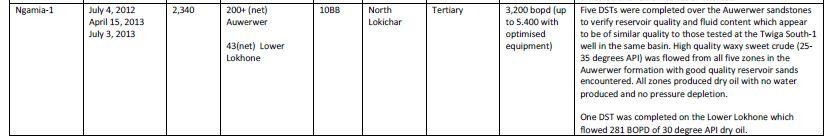

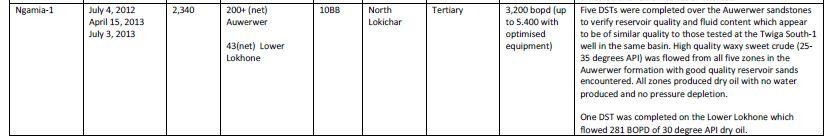

The company found oil with the first hit in March 2012. The initial successful results from Ngamia-1 well (AOI 50% WI, Tullow 50% WI) in Kenya encountered over 100 meters of net light oil in the Upper Lokhone Sand Section that grew during the next months finding an additional 43 meters of potential oil in the Lower Lokhone Sandstone Section. This was the first oil discovery in Kenya and this boosted the share price by more than 500%. However Tullow, Africa Oil's partner, indicated it would be at least a year before it knows whether its March discovery (Ngamia-1 well) can be extracted and exported.

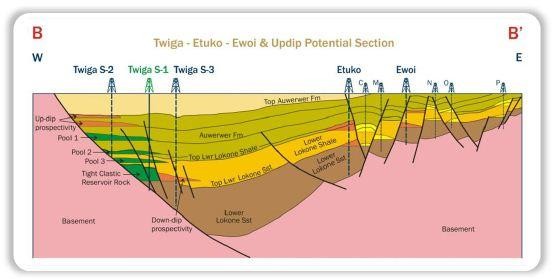

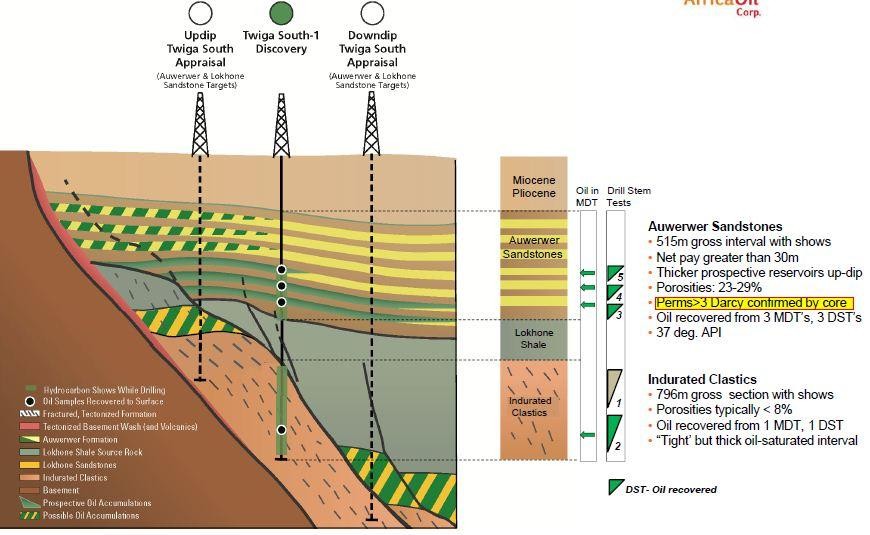

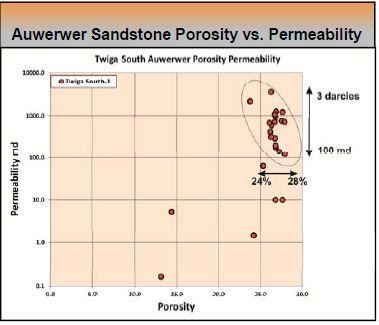

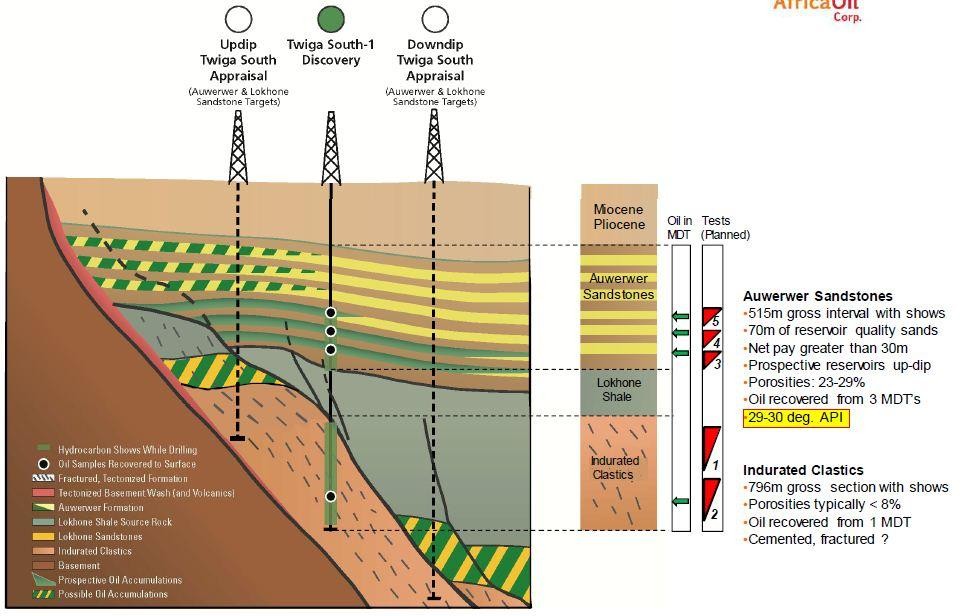

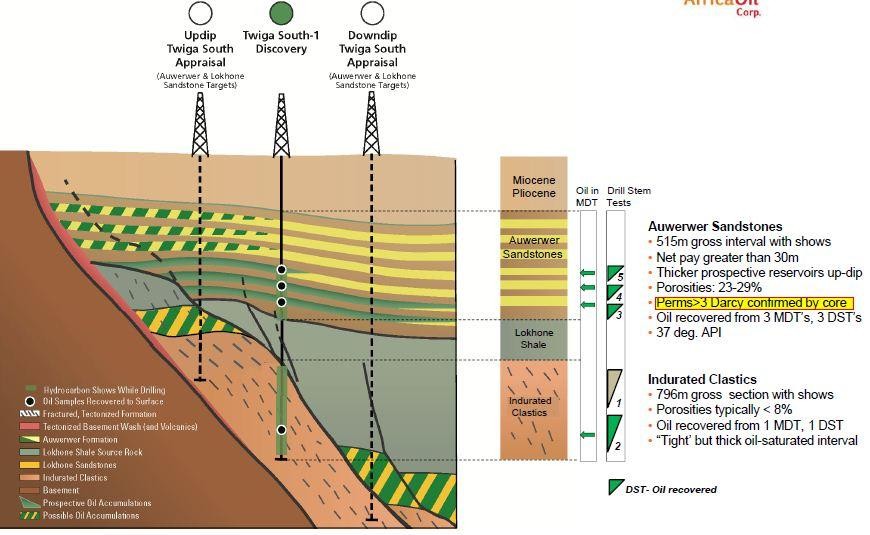

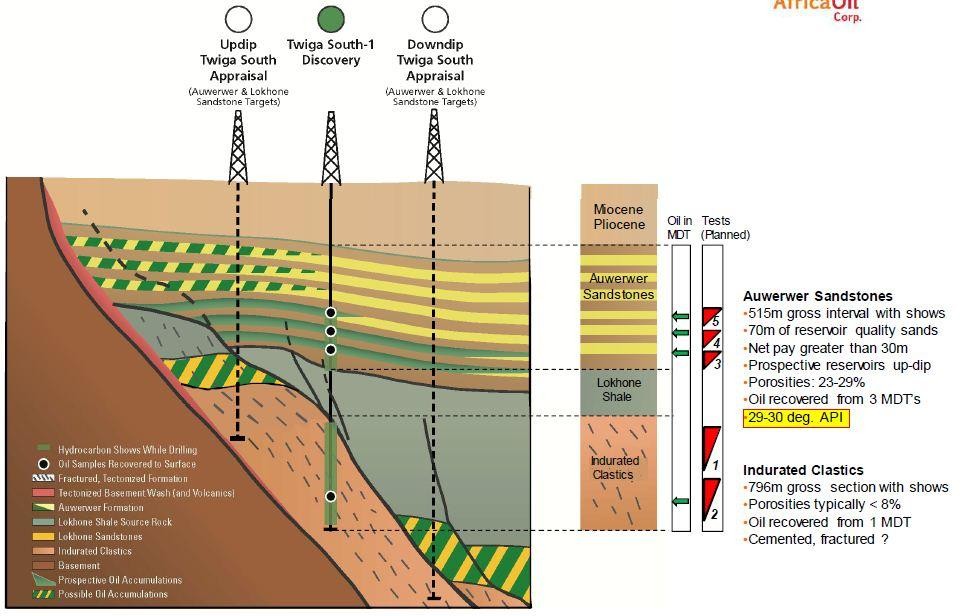

The next well of Africa Oil, Twiga South-1, was drilled in September and it represents the next step in expanding the play and proving up the 'string of pearls' concept. The company said recently that it encountered oil but no further details have been provided yet so the commercial viability of this discovery has yet to be ascertained.

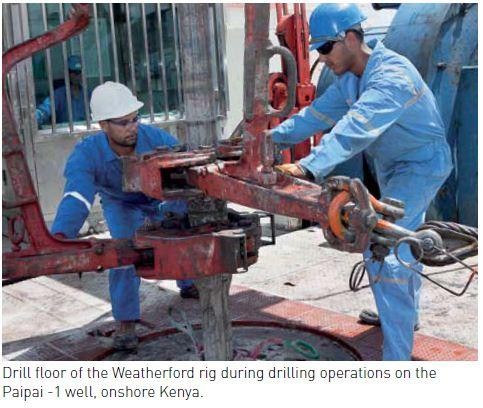

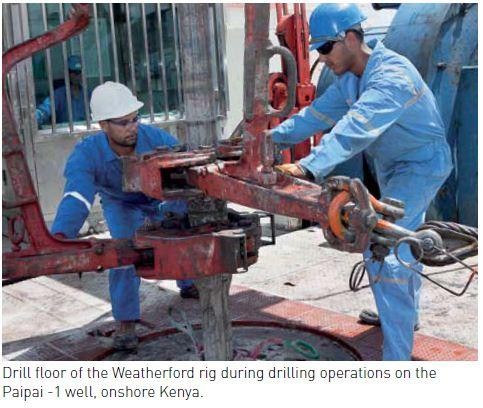

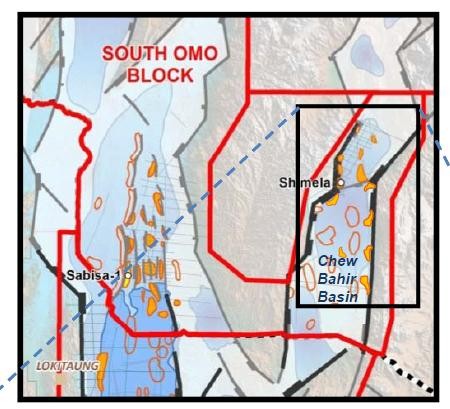

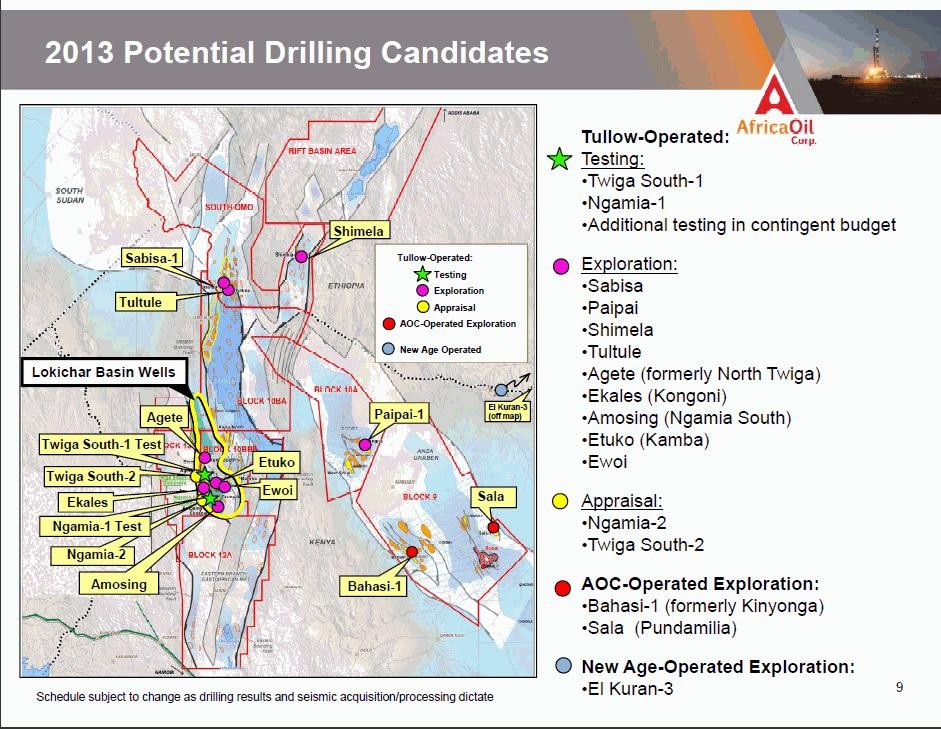

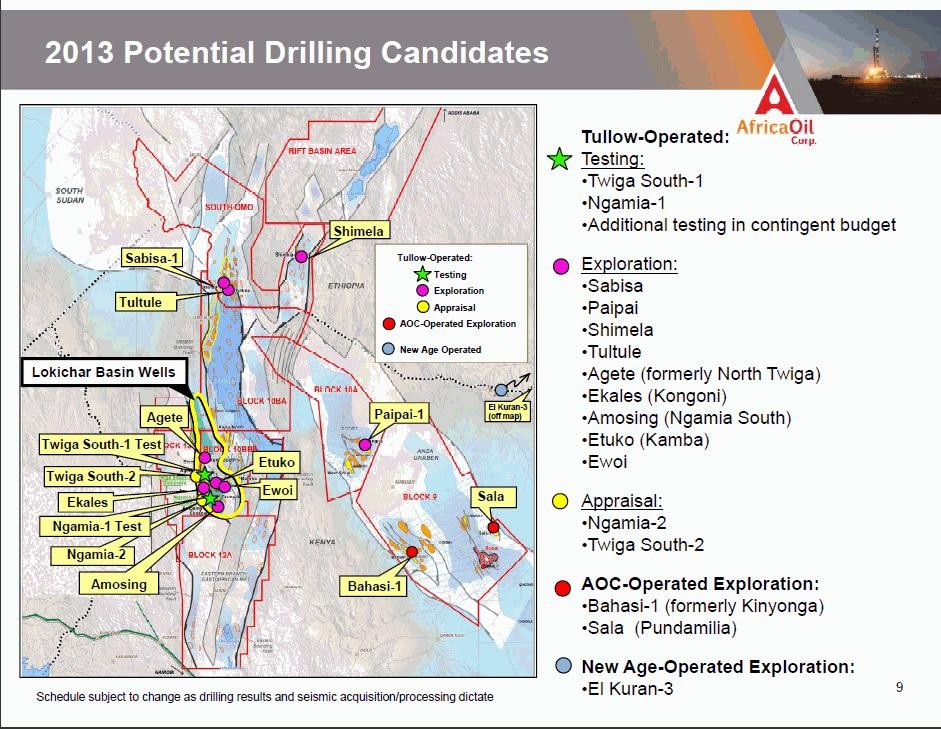

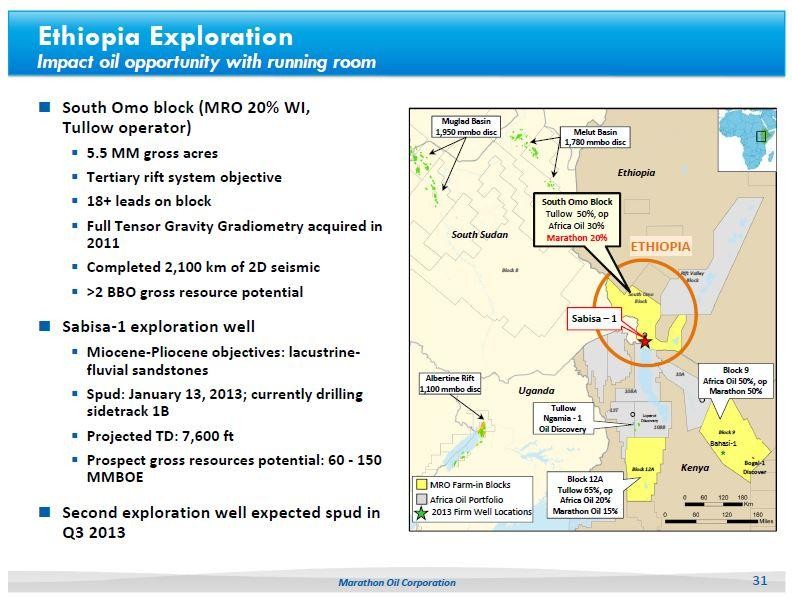

The company will continuously drill high impact exploration targets for the remainder of 2012. In onshore Kenya, the Paipai-1 well in Block 10A, was drilled in October and the market still awaits for the results. In onshore Ethiopia, the exploration drilling campaign will commence with the Sabisa-1 well in the South Omo Block before year end.

Regarding Somalia, the first 2 wells drilled by Horn Petroleum (45% owned by Africa Oil) didn't find oil.

Valuation

Africa Oil Corp trades with a price to book value of 9.3. The company has zero production so it has zero revenue and thus negative funds from operations. The company holds $55 million cash but the drilling cost in Kenya is about $15-20 million per well. The company also announced an increase at its reserves in Aug 2012. However they are Prospective reserves and they aren't Proven and Probable Reserves (2P). Prospective reserves means that there is no certainty that any portion of the Prospective Resources will be discovered. If discovered, there isn't certainty that the discovery will be commercially viable to produce any portion of the resources.

Some holders will debate that Africa Oil has a big acreage and new discoveries have been announced on all sides of Africa Oil's land position including the major Albert Graben oil discovery in neighboring Uganda. I'll comment that it's widely known in the oil & gas universe that you and I could be neighbors and you are sitting on 1 billion barrels recoverable and I have goat pasture. So this acreage statement lacks punch.

Insiders

According to regulatory filings, the insiders have been selling since July 2012. I accept that the insiders sell for many reasons. The insiders also buy only for one reason and I havn't seen any of them buy since the share price has jumped to the current levels.

Geopolitical risks

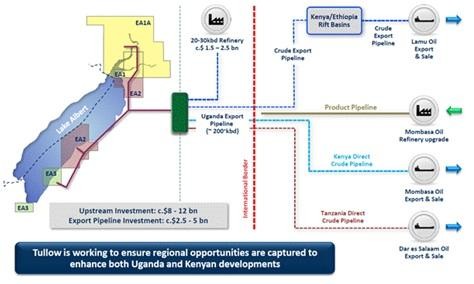

The geopolitical risks of Africa are well known. The social unrest, the political turmoil, the civil wars, the pirates attack, the lack of infrastructure are usual. "No matter where you are in the world, where there's no infrastructure and no history of the oil business, it will take at least half a dozen years to go from exploration phase to development concepts," Tim O'Hanlon, Tullow's vice president for Africa, told Reuters.

In Uganda, the pipeline to get the oil to the coast for export will not be in place before 2018 at the earliest. In Kenya, the Government has already started to complain about its current 10% stake and they want a 25% share although the country has not found any commercially viable oil source yet. Tullow indicated it would be at least a year before it knows whether its March discovery with Africa Oil (Ngamia-1 well) can be extracted and exported.

Conclusion

I believe Africa Oil Corporation's current market cap defies any logic and I can't find any rationale behind it. I think long investors had better stay away from Africa Oil as there are significant downside risks. Speculative investors should consider a short position capitalizing on the asymmetric risk/reward proposition at these unsustainable levels. A sharp revaluation to the downside may be coming.

http://beta.fool.com/traderinvestor70/2012/11/23/how-close-a…

(Es würde mich stark verwundern, wenn es bei 25% Regierungsanteil bleiben sollte. Eher 50%, sobald der erste Tropfen Richtung Küste fließt.)

sowie viel Kraft und Nerven in 2013 bei event. Kursen unter 5 CAD. (wobei ich diese Kurse niemanden wünsche)

Vielleicht erbarmt sich in 2013 ein Major den Laden für 7 oder 8 CAD zu übernehmen,

denn ein no-brainer ist dieses Invest in keinem Fall...

Anbei nochmal ein (imo) guter Artikel, welcher vor einem Monat von vielen (auch ich habe ihn belächelt) verspottet wurde.

(siehe untere comments)

How Close is the Africa Oil Bubble to Bursting?

By Nathan Kirykos - November 23, 2012 28 Comments

Nathan is a member of The Motley Fool Blog Network -- entries represent the personal opinions of our bloggers and are not formally edited.

Introduction

The investors often propel some companies' valuation at high levels making them a bubble. I like identifying and exposing these bubbles before they implode. The greed isn't a wise investment strategy. Many people are driven by greed and they want a bubble to go higher as they have a biased perception of reality. Once the implosion occurs, they recognize their mistake but it is too late. So I'll analyze the case of Africa Oil Corporation (TSXV: AOI). Is it a result of people's greed or ignorance?

Operations Overview

Africa Oil is a Canadian energy company with assets in Kenya, Ethiopia, Mali and Somalia through its 45% stake in Horn Petroleum Corporation. Africa Oil's East African holdings are in excess of 300,000 square kilometers. The company doesn't have any production today and it is in a multi-well drilling campaign in Kenya and Ethiopia during the last months.

Corporate Developments

The company found oil with the first hit in March 2012. The initial successful results from Ngamia-1 well (AOI 50% WI, Tullow 50% WI) in Kenya encountered over 100 meters of net light oil in the Upper Lokhone Sand Section that grew during the next months finding an additional 43 meters of potential oil in the Lower Lokhone Sandstone Section. This was the first oil discovery in Kenya and this boosted the share price by more than 500%. However Tullow, Africa Oil's partner, indicated it would be at least a year before it knows whether its March discovery (Ngamia-1 well) can be extracted and exported.

The next well of Africa Oil, Twiga South-1, was drilled in September and it represents the next step in expanding the play and proving up the 'string of pearls' concept. The company said recently that it encountered oil but no further details have been provided yet so the commercial viability of this discovery has yet to be ascertained.

The company will continuously drill high impact exploration targets for the remainder of 2012. In onshore Kenya, the Paipai-1 well in Block 10A, was drilled in October and the market still awaits for the results. In onshore Ethiopia, the exploration drilling campaign will commence with the Sabisa-1 well in the South Omo Block before year end.

Regarding Somalia, the first 2 wells drilled by Horn Petroleum (45% owned by Africa Oil) didn't find oil.

Valuation

Africa Oil Corp trades with a price to book value of 9.3. The company has zero production so it has zero revenue and thus negative funds from operations. The company holds $55 million cash but the drilling cost in Kenya is about $15-20 million per well. The company also announced an increase at its reserves in Aug 2012. However they are Prospective reserves and they aren't Proven and Probable Reserves (2P). Prospective reserves means that there is no certainty that any portion of the Prospective Resources will be discovered. If discovered, there isn't certainty that the discovery will be commercially viable to produce any portion of the resources.

Some holders will debate that Africa Oil has a big acreage and new discoveries have been announced on all sides of Africa Oil's land position including the major Albert Graben oil discovery in neighboring Uganda. I'll comment that it's widely known in the oil & gas universe that you and I could be neighbors and you are sitting on 1 billion barrels recoverable and I have goat pasture. So this acreage statement lacks punch.

Insiders

According to regulatory filings, the insiders have been selling since July 2012. I accept that the insiders sell for many reasons. The insiders also buy only for one reason and I havn't seen any of them buy since the share price has jumped to the current levels.

Geopolitical risks

The geopolitical risks of Africa are well known. The social unrest, the political turmoil, the civil wars, the pirates attack, the lack of infrastructure are usual. "No matter where you are in the world, where there's no infrastructure and no history of the oil business, it will take at least half a dozen years to go from exploration phase to development concepts," Tim O'Hanlon, Tullow's vice president for Africa, told Reuters.

In Uganda, the pipeline to get the oil to the coast for export will not be in place before 2018 at the earliest. In Kenya, the Government has already started to complain about its current 10% stake and they want a 25% share although the country has not found any commercially viable oil source yet. Tullow indicated it would be at least a year before it knows whether its March discovery with Africa Oil (Ngamia-1 well) can be extracted and exported.

Conclusion

I believe Africa Oil Corporation's current market cap defies any logic and I can't find any rationale behind it. I think long investors had better stay away from Africa Oil as there are significant downside risks. Speculative investors should consider a short position capitalizing on the asymmetric risk/reward proposition at these unsustainable levels. A sharp revaluation to the downside may be coming.

http://beta.fool.com/traderinvestor70/2012/11/23/how-close-a…

(Es würde mich stark verwundern, wenn es bei 25% Regierungsanteil bleiben sollte. Eher 50%, sobald der erste Tropfen Richtung Küste fließt.)

2012's Top 5 Oil & Gas Plays

by Jen Alic

|

OilPrice.com

|

Tuesday, December 25, 2012

2012 has been a stellar year for oil and gas. From East Africa to North America, new technology, major new discoveries, an unparalleled appetite for exploration and a metamorphosing perception of risk have changed the playing field.

We're looking at potential rather than existing production, and here are our Top 5 picks for this year:

Turkana County, Kenya

We have to start with Kenya, the biggest success story of the year.

In March, the UK's Tullow Oil and Canada's Africa Oil Corp. discovered 100 meters of oil in the Ngamia-1 well. The euphoria was in part because this discovery was made on the very first try in the very first well. Stocks shot up to record highs as a result.

The euphoria has not abated. In late November, the same duo made another find of 30 meters of oil in the nearby Twiga-1 well.

September also saw Kenya strike 53 meters of natural gas in its first-ever offshore find in the Mbawa-1 well, off the coast of Malindi. US-based Apache Corp. owns 50% the well in a consortium with a handful of other companies. They're still digging, hoping that going deeper will reveal the oil.

The bigger picture, however, is that only the surface has been scratched in terms of exploration. The East Africa Rift is believed to hold over 70 billion barrels of untapped crude oil, while offshore Kenya, Tanzania and Mozambique have a joint estimated 250 trillion cubic feet of natural gas. There may be offshore oil, too. The oil discoveries in Kenya so far have been confined to one massive basin, and there are six more.

In addition to the size of the prize here, Kenya is favorable for other reasons as well: It offers relative political stability in the midst of a rather restless Africa; it offers attractive fiscal terms; it offers easy access to export markets; and it has an appetite for infrastructure that is hard to beat.

While 2013 may see some changes in the regulatory environment that could be less favorable, as for 2012, Kenya remains THE number one East African play in terms of potential. Next year will give us a better idea of commercial viability.

Bakken, North Dakota

The Bakken shale play has placed North Dakota ahead of Alaska, making it the number two oil producer in the US for 2012, after Texas. Because of Bakken, the US has increased oil production this year to a level it hasn't seen in almost a decade and a half. In one month alone this year, North Dakota issued 370 drilling permits.

Stretching from Eastern Montana to Western North Dakota and across parts of Saskatchewa and Manitoba in the Williston Basin, the Bakken Shale Play could yield some 4.3 billion barrels of oil, according to the US Geological Survey. That's the modest estimate. Continental Resources—one of the major Bakken players—estimates as much as 40 billion barrels.

The clincher is that much of the vast Bakken Petroleum System has not even been tapped. So far, drilling has primarily targeted the Middle Bakken and the upper Three Forks Zones. The Three Forks Zones have not been fully tapped, and the Upper Bakken Shale hasn't really been tapped at all.

Eagle Ford, South Texas

Eagle Ford is potentially the next Bakken. It's one of the most ACTIVE plays in the US right now. And what the majors and juniors are playing with is 7,500 in total acreage, five producing wells, two more wells being drilled, and the potential for 100 wells. This year, oil production has increased to some 300,000 bpd (as of August).

Natural gas is also a major Eagle Ford offering. Last year, it produced 914 million cubic feet of natural gas, though that has dropped slightly for this year.

So far, drilling seems to have had even better results than in Bakken. And there is a great deal of confidence and optimism. Enough so that Marathon Oil is planning to shift its primary focus from Bakken to Eagle Ford and spend one-third of its operating budget there. Right now Marathon is producing around 40,000 net barrels of oil equivalent (boe) per day and plans to more than double this next year. It's already doubled production this year (and, incidentally, seen its profits jump 11% in the first quarter).

The biggest producer is EOG Resources, putting out about 110,000 boe/day and holding reserves of around 1.6 billion boe.

Analysts think Eagle Ford could end up out-producing the Permian Basin in west Texas—and soon.

Mediterranean Plays

The Levant Basin in the Mediterranean has an estimated 122 trillion cubic feet of recoverable natural gas, and around 1.7 billion barrels of recoverable oil. And the area has seen a flurry of activity recently.

Between 25 and 33 billion cubic feet of this gas is in Israeli waters. The rest is carved up between Greek-held Northern Cyprus (which is a bit problematic), Syria and Lebanon.

Of course, along with this potential comes some uncomfortable geopolitics; on one hand among Israel, Lebanon and Syria; on the other hand between Israel, Turkey and the Greek Cypriots.

The first new natural gas field in the region is expected to begin full-scale production this year, with two additional fields coming on-line over the next six years.

Specifically, we're talking about:

•The discovery to two offshore natural gas fields in northern Israel (Leviathan and Tamar) with an estimated 25 trillion cubic feet (about 100 years year of gas for Israeli domestic use)

•Estimates that Israel has a potential 1.9 billion barrels of untapped oil

•About 5-6 tcf of natural gas in the Aphrodite field claimed by Greek-held Northern Cyprus (just west of Israel's Leviathan field)

Exploitation will be a bit expensive, though. Israel's offshore fields are located 100 kilometers from the coast and in 6,000 feet of water. The natural gas is some 5,000 feet under the sea bed.

Offshore Tanzania & Mozambique

Tanzania has become a gas sensation in a very short time, with recent offshore discoveries of some 33 trillion cubic feet.

Sweetening the deal, we have political stability and low security risk, relatively speaking, as well as an existing 70-million-cubic-feet/day capacity for natural gas processing. More gas infrastructure is in the works.

Next door, Mozambique's 130 trillion cubic feet of gas in its offshore Rovuma Basin is eye candy for foreign investors, and officials believe there is double this amount still waiting to be discovered. It's not as attractive as Tanzania for one reason: There is no infrastructure.

http://www.rigzone.com/news/article.asp?hpf=1&a_id=122948

by Jen Alic

|

OilPrice.com

|

Tuesday, December 25, 2012

2012 has been a stellar year for oil and gas. From East Africa to North America, new technology, major new discoveries, an unparalleled appetite for exploration and a metamorphosing perception of risk have changed the playing field.

We're looking at potential rather than existing production, and here are our Top 5 picks for this year:

Turkana County, Kenya

We have to start with Kenya, the biggest success story of the year.

In March, the UK's Tullow Oil and Canada's Africa Oil Corp. discovered 100 meters of oil in the Ngamia-1 well. The euphoria was in part because this discovery was made on the very first try in the very first well. Stocks shot up to record highs as a result.

The euphoria has not abated. In late November, the same duo made another find of 30 meters of oil in the nearby Twiga-1 well.

September also saw Kenya strike 53 meters of natural gas in its first-ever offshore find in the Mbawa-1 well, off the coast of Malindi. US-based Apache Corp. owns 50% the well in a consortium with a handful of other companies. They're still digging, hoping that going deeper will reveal the oil.

The bigger picture, however, is that only the surface has been scratched in terms of exploration. The East Africa Rift is believed to hold over 70 billion barrels of untapped crude oil, while offshore Kenya, Tanzania and Mozambique have a joint estimated 250 trillion cubic feet of natural gas. There may be offshore oil, too. The oil discoveries in Kenya so far have been confined to one massive basin, and there are six more.

In addition to the size of the prize here, Kenya is favorable for other reasons as well: It offers relative political stability in the midst of a rather restless Africa; it offers attractive fiscal terms; it offers easy access to export markets; and it has an appetite for infrastructure that is hard to beat.

While 2013 may see some changes in the regulatory environment that could be less favorable, as for 2012, Kenya remains THE number one East African play in terms of potential. Next year will give us a better idea of commercial viability.

Bakken, North Dakota

The Bakken shale play has placed North Dakota ahead of Alaska, making it the number two oil producer in the US for 2012, after Texas. Because of Bakken, the US has increased oil production this year to a level it hasn't seen in almost a decade and a half. In one month alone this year, North Dakota issued 370 drilling permits.

Stretching from Eastern Montana to Western North Dakota and across parts of Saskatchewa and Manitoba in the Williston Basin, the Bakken Shale Play could yield some 4.3 billion barrels of oil, according to the US Geological Survey. That's the modest estimate. Continental Resources—one of the major Bakken players—estimates as much as 40 billion barrels.

The clincher is that much of the vast Bakken Petroleum System has not even been tapped. So far, drilling has primarily targeted the Middle Bakken and the upper Three Forks Zones. The Three Forks Zones have not been fully tapped, and the Upper Bakken Shale hasn't really been tapped at all.

Eagle Ford, South Texas

Eagle Ford is potentially the next Bakken. It's one of the most ACTIVE plays in the US right now. And what the majors and juniors are playing with is 7,500 in total acreage, five producing wells, two more wells being drilled, and the potential for 100 wells. This year, oil production has increased to some 300,000 bpd (as of August).

Natural gas is also a major Eagle Ford offering. Last year, it produced 914 million cubic feet of natural gas, though that has dropped slightly for this year.

So far, drilling seems to have had even better results than in Bakken. And there is a great deal of confidence and optimism. Enough so that Marathon Oil is planning to shift its primary focus from Bakken to Eagle Ford and spend one-third of its operating budget there. Right now Marathon is producing around 40,000 net barrels of oil equivalent (boe) per day and plans to more than double this next year. It's already doubled production this year (and, incidentally, seen its profits jump 11% in the first quarter).

The biggest producer is EOG Resources, putting out about 110,000 boe/day and holding reserves of around 1.6 billion boe.

Analysts think Eagle Ford could end up out-producing the Permian Basin in west Texas—and soon.

Mediterranean Plays

The Levant Basin in the Mediterranean has an estimated 122 trillion cubic feet of recoverable natural gas, and around 1.7 billion barrels of recoverable oil. And the area has seen a flurry of activity recently.

Between 25 and 33 billion cubic feet of this gas is in Israeli waters. The rest is carved up between Greek-held Northern Cyprus (which is a bit problematic), Syria and Lebanon.

Of course, along with this potential comes some uncomfortable geopolitics; on one hand among Israel, Lebanon and Syria; on the other hand between Israel, Turkey and the Greek Cypriots.

The first new natural gas field in the region is expected to begin full-scale production this year, with two additional fields coming on-line over the next six years.

Specifically, we're talking about:

•The discovery to two offshore natural gas fields in northern Israel (Leviathan and Tamar) with an estimated 25 trillion cubic feet (about 100 years year of gas for Israeli domestic use)

•Estimates that Israel has a potential 1.9 billion barrels of untapped oil

•About 5-6 tcf of natural gas in the Aphrodite field claimed by Greek-held Northern Cyprus (just west of Israel's Leviathan field)

Exploitation will be a bit expensive, though. Israel's offshore fields are located 100 kilometers from the coast and in 6,000 feet of water. The natural gas is some 5,000 feet under the sea bed.

Offshore Tanzania & Mozambique

Tanzania has become a gas sensation in a very short time, with recent offshore discoveries of some 33 trillion cubic feet.

Sweetening the deal, we have political stability and low security risk, relatively speaking, as well as an existing 70-million-cubic-feet/day capacity for natural gas processing. More gas infrastructure is in the works.

Next door, Mozambique's 130 trillion cubic feet of gas in its offshore Rovuma Basin is eye candy for foreign investors, and officials believe there is double this amount still waiting to be discovered. It's not as attractive as Tanzania for one reason: There is no infrastructure.

http://www.rigzone.com/news/article.asp?hpf=1&a_id=122948

Antwort auf Beitrag Nr.: 43.959.794 von gabbo62 am 25.12.12 17:07:10While 2013 may see some changes in the regulatory environment that could be less favorable...

Der slow stochastic ist wieder mal am Scheitelpunkt.

Was das zu 90% bedeutet, ist ja jedem Trader bekannt.

Schaun wir mal, was AOI draus macht.

Was das zu 90% bedeutet, ist ja jedem Trader bekannt.

Schaun wir mal, was AOI draus macht.

Hallo zusammen!

Demnächst (Januar) werden die nächsten Bohrergebnisse aus Kenia und Äthiopien erwartet. Kann mir jemand sagen, wie lange es dauert bis Africa Oil die ersten Umsätze mit verkauftem Öl machen wird? Kann man hierzu schon eine zeitliche Abschätzung abgeben?

Beste Grüße

Demnächst (Januar) werden die nächsten Bohrergebnisse aus Kenia und Äthiopien erwartet. Kann mir jemand sagen, wie lange es dauert bis Africa Oil die ersten Umsätze mit verkauftem Öl machen wird? Kann man hierzu schon eine zeitliche Abschätzung abgeben?

Beste Grüße

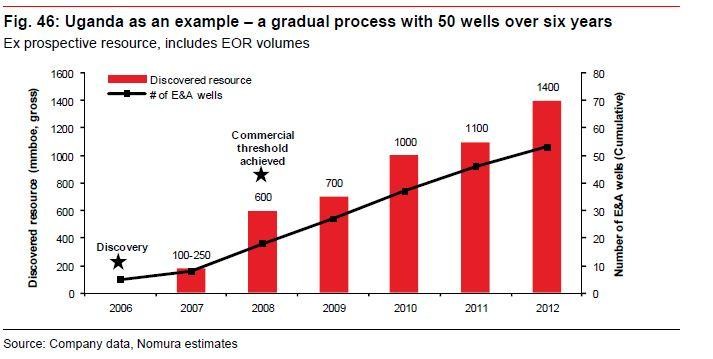

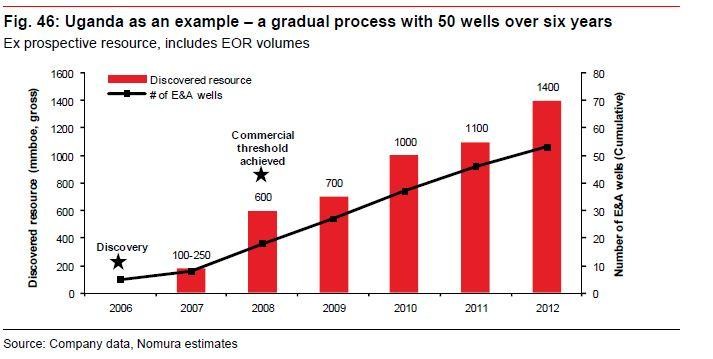

Antwort auf Beitrag Nr.: 43.962.121 von Kimbel am 27.12.12 14:27:00Man geht von circa 5 Jahren bis zum Produktionsstart aus. Das wäre wesentlich schneller als in Uganda, wo Tullow schon in 2006 Öldiscoveries bohrte. Spielt aber auch keine Rolle, weil Africa Oil wahrscheinlich nicht das Unternehmen wird, das Öl fördert und verkauft. Bis dahin ist das Unternehmen meiner Meinung nach an einen Major verkauft. Machen die Lundins immer so.

Antwort auf Beitrag Nr.: 43.961.447 von x_trader am 27.12.12 10:48:48Hallo X-Trader,

ich verwende einen anderen Slow STO mit %K(14),%D(3) und der sieht etwas anders aus als Deiner. ( Es ist mein Favorit:kiss

Hier laufen wir fast parallel nach oben und befinden uns erst bei 57,55% zu 52,91%. Also haben wir noch viel Luft nach oben.

MACD ist nun auch im grünen Bereich.

RSI ist bei 39,01% und somit auch im grünen Bereich und noch viel Luft nach oben.

Interessant wirds nun beim SAR. Hier muß die Marke von 7,24 CAN$ getroffen werden.Dann geht so richtig die Post ab

Das GAP bis 7,50 CAN$ haben wir dieses Jahr leider nicht geschlossen, aber ich denke das sich das Anfang 2013 sehr schnell erledigen wird

Wer wie ich zugekauft hat, kann sich schon jetzt über einen guten Gewinn freuen und es wird noch weiter gehen.

Im Nachhinein wird sich der Zukauf bei 5,03€ als einmaliger Glücksfall herausstellen. Wie schnell das gehen kann hat man ja schon ende Juni sehen können. Da lief der Kurs in 5 Tagen von 6,5 CAN$ bis auf über 10 CAN$.

Bei einer guten Meldung können wir dies in 2013 bei weiten noch toppen

So dann verabschiede ich mich mal für dieses Jahr und wünsche allen aoi Investierten einen guten Rutsch ins Jahr 2013.

Niki

ich verwende einen anderen Slow STO mit %K(14),%D(3) und der sieht etwas anders aus als Deiner. ( Es ist mein Favorit:kiss

Hier laufen wir fast parallel nach oben und befinden uns erst bei 57,55% zu 52,91%. Also haben wir noch viel Luft nach oben.

MACD ist nun auch im grünen Bereich.

RSI ist bei 39,01% und somit auch im grünen Bereich und noch viel Luft nach oben.

Interessant wirds nun beim SAR. Hier muß die Marke von 7,24 CAN$ getroffen werden.Dann geht so richtig die Post ab

Das GAP bis 7,50 CAN$ haben wir dieses Jahr leider nicht geschlossen, aber ich denke das sich das Anfang 2013 sehr schnell erledigen wird

Wer wie ich zugekauft hat, kann sich schon jetzt über einen guten Gewinn freuen und es wird noch weiter gehen.

Im Nachhinein wird sich der Zukauf bei 5,03€ als einmaliger Glücksfall herausstellen. Wie schnell das gehen kann hat man ja schon ende Juni sehen können. Da lief der Kurs in 5 Tagen von 6,5 CAN$ bis auf über 10 CAN$.

Bei einer guten Meldung können wir dies in 2013 bei weiten noch toppen

So dann verabschiede ich mich mal für dieses Jahr und wünsche allen aoi Investierten einen guten Rutsch ins Jahr 2013.

Niki

Kenya: Oil Expectations Rise in 2013

By Solomon Kirimi, 28 December 2012

Kenya has no confirmed oil deposits yet but the year 2012 will remain the best for Kenya's quest to join the league of oil producers.

For a country which a year ago had no reason to think of ever becoming an oil producer, two wells at appraisal stage in Northern Kenya and gas finds at the coast is exciting.

It all started on March 26th of 2012, with the announcement that Ngamia-1 oil well in Lokichar area of Turkana in the Rift Basin had 20 metres of net oil pay.

Tullow Oil made the announcement that the Ngamia-1 exploration well, located in Block 10BB, had then been drilled to a depth of 1,041 metres, within which light waxy crude was discovered.

"This is an excellent start to our major exploration campaign in the East African rift basins and to make a good oil discovery in our first well is beyond our expectations and bodes well for the material programme ahead of us," said Tullow Exploration Director Angus McCoss, We look forward to further success as seismic and drilling activities continue to gather pace."

Two months later the Ngamia-1 well encountered oil and gas shows over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

"God can not be so unfair to give our neighbor oil and gas and leave Kenya with nothing," energy minister Kiraitu Murungi said in reference to oil discoveries in Uganda, huge gas deposit find in Tanzania and the already oil producing Sudan.

The discoveries by Tullow suddenly the interest in exploration of in Kenya were revived just over a half a year after being dampened by the exit of Chinese explorer CNOOC from Isiolo in October 2012 after finding just traces of gas.

The Isiolo Boghal-1 well in block 9 well was plugged and abandoned because the gas was deemed to be of no commercial value.

"If the gas was of commercial value, Kenya would have received a lot of interest for exploration blocks," The then discouraged Energy permanent secretary Patrick Nyoike said.

CNOOC had sunk $26 million (Sh2.2 billion) to drill the well to a depth of 5,085 metres and quit before reaching 5,556 metres initial target.

CNOOC partner in the initial venture African Oil have now partnered with Marathon Oil to re-open the well following the successes by Tullow oil up north.

The lucky streak by Tullow oil followed them offshore to Mbawa1 in Lamu basin where 50 metres of net gas pay was found.

Tullow is a minor shareholder in the block L8 with Amerca's Apache corporation, Austalia's Pancontinental. Although the gas find was not of commercial value and was plugged, this increased the appetite for explorers with prospects looking good for presence of oil and gas of the Kenyan coast.

Tullow Oil's good run of results followed them to Twiga South-1 exploration well in Block 13T where in late November they encountered oil, confirming a rush announcement by partners Africa Oil Corp on October 26 2012.

Tullow Oil plc announced that the Twiga South-1 exploration well drilling had encountered 30 metres of net oil pay. A further potential of a gross interval of 796 metres net pay is to be assessed before being declared.

The finds have now moved Kenya from a high risk exploration country to high value target for world majors looking for a piece of the action in a region promising to be latest exploration frontier.

http://allafrica.com/stories/201212281070.html

By Solomon Kirimi, 28 December 2012

Kenya has no confirmed oil deposits yet but the year 2012 will remain the best for Kenya's quest to join the league of oil producers.

For a country which a year ago had no reason to think of ever becoming an oil producer, two wells at appraisal stage in Northern Kenya and gas finds at the coast is exciting.

It all started on March 26th of 2012, with the announcement that Ngamia-1 oil well in Lokichar area of Turkana in the Rift Basin had 20 metres of net oil pay.

Tullow Oil made the announcement that the Ngamia-1 exploration well, located in Block 10BB, had then been drilled to a depth of 1,041 metres, within which light waxy crude was discovered.

"This is an excellent start to our major exploration campaign in the East African rift basins and to make a good oil discovery in our first well is beyond our expectations and bodes well for the material programme ahead of us," said Tullow Exploration Director Angus McCoss, We look forward to further success as seismic and drilling activities continue to gather pace."

Two months later the Ngamia-1 well encountered oil and gas shows over a gross interval of 140 metres from a depth of 1,800 metres to 1,940 metres.

"God can not be so unfair to give our neighbor oil and gas and leave Kenya with nothing," energy minister Kiraitu Murungi said in reference to oil discoveries in Uganda, huge gas deposit find in Tanzania and the already oil producing Sudan.

The discoveries by Tullow suddenly the interest in exploration of in Kenya were revived just over a half a year after being dampened by the exit of Chinese explorer CNOOC from Isiolo in October 2012 after finding just traces of gas.

The Isiolo Boghal-1 well in block 9 well was plugged and abandoned because the gas was deemed to be of no commercial value.

"If the gas was of commercial value, Kenya would have received a lot of interest for exploration blocks," The then discouraged Energy permanent secretary Patrick Nyoike said.

CNOOC had sunk $26 million (Sh2.2 billion) to drill the well to a depth of 5,085 metres and quit before reaching 5,556 metres initial target.

CNOOC partner in the initial venture African Oil have now partnered with Marathon Oil to re-open the well following the successes by Tullow oil up north.

The lucky streak by Tullow oil followed them offshore to Mbawa1 in Lamu basin where 50 metres of net gas pay was found.

Tullow is a minor shareholder in the block L8 with Amerca's Apache corporation, Austalia's Pancontinental. Although the gas find was not of commercial value and was plugged, this increased the appetite for explorers with prospects looking good for presence of oil and gas of the Kenyan coast.

Tullow Oil's good run of results followed them to Twiga South-1 exploration well in Block 13T where in late November they encountered oil, confirming a rush announcement by partners Africa Oil Corp on October 26 2012.

Tullow Oil plc announced that the Twiga South-1 exploration well drilling had encountered 30 metres of net oil pay. A further potential of a gross interval of 796 metres net pay is to be assessed before being declared.

The finds have now moved Kenya from a high risk exploration country to high value target for world majors looking for a piece of the action in a region promising to be latest exploration frontier.

http://allafrica.com/stories/201212281070.html

Den Januar-Termin sollten wir uns im Auge behalten:

From the Tullow website:

Date Event Details

11 Jan 2013 Trading statement and operational update Regulatory announcement and conference calls

13 Feb 2013 2012 full year results Regulatory announcement, presentations, webcast and conference calls

From the Tullow website:

Date Event Details

11 Jan 2013 Trading statement and operational update Regulatory announcement and conference calls

13 Feb 2013 2012 full year results Regulatory announcement, presentations, webcast and conference calls

http://www.nation.co.ke/News/Chinese+firm+used+new+technolog…

Chinese firm used new technology to find oil

Secrets of how oil was found in Turkana are now out.

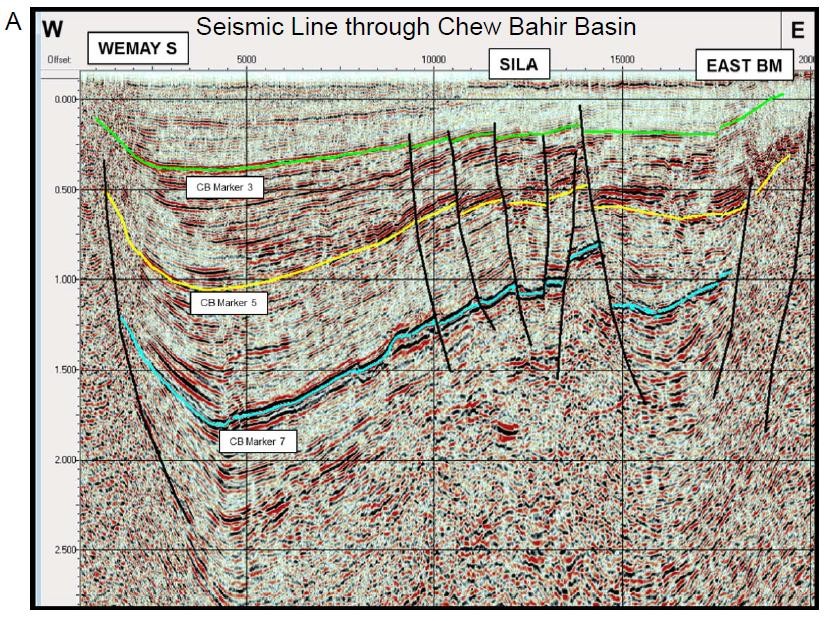

A Chinese company contracted by Tullow Oil to collect data on rock formations and underground properties in Ngamia 1 had the technology to locate the oil deposits.

The Chinese firm hit Ngamia 1 with huge sound bursts and with special listening devises resulting in them being able to point out the most likely oil hotspots.

“Loaded with the information we were ready to go,” said Mr David Sloan, one of the senior technical people at Tullow Kenya during a media tour of the site on Thursday.

“The use of this advanced and expensive technology — 3D seismic shooting — which had not been used in earlier digs made a major difference,” says Mr Martin Haye, a Commissioner for Petroleum Energy at the Ministry of Energy.

According to the Permanent Secretary in the ministry Patrick Nyoike, it costs about $40,000 (Sh3.2 million) to shoot one square kilometre and you cannot do less that 200 square kilometres.

“This find which was announced by the government last month is largely attributed to these advanced data collection technologies,” Mr Nyoike said on Friday in an advertorial.

But deliberate government policies may also have helped in bringing about the Turkana oil find. According to a brief from Tullow Oil, a recent revision of guidelines on investing in the sector made the country attractive for major players with strong financial and technical exploration capabilities.

Such companies, says PS Nyoike include, Anadarko, BG Group, Total, Tullow Oil, Africa Oil and Ophir. Between June and end of next year, Njoike says some five exploratory wells will have been dug.

Indian Ocean

It is not clear from which side Kenyans should expect the next oil news with Mr Haye optimistic that this may be coming soon from planned offshore drilling at the Indian Ocean by the American outfit called Apache.

But Tullow is already preparing to move to another site in Marsabit County at a place called Papai-1. Already, explained Mr David Hawes who is in charge of drilling operations at Ngamia-1, a platform to place a drilling rig is nearing completion at the Marsabit site.

Last week Environment minister Chirau Mwakwere, hinted that the shooting technology which can be delivered either from a ship, land vibrators or from a light plane will be aggressively deployed in future search for minerals.

Mr Mwakwere said his ministry proposed to spend Sh15 billion for an aerial survey to prospect for more minerals. He said mining was the new frontier in the country’s development but resources were needed to fully open up the sector.

Mr Mwakwere said his ministry had tabled a Bill in Parliament to revise the Mining Act, that will also address the mining hours which the National Environmental Management Authority had set at 8am to 5pm while the country was moving towards a 24-hour economy.

The Ngamia 1 well drilling is a 24-hour operation supported by diesel electricity power generators producing over 1500 horse power. It employs about 200 people and according to Mr Martin Nyoro, the Tallow Kenya general manager, getting competent technical people within the country remained a major challenge.

Actual drilling work, says Tullow Kenya, General Manager Mr Martin Nyoro, took about three months before they struck oil, much earlier than they had expected.

But at the site you do not see the oil, not even smell it, not even a whiff of the black gold even while standing at the foot of the rig that rises to about 140 ft. The oil, explained Mr Howes, is not like a lake but more like the sponge used while bathing. “The act of pressing induces the oil to come out.”

Chinese firm used new technology to find oil

Secrets of how oil was found in Turkana are now out.

A Chinese company contracted by Tullow Oil to collect data on rock formations and underground properties in Ngamia 1 had the technology to locate the oil deposits.

The Chinese firm hit Ngamia 1 with huge sound bursts and with special listening devises resulting in them being able to point out the most likely oil hotspots.

“Loaded with the information we were ready to go,” said Mr David Sloan, one of the senior technical people at Tullow Kenya during a media tour of the site on Thursday.

“The use of this advanced and expensive technology — 3D seismic shooting — which had not been used in earlier digs made a major difference,” says Mr Martin Haye, a Commissioner for Petroleum Energy at the Ministry of Energy.

According to the Permanent Secretary in the ministry Patrick Nyoike, it costs about $40,000 (Sh3.2 million) to shoot one square kilometre and you cannot do less that 200 square kilometres.

“This find which was announced by the government last month is largely attributed to these advanced data collection technologies,” Mr Nyoike said on Friday in an advertorial.

But deliberate government policies may also have helped in bringing about the Turkana oil find. According to a brief from Tullow Oil, a recent revision of guidelines on investing in the sector made the country attractive for major players with strong financial and technical exploration capabilities.

Such companies, says PS Nyoike include, Anadarko, BG Group, Total, Tullow Oil, Africa Oil and Ophir. Between June and end of next year, Njoike says some five exploratory wells will have been dug.

Indian Ocean

It is not clear from which side Kenyans should expect the next oil news with Mr Haye optimistic that this may be coming soon from planned offshore drilling at the Indian Ocean by the American outfit called Apache.

But Tullow is already preparing to move to another site in Marsabit County at a place called Papai-1. Already, explained Mr David Hawes who is in charge of drilling operations at Ngamia-1, a platform to place a drilling rig is nearing completion at the Marsabit site.

Last week Environment minister Chirau Mwakwere, hinted that the shooting technology which can be delivered either from a ship, land vibrators or from a light plane will be aggressively deployed in future search for minerals.

Mr Mwakwere said his ministry proposed to spend Sh15 billion for an aerial survey to prospect for more minerals. He said mining was the new frontier in the country’s development but resources were needed to fully open up the sector.

Mr Mwakwere said his ministry had tabled a Bill in Parliament to revise the Mining Act, that will also address the mining hours which the National Environmental Management Authority had set at 8am to 5pm while the country was moving towards a 24-hour economy.

The Ngamia 1 well drilling is a 24-hour operation supported by diesel electricity power generators producing over 1500 horse power. It employs about 200 people and according to Mr Martin Nyoro, the Tallow Kenya general manager, getting competent technical people within the country remained a major challenge.

Actual drilling work, says Tullow Kenya, General Manager Mr Martin Nyoro, took about three months before they struck oil, much earlier than they had expected.

But at the site you do not see the oil, not even smell it, not even a whiff of the black gold even while standing at the foot of the rig that rises to about 140 ft. The oil, explained Mr Howes, is not like a lake but more like the sponge used while bathing. “The act of pressing induces the oil to come out.”

@gabbo62: MANY THANKS für die Recherche und die vielen interessanten Beiträge - Dir und allen AOIlern wünsche ich einen guten Start ins Neue Jahr!

Es folgen noch ein paar Fundstücke zu Afrika im Allgemeinen, der Übersichtlichkeit wegen nur mit Headline und ggf. einem kurzen Zitat - bei Interesse einfach reinlesen...

...........................................

Africa: A Story of Growth

Africa's steady and robust economic growth over the past decade has thrust the continent onto the world stage as a serious player. Local economies stagnated in every part of the world during the global recession of 2008 and 2009, but Sub-Saharan Africa was one of the least affected regions due to its relatively weak ties to the crisis epicenters in Europe and the U.S.--and its growth rate has returned to previous heights.

http://www.theatlantic.com/sponsored/connections/archive/201…

[Anm.: Viele Statistiken/Graphiken bzgl. u.a. Pro-Kopf-Einkommen, Infrastruktur etc.]

------------------

Five Countries To Watch

By Francis Njubi Nesbitt

In May 2000, The Economist magazine declared that Africa was "the hopeless continent." Eleven years later, in 2011, it referred to Africa as "the hopeful continent." And on October 20, 2012, the magazine stated: "In recent years investors have been piling into Lagos and Nairobi as if they were Frankfurt and Tokyo of old." [...]

http://individual.troweprice.com/public/Retail/Planning-&-Re…

------------------

Riches In The Ground

By Oliver August

[...]The health of Africa's mining sector is rivaled by the oil and gas industry. The continent is so rich in fossil fuels that only five of Africa's 54 countries do not currently produce or explore for oil.

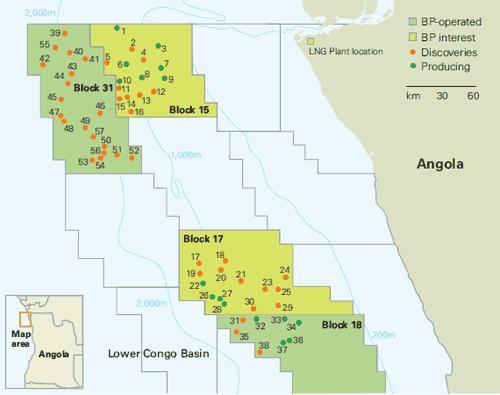

African oil used to come mostly from the continent's west coast, running southward from Nigeria via Equatorial Guinea down to Angola, which now competes with Saudi Arabia to be China's biggest oil supplier. But the east coast is fast turning into an alternative destination for drillers. Countries such as Kenya and Uganda that were once considered resource-limited now have plans to sink hundreds of wells into the ground. And not just for oil. Recently discovered reserves of natural gas are believed to be equally abundant down the east coast, fueling the area's rise as a potential rival to the Persian Gulf states.[...]

http://individual.troweprice.com/public/Retail/Planning-&-Re…

Es folgen noch ein paar Fundstücke zu Afrika im Allgemeinen, der Übersichtlichkeit wegen nur mit Headline und ggf. einem kurzen Zitat - bei Interesse einfach reinlesen...

...........................................

Africa: A Story of Growth

Africa's steady and robust economic growth over the past decade has thrust the continent onto the world stage as a serious player. Local economies stagnated in every part of the world during the global recession of 2008 and 2009, but Sub-Saharan Africa was one of the least affected regions due to its relatively weak ties to the crisis epicenters in Europe and the U.S.--and its growth rate has returned to previous heights.

http://www.theatlantic.com/sponsored/connections/archive/201…

[Anm.: Viele Statistiken/Graphiken bzgl. u.a. Pro-Kopf-Einkommen, Infrastruktur etc.]

------------------

Five Countries To Watch

By Francis Njubi Nesbitt

In May 2000, The Economist magazine declared that Africa was "the hopeless continent." Eleven years later, in 2011, it referred to Africa as "the hopeful continent." And on October 20, 2012, the magazine stated: "In recent years investors have been piling into Lagos and Nairobi as if they were Frankfurt and Tokyo of old." [...]

http://individual.troweprice.com/public/Retail/Planning-&-Re…

------------------

Riches In The Ground

By Oliver August

[...]The health of Africa's mining sector is rivaled by the oil and gas industry. The continent is so rich in fossil fuels that only five of Africa's 54 countries do not currently produce or explore for oil.

African oil used to come mostly from the continent's west coast, running southward from Nigeria via Equatorial Guinea down to Angola, which now competes with Saudi Arabia to be China's biggest oil supplier. But the east coast is fast turning into an alternative destination for drillers. Countries such as Kenya and Uganda that were once considered resource-limited now have plans to sink hundreds of wells into the ground. And not just for oil. Recently discovered reserves of natural gas are believed to be equally abundant down the east coast, fueling the area's rise as a potential rival to the Persian Gulf states.[...]

http://individual.troweprice.com/public/Retail/Planning-&-Re…

Ein zwar etwas langer, wie ich finde aber sehr lesenswerter Artikel:

.................

Oil and gas discoveries make East Africa a rich hunting ground for global explorers

By ZEDDY SAMBU

Posted Monday, December 31 2012 at 18:19

The Ngamia 1 oil exploration rig in Turkana County. East Africa holds great potential for investment opportunities within the oil and gas sector following recent discoveries of the natural resource. file Nation Media Group

In Summary

•As the scrambles for new blocks in Kenya continues, experts believe there is a high probability of a gas find along the East African coastline which shares the same geological formation with some of the gas-rich blocks in Tanzania and Mozambique.

•East Africa is now seen as the “new promised land” or the “next epicentre” for global natural gas, the latest “new frontier. With the recent massive discoveries, it represents the growth engine for Africa’s natural gas sector.

•A report titled Global Race for African Oil says East Africa will soon be the world’s most important energy producer in 2040, during which trillions of dollars will be pumped in in exchange for its natural resources —with most of the money set to come from China.

East Africa’s oil and gas potential has been compared to the gold rush in South Africa —where production of the commodity went from zero in 1886 to 23 per cent of the global supply in just 10 years.

As the scrambles for new blocks in Kenya continues, experts believe there is a high probability of a gas find along the East African coastline which shares the same geological formation with some of the gas-rich blocks in Tanzania and Mozambique.

While interest in Kenya’s exploration blocks has risen since UK firm, Tullow Oil, announced two successful oil-finds in Turkana County within the Tertiary Rift Basin, several multinational oil exploration companies are set to begin bidding for five or more new offshore oil and gas exploration sites in Kenya in the coming weeks.

Ministry of Energy officials have asked the Director of Survey to speed up the mapping of new offshore areas to facilitate the publication of sites and award acreage to prospecting firms.

Officials say it expects five new offshore sites as the country and the East Africa sees a significant increase in exploration in recent years. Oil major Shell already has interests in Tanzania, and the acquisition of Cove would mark the entry by PTTEP of Thailand into Kenya and Mozambique.

The prospects have been mapped in four sedimentary basins—Lamu, Anza , Mandera and the Tertiary Rift .

International firms are expected to negotiate with the government for rights to explore acreage in water depths of between 3,000 and 4,000 metres, quite an expensive undertaking by mainly medium and large-sized firms.

The twin discoveries in Turkana County confirms that there is a working hydrocarbon system in the country and marks the beginning of a long way journey in the oil and gas lifecycle.

The regional gas boom has attracted a long list of players including super majors (ExxonMobil, Total and Royal Dutch Shell), large international E&Ps (Anadarko and BG Group), hybrid IOC/NOCs (Statoil, Petrobras and Galp Energia) and smaller regional specialists (Tullow, Ophir Energy/Dominion, Cove Energy, Pancontinental Oil & Gas NL and Premier Oil).

Kenya’s oil search has attracted more than 23 players since March, among them US giant Anadarko Corp, with the company holding stakes in five blocks off the country’s coast.

Anadarko Petroleum Corp previously known as Algeria’s number one independent producer made significant gas discoveries offshore Mozambique in early 2012 and has branched out into other regions of Africa. Two wells— Kiboko prospect in block L11B and the Kubwa prospect in block L7 will be its first in Kenya. The company is the operator of blocks L7 and L11B, holding 45 per cent of the licences in each.

Meanwhile, Total has a 40 per cent stake, with Cove Energy holding the remainder.

“We are now preparing Anadarko to start drilling in late 2012 or early 2013. I guess next year I’ll be talking about billions of barrels discovered in Kenya,” added Mr Nyoike.

Overall, the Ministry of Energy expects to drill at least a dozen more wells onshore and offshore in the new year as Kenya aims to stake a bigger claim on profits from its natural resources exploration boom. The country is seeking 25 per cent stake in the production activities of oil and gas companies operating here.

Anadarko’s Vice-President for International Exploration, Frank Patterson recently said two three-dimensional surveys have been acquired and have already been processed “two months earlier than expected.”

“Drilling is likely to begin in late 2012/early 2013, dependent on rig availability. The programme is moving quite well,” said Mr Patterson.

“Activity in East Africa will increase significantly as world powers and international integrated oil players jockey for positions via both acquisitions and exploration. Medium-sized companies are asking for these blocks,” said Energy PS Patrick Nyoike.

Industry researchers say the epicentre of the world’s oil and gas reserves is shifting to East Africa from the Middle East.

With stability in the Middle East deteriorating, oil-consumers from these “Arab Spring” countries, including Kenya, continue to consider their options, with the Middle East losing its pole position as an oil producer.

Kenya’s Energy policy makers agree: “We will soon be the new Middle East,” Energy minister Kiraitu Murungi said recently.

A report titled Global Race for African Oil says East African oil, an up-and-coming energy giant, may soon beat Middle Eastern oil in the global markets. The December 2012 report by Casey Research Energy Team examines East Africa’s future role in the race for energy security, supporting geologists that have long been questioning how long Saudi Arabia could maintain production with its aging oil fields and aversion to foreign expertise.

It says the region will soon be the world’s most important energy producer in 2040, during which trillions of dollars will be pumped in in exchange for its natural resources —with most of the money set to come from China.

Feeding ground

“In the space of a few years, East Africa has become a feeding ground for most of the world’s oil majors, which have sniffed our resources of oil and gas on a truly gargantuan scale ,” said Malcolm Graham-Wood, oil analyst, VSA Capital.

Another report notes that the most dynamic recent developments in the African natural gas sector have been in East Africa. The region is now seen as the “new promised land” or the “next epicentre” for global natural gas, the latest “new frontier. With the recent massive discoveries, it represents the growth engine for Africa’s natural gas sector.

“Ten years ago, East Africa was a non-story as far as oil and gas were concerned, with complex geology, poor seismic data and difficult political factors resulting in only a few local coastal explorations with little consequence.

“Currently, only a few East African countries have actual resources or better yet, reserves. As exploration ramps up and development begins in earnest, however, resource, reserve, and production numbers are likely to run up much higher,” says the report.

Demand will push companies with operations in the region skyward, larger market capitalisation will fuel more exploration, drilling programmes will uncover more deposit while stocks will shoot and the early investor will be along for the ride.

Africa is certainly the hot spot for oil and gas exploration as well as foreign investment. But East Africa stands out on the continent. Geologically, East Africa is a much more complex system than West Africa, thus the lack of exploration until the last few years.

Today, the East African Rift system is the largest continental one on Earth. From the Red Sea, it extends some 3,500 kilometres though Somalia, Kenya, Uganda, Rwanda, Burundi, Tanzania, and Mozambique. These potential areas for oil production are several magnitudes larger than the entire North Sea — which produces one-third of Europe’s oil and gas needs.

“The race is on for African oil and recently, the East African Rift has been drawing oil companies from around the world.

“World-class oil deposits lie under and off the coast of East Africa. Major oil companies and wildcatters alike have been vying for position here in recent years. East Africa can help other countries get it,” the report notes.

While small-scale exploration and production had been going on for decades in the sub-region, US independent producer Anadarko opened the new frontier in 2010 with its massive Windjammer discovery in Area 1 of the Rovuma Basin in offshore northern Mozambique.

Four subsequent discoveries in the area by Anadarko, along with major discoveries in nearby Area 4 by ENI in the Mamba prospect, have boosted recoverable reserve estimates for Mozambique to as high as three tcm (trillion cubic metres).

In the adjoining Tanzanian portion of the Rovuma Basin, BG Group and Ophir Energy have also hit major gas deposits, as has Statoil and its partner ExxonMobil.

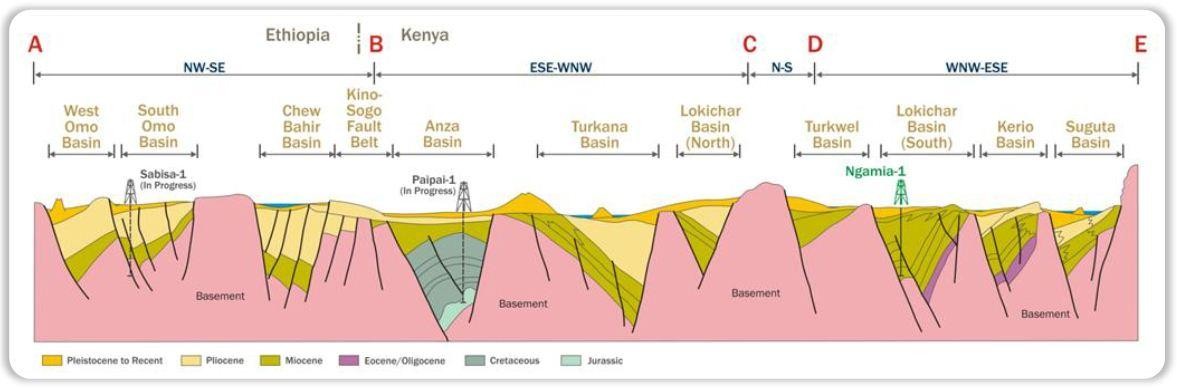

Interest in neighbouring offshore Kenya and Madagascar is increasing, based on the belief that similar geological compositions will be found. The Tertiary Rift Basin contains Block 10BB and Block 13T— the March 2012 discovery.

Prior to Ngamia, the Loperot-1 well was drilled by Shell in 1992, where it recovered 29 degrees API of waxy crude oil. Though this finding demonstrated a working petroleum system, Shell gave up on the project when it discovered that the sandstones were water-bearing.

Ten wells have been drilled in the Lamu Basin since the 1950s, and an additional 820 square kilometres of 3D seismic data acquired offshore. Though several wells had indications of hydrocarbon presence, none was fully assessed or completed for production.

The Anza Basin had 10 wells drilled between 1985 and 1990 by Amoco and Total, but none of them showed indication of hydrocarbons.

The same group drilled two wells in the Mandera Basin during the same period, but the wells were also dry. The Bogal-1 exploration well, drilled in 2009 by CNOOC, also proved dry and was subsequently plugged and abandoned.

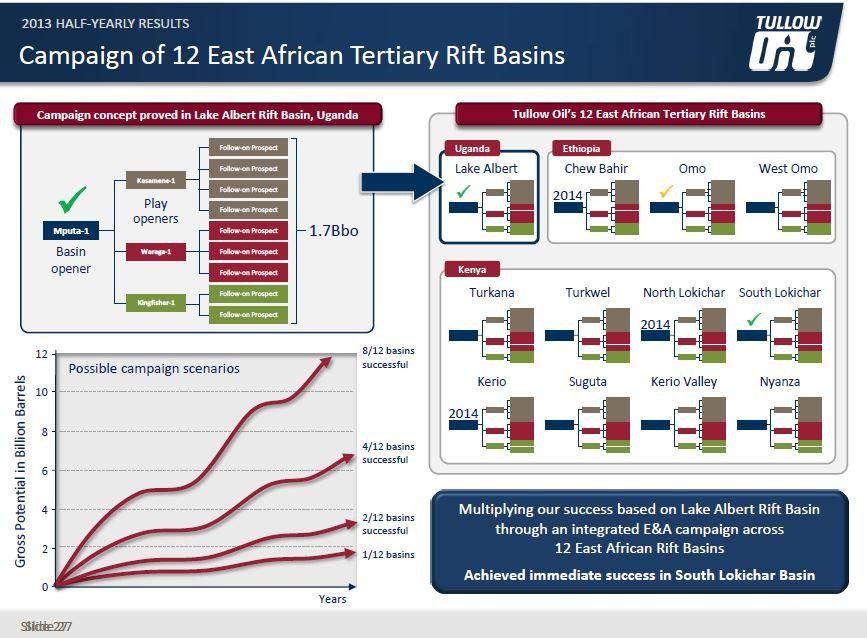

As recently as 2006, East Africa did not even make the list of oil producers. That began to change in 2007 when Heritage Oil and Tullow Oil announced a one-billion-barrel discovery in Lake Albert, Uganda.

Oil and gas explorers have reported major discoveries each year in the region since then, most recently out of a Kenyan project of Africa Oil spudded in January 2012.

http://www.businessdailyafrica.com/Oil-and-gas-discoveries-i…

.................

Oil and gas discoveries make East Africa a rich hunting ground for global explorers

By ZEDDY SAMBU

Posted Monday, December 31 2012 at 18:19

The Ngamia 1 oil exploration rig in Turkana County. East Africa holds great potential for investment opportunities within the oil and gas sector following recent discoveries of the natural resource. file Nation Media Group

In Summary

•As the scrambles for new blocks in Kenya continues, experts believe there is a high probability of a gas find along the East African coastline which shares the same geological formation with some of the gas-rich blocks in Tanzania and Mozambique.

•East Africa is now seen as the “new promised land” or the “next epicentre” for global natural gas, the latest “new frontier. With the recent massive discoveries, it represents the growth engine for Africa’s natural gas sector.

•A report titled Global Race for African Oil says East Africa will soon be the world’s most important energy producer in 2040, during which trillions of dollars will be pumped in in exchange for its natural resources —with most of the money set to come from China.

East Africa’s oil and gas potential has been compared to the gold rush in South Africa —where production of the commodity went from zero in 1886 to 23 per cent of the global supply in just 10 years.

As the scrambles for new blocks in Kenya continues, experts believe there is a high probability of a gas find along the East African coastline which shares the same geological formation with some of the gas-rich blocks in Tanzania and Mozambique.

While interest in Kenya’s exploration blocks has risen since UK firm, Tullow Oil, announced two successful oil-finds in Turkana County within the Tertiary Rift Basin, several multinational oil exploration companies are set to begin bidding for five or more new offshore oil and gas exploration sites in Kenya in the coming weeks.

Ministry of Energy officials have asked the Director of Survey to speed up the mapping of new offshore areas to facilitate the publication of sites and award acreage to prospecting firms.

Officials say it expects five new offshore sites as the country and the East Africa sees a significant increase in exploration in recent years. Oil major Shell already has interests in Tanzania, and the acquisition of Cove would mark the entry by PTTEP of Thailand into Kenya and Mozambique.

The prospects have been mapped in four sedimentary basins—Lamu, Anza , Mandera and the Tertiary Rift .

International firms are expected to negotiate with the government for rights to explore acreage in water depths of between 3,000 and 4,000 metres, quite an expensive undertaking by mainly medium and large-sized firms.

The twin discoveries in Turkana County confirms that there is a working hydrocarbon system in the country and marks the beginning of a long way journey in the oil and gas lifecycle.

The regional gas boom has attracted a long list of players including super majors (ExxonMobil, Total and Royal Dutch Shell), large international E&Ps (Anadarko and BG Group), hybrid IOC/NOCs (Statoil, Petrobras and Galp Energia) and smaller regional specialists (Tullow, Ophir Energy/Dominion, Cove Energy, Pancontinental Oil & Gas NL and Premier Oil).

Kenya’s oil search has attracted more than 23 players since March, among them US giant Anadarko Corp, with the company holding stakes in five blocks off the country’s coast.

Anadarko Petroleum Corp previously known as Algeria’s number one independent producer made significant gas discoveries offshore Mozambique in early 2012 and has branched out into other regions of Africa. Two wells— Kiboko prospect in block L11B and the Kubwa prospect in block L7 will be its first in Kenya. The company is the operator of blocks L7 and L11B, holding 45 per cent of the licences in each.

Meanwhile, Total has a 40 per cent stake, with Cove Energy holding the remainder.

“We are now preparing Anadarko to start drilling in late 2012 or early 2013. I guess next year I’ll be talking about billions of barrels discovered in Kenya,” added Mr Nyoike.

Overall, the Ministry of Energy expects to drill at least a dozen more wells onshore and offshore in the new year as Kenya aims to stake a bigger claim on profits from its natural resources exploration boom. The country is seeking 25 per cent stake in the production activities of oil and gas companies operating here.

Anadarko’s Vice-President for International Exploration, Frank Patterson recently said two three-dimensional surveys have been acquired and have already been processed “two months earlier than expected.”

“Drilling is likely to begin in late 2012/early 2013, dependent on rig availability. The programme is moving quite well,” said Mr Patterson.

“Activity in East Africa will increase significantly as world powers and international integrated oil players jockey for positions via both acquisitions and exploration. Medium-sized companies are asking for these blocks,” said Energy PS Patrick Nyoike.

Industry researchers say the epicentre of the world’s oil and gas reserves is shifting to East Africa from the Middle East.

With stability in the Middle East deteriorating, oil-consumers from these “Arab Spring” countries, including Kenya, continue to consider their options, with the Middle East losing its pole position as an oil producer.

Kenya’s Energy policy makers agree: “We will soon be the new Middle East,” Energy minister Kiraitu Murungi said recently.

A report titled Global Race for African Oil says East African oil, an up-and-coming energy giant, may soon beat Middle Eastern oil in the global markets. The December 2012 report by Casey Research Energy Team examines East Africa’s future role in the race for energy security, supporting geologists that have long been questioning how long Saudi Arabia could maintain production with its aging oil fields and aversion to foreign expertise.

It says the region will soon be the world’s most important energy producer in 2040, during which trillions of dollars will be pumped in in exchange for its natural resources —with most of the money set to come from China.

Feeding ground

“In the space of a few years, East Africa has become a feeding ground for most of the world’s oil majors, which have sniffed our resources of oil and gas on a truly gargantuan scale ,” said Malcolm Graham-Wood, oil analyst, VSA Capital.

Another report notes that the most dynamic recent developments in the African natural gas sector have been in East Africa. The region is now seen as the “new promised land” or the “next epicentre” for global natural gas, the latest “new frontier. With the recent massive discoveries, it represents the growth engine for Africa’s natural gas sector.

“Ten years ago, East Africa was a non-story as far as oil and gas were concerned, with complex geology, poor seismic data and difficult political factors resulting in only a few local coastal explorations with little consequence.

“Currently, only a few East African countries have actual resources or better yet, reserves. As exploration ramps up and development begins in earnest, however, resource, reserve, and production numbers are likely to run up much higher,” says the report.

Demand will push companies with operations in the region skyward, larger market capitalisation will fuel more exploration, drilling programmes will uncover more deposit while stocks will shoot and the early investor will be along for the ride.

Africa is certainly the hot spot for oil and gas exploration as well as foreign investment. But East Africa stands out on the continent. Geologically, East Africa is a much more complex system than West Africa, thus the lack of exploration until the last few years.

Today, the East African Rift system is the largest continental one on Earth. From the Red Sea, it extends some 3,500 kilometres though Somalia, Kenya, Uganda, Rwanda, Burundi, Tanzania, and Mozambique. These potential areas for oil production are several magnitudes larger than the entire North Sea — which produces one-third of Europe’s oil and gas needs.

“The race is on for African oil and recently, the East African Rift has been drawing oil companies from around the world.

“World-class oil deposits lie under and off the coast of East Africa. Major oil companies and wildcatters alike have been vying for position here in recent years. East Africa can help other countries get it,” the report notes.

While small-scale exploration and production had been going on for decades in the sub-region, US independent producer Anadarko opened the new frontier in 2010 with its massive Windjammer discovery in Area 1 of the Rovuma Basin in offshore northern Mozambique.

Four subsequent discoveries in the area by Anadarko, along with major discoveries in nearby Area 4 by ENI in the Mamba prospect, have boosted recoverable reserve estimates for Mozambique to as high as three tcm (trillion cubic metres).

In the adjoining Tanzanian portion of the Rovuma Basin, BG Group and Ophir Energy have also hit major gas deposits, as has Statoil and its partner ExxonMobil.

Interest in neighbouring offshore Kenya and Madagascar is increasing, based on the belief that similar geological compositions will be found. The Tertiary Rift Basin contains Block 10BB and Block 13T— the March 2012 discovery.

Prior to Ngamia, the Loperot-1 well was drilled by Shell in 1992, where it recovered 29 degrees API of waxy crude oil. Though this finding demonstrated a working petroleum system, Shell gave up on the project when it discovered that the sandstones were water-bearing.

Ten wells have been drilled in the Lamu Basin since the 1950s, and an additional 820 square kilometres of 3D seismic data acquired offshore. Though several wells had indications of hydrocarbon presence, none was fully assessed or completed for production.

The Anza Basin had 10 wells drilled between 1985 and 1990 by Amoco and Total, but none of them showed indication of hydrocarbons.

The same group drilled two wells in the Mandera Basin during the same period, but the wells were also dry. The Bogal-1 exploration well, drilled in 2009 by CNOOC, also proved dry and was subsequently plugged and abandoned.

As recently as 2006, East Africa did not even make the list of oil producers. That began to change in 2007 when Heritage Oil and Tullow Oil announced a one-billion-barrel discovery in Lake Albert, Uganda.

Oil and gas explorers have reported major discoveries each year in the region since then, most recently out of a Kenyan project of Africa Oil spudded in January 2012.

http://www.businessdailyafrica.com/Oil-and-gas-discoveries-i…

Über die Entwicklung Kenyas hin zum Ölproduzenten:

.............................

Striking ‘black gold’ to change Kenya’s fortunes

By ZEDDY SAMBU

Posted Sunday, December 30 2012 at 19:56

Workers at the oil rig as the drilling of the oil is going on at Ngamia 1 in Turkana county, April 5th, 2012. The discovery of oil in Turkana has caused a lot of interest in the region.

In Summary•Industry experts say that when the oil is proven to be of sufficient exploitable quantities, then the government has to first invest in infrastructure to bring it to the market. The next phase of development will be the production stage — the level that Uganda, which discovered oil six years ago is currently at.

After walking the long and difficult journey for nearly six decades in search of oil and gas deposits, Kenya announced its first successful discovery this year in Turkana and offshore, a major milestone for the country.

The discovery of about 52 net metres of natural gas in Mbawa prospect, an offshore block off the coast of Lamu, also confirmed that there are viable hydrocarbon deposits in the Tertiary Rift.

It also puts to rest previous perceptions that the region has no hydrocarbons after in 2007 Australia’s Woodside Petroleum Ltd hit a dry well at its Pomboo-1 off the coast.

Kenya’s four major basins — Anza, Lamu, Rift and Mandera four sedimentary basins of Lamu, Mandera, Anza and Tertiary Rift —have a combined surface area of about 485,000 square kilometres.

Experts, however, want policy makers to develop comprehensive oil and gas policies, strategies, legal and institutional framework that is transparent and robust and with Kenyans intended as key beneficiaries of these natural resources.

“With discoveries of oil, a comprehensive master plan for petroleum now becomes a priority,” said industry consultant George Wachira.

Eric Aligula , head of infrastructure at the public policy think tank, KIPPRA is urging policy makers to fast-track investments in the sector to link production areas and demand centres in the sector.

“We should deal with infrastructure which is the biggest challenge in the oil sector ,” said Dr Aligula.

Even as the commercial value is awaited in the new year, of importance now is how the discovery of oil will transform the economic, energy and infrastructure landscape, enabling the country to gain rapid growth.

“If the deposits are found to be commercially viable, it would be a key enabler of economic development in Kenya and would sit alongside Vision 2030, the economic blueprint that aims at turning the country into a middle income country in the next 18 years,” said Martin Mbogo, general manager for Tullow Kenya.

Industry experts say that when the oil is proven to be of sufficient exploitable quantities, then the government has to first invest in infrastructure to bring it to the market. The next phase of development will be the production stage — the level that Uganda, which discovered oil six years ago is currently at.

But multiple wells will need to be drilled to confirm commerciality of the oil discoveries both in the onshore Block 10BB and offshore Block L8, despite the fact that the discoveries of both crude oil in the onshore and natural gas in the offshore is confirmation that there are active and working petroleum systems in Kenya’s sedimentary basins.

“Producing oil requires investment, infrastructure and a compelling commercial argument. Two well outcomes on their own, cannot give a complete picture of the basin’s potential so more wells will be drilled and more testing and appraisal work will be completed,” said Mr Mbogo.

Tullow Oil, plans to explore the Lokichar sub basin but also other prospects that have been mapped in the Tertiary Rift while US independent oil major, Anadarko Corporation last week spud two ultra deep offshore wells off the coast of Lamu. US explorer Apache Corporation is continuing with drilling of the offshore well in the Mbawa prospect.

The search for oil is also set to intensify as five new onshore and offshore blocks are currently being redrawn by the Survey of Kenya.

Mwendia Nyaga, an industry expert said any investment in the right petroleum infrastructure to build a robust oil and gas industry is now justified.

The search for the ‘black gold’ has taken years. Perceived high geological risk in Kenya was for the last five decades, a key disincentive that turned away major oil companies who own the risk capital for investment in oil and gas exploration. Major exploration companies had kept away from Kenya due to the history of hitting dry wells and they preferred to invest in countries with proven petroleum reserves .

Between 1960 to 2010, a total of 32 oil exploration wells had been drilled, but all were classified as dry although 18 of them had some oil and gas shows. Of the 46 petroleum exploration blocks, nine of which were created following the March, 2012, first discovery at Ngamia 1 well, 44 are licensed to international oil companies. A number of high profile international oil companies continue to express interest in the country’s four petroleum exploration acreage.

http://www.businessdailyafrica.com/oil-to-change-Kenya-fortu…

.............................

Striking ‘black gold’ to change Kenya’s fortunes

By ZEDDY SAMBU

Posted Sunday, December 30 2012 at 19:56

Workers at the oil rig as the drilling of the oil is going on at Ngamia 1 in Turkana county, April 5th, 2012. The discovery of oil in Turkana has caused a lot of interest in the region.

In Summary•Industry experts say that when the oil is proven to be of sufficient exploitable quantities, then the government has to first invest in infrastructure to bring it to the market. The next phase of development will be the production stage — the level that Uganda, which discovered oil six years ago is currently at.

After walking the long and difficult journey for nearly six decades in search of oil and gas deposits, Kenya announced its first successful discovery this year in Turkana and offshore, a major milestone for the country.

The discovery of about 52 net metres of natural gas in Mbawa prospect, an offshore block off the coast of Lamu, also confirmed that there are viable hydrocarbon deposits in the Tertiary Rift.

It also puts to rest previous perceptions that the region has no hydrocarbons after in 2007 Australia’s Woodside Petroleum Ltd hit a dry well at its Pomboo-1 off the coast.

Kenya’s four major basins — Anza, Lamu, Rift and Mandera four sedimentary basins of Lamu, Mandera, Anza and Tertiary Rift —have a combined surface area of about 485,000 square kilometres.

Experts, however, want policy makers to develop comprehensive oil and gas policies, strategies, legal and institutional framework that is transparent and robust and with Kenyans intended as key beneficiaries of these natural resources.

“With discoveries of oil, a comprehensive master plan for petroleum now becomes a priority,” said industry consultant George Wachira.