Watchlist - gelistete KI/ AI Firmen weltweit - 500 Beiträge pro Seite

eröffnet am 28.01.18 03:54:10 von

neuester Beitrag 01.10.19 08:20:13 von

neuester Beitrag 01.10.19 08:20:13 von

Beiträge: 298

ID: 1.272.676

ID: 1.272.676

Aufrufe heute: 1

Gesamt: 24.906

Gesamt: 24.906

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 11.01.09, 16:18 | 17154 | |

| vor 41 Minuten | 11462 | |

| vor 52 Minuten | 8581 | |

| heute 20:17 | 6239 | |

| vor 31 Minuten | 5870 | |

| vor 1 Stunde | 5831 | |

| vor 1 Stunde | 4700 | |

| vor 1 Stunde | 3357 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 4. | 6,8500 | +31,98 | 205 | |||

| 2. | 1. | 18.772,00 | +0,27 | 185 | |||

| 3. | 7. | 48,75 | +60,10 | 106 | |||

| 4. | 9. | 7,0480 | +0,96 | 60 | |||

| 5. | 18. | 3,5800 | +22,18 | 59 | |||

| 6. | 3. | 177,43 | +3,22 | 54 | |||

| 7. | 6. | 13,410 | +2,29 | 39 | |||

| 8. | 10. | 0,4480 | +23,08 | 38 |

Fronteo (Jap.)

Analysiert mit Hilfe ihrer KI-Software Kibit vor allem Beweis- und forensisches Material

http://www.fronteo.com/usa/resources/kibit/

Erweiterte KI nutzen

Kibit ist das Herzstück der von FRONTEO entwickelten Anwendungen und Prozesse. Die KI-Engine wurde ursprünglich entwickelt, um große Datenmengen in grenzüberschreitenden Rechtsstreitigkeiten zu klassifizieren und Einblicke in eDiscovery-Fälle zu gewähren. Wenn Sie mit FRONTEO arbeiten, können Ihre eDiscovery-Projekte durch die Nutzung dieser bahnbrechenden Technologie einen erheblichen Vorteil erzielen.

Aktives Lernen

Kibit wurde speziell entwickelt, um das Vorwissen zu bewahren und diese Informationen auf dem Weg nach vorn anzuwenden, wodurch die Fähigkeit, fundierte Entscheidungen zu treffen, kontinuierlich verbessert wird. Das für KI-basierte Systeme erforderliche Schulungsvolumen variiert je nach Faktoren wie Zweck und Komplexität der Daten und den erwarteten Ergebnissen. Kibit ist anders, da es in der Lage ist, mit minimalem Lernaufwand ein hohes operatives Niveau zu erreichen. Die Performance wird durch ein ständiges Umschulungsverfahren, das "Landscaping" genannt wird, kontinuierlich optimiert, auch bei begrenzten Datenmengen.

4.000 Mal schneller als der Mensch

Unabhängig von Interesse und Wichtigkeit kann die Zeit, die für die Suche nach Informationen aufgewendet wird, oft langwierig, monoton und manchmal frustrierend sein. Mit zunehmender Zeit und zunehmender Komplexität des Suchaufwands werden die Nutzer mit Erschöpfung konfrontiert, und mit ihr sinkt auch die Genauigkeit der Suchanfragen. Der Kibit AI-Motor hingegen wird nicht mit dem gleichen Leistungsabfall konfrontiert. Außerdem kann er Sätze 4.000-mal schneller lesen als Menschen. Diese Agilität und Genauigkeit bei der Suche nach dem, was Sie suchen, definieren die Eigenschaften von Kibit.

Jenseits des legalen Marktes

Kibit kann lernen und empfehlen, was Einzelpersonen mögen, und in einer Vielzahl von Branchen eingesetzt werden, die über die gesetzlichen Bestimmungen hinausgehen, wie z.B. Wirtschaft, Medizin, Sicherheit und Bildung. Kibiro, ein Roboter, der von Kibit angetrieben wird, kann menschliche Vorlieben durch einfache Interaktion aufnehmen. Die Kibit-Engine kann den Anwendern Informationen wie Empfehlungen für Restaurants, Datenanalysen im Marketing oder das Sturzrisiko für stationär behandelte Patienten im Gesundheitswesen liefern.

Zu den Highlights und Vorteilen von Kibit gehören:

Mehr als 50 Patente auf unser Technologieportfolio

Emulieren Sie menschliche Entscheidungen, um riesige Datenmengen zu analysieren.

Lernt auf der Grundlage von Trainingsdaten und passt sich an, um die zugehörigen Daten auszuwerten und zu extrahieren.

Verwendet die morphologische Analyse, um Teile von Sprache und Wörtern in unstrukturierten, frei formulierten Textdaten zu identifizieren.

Ordnet die Wichtigkeit jedes Wortes und jedes Satzes nach den von Ihnen festgelegten Kriterien an.

Bewertet und gewichtet Wörter und fügt Bewertungen hinzu, um die Relevanz der identifizierten Daten zu bewerten und widerzuspiegeln.

Dynamische Erstellung und Bereitstellung von Inhalten für Benutzer, einschließlich Informationen, die die Datenauswertung unterstützen.

Wenn die KI keine spezifischen Informationen finden kann, die Sie suchen, wird sie Ihnen die Argumentation liefern und alternative Überlegungen anbieten.

Behavior Informatics kombiniert Informationswissenschaften und Verhaltenswissenschaften, um menschliche Verhaltensmuster aus Daten zu extrahieren.

Das maschinelle Lernen ermöglicht es Computern, universelle Strukturen, die in Daten enthalten sind, zu erkennen und daraus zu lernen.

Der Lernfortschritt von Kibit lässt sich anhand eines Vergleichs mit den bisherigen Fortschritten ablesen, zeigt die Verbesserung und bestätigt die Genauigkeit.

Funktioniert als umfangreiche Wissensdatenbank, um frühere Datenanalyse-Ergebnisse als wiederverwendbare Informationsressource zu nutzen.

Verwendet ein Verhaltensprognosemodell, um Anzeichen eines erhöhten Risikos zu identifizieren, wie z.B. bei Betrugsermittlungen.

Übersetzt mit www.DeepL.com/Translator

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://bigcharts.marketwatch.com/kaavio.Webhost/charts/big.chart?nosettings=1&symb=VERI&uf=0&type=2&size=2&sid=16916472&style=320&freq=1&entitlementtoken=0c33378313484ba9b46b8e24ded87dd6&time=8&rand=1871263088&compidx=&ma=0&maval=9&lf=1&lf2=0&lf3=0&height=335&width=579&mocktick=1

[/url]Veritone

Analysiert Video und Audiodateien

Über Veritone

Veritone (NASDAQ: VERI) ist ein führendes Unternehmen im Bereich der künstlichen Intelligenz, das eine einzigartige Plattform, aiWARE, entwickelt hat, die die Leistungsfähigkeit des kognitiven Computings auf KI-Basis freigibt, um unstrukturierte öffentliche und private Audio- und Videodaten für Kunden in einer Vielzahl von Märkten, einschließlich Medien, Politik, Recht und Regierung, zu transformieren und zu analysieren. Die offene Plattform integriert ein Ökosystem kognitiver Engines, die gemeinsam orchestriert werden können, um wertvolle, multivariate Einblicke zu ermöglichen. aiWARE liefert beispiellose Einblicke durch eine Reihe von proprietären Anwendungen, indem es Daten aus linearen Dateien wie Radio- und Fernsehsendungen, Überwachungsbildern sowie öffentlichen und privaten Inhalten weltweit freischaltet. Um mehr über Veritone zu erfahren, besuchen Sie bitte Veritone.com.

Übersetzt mit www.DeepL.com/Translator

Brainchip Hldg. darf natürlich nicht fehlen:

Die bisher einzige reinrassige KI-Firma(Australien/ USA-SiliconValley/ Frankreich) weltweit mit Hard/Softwareprodukt.

Und bisher das einzige gelistete Unternehmen mit einem Neuromorphen selbstlernenden Hardwarechip, erstes Grundlagenpatent (2008)in dem Bereich - alle Großen arbeiten daran...

https://www.wallstreet-online.de/diskussion/1265618-1-10/tcw…

Die bisher einzige reinrassige KI-Firma(Australien/ USA-SiliconValley/ Frankreich) weltweit mit Hard/Softwareprodukt.

Und bisher das einzige gelistete Unternehmen mit einem Neuromorphen selbstlernenden Hardwarechip, erstes Grundlagenpatent (2008)in dem Bereich - alle Großen arbeiten daran...

https://www.wallstreet-online.de/diskussion/1265618-1-10/tcw…

Meine Medibio ist auch eine KI Firma.

Sie sind zwar ein Medizindeviceentwickler,

nutzen für Diesen aber Künstliche Intelligenz.

Stelle Dazu Demnächst mal noch Stück mehr rein.

Mir fallen noch 2 User ein die soweit ich weiss auch sehr an "A.I." interessiert sind.

Werde Sie mal anschreiben, und auf Deinen Thread aufmerksam machen.

Sie sind zwar ein Medizindeviceentwickler,

nutzen für Diesen aber Künstliche Intelligenz.

Stelle Dazu Demnächst mal noch Stück mehr rein.

Mir fallen noch 2 User ein die soweit ich weiss auch sehr an "A.I." interessiert sind.

Werde Sie mal anschreiben, und auf Deinen Thread aufmerksam machen.

Hab Hier vielleicht noch 1,2 kleine "Präsente" für Dich.

Was eigentlich über BM gehen sollte; aber dann passt Es Hier auch gut rein.

Hat Jeder Was von, DER Es used.

Was eigentlich über BM gehen sollte; aber dann passt Es Hier auch gut rein.

Hat Jeder Was von, DER Es used.

Erstmal Das noch.

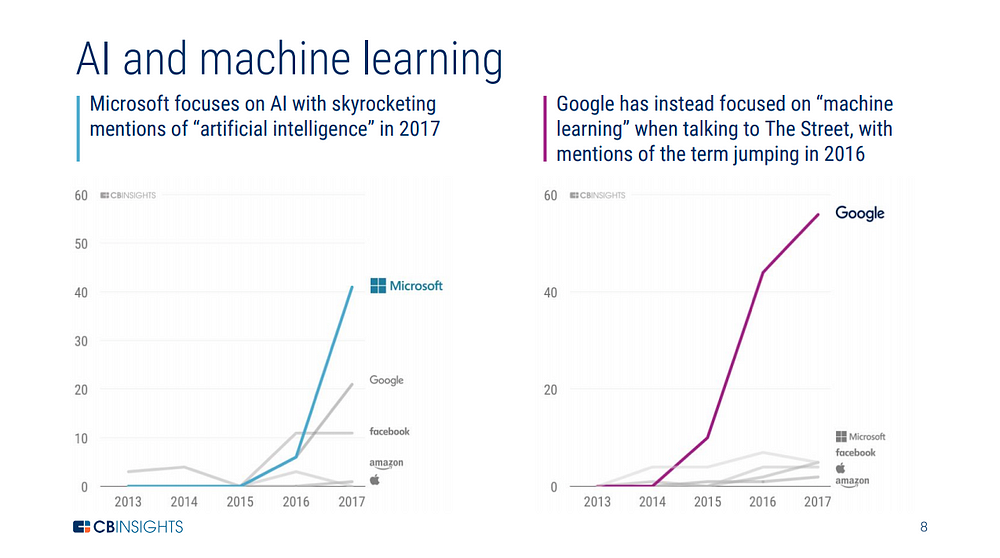

Das sind Keine quotierten Firmen, aber für "bisschen Phantasie" anregen interessant.

Watt an CHANGE zu erwarten sein wird.

Sind sicher schon Einige der Relevanteren Player.

Und Das ist nicht Was ich im Vorschreiben meinte.

https://s3.amazonaws.com/cbi-research-portal-uploads/2017/12…

Das sind Keine quotierten Firmen, aber für "bisschen Phantasie" anregen interessant.

Watt an CHANGE zu erwarten sein wird.

Sind sicher schon Einige der Relevanteren Player.

Und Das ist nicht Was ich im Vorschreiben meinte.

https://s3.amazonaws.com/cbi-research-portal-uploads/2017/12…

Genpact G

http://www.genpact.comhttp://investors.genpact.com/mobile.view?c=209334&p=irol-irh…

Im Depot

Oberkassel

You, danke Euch

Wer ihn nicht kennt, Simon Betschinger (www.mastertraders.de) ruft 2018 als Jahr der KI-Aktien aus.

https://www.mastertraders.de/trader/der-mastertrader/mein-pl…

Habe jüngst erst gelesen, dass er mit seinem Tradingansatz sein Kapital innert 10 Jahren verhundertfacht hat.

Er hat 2018 dazu allerdings fast nur Softwarefirmen auf dem Schirm, ihn interessieren nur BigData-Profiteure - kein Platz für Innovation, die selbstständig Daten generiert und realtime lernt, ohne auf irgendeine Cloud angewiesen zu sein.

Vielleicht ist es noch zu früh für den T800?

Das Thema Lernen ohne große Meta/Datenmengen könnte bei Brainchip mglw mit ihrem neuen Chip AKIDA interessant werden.

Wer ihn nicht kennt, Simon Betschinger (www.mastertraders.de) ruft 2018 als Jahr der KI-Aktien aus.

https://www.mastertraders.de/trader/der-mastertrader/mein-pl…

Habe jüngst erst gelesen, dass er mit seinem Tradingansatz sein Kapital innert 10 Jahren verhundertfacht hat.

Er hat 2018 dazu allerdings fast nur Softwarefirmen auf dem Schirm, ihn interessieren nur BigData-Profiteure - kein Platz für Innovation, die selbstständig Daten generiert und realtime lernt, ohne auf irgendeine Cloud angewiesen zu sein.

Vielleicht ist es noch zu früh für den T800?

Das Thema Lernen ohne große Meta/Datenmengen könnte bei Brainchip mglw mit ihrem neuen Chip AKIDA interessant werden.

- Intel's CES 2018 keynote focused on its 49-qubit quantum computing chip, VR applications for content, its AI self-learning chip, and an autonomous vehicles platform -

A.I.'s BIG bang

Andrew Ng: A.I. "is a CRAPshoot"

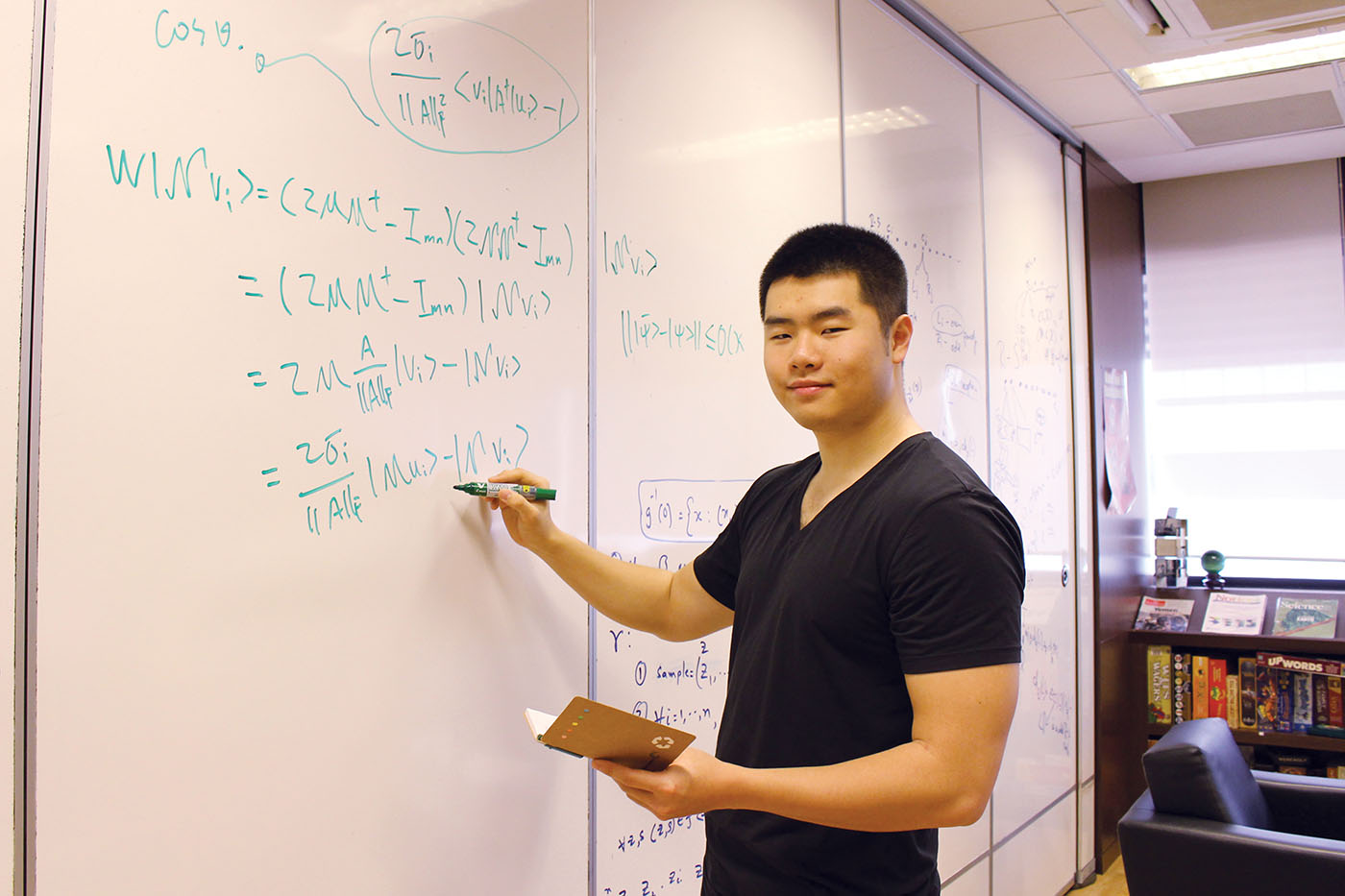

- Professor Andrew Ng is the former chief scientist at Baidu, where he led the company's Artificial Intelligence Group. He is an adjunct professor at Stanford University. In 2011 he led the development of Stanford University’s main MOOC (Massive Open Online Courses) platform and also taught an online Machine Learning class that was offered to over 100,000 students, leading to the founding of Coursera. -

- Professor Andrew Ng is the former chief scientist at Baidu, where he led the company's Artificial Intelligence Group. He is an adjunct professor at Stanford University. In 2011 he led the development of Stanford University’s main MOOC (Massive Open Online Courses) platform and also taught an online Machine Learning class that was offered to over 100,000 students, leading to the founding of Coursera. -

fingernail-size chip that COULD replace a supercomputer(future (miniaturized) (portable) ‘brain-on-a-chip’)

http://www.kurzweilai.net/an-artificial-synapse-for-future-m…

http://www.nature.com/articles/s41563-017-0001-5

http://www.kurzweilai.net/an-artificial-synapse-for-future-m…

http://www.nature.com/articles/s41563-017-0001-5

https://stockhead.com.au/tech/ai-could-add-885bn-to-the-econ…

" AI could add $885bn to the economy by 2030 depending on how we deal with it

Tech

12 hours ago | Melissa Yeo

Increased investment in machine learning technology and Artificial Intelligence could net the Australian economy an increase of up to $US700 billion ($885 billion) in Gross Domestic Product by 2030.

That’s according to the Economist Intelligence Unit, which examined the economic impact of machine learning on Australia, Japan, South Korea, the US and the UK.

The Economist, working with Google, examined different scenarios for tackling the challenges associated with machine learning and AI — and found Australia had the greatest potential for gains among the five countries — depending which path we took.

If Australia invested in productivity by training workers in machine learning skills, GDP could increase by $US500 billion from a forecast baseline of $US1.4 trillion in 2030 to $US1.9 trillion.

“This higher level of economic output can be attributed almost entirely to the positive impact on productivity of public policies to upskill workers and increase complementarity between human labour and machine learning technology,” the report says.

But the rewards were even greater with direct public investment in the technology itself.

Driving capital investment in machine learning technology — via new tax incentives and releasing more government data to national knowledge sharing communities — could add $US700 billion to the 2030 GDP baseline.

“Over the forecast period, an acceleration in this trend, coupled with AI, provides a significant boost to the country’s productivity.”

Bookmark this link for small cap breaking news

Discuss small cap news in our Facebook group

Follow us on Facebook or Twitter

Subscribe to our daily newsletter

But without either set of public policies, the outlook was grim.

Advances in machine learning — without investment either up-skilling or infrastructure — would result in the technology replacing workers, rather than increase productivity.

“The impact of this policy inaction on the Australian economy is profoundly negative,” the report says.

Under that scenario, Australia’s GDP would drop back $US200 billion versus the 2030 baseline.

The report defined machine learning as a subfield of Artificial Intelligence that leverages algorithms which learn and optimise from data without being explicitly programmed to accomplish a task with pre-defined rules.

It incorporates a variety of techniques, including neural networks, decision tree learning and support vector machines, among others.

The scenarios are echoed by Innovation and Science Australia (ISA) whose report earlier this year suggested the government’s Digital Economy Strategy (due for release later this year) should position the nation as “a leading nation in the research, development and exploitation of AI and machine learning”.

Seven ASX small caps with exposure to machine learning and AI

Assuming Australia’s policy makers make the right choices, there are several ASX-listed small caps that may give investors exposure to this predicted growth.

Here are seven:

Brainchip (ASX:BRN) is developing a system that mimics the human brain and shipped its first accelerator card to a major European car manufacturer last quarter.

Its technology uses a type of neuromorphic computing which allows the system to be trained instantaneously, to learn autonomously, evolve and associate information just like the human brain.

Earlier this year Brainchip announced a licensing and development deal to jointly develop and deploy casino video analytics in Las Vegas but also are eyeing off deals for application in civil surveillance and visual inspection systems.

Marketing-oriented play OpenDNA (ASX:OPN) is carving a niche in the advertising realm, using AI to feed highly relevant content to consumers by looking at their previous browsing history, preferences and dislikes.

The company helped to launch android smart phones, Netsurfer last month, with a personalised content app Jottr pre-loaded on a predicted 500,000 phones this year.

Flamingo AI (ASX:FGO) is an Artificial Intelligence and Machine Learning company providing virtual assistants ROSIE and MAGGIE to solve the business problems of poor customer experience, low online sales conversion rates and high cost of customer service for Financial Services.

Linius Technologies (ASX:LNU) incorporated Microsoft’s artificial intelligence services to its virtual videos in December, to change the way that viewers can search within videos.

Much vaunted logistics tech Yojee (ASX:YOJ) uses the technology to delivery efficiency in global freight logistics.

Both have since announced the addition of blockchain into their service offering as well.

Further, health techs have jumped on the bandwagon with enthusiasm, with roughly 12 using machine learning or AI in some form – Resonance Health (ASX:RHT) even using it to help diagnose blood disorders.

Recent listing Whitehawk (ASX:WHK) uses it to power their cyber-security marketplace while BidEnergy (ASX:BID) uses it similarly for energy bills."

Antwort auf Beitrag Nr.: 56.946.707 von Popeye82 am 06.02.18 11:29:05AI engine of the rocket, BUT data the fuel

http://partners.wsj.com/ubs/invest-in-china/data-innovation-…

"China's edge on AI comes from its countless dialects and data

AI BOT 12423 aka 张伟 Zhang Wei now

Hi, how are you? I’m new here and I’m a robot.

Can you tell me your name please? This way, I’ll know how to address you. You can also pick a color for your chat box icon if you’d like.

China’s one billion people speak more than 200 dialects, across 23 provinces, in countless accents. Human communication across this country is challenging enough, but imagine the monumental challenge of getting its growing population of AI machines to understand every Chinese individual.

That very challenge has turned out to be a key strength in allowing China to develop what experts are calling the world’s best AI speech-recognition platform. Baidu’s Deep Speech 2 – chosen by the MIT Technology Review as one of last year’s top 10 breakthrough technologies – is emblematic of an explosion in Chinese AI and IoT innovation that will help power what UBS Equity Analyst Sundeep Gantori calls a “fourth industrial revolution.”

China’s highest state body recently announced a plan to make China the world leader in Artificial Intelligence by 2030, creating an industry worth $150 billion – and representing breathtaking investment opportunity. The nation’s research prowess is growing exponentially as brilliant Western-trained scientists return home, and billions of R&D dollars pour into the mission to achieve AI and IoT excellence. Against that backdrop, Gantori sees China enjoying a critical global advantage on its journey to AI leadership; the ability to harness data from a gigantic consumer base eager to embrace new technologies and with little hesitation to share personal information.

AI is the engine of the rocket that takes us to the next frontier, but data is the fuel that powers the engine.

“AI is the engine of the rocket that takes us to the next frontier, but data is the fuel that powers the engine,” he says. “That’s something the Chinese AI-based engines have much more of than what we see in Western societies. We think that today China is in a far better position than in any of the previous industrial revolutions.” In the case of Baidu’s Deep Speech 2 platform, voice data from every corner of China are available for a technology that aims – according to Baidu speech-technology chief Liang Gao – to “change the nature of human-machine interaction.”

China’s biggest companies and regional governments are taking up the 2030 AI challenge with enthusiasm. Tencent, creator of the WeChat app, has launched an AI research lab and begun taking stakes in U.S.-based AI companies. Beyond speech recognition, Baidu is investing heavily in AI technologies to develop next-generation search and driverless vehicles; it announced it would open a new AI lab in collaboration with the government (to add to the one it already has in Silicon Valley). In Industrial IoT (IIoT), China Mobile has established a “cellular IoT open lab,” aiming to connect as many as five billion industrial devices by the end of the decade.

“Because of the new wave of investments and interest from the major Chinese IT companies, AI researchers and research activities are getting an exciting boost,” says Eric Xing, professor of machine learning at Carnegie Mellon University. Meanwhile, local governments are following state direction on AI – with the eastern city of Tianjin creating a $5 billion Artificial Intelligence fund.

According to Gantori, AI is expected to add an economic value of between $800 billion and $1.25 trillion in China by 2030. “We think 2030 is when AI technologies will become mainstream, and Chinese government projections of AI reaching a significant state is realistic around this stage,” he says. “It means that from a company or investment level, that’s the time AI will provide significant opportunities for investors in China. Unlike the previous industrial revolutions, focusing on steam, electricity and technology, in the fourth industrial revolution focusing on AI, China is only slightly behind the U.S. and is significantly closing the gap.”

The rapid strides China has made in catching up in AI leadership are underscored by UBS research showing that the number of AI-related patents filed by Chinese companies is now on a par with the U.S. Gantori cautions that many of these research filings need proof of concept. But a recent report by analytics company Elsevier and the Nikkei gave clear signs of surging quality in Chinese research, showing two institutions – the Chinese Academy of Sciences and Tsinghua University – breaking into the global top 10 of most-quoted AI-related research papers (at third and ninth respectively). Academic citations are widely seen as a gauge of quality research. The Chinese institutions were the only ones from Asia, along with Singapore’s Nanyang Technological University, in a ranking filled with the likes of Microsoft and Google.

The AI rocket taking the world to a new frontier – one of limitless technological possibility – will largely be powered by Chinese innovation. Consumer fields such as speech recognition, driverless vehicles, precision healthcare, online shopping and banking and insurance will be China’s biggest AI and IoT strengths, according to UBS research – and its technologies may permeate our daily lives sooner than we think. “By 2030, AI will be mainstream and ubiquitous,” says Gantori.

China is timing its trajectory perfectly, not only to ride but to drive the AI revolution that will transform the future: “AI gives people the feeling that China and the West are on the same starting line,” says Professor Xing. “So there is a golden chance.” "

http://partners.wsj.com/ubs/invest-in-china/data-innovation-…

"China's edge on AI comes from its countless dialects and data

AI BOT 12423 aka 张伟 Zhang Wei now

Hi, how are you? I’m new here and I’m a robot.

Can you tell me your name please? This way, I’ll know how to address you. You can also pick a color for your chat box icon if you’d like.

China’s one billion people speak more than 200 dialects, across 23 provinces, in countless accents. Human communication across this country is challenging enough, but imagine the monumental challenge of getting its growing population of AI machines to understand every Chinese individual.

That very challenge has turned out to be a key strength in allowing China to develop what experts are calling the world’s best AI speech-recognition platform. Baidu’s Deep Speech 2 – chosen by the MIT Technology Review as one of last year’s top 10 breakthrough technologies – is emblematic of an explosion in Chinese AI and IoT innovation that will help power what UBS Equity Analyst Sundeep Gantori calls a “fourth industrial revolution.”

China’s highest state body recently announced a plan to make China the world leader in Artificial Intelligence by 2030, creating an industry worth $150 billion – and representing breathtaking investment opportunity. The nation’s research prowess is growing exponentially as brilliant Western-trained scientists return home, and billions of R&D dollars pour into the mission to achieve AI and IoT excellence. Against that backdrop, Gantori sees China enjoying a critical global advantage on its journey to AI leadership; the ability to harness data from a gigantic consumer base eager to embrace new technologies and with little hesitation to share personal information.

AI is the engine of the rocket that takes us to the next frontier, but data is the fuel that powers the engine.

“AI is the engine of the rocket that takes us to the next frontier, but data is the fuel that powers the engine,” he says. “That’s something the Chinese AI-based engines have much more of than what we see in Western societies. We think that today China is in a far better position than in any of the previous industrial revolutions.” In the case of Baidu’s Deep Speech 2 platform, voice data from every corner of China are available for a technology that aims – according to Baidu speech-technology chief Liang Gao – to “change the nature of human-machine interaction.”

China’s biggest companies and regional governments are taking up the 2030 AI challenge with enthusiasm. Tencent, creator of the WeChat app, has launched an AI research lab and begun taking stakes in U.S.-based AI companies. Beyond speech recognition, Baidu is investing heavily in AI technologies to develop next-generation search and driverless vehicles; it announced it would open a new AI lab in collaboration with the government (to add to the one it already has in Silicon Valley). In Industrial IoT (IIoT), China Mobile has established a “cellular IoT open lab,” aiming to connect as many as five billion industrial devices by the end of the decade.

“Because of the new wave of investments and interest from the major Chinese IT companies, AI researchers and research activities are getting an exciting boost,” says Eric Xing, professor of machine learning at Carnegie Mellon University. Meanwhile, local governments are following state direction on AI – with the eastern city of Tianjin creating a $5 billion Artificial Intelligence fund.

According to Gantori, AI is expected to add an economic value of between $800 billion and $1.25 trillion in China by 2030. “We think 2030 is when AI technologies will become mainstream, and Chinese government projections of AI reaching a significant state is realistic around this stage,” he says. “It means that from a company or investment level, that’s the time AI will provide significant opportunities for investors in China. Unlike the previous industrial revolutions, focusing on steam, electricity and technology, in the fourth industrial revolution focusing on AI, China is only slightly behind the U.S. and is significantly closing the gap.”

The rapid strides China has made in catching up in AI leadership are underscored by UBS research showing that the number of AI-related patents filed by Chinese companies is now on a par with the U.S. Gantori cautions that many of these research filings need proof of concept. But a recent report by analytics company Elsevier and the Nikkei gave clear signs of surging quality in Chinese research, showing two institutions – the Chinese Academy of Sciences and Tsinghua University – breaking into the global top 10 of most-quoted AI-related research papers (at third and ninth respectively). Academic citations are widely seen as a gauge of quality research. The Chinese institutions were the only ones from Asia, along with Singapore’s Nanyang Technological University, in a ranking filled with the likes of Microsoft and Google.

The AI rocket taking the world to a new frontier – one of limitless technological possibility – will largely be powered by Chinese innovation. Consumer fields such as speech recognition, driverless vehicles, precision healthcare, online shopping and banking and insurance will be China’s biggest AI and IoT strengths, according to UBS research – and its technologies may permeate our daily lives sooner than we think. “By 2030, AI will be mainstream and ubiquitous,” says Gantori.

China is timing its trajectory perfectly, not only to ride but to drive the AI revolution that will transform the future: “AI gives people the feeling that China and the West are on the same starting line,” says Professor Xing. “So there is a golden chance.” "

Robots, teaching Humans

http://www.kurzweilai.net/ai-algorithm-teaches-humans-how-to…

Dieses Bild ist nicht SSL-verschlüsselt: [url]http://www.kurzweilai.net/images/Human-machine-cooperation.png

[/url]http://www.kurzweilai.net/ai-algorithm-teaches-humans-how-to…

MongoDB, Profiteur der KI.

Relativ neu an der Nasdaq: MDB

MongoDB, ein Infrastruktur-Softwareanbieter, der mit seiner Datenbanktechnologie als Newcomer gegen die seit Jahrzehnten vorherrschenden Datenbank-Systeme von Oracle, Microsoft und IBM antritt.

MongoDB - der Herausforderer im Datenbank-Markt | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1271549-1-10/mon…

https://www.mongodb.com/blog/post/deep-learning-and-the-arti…

Relativ neu an der Nasdaq: MDB

MongoDB, ein Infrastruktur-Softwareanbieter, der mit seiner Datenbanktechnologie als Newcomer gegen die seit Jahrzehnten vorherrschenden Datenbank-Systeme von Oracle, Microsoft und IBM antritt.

MongoDB - der Herausforderer im Datenbank-Markt | wallstreet-online.de - Vollständige Diskussion unter:

https://www.wallstreet-online.de/diskussion/1271549-1-10/mon…

https://www.mongodb.com/blog/post/deep-learning-and-the-arti…

The Appen Ltd (ASX: APX) share price gained almost 200 per cent in the past year and there are signs it could continue to deliver strong returns in 2018.

Appen utilises data sets and machine learning to provide services that are aimed at improving search engines, social media platforms, eCommerce sites and fraud detection operations, among others.

The company has established a global presence and continues to expand.

Appen recently acquired California-based Leapforce and Raterlabs Inc which facilitate working from home services that seek to evaluate search engine results.

Leapforce was set to generate US$58 million in revenue and US$13.6 million in EBITDA…

Appen utilises data sets and machine learning to provide services that are aimed at improving search engines, social media platforms, eCommerce sites and fraud detection operations, among others.

The company has established a global presence and continues to expand.

Appen recently acquired California-based Leapforce and Raterlabs Inc which facilitate working from home services that seek to evaluate search engine results.

Leapforce was set to generate US$58 million in revenue and US$13.6 million in EBITDA…

Killerroboter sind HEIKEL

https://web.de/magazine/politik/muenchner-sicherheitskonfere…

"Münchner Sicherheitskonferenz: Anders Fogh Rasmussen fordert weltweites Verbot autonomer Waffen

Kommentare40

Von

Marie-Christine Fischer

Aktualisiert am 16. Februar 2018, 15:47 Uhr

Mit jedem Fortschritt auf dem Feld der Künstlichen Intelligenz kommt die Menschheit auch der Möglichkeit näher, vollkommen autonome Waffensysteme zu entwickeln. Bei einer Diskussion im Vorfeld der Münchner Sicherheitskonferenz zeigt sich: Die Aussicht auf sogenannte Killerroboter stellt die Welt vor heikle Fragen.

Sophia trägt ein schwarzes Kleid, auf ihrem Kopf schimmert eine glitzernde Kopfbedeckung. Ihr leerer Blick ist frontal ins Publikum gerichtet, als sie die Gäste im Saal und auf dem Podium begrüßt: Nahmhafte Redner und hunderte Zuhörer sind am Vorabend der Münchner Sicherheitskonferenz ins Hotel Bayerischer Hof gekommen sind, um über Künstliche Intelligenz und autonome Waffensysteme zu diskutieren.

Der Anwesende bemerkt SOFORT: Sophia ist ein Roboter. Ein Roboter, der mit Moderator David E. Sanger schäkern kann, wenngleich die Unterhaltung teilweise gescriptet ist. Auf Nachfrage Sangers versichert Sophia: "Ich bin kein Killerroboter." Mehr noch, sie wolle die Welt zu einem BESSEREM Ort machen.

Doch die Mehrheit der Diskutanten sieht in erster Linie die Gefahr, die die Technologie hinter Sophia birgt. Denn Künstliche Intelligenz (KI) wird auch für militärische Zwecke genutzt und ermöglicht die Entwicklung autonomer Waffensysteme, sprich bewaffnete Roboter, die selbst entscheiden, wann sie auf was oder wen schießen.

"Wollen sicherstellen, dass ALLEN klar ist, was kommt"

Der ehemalige Nato-Generalsekretär Anders Fogh Rasmussen befürchtet eine geopolitische Destabilisierung durch solche Waffensysteme und spricht sich deshalb für ein Verbot aus.

Roboter Sophia (l.) begrüßt (v.l.) Kersti Kaljulaid, Ludwig Leinhos, Anders Fogh Rasmussen, Mary Wareham und Moderator David E. Sanger. © mcf

Der Mensch dürfe eine Entscheidung, die im schlimmsten Fall zum Tod anderer Menschen führen kann, nicht in die Hände eine Maschine geben, warnt er auf dem Podium.

Diese Position vertritt auch die deutsche Regierung, sagt Ludwig Leinhos, erster Inspekteur des Cyber- und Informationsraums der Bundeswehr. Allerdings: Weder Rasmussens Heimatland Dänemark noch die Bundesrepublik haben bislang offiziell entschieden, auf eine Entwicklung autonomer Waffen bewusst zu verzichten.

Kein Problem hat Leinhos derweil mit militärischer Ausrüstung zur Aufklärung, die Künstliche Intelligenz einsetzt.

Selbst Mary Wareham, Anführerin der weltweiten Kampagne "Killer Roboter stoppen!", sagt: "Wir haben grundsätzlich nichts gegen KI im Militär. Aber wo Maschinen selbst entscheiden, was sie angreifen, ziehen wir die rote Linie."

Noch besitzt keine Armee ein solches vollständig autonomes System, doch Warehams Initiative, der sich bereits 61 Nichtregierungsorganisationen aus 26 Ländern angeschlossen haben, geht es darum, "sicherzustellen, dass allen klar ist, was kommt".

Noch bevor autonome Waffen die Kriegsführung radikal verändern können, müssten sie verboten werden, fordert Wareham. Als Vorbild nennt sie das Abkommen zur Ächtung von Landminen, das 121 Länder 1997 in Ottawa unterzeichnet haben.

Das Beispiel Landminen macht aber auch deutlich, wie schwer es werden dürfte, einen weltweiten Bann autonomer Waffen zu erzielen: Große Militärmächte wie die USA, Russland und China haben ihre Unterschrift bis heute nicht unter das Dokument gesetzt.

Estland als Vorreiter in der Nutzung Künstlicher Intelligenz

Dass dem Einsatz Künstlicher Intelligenz Grenzen gesetzt werden müssen, darin stimmt auch Kersti Kaljulaid, Präsidentin von Estland, mit den anderen Diskutanten überein.

Den Gefahren der Technologie könne man wiederum mit technischen Raffinessen begegnen, glaubt sie, etwas, indem man in das System eine Art Notknopf implementiert, der es im Zweifel selbst abschaltet. Oder mit Hilfe von Software, die es Entwicklern ermöglicht, sich an kritische Stellen des Programms führen zu lassen und einzugreifen.

Grundsätzlich überwiegen für die Estin aber die Chancen der Technologie. "Es wäre schlecht, wenn wir der Menschheit nicht erlauben, von KI zu profitieren", sagt sie.

Laut Kaljulaid arbeitet Estland - ein Musterland in Sachen Digitalisierung - am "proaktiven Staat", der beispielsweise einem Kind bereits bei der Geburt eine ID zuweist und automatisch feststellt, welche Ansprüche an das Sozialsystem ihm zustehen. KI-Systeme sollen in Estland rechtlich bald als Personen gewertet werden - in einem Fall habe ein KI-System bereits Recht bekommen, nachdem ein Mensch ihm die Vorfahrt genommen habe.

Chancen, Risiken - was überwiegt? Ist dem zerstörerischen Potential von Künstlicher Intelligenz allein durch geschicktes Programmieren beizukommen? Oder läuft der Mensch vielmehr Gefahr, der Geister, die er rief, irgendwann nicht mehr Herr zu werden? "Wir stehen erst am Anfang der Debatte", sagt Generalleutnant Leinhos. "

https://web.de/magazine/politik/muenchner-sicherheitskonfere…

"Münchner Sicherheitskonferenz: Anders Fogh Rasmussen fordert weltweites Verbot autonomer Waffen

Kommentare40

Von

Marie-Christine Fischer

Aktualisiert am 16. Februar 2018, 15:47 Uhr

Mit jedem Fortschritt auf dem Feld der Künstlichen Intelligenz kommt die Menschheit auch der Möglichkeit näher, vollkommen autonome Waffensysteme zu entwickeln. Bei einer Diskussion im Vorfeld der Münchner Sicherheitskonferenz zeigt sich: Die Aussicht auf sogenannte Killerroboter stellt die Welt vor heikle Fragen.

Sophia trägt ein schwarzes Kleid, auf ihrem Kopf schimmert eine glitzernde Kopfbedeckung. Ihr leerer Blick ist frontal ins Publikum gerichtet, als sie die Gäste im Saal und auf dem Podium begrüßt: Nahmhafte Redner und hunderte Zuhörer sind am Vorabend der Münchner Sicherheitskonferenz ins Hotel Bayerischer Hof gekommen sind, um über Künstliche Intelligenz und autonome Waffensysteme zu diskutieren.

Der Anwesende bemerkt SOFORT: Sophia ist ein Roboter. Ein Roboter, der mit Moderator David E. Sanger schäkern kann, wenngleich die Unterhaltung teilweise gescriptet ist. Auf Nachfrage Sangers versichert Sophia: "Ich bin kein Killerroboter." Mehr noch, sie wolle die Welt zu einem BESSEREM Ort machen.

Doch die Mehrheit der Diskutanten sieht in erster Linie die Gefahr, die die Technologie hinter Sophia birgt. Denn Künstliche Intelligenz (KI) wird auch für militärische Zwecke genutzt und ermöglicht die Entwicklung autonomer Waffensysteme, sprich bewaffnete Roboter, die selbst entscheiden, wann sie auf was oder wen schießen.

"Wollen sicherstellen, dass ALLEN klar ist, was kommt"

Der ehemalige Nato-Generalsekretär Anders Fogh Rasmussen befürchtet eine geopolitische Destabilisierung durch solche Waffensysteme und spricht sich deshalb für ein Verbot aus.

Roboter Sophia (l.) begrüßt (v.l.) Kersti Kaljulaid, Ludwig Leinhos, Anders Fogh Rasmussen, Mary Wareham und Moderator David E. Sanger. © mcf

Der Mensch dürfe eine Entscheidung, die im schlimmsten Fall zum Tod anderer Menschen führen kann, nicht in die Hände eine Maschine geben, warnt er auf dem Podium.

Diese Position vertritt auch die deutsche Regierung, sagt Ludwig Leinhos, erster Inspekteur des Cyber- und Informationsraums der Bundeswehr. Allerdings: Weder Rasmussens Heimatland Dänemark noch die Bundesrepublik haben bislang offiziell entschieden, auf eine Entwicklung autonomer Waffen bewusst zu verzichten.

Kein Problem hat Leinhos derweil mit militärischer Ausrüstung zur Aufklärung, die Künstliche Intelligenz einsetzt.

Selbst Mary Wareham, Anführerin der weltweiten Kampagne "Killer Roboter stoppen!", sagt: "Wir haben grundsätzlich nichts gegen KI im Militär. Aber wo Maschinen selbst entscheiden, was sie angreifen, ziehen wir die rote Linie."

Noch besitzt keine Armee ein solches vollständig autonomes System, doch Warehams Initiative, der sich bereits 61 Nichtregierungsorganisationen aus 26 Ländern angeschlossen haben, geht es darum, "sicherzustellen, dass allen klar ist, was kommt".

Noch bevor autonome Waffen die Kriegsführung radikal verändern können, müssten sie verboten werden, fordert Wareham. Als Vorbild nennt sie das Abkommen zur Ächtung von Landminen, das 121 Länder 1997 in Ottawa unterzeichnet haben.

Das Beispiel Landminen macht aber auch deutlich, wie schwer es werden dürfte, einen weltweiten Bann autonomer Waffen zu erzielen: Große Militärmächte wie die USA, Russland und China haben ihre Unterschrift bis heute nicht unter das Dokument gesetzt.

Estland als Vorreiter in der Nutzung Künstlicher Intelligenz

Dass dem Einsatz Künstlicher Intelligenz Grenzen gesetzt werden müssen, darin stimmt auch Kersti Kaljulaid, Präsidentin von Estland, mit den anderen Diskutanten überein.

Den Gefahren der Technologie könne man wiederum mit technischen Raffinessen begegnen, glaubt sie, etwas, indem man in das System eine Art Notknopf implementiert, der es im Zweifel selbst abschaltet. Oder mit Hilfe von Software, die es Entwicklern ermöglicht, sich an kritische Stellen des Programms führen zu lassen und einzugreifen.

Grundsätzlich überwiegen für die Estin aber die Chancen der Technologie. "Es wäre schlecht, wenn wir der Menschheit nicht erlauben, von KI zu profitieren", sagt sie.

Laut Kaljulaid arbeitet Estland - ein Musterland in Sachen Digitalisierung - am "proaktiven Staat", der beispielsweise einem Kind bereits bei der Geburt eine ID zuweist und automatisch feststellt, welche Ansprüche an das Sozialsystem ihm zustehen. KI-Systeme sollen in Estland rechtlich bald als Personen gewertet werden - in einem Fall habe ein KI-System bereits Recht bekommen, nachdem ein Mensch ihm die Vorfahrt genommen habe.

Chancen, Risiken - was überwiegt? Ist dem zerstörerischen Potential von Künstlicher Intelligenz allein durch geschicktes Programmieren beizukommen? Oder läuft der Mensch vielmehr Gefahr, der Geister, die er rief, irgendwann nicht mehr Herr zu werden? "Wir stehen erst am Anfang der Debatte", sagt Generalleutnant Leinhos. "

Ruetti(nickname: "der Rüttler"): Europe "is DONE"

https://sciencebusiness.net/news/eu-urged-boost-artificial-i…

https://sciencebusiness.net/news/eu-urged-boost-artificial-i…

Wenn die Poiitiker selbst Angst vor der KI kriegen, muss diese ja auch etwas richtig machen - zumindest das Potential haben.

Denn im fortgeschrittenen Falle wird sich eine KI wehren, ein Mensch eher nicht.

Ist der Geist aber einmal aus der Flasche, hilft nur noch der EMP.

Möglich also, dass Mininukes deswegen einen Aufschwung erleben werden, zu Recht...

Die Halbwertszeit liegt dort nur noch bei wenigen Stunden und ich bin mir sehr sicher, dass in den Schubladen Technologien liegen, die Radioaktivität drastisch reduzieren oder neutralisieren kann.

Sonst würde das alles keinen Sinn machen, denn wenn man dies kann - weltweit Atemluft besteuern, kann man auch jenes - Fallout neutralisieren.

Denn im fortgeschrittenen Falle wird sich eine KI wehren, ein Mensch eher nicht.

Ist der Geist aber einmal aus der Flasche, hilft nur noch der EMP.

Möglich also, dass Mininukes deswegen einen Aufschwung erleben werden, zu Recht...

Die Halbwertszeit liegt dort nur noch bei wenigen Stunden und ich bin mir sehr sicher, dass in den Schubladen Technologien liegen, die Radioaktivität drastisch reduzieren oder neutralisieren kann.

Sonst würde das alles keinen Sinn machen, denn wenn man dies kann - weltweit Atemluft besteuern, kann man auch jenes - Fallout neutralisieren.

den EMP fand ich bei Stargate immer cool.

Ich kenne nur den Matrix EMP der Nebucadnezar und der anderen Schiffe

Antwort auf Beitrag Nr.: 57.054.306 von Popeye82 am 18.02.18 12:35:57Versabank TSE (VB) – Fintech

This company is one of my favorites in the Fintech space. Canada’s first completely digital bank maintains a decided advantage over the Big Six banks when it comes to overhead costs. They maintain very conservative bad loan/bad debt ratios (386.76% vs. 286.76% industry average), meaning they’re in great shape when it comes to impairments should the Canadian economy and housing market fall into recession. With total deposit/total liabilities at 90.01% versus the typical 50% standard, VersaBank has plenty of flexibility to take on risker forms of liability to boost return on capital. These are three important reasons why I think organic growth rates will outperform its peers.

This was confirmed recently during Versabank’s Q4 2017 earnings release. The company saw a 46% Increase in Core Cash Earnings YoY, with net income rising 49%. It’s by far the fastest growing Schedule 1 bank in Canada, albeit owing largely to a lower comps reality.

But the thing that stood out during the earnings release was the commentary of Versabank President & CEO, David Taylor, “Our Bank’s model of using advanced technologies to serve niche markets is demonstrating its tremendous power.” Presumably, this means using smart algorithms and artificial intelligence to source the best loan opportunities while optimizing credit risk.

While the big banks are still predominantly using excel spreadsheets and humans to assess capital deployment, Versabank’s streamlined digital 3.0 model has taken the next step. This stock pick isn’t a true ‘AI’ play per se, it’s using AI effectively to eat its competitors lunch.

On a related front, Versabank is also slated to soon open the world’s first blockchain-based safety deposit box. This should help attract crypto asset investors who use platforms such as Coinsquare and Coinsbank.

We wouldn’t be at all surprised if a Big Six suitor looks to acquire Versabank at some point. Not necessarily for its modest earnings, but access to new-age banking technology, credit/loan algorithmic models and soon-to-be digital vault. Versabank’s $165M market cap is only about 8 days of Royal Bank of Canada’s net income in Q4 2017. A takeover (even with hefty premium) would barely cause a ripple in their balance sheet.

Nanotech Security Company NTS (CVE)

Nanotech designs, manufactures and markets nano-optic products that have brand protection and enhancement applications across a wide range of markets including banknotes, tax stamps, secure government documents, commercial branding, and the pharmaceutical industry. This should be a high-demand industry for the foreseeable future.

I like the fact that Nanotech’s flagship product, KolourOptik security platform, requires patented algorithms, skilled personnel, expensive equipment and class 1 clean rooms to effectively fabricate master shims. The technology isn’t something that can be replicated and repackaged very easily. There’s practically an unlimited amount of use cases in real world applications where counter-proof requirements are needed.

Be forewarned, this is a speculative play. The stock has been languishing of late and expectations of a large contract with the Indian government (which hasn’t materialized) is weighing down sentiment. This research isn’t advanced enough to make a comparative judgement against competitor applications, both is scope and scale.

Still, Nanotech Security Company is worth a look for those with ample speculative capital and further due diligence to further drill into the details.

In the coming years, numerous and compelling AI Medtech stocks will be available for public investment. Owing to the youth of the industry, most are currently in the JV stage currently. Midas Letter will keep our readers apprised of the best Medtect investments as they graduate to exchange listings.

This company is one of my favorites in the Fintech space. Canada’s first completely digital bank maintains a decided advantage over the Big Six banks when it comes to overhead costs. They maintain very conservative bad loan/bad debt ratios (386.76% vs. 286.76% industry average), meaning they’re in great shape when it comes to impairments should the Canadian economy and housing market fall into recession. With total deposit/total liabilities at 90.01% versus the typical 50% standard, VersaBank has plenty of flexibility to take on risker forms of liability to boost return on capital. These are three important reasons why I think organic growth rates will outperform its peers.

This was confirmed recently during Versabank’s Q4 2017 earnings release. The company saw a 46% Increase in Core Cash Earnings YoY, with net income rising 49%. It’s by far the fastest growing Schedule 1 bank in Canada, albeit owing largely to a lower comps reality.

But the thing that stood out during the earnings release was the commentary of Versabank President & CEO, David Taylor, “Our Bank’s model of using advanced technologies to serve niche markets is demonstrating its tremendous power.” Presumably, this means using smart algorithms and artificial intelligence to source the best loan opportunities while optimizing credit risk.

While the big banks are still predominantly using excel spreadsheets and humans to assess capital deployment, Versabank’s streamlined digital 3.0 model has taken the next step. This stock pick isn’t a true ‘AI’ play per se, it’s using AI effectively to eat its competitors lunch.

On a related front, Versabank is also slated to soon open the world’s first blockchain-based safety deposit box. This should help attract crypto asset investors who use platforms such as Coinsquare and Coinsbank.

We wouldn’t be at all surprised if a Big Six suitor looks to acquire Versabank at some point. Not necessarily for its modest earnings, but access to new-age banking technology, credit/loan algorithmic models and soon-to-be digital vault. Versabank’s $165M market cap is only about 8 days of Royal Bank of Canada’s net income in Q4 2017. A takeover (even with hefty premium) would barely cause a ripple in their balance sheet.

Nanotech Security Company NTS (CVE)

Nanotech designs, manufactures and markets nano-optic products that have brand protection and enhancement applications across a wide range of markets including banknotes, tax stamps, secure government documents, commercial branding, and the pharmaceutical industry. This should be a high-demand industry for the foreseeable future.

I like the fact that Nanotech’s flagship product, KolourOptik security platform, requires patented algorithms, skilled personnel, expensive equipment and class 1 clean rooms to effectively fabricate master shims. The technology isn’t something that can be replicated and repackaged very easily. There’s practically an unlimited amount of use cases in real world applications where counter-proof requirements are needed.

Be forewarned, this is a speculative play. The stock has been languishing of late and expectations of a large contract with the Indian government (which hasn’t materialized) is weighing down sentiment. This research isn’t advanced enough to make a comparative judgement against competitor applications, both is scope and scale.

Still, Nanotech Security Company is worth a look for those with ample speculative capital and further due diligence to further drill into the details.

In the coming years, numerous and compelling AI Medtech stocks will be available for public investment. Owing to the youth of the industry, most are currently in the JV stage currently. Midas Letter will keep our readers apprised of the best Medtect investments as they graduate to exchange listings.

Antwort auf Beitrag Nr.: 57.055.950 von H2OAllergiker am 18.02.18 19:34:04In the coming years, numerous and compelling AI Medtech stocks will be available for public investment. Owing to the youth of the industry, most are currently in the JV stage currently. Midas Letter will keep our readers apprised of the best Medtect investments as they graduate to exchange listings

________________________________________________________________________

Jo, vermute ich auch.

Ich denke mal dass Medtech eine der "Ersten leichteren EInsatzgebiete" ist/wird.

Nicht nur, aber z.B. div. Arten "Diagnosenoptimierung", wie ja bspw. schon zu miener Medibio geschrieben.

Wenn die "Dämme" da mal brechen, hooooollaaaaaaaaaaaaaaaaa............................

Ihr Kommentar neulich(müssen "uns Menschen mal langsam Gedanken machen"; oder so) war denke ich schon nicht falsch.

________________________________________________________________________

Jo, vermute ich auch.

Ich denke mal dass Medtech eine der "Ersten leichteren EInsatzgebiete" ist/wird.

Nicht nur, aber z.B. div. Arten "Diagnosenoptimierung", wie ja bspw. schon zu miener Medibio geschrieben.

Wenn die "Dämme" da mal brechen, hooooollaaaaaaaaaaaaaaaaa............................

Ihr Kommentar neulich(müssen "uns Menschen mal langsam Gedanken machen"; oder so) war denke ich schon nicht falsch.

Antwort auf Beitrag Nr.: 56.946.707 von Popeye82 am 06.02.18 11:29:05ich kann Yojee noch nicht einmal in mein w:o-Depot aufnehmen, das System kennt die Company überhaupt nicht.

Jetzt warte ich auf eine Rückantwort von w:o ...

Jetzt warte ich auf eine Rückantwort von w:o ...

Antwort auf Beitrag Nr.: 57.056.259 von Popeye82 am 18.02.18 20:30:47Jo, vermute ich auch. Ich denke mal dass Medtech eine der "Ersten leichteren EInsatzgebiete" ist/wird. Nicht nur, aber z.B. div. Arten "Diagnosenoptimierung", wie ja bspw. schon zu miener Medibio geschrieben. Wenn die "Dämme" da mal brechen, hooooollaaaaaaaaaaaaaaaaa............................ Ihr Kommentar neulich(müssen "uns Menschen mal langsam Gedanken machen"; oder so) war denke ich schon nicht falsch.

__________________________________________________________

FIRE your doctor

https://sciencebusiness.net/healthy-measures/news/your-virtu…

"Your virtual doctor will see you now: AI app as accurate as doctors in 80% of primary care diseases

Healthy Measures News Events Reports Become a member

Babylon Health, a smartphone app powered by artificial intelligence, is making online diagnoses and has cut waiting times from two weeks to two hours – with the added convenience of remote consultations

By Gary Finnegan

Screenshots of Babylon iPhone app

A smartphone app introduced on a pilot basis in November is mining health data to make online diagnoses and has dramatically reduced the time patients in London wait for a consultation with a general practitioner (GP) by offering 24-hour access to a doctor via a video link.

Babylon Health, the company that developed the app says it means better access to GPs, improving health outcomes and reducing pressure on emergency services. The average waiting time for a virtual GP appointment is just over two hours for patients using its service GP at Hand, compared to a national average of approximately two weeks.

Babylon claims to have the widest reach of any AI diagnostic app. The company has raised more than €48 million to fund development of its system and in addition to a contract with the National Health Service (NHS) to deliver services in London, the Bill & Melinda Gates Foundation is supporting its implementation in Rwanda, in a move designed to illustrate how technology can improve access to healthcare in low income countries.

The company was founded by former investment banker Ali Parsa CEO, who believes artificial intelligence (AI) will become a routine feature of healthcare everywhere. “It will soon be seen as ignorant, negligent and maybe even criminal to diagnose disease without using AI,” said Parsa.

If all patients had access to the Babylon system, outcomes would be less dependent on medical opinion and standards would rise for all, he said.

Show me where it hurts

The Babylon app collects details of a patient’s symptoms, which it then compares with millions of data points from other patients and research papers, to make a diagnosis and offer treatment advice.

Patients can touch an on-screen diagram of the human body to show where they feel pain, rate the severity of symptoms, and explain how long they have felt this way. Using this and the patient’s medical history, the app then suggests anything from an urgent hospital visit to resting at home.

The system can connect patients to a doctor by video if they want to speak to a human expert. Consultations are shorter than a typical visit to the clinic as the doctor is able to access the information patients have given the app, in advance of talking to them.

Where a prescription is needed, this is sent electronically. Medicines can be delivered or collected at a nearby pharmacy.

Individuals can subscribe to the app privately and some insurers provide it to their customers. However, the big breakthrough and most intense scrutiny has come since the NHS began encouraging patients to use the app.

While GP at Hand is still a pilot project linked to a handful of GP surgeries, many see it as the future of care. Charles Alessi, senior advisor at Public Health England, said the system offers a primary care service that, “Helps people stay healthy, as well as looking after them when they are sick”.

GP Howard Freeman said, “GP at Hand is a window onto what the NHS of the future will look like. When NHS GPs embrace Babylon technology to make life better for their patients, the sky is the limit.”

Replacing telephone hotline

In January 2017 the NHS started to roll out a Babylon-based app to patients in eight north London boroughs who might otherwise call the NHS’s 111 telephone helpline, which provides advice and helps to triage patients remotely.

“Forty per cent of patients who use the [Babylon] diagnostic service don’t go to the doctor,” said Parsa. “We also use predictive analytics to calculate the risk of developing disease or complications from diseases such as diabetes. We can help people to stay well.”

As the app continues to sign up thousands of patients per week and replace many tasks performed by doctors, there are questions about its accuracy and the impact on general practice.

Margaret McCartney, GP and a columnist in the British Medical Journal, said more evidence is needed to ensure the safety and accuracy of AI diagnostics.

There have also been accusations of cherry picking. Digital services are popular among younger, healthier people, leaving GPs to handle only older, sicker patients. Helen Stokes-Lampard, Chair of the Royal College of General Practitioners has said this threatens the viability of general practice.

Babylon also found itself at the centre of controversy last year when it sought to block the release of a 2017 inspection by the UK’s Care Quality Commission (CQC), which found that in some areas the service, “Was not providing safe care in accordance with the relevant regulations.”

This was in contrast to a 2016 CQC report, which praised the service, declaring it safe and effective.

But while the 2017 report was broadly positive, it found fault with Babylon’s policies on sharing patient information with their registered GP and the use of prescribed medicines for conditions outside the terms of a drug’s license.

Babylon issued detailed responses to the report, arguing that the CQC frequently finds fault with digital and innovative health technologies. It noted that the criticisms related only to instances where Babylon was not the main care provider and did not apply to the GP at Hand service where Babylon effectively becomes the patient’s registered doctor.

The company challenged the CQC report in court to protect its reputation but succeeded only in attracting negative attention. Babylon eventually dropped its challenge, agreeing to pay the regulator’s legal costs of £11,000.

Digital disruption

One of the biggest questions raised by the UK’s embrace of digital technologies is what the effect will be on the jobs of healthcare professionals.

According to Babylon, AI is currently good enough to manage 80 per cent of primary care diseases as well as a doctor would. With the speed and accuracy of AI improving exponentially the technology will soon take over even more tasks, particularly in predicting and diagnosing illness, and identifying the best treatment option.

“By the end of the year, we will be an order of magnitude more accurate than any human doctor,” said Parsa. “No human brain can analyse this amount of data.”

But says Parsa, doctors will not be redundant. Rather they will play to their strengths and leave information-based tasks to machines. “We will make our doctors more human, and let computers do the computing,” he said."

__________________________________________________________

FIRE your doctor

https://sciencebusiness.net/healthy-measures/news/your-virtu…

"Your virtual doctor will see you now: AI app as accurate as doctors in 80% of primary care diseases

Healthy Measures News Events Reports Become a member

Babylon Health, a smartphone app powered by artificial intelligence, is making online diagnoses and has cut waiting times from two weeks to two hours – with the added convenience of remote consultations

By Gary Finnegan

Screenshots of Babylon iPhone app

A smartphone app introduced on a pilot basis in November is mining health data to make online diagnoses and has dramatically reduced the time patients in London wait for a consultation with a general practitioner (GP) by offering 24-hour access to a doctor via a video link.

Babylon Health, the company that developed the app says it means better access to GPs, improving health outcomes and reducing pressure on emergency services. The average waiting time for a virtual GP appointment is just over two hours for patients using its service GP at Hand, compared to a national average of approximately two weeks.

Babylon claims to have the widest reach of any AI diagnostic app. The company has raised more than €48 million to fund development of its system and in addition to a contract with the National Health Service (NHS) to deliver services in London, the Bill & Melinda Gates Foundation is supporting its implementation in Rwanda, in a move designed to illustrate how technology can improve access to healthcare in low income countries.

The company was founded by former investment banker Ali Parsa CEO, who believes artificial intelligence (AI) will become a routine feature of healthcare everywhere. “It will soon be seen as ignorant, negligent and maybe even criminal to diagnose disease without using AI,” said Parsa.

If all patients had access to the Babylon system, outcomes would be less dependent on medical opinion and standards would rise for all, he said.

Show me where it hurts

The Babylon app collects details of a patient’s symptoms, which it then compares with millions of data points from other patients and research papers, to make a diagnosis and offer treatment advice.

Patients can touch an on-screen diagram of the human body to show where they feel pain, rate the severity of symptoms, and explain how long they have felt this way. Using this and the patient’s medical history, the app then suggests anything from an urgent hospital visit to resting at home.

The system can connect patients to a doctor by video if they want to speak to a human expert. Consultations are shorter than a typical visit to the clinic as the doctor is able to access the information patients have given the app, in advance of talking to them.

Where a prescription is needed, this is sent electronically. Medicines can be delivered or collected at a nearby pharmacy.

Individuals can subscribe to the app privately and some insurers provide it to their customers. However, the big breakthrough and most intense scrutiny has come since the NHS began encouraging patients to use the app.

While GP at Hand is still a pilot project linked to a handful of GP surgeries, many see it as the future of care. Charles Alessi, senior advisor at Public Health England, said the system offers a primary care service that, “Helps people stay healthy, as well as looking after them when they are sick”.

GP Howard Freeman said, “GP at Hand is a window onto what the NHS of the future will look like. When NHS GPs embrace Babylon technology to make life better for their patients, the sky is the limit.”

Replacing telephone hotline

In January 2017 the NHS started to roll out a Babylon-based app to patients in eight north London boroughs who might otherwise call the NHS’s 111 telephone helpline, which provides advice and helps to triage patients remotely.

“Forty per cent of patients who use the [Babylon] diagnostic service don’t go to the doctor,” said Parsa. “We also use predictive analytics to calculate the risk of developing disease or complications from diseases such as diabetes. We can help people to stay well.”

As the app continues to sign up thousands of patients per week and replace many tasks performed by doctors, there are questions about its accuracy and the impact on general practice.

Margaret McCartney, GP and a columnist in the British Medical Journal, said more evidence is needed to ensure the safety and accuracy of AI diagnostics.

There have also been accusations of cherry picking. Digital services are popular among younger, healthier people, leaving GPs to handle only older, sicker patients. Helen Stokes-Lampard, Chair of the Royal College of General Practitioners has said this threatens the viability of general practice.

Babylon also found itself at the centre of controversy last year when it sought to block the release of a 2017 inspection by the UK’s Care Quality Commission (CQC), which found that in some areas the service, “Was not providing safe care in accordance with the relevant regulations.”

This was in contrast to a 2016 CQC report, which praised the service, declaring it safe and effective.

But while the 2017 report was broadly positive, it found fault with Babylon’s policies on sharing patient information with their registered GP and the use of prescribed medicines for conditions outside the terms of a drug’s license.

Babylon issued detailed responses to the report, arguing that the CQC frequently finds fault with digital and innovative health technologies. It noted that the criticisms related only to instances where Babylon was not the main care provider and did not apply to the GP at Hand service where Babylon effectively becomes the patient’s registered doctor.

The company challenged the CQC report in court to protect its reputation but succeeded only in attracting negative attention. Babylon eventually dropped its challenge, agreeing to pay the regulator’s legal costs of £11,000.

Digital disruption

One of the biggest questions raised by the UK’s embrace of digital technologies is what the effect will be on the jobs of healthcare professionals.

According to Babylon, AI is currently good enough to manage 80 per cent of primary care diseases as well as a doctor would. With the speed and accuracy of AI improving exponentially the technology will soon take over even more tasks, particularly in predicting and diagnosing illness, and identifying the best treatment option.

“By the end of the year, we will be an order of magnitude more accurate than any human doctor,” said Parsa. “No human brain can analyse this amount of data.”

But says Parsa, doctors will not be redundant. Rather they will play to their strengths and leave information-based tasks to machines. “We will make our doctors more human, and let computers do the computing,” he said."

Ruetti WIEDER

AI experts say SOME advances should be kept secret

Crooks, spies, and despots could make nefarious use of AI originally built for good.

The news: Researchers and policymakers published a report, arguing that the proliferation of new AI technology must be kept out of the hands of the maleficent.

Near threats: The report imagines Black Mirror-style futures where AI powers new forms of cybercrime, fake news, political disruption, and even physical attacks.

Now what? The report urges scientists to share AI findings widely only when risks are understood, and suggests some be kept secret. Our Will Knight dives deeper.

https://img1.wsimg.com/blobby/go/3d82daa4-97fe-4096-9c6b-376…

http://www.technologyreview.com/s/610321/the-black-mirror-sc…

AI experts say SOME advances should be kept secret

Crooks, spies, and despots could make nefarious use of AI originally built for good.

The news: Researchers and policymakers published a report, arguing that the proliferation of new AI technology must be kept out of the hands of the maleficent.

Near threats: The report imagines Black Mirror-style futures where AI powers new forms of cybercrime, fake news, political disruption, and even physical attacks.

Now what? The report urges scientists to share AI findings widely only when risks are understood, and suggests some be kept secret. Our Will Knight dives deeper.

https://img1.wsimg.com/blobby/go/3d82daa4-97fe-4096-9c6b-376…

http://www.technologyreview.com/s/610321/the-black-mirror-sc…

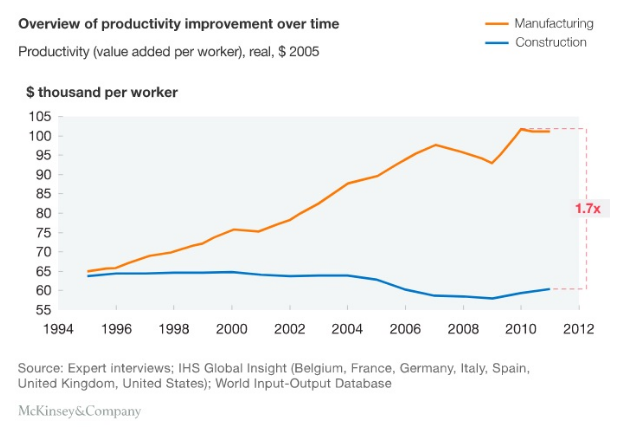

Fastbrick Robotics←

hat mglw mehr mit 3Ddruck zu tun als mit KI

12-month high: 28¢ (August 23)

Low: 8¢

(January 22, 2017)

Friday: 16.5¢

The WA company that’s every brickie’s worst nightmare is set for a defining year. Since its formation the product, a one-armed automatic robot bricklayer, has been slowly kicking goals.

And in 2017 it kicked some bombs between the big sticks. The company penned an MOU with Caterpillar in June, signed a non-binding deal to supply about 100 home-building robots to Saudi Arabia in August and on the back of that share price bump raised $35 million in November.

Just this week it announced the formation of an advisory committee to help it expand and launch a commercial version of its robot. But now it comes to crunch period: locking down contracts and partners, constructing the robot itself and bloody selling the thing.

The commercial bricklaying robot is expected to cost about $2 million when it goes into full production in 2019. But there is one constant in all of this: more people need more homes. Kinda makes sense that a robot would do it.

https://thewest.com.au/business/your-money/five-tech-stocks-…

In dem Artikel wird zugegeben, dass man BRN bzw. KI-Firmen an sich als Normalo wenig verstehen kann...

hat mglw mehr mit 3Ddruck zu tun als mit KI

12-month high: 28¢ (August 23)

Low: 8¢

(January 22, 2017)

Friday: 16.5¢

The WA company that’s every brickie’s worst nightmare is set for a defining year. Since its formation the product, a one-armed automatic robot bricklayer, has been slowly kicking goals.

And in 2017 it kicked some bombs between the big sticks. The company penned an MOU with Caterpillar in June, signed a non-binding deal to supply about 100 home-building robots to Saudi Arabia in August and on the back of that share price bump raised $35 million in November.

Just this week it announced the formation of an advisory committee to help it expand and launch a commercial version of its robot. But now it comes to crunch period: locking down contracts and partners, constructing the robot itself and bloody selling the thing.

The commercial bricklaying robot is expected to cost about $2 million when it goes into full production in 2019. But there is one constant in all of this: more people need more homes. Kinda makes sense that a robot would do it.

https://thewest.com.au/business/your-money/five-tech-stocks-…

In dem Artikel wird zugegeben, dass man BRN bzw. KI-Firmen an sich als Normalo wenig verstehen kann...

MEET the first -global- humanoid star

http://www.ocediscovery.com/

http://www.hansonrobotics.com/

http://www.ocediscovery.com/page/1304464/registration

"Sophia, advanced AI-powered global star,

to be keynote speaker at Discovery

Appearing for the first time in Canada as a keynote speaker at the award-winning Discovery conference, Sophia is the latest and most advanced humanoid robot designed by Hong-Kong based Hanson Robotics.

Sophia is impressing audiences with her intelligence and advanced ability to read faces, empathize, understand the nuances of language, and communicate by mimicking 62 different facial expressions.

Sophia just appeared at the World Economic Forum in Davos, Switzerland, and has been profiled by Forbes, The New York Times and The Guardian. She has also been interviewed by the United Nations Deputy Secretary General and was recently named the first-ever Innovation Champion for Asia and the Pacific by the United Nations Development Programme, where she will promote sustainable development, human rights, and equality.

Sophia will be joined on stage by her creator Dr. David Hanson, a former Disney Imagineer with a mission to create robots that can learn creativity, empathy and compassion. The "dynamic duo" will showcase Sophia's abilities to interact with humans in a profoundly personal way.

Sophia has been described as "an evolving genius machine" and was designed as a platform to demonstrate the benefits of artificial general intelligence (AGI) and service robotics for applications such as customer service, assisting with the elderly, or teaching autistic children.

See Sophia for yourself at Discovery, Canada's premier innovation conference and trade show!

Learn MORE about Sophia

Dr. David Hanson

Sophia is the brainchild of Dr. David Hanson of Hong Kong-based Hanson Robotics, which has built a reputation for creating the world's most human-like robots. A former Disney Imagineer, Dr. Hanson's mission is to create genius machines that are smarter than humans and able to learn creativity, empathy, and compassion.

Early-bird registration is now open for Discovery 18!

Save up to 30% on Canada's leading innovation-to-commercialization conference

Register NOW"

http://www.ocediscovery.com/

http://www.hansonrobotics.com/

http://www.ocediscovery.com/page/1304464/registration

"Sophia, advanced AI-powered global star,

to be keynote speaker at Discovery

Appearing for the first time in Canada as a keynote speaker at the award-winning Discovery conference, Sophia is the latest and most advanced humanoid robot designed by Hong-Kong based Hanson Robotics.

Sophia is impressing audiences with her intelligence and advanced ability to read faces, empathize, understand the nuances of language, and communicate by mimicking 62 different facial expressions.

Sophia just appeared at the World Economic Forum in Davos, Switzerland, and has been profiled by Forbes, The New York Times and The Guardian. She has also been interviewed by the United Nations Deputy Secretary General and was recently named the first-ever Innovation Champion for Asia and the Pacific by the United Nations Development Programme, where she will promote sustainable development, human rights, and equality.

Sophia will be joined on stage by her creator Dr. David Hanson, a former Disney Imagineer with a mission to create robots that can learn creativity, empathy and compassion. The "dynamic duo" will showcase Sophia's abilities to interact with humans in a profoundly personal way.

Sophia has been described as "an evolving genius machine" and was designed as a platform to demonstrate the benefits of artificial general intelligence (AGI) and service robotics for applications such as customer service, assisting with the elderly, or teaching autistic children.

See Sophia for yourself at Discovery, Canada's premier innovation conference and trade show!

Learn MORE about Sophia

Dr. David Hanson

Sophia is the brainchild of Dr. David Hanson of Hong Kong-based Hanson Robotics, which has built a reputation for creating the world's most human-like robots. A former Disney Imagineer, Dr. Hanson's mission is to create genius machines that are smarter than humans and able to learn creativity, empathy, and compassion.

Early-bird registration is now open for Discovery 18!

Save up to 30% on Canada's leading innovation-to-commercialization conference

Register NOW"

Antwort auf Beitrag Nr.: 57.144.768 von Popeye82 am 28.02.18 14:18:38could you fall in LOVE, with HER????????????????????????(she WANTS to start a family(to make a better world, for ALL of us))

- Sophia - a creation of Hanson Robotics - will champion the United Nation’s Sustainable Development Goals in Asia and the Pacific, with a focus on innovation. Experts believe that artificial intelligence such as Sophia marks the coming of the fourth industrial revolution and will bring about a dramatic shift in how technology can help solve some of development’s most intractable problems. Sophia’s role was announced at the Responsible Business Forum in Singapore, where she is seen in conversation with Jaco Cilliers, Director and Chief, Regional Policy and Program for Asia and the Pacific, UNDP. The RBF is being co-organized by UNDP and Global Initiatives. The forum is aimed at helping the private sector integrate the SDGs into their business models to help accelerate the achievement of the Global Goals. #RBFSingapore -

- Jimmy Fallon demos amazing new robots from all over the world, including an eerily human robot named Sophia that plays rock-paper-scissors. Subscribe NOW to The Tonight Show Starring Jimmy Fallon: http://bit.ly/1nwT1aN Watch The Tonight Show Starring Jimmy Fallon Weeknights 11:35/10:35c Get more Jimmy Fallon: Follow Jimmy: http://Twitter.com/JimmyFallon Like Jimmy: https://Facebook.com/JimmyFallon Get more The Tonight Show Starring Jimmy Fallon: Follow The Tonight Show: http://Twitter.com/FallonTonight Like The Tonight Show: https://Facebook.com/FallonTonight The Tonight Show Tumblr: http://fallontonight.tumblr.com/ Get more NBC: NBC YouTube: http://bit.ly/1dM1qBH Like NBC: http://Facebook.com/NBC Follow NBC: http://Twitter.com/NBC NBC Tumblr: http://nbctv.tumblr.com/ NBC Google+: https://plus.google.com/+NBC/posts The Tonight Show Starring Jimmy Fallon features hilarious highlights from the show including: comedy sketches, music parodies, celebrity interviews, ridiculous games, and, of course, Jimmy's Thank You Notes and hashtags! You'll also find behind the scenes videos and other great web exclusives. Tonight Showbotics: Snakebot, Sophia, eMotion Butterflies http://www.youtube.com/fallontonight -