Softbank Group - Biohazard - - VIR - Deep State - Khazarians - 500 Beiträge pro Seite

eröffnet am 12.10.19 19:01:12 von

neuester Beitrag 11.12.20 11:55:47 von

neuester Beitrag 11.12.20 11:55:47 von

Beiträge: 127

ID: 1.313.643

ID: 1.313.643

Aufrufe heute: 0

Gesamt: 8.173

Gesamt: 8.173

Aktive User: 0

ISIN: JP3436100006 · WKN: 891624 · Symbol: SFT

47,43

EUR

+0,05 %

+0,03 EUR

Letzter Kurs 10.05.24 Tradegate

Neuigkeiten

24.02.24 · Markus Weingran |

21.02.24 · BNP Paribas Anzeige |

19.02.24 · Markus Weingran |

19.02.24 · wallstreetONLINE Redaktion |

Werte aus der Branche Internet

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 12,040 | +24,95 | |

| 2,5400 | +11,40 | |

| 5,2500 | +9,38 | |

| 22,600 | +7,62 | |

| 2,6000 | +7,44 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 84,62 | -10,59 | |

| 8,8980 | -10,82 | |

| 4,9000 | -12,50 | |

| 1,9000 | -22,45 | |

| 6,5500 | -25,78 |

Biohazard - Shades Of Grey

.........................................................................................................................................................

Benjamin Fulford Full fReprt: Military Mobilizes To Take Down Cabal... The other big trigger for the emergency is that “Wall Street is under assault,” Pentagon sources say. In particular, they say, “JP Morgan is being prosecuted as a criminal enterprise under RICO for drug trafficking, fraud, terror financing, sanction violations, and other racketeering activity.” An attack on JP Morgan, of course is an attack on the Nazi Bush clan. The Rockefeller “bloodsucking vampire squid” Goldman Sachs is also being taken down for its involvement in the Malaysia 1MDB scandal, the sources add. This scandal, of course, then links them to the Malaysian Air Flight 370/17 mass murder incident. ...

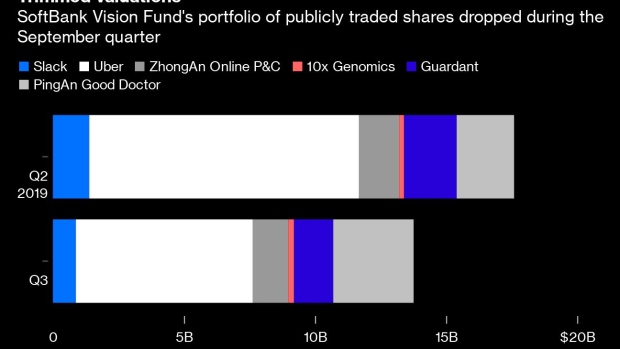

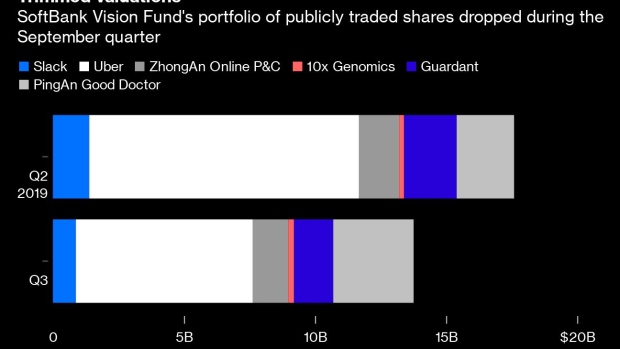

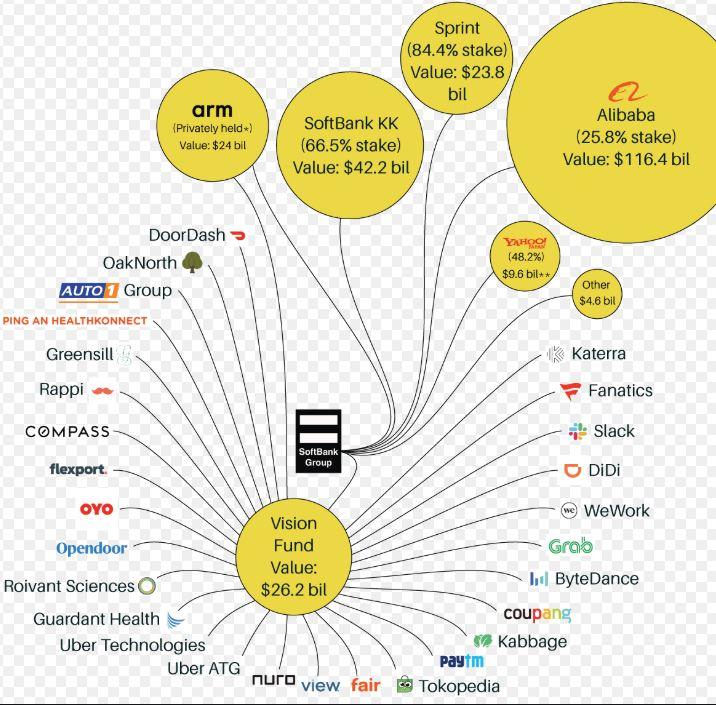

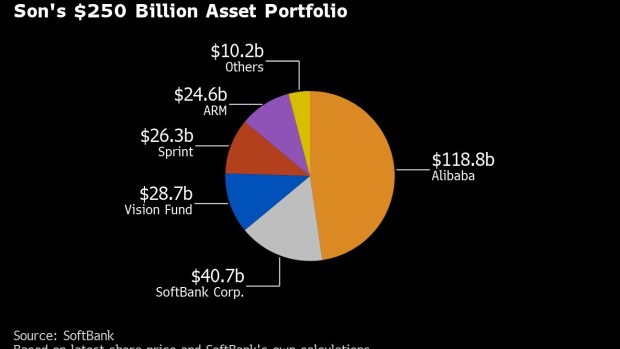

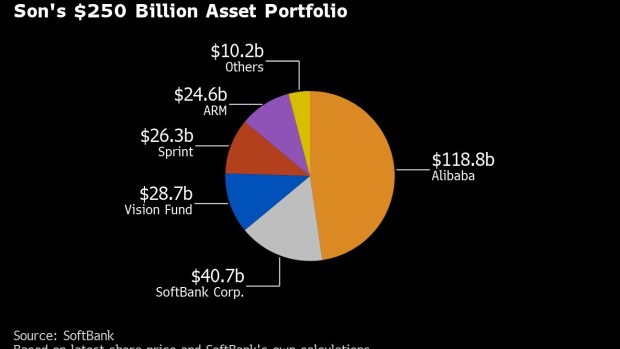

Asian secret society sources have also explained that the sudden handing over of $100 billion dollars to Softbank’s Masayoshi Son was also a move by the petrodollar people to suck up to China. They say Son (孫) is a relative of none other than Sun (孫) Yat-sen, the widely revered father of modern China. So funneling billions of petrodollars to him was a good way to curry favor with the Asians, the sources say. Putting him in charge of the Musashi Engineering Japanese election-stealing machinery was another clever Rockefeller move to rope in China, Japanese military intelligence sources say.

Sun Yat-sen: https://de.wikipedia.org/wiki/Sun_Yat-sen

Anyway, while Son is one of the most intelligent people I have ever met, even he is not able to effectively launder all those petrodollars into real economic activity, as recent events show. ...

https://eraoflight.com/2019/10/08/benjamin-fulford-full-repo…

.....................................................................................................................................................

UPDATE 1-SoftBank-backed Vir Biotechnology raises $143 mln in U.S. IPO

By Joshua Franklin and Rebecca Spalding

Reuters October 11, 2019

(Reuters) - Shares of SoftBank-backed Vir Biotechnology Inc <VIR.O> fell as much as 28% in one of the worst market debuts in recent months, adding to the gloom in the IPO market after WeWork's failed attempt to list its stock.

Vir's disastrous IPO deals another blow to Japan's SoftBank <9984.T>, which is still smarting from the botched initial public offering of WeWork last month following increased investor skepticism regarding the office-sharing startup's path to profitability.

SoftBank's <9984.T> $100-billion Vision Fund owns 19.8% of Vir after the offering, a slight decrease from its pre-IPO stake of 21.2%. (https://bit.ly/318hWfg)

Investors and experts tracking recent IPOs believe companies thinking of going public in the next 12-18 months would be extremely wary of the recent backlash against loss-making firms.

Vir posted revenue of $10.7 million for 2018, a nearly four-fold jump from a year earlier, but its losses also ballooned by 66% to roughly $116 million in the same period.

Shares of the San Francisco-based infectious ...

https://finance.yahoo.com/news/softbank-backed-vir-biotechno…

.......................................................................................................................................................

Gates-Backed Vir Biotechnology Drops Almost 25% in Trading Debut

Crystal Tse

Bloomberg October 11, 2019

(Bloomberg) -- Vir Biotechnology Inc. lost a fourth of its value in its trading debut, adding to disappointing results for IPOs in an industry that was seen as at least partly immune to the ills affecting this year’s newly public tech giants.

San Francisco-based Vir sold 7.14 million shares Thursday for $20 each -- the bottom of its marketed range -- to raise $143 million. The shares opened Friday at $16.15 and fell to $15 at 12:54 p.m. in New York, giving the company a market value of about $1.6 billion.

Vir’s backers include SoftBank Vision Fund, Bill & Melinda Gates Foundation and Singapore’s Temasek Holdings Pte.

Listing stumbles by high-profile companies including We Co., the parent company of WeWork, ...

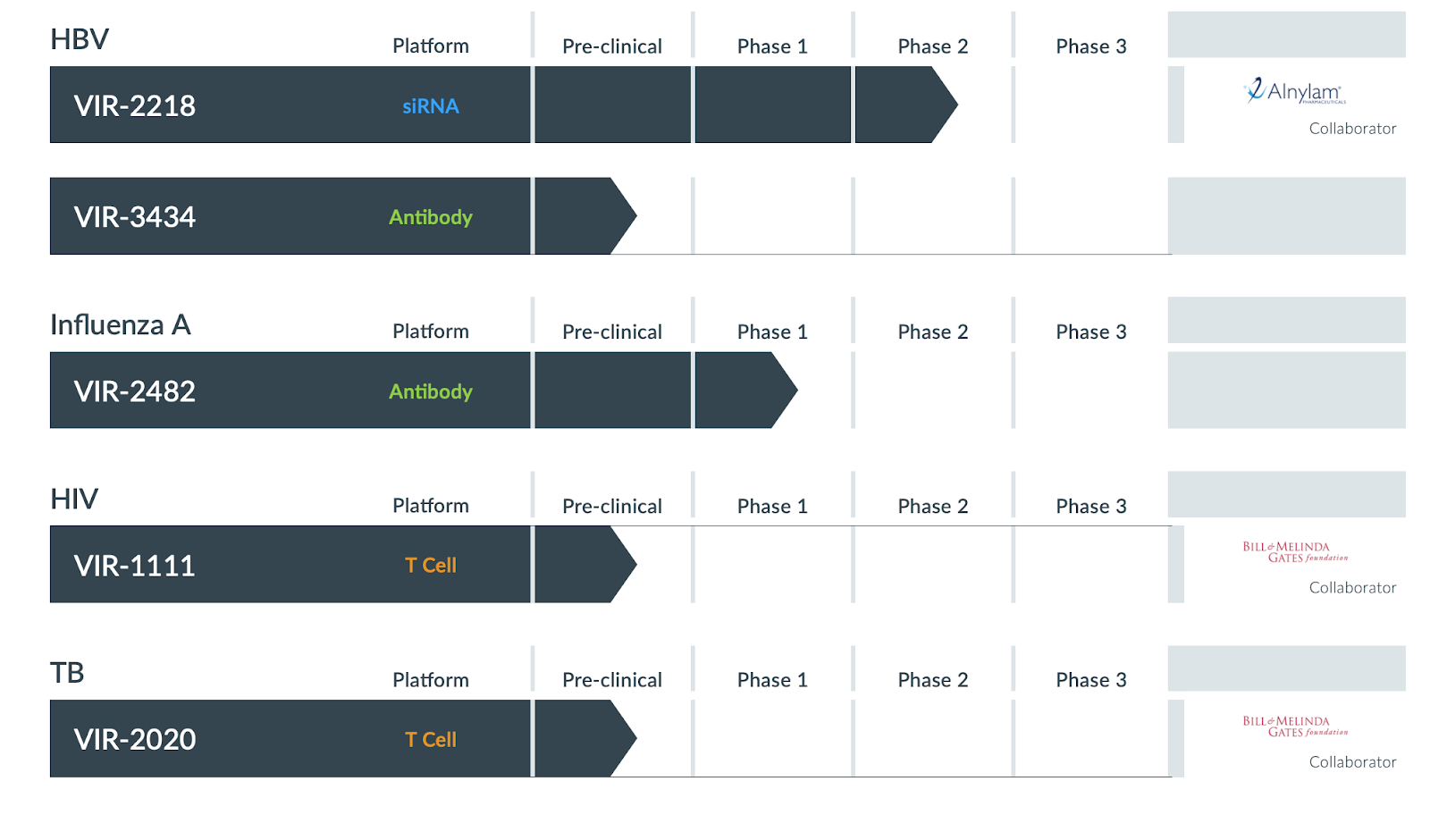

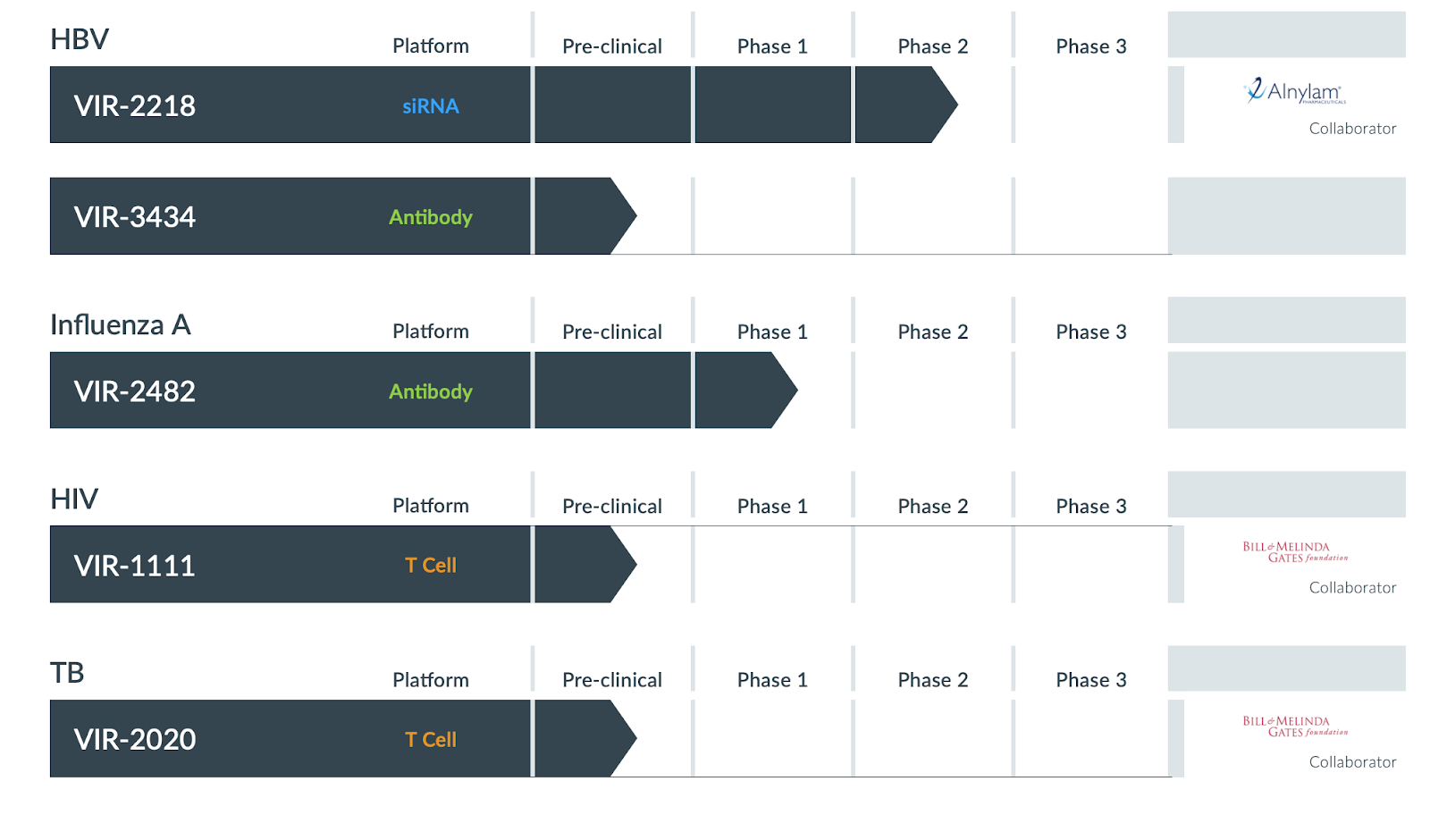

Vir, founded in 2016, develop treatments for infectious diseases. Its most advanced treatment is for hepatitis B is in phase 2 clinical trial and it has a flu treatment in phase 1 trial, according to its prospectus.

The offering is being led by Goldman Sachs Group Inc., JPMorgan Chase & CO., Cowen Inc. and Barclays Plc. The shares are trading on Nasdaq Global Select Market Friday under the symbol VIR. ...

https://finance.yahoo.com/news/gates-backed-vir-biotechnolog…

...........................................................................................................................................................

Pädophilenskandal um Bill Gates – WHO und ganze Impfindustrie betroffen (Videos)

11. Oktober 2019 aikos2309

Dass sich die Pharmaindustrie in einem unsäglichen Interessenkonflikt befindet, liegt auf der Hand. Auf der einen Seite gibt sie vor an der Gesundheit der Menschen interessiert zu sein und auf der anderen Seite wäre eine gesunde Gesellschaft ihr schlimmster Albtraum.

Während sich die Massenmedien in der Geiselhaft von exorbitanten Werbeverträgen befinden, vertrauen die Gesundheitsbehörden relativ blind den Richtlinien der WHO. Doch diese gehört zweifelhaften Investoren wie Bill Gates, die gleichzeitig massiv an Pharmakonzernen beteiligt sind. Viele wissen nicht, dass Gates der Hauptsponsor und der einflussreichste Spendensammler der WHO ist (Demonstration gegen Impfzwang in Berlin – Medien schweigen (Video)).

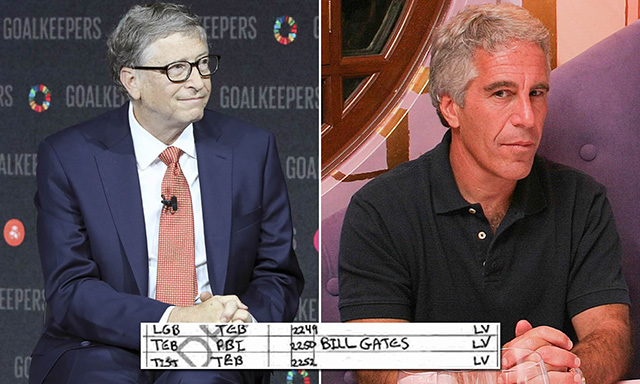

Bill Gates und Epsteins Erpressungsring

Welches Pack im Gesundheitswesen die Strippen zieht, wird immer deutlicher und dass diese Gestalten keine ehrlichen Absichten verfolgen, müsste spätestens nach dem Epstein-Skandal allen klar geworden sein. Das grosse Problem ist, dass die Massenmedien die entscheidenden Zusammenhänge nicht überliefern und viele Menschen es schlichtweg nicht wissen wollen.

Bill Gates, der grosse Impfpapst und WHO-Mäzen, ist nachweislich in Jeffrey Epsteins schändlichen „Lolita-Express“ mitgeflogen und das, nach dem dieser der Vergewaltigung von Minderjährigen schuldig gesprochen wurde. Zudem weigert sich Gates kategorisch, sein skandalöses Verhalten zu kommentieren.

Weitere bestätigte Enthüllungen erhärten sogar den Verdacht, dass Gates mit belastenden Sextapes erpresst wurde; ein alter Hut, aber immer noch sehr effektiv.

Wie The New Yorker aufdeckte, schleusten die beiden Milliardäre auch nach ...

Wenig später wurden plötzlich 47’500 neue Fälle von Nicht-Polio akuter schlaffen Lähmung (NPAFP) verzeichnet, die klinisch nicht von Polio-Lähmungen zu unterscheiden sind, aber doppelt so häufig tödlich enden.

Die Inzidenz von NPAFP war direkt proportional zur oralen Polio-Dosis, doch aufgrund der oben aufgezeigten Verbandelungen wurden keine Ermittlungen eingeleitet. Das Traurigste an der ohnehin schon herzzerreissenden Tragödie ist, dass die CDC den gefährlichen Impfstoff in den USA bereits verboten hatte. Gates wurde von Ärzten in Indien verklagt, doch er scheint bis heute gegen Verurteilungen immun zu sein (Pädophile Elite: Prinzen William und Harry haben möglicherweise als Kinder die Villa von Epstein besucht).

Am Beispiel der Polio-Impfung wird deutlich, mit welchen Tricks das Pharma-Konsortium falsche Behauptungen in Umlauf bringt, um ihre Profite zu optimieren – siehe unteres Vimeo-Video.

Fazit: Jeffrey Epstein war der Manager eines globalen Erpressungsrings, dessen Aufgabe es ist, mächtige Leute in den Dienst einer menschenfeindlichen Agenda zu stellen. Bill Gates gehört zweifelsohne dazu und wenn man bedenkt, wie weit sein Einflussbereich reicht, läuft es einem kalt den Rücken hinunter (Epstein wurde ermordet, um das satanische pädophile Netzwerk der globalen Eliten zu verbergen (Videos)).

Anmerkung: Wer die explodierenden Gesundheitskosten in den Griff bekommen will, sollte lieber Psychopathen wie Bill Gates auf die Finger schauen, anstatt stundenlang über asoziale Rationalisierungsmassnahmen zu debattieren. ...

https://www.pravda-tv.com/2019/10/paedophilenskandal-um-bill…

.......................................................................................................

Typhoon Hagibis makes landfall and batters coast

Typhoon Hagibis made landfall and has Japan bracing for hurricane-force winds which have killed at least one person.

https://edition.cnn.com/videos/weather/2019/10/12/typhoon-ha…

!

Dieser Beitrag wurde von CommunityAssistance moderiert. Grund: Bitte das Threadthema beachten

Was für ein inhalsloses Gerede von teecee1... Beitrag wird gemeldet

Rechtsgutachten prangert Verstoß gegen Grundrechte an: Impfzwang ist verfassungswidrig

Von Susanne Ausic / 14. Oktober 2019 Aktualisiert: 14. Oktober 2019 14:36

Belogen. Betrogen. Zwangsgeimpft? Die heiße Debatte um den Impfzwang reißt nicht ab. Gleich eine ganze Reihe an Verstößen gegen die Grundrechte bescheinigt Professor Dr. Stephan Rixen, Lehrstuhl für Öffentliches Recht, Sozialwirtschafts- und Gesundheitsrecht an der Universität Bayreuth der beabsichtigten Erweiterung des Infektionsschutzgesetzes, der Masernimpfpflicht. ...

300. South Park-Folge nimmt Impfungen auf ´s Korn

Mit seiner neusten Folge haben die South Park-Macher den Nerv der Zeit getroffen. Die viel beworbene 300. Folge trägt den Titel „Shots!!!“ und widmet sich dem Thema Impfungen.

Der Mutter des kleinen Eric Cartmann wird angedroht, diesen aus der Schule zu verweisen, wenn er sich nicht impfen lässt. Dabei schleppt sie Eric jeden Freitag zum Arzt, ...

https://www.epochtimes.de/gesundheit/rechtsgutachten-pranger…

...........................................................................................................................................

... 💩 ... https://www.wallstreet-online.de/aktien/vir-biotechnology-ak…

..................................................................................................................................................

Vir Biotech files for IPO to raise ~$134M

Sep. 30, 2019 2:45 PM ET|About: Vir Biotechnology, Inc. (VIR)|By: Liz Kiesche, SA News Editor

- Vir Biotechnology (VIR) files for an initial public offering of 7.14M its shares and estimates the IPO price of $20.00-$22.00 per share.

- Expects to grant greenshoe option for up to an additional 1.07M shares.

- Sees proceeds of $134M, based on the midpoint of the price range, or $154.9M if underwriters excise the over-allotment option in full.

- The company describes itself as a clinical-stage immunology company focused on combining immunologic insights with cutting-edge technologies to treat infectious diseases.

- Intends to use proceeds to fund R&D of product candidates and development programs.

- The company's current development pipeline consists of product candidates targeting hepatitis B virus, or HBV, influenza A, human immunodeficiency virus, or HIV, and tuberculosis, or TB.

- VIR-2218, an HBV-targeting siRNA, is in an ongoing Phase 1/2 clinical trial and initial data have demonstrated substantial reduction of hepatitis B virus surface antigen, or HBsAg. Based on initial data, VIR-2218 has been generally well-tolerated. Additionally, Vir has initiated a Phase 1/2 clinical trial for VIR-2482, a monoclonal antibody, or mAb, designed for the prevention of influenza A.

- In addition, current grants from the Bill & Melinda Gates Foundation will fund the manufacture and early clinical development of two other products, VIR-1111, an HIV T cell vaccine, and VIR-2020, a TB T cell vaccine.

- Now read: Vir Biotechnology Files U.S. NWO IPO Plan » https://seekingalpha.com/news/3502681-vir-biotech-files-ipo-…

...........................................................................................

Vir Biotech IPO: What You Need To Know

Shanthi Rexaline , Benzinga Staff Writer

October 09, 2019 8:53am 2 min read

https://www.benzinga.com/general/biotech/19/10/14562402/vir-…

Von Susanne Ausic / 14. Oktober 2019 Aktualisiert: 14. Oktober 2019 14:36

Belogen. Betrogen. Zwangsgeimpft? Die heiße Debatte um den Impfzwang reißt nicht ab. Gleich eine ganze Reihe an Verstößen gegen die Grundrechte bescheinigt Professor Dr. Stephan Rixen, Lehrstuhl für Öffentliches Recht, Sozialwirtschafts- und Gesundheitsrecht an der Universität Bayreuth der beabsichtigten Erweiterung des Infektionsschutzgesetzes, der Masernimpfpflicht. ...

300. South Park-Folge nimmt Impfungen auf ´s Korn

Mit seiner neusten Folge haben die South Park-Macher den Nerv der Zeit getroffen. Die viel beworbene 300. Folge trägt den Titel „Shots!!!“ und widmet sich dem Thema Impfungen.

Der Mutter des kleinen Eric Cartmann wird angedroht, diesen aus der Schule zu verweisen, wenn er sich nicht impfen lässt. Dabei schleppt sie Eric jeden Freitag zum Arzt, ...

https://www.epochtimes.de/gesundheit/rechtsgutachten-pranger…

...........................................................................................................................................

... 💩 ... https://www.wallstreet-online.de/aktien/vir-biotechnology-ak…

..................................................................................................................................................

Vir Biotech files for IPO to raise ~$134M

Sep. 30, 2019 2:45 PM ET|About: Vir Biotechnology, Inc. (VIR)|By: Liz Kiesche, SA News Editor

- Vir Biotechnology (VIR) files for an initial public offering of 7.14M its shares and estimates the IPO price of $20.00-$22.00 per share.

- Expects to grant greenshoe option for up to an additional 1.07M shares.

- Sees proceeds of $134M, based on the midpoint of the price range, or $154.9M if underwriters excise the over-allotment option in full.

- The company describes itself as a clinical-stage immunology company focused on combining immunologic insights with cutting-edge technologies to treat infectious diseases.

- Intends to use proceeds to fund R&D of product candidates and development programs.

- The company's current development pipeline consists of product candidates targeting hepatitis B virus, or HBV, influenza A, human immunodeficiency virus, or HIV, and tuberculosis, or TB.

- VIR-2218, an HBV-targeting siRNA, is in an ongoing Phase 1/2 clinical trial and initial data have demonstrated substantial reduction of hepatitis B virus surface antigen, or HBsAg. Based on initial data, VIR-2218 has been generally well-tolerated. Additionally, Vir has initiated a Phase 1/2 clinical trial for VIR-2482, a monoclonal antibody, or mAb, designed for the prevention of influenza A.

- In addition, current grants from the Bill & Melinda Gates Foundation will fund the manufacture and early clinical development of two other products, VIR-1111, an HIV T cell vaccine, and VIR-2020, a TB T cell vaccine.

- Now read: Vir Biotechnology Files U.S. NWO IPO Plan » https://seekingalpha.com/news/3502681-vir-biotech-files-ipo-…

...........................................................................................

Vir Biotech IPO: What You Need To Know

Shanthi Rexaline , Benzinga Staff Writer

October 09, 2019 8:53am 2 min read

https://www.benzinga.com/general/biotech/19/10/14562402/vir-…

Financial Times fährt neue, schwere Attacke gegen Wirecard

Veröffentlicht am 15. Oktober 2019, 9:26

Die Financial Times verschärft ihre Attacken gegen Wirecard.

London/München, 15. Oktober (WNM) – Die Financial Times verschärft ihre Attacken gegen Wirecard. In einer ausführlichen Recherche gibt das Blatt an, von Whistleblowern neue Informationen über die Buchhaltungspraktiken bei Wirecard erhalten zu haben. Die Vorgänge sind nach Aussage der FT fragwürdig.

Das Blatt schreibt, ... https://www.finanznachrichten.de/nachrichten-2019-10/4790537…

....................................................................

... ... und WeWok erinnert mich irgendwie an ... DT und T-Online ... Sprint - T- Mobile

... und WeWok erinnert mich irgendwie an ... DT und T-Online ... Sprint - T- Mobile

....................................

Veröffentlicht am 15. Oktober 2019, 9:26

Die Financial Times verschärft ihre Attacken gegen Wirecard.

London/München, 15. Oktober (WNM) – Die Financial Times verschärft ihre Attacken gegen Wirecard. In einer ausführlichen Recherche gibt das Blatt an, von Whistleblowern neue Informationen über die Buchhaltungspraktiken bei Wirecard erhalten zu haben. Die Vorgänge sind nach Aussage der FT fragwürdig.

Das Blatt schreibt, ... https://www.finanznachrichten.de/nachrichten-2019-10/4790537…

....................................................................

...

... und WeWok erinnert mich irgendwie an ... DT und T-Online ... Sprint - T- Mobile

... und WeWok erinnert mich irgendwie an ... DT und T-Online ... Sprint - T- Mobile

....................................

Antwort auf Beitrag Nr.: 61.694.818 von teecee1 am 15.10.19 13:35:18 ... Nichts ...

Formaldehyd

..........

Emissionsquellen

Bestimmte formaldehydhaltige Materialien (unter anderen Holzwerkstoffe, Bodenbeläge, Möbel und Textilien) können durch Ausgasung eine Kontamination der Atemluft in geschlossenen Räumen bewirken. In den achtziger Jahren sind in diesem Zusammenhang insbesondere Spanplatten und Sperrholz, zu deren Herstellung Aminoplaste als Bindemittel eingesetzt wurden, unter Verdacht gekommen. Es sind jedoch zum einen heute viele formaldehydfrei verklebte Holzwerkstoffe und Möbel im Handel erhältlich. Zum anderen wurden aber auch die Emissionen in den auf Formaldehyd basierenden Holzwerkstoffen deutlich reduziert. Trotzdem kommt es immer noch zu Grenzwertüberschreitungen in Kinderbetten.[51] Die Schadstoffsanierung formaldehydbelasteter Gebäude ist aber vor allem bei älteren Holzfertighäusern nach wie vor ein großes Thema. ...

Eine weitere wichtige Quelle für die Emission von Formaldehyd sind unvollständig ablaufende ...

... ...wenn man in billig ausgestattettetttette Büros ... zu viel ☕ trinkt ... und ständig auf sein ...

...wenn man in billig ausgestattettetttette Büros ... zu viel ☕ trinkt ... und ständig auf sein ...

https://de.wikipedia.org/wiki/Formaldehyd

.........................................................................................................................................................

WeWork Removes Thousands Of Phone Booths Due To "Elevated Formaldehyde"

by Tyler Durden

Mon, 10/14/2019 - 21:30

It isn't just WeWork's now-pulled IPO that's toxic at the company: according to a Business Insider report, the company emailed its tenants on Monday telling them that there was "potentially elevated levels of formaldehyde" in phone booths throughout WeWork offices in the U.S. and Canada. Why they used the word potential is unclear - according to the report, the company admitted that "tests for high levels of formaldehyde came back positive late last week."

The email stated that the company was removing 1,600 phone booth from locations that "may be impacted" in addition to 700 other booths that have yet to be tested for formaldehyde. At some WeWork spaces on Monday, there were taped signs reading: “CAUTION: DO NOT USE” over the phone booths. ---

https://www.zerohedge.com/technology/wework-removes-thousand…

.......................................................................................................................................................

... ... irgendeinen Grund braucht man ja ...

... irgendeinen Grund braucht man ja ...

Schadenfall WeWork: Start-up muss tausende Arbeitsplätze wegen Krebsrisiko schließen

16. Oktober 2019

n einigen Räumlichkeiten des amerikanischen Start-ups WeWork wird nicht mehr geworkt. In tausenden Phone Booths wurde die krebserregende Chemikalie Formaldehyd entdeckt. Ironischerweise ist das Geschäft der Amerikaner das Vermieten von Büroräumen.

Das Timing ist nicht perfekt, das Unternehmen musste im letzten Monat einen Börsengang absagen und kämpft derzeit wohl um den Fortbestand. In so einer Zeit ist es ungünstig, wenn in den USA und Kanada 2.300 Telefonräume geschlossen werden müssen.

Bei den sogenannten Phone Booths handelt es sich um private Arbeitsplätze, von denen aus Mitarbeiter telefonieren können. Diese werden nun geschlossen, nachdem sich die darin eingesetzten Angestellten über den Geruch sowie über Irritationen der Augen beschwert hatten. Die folgende Untersuchung ergab die Anwesenheit des karzinogenen Materials Formaldehyd. ...

https://versicherungswirtschaft-heute.de/maerkte-und-vertrie…

..................................................................................................

... ... hört sich doch gut an ... Kosten Einsparung ... die Wende neu streichen ...

... hört sich doch gut an ... Kosten Einsparung ... die Wende neu streichen ...

16.10.2019 08:18

Nach Absage von WeWork IPO: WeWork will angeblich 2.000 Stellen streichen

... Grund für die Schwierigkeiten bei WeWork sei unter anderem, dass es in den zwei größten Märkten, New York und London, nach Jahren des Wachstums nahezu keine Neueröffnungen mehr gibt. Ein 850-Millionen-Dollar-Deal in Manhattan stehe auf der Kippe und auch in London wollen zwei große Vermieter, wegen der ungewissen Zukunft, keine neuen Verträge unterzeichnen. ...

https://www.finanzen.net/nachricht/aktien/kosten-einsparen-n…

..........................................................................................................................

"The Bull Report" by GK - 10.13.19

10/13/2019 10:19:00 PM

... The other bullshit high on their agenda was vaccine bullshit where people with clean water and organic food without pollutants being rained upon them from airplanes spraying chemicals (chemtrails) which was a mix of aluminum, barium and other highly toxic bullshit would be way healthier than if they injected a cocktail mix of fetuses, mercury, antifreeze and other bullshit sure to seed hundreds of new diseases that Doctors would bullshit their way through making the Pharmaceutical companies even richer by "managing disease" rather than "curing disease" which is a whole lot of bullshit if you ask me.

The main point of the bullshit agenda was of course to cover up all the bullshit they thought people were too dumb to notice and someone asked whose bullshit idea was it to shovel so much bullshit on the masses that they were woken up by suffocating under bullshit and someone said well, when we employ such mottos in the world as By Deception We Shall Do War and teach dirty tricks in Army War College it was sort of predictable that bullshit would lead to more bullshit and may the best bullshitter win.

"Yes" someone said, but how does bullshit help humanity to evolve and solve bullshit like the bullshit we have unleashed on the Earth by us playing big know-it-all bullshit Gods with bio-warfare and uranium based weaponry and nuclear waste and the bullshit done to the environment trying to pull bullshit out of the ground to run engines that could easily run on less toxic bullshit and how even their uneducated illegal alien Mexican gardener knows the difference between what pollutes the planet and what jeopardizes the planet with bullshit that works against nature and not with nature but then someone said that is where our bullshit sustainability movement comes in with Agenda 21 bullshit.

Now Agenda 30 Bullshit but who's counting?

Those who never really paid much attention to the bullshit in government or in the general populace were starting to half listen to the bullshit and wonder what was bullshit and what wasn't bullshit. ...

Happy with this bullshit decision they agreed to meet again in two months and the bullshit came to an end for the time being, although there was plenty of bullshit they didn't discuss including the bullshit some dude on a blog accused them of which was being guilty of perpetuating bullshit above and beyond bullshit which apparently is against some bullshit in the Constitution and Bill of Rights and the Magna Carta. Which wasn't Bullshit but treated as bullshit by the bullshitters who bullshitted their way into positions of power taking a bull sized shit on the oath they swore to uphold.

Don't look for this bullshit on the news though because they are covering some BullSchiff Bullshit instead.

https://inteldinarchronicles.blogspot.com/2019/10/the-bull-report-by-gk-101319.html

Kind Regards

Dr. Bullshit

Formaldehyd

..........

Emissionsquellen

Bestimmte formaldehydhaltige Materialien (unter anderen Holzwerkstoffe, Bodenbeläge, Möbel und Textilien) können durch Ausgasung eine Kontamination der Atemluft in geschlossenen Räumen bewirken. In den achtziger Jahren sind in diesem Zusammenhang insbesondere Spanplatten und Sperrholz, zu deren Herstellung Aminoplaste als Bindemittel eingesetzt wurden, unter Verdacht gekommen. Es sind jedoch zum einen heute viele formaldehydfrei verklebte Holzwerkstoffe und Möbel im Handel erhältlich. Zum anderen wurden aber auch die Emissionen in den auf Formaldehyd basierenden Holzwerkstoffen deutlich reduziert. Trotzdem kommt es immer noch zu Grenzwertüberschreitungen in Kinderbetten.[51] Die Schadstoffsanierung formaldehydbelasteter Gebäude ist aber vor allem bei älteren Holzfertighäusern nach wie vor ein großes Thema. ...

Eine weitere wichtige Quelle für die Emission von Formaldehyd sind unvollständig ablaufende ...

...

...wenn man in billig ausgestattettetttette Büros ... zu viel ☕ trinkt ... und ständig auf sein ...

...wenn man in billig ausgestattettetttette Büros ... zu viel ☕ trinkt ... und ständig auf sein ...https://de.wikipedia.org/wiki/Formaldehyd

.........................................................................................................................................................

WeWork Removes Thousands Of Phone Booths Due To "Elevated Formaldehyde"

by Tyler Durden

Mon, 10/14/2019 - 21:30

It isn't just WeWork's now-pulled IPO that's toxic at the company: according to a Business Insider report, the company emailed its tenants on Monday telling them that there was "potentially elevated levels of formaldehyde" in phone booths throughout WeWork offices in the U.S. and Canada. Why they used the word potential is unclear - according to the report, the company admitted that "tests for high levels of formaldehyde came back positive late last week."

The email stated that the company was removing 1,600 phone booth from locations that "may be impacted" in addition to 700 other booths that have yet to be tested for formaldehyde. At some WeWork spaces on Monday, there were taped signs reading: “CAUTION: DO NOT USE” over the phone booths. ---

https://www.zerohedge.com/technology/wework-removes-thousand…

.......................................................................................................................................................

...

... irgendeinen Grund braucht man ja ...

... irgendeinen Grund braucht man ja ...Schadenfall WeWork: Start-up muss tausende Arbeitsplätze wegen Krebsrisiko schließen

16. Oktober 2019

n einigen Räumlichkeiten des amerikanischen Start-ups WeWork wird nicht mehr geworkt. In tausenden Phone Booths wurde die krebserregende Chemikalie Formaldehyd entdeckt. Ironischerweise ist das Geschäft der Amerikaner das Vermieten von Büroräumen.

Das Timing ist nicht perfekt, das Unternehmen musste im letzten Monat einen Börsengang absagen und kämpft derzeit wohl um den Fortbestand. In so einer Zeit ist es ungünstig, wenn in den USA und Kanada 2.300 Telefonräume geschlossen werden müssen.

Bei den sogenannten Phone Booths handelt es sich um private Arbeitsplätze, von denen aus Mitarbeiter telefonieren können. Diese werden nun geschlossen, nachdem sich die darin eingesetzten Angestellten über den Geruch sowie über Irritationen der Augen beschwert hatten. Die folgende Untersuchung ergab die Anwesenheit des karzinogenen Materials Formaldehyd. ...

https://versicherungswirtschaft-heute.de/maerkte-und-vertrie…

..................................................................................................

...

... hört sich doch gut an ... Kosten Einsparung ... die Wende neu streichen ...

... hört sich doch gut an ... Kosten Einsparung ... die Wende neu streichen ...16.10.2019 08:18

Nach Absage von WeWork IPO: WeWork will angeblich 2.000 Stellen streichen

... Grund für die Schwierigkeiten bei WeWork sei unter anderem, dass es in den zwei größten Märkten, New York und London, nach Jahren des Wachstums nahezu keine Neueröffnungen mehr gibt. Ein 850-Millionen-Dollar-Deal in Manhattan stehe auf der Kippe und auch in London wollen zwei große Vermieter, wegen der ungewissen Zukunft, keine neuen Verträge unterzeichnen. ...

https://www.finanzen.net/nachricht/aktien/kosten-einsparen-n…

..........................................................................................................................

"The Bull Report" by GK - 10.13.19

10/13/2019 10:19:00 PM

... The other bullshit high on their agenda was vaccine bullshit where people with clean water and organic food without pollutants being rained upon them from airplanes spraying chemicals (chemtrails) which was a mix of aluminum, barium and other highly toxic bullshit would be way healthier than if they injected a cocktail mix of fetuses, mercury, antifreeze and other bullshit sure to seed hundreds of new diseases that Doctors would bullshit their way through making the Pharmaceutical companies even richer by "managing disease" rather than "curing disease" which is a whole lot of bullshit if you ask me.

The main point of the bullshit agenda was of course to cover up all the bullshit they thought people were too dumb to notice and someone asked whose bullshit idea was it to shovel so much bullshit on the masses that they were woken up by suffocating under bullshit and someone said well, when we employ such mottos in the world as By Deception We Shall Do War and teach dirty tricks in Army War College it was sort of predictable that bullshit would lead to more bullshit and may the best bullshitter win.

"Yes" someone said, but how does bullshit help humanity to evolve and solve bullshit like the bullshit we have unleashed on the Earth by us playing big know-it-all bullshit Gods with bio-warfare and uranium based weaponry and nuclear waste and the bullshit done to the environment trying to pull bullshit out of the ground to run engines that could easily run on less toxic bullshit and how even their uneducated illegal alien Mexican gardener knows the difference between what pollutes the planet and what jeopardizes the planet with bullshit that works against nature and not with nature but then someone said that is where our bullshit sustainability movement comes in with Agenda 21 bullshit.

Now Agenda 30 Bullshit but who's counting?

Those who never really paid much attention to the bullshit in government or in the general populace were starting to half listen to the bullshit and wonder what was bullshit and what wasn't bullshit. ...

Happy with this bullshit decision they agreed to meet again in two months and the bullshit came to an end for the time being, although there was plenty of bullshit they didn't discuss including the bullshit some dude on a blog accused them of which was being guilty of perpetuating bullshit above and beyond bullshit which apparently is against some bullshit in the Constitution and Bill of Rights and the Magna Carta. Which wasn't Bullshit but treated as bullshit by the bullshitters who bullshitted their way into positions of power taking a bull sized shit on the oath they swore to uphold.

Don't look for this bullshit on the news though because they are covering some BullSchiff Bullshit instead.

https://inteldinarchronicles.blogspot.com/2019/10/the-bull-report-by-gk-101319.html

Kind Regards

Dr. Bullshit

Antwort auf Beitrag Nr.: 61.681.251 von teecee1 am 12.10.19 19:01:12The Kabbalah Cabal: WeWork Founder Neumann Integrated Jewish Mysticism Into Business

by Tyler Durden

Wed, 10/16/2019 - 12:14

Former WeWork CEO Adam Neumann integrated the Jewish mystical tradition of Kabbalah into daily life during the company's early years - while also tapping the religious sect's network of wealthy adherents for funding, according to the Wall Street Journal.

Every week, WeWork senior executives would gather in Neumann's office to study with a teacher from the Kabbalah Centre - one of the group's locations in over 40 cities across the globe, including New York and Los Angeles.

While sessions weren't mandatory, participation was encouraged according to people who attended the meetings with the spiritual leader.

At least two students were sources of early funding while several senior employees were Centre students, according to people familiar with the matter. Its tenets influenced WeWork’s community-centric philosophy, and its teachers were a regular presence in the company’s offices and on company retreats, according to other people familiar with the matter. -WSJ

Kabbalah originated in 12th-century France, and aims to uncover how divine forces powering the universe are related to the Torah. Many celebrities, including Ashton Kutcher and Madonna, practice the unique brand of self-help Jewish mysticism.

The number 18, an auspicious number in Judaism and emphasized in Jewish mystical circles, often made an appearance in WeWork business decisions, according to people familiar with the matter.

While in a hot tub on his 39th birthday in 2018 and talking on a conference call with WeWork executives, Mr. Neumann decided WeWork would sell $702 million in its first bond offering, according to a person who witnessed the scene. Mr. Neumann came to that figure by multiplying his age by 18, boosting the planned borrowing amount by $2 million, people familiar with the matter said.

Mr. Neumann at one point told staff he was hoping to hold We’s IPO on Sept. 18, citing the date’s spiritual significance, before it got pushed back, current and former We employees said.

WeWork's parent company, We Co., shelved plans for an IPO last month amid controversy over governance issues and investor concerns over skyrocketing losses. Neumann, who stepped down during the controversy, stands to see his voting power further diluted as SoftBank Group - which already owns 1/3 of the company, explores new financing. ...

https://www.zerohedge.com/personal-finance/wework-founder-ne…

.................................................................................................................................................

Bill Gates Met With Jeffrey Epstein Many Times, Despite His Past

At Jeffrey Epstein’s Manhattan mansion in 2011, from left: James E. Staley, at the time a senior JPMorgan executive; former Treasury Secretary Lawrence Summers; Mr. Epstein; Bill Gates, Microsoft’s co-founder; and Boris Nikolic, who was the Bill and Melinda Gates Foundation’s science adviser.

https://twitter.com/zerohedge/status/1183201778239758336

By Emily Flitter and James B. Stewart

Oct. 12, 2019

Jeffrey Epstein, the convicted sex offender who committed suicide in prison, managed to lure an astonishing array of rich, powerful and famous men into his orbit.

There were billionaires (Leslie Wexner and Leon Black), politicians (Bill Clinton and Bill Richardson), Nobel laureates (Murray Gell-Mann and Frank Wilczek) and even royals (Prince Andrew).

Few, though, compared in prestige and power to the world’s second-richest person, a brilliant and intensely private luminary: Bill Gates. And unlike many others, Mr. Gates started the relationship after Mr. Epstein was convicted of sex crimes.

Mr. Gates, the Microsoft co-founder, whose $100 billion-plus fortune has endowed the world’s largest charitable organization, has done his best to minimize his connections to Mr. Epstein. “I didn’t have any business relationship or friendship with him,” he told The Wall Street Journal last month.

In fact, beginning in 2011, Mr. Gates met with Mr. Epstein on numerous occasions — including at least three times at Mr. Epstein’s palatial Manhattan townhouse, and at least once staying late into the night, according to interviews with more than a dozen people familiar with the relationship, as well as documents reviewed by The New York Times.

Employees of Mr. Gates’s foundation also paid multiple visits to Mr. Epstein’s mansion. And Mr. Epstein spoke with the Bill and Melinda Gates Foundation and JPMorgan Chase about a proposed multibillion-dollar charitable fund — an arrangement that had the potential to generate enormous fees for Mr. Epstein.

“His lifestyle is very different and kind of intriguing although it would not work for me,” Mr. Gates emailed colleagues in 2011, after his first get-together with Mr. Epstein.

Bridgitt Arnold, a spokeswoman for Mr. Gates, said he “was referring only to the unique décor of the Epstein residence — and Epstein’s habit of spontaneously bringing acquaintances in to meet Mr. Gates.” ...

https://www.nytimes.com/2019/10/12/business/jeffrey-epstein-…

by Tyler Durden

Wed, 10/16/2019 - 12:14

Former WeWork CEO Adam Neumann integrated the Jewish mystical tradition of Kabbalah into daily life during the company's early years - while also tapping the religious sect's network of wealthy adherents for funding, according to the Wall Street Journal.

Every week, WeWork senior executives would gather in Neumann's office to study with a teacher from the Kabbalah Centre - one of the group's locations in over 40 cities across the globe, including New York and Los Angeles.

While sessions weren't mandatory, participation was encouraged according to people who attended the meetings with the spiritual leader.

At least two students were sources of early funding while several senior employees were Centre students, according to people familiar with the matter. Its tenets influenced WeWork’s community-centric philosophy, and its teachers were a regular presence in the company’s offices and on company retreats, according to other people familiar with the matter. -WSJ

Kabbalah originated in 12th-century France, and aims to uncover how divine forces powering the universe are related to the Torah. Many celebrities, including Ashton Kutcher and Madonna, practice the unique brand of self-help Jewish mysticism.

The number 18, an auspicious number in Judaism and emphasized in Jewish mystical circles, often made an appearance in WeWork business decisions, according to people familiar with the matter.

While in a hot tub on his 39th birthday in 2018 and talking on a conference call with WeWork executives, Mr. Neumann decided WeWork would sell $702 million in its first bond offering, according to a person who witnessed the scene. Mr. Neumann came to that figure by multiplying his age by 18, boosting the planned borrowing amount by $2 million, people familiar with the matter said.

Mr. Neumann at one point told staff he was hoping to hold We’s IPO on Sept. 18, citing the date’s spiritual significance, before it got pushed back, current and former We employees said.

WeWork's parent company, We Co., shelved plans for an IPO last month amid controversy over governance issues and investor concerns over skyrocketing losses. Neumann, who stepped down during the controversy, stands to see his voting power further diluted as SoftBank Group - which already owns 1/3 of the company, explores new financing. ...

https://www.zerohedge.com/personal-finance/wework-founder-ne…

.................................................................................................................................................

Bill Gates Met With Jeffrey Epstein Many Times, Despite His Past

At Jeffrey Epstein’s Manhattan mansion in 2011, from left: James E. Staley, at the time a senior JPMorgan executive; former Treasury Secretary Lawrence Summers; Mr. Epstein; Bill Gates, Microsoft’s co-founder; and Boris Nikolic, who was the Bill and Melinda Gates Foundation’s science adviser.

https://twitter.com/zerohedge/status/1183201778239758336

By Emily Flitter and James B. Stewart

Oct. 12, 2019

Jeffrey Epstein, the convicted sex offender who committed suicide in prison, managed to lure an astonishing array of rich, powerful and famous men into his orbit.

There were billionaires (Leslie Wexner and Leon Black), politicians (Bill Clinton and Bill Richardson), Nobel laureates (Murray Gell-Mann and Frank Wilczek) and even royals (Prince Andrew).

Few, though, compared in prestige and power to the world’s second-richest person, a brilliant and intensely private luminary: Bill Gates. And unlike many others, Mr. Gates started the relationship after Mr. Epstein was convicted of sex crimes.

Mr. Gates, the Microsoft co-founder, whose $100 billion-plus fortune has endowed the world’s largest charitable organization, has done his best to minimize his connections to Mr. Epstein. “I didn’t have any business relationship or friendship with him,” he told The Wall Street Journal last month.

In fact, beginning in 2011, Mr. Gates met with Mr. Epstein on numerous occasions — including at least three times at Mr. Epstein’s palatial Manhattan townhouse, and at least once staying late into the night, according to interviews with more than a dozen people familiar with the relationship, as well as documents reviewed by The New York Times.

Employees of Mr. Gates’s foundation also paid multiple visits to Mr. Epstein’s mansion. And Mr. Epstein spoke with the Bill and Melinda Gates Foundation and JPMorgan Chase about a proposed multibillion-dollar charitable fund — an arrangement that had the potential to generate enormous fees for Mr. Epstein.

“His lifestyle is very different and kind of intriguing although it would not work for me,” Mr. Gates emailed colleagues in 2011, after his first get-together with Mr. Epstein.

Bridgitt Arnold, a spokeswoman for Mr. Gates, said he “was referring only to the unique décor of the Epstein residence — and Epstein’s habit of spontaneously bringing acquaintances in to meet Mr. Gates.” ...

https://www.nytimes.com/2019/10/12/business/jeffrey-epstein-…

Antwort auf Beitrag Nr.: 61.694.818 von teecee1 am 15.10.19 13:35:18Achtung!

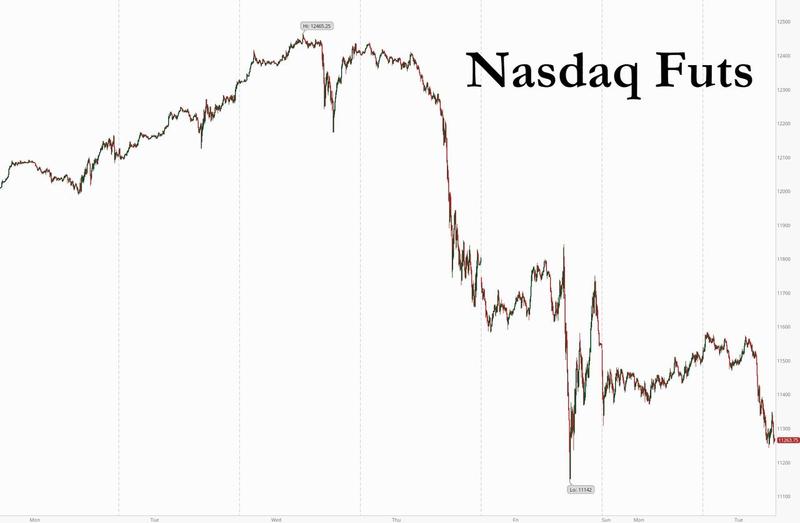

Breaking News: Extremes Absturz Signal!

weiterlesen >>

...........................................................................................................................................

Softbank Group vs Damenhandtasche

Masayoshi Son beim veteilen des Fiatgeldes ... gierige Krähen stürzen sich ... werden sich dabei den Hals brechen ...

http://finalwakeupcall.info/de/2019/03/13/qfs-auserweltliche…

.................................................................................................................................................

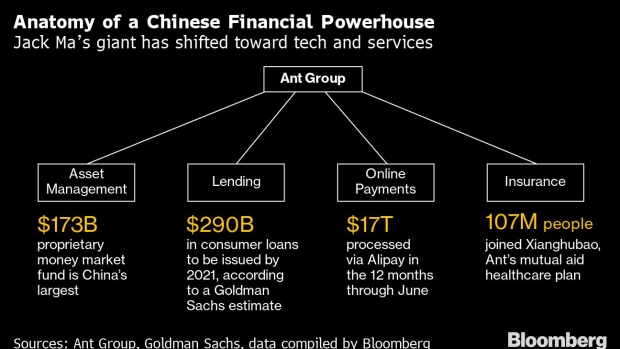

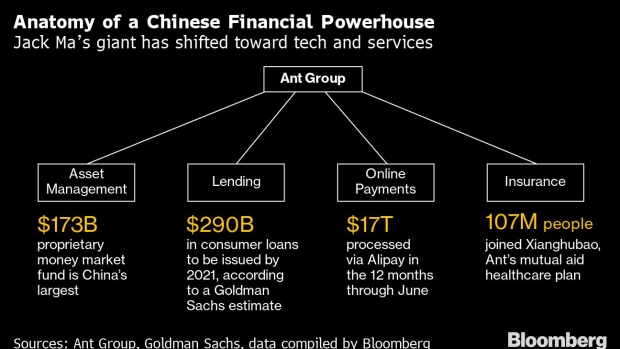

Mega-Finanzierungsrunde: Indisches Fintech sammelt 2 Milliarden Dollar ein

16.10.2019, 13:28 Uhr

Paytm soll einem Medienbericht zufolge kurz vor Abschluss einer zwei Milliarden US-Dollar schweren Finanzierungsrunde stehen. Mit an Bord sind demnach Softbank und Ant Financial. ...

Paytm nach Kapitalspritze 16 Milliarden wert (... ... wer legt dennnnnn sowas fest ...)

... wer legt dennnnnn sowas fest ...)

Die Verhandlungen über die Finanzierung sollen sich den von Bloomberg zitierten Insidern zufolge schon im Endstadium befinden. Allerdings sei ein Scheitern noch jederzeit möglich. Sollte es zu einer Einigung kommen, ...

https://t3n.de/news/mega-finanzierungsrunde-fintech-1208733/

...................................................................................................................................................

„Financial Times” vs. Wirecard-Aktie: Die Geschichte ist noch nicht zu Ende!

Nachrichtenquelle: The Motley Fool | 17.10.2019, 08:20

Wer dachte, infolge der Aufklärung der „Financial Times“ (FT)-Vorwürfe, Wirecard (WKN: 747206) habe seine Umsätze in Singapur geschönt, würde es ruhiger um den Zahlungsdienstleister werden, sieht sich getäuscht. Die in London ansässige Zeitung ist von ihren Recherchen überzeugt und erhebt deshalb nun erneut schwere Vorwürfe gegen den Zahlungsdienstleister. Aber wie lauten sie?

Hier ist der nächste Teil der FT-versus-Wirecard-Geschichte.

Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/11821597-financia…

https://www.4investors.de/nachrichten/boerse.php?sektion=sto…

... ... ohne Munition fängt man keine Klage an ...

... ohne Munition fängt man keine Klage an ...

................................................................................

Deutsche Bank beschenkt jahrelang Chinas Funktionäre

Von Reinhard Werner16. Oktober 2019 Aktualisiert: 16. Oktober 2019 18:54

Dreiste Geschenke an Parteibonzen im Gesamtwert von 200.000 US-Dollar, Berater mit Millionenhonoraren und Jobs für mehr als 100 Verwandte von KP-Funktionären: Die Deutsche Bank ging beim Ausbau ihres China-Geschäfts in die Vollen. ...

https://www.epochtimes.de/wirtschaft/unternehmen/deutsche-ba…

............................................................................

Bargeldlose Vetternwirtschaft ... 1000 €uro Grenze ... 2020 ...

.............................................................................

Breaking News: Extremes Absturz Signal!

weiterlesen >>

...........................................................................................................................................

Softbank Group vs Damenhandtasche

Masayoshi Son beim veteilen des Fiatgeldes ... gierige Krähen stürzen sich ... werden sich dabei den Hals brechen ...

http://finalwakeupcall.info/de/2019/03/13/qfs-auserweltliche…

.................................................................................................................................................

Mega-Finanzierungsrunde: Indisches Fintech sammelt 2 Milliarden Dollar ein

16.10.2019, 13:28 Uhr

Paytm soll einem Medienbericht zufolge kurz vor Abschluss einer zwei Milliarden US-Dollar schweren Finanzierungsrunde stehen. Mit an Bord sind demnach Softbank und Ant Financial. ...

Paytm nach Kapitalspritze 16 Milliarden wert (...

... wer legt dennnnnn sowas fest ...)

... wer legt dennnnnn sowas fest ...)Die Verhandlungen über die Finanzierung sollen sich den von Bloomberg zitierten Insidern zufolge schon im Endstadium befinden. Allerdings sei ein Scheitern noch jederzeit möglich. Sollte es zu einer Einigung kommen, ...

https://t3n.de/news/mega-finanzierungsrunde-fintech-1208733/

...................................................................................................................................................

„Financial Times” vs. Wirecard-Aktie: Die Geschichte ist noch nicht zu Ende!

Nachrichtenquelle: The Motley Fool | 17.10.2019, 08:20

Wer dachte, infolge der Aufklärung der „Financial Times“ (FT)-Vorwürfe, Wirecard (WKN: 747206) habe seine Umsätze in Singapur geschönt, würde es ruhiger um den Zahlungsdienstleister werden, sieht sich getäuscht. Die in London ansässige Zeitung ist von ihren Recherchen überzeugt und erhebt deshalb nun erneut schwere Vorwürfe gegen den Zahlungsdienstleister. Aber wie lauten sie?

Hier ist der nächste Teil der FT-versus-Wirecard-Geschichte.

Vollständiger Artikel unter: https://www.wallstreet-online.de/nachricht/11821597-financia…

https://www.4investors.de/nachrichten/boerse.php?sektion=sto…

...

... ohne Munition fängt man keine Klage an ...

... ohne Munition fängt man keine Klage an ...................................................................................

Deutsche Bank beschenkt jahrelang Chinas Funktionäre

Von Reinhard Werner16. Oktober 2019 Aktualisiert: 16. Oktober 2019 18:54

Dreiste Geschenke an Parteibonzen im Gesamtwert von 200.000 US-Dollar, Berater mit Millionenhonoraren und Jobs für mehr als 100 Verwandte von KP-Funktionären: Die Deutsche Bank ging beim Ausbau ihres China-Geschäfts in die Vollen. ...

https://www.epochtimes.de/wirtschaft/unternehmen/deutsche-ba…

............................................................................

Bargeldlose Vetternwirtschaft ... 1000 €uro Grenze ... 2020 ...

.............................................................................

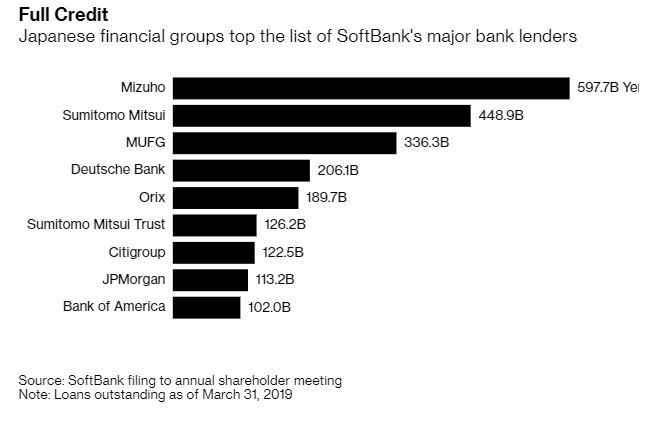

Antwort auf Beitrag Nr.: 61.711.297 von teecee1 am 17.10.19 10:12:32 ...  ... steigen SoftBank'sters "Schulden" (.Verbindlichkeiten.) über 100 Mrd. $ Tollar ... ??? ...

... steigen SoftBank'sters "Schulden" (.Verbindlichkeiten.) über 100 Mrd. $ Tollar ... ??? ...

💣

WeWork Valuation Collapse From Cash Crunch Could Crush Hong Kong Office Market

by Tyler Durden

Fri, 10/18/2019 - 19:25

WeWork running out of cash has derailed the company's plan for massive expansion worldwide. JPMorgan Chase and SoftBank/Vision Fund are preparing to offer the company financial lifelines to avoid bankruptcy in the coming months.

As Bloomberg reports, SoftBank is assembling a rescue financing plan for WeWork that may value the office-sharing company below $8 billion, according to people familiar with the discussions.

The new figure is a fraction of the $47 billion valuation the startup commanded as recently as January. The talks are fluid and the terms could change, said the people, who requested anonymity because the discussions are private. ...

WeWork's footprint of shared office spaces in Hong Kong has jumped 700% since 2016, from 112,000 square feet to 821,300 square feet in 2H19.

While WeWork's S1 SEC filing never told investors that the sole reason for an IPO was to remain solvent (great job Goldman), the failed IPO attempt last month, suggests that its growth in Hong Kong will level off shortly.

WeWork has been regarded as the savior of Hong Kong's office space market.

So if there's a deceleration in new leases and or other acquisitions, it could be disastrous for the city, real estate firm Savills told FT. ...

Henry Chin, head of research for Asia Pacific at CBRE, said that WeWork "took long leases at the top of the market, then the market turned." ...

https://www.zerohedge.com/markets/wework-cash-crunch-could-b…

.....................................................................................................................................

Crash am US-Repo Markt – neue Rekordintervention der Fed

Veröffentlicht vor 14 Stunden / am 18. Oktober 2019 16:50

Von Hannes Zipfel

Glaubte man den Aussagen von Fed-Chef Jerome Powell vom 18. September, so handelte es sich bei dem Crash am US-Repo Markt vom 17. September nur um das Ergebnis von temporären Sonderfaktoren. Die Notmaßnahmen der US-Notenbank halten nun jedoch schon seit über einem Monat an und erreichten gestern ein neues Rekordvolumen.

Crash am US-Repo Markt – der Stress hört nicht auf

Bereits seit dem 17. September muss die US-Notenbank am amerikanischen Repo-Markt intervenieren, um einen Crash zu vermeiden. Dabei spielen US-Staatsanleihen eine wichtige Rolle. Am Repo-Markt können Banken Staatsanleihen via Rückkaufvereinbarung (Repurchase Agreement) verpfänden und sich so kurzfristig benötigte Liquidität beschaffen. Sie erhalten den Gegenwert der Anleihe und verpflichten sich, diese nach kurzer Zeit, z. B. nach einem Tag, zum gleichen Preis wieder zurückzukaufen. Für den Zeitraum der Verpfändung müssen wie bei einem Pfandleiher Zinsen bezahlt werden, die sogenannte Overnight Repo Rate. Dieser Zinssatz bewegt sich normalerweise unterhalb des US-Leitzinses, bei aktuell 1,92 Prozent. Am 17. September schoss dieser Zins jedoch auf 10 Prozent p. a. nach oben, obwohl die US-Notenbank die Leitzinsen ihrerseits vorher zweimal gesenkt hatte:

https://finanzmarktwelt.de/crash-am-us-repo-markt-neue-rekor…

............................................................................................................................................

... ... alle schwitzen im selben Flüchtlings-Boot ... bitte rettet UNS ... wie 2008 ...

... alle schwitzen im selben Flüchtlings-Boot ... bitte rettet UNS ... wie 2008 ...

J.Ackermann ...

J.Ackermann ...

Dimon says money-market turmoil last month risks morphing into a crisis if Fed falters

Published: Oct 18, 2019 5:03 p.m. ET

‘They’re quite bright,’ JPMorgan CEO says of regulators’ ability to work out repo problems

By Greg Robb

Bank lobbyists, like magicians, are skilled at the art of legerdemain. Whenever there are unexpected problems in the financial markets, they are quick to create the illusion of financial regulation as the culprit. In doing so, they divert attention from the real cause, which is all-too-often misbehavior on the part of the banks they represent. ...

https://www.marketwatch.com/story/dimon-says-money-market-tu…

..................................................................................................................................

Ray Dalio Warns Of Looming "Big Sag" That Will Rattle Global Markets

by Tyler Durden

Fri, 10/18/2019 - 20:45

Ray Dalio never misses an opportunity to tell a room full of absurdly rich people how their unchecked greed and unwillingness to lift their heel from the throat of the poor could usher in a global revolution.

And what better venue for this than the IMF's annual meeting in Washington? ...

Suddenly, one of the other panelists raised another topic and took the discussion in a different direction - one which Dalio was blithe to explore: the surge in corporate credit since the crisis. ...

Dalio:

https://www.zerohedge.com/markets/ray-dalio-warns-looming-bi…

..............................................................................................................................................

October 17, 2019 / 3:50 PM / 2 days ago

Abu Dhabi's Mubadala eyes debt market, weighs SoftBank's Vision Fund 2: CEO

Stanley Carvalho, Hadeel Al Sayegh 3 Min Read

ABU DHABI (Reuters) - Abu Dhabi state investor Mubadala Investment Co is weighing debt issuance amid attractive market conditions and could invest in oil giant Saudi Aramco’s planned share offering, its group chief executive said on Thursday. ...

https://www.reuters.com/article/us-mubadala-invst-investment…

...................................................................................................................................................

Aramco Again Delays Long-Awaited IPO; Is WeWork To Blame?

by Tyler Durden

Thu, 10/17/2019 - 14:47

For the past two years, investors and especially investment bankers have been salivating at the opportunity to buy (or short), and/or collect billions in underwriting fees for what would eventually be the world's largest publicly traded company: Saudi Aramco, whose valuation would be anywhere between $1.5 and $2 trillion.

They will have to wait some more, because after weeks of news that the "zombie" Aramco IPO was set to go public, it is being delayed once again, with the FT reporting that the Saudi energy giant again postponed the launch of its long-awaited initial public offering on Sunday, "putting the November timeline for the flotation in jeopardy." Aramco was expected to release its IPO prospectus next week ahead of a listing of up to 3% of the company as early as next month. ...

https://www.zerohedge.com/markets/aramco-again-delays-long-a…

💹💹💹💹

...............................

... steigen SoftBank'sters "Schulden" (.Verbindlichkeiten.) über 100 Mrd. $ Tollar ... ??? ...

... steigen SoftBank'sters "Schulden" (.Verbindlichkeiten.) über 100 Mrd. $ Tollar ... ??? ...💣

WeWork Valuation Collapse From Cash Crunch Could Crush Hong Kong Office Market

by Tyler Durden

Fri, 10/18/2019 - 19:25

WeWork running out of cash has derailed the company's plan for massive expansion worldwide. JPMorgan Chase and SoftBank/Vision Fund are preparing to offer the company financial lifelines to avoid bankruptcy in the coming months.

As Bloomberg reports, SoftBank is assembling a rescue financing plan for WeWork that may value the office-sharing company below $8 billion, according to people familiar with the discussions.

The new figure is a fraction of the $47 billion valuation the startup commanded as recently as January. The talks are fluid and the terms could change, said the people, who requested anonymity because the discussions are private. ...

WeWork's footprint of shared office spaces in Hong Kong has jumped 700% since 2016, from 112,000 square feet to 821,300 square feet in 2H19.

While WeWork's S1 SEC filing never told investors that the sole reason for an IPO was to remain solvent (great job Goldman), the failed IPO attempt last month, suggests that its growth in Hong Kong will level off shortly.

WeWork has been regarded as the savior of Hong Kong's office space market.

So if there's a deceleration in new leases and or other acquisitions, it could be disastrous for the city, real estate firm Savills told FT. ...

Henry Chin, head of research for Asia Pacific at CBRE, said that WeWork "took long leases at the top of the market, then the market turned." ...

https://www.zerohedge.com/markets/wework-cash-crunch-could-b…

.....................................................................................................................................

Crash am US-Repo Markt – neue Rekordintervention der Fed

Veröffentlicht vor 14 Stunden / am 18. Oktober 2019 16:50

Von Hannes Zipfel

Glaubte man den Aussagen von Fed-Chef Jerome Powell vom 18. September, so handelte es sich bei dem Crash am US-Repo Markt vom 17. September nur um das Ergebnis von temporären Sonderfaktoren. Die Notmaßnahmen der US-Notenbank halten nun jedoch schon seit über einem Monat an und erreichten gestern ein neues Rekordvolumen.

Crash am US-Repo Markt – der Stress hört nicht auf

Bereits seit dem 17. September muss die US-Notenbank am amerikanischen Repo-Markt intervenieren, um einen Crash zu vermeiden. Dabei spielen US-Staatsanleihen eine wichtige Rolle. Am Repo-Markt können Banken Staatsanleihen via Rückkaufvereinbarung (Repurchase Agreement) verpfänden und sich so kurzfristig benötigte Liquidität beschaffen. Sie erhalten den Gegenwert der Anleihe und verpflichten sich, diese nach kurzer Zeit, z. B. nach einem Tag, zum gleichen Preis wieder zurückzukaufen. Für den Zeitraum der Verpfändung müssen wie bei einem Pfandleiher Zinsen bezahlt werden, die sogenannte Overnight Repo Rate. Dieser Zinssatz bewegt sich normalerweise unterhalb des US-Leitzinses, bei aktuell 1,92 Prozent. Am 17. September schoss dieser Zins jedoch auf 10 Prozent p. a. nach oben, obwohl die US-Notenbank die Leitzinsen ihrerseits vorher zweimal gesenkt hatte:

https://finanzmarktwelt.de/crash-am-us-repo-markt-neue-rekor…

............................................................................................................................................

...

... alle schwitzen im selben Flüchtlings-Boot ... bitte rettet UNS ... wie 2008 ...

... alle schwitzen im selben Flüchtlings-Boot ... bitte rettet UNS ... wie 2008 ...

J.Ackermann ...

J.Ackermann ...Dimon says money-market turmoil last month risks morphing into a crisis if Fed falters

Published: Oct 18, 2019 5:03 p.m. ET

‘They’re quite bright,’ JPMorgan CEO says of regulators’ ability to work out repo problems

By Greg Robb

Bank lobbyists, like magicians, are skilled at the art of legerdemain. Whenever there are unexpected problems in the financial markets, they are quick to create the illusion of financial regulation as the culprit. In doing so, they divert attention from the real cause, which is all-too-often misbehavior on the part of the banks they represent. ...

https://www.marketwatch.com/story/dimon-says-money-market-tu…

..................................................................................................................................

Ray Dalio Warns Of Looming "Big Sag" That Will Rattle Global Markets

by Tyler Durden

Fri, 10/18/2019 - 20:45

Ray Dalio never misses an opportunity to tell a room full of absurdly rich people how their unchecked greed and unwillingness to lift their heel from the throat of the poor could usher in a global revolution.

And what better venue for this than the IMF's annual meeting in Washington? ...

Suddenly, one of the other panelists raised another topic and took the discussion in a different direction - one which Dalio was blithe to explore: the surge in corporate credit since the crisis. ...

Dalio:

https://www.zerohedge.com/markets/ray-dalio-warns-looming-bi…

..............................................................................................................................................

October 17, 2019 / 3:50 PM / 2 days ago

Abu Dhabi's Mubadala eyes debt market, weighs SoftBank's Vision Fund 2: CEO

Stanley Carvalho, Hadeel Al Sayegh 3 Min Read

ABU DHABI (Reuters) - Abu Dhabi state investor Mubadala Investment Co is weighing debt issuance amid attractive market conditions and could invest in oil giant Saudi Aramco’s planned share offering, its group chief executive said on Thursday. ...

https://www.reuters.com/article/us-mubadala-invst-investment…

...................................................................................................................................................

Aramco Again Delays Long-Awaited IPO; Is WeWork To Blame?

by Tyler Durden

Thu, 10/17/2019 - 14:47

For the past two years, investors and especially investment bankers have been salivating at the opportunity to buy (or short), and/or collect billions in underwriting fees for what would eventually be the world's largest publicly traded company: Saudi Aramco, whose valuation would be anywhere between $1.5 and $2 trillion.

They will have to wait some more, because after weeks of news that the "zombie" Aramco IPO was set to go public, it is being delayed once again, with the FT reporting that the Saudi energy giant again postponed the launch of its long-awaited initial public offering on Sunday, "putting the November timeline for the flotation in jeopardy." Aramco was expected to release its IPO prospectus next week ahead of a listing of up to 3% of the company as early as next month. ...

https://www.zerohedge.com/markets/aramco-again-delays-long-a…

💹💹💹💹

...............................

Antwort auf Beitrag Nr.: 61.724.564 von teecee1 am 19.10.19 11:22:32Beachten: - "Das Bunte vom Himmel", ...

Blitzeinschlag zum Ad-Zock ...

weiterlesen >>

.............................................................................................................................................

Tokyo looks to close SoftBank’s billions-saving tax route

Bauer Masayoshi Son in Tokyo in July 2017. Photographer: Kiyoshi Ota/Bloomberg

By Ryohei Yasoshima

October 21, 2019

Japan’s Finance Ministry plans to close a tax loophole that came to light after SoftBank Group paid no tax in Japan last year thanks to a series of complex paper transactions.

Creating large scale losses by shifting assets within the group, and negating profits made in other sectors with the intent to reduce the tax bill, will not be tolerated.

For instance, if a parent company took away the core operations from a subsidiary and sold off the company for a cheap price, the difference between the book value and the sale price can be counted as paper losses.

To shut down this loophole, the ministry is considering automatically reducing the book value when the ...

Read more at: https://www.dealstreetasia.com/stories/softbank-tax-route-to…

.........................................................................................................................................

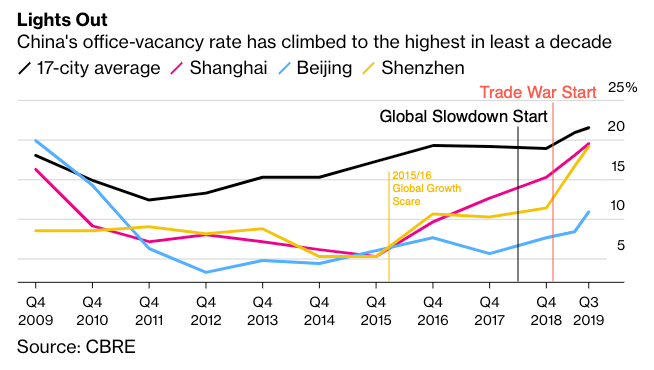

Office Vacancies In China Hit Decade High Amid Economic Turmoil

by Tyler Durden

Fri, 10/18/2019 - 23:25

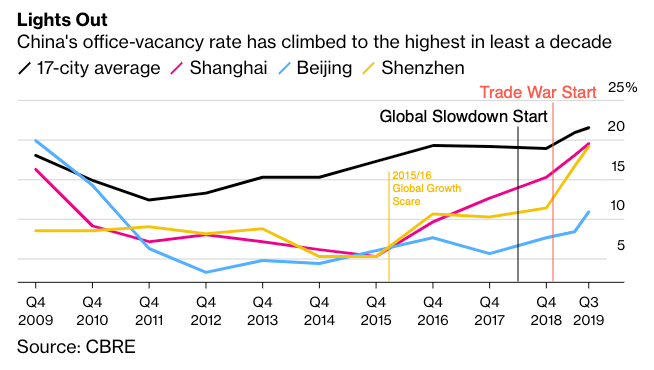

A darkening outlook for China's economy continues to materialize week by week.

New data from commercial property group CBRE warns the country's office vacancy rate has just surged to the highest since the financial crisis of 2007–2008, first reported by Bloomberg.

CBRE said the vacancy rate for commercial office space in 17 major cities rose to 21.5% in 3Q19, a level not seen since the global economy was melting down in 2008.

Sam Xie, CBRE's head of research in China, said the recent "spike" in vacancies is one of the worst since the last financial crisis.

......

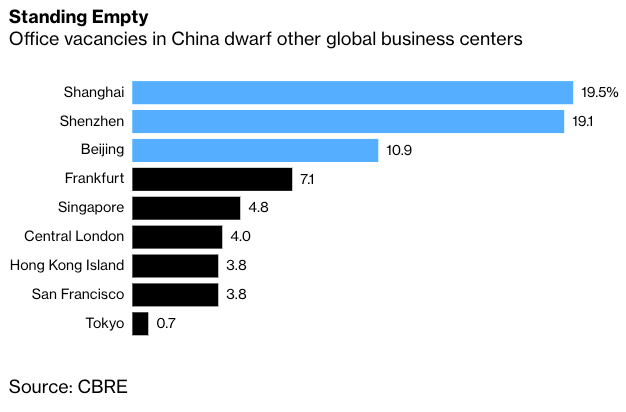

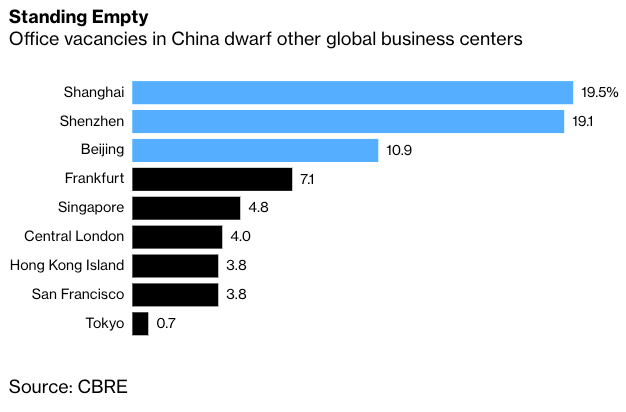

As shown in the Bloomberg chart below, using CBRE data, Shanghai and Shenzhen had the highest office vacancies than any other city, and both had around 20% of office spaces dormant.

https://www.zerohedge.com/economics/office-vacancies-china-h…

..........................................................................................................................................

WeWork, Sun Hung Kai sign lease deal as struggling US start-up prepares to open co-working space in Nanjing

WeWork signs traditional lease agreement with Sun Hung Kai Properties for four floors in the recently completed Nanjing International Finance Center Tower One

Pearl Liu

Updated: 10:00am, 19 Oct, 2019

Struggling co-working firm WeWork has opted for a traditional long-term lease agreement with Sun Hung Kai Properties to open its first hub in Nanjing.

The world’s largest flexible office space provider said on Friday that it has leased four floors in SHKP’s Nanjing International Finance Center Tower One. Although it did not say when it plans to open the space, WeWork said it aims to have three hubs in the capital of China’s southern Jiangsu province up and running by the end of the year.

Under the traditional tenancy lease agreement, a company usually pays a large upfront deposit for a lease that could be for as long as 10 years. In Hong Kong, WeWork has signed a few long-term leases with Hysan Development. Co-working operators usually opt for an asset-light model where they share revenues with the landlords.

Although the US firm did not say how much it had paid to secure space in SHKP’s newly completed complex, comprising two office towers, retail space and hotel in Nanjing’s central business district, the average daily rent in the area was 4.7 yuan per square metre, according to Savills.

Each floor of Nanjing IFC is roughly around 1,400 square metres, which means that WeWork could pay around 820,000 yuan (US$116,000) a month in rent, excluding management fees.

However, ...

https://www.scmp.com/business/companies/article/3033609/wewo…

💹um💹um ex

..............................

Blitzeinschlag zum Ad-Zock ...

weiterlesen >>

.............................................................................................................................................

Tokyo looks to close SoftBank’s billions-saving tax route

Bauer Masayoshi Son in Tokyo in July 2017. Photographer: Kiyoshi Ota/Bloomberg

By Ryohei Yasoshima

October 21, 2019

Japan’s Finance Ministry plans to close a tax loophole that came to light after SoftBank Group paid no tax in Japan last year thanks to a series of complex paper transactions.

Creating large scale losses by shifting assets within the group, and negating profits made in other sectors with the intent to reduce the tax bill, will not be tolerated.

For instance, if a parent company took away the core operations from a subsidiary and sold off the company for a cheap price, the difference between the book value and the sale price can be counted as paper losses.

To shut down this loophole, the ministry is considering automatically reducing the book value when the ...

Read more at: https://www.dealstreetasia.com/stories/softbank-tax-route-to…

.........................................................................................................................................

Office Vacancies In China Hit Decade High Amid Economic Turmoil

by Tyler Durden

Fri, 10/18/2019 - 23:25

A darkening outlook for China's economy continues to materialize week by week.

New data from commercial property group CBRE warns the country's office vacancy rate has just surged to the highest since the financial crisis of 2007–2008, first reported by Bloomberg.

CBRE said the vacancy rate for commercial office space in 17 major cities rose to 21.5% in 3Q19, a level not seen since the global economy was melting down in 2008.

Sam Xie, CBRE's head of research in China, said the recent "spike" in vacancies is one of the worst since the last financial crisis.

......

As shown in the Bloomberg chart below, using CBRE data, Shanghai and Shenzhen had the highest office vacancies than any other city, and both had around 20% of office spaces dormant.

https://www.zerohedge.com/economics/office-vacancies-china-h…

..........................................................................................................................................

WeWork, Sun Hung Kai sign lease deal as struggling US start-up prepares to open co-working space in Nanjing

WeWork signs traditional lease agreement with Sun Hung Kai Properties for four floors in the recently completed Nanjing International Finance Center Tower One

Pearl Liu

Updated: 10:00am, 19 Oct, 2019

Struggling co-working firm WeWork has opted for a traditional long-term lease agreement with Sun Hung Kai Properties to open its first hub in Nanjing.

The world’s largest flexible office space provider said on Friday that it has leased four floors in SHKP’s Nanjing International Finance Center Tower One. Although it did not say when it plans to open the space, WeWork said it aims to have three hubs in the capital of China’s southern Jiangsu province up and running by the end of the year.

Under the traditional tenancy lease agreement, a company usually pays a large upfront deposit for a lease that could be for as long as 10 years. In Hong Kong, WeWork has signed a few long-term leases with Hysan Development. Co-working operators usually opt for an asset-light model where they share revenues with the landlords.

Although the US firm did not say how much it had paid to secure space in SHKP’s newly completed complex, comprising two office towers, retail space and hotel in Nanjing’s central business district, the average daily rent in the area was 4.7 yuan per square metre, according to Savills.

Each floor of Nanjing IFC is roughly around 1,400 square metres, which means that WeWork could pay around 820,000 yuan (US$116,000) a month in rent, excluding management fees.

However, ...

https://www.scmp.com/business/companies/article/3033609/wewo…

💹um💹um ex

..............................

Antwort auf Beitrag Nr.: 61.733.605 von teecee1 am 21.10.19 11:00:02 ... wieder nichts ...

..........................................................................................................................................................

Milliardenbetrüger Jürgen Schneider

Der Gauner mit der weißen Weste

https://www.spiegel.de/geschichte/milliardenbetrueger-juerge…

https://de.wikipedia.org/wiki/J%C3%BCrgen_Schneider_(Bauunte…

..........................................................................................................................................................

The Most Wanted Cleverness People Ever Ever ...

ADAM & EVA ... Neumann ...

...........................................................................................................................................................

One Bank's Stunning Chart Showing The Second Tech Bubble In All Its Glory

by Tyler Durden

Tue, 10/22/2019 - 18:17

If there is one thing the WeWork fiasco has taught us, it is that cracks in many legacy narratives - most notably that of "growth at any cost" over "profits and margins" - are starting to finally appear and affect investment decisions: just ask SoftBank's Masayoshi Son who in the span of just a few months has transformed from one of Wall Street's most admired investors to a pariah who not only does not understand simple fundamentals and instead like a clueless teenage girl chases after tall dudes with silky, long hair even if that means billions in losses, but will throw his investors under the bus just to chase a vanity investment to its bitter chapter-11 end.

But if one digs deeper, WeWork's house of shared office space came crashing down only after it became clear that the primary source of its heretofore unlimited growth, virtually unlimited cash spending by both companies and investors, was coming to an end, something which Goldman showed finally took place this year, as the total change in cash spending - including spending on CapEx as well as buybacks and dividends - in Q2 plunged 13% Y/Y. It's is hardly a coincidence that that's when WeWork's troubles first emerged, and when its bankers scrambled to take the company public.

https://www.zerohedge.com/markets/one-banks-stunning-chart-s…

.........................................................................................................................................................

Tech and finance experts are shocked by SoftBank’s 'stone cold crazy' $1.7 billion golden parachute for ousted WeWork CEO Adam Neumann

Aaron Holmes, Business Insider 12h

*Legal experts said a shareholder lawsuit is unlikely, but that shareholders have good reason to be upset by the deal.

' Meanwhile, outside experts said the episode tarnishes the reputation of SoftBank and its billionaire CEO Masayoshi Son. ... ...

Legal experts say a shareholder lawsuit against WeWork seems unlikely

Minor Myers, a professor at UConn Law School specializing in corporate finance, said WeWork is unlikely to see a shareholder lawsuit, even if shareholders have good reason to be upset about how much money Neumann walked away with.

"The existing group of stockholders is employees and sophisticated investors," Myers said. "These are people who are generally reluctant to bring lawsuits, because you have to say 'Hey you tricked me,' which doesn't make you look particularly sophisticated."

Charles Korsmo, a professor of corporate law at Case Western Reserve, said he doesn't expect a shareholder lawsuit either.

"[Shareholders] are getting the opportunity to sell into SoftBank's tender offer, so they are probably feeling better than they were yesterday," he said. "The WeWork shareholders themselves are primarily sophisticated parties who would likely be embarrassed to sue claiming they had been bamboozled."

But experts agreed that shareholders have good reason to be upset at the deal

Myers noted that WeWork's S-1 filing claimed Neumann was integral to the company's success, which could have made his departure a liability — but since the company never went public, those claims aren't grounds for a suit.

"There's a reason to be upset with SoftBank. If you think there's a problem with Adam Neumann, why didn't you do this before?" he said.

Korsmo predicted that SoftBank could face shareholder ire. SoftBank has sunk more than $10 billion into WeWork already.

"If anyone has reason for feeling aggrieved, it is the public shareholders of SoftBank, which appears to be throwing good money after bad," Korsmo said. ...

https://www.businessinsider.de/experts-react-softbank-17-bil…

.....................................................................................................................................................

NYU professor Scott Galloway says that the era of startups growing at all costs is coming to a close, and it means Uber is likely going to have to change its business model

Scott Galloway, Section4

18.10.2019, 22:48

* Scott Galloway, the best-selling author and well-known tech-industry pundit, is a professor of marketing at New York University's Stern School of Business. His weekly business videos at Section4 and Winners & Losers have generated millions of views.

* The following is his recent blog post in full, republished by permission. It originally ran on his own blog,"No Mercy / No Malice."

* In it, he says that companies generally have either growth or margins — but generally not both. But the rise of companies Microsoft, Google, and Facebook showed that some rare companies are able to do it all.

* But companies like WeWork and Uber show an "infatuation" with growth, which is rapidly coming to an end as they reckon with a shift to margins. Even Netflix adopted this shift in their earnings call.

... 🍻 ... 🥂 ... 🍻 ... 🤢 ...