Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Sa - 500 Beiträge pro Seite | Diskussion im Forum

eröffnet am 04.12.19 19:37:28 von

neuester Beitrag 27.03.23 12:40:58 von

neuester Beitrag 27.03.23 12:40:58 von

Beiträge: 59

ID: 1.316.459

ID: 1.316.459

Aufrufe heute: 0

Gesamt: 5.181

Gesamt: 5.181

Aktive User: 0

Es handelt sich um einen automatisiert angelegten Thread zur Nachricht "Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Saudi Aramco-Aktie ausbremsen" vom Autor Redaktion w:o

Es ist der größte Schritt des Orients seit Jahrzehnten. Der Öl-Gigant Saudi Aramco aus dem Königreich Saudi-Arabien geht im Dezember auf das Börsenparkett der Saudi Stock Exchange Tadawul in Riad. Eine Zweitnotierung an einer westlichen Börse könnte …

Lesen Sie den ganzen Artikel: Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Saudi Aramco-Aktie ausbremsen

Es ist der größte Schritt des Orients seit Jahrzehnten. Der Öl-Gigant Saudi Aramco aus dem Königreich Saudi-Arabien geht im Dezember auf das Börsenparkett der Saudi Stock Exchange Tadawul in Riad. Eine Zweitnotierung an einer westlichen Börse könnte …

Lesen Sie den ganzen Artikel: Exklusivinterview mit Omar Abu Rashed : Union Investment-Aktienexperte: Ölpreis und König könnten Saudi Aramco-Aktie ausbremsen

dpa-AFX

04.12.2019 | 13:49

IPO/Kreise: Saudi Aramco will Spanne beim Ausgabepreis voll ausschöpfen

Der saudische Ölriese Saudi Aramco soll Insidern zufolge für seinen geplanten Börsengang das obere Ende der zuvor bekannten Preisspanne anpeilen. Das Aktienpaket im Umfang von 1,5 Prozent aller Anteile soll demnach für 32 saudische Rial (7,71 Euro) je Anteilsschein an der Börse platziert werden, wie die Nachrichtenagentur Bloomberg am Mittwoch unter Verweis auf mit der Sache vertraute Personen berichtete.

Viele lokale Investoren hätten ihre Bestellungen mit der Erwartung verbunden, dass eine starke Nachfrage zu einem Preis am oberen Ende der Spanne führen werde, hieß es weiter in dem Bericht der Agentur. Der Prospekt hatte zuvor von einer Spanne zwischen 30 und 32 Rial gesprochen. Die offizielle Bekanntgabe des Ausgabepreises wird laut Prospekt für diesen ...

https://www.finanznachrichten.de/nachrichten-2019-12/4834056…

...........................................................................................................................................

04.12.2019

Saudi-Prinz erlebt bei Börsegang von Aramco kleine Enttäuschung

30 Milliarden Dollar an Erlösen wollte Kronprinz Salman mit dem Börsengang von Aramco erlösen. Es dürften höchsten 25,6 Milliarden Dollar werden.

von Irmgard Kischko

Es ist ein Börsegang der Rekorde und trotzdem löst er keinen Enthusiasmus bei den Anlegern aus: Der staatliche saudische Ölkonzern Aramco, der über die weltweit zweitgrößten Erdölreserven (nach Venezuela) verfügt, geht an die Börse. 25,6 Milliarden Dollar sollen damit in die Kassen des ultrakonservativen Staates gespült werden.

So viel hat nicht einmal der chinesische Onlinehändler Alibaba geschafft, der mit seiner Aktienausgabe im Jahr 2014 rund 25 Milliarden Dollar einnahm. Und doch dürfte Kronprinz Mohammed bin Salman damit nicht zufrieden sein. Er träumte von 30 Milliarden Dollar, die der Verkauf von nur 1,5 Prozent von Aramco an Aktionäre einbringen sollte. Die Nachfrage der Anleger sei aber nicht berauschend gewesen, heißt es bei den Banken, die die Emission betreuen. Zwar war das Angebot 1,7-fach überzeichnet. Bei besonders erfolgreichen Börsegängen liege die Überzeichnung aber oft beim 20-fachen. Salman kämpft trotzdem dafür, dass die Aramco-Aktien am oberen Ende des Preisbandes von 30 bis 32 Rial (7,2 bis 7,7 Euro) platziert werden. Er braucht das Geld, für seinen Plan, die Wirtschaft des Landes weniger vom Öl abhängig zu machen und den sozialen Frieden zu sichern.

Gespalten

Die nicht allzu überbordende Nachfrage nach Aramco-Aktien hat mehrere Gründe. Zum einen wurde ein Teil ...

https://kurier.at/wirtschaft/saudi-prinz-erlebt-bei-boersega…

................................................................................................................................................

Benjamin Fulford Report: "Things Heat up" -- November 25, 2019

11/28/2019 01:56:00 AM Benjamin Fulford, CIA, Corruption, Economics, Federal Reserve, Geopolitics, Intel, Israel, Khazarian, Secret Societies, Trump, UK, US Government, USA, Zionist

Weekly Geo-political News and Analysis

Things heat up as Netanyahu indicted, while Trump declares war on the Queen

November 25, 2019

By Benjamin Fulford

...

Trump, meanwhile, is also attacking Wall Street, according to the Pentagon sources. “After the failed IPOs of WeWork, Lyft, and Uber, greedy Wall Street is unable to make much money from the pump-and-dump Aramco IPO, as their top dogs like JP Morgan and Goldman Sachs face DOJ criminal enterprise investigations along with Boeing, General Electric, and other corporate miscreants,” the sources say.

Saudi Aramco, of course, is key to the support of the Rockefeller petrodollar. On this front, the Pentagon sources note, “The Canada Pension Plan Investment Board, the Russian oil company Lukoil, and the Malaysian national oil company Petronas all say no to Aramco, leading other pensions like the Japan Pension Investment Fund and state-owned oil companies like Rosneft, PetroChina, Sinopec, Gazprom, Petrobras, and Pertamina to follow.” ...

https://operationdisclosure1.blogspot.com/2019/11/benjamin-f…

04.12.2019 | 13:49

IPO/Kreise: Saudi Aramco will Spanne beim Ausgabepreis voll ausschöpfen

Der saudische Ölriese Saudi Aramco soll Insidern zufolge für seinen geplanten Börsengang das obere Ende der zuvor bekannten Preisspanne anpeilen. Das Aktienpaket im Umfang von 1,5 Prozent aller Anteile soll demnach für 32 saudische Rial (7,71 Euro) je Anteilsschein an der Börse platziert werden, wie die Nachrichtenagentur Bloomberg am Mittwoch unter Verweis auf mit der Sache vertraute Personen berichtete.

Viele lokale Investoren hätten ihre Bestellungen mit der Erwartung verbunden, dass eine starke Nachfrage zu einem Preis am oberen Ende der Spanne führen werde, hieß es weiter in dem Bericht der Agentur. Der Prospekt hatte zuvor von einer Spanne zwischen 30 und 32 Rial gesprochen. Die offizielle Bekanntgabe des Ausgabepreises wird laut Prospekt für diesen ...

https://www.finanznachrichten.de/nachrichten-2019-12/4834056…

...........................................................................................................................................

04.12.2019

Saudi-Prinz erlebt bei Börsegang von Aramco kleine Enttäuschung

30 Milliarden Dollar an Erlösen wollte Kronprinz Salman mit dem Börsengang von Aramco erlösen. Es dürften höchsten 25,6 Milliarden Dollar werden.

von Irmgard Kischko

Es ist ein Börsegang der Rekorde und trotzdem löst er keinen Enthusiasmus bei den Anlegern aus: Der staatliche saudische Ölkonzern Aramco, der über die weltweit zweitgrößten Erdölreserven (nach Venezuela) verfügt, geht an die Börse. 25,6 Milliarden Dollar sollen damit in die Kassen des ultrakonservativen Staates gespült werden.

So viel hat nicht einmal der chinesische Onlinehändler Alibaba geschafft, der mit seiner Aktienausgabe im Jahr 2014 rund 25 Milliarden Dollar einnahm. Und doch dürfte Kronprinz Mohammed bin Salman damit nicht zufrieden sein. Er träumte von 30 Milliarden Dollar, die der Verkauf von nur 1,5 Prozent von Aramco an Aktionäre einbringen sollte. Die Nachfrage der Anleger sei aber nicht berauschend gewesen, heißt es bei den Banken, die die Emission betreuen. Zwar war das Angebot 1,7-fach überzeichnet. Bei besonders erfolgreichen Börsegängen liege die Überzeichnung aber oft beim 20-fachen. Salman kämpft trotzdem dafür, dass die Aramco-Aktien am oberen Ende des Preisbandes von 30 bis 32 Rial (7,2 bis 7,7 Euro) platziert werden. Er braucht das Geld, für seinen Plan, die Wirtschaft des Landes weniger vom Öl abhängig zu machen und den sozialen Frieden zu sichern.

Gespalten

Die nicht allzu überbordende Nachfrage nach Aramco-Aktien hat mehrere Gründe. Zum einen wurde ein Teil ...

https://kurier.at/wirtschaft/saudi-prinz-erlebt-bei-boersega…

................................................................................................................................................

Benjamin Fulford Report: "Things Heat up" -- November 25, 2019

11/28/2019 01:56:00 AM Benjamin Fulford, CIA, Corruption, Economics, Federal Reserve, Geopolitics, Intel, Israel, Khazarian, Secret Societies, Trump, UK, US Government, USA, Zionist

Weekly Geo-political News and Analysis

Things heat up as Netanyahu indicted, while Trump declares war on the Queen

November 25, 2019

By Benjamin Fulford

...

Trump, meanwhile, is also attacking Wall Street, according to the Pentagon sources. “After the failed IPOs of WeWork, Lyft, and Uber, greedy Wall Street is unable to make much money from the pump-and-dump Aramco IPO, as their top dogs like JP Morgan and Goldman Sachs face DOJ criminal enterprise investigations along with Boeing, General Electric, and other corporate miscreants,” the sources say.

Saudi Aramco, of course, is key to the support of the Rockefeller petrodollar. On this front, the Pentagon sources note, “The Canada Pension Plan Investment Board, the Russian oil company Lukoil, and the Malaysian national oil company Petronas all say no to Aramco, leading other pensions like the Japan Pension Investment Fund and state-owned oil companies like Rosneft, PetroChina, Sinopec, Gazprom, Petrobras, and Pertamina to follow.” ...

https://operationdisclosure1.blogspot.com/2019/11/benjamin-f…

Wo ist hier die Phantasie?

Ok. Aramco sitzt auf Ölreserven. Diese werden nach and nach verkauft.Und weiter?

Welche Entwicklungen kann es geben, welche neuen Geschäftsgebiete, welche neuen Produkte, welche Märkte können zusätzlich erschlossen werden?

Ich sehe nichts.

Es ist wohl die langweiligste Aktie, die ich je gesehen habe. Oder nicht?

Also: Woher kommt Phantasie für diesen Wert?

Antwort auf Beitrag Nr.: 62.080.943 von teecee1 am 04.12.19 19:37:28Samstag, 7. Dezember 2019

X-22 Report vom 6.12.2019 - Botschaft gesendet und empfangen - Zeit für den Hammer - Die Verantwortlichen werden bestraft. - Episode 2039b

... ... 9/11 ... Krieg ums OIL ... Petro Dollar System ... Anschalg auf saudische Ölanlagen ... persischer Golf Tankeranschläge ... ect ...

... 9/11 ... Krieg ums OIL ... Petro Dollar System ... Anschalg auf saudische Ölanlagen ... persischer Golf Tankeranschläge ... ect ...

...

Gestern sprachen wir darüber, wie die Fake-News sagten, dass wir 12000, 14000, 15000 Soldaten in den Nahen Osten schicken, um den Iran zu zerschlagen.

Und wir sagten, das ist absolut gefälscht, unecht und falsch.

Trump twitterte heute:

Die heutige Geschichte, dass wir 12.000 Soldaten nach Saudi-Arabien schicken, ist falsch oder, um es genauer auszudrücken, Fake News!

...

Und die US-Beamten sagen, dass der Verdächtige bei der Schießerei auf dem Marineflugplatz in Pensacola ein Luftfahrtschüler aus Saudi-Arabien war.

Nun, das ist sehr interessant. Sie sagen, dass das mit Terror zu tun hatte.

Und wenn wir in der Zeit zurückgehen, wissen wir, dass Hillary und Obama Visa für eine Rekordzahl von saudischen Besuchern hier in den Vereinigten Staaten ausstellten.

Und wenn wir uns das ansehen, können wir sehen, dass Hillary Clinton die Zahl der Visa für saudische Besucher in den USA verdoppelt hat, während sie dabei half, ein Abkommen mit dem Königreich abzuschließen, um auf Sicherheitsverfahren für saudische Staatsangehörige bei ihrer Ankunft in den USA zu verzichten.

Insgesamt hat die Obama-Regierung die Schleusen für mehr als 700 und 9000 saudische Staatsangehörige geöffnet, von denen die meisten ein Studenten- oder Geschäftsvisum beantragt haben.

Hmm. Ich frage mich, ob dieses Individuum einer davon war.

Trump twitterte folgendes:

König Salman von Saudi-Arabien rief gerade dazu auf, sein aufrichtiges Beileid auszusprechen und den Familien und Freunden der Krieger, die bei dem Angriff in Pensacola, Florida, getötet und verwundet wurden, seine Anteilnahme zu bekunden......

https://qlobal-change.blogspot.com/2019/12/x-22-report-vom-6…

.......................................

Saudischer Schütze von Florida soll vor Tat antiamerikanisches Manifest veröffentlicht haben

7.12.2019 • 18:16 Uhr https://de.rt.com/21q7

Der Schütze, der auf einem Militärstützpunkt im US-Bundesstaat Florida drei Menschen getötet hat, soll vor der Tat ein Manifest auf Twitter veröffentlicht haben. Das berichtet die Washington Post unter Verweis auf mehrere US-Medien.

Die Site Intelligence Group und das Middle East Media Research Institute, ...

https://deutsch.rt.com/nordamerika/95551-saudischer-schutze-…

.................................................

Terrorism Probe Opened After Pensacola Shooter IDed As Saudi National Mohammed Alshamrani; Was There For Pilot Training

by Tyler Durden

Fri, 12/06/2019 - 16:58

Update 5: Fla. Sen. Rick Scott has called for an end to the program that brought the Pensacola shooter to the US. ...

https://www.zerohedge.com/health/active-shooter-pensacola-na…

.....................................................

Six Saudis Arrested For Questioning After Pensacola Shooting - Three Were Filming Attack

by Tyler Durden

Fri, 12/06/2019 - 22:45

Six Saudi nationals were taken into custody for questioning near the Florida naval base where an Air Force trainee - also from Saudi Arabia - opened fire Friday morning, killing three before a sheriff's deputy shot and killed him. ...

https://www.zerohedge.com/political/six-saudis-arrested-and-…

X-22 Report vom 6.12.2019 - Botschaft gesendet und empfangen - Zeit für den Hammer - Die Verantwortlichen werden bestraft. - Episode 2039b

...

... 9/11 ... Krieg ums OIL ... Petro Dollar System ... Anschalg auf saudische Ölanlagen ... persischer Golf Tankeranschläge ... ect ...

... 9/11 ... Krieg ums OIL ... Petro Dollar System ... Anschalg auf saudische Ölanlagen ... persischer Golf Tankeranschläge ... ect ......

Gestern sprachen wir darüber, wie die Fake-News sagten, dass wir 12000, 14000, 15000 Soldaten in den Nahen Osten schicken, um den Iran zu zerschlagen.

Und wir sagten, das ist absolut gefälscht, unecht und falsch.

Trump twitterte heute:

Die heutige Geschichte, dass wir 12.000 Soldaten nach Saudi-Arabien schicken, ist falsch oder, um es genauer auszudrücken, Fake News!

...

Und die US-Beamten sagen, dass der Verdächtige bei der Schießerei auf dem Marineflugplatz in Pensacola ein Luftfahrtschüler aus Saudi-Arabien war.

Nun, das ist sehr interessant. Sie sagen, dass das mit Terror zu tun hatte.

Und wenn wir in der Zeit zurückgehen, wissen wir, dass Hillary und Obama Visa für eine Rekordzahl von saudischen Besuchern hier in den Vereinigten Staaten ausstellten.

Und wenn wir uns das ansehen, können wir sehen, dass Hillary Clinton die Zahl der Visa für saudische Besucher in den USA verdoppelt hat, während sie dabei half, ein Abkommen mit dem Königreich abzuschließen, um auf Sicherheitsverfahren für saudische Staatsangehörige bei ihrer Ankunft in den USA zu verzichten.

Insgesamt hat die Obama-Regierung die Schleusen für mehr als 700 und 9000 saudische Staatsangehörige geöffnet, von denen die meisten ein Studenten- oder Geschäftsvisum beantragt haben.

Hmm. Ich frage mich, ob dieses Individuum einer davon war.

Trump twitterte folgendes:

König Salman von Saudi-Arabien rief gerade dazu auf, sein aufrichtiges Beileid auszusprechen und den Familien und Freunden der Krieger, die bei dem Angriff in Pensacola, Florida, getötet und verwundet wurden, seine Anteilnahme zu bekunden......

https://qlobal-change.blogspot.com/2019/12/x-22-report-vom-6…

.......................................

Saudischer Schütze von Florida soll vor Tat antiamerikanisches Manifest veröffentlicht haben

7.12.2019 • 18:16 Uhr https://de.rt.com/21q7

Der Schütze, der auf einem Militärstützpunkt im US-Bundesstaat Florida drei Menschen getötet hat, soll vor der Tat ein Manifest auf Twitter veröffentlicht haben. Das berichtet die Washington Post unter Verweis auf mehrere US-Medien.

Die Site Intelligence Group und das Middle East Media Research Institute, ...

https://deutsch.rt.com/nordamerika/95551-saudischer-schutze-…

.................................................

Terrorism Probe Opened After Pensacola Shooter IDed As Saudi National Mohammed Alshamrani; Was There For Pilot Training

by Tyler Durden

Fri, 12/06/2019 - 16:58

Update 5: Fla. Sen. Rick Scott has called for an end to the program that brought the Pensacola shooter to the US. ...

https://www.zerohedge.com/health/active-shooter-pensacola-na…

.....................................................

Six Saudis Arrested For Questioning After Pensacola Shooting - Three Were Filming Attack

by Tyler Durden

Fri, 12/06/2019 - 22:45

Six Saudi nationals were taken into custody for questioning near the Florida naval base where an Air Force trainee - also from Saudi Arabia - opened fire Friday morning, killing three before a sheriff's deputy shot and killed him. ...

https://www.zerohedge.com/political/six-saudis-arrested-and-…

...  ... einen Grund gibt es ... liegt aber nicht bei Aramco ... der ist Nebensache ... Erpressung durch den DS ... Drain the Swamp ...

... einen Grund gibt es ... liegt aber nicht bei Aramco ... der ist Nebensache ... Erpressung durch den DS ... Drain the Swamp ...

Saudi-Arabien beendet Geschlechtertrennung in Restaurants und Cafés

Aktualisiert am 08. Dezember 2019, 23:10 Uhr

Kleine Schritte in Richtung Gleichberechtigung: In Saudi-Arabien müssen Frauen künftig keinen Extra-Eingang mehr benützen, wenn sie in Restaurants oder Cafés gehen. Das streng muslimische Land will sich zumindest ein wenig westlichen Gepflogenheiten anpassen.

Männer und Frauen dürfen in Restaurants und Cafés in Saudi-Arabien künftig denselben Eingang nutzen. In dem streng konservativen Land galt bisher die Vorschrift, dass Frauen und Familien einen Eingang nutzen müssen und Männer einen weiteren. Das saudische Ministerium für Gemeinden und ländliche Angelegenheiten kündigte am Sonntag auf Twitter an, ...

https://www.gmx.net/magazine/panorama/saudi-arabien-beendet-…

..................................................................................................................................................

Vier Gründe, warum Anleger nicht in Saudi Aramco investieren sollten

Am Mittwoch bringt der saudische Erdölkonzern seine Anteilsscheine in den Handel. Wer sich von den Superlativen beeindrucken lässt, könnte sich die Finger verbrennen.

09.12.2019 16:40

Gioia da Silva

Saudi Aramco ist ein Gigant sondergleichen. Die Bewertung des profitabelsten Unternehmens der Welt liegt bei 1'700 Milliarden US-Dollar, was etwa dem Wert aller Güter und Dienstleistungen entspricht, die jährlich in Kanada produziert werden. Ab Mittwoch sind die ersten Aktien des Erdölkonzerns an der Börse des arabischen Königreiches erhältlich – allerdings gibt Saudi Aramco "nur" Anteilsscheine im Gesamtwert von 25 Milliarden US-Dollar aus.

Womit wir schon beim ersten Problem wären. ...

https://www.cash.ch/news/politik/groesstes-ipo-der-geschicht…

.......................................................................................................................................................

Forget The Hype, Aramco Shares May Be Valued At Zero Next Year

by Tyler Durden

Mon, 12/09/2019 - 09:18

Authored by Simon Watkins via OilPrice.com,

This week will see the onset of full trading activity in the shares of Saudi Arabia’s flagship oil company, Aramco. Through a combination of wooing local retail investors via preferential loans, threatening wealthy Saudis with the sort of treatment they had during their imprisonment in the Ritz Carlton in 2017, and inveigling the two principal credit ratings agencies to toe the exact Saudi line on the ‘lack of significance’ of the ‘Houthi’ attacks on Abqaiq and Khurais, the Saudis have finally been able to sell off a part of Aramco. It may be nearly three years late, only around one third of the original amount intended, have no foreign listing, and be priced to value the entire company at much less than the US$2 trillion that Crown Prince Mohammad bin Salman (MbS) had staked his reputation on but it is done.

The shares are to be finally priced at the top end of the initial range, at SAR 32 (US$8), according to Saudi sources. The problem with this is that within the coming year Aramco shares could well be valued at US$0.

The reason for this is not connected to the fact that Aramco does not actually own any of the sites from which it extracts oil and gas – not a single field, not a single well. It is not connected to the fact that it is used as a conduit to fund the latest harebrained social or vanity projects that are nothing to do with its core business – including developing a USS5 billion ship repair and creating the King Abdullah University of Science and Technology. And nor is it connected to the mathematically impossible assertion by the Saudis that its oil reserves have remained at basically the same level for the last 30 or more years despite Saudi pumping an average of nearly three billion barrels of oil every year from 1973 to the end of 2017 - totalling 132 billion barrels – with no new significant oil finds being made during that period. It is not even connected to the multiple class-action lawsuits that Saudi Arabia is facing from the families of the ‘9-11’ terrorist attacks for its part in them (15 of the 19 hijackers were Saudi nationals) nor to MbS personally giving the order to murder journalist Jamal Khashoggi, according to the CIA, among many others. These, though, were key reasons why no listing for Aramco took place in the U.S., and indeed the U.K. ...

https://www.zerohedge.com/energy/forget-hype-aramco-shares-m…

... einen Grund gibt es ... liegt aber nicht bei Aramco ... der ist Nebensache ... Erpressung durch den DS ... Drain the Swamp ...

... einen Grund gibt es ... liegt aber nicht bei Aramco ... der ist Nebensache ... Erpressung durch den DS ... Drain the Swamp ... Saudi-Arabien beendet Geschlechtertrennung in Restaurants und Cafés

Aktualisiert am 08. Dezember 2019, 23:10 Uhr

Kleine Schritte in Richtung Gleichberechtigung: In Saudi-Arabien müssen Frauen künftig keinen Extra-Eingang mehr benützen, wenn sie in Restaurants oder Cafés gehen. Das streng muslimische Land will sich zumindest ein wenig westlichen Gepflogenheiten anpassen.

Männer und Frauen dürfen in Restaurants und Cafés in Saudi-Arabien künftig denselben Eingang nutzen. In dem streng konservativen Land galt bisher die Vorschrift, dass Frauen und Familien einen Eingang nutzen müssen und Männer einen weiteren. Das saudische Ministerium für Gemeinden und ländliche Angelegenheiten kündigte am Sonntag auf Twitter an, ...

https://www.gmx.net/magazine/panorama/saudi-arabien-beendet-…

..................................................................................................................................................

Vier Gründe, warum Anleger nicht in Saudi Aramco investieren sollten

Am Mittwoch bringt der saudische Erdölkonzern seine Anteilsscheine in den Handel. Wer sich von den Superlativen beeindrucken lässt, könnte sich die Finger verbrennen.

09.12.2019 16:40

Gioia da Silva

Saudi Aramco ist ein Gigant sondergleichen. Die Bewertung des profitabelsten Unternehmens der Welt liegt bei 1'700 Milliarden US-Dollar, was etwa dem Wert aller Güter und Dienstleistungen entspricht, die jährlich in Kanada produziert werden. Ab Mittwoch sind die ersten Aktien des Erdölkonzerns an der Börse des arabischen Königreiches erhältlich – allerdings gibt Saudi Aramco "nur" Anteilsscheine im Gesamtwert von 25 Milliarden US-Dollar aus.

Womit wir schon beim ersten Problem wären. ...

https://www.cash.ch/news/politik/groesstes-ipo-der-geschicht…

.......................................................................................................................................................

Forget The Hype, Aramco Shares May Be Valued At Zero Next Year

by Tyler Durden

Mon, 12/09/2019 - 09:18

Authored by Simon Watkins via OilPrice.com,

This week will see the onset of full trading activity in the shares of Saudi Arabia’s flagship oil company, Aramco. Through a combination of wooing local retail investors via preferential loans, threatening wealthy Saudis with the sort of treatment they had during their imprisonment in the Ritz Carlton in 2017, and inveigling the two principal credit ratings agencies to toe the exact Saudi line on the ‘lack of significance’ of the ‘Houthi’ attacks on Abqaiq and Khurais, the Saudis have finally been able to sell off a part of Aramco. It may be nearly three years late, only around one third of the original amount intended, have no foreign listing, and be priced to value the entire company at much less than the US$2 trillion that Crown Prince Mohammad bin Salman (MbS) had staked his reputation on but it is done.

The shares are to be finally priced at the top end of the initial range, at SAR 32 (US$8), according to Saudi sources. The problem with this is that within the coming year Aramco shares could well be valued at US$0.

The reason for this is not connected to the fact that Aramco does not actually own any of the sites from which it extracts oil and gas – not a single field, not a single well. It is not connected to the fact that it is used as a conduit to fund the latest harebrained social or vanity projects that are nothing to do with its core business – including developing a USS5 billion ship repair and creating the King Abdullah University of Science and Technology. And nor is it connected to the mathematically impossible assertion by the Saudis that its oil reserves have remained at basically the same level for the last 30 or more years despite Saudi pumping an average of nearly three billion barrels of oil every year from 1973 to the end of 2017 - totalling 132 billion barrels – with no new significant oil finds being made during that period. It is not even connected to the multiple class-action lawsuits that Saudi Arabia is facing from the families of the ‘9-11’ terrorist attacks for its part in them (15 of the 19 hijackers were Saudi nationals) nor to MbS personally giving the order to murder journalist Jamal Khashoggi, according to the CIA, among many others. These, though, were key reasons why no listing for Aramco took place in the U.S., and indeed the U.K. ...

https://www.zerohedge.com/energy/forget-hype-aramco-shares-m…

Antwort auf Beitrag Nr.: 62.116.325 von teecee1 am 09.12.19 19:28:03 ...  ... Telekom -90% ... T-Online -100% ...

... Telekom -90% ... T-Online -100% ...

"Volksaktie" Saudi Aramco

Die Deutsche Telekom der Saudis

Größter Ölproduzent, profitabelstes Unternehmen der Welt: Saudi Aramco ist ein Konzern der Superlative. Nun soll er noch einen Rekordbörsengang hinlegen - auch dank kauffreudiger saudischer Kleinanleger.

Von Tim Bartz, Frankfurt am Main

... sondern daran, dass Riad Aramco weiterhin zu 98,5 Prozent kontrolliert und die gewaltigen Dividenden beinahe im Alleingang abräumt ...

... Zudem ist die Dividendenrendite unattraktiv. ... ... niedriger als die Kreditzinsen für die Kleinanleger + Gebühren ...

... niedriger als die Kreditzinsen für die Kleinanleger + Gebühren ...

https://www.spiegel.de/wirtschaft/unternehmen/saudi-aramco-w…

................................

... ... Spülmittel ... was wird gespült ... herausgespült ...

... Spülmittel ... was wird gespült ... herausgespült ...

Dienstag, 10. Dezember 2019

Trotz Aramco-Börsengang

Saudi-Arabien erwartet Milliarden-Defizit

Der weltgrößte Börsengang könnte Saudi-Arabien eine dreistellige Milliardensumme in die Staatskassen spülen. Das Geld kann das Regime in Riad sehr gut gebrauchen. Das Haushaltsdefizit dürfte 2020 noch einmal deutlich zulegen. ...

https://www.n-tv.de/wirtschaft/Saudi-Arabien-erwartet-Millia…

.................................

... ... was hängt man alls auf ... Wäsche ... Geld ...

... was hängt man alls auf ... Wäsche ... Geld ...

Saudi Aramco:

So wird Saudi-Arabien noch stärker an den Märkten hängen

Saudi-Arabien bringt seinen staatlichen Ölkonzern an die Börse. Das wird nicht ganz so groß wie geplant. Aber für die Zukunft des Landes hat der Schritt enorme Bedeutung.

Eine Analyse von Heike Buchter, New York

https://www.zeit.de/wirtschaft/2019-12/saudi-aramco-oelkonze…

... Telekom -90% ... T-Online -100% ...

... Telekom -90% ... T-Online -100% ..."Volksaktie" Saudi Aramco

Die Deutsche Telekom der Saudis

Größter Ölproduzent, profitabelstes Unternehmen der Welt: Saudi Aramco ist ein Konzern der Superlative. Nun soll er noch einen Rekordbörsengang hinlegen - auch dank kauffreudiger saudischer Kleinanleger.

Von Tim Bartz, Frankfurt am Main

... sondern daran, dass Riad Aramco weiterhin zu 98,5 Prozent kontrolliert und die gewaltigen Dividenden beinahe im Alleingang abräumt ...

... Zudem ist die Dividendenrendite unattraktiv. ...

... niedriger als die Kreditzinsen für die Kleinanleger + Gebühren ...

... niedriger als die Kreditzinsen für die Kleinanleger + Gebühren ...https://www.spiegel.de/wirtschaft/unternehmen/saudi-aramco-w…

................................

...

... Spülmittel ... was wird gespült ... herausgespült ...

... Spülmittel ... was wird gespült ... herausgespült ... Dienstag, 10. Dezember 2019

Trotz Aramco-Börsengang

Saudi-Arabien erwartet Milliarden-Defizit

Der weltgrößte Börsengang könnte Saudi-Arabien eine dreistellige Milliardensumme in die Staatskassen spülen. Das Geld kann das Regime in Riad sehr gut gebrauchen. Das Haushaltsdefizit dürfte 2020 noch einmal deutlich zulegen. ...

https://www.n-tv.de/wirtschaft/Saudi-Arabien-erwartet-Millia…

.................................

...

... was hängt man alls auf ... Wäsche ... Geld ...

... was hängt man alls auf ... Wäsche ... Geld ...Saudi Aramco:

So wird Saudi-Arabien noch stärker an den Märkten hängen

Saudi-Arabien bringt seinen staatlichen Ölkonzern an die Börse. Das wird nicht ganz so groß wie geplant. Aber für die Zukunft des Landes hat der Schritt enorme Bedeutung.

Eine Analyse von Heike Buchter, New York

https://www.zeit.de/wirtschaft/2019-12/saudi-aramco-oelkonze…

Antwort auf Beitrag Nr.: 62.126.765 von teecee1 am 10.12.19 21:06:57wer hier investiert kann ruhig auch verlieren.In Zeiten der Energiewende würde ich hier keinen einzigen Cent ausgeben. Es sei denn, man schmeißt wie schon einmal die erneuerbaren Energien in den Gulli, doch das kann sich die Welt jetzt nicht mehr leisten.

Besser jetzt Goldminen, Wasserstoffaktein und künstliche Intelligenz-hier liegt die Zukunft.Die Öl Multis können jetzt ruhig pleite gehen.....

Besser jetzt Goldminen, Wasserstoffaktein und künstliche Intelligenz-hier liegt die Zukunft.Die Öl Multis können jetzt ruhig pleite gehen.....

Antwort auf Beitrag Nr.: 62.126.765 von teecee1 am 10.12.19 21:06:57Breaking News: ... Wasser-Tretminen-Intelligenz ...

Die 2.222%-Wiederholung!?

weiterlesen >> ... nur Fliegen sind schöner ...

... ... ohne Öl gibt es keine einzige Unze Gold ... ect. ect. ect. ...

... ohne Öl gibt es keine einzige Unze Gold ... ect. ect. ect. ...

......................................................................................................................

... ... „so wertvoll wie eine kleine Bannane“ ... oder war es eine Gurke ...

... „so wertvoll wie eine kleine Bannane“ ... oder war es eine Gurke ...

... was kann man noch an die Wand kleben ... ne Curry-Wurst mit ... ne °peeep° Wurst ... den Hans-Wurst ...

... https://www.epochtimes.de/feuilleton/kultur/realsatire-120-0…

.........................................................................................................................

IPO/ROUNDUP:

Aramco wird nach Börsengang wertvollstes Unternehmen der Welt

Nachrichtenagentur: dpa-AFX 11.12.2019, 12:30 | 446 | 0 | 0

RIAD (dpa-AFX) - Der saudische Ölgigant Aramco hat den bisher größten Börsengang hingelegt und das Technologie-Schwergewicht Apple als wertvollstes Unternehmen der Welt abgelöst. Am ersten Handelstag an der saudischen Wertpapierbörse Tadawul am Mittwoch wurden Aktien des Staatskonzerns unter dem Symbol 2222 zum höchstmöglichen Preis von 35,2 Riyal (9,39 Dollar) gehandelt. Das entsprach dem erlaubten Tageslimit von zehn Prozent über dem zuvor festgelegten Ausgabepreis von 32 Riyal (8,53 Dollar). ...

IPO/ROUNDUP: Aramco wird nach Börsengang wertvollstes Unternehmen der Welt | wallstreet-online.de - Vollständiger Artikel unter:

https://www.wallstreet-online.de/nachricht/11977640-ipo-roun…

Die 2.222%-Wiederholung!?

weiterlesen >> ... nur Fliegen sind schöner ...

...

... ohne Öl gibt es keine einzige Unze Gold ... ect. ect. ect. ...

... ohne Öl gibt es keine einzige Unze Gold ... ect. ect. ect. .........................................................................................................................

...

... „so wertvoll wie eine kleine Bannane“ ... oder war es eine Gurke ...

... „so wertvoll wie eine kleine Bannane“ ... oder war es eine Gurke ...... was kann man noch an die Wand kleben ... ne Curry-Wurst mit ... ne °peeep° Wurst ... den Hans-Wurst ...

... https://www.epochtimes.de/feuilleton/kultur/realsatire-120-0…

.........................................................................................................................

IPO/ROUNDUP:

Aramco wird nach Börsengang wertvollstes Unternehmen der Welt

Nachrichtenagentur: dpa-AFX 11.12.2019, 12:30 | 446 | 0 | 0

RIAD (dpa-AFX) - Der saudische Ölgigant Aramco hat den bisher größten Börsengang hingelegt und das Technologie-Schwergewicht Apple als wertvollstes Unternehmen der Welt abgelöst. Am ersten Handelstag an der saudischen Wertpapierbörse Tadawul am Mittwoch wurden Aktien des Staatskonzerns unter dem Symbol 2222 zum höchstmöglichen Preis von 35,2 Riyal (9,39 Dollar) gehandelt. Das entsprach dem erlaubten Tageslimit von zehn Prozent über dem zuvor festgelegten Ausgabepreis von 32 Riyal (8,53 Dollar). ...

IPO/ROUNDUP: Aramco wird nach Börsengang wertvollstes Unternehmen der Welt | wallstreet-online.de - Vollständiger Artikel unter:

https://www.wallstreet-online.de/nachricht/11977640-ipo-roun…

Antwort auf Beitrag Nr.: 62.134.523 von teecee1 am 11.12.19 17:13:58selbst wenn dass Teil steigt, würde ich schon als Prinzip keinen Euro investieren. Wenn ich überlege, wie die uns hunderte Jahre ausgenommen haben.

Der Börsengang dient nur dazu, Geld reinzubekommen, da die genau wissen, dass die Zeiten des Öls zu ende gehen

Der Börsengang dient nur dazu, Geld reinzubekommen, da die genau wissen, dass die Zeiten des Öls zu ende gehen

Antwort auf Beitrag Nr.: 62.134.523 von teecee1 am 11.12.19 17:13:58News! ... 🌲🌲🌲🦌🌲🌲🌲🦃🌲🌲 ... findet den H-Ochs ...

Jetzt den Akku aufladen und noch vor Jahresende

den 2222 Jahre alten Schampus öffnen!? ...

weiterlesen >> ... alles Greta ... ⛄ ... 🎅 ...

......................................................................................................................................................

Trump bezeichnete Thunbergs Ernennung zur „Person des Jahres“ als lächerlich

15:28 12.12.2019Zum https://sptnkne.ws/AED8

US-Präsident Donald Trump hat Thunbergs Ehrung zur „Persönlichkeit des Jahres“ vom renommierten US-Magazin „Time“ als lächerlich bezeichnet.

Am Mittwoch hatte „Time“ die junge schwedische Klimaaktivistin als „Person des Jahres“ getitelt. Begründet wurde dies damit, dass Thunberg viel mehr als andere getan habe, um die Klimaprobleme von hinter den Kulissen in den Mittelpunkt zu rücken.

„So lächerlich. Greta muss an ihrem Aggressionsbewältigungsproblem arbeiten und dann mit einem Freund einen guten, alten Film ansehen! Entspann dich Greta, entspann dich!“, so kommentierte Trump die Auszeichnung auf seiner Twitter-Seite am Donnerstag.

... 🎖 ...

.....................................................................................................................................................

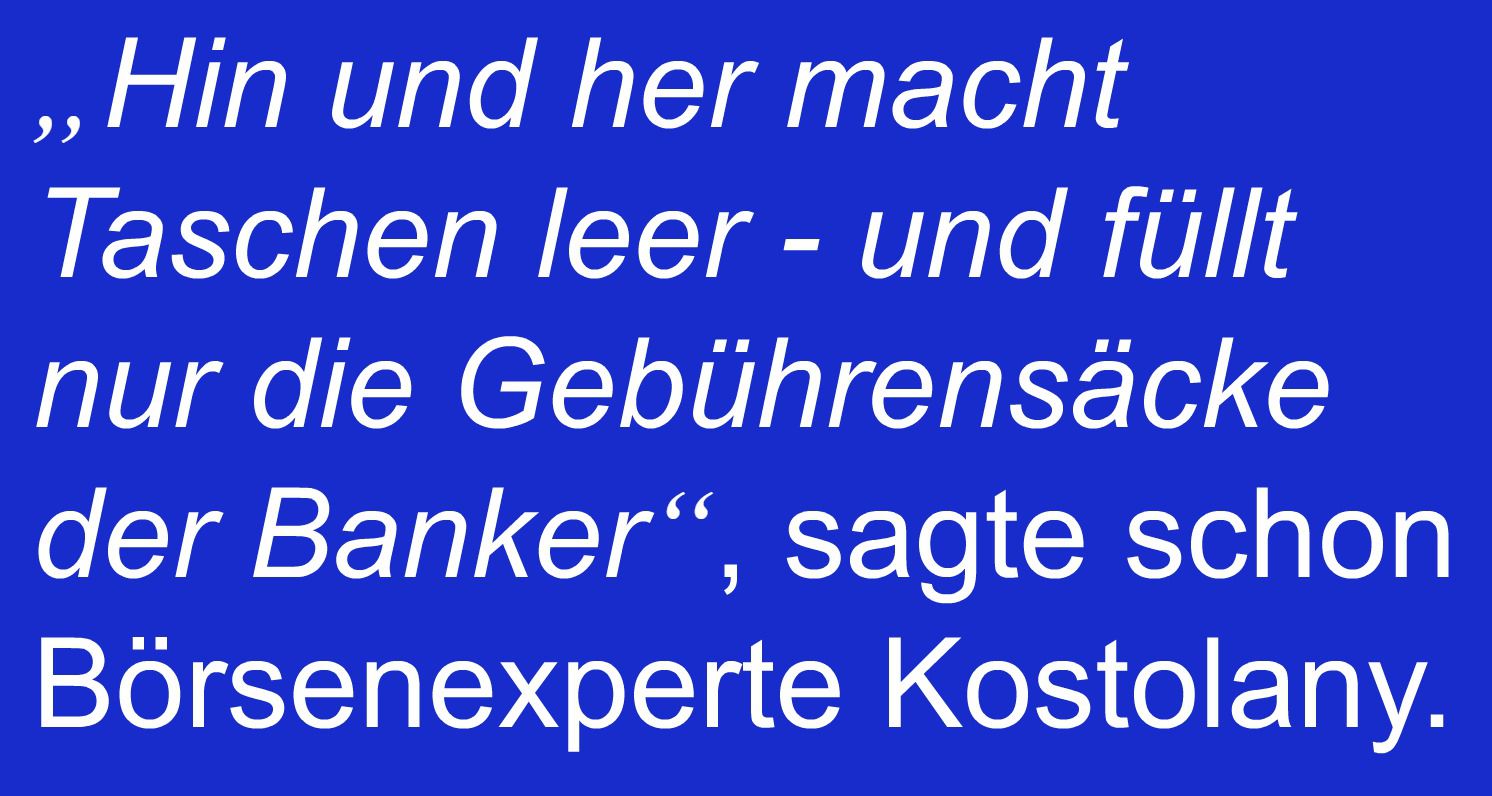

The Wall Street Bankers Who Burst Aramco’s $2 Trillion Bubble

Javier Blas, Dinesh Nair and Matthew Martin

Bloomberg December 11, 2019

(Bloomberg) -- The chairman of the world’s biggest oil company was about to lose his temper.

At a meeting in Riyadh on a sultry October evening, Achintya Mangla, one of JPMorgan Chase & Co.’s most senior bankers, had told Yasir Al-Rumayyan there was no way international investors were going to value Saudi Aramco -- just weeks away from an initial public offering -- at $2 trillion.

Al-Rumayyan, who’d risen in just a few years from head of a mid-sized investment bank in Riyadh to one of the most powerful jobs in the global economy, erupted. He unleashed a torrent of expletives in Arabic and English that shocked the roomful of battle-hardened bankers. The chairman was probably worried about telling his boss, the crown prince who locked up many of the nation’s wealthiest people in a five-star hotel just two years ago.

In the three and a half years since Saudi Arabia’s Mohammed bin Salman first proposed an initial public offering of Aramco, the state oil company that pumps 10% of the world’s oil, the $2 trillion valuation had caused trouble.

The prince, who runs the day-to-day affairs of the kingdom, had long insisted on the stratospheric valuation, almost double any other business on the planet, and nobody had been able to convince him global investors didn’t agree. Anyone who argued with him got pushed aside, including Khalid Al-Falih, sacked as Aramco chairman and oil minister earlier this year.

This account is based on interviews with bankers, consultants, executives, government officials and members of the royal family, many of whom asked not to be identified discussing private meetings and conversations. Aramco, the banks and fund managers all declined to comment.

When bankers pitched for a role on the IPO this year, they told Al-Rumayyan what he needed to hear: that $2 trillion wasn’t out of the question. The range initially pitched by Wall Street was $1.7 trillion to $2.4 trillion, according to people involved in the process ...

... ... 💲 2.222 ... Aramco dütfte als einziger keine Schulden haben ... Verblindlichtkeiten ... 😭 ...

... 💲 2.222 ... Aramco dütfte als einziger keine Schulden haben ... Verblindlichtkeiten ... 😭 ...

https://www.silver-phoenix500.com/article/world%E2%80%99s-la…

Jetzt den Akku aufladen und noch vor Jahresende

den 2222 Jahre alten Schampus öffnen!? ...

weiterlesen >> ... alles Greta ... ⛄ ... 🎅 ...

......................................................................................................................................................

Trump bezeichnete Thunbergs Ernennung zur „Person des Jahres“ als lächerlich

15:28 12.12.2019Zum https://sptnkne.ws/AED8

US-Präsident Donald Trump hat Thunbergs Ehrung zur „Persönlichkeit des Jahres“ vom renommierten US-Magazin „Time“ als lächerlich bezeichnet.

Am Mittwoch hatte „Time“ die junge schwedische Klimaaktivistin als „Person des Jahres“ getitelt. Begründet wurde dies damit, dass Thunberg viel mehr als andere getan habe, um die Klimaprobleme von hinter den Kulissen in den Mittelpunkt zu rücken.

„So lächerlich. Greta muss an ihrem Aggressionsbewältigungsproblem arbeiten und dann mit einem Freund einen guten, alten Film ansehen! Entspann dich Greta, entspann dich!“, so kommentierte Trump die Auszeichnung auf seiner Twitter-Seite am Donnerstag.

... 🎖 ...

.....................................................................................................................................................

The Wall Street Bankers Who Burst Aramco’s $2 Trillion Bubble

Javier Blas, Dinesh Nair and Matthew Martin

Bloomberg December 11, 2019

(Bloomberg) -- The chairman of the world’s biggest oil company was about to lose his temper.

At a meeting in Riyadh on a sultry October evening, Achintya Mangla, one of JPMorgan Chase & Co.’s most senior bankers, had told Yasir Al-Rumayyan there was no way international investors were going to value Saudi Aramco -- just weeks away from an initial public offering -- at $2 trillion.

Al-Rumayyan, who’d risen in just a few years from head of a mid-sized investment bank in Riyadh to one of the most powerful jobs in the global economy, erupted. He unleashed a torrent of expletives in Arabic and English that shocked the roomful of battle-hardened bankers. The chairman was probably worried about telling his boss, the crown prince who locked up many of the nation’s wealthiest people in a five-star hotel just two years ago.

In the three and a half years since Saudi Arabia’s Mohammed bin Salman first proposed an initial public offering of Aramco, the state oil company that pumps 10% of the world’s oil, the $2 trillion valuation had caused trouble.

The prince, who runs the day-to-day affairs of the kingdom, had long insisted on the stratospheric valuation, almost double any other business on the planet, and nobody had been able to convince him global investors didn’t agree. Anyone who argued with him got pushed aside, including Khalid Al-Falih, sacked as Aramco chairman and oil minister earlier this year.

This account is based on interviews with bankers, consultants, executives, government officials and members of the royal family, many of whom asked not to be identified discussing private meetings and conversations. Aramco, the banks and fund managers all declined to comment.

When bankers pitched for a role on the IPO this year, they told Al-Rumayyan what he needed to hear: that $2 trillion wasn’t out of the question. The range initially pitched by Wall Street was $1.7 trillion to $2.4 trillion, according to people involved in the process ...

...

... 💲 2.222 ... Aramco dütfte als einziger keine Schulden haben ... Verblindlichtkeiten ... 😭 ...

... 💲 2.222 ... Aramco dütfte als einziger keine Schulden haben ... Verblindlichtkeiten ... 😭 ...

https://www.silver-phoenix500.com/article/world%E2%80%99s-la…

Antwort auf Beitrag Nr.: 62.144.576 von teecee1 am 12.12.19 16:50:27Ölriese

Saudi Aramco zahlt Banken nur 64 Millionen Dollar für IPO-Job

Saudi Aramco wird unterrichteten Kreisen zufolge den Banken, die den weltgrössten Börsengang arrangiert haben, insgesamt nur 64 Millionen Dollar zu zahlen.

14.12.2019 02:13

Das dürfte eine Enttäuschung für die Wall-Street-Häuser sein, die jahrelang an der Transaktion gearbeitet haben.

Die Provisionen entsprechen 0,25% des über den Börsengang beschafften ... 💵

https://www.cash.ch/news/top-news/oelriese-saudi-aramco-zahl…

...............................

December 15, 2019 / 7:56 AM / Updated 3 hours ago

Aramco shares inch up in early Sunday trade

DUBAI (Reuters) - Saudi Aramco (2222.SE) shares were up 1% at 37.2 riyals ($9.89) in early trade on Sunday. ...

https://www.reuters.com/article/us-saudi-aramco-ipo/aramco-s…

...........

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

.....................................................................................................................................................

Von Nachfrage getrieben: China gewinnt das Offshore-Wettrennen um Erdöl

15.12.2019 • 09:00 Uhr https://de.rt.com/21tz

Die Volksrepublik China fördert eigenes Erdöl, das jedoch nicht ausreicht, um seinen inländischen Bedarf zu decken. Daher setzt es seine riesigen Devisenreserven ein, um auch in riskanten und intransparenten Offshore-Geschäften an Förderrechte zu gelangen.

Chinas internationale Präsenz im Offshore-Ölsektor wächst schnell, da seine Ölkonzerne bereit sind, ...

https://deutsch.rt.com/wirtschaft/95687-china-gewinnt-offsho…

... ... jede Ölpfütze anzuzapfen ...

... jede Ölpfütze anzuzapfen ...

...........................................................

„Warum leiht die Weltbank China Geld?” Trump kritisiert Kredite an zweitgrößte Volkswirtschaft der Welt

Epoch Times 7. Dezember 2019 Aktualisiert: 7. Dezember 2019 11:50

US-Präsident Trump hat die Vergabe von Krediten der Weltbank an China scharf kritisiert. Das kommunistisch regierte Land sei nicht auf Kredite der Weltbank angewiesen.

https://www.epochtimes.de/politik/welt/trump-kritisiert-welt…

https://www.epochtimes.de/china/china-koennte-bald-in-zahlun…

.......................................................................................................................................................

Chevron's $11 Billion Write Down Is A Warning For The Entire Oil Industry

by Tyler Durden

Thu, 12/12/2019 - 11:05

Authored by Nick Cunningham via OilPrice.com,

Chevron said that it would write down $11 billion in assets in the fourth quarter, much of which is tied to natural gas in Appalachia. The impairment is a sign that the waters are getting pretty rough for the oil and gas industry, due to a combination of supply surpluses, low prices, the struggling and unproven business case for large-scale shale drilling, and the looming threat of peak demand.

The write down comes as Chevron lowered its long-term forecast for oil and gas prices, which directly impacted the value of its assets. “We have to make the tough choices to high-grade our portfolio and invest in the highest-return projects in the world we see ahead of us, and that’s a different world than the one that lies behind us,” Chevron Chief Executive Mike Wirth said in an interview with the Wall Street Journal.

The WSJ says the admission that billions of dollars’ worth of assets are worth a lot less than previously thought could force others to “publicly reassess the value of their holdings in the face of a global supply glut and growing investor concerns about the long-term future of fossil fuels.”

The write down is also an indictment of shale gas drilling in Appalachia. Low prices and a track record of not producing any profits has ...

https://www.zerohedge.com/energy/chevrons-11-billion-write-d…

........................................................................................................................................................

„Total“-Raffinerie in Nordfrankreich fängt Feuer

14:09 14.12.2019(aktualisiert 14:26 14.12.2019) https://sptnkne.ws/AFPQ

Im französischen Departement Seine-Maritime ist es am Samstagmorgen in einer Erdölraffinerie des Unternehmens „Total“ zu einem Brand gekommen. Das teilt die Zeitung Le Parisien mit.

Der Brand sei am Samstag um vier Uhr Ortszeit ausgebrochen, so das Unternehmen. Auf dem Gelände der Ölraffinerie in Seine-Maritime habe eine Beschickungspumpe Feuer gefangen.

Ein auf Facebook veröffentlichtes Video zeigt eine große Feuerwolke im Nachthimmel, ...

https://de.sputniknews.com/panorama/20191214326228220-total-…

... ... Chef, wir haben kein Geld ... verbrannt ...

... Chef, wir haben kein Geld ... verbrannt ...

Saudi Aramco zahlt Banken nur 64 Millionen Dollar für IPO-Job

Saudi Aramco wird unterrichteten Kreisen zufolge den Banken, die den weltgrössten Börsengang arrangiert haben, insgesamt nur 64 Millionen Dollar zu zahlen.

14.12.2019 02:13

Das dürfte eine Enttäuschung für die Wall-Street-Häuser sein, die jahrelang an der Transaktion gearbeitet haben.

Die Provisionen entsprechen 0,25% des über den Börsengang beschafften ... 💵

https://www.cash.ch/news/top-news/oelriese-saudi-aramco-zahl…

...............................

December 15, 2019 / 7:56 AM / Updated 3 hours ago

Aramco shares inch up in early Sunday trade

DUBAI (Reuters) - Saudi Aramco (2222.SE) shares were up 1% at 37.2 riyals ($9.89) in early trade on Sunday. ...

https://www.reuters.com/article/us-saudi-aramco-ipo/aramco-s…

...........

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

.....................................................................................................................................................

Von Nachfrage getrieben: China gewinnt das Offshore-Wettrennen um Erdöl

15.12.2019 • 09:00 Uhr https://de.rt.com/21tz

Die Volksrepublik China fördert eigenes Erdöl, das jedoch nicht ausreicht, um seinen inländischen Bedarf zu decken. Daher setzt es seine riesigen Devisenreserven ein, um auch in riskanten und intransparenten Offshore-Geschäften an Förderrechte zu gelangen.

Chinas internationale Präsenz im Offshore-Ölsektor wächst schnell, da seine Ölkonzerne bereit sind, ...

https://deutsch.rt.com/wirtschaft/95687-china-gewinnt-offsho…

...

... jede Ölpfütze anzuzapfen ...

... jede Ölpfütze anzuzapfen ..............................................................

„Warum leiht die Weltbank China Geld?” Trump kritisiert Kredite an zweitgrößte Volkswirtschaft der Welt

Epoch Times 7. Dezember 2019 Aktualisiert: 7. Dezember 2019 11:50

US-Präsident Trump hat die Vergabe von Krediten der Weltbank an China scharf kritisiert. Das kommunistisch regierte Land sei nicht auf Kredite der Weltbank angewiesen.

https://www.epochtimes.de/politik/welt/trump-kritisiert-welt…

https://www.epochtimes.de/china/china-koennte-bald-in-zahlun…

.......................................................................................................................................................

Chevron's $11 Billion Write Down Is A Warning For The Entire Oil Industry

by Tyler Durden

Thu, 12/12/2019 - 11:05

Authored by Nick Cunningham via OilPrice.com,

Chevron said that it would write down $11 billion in assets in the fourth quarter, much of which is tied to natural gas in Appalachia. The impairment is a sign that the waters are getting pretty rough for the oil and gas industry, due to a combination of supply surpluses, low prices, the struggling and unproven business case for large-scale shale drilling, and the looming threat of peak demand.

The write down comes as Chevron lowered its long-term forecast for oil and gas prices, which directly impacted the value of its assets. “We have to make the tough choices to high-grade our portfolio and invest in the highest-return projects in the world we see ahead of us, and that’s a different world than the one that lies behind us,” Chevron Chief Executive Mike Wirth said in an interview with the Wall Street Journal.

The WSJ says the admission that billions of dollars’ worth of assets are worth a lot less than previously thought could force others to “publicly reassess the value of their holdings in the face of a global supply glut and growing investor concerns about the long-term future of fossil fuels.”

The write down is also an indictment of shale gas drilling in Appalachia. Low prices and a track record of not producing any profits has ...

https://www.zerohedge.com/energy/chevrons-11-billion-write-d…

........................................................................................................................................................

„Total“-Raffinerie in Nordfrankreich fängt Feuer

14:09 14.12.2019(aktualisiert 14:26 14.12.2019) https://sptnkne.ws/AFPQ

Im französischen Departement Seine-Maritime ist es am Samstagmorgen in einer Erdölraffinerie des Unternehmens „Total“ zu einem Brand gekommen. Das teilt die Zeitung Le Parisien mit.

Der Brand sei am Samstag um vier Uhr Ortszeit ausgebrochen, so das Unternehmen. Auf dem Gelände der Ölraffinerie in Seine-Maritime habe eine Beschickungspumpe Feuer gefangen.

Ein auf Facebook veröffentlichtes Video zeigt eine große Feuerwolke im Nachthimmel, ...

https://de.sputniknews.com/panorama/20191214326228220-total-…

...

... Chef, wir haben kein Geld ... verbrannt ...

... Chef, wir haben kein Geld ... verbrannt ...

Antwort auf Beitrag Nr.: 62.163.054 von teecee1 am 15.12.19 13:41:58

................

Saudi-Arabien wirbt für mehr Investitionen aus Deutschland

Epoch Times16. Dezember 2019 Aktualisiert: 16. Dezember 2019 19:34

Saudi-Arabien hat trotz Öleinnahmen seit einigen Jahren ein wachsendes Haushaltsdefizit. Man verließ sich über Jahrzehnte hinweg auf wachsende Einnahmen aus dem Ölgeschäft und versäumte es tragfähige weitere Wirtschaftssektoren im Land aufzubauen.

Der saudische Finanzminister Mohammed al-Dschadan fordert deutsche Geldgeber auf, mehr in Saudi-Arabien zu investieren. Es gebe zwar schon deutsche Unternehmen, die in Saudi-Arabien aktiv seien, „ich würde es aber begrüßen, wenn noch mehr kämen und sich an unseren Mega-Infrastrukturprojekten beteiligten. Da schreiben wir bedeutende Aufträge aus“, sagte der Minister dem „Handelsblatt“ (Dienstagsausgabe).

Saudi-Arabien plant einen dreistelligen Milliardenbetrag für den Umbau seiner Wirtschaft. Finanziert werden sollen die Projekte unter anderem mit den Einnahmen aus dem Börsengang in der vergangenen Woche: Der staatliche saudische Ölgigant Saudi Aramco nahm 25,6 Milliarden Dollar für 1,5 Prozent seiner Aktien ein und wurde damit zum mit Abstand wertvollsten Unternehmen der Welt.

Al-Dschadan berichtet zudem von geplanten weiteren Privatisierungen: „Wir werden noch viele weitere Unternehmen privatisieren, vor allem in den Bereichen Bildung, Gesundheitswesen, Wasserversorgung, Abwasseraufbereitung.“ Der Minister kündigte zudem an, ...

https://www.epochtimes.de/politik/deutschland/saudi-arabien-…

... 🦃 ... findet den Altmaier, Steinmeier, Ostereier ...

... kleiner Hinweis: ... Dromedar ... 💩 💣 ...

..................................................................................................................

https://twitter.com/USArmy/status/1206032396413546496

...................................................................................................................................................

Aramco Up for Third Session With Eye on Passive Flows: Inside EM

Filipe Pacheco, Bloomberg News

(Bloomberg) -- Saudi Aramco shares advance for a third session -- though the market valuation remained below $2 trillion -- with investors focusing on the energy company’s inclusion in major international equity indexes this week.

The stock climbs 1% in Riyadh, extending gains since it started trading on Wednesday to 16%. The main Saudi index also advances, along with peers in the Middle East, as they catch up with global markets after the U.S. and China agreed on a phase-one trade deal last week.

MSCI Inc., which compiles the most popular emerging-market equities index, will add Aramco to its benchmarks using the closing price of Dec. 17. FTSE Russell will follow suit using the price of Dec. 19. ...

https://www.bnnbloomberg.ca/aramco-up-for-third-session-with…

... ... wird von Black Rock verwaltet ...

... wird von Black Rock verwaltet ...

...............

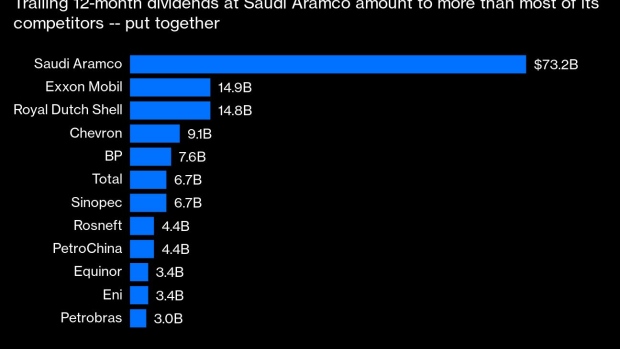

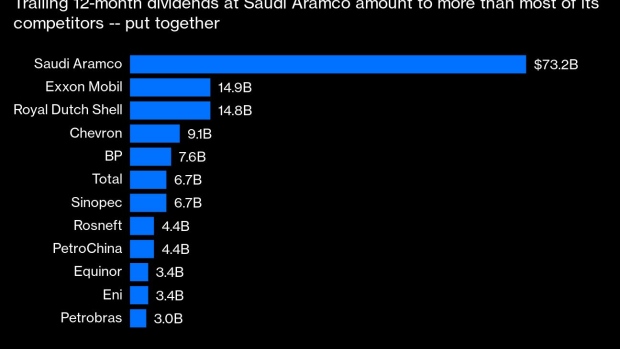

Giant Saudi Oil IPO Coming To ETFs

[ETF.com]

Sumit Roy

ETF.comDecember 17, 2019

.........

Pros & Cons

Aramco’s dividend yield is in line with what oil majors like Exxon, Chevron and others are paying. Exxon currently yields 5%; Chevron yields 4%; ConocoPhillips yields 2.8%; BP yields 6.3%; and Royal Dutch Shell yields 5.4%.

World's Biggest Oil Companies

https://finance.yahoo.com/news/giant-saudi-oil-ipo-coming-05…

........................................................................................................................................

Saudi Aramco's Share Price: Market Manipulation Suggestions

Dec. 14, 2019 4:28 PM ET|

About: Saudi Aramco (ARMCO)

* Saudi Aramco started trading and went limit-up first day.

* On day 2, the valuation of Aramco hit $2 trillion.

* Observers point to market manipulation.

* Saudi stock exchange isn't a 'free market.'

* International listing for the IPO is doubtful.

https://seekingalpha.com/article/4312522-saudi-aramcos-share…

....................................................................................................................................................

Want to invest in Saudi Aramco? There’s an ETF for that.

Published: Dec 14, 2019 9:46 a.m. ET

Caution is warranted but if you like the idea of investing in the Saudi oil giant, here’s the best way

By Andrea Riquier

Are you an American intrigued by the idea of investing in Aramco, the massive Saudi national oil concern? ...

The ETF tracks a grouping of companies called the MSCI Saudi Arabia IMI 25/50 Index. The fund rebalances when the index does, according to its manager, BlackRock. ...

https://www.marketwatch.com/story/want-to-invest-in-saudi-ar…

... ... Venezuela ... PDVSA ...

... Venezuela ... PDVSA ...

................

Saudi-Arabien wirbt für mehr Investitionen aus Deutschland

Epoch Times16. Dezember 2019 Aktualisiert: 16. Dezember 2019 19:34

Saudi-Arabien hat trotz Öleinnahmen seit einigen Jahren ein wachsendes Haushaltsdefizit. Man verließ sich über Jahrzehnte hinweg auf wachsende Einnahmen aus dem Ölgeschäft und versäumte es tragfähige weitere Wirtschaftssektoren im Land aufzubauen.

Der saudische Finanzminister Mohammed al-Dschadan fordert deutsche Geldgeber auf, mehr in Saudi-Arabien zu investieren. Es gebe zwar schon deutsche Unternehmen, die in Saudi-Arabien aktiv seien, „ich würde es aber begrüßen, wenn noch mehr kämen und sich an unseren Mega-Infrastrukturprojekten beteiligten. Da schreiben wir bedeutende Aufträge aus“, sagte der Minister dem „Handelsblatt“ (Dienstagsausgabe).

Saudi-Arabien plant einen dreistelligen Milliardenbetrag für den Umbau seiner Wirtschaft. Finanziert werden sollen die Projekte unter anderem mit den Einnahmen aus dem Börsengang in der vergangenen Woche: Der staatliche saudische Ölgigant Saudi Aramco nahm 25,6 Milliarden Dollar für 1,5 Prozent seiner Aktien ein und wurde damit zum mit Abstand wertvollsten Unternehmen der Welt.

Al-Dschadan berichtet zudem von geplanten weiteren Privatisierungen: „Wir werden noch viele weitere Unternehmen privatisieren, vor allem in den Bereichen Bildung, Gesundheitswesen, Wasserversorgung, Abwasseraufbereitung.“ Der Minister kündigte zudem an, ...

https://www.epochtimes.de/politik/deutschland/saudi-arabien-…

... 🦃 ... findet den Altmaier, Steinmeier, Ostereier ...

... kleiner Hinweis: ... Dromedar ... 💩 💣 ...

..................................................................................................................

https://twitter.com/USArmy/status/1206032396413546496

...................................................................................................................................................

Aramco Up for Third Session With Eye on Passive Flows: Inside EM

Filipe Pacheco, Bloomberg News

(Bloomberg) -- Saudi Aramco shares advance for a third session -- though the market valuation remained below $2 trillion -- with investors focusing on the energy company’s inclusion in major international equity indexes this week.

The stock climbs 1% in Riyadh, extending gains since it started trading on Wednesday to 16%. The main Saudi index also advances, along with peers in the Middle East, as they catch up with global markets after the U.S. and China agreed on a phase-one trade deal last week.

MSCI Inc., which compiles the most popular emerging-market equities index, will add Aramco to its benchmarks using the closing price of Dec. 17. FTSE Russell will follow suit using the price of Dec. 19. ...

https://www.bnnbloomberg.ca/aramco-up-for-third-session-with…

...

... wird von Black Rock verwaltet ...

... wird von Black Rock verwaltet ..................

Giant Saudi Oil IPO Coming To ETFs

[ETF.com]

Sumit Roy

ETF.comDecember 17, 2019

.........

Pros & Cons

Aramco’s dividend yield is in line with what oil majors like Exxon, Chevron and others are paying. Exxon currently yields 5%; Chevron yields 4%; ConocoPhillips yields 2.8%; BP yields 6.3%; and Royal Dutch Shell yields 5.4%.

World's Biggest Oil Companies

https://finance.yahoo.com/news/giant-saudi-oil-ipo-coming-05…

........................................................................................................................................

Saudi Aramco's Share Price: Market Manipulation Suggestions

Dec. 14, 2019 4:28 PM ET|

About: Saudi Aramco (ARMCO)

* Saudi Aramco started trading and went limit-up first day.

* On day 2, the valuation of Aramco hit $2 trillion.

* Observers point to market manipulation.

* Saudi stock exchange isn't a 'free market.'

* International listing for the IPO is doubtful.

https://seekingalpha.com/article/4312522-saudi-aramcos-share…

....................................................................................................................................................

Want to invest in Saudi Aramco? There’s an ETF for that.

Published: Dec 14, 2019 9:46 a.m. ET

Caution is warranted but if you like the idea of investing in the Saudi oil giant, here’s the best way

By Andrea Riquier

Are you an American intrigued by the idea of investing in Aramco, the massive Saudi national oil concern? ...

The ETF tracks a grouping of companies called the MSCI Saudi Arabia IMI 25/50 Index. The fund rebalances when the index does, according to its manager, BlackRock. ...

https://www.marketwatch.com/story/want-to-invest-in-saudi-ar…

...

... Venezuela ... PDVSA ...

... Venezuela ... PDVSA ...

Hat noch jemand "gezeichnet"?

Miezi

Miezi

Antwort auf Beitrag Nr.: 62.177.460 von teecee1 am 17.12.19 11:08:28After Aramco’s Record IPO, Traders Now Ask How to Short Shares

Brandon Kochkodin Bloomberg December 27, 2019

(Bloomberg) -- Shares of Saudi Aramco have shot up 10% since its record-setting $25.6 billion initial public offering earlier this month. That’s got bearish traders wondering whether they can short shares of the Gulf oil giant.

The answer: Not easily.

Normally, you wouldn’t even need to ask the question. Short sales -- when an investor borrows shares, sells them and then tries to buy them back at a lower price and profit from the difference -- are an established feature of exchanges across the world and practically a requirement for inclusion in MSCI indexes.

But when the company is Saudi Arabia’s crown jewel and when shares are listed on the kingdom’s Tadawul exchange, the answer is anything but obvious.

The Tadawul exchange does, on paper, permit short-selling, introducing it in 2017. But in practice the market for borrowing and lending shares in Saudi Arabia is illiquid, according to Marie Salem, head of institutions at Daman Securities in Dubai.

That’s because of a lack of familiarity with the concept of shorting shares. Religious scholars in Saudi Arabia long perceived short sales as a violation of Shariah although it’s permitted in other Islamic countries like Malaysia, according to Muhammed-Shahid Ebrahim, a professor of Islamic Finance at Durham University.

“The basic idea about Islamic finance is that you need to be equitable to people,” said Ebrahim. “You can’t sell what you don’t own is in the Koran.”

So investors with a pessimistic outlook on the value of a Tadawul-listed stock have to look abroad for shares to borrow to cover a short position.

But in the case of Aramco, ...

https://finance.yahoo.com/news/aramco-record-ipo-traders-now…

...................................................................................................................................................

... This name was later changed to Akzo Nobel which is owned by this Drugs King, where the waste from Shell, with subsidiary Billiton by mixing the Wolman salts, which contain Arsenic and Chromium 6, deliberately make the world's population sick.

We are deliberately sprayed with this waste, which via incineration power plant as fine dust by means of Chemtrails is an attack on our lives and food, water and air by the Bilderberg Nazis of the Netherlands.

The CO2 Fable, in which the blame is laid on the population, but the government deliberately mixes waste into fuel oil, which is sold as cheap ship's oil, pollutes more than 1375 more emissions than all cars in the world. ...

https://operationdisclosure1.blogspot.com/2019/12/transition…

.......................................................................................................................................................

Japan entsendet Kriegsschiffe in den Nahen Osten

27.12.2019 12:00

Japan wird in Kürze Kriegsschiffe in den Nahen Osten entsenden, um seine Handelswege zu schützen.

https://deutsche-wirtschafts-nachrichten.de/501517/Japan-ent…

.............................

... ... kamen die Raketen(Drohnen) etwa aus Kuweit ...

... kamen die Raketen(Drohnen) etwa aus Kuweit ...

December 24, 2019 / 1:32 PM

Chevron expects full oil output from Saudi-Kuwaiti field within 12 months

LONDON (Reuters) - U.S. oil major Chevron said on Tuesday it expects Saudi-Kuwaiti Neutral Zone’s Wafra oilfield to return to full production within 12 months.

Kuwait and Saudi Arabia on Tuesday signed a deal aiming to end their five-year dispute over the Neutral Zone and resume production which can amount to up to 0.5 percent of global oil supply.

“We welcome the signing of a memorandum of understanding between the governments of Kingdom of Saudi Arabia and the State of Kuwait which will lead to a restart of production and operations in the Wafra Joint Operations,” ...

https://www.reuters.com/article/us-kuwait-saudi-oil-chevron/…

https://www.wiwo.de/politik/ausland/oelfeld-chafdschi-kuwait…

Brandon Kochkodin Bloomberg December 27, 2019

(Bloomberg) -- Shares of Saudi Aramco have shot up 10% since its record-setting $25.6 billion initial public offering earlier this month. That’s got bearish traders wondering whether they can short shares of the Gulf oil giant.

The answer: Not easily.

Normally, you wouldn’t even need to ask the question. Short sales -- when an investor borrows shares, sells them and then tries to buy them back at a lower price and profit from the difference -- are an established feature of exchanges across the world and practically a requirement for inclusion in MSCI indexes.

But when the company is Saudi Arabia’s crown jewel and when shares are listed on the kingdom’s Tadawul exchange, the answer is anything but obvious.

The Tadawul exchange does, on paper, permit short-selling, introducing it in 2017. But in practice the market for borrowing and lending shares in Saudi Arabia is illiquid, according to Marie Salem, head of institutions at Daman Securities in Dubai.

That’s because of a lack of familiarity with the concept of shorting shares. Religious scholars in Saudi Arabia long perceived short sales as a violation of Shariah although it’s permitted in other Islamic countries like Malaysia, according to Muhammed-Shahid Ebrahim, a professor of Islamic Finance at Durham University.

“The basic idea about Islamic finance is that you need to be equitable to people,” said Ebrahim. “You can’t sell what you don’t own is in the Koran.”

So investors with a pessimistic outlook on the value of a Tadawul-listed stock have to look abroad for shares to borrow to cover a short position.

But in the case of Aramco, ...

https://finance.yahoo.com/news/aramco-record-ipo-traders-now…

...................................................................................................................................................

... This name was later changed to Akzo Nobel which is owned by this Drugs King, where the waste from Shell, with subsidiary Billiton by mixing the Wolman salts, which contain Arsenic and Chromium 6, deliberately make the world's population sick.

We are deliberately sprayed with this waste, which via incineration power plant as fine dust by means of Chemtrails is an attack on our lives and food, water and air by the Bilderberg Nazis of the Netherlands.

The CO2 Fable, in which the blame is laid on the population, but the government deliberately mixes waste into fuel oil, which is sold as cheap ship's oil, pollutes more than 1375 more emissions than all cars in the world. ...

https://operationdisclosure1.blogspot.com/2019/12/transition…

.......................................................................................................................................................

Japan entsendet Kriegsschiffe in den Nahen Osten

27.12.2019 12:00

Japan wird in Kürze Kriegsschiffe in den Nahen Osten entsenden, um seine Handelswege zu schützen.

https://deutsche-wirtschafts-nachrichten.de/501517/Japan-ent…

.............................

...

... kamen die Raketen(Drohnen) etwa aus Kuweit ...

... kamen die Raketen(Drohnen) etwa aus Kuweit ...December 24, 2019 / 1:32 PM

Chevron expects full oil output from Saudi-Kuwaiti field within 12 months

LONDON (Reuters) - U.S. oil major Chevron said on Tuesday it expects Saudi-Kuwaiti Neutral Zone’s Wafra oilfield to return to full production within 12 months.

Kuwait and Saudi Arabia on Tuesday signed a deal aiming to end their five-year dispute over the Neutral Zone and resume production which can amount to up to 0.5 percent of global oil supply.

“We welcome the signing of a memorandum of understanding between the governments of Kingdom of Saudi Arabia and the State of Kuwait which will lead to a restart of production and operations in the Wafra Joint Operations,” ...

https://www.reuters.com/article/us-kuwait-saudi-oil-chevron/…

https://www.wiwo.de/politik/ausland/oelfeld-chafdschi-kuwait…

Antwort auf Beitrag Nr.: 62.241.812 von teecee1 am 28.12.19 20:56:47

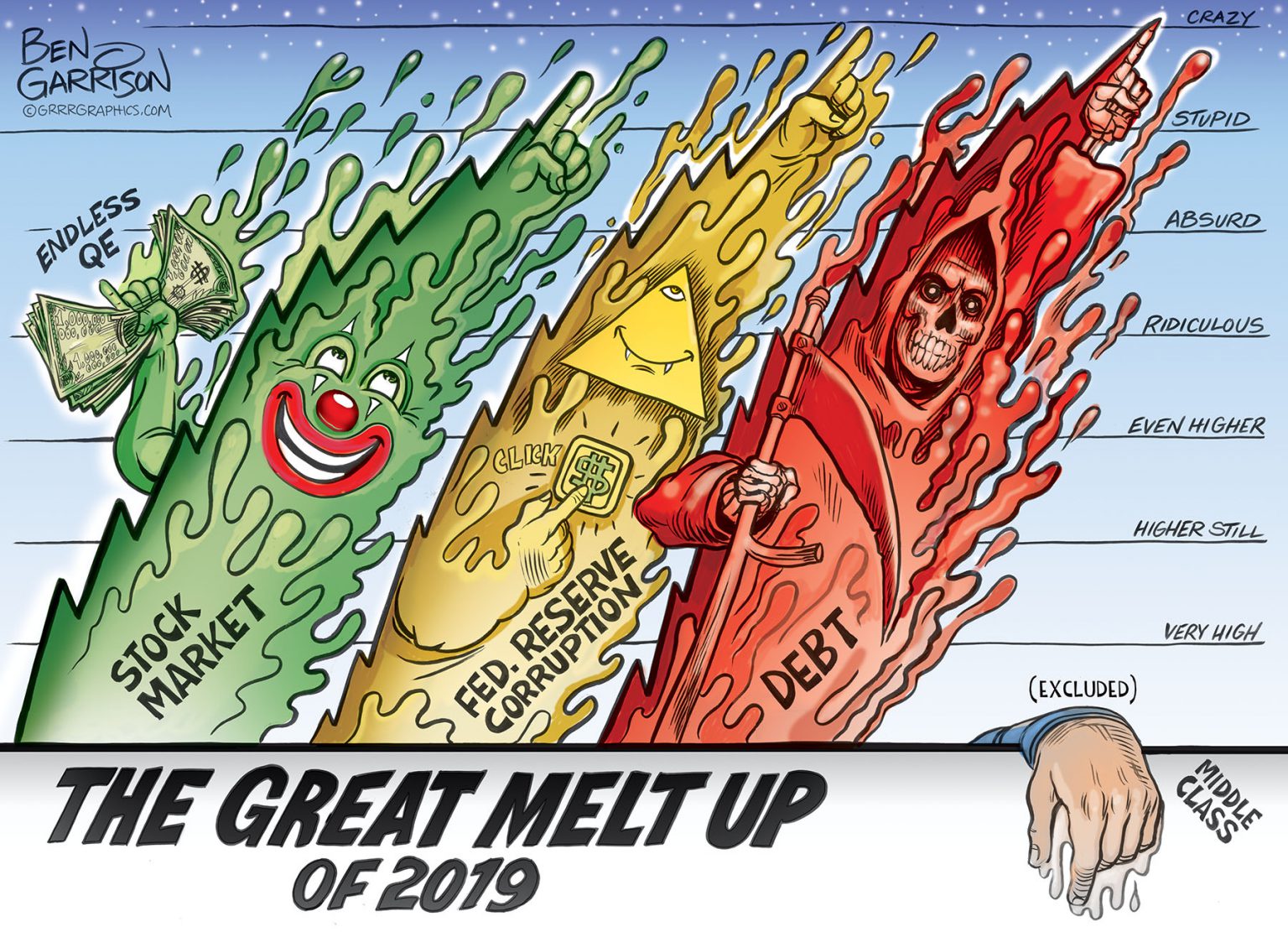

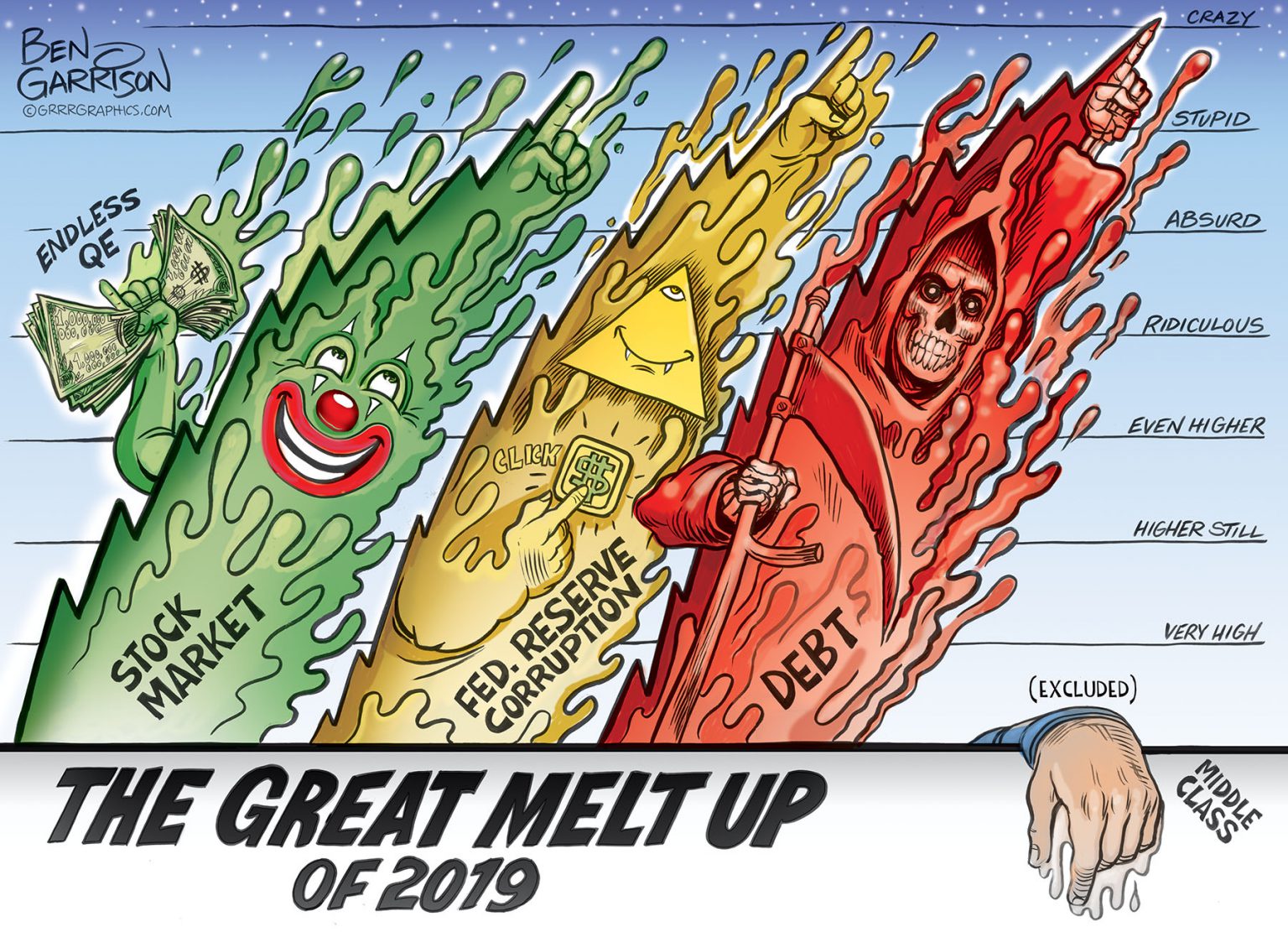

The year 2019 has been a year of bubbles

The stock market reached new all-time highs. This has occurred because the Federal Reserve’s ‘quantitative easing’ never really ended. Instead of consulting Congress like they did in 2008, the Fed simply creates currency out of thin air and hands it out to its member central banks. A lot of that easy money goes into the stock market, which mostly benefits the top of the pyramid that owns most of the major ...

https://grrrgraphics.com/the-2019-melt-up

..................................................................................................................................................

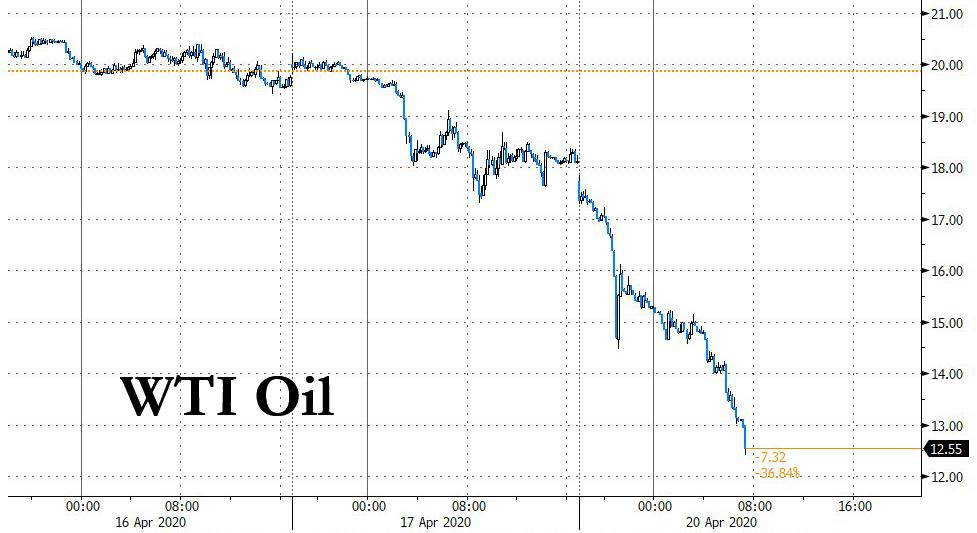

Gulf Stocks Plunge On War Threat, Aramco Hits Lowest Since IPO

by Tyler Durden

Sun, 01/05/2020 - 08:45

Gulf stock markets plunged on Sunday, with Saudi, Kuwaiti, Dubai, Qatari, and Egyptian stocks leading heavy losses after top Iranian military commander Qassem Soleimani was assassinated by a US drone airstrike at Baghdad International Airport on Friday, reported Reuters.

The Saudi Stock Exchange (Tadawul) fell 170 points to 8,226, or down -2%, on heavy volume. The index was weighed down by significant losses in telecommunications, industrials, healthcare, and financials.

Shares of Saudi Aramco fell 1.7% on Sunday, hitting 34.55 riyals ($9.21) per share, now at its lowest level since last month's IPO.

https://www.zerohedge.com/markets/gulf-stocks-plunge-war-thr…

......................................................................................................................................................

05.01.2020 18:21

Aramco-Kurs sinkt angesichts der Eskalation zwischen USA und Iran

Die Aktie des saudi-arabischen Ölgiganten Aramco hat inmitten der zunehmenden Spannungen zwischen den USA und dem Iran deutlich an Wert verloren.

Die Aramco-Aktie schloss am Sonntag auf dem tiefsten Stand seit dem Börsengang im Dezember. Alle Börsenplätze in den sechs Staaten des Golfkooperationsrates (GKR) schlossen am ersten Handelstag nach der ...

https://www.finanzen.net/nachricht/aktien/tiefster-stand-sei…

........................................................................................................................................................

The year 2019 has been a year of bubbles

The stock market reached new all-time highs. This has occurred because the Federal Reserve’s ‘quantitative easing’ never really ended. Instead of consulting Congress like they did in 2008, the Fed simply creates currency out of thin air and hands it out to its member central banks. A lot of that easy money goes into the stock market, which mostly benefits the top of the pyramid that owns most of the major ...

https://grrrgraphics.com/the-2019-melt-up

..................................................................................................................................................

Gulf Stocks Plunge On War Threat, Aramco Hits Lowest Since IPO

by Tyler Durden

Sun, 01/05/2020 - 08:45

Gulf stock markets plunged on Sunday, with Saudi, Kuwaiti, Dubai, Qatari, and Egyptian stocks leading heavy losses after top Iranian military commander Qassem Soleimani was assassinated by a US drone airstrike at Baghdad International Airport on Friday, reported Reuters.

The Saudi Stock Exchange (Tadawul) fell 170 points to 8,226, or down -2%, on heavy volume. The index was weighed down by significant losses in telecommunications, industrials, healthcare, and financials.

Shares of Saudi Aramco fell 1.7% on Sunday, hitting 34.55 riyals ($9.21) per share, now at its lowest level since last month's IPO.

https://www.zerohedge.com/markets/gulf-stocks-plunge-war-thr…

......................................................................................................................................................

05.01.2020 18:21

Aramco-Kurs sinkt angesichts der Eskalation zwischen USA und Iran

Die Aktie des saudi-arabischen Ölgiganten Aramco hat inmitten der zunehmenden Spannungen zwischen den USA und dem Iran deutlich an Wert verloren.

Die Aramco-Aktie schloss am Sonntag auf dem tiefsten Stand seit dem Börsengang im Dezember. Alle Börsenplätze in den sechs Staaten des Golfkooperationsrates (GKR) schlossen am ersten Handelstag nach der ...

https://www.finanzen.net/nachricht/aktien/tiefster-stand-sei…

........................................................................................................................................................

Antwort auf Beitrag Nr.: 62.288.198 von teecee1 am 05.01.20 21:39:27

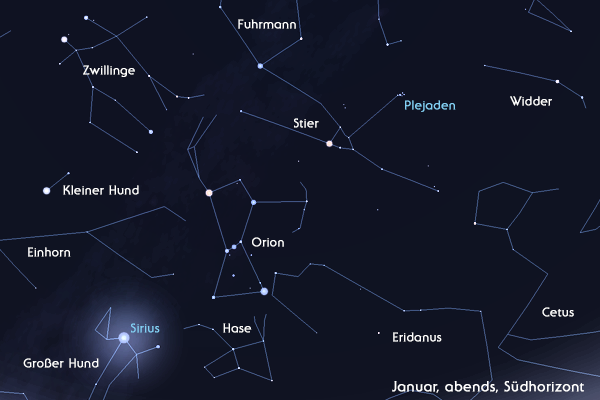

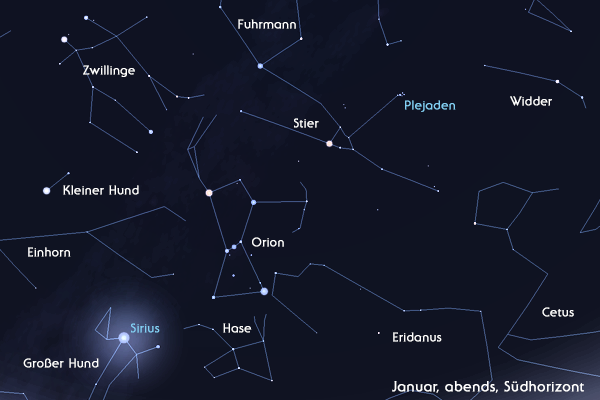

https://astrokramkiste.de/orion

... ... Oriongürtel die heiligen 3 Sterne -> Aldebaran 1 Kind -> Plejaden ...

... Oriongürtel die heiligen 3 Sterne -> Aldebaran 1 Kind -> Plejaden ...

.........................................................................................................................................

2222 Saudi Arabian Oil Co.

Price: 32.95

Change

-0.45 ( -1.35% )

Prev. Close

33.40

Open

33.35

High

33.35

Low:

32.80

https://www.tadawul.com.sa/wps/portal/tadawul/market-partici…

.....

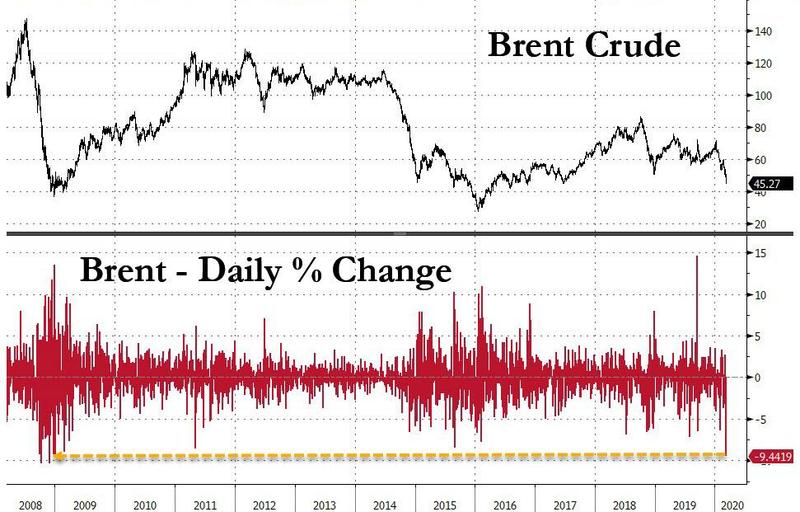

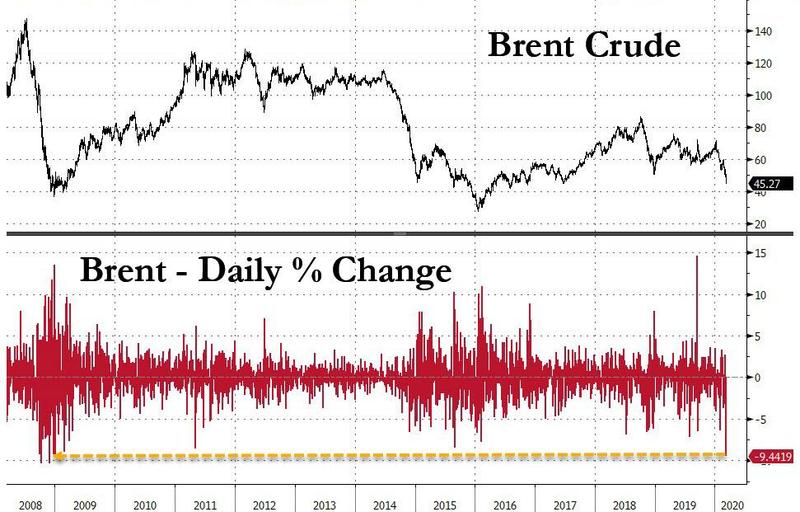

Saudi underperforms; Aramco lowest since IPO

Sunday, 09 Feb 2020

4:51 PM MYT

BENGALURU: Saudi Arabia's stock market led most Gulf bourses lower on Sunday after oil prices plunged more than 6% at the end of last week, ...

https://www.thestar.com.my/business/business-news/2020/02/09…

... ... ein Bericht finde ich nicht mehr ... Regierungsausgeben ... zu niedriger Ölpreis ... etc. ...

... ein Bericht finde ich nicht mehr ... Regierungsausgeben ... zu niedriger Ölpreis ... etc. ...

............................................................................................................................................

......................................

... Corona Viren ... 🦃 ...

Saudi-Arabien meldet Ausbruch der hochansteckenden Geflügelpest

5.02.2020 • 20:05 Uhr https://de.rt.com/23d1

Aus Saudi-Arabien wurde der Ausbruch von Tiererkrankungen mit dem gefährlichen Vogelgrippe-Virus gemeldet, warnt die Weltorganisation für Tiergesundheit (OIE). Aus Vietnam kamen kamen ebenfalls Berichte über Geflügelpest, ...

...................................

February 6, 2020 / 7:49 PM / 3 days ago

Saudi Aramco sees increase in attempted cyber attacks

Marwa Rashad

3 Min Read

RIYADH (Reuters) - Saudi Aramco has seen an increase in attempted cyber attacks since the final quarter of 2019, which the company has so far successfully countered, the state oil giant’s chief information security officer told Reuters on Thursday. ...

https://www.reuters.com/article/us-saudi-aramco-security/sau…

....................................................................................................................................

Taps open for Saudi listings after Aramco's record IPO

By Hadeel Al Sayegh and Marwa Rashad

Reuters February 4, 2020

DUBAI/RIYADH (Reuters) - Several Saudi Arabian companies are planning to list shares on the Riyadh exchange in coming months in the wake of oil giant Aramco's record IPO. ...

The Sulaiman al-Habib Medical Group, one of the Middle East's biggest hospital operators, is among the first companies to seek a Riyadh listing after Aramco, having delayed the deal due to the state oil company's IPO.

It plans to raise around $500 million and will launch the offering on Feb. 5, according to two sources close to the deal.

The medical group did not immediately respond to a request for comment. ...