Gewinnerbranchen der Jahre 2006 bis 2040 (Seite 956)

eröffnet am 10.12.06 16:57:17 von

neuester Beitrag 16.02.24 09:33:08 von

neuester Beitrag 16.02.24 09:33:08 von

Beiträge: 94.068

ID: 1.099.361

ID: 1.099.361

Aufrufe heute: 0

Gesamt: 3.535.968

Gesamt: 3.535.968

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| gestern 23:32 | 135 | |

| gestern 22:06 | 82 | |

| gestern 20:02 | 66 | |

| vor 1 Stunde | 55 | |

| gestern 18:36 | 49 | |

| gestern 23:33 | 49 | |

| vor 1 Stunde | 46 | |

| gestern 16:03 | 37 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 1. | 18.159,50 | -0,16 | 207 | |||

| 2. | 2. | 193,90 | +15,22 | 119 | |||

| 3. | 3. | 2.333,07 | -0,07 | 60 | |||

| 4. | 4. | 65,95 | -2,66 | 50 | |||

| 5. | 5. | 7,9000 | +7,48 | 46 | |||

| 6. | 6. | 0,8300 | -29,66 | 38 | |||

| 7. | 7. | 15,116 | -5,73 | 37 | |||

| 8. | 9. | 2,4050 | +25,82 | 31 |

Beitrag zu dieser Diskussion schreiben

Antwort auf Beitrag Nr.: 58.749.079 von clearasil am 20.09.18 13:33:45zu Covalon - da ist die lange angekündigte Übernahme, in den USA, Aufbau Vertriebsnetz, ergänzende Produkte.

Covalon Announces Definitive Agreement to Acquire AquaGuard and its Specialized Salesforce Capable of Selling Covalon’s Products Throughout the United States

Thu September 20, 2018 7:00 AM|Business Wire|About: CVALF

MISSISSAUGA, Ontario--(BUSINESS WIRE)-- Covalon Technologies Ltd. (CVALF) (the "Company" or "Covalon") (TSXV: COV.V; OTCQX: CVALF), an advanced medical technologies company, today announces that it has entered into a definitive agreement to acquire AquaGuard, the Seattle, Washington-based division of medical technologies company Cenorin, LLC. AquaGuard’s specialized products provide patients with crucial moisture protection for wound, surgical, and vascular access sites throughout the body while showering.

Brian Pedlar, Chief Executive Officer of Covalon, said, “I am very excited about this acquisition – AquaGuard’s experienced sales team and specialized product line are a perfect synergistic fit for Covalon’s business. AquaGuard’s talented sales team has built strong relationships with clinicians and hospital staff throughout the United States that make decisions on the very same products Covalon makes – vascular access dressings, surgical site management products, and advanced wound care dressings.”

https://seekingalpha.com/pr/17275544-covalon-announces-defin…" target="_blank" rel="nofollow ugc noopener">

https://seekingalpha.com/pr/17275544-covalon-announces-defin…

__________________________________________________________________________

und Das ist Hier jetzt Charlies Chocolate Factory?

Covalon Announces Definitive Agreement to Acquire AquaGuard and its Specialized Salesforce Capable of Selling Covalon’s Products Throughout the United States

Thu September 20, 2018 7:00 AM|Business Wire|About: CVALF

MISSISSAUGA, Ontario--(BUSINESS WIRE)-- Covalon Technologies Ltd. (CVALF) (the "Company" or "Covalon") (TSXV: COV.V; OTCQX: CVALF), an advanced medical technologies company, today announces that it has entered into a definitive agreement to acquire AquaGuard, the Seattle, Washington-based division of medical technologies company Cenorin, LLC. AquaGuard’s specialized products provide patients with crucial moisture protection for wound, surgical, and vascular access sites throughout the body while showering.

Brian Pedlar, Chief Executive Officer of Covalon, said, “I am very excited about this acquisition – AquaGuard’s experienced sales team and specialized product line are a perfect synergistic fit for Covalon’s business. AquaGuard’s talented sales team has built strong relationships with clinicians and hospital staff throughout the United States that make decisions on the very same products Covalon makes – vascular access dressings, surgical site management products, and advanced wound care dressings.”

https://seekingalpha.com/pr/17275544-covalon-announces-defin…" target="_blank" rel="nofollow ugc noopener">

https://seekingalpha.com/pr/17275544-covalon-announces-defin…

__________________________________________________________________________

und Das ist Hier jetzt Charlies Chocolate Factory?

https://ir.chipotle.com/2018-10-25-Chipotle-Announces-Third-…

Comparable restaurant sales increased 4.4%

Adjusted diluted earnings per share ...was $2.16,

CMG Turnaround läuft weiter, bis zum Vorkrisen-EPS ist aber noch ein Weg.

Comparable restaurant sales increased 4.4%

Adjusted diluted earnings per share ...was $2.16,

CMG Turnaround läuft weiter, bis zum Vorkrisen-EPS ist aber noch ein Weg.

***

ALGN heute mit dem -22%-Tageshammer-Moment. Und wieder sind wohl die wenigsten Momentumreiter rechtzeitig aus der Aktie herausgekommen. Binnen wenigen Wochen fast halbiert. Und jetzt sitzen viele in der Aktie (und anderen) auf Verlusten, was die Verkaufsbereitschaft natürlich kräftig erhöht. Das macht die Sache gefährlich.

http://investor.aligntech.com/news-releases/news-release-det…

Wächst "nur" noch um 30% statt vielleicht erwarteter und gewohnter 50%.

Am Ende kommen die meisten Aktien halt dann doch auf Durchschnittsbewertungen zurück.

***

Auch bspw LKQ stark korrigiert. Durch die kurze heftige Korrektur schon wieder günstig, KGV 12.

Andererseits der Chart wie bei vielen anderen auch so angeschlagen wie seit fünf Jahren nicht mehr.

***

muss irgendwann auch wieder einsteigen

Stimmt. Wenn alle anderen verkaufen wollen, muss man mit einer gewissen Verachtung seinem Ersparten gegenüber da sein und nehmen was die anderen loswerden wollen.

young growth mit guten Zahlen kaufen. sag ich mal so.

Mit Small in eine mögliche Rezession ? Ist das nicht eher ein Fall für LargeValue?

Vor Kurzem von einem Angestellten eines Stoxx600-Rohstoffunternehmens gehört, dass Auftragseingänge aus China (aber auch anderswo) schwächeln.

***

Hin- und Herschwankungen werden wir uns die nächsten Jahre

Was ingesamt nicht schlecht wäre. Erstens ergäbe das Trading-Chancen. Zweitens würden dadurch Bewertungen abgebaut.

ALGN heute mit dem -22%-Tageshammer-Moment. Und wieder sind wohl die wenigsten Momentumreiter rechtzeitig aus der Aktie herausgekommen. Binnen wenigen Wochen fast halbiert. Und jetzt sitzen viele in der Aktie (und anderen) auf Verlusten, was die Verkaufsbereitschaft natürlich kräftig erhöht. Das macht die Sache gefährlich.

http://investor.aligntech.com/news-releases/news-release-det…

Wächst "nur" noch um 30% statt vielleicht erwarteter und gewohnter 50%.

Am Ende kommen die meisten Aktien halt dann doch auf Durchschnittsbewertungen zurück.

***

Auch bspw LKQ stark korrigiert. Durch die kurze heftige Korrektur schon wieder günstig, KGV 12.

Andererseits der Chart wie bei vielen anderen auch so angeschlagen wie seit fünf Jahren nicht mehr.

***

muss irgendwann auch wieder einsteigen

Stimmt. Wenn alle anderen verkaufen wollen, muss man mit einer gewissen Verachtung seinem Ersparten gegenüber da sein und nehmen was die anderen loswerden wollen.

young growth mit guten Zahlen kaufen. sag ich mal so.

Mit Small in eine mögliche Rezession ? Ist das nicht eher ein Fall für LargeValue?

Vor Kurzem von einem Angestellten eines Stoxx600-Rohstoffunternehmens gehört, dass Auftragseingänge aus China (aber auch anderswo) schwächeln.

***

Hin- und Herschwankungen werden wir uns die nächsten Jahre

Was ingesamt nicht schlecht wäre. Erstens ergäbe das Trading-Chancen. Zweitens würden dadurch Bewertungen abgebaut.

Antwort auf Beitrag Nr.: 59.053.888 von Simonswald am 25.10.18 14:24:17Jemand mit Benchmark-Risiko hier ?

einer auf jeden Fall. wer aussteigt, muss irgendwann auch wieder einsteigen - aber du hast das fein hingekriegt!

wer aussteigt, muss irgendwann auch wieder einsteigen - aber du hast das fein hingekriegt!  ausser ein paar seltsame werte-käufe vielleicht.

ausser ein paar seltsame werte-käufe vielleicht.

wenn es so raschelt, gibt es fast nirgendwo Deckung.

Positionierung: die großen überkapitalisierten meiden, young growth mit guten Zahlen kaufen. sag ich mal so.

auf große Hin- und Herschwankungen werden wir uns die nächsten Jahre einstellen dürfen - vermute ich. stures b+h wird sicher nicht einfacher werden.

einer auf jeden Fall.

wer aussteigt, muss irgendwann auch wieder einsteigen - aber du hast das fein hingekriegt!

wer aussteigt, muss irgendwann auch wieder einsteigen - aber du hast das fein hingekriegt!  ausser ein paar seltsame werte-käufe vielleicht.

ausser ein paar seltsame werte-käufe vielleicht.

wenn es so raschelt, gibt es fast nirgendwo Deckung.

Positionierung: die großen überkapitalisierten meiden, young growth mit guten Zahlen kaufen. sag ich mal so.

auf große Hin- und Herschwankungen werden wir uns die nächsten Jahre einstellen dürfen - vermute ich. stures b+h wird sicher nicht einfacher werden.

Hallo!

Jemand mit Benchmark-Risiko hier ?

Gestern erneut ein bemerkenswert stark negativer Tag, Statistisch kommt solch ein -3,5%-Tag nur zwei oder drei Mal pro Jahr vor.

In der Gesamtschau des bisherigen Jahres und den gehäuft stark negativen Tagen scheint sich da was anzukündigen. Zumindest eine Normalisierung übertriebener KGVs, vielleicht sogar eine Rezession.

Wie positioniert man sich da sinnvoll? Meine antizyklischen "Value"-Versuche (F, IBM...) jedenfalls gingen bislang auch nicht auf und halfen auch gestern nicht. Einzig die klassischen defensiven Bereiche wie Staples boten noch Schutz.

Jemand mit Benchmark-Risiko hier ?

Gestern erneut ein bemerkenswert stark negativer Tag, Statistisch kommt solch ein -3,5%-Tag nur zwei oder drei Mal pro Jahr vor.

In der Gesamtschau des bisherigen Jahres und den gehäuft stark negativen Tagen scheint sich da was anzukündigen. Zumindest eine Normalisierung übertriebener KGVs, vielleicht sogar eine Rezession.

Wie positioniert man sich da sinnvoll? Meine antizyklischen "Value"-Versuche (F, IBM...) jedenfalls gingen bislang auch nicht auf und halfen auch gestern nicht. Einzig die klassischen defensiven Bereiche wie Staples boten noch Schutz.

Wass für ein brutal hartes Umfeld für Investitionen. Man kann den Eindruck haben, dass alles sich als Flopp erweist.

Und wenn ausnahmsweise mal etwas funktioniert, dann kommt bald eine bessere Neuentwicklung um die Ecke. So wie jetzt mit bspw. RO6875281.

https://thefly.com/landingPageNews.php?id=2808234&headline=N…

The 11% and 20% overall response rate for single agent RO6875281 in squamous cell head and neck cancer and melanoma is compelling,

INCY: now-disproven IDO inhibitor story,

Nektar Therapeutics ...stock has "zero value."

http://blogs.sciencemag.org/pipeline/archives/2018/05/01/ido…

IDO inhibitors? CB1 antagonists for obesity? Cathepsin K inhibitors? Anti-amyloid antibodies? Mixed PPAR ligands? CETP inhibitors? Substance P inhibitors? Gamma-secretase inhibitors?

Und wenn ausnahmsweise mal etwas funktioniert, dann kommt bald eine bessere Neuentwicklung um die Ecke. So wie jetzt mit bspw. RO6875281.

https://thefly.com/landingPageNews.php?id=2808234&headline=N…

The 11% and 20% overall response rate for single agent RO6875281 in squamous cell head and neck cancer and melanoma is compelling,

INCY: now-disproven IDO inhibitor story,

Nektar Therapeutics ...stock has "zero value."

http://blogs.sciencemag.org/pipeline/archives/2018/05/01/ido…

IDO inhibitors? CB1 antagonists for obesity? Cathepsin K inhibitors? Anti-amyloid antibodies? Mixed PPAR ligands? CETP inhibitors? Substance P inhibitors? Gamma-secretase inhibitors?

Antwort auf Beitrag Nr.: 59.016.193 von vostock am 21.10.18 23:00:40 Vielen Dank clearasil für den Marker Artikel. CAR-T Zelltherapie wird sicher eine grosse Chance. Die Frage ist, ob dieser Einzelwert es schaffen wird. Ich überlege schon eine Weile, wie man die Wahrscheinlichkeit abschätzen könnte, dass eine bestimmte Biotech-Firma überlebt. Die ganze Geschichte mit der Hand aufzuarbeiten, ist ein bisschen mühsam und Zahlen habe ich leider noch keine gefunden.

spannende Frage, ob MRKR es schaffen wird, bis jetzt sieht es zumindest sehr gut aus, mit einem wirklich hochinteressanten Ansatz - den Rest wird die Zeit zeigen.

die richtigen Branchen wurden hier sicher ausgiebigst beackert...

spannende Frage, ob MRKR es schaffen wird, bis jetzt sieht es zumindest sehr gut aus, mit einem wirklich hochinteressanten Ansatz - den Rest wird die Zeit zeigen.

die richtigen Branchen wurden hier sicher ausgiebigst beackert...

Antwort auf Beitrag Nr.: 58.993.407 von clearasil am 18.10.18 15:28:02Guten Abend

Vielen Dank clearasil für den Marker Artikel. CAR-T Zelltherapie wird sicher eine grosse Chance. Die Frage ist, ob dieser Einzelwert es schaffen wird. Ich überlege schon eine Weile, wie man die Wahrscheinlichkeit abschätzen könnte, dass eine bestimmte Biotech-Firma überlebt. Die ganze Geschichte mit der Hand aufzuarbeiten, ist ein bisschen mühsam und Zahlen habe ich leider noch keine gefunden.

Somit würde ich nur kleine Positiionen davon kaufen...

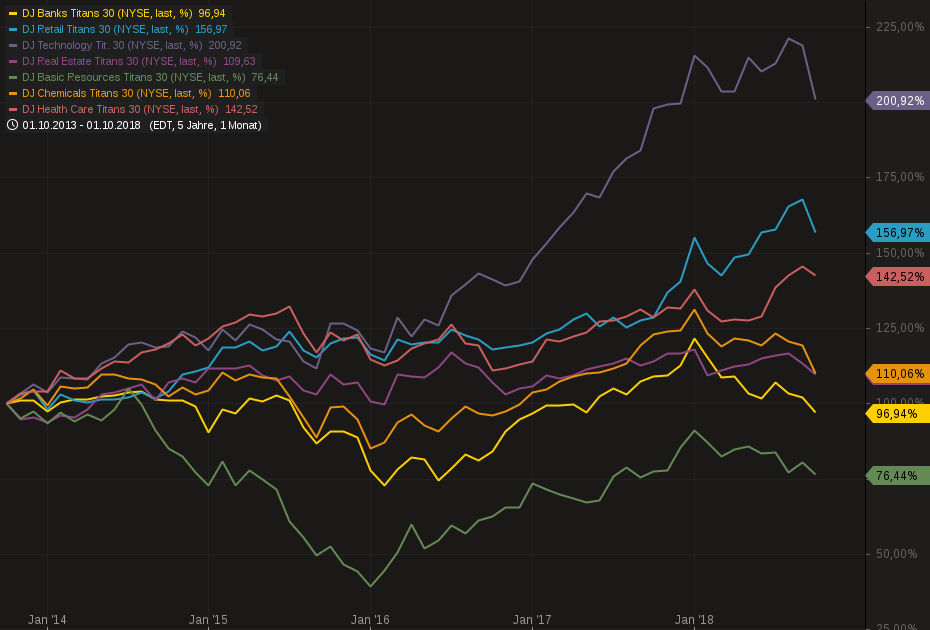

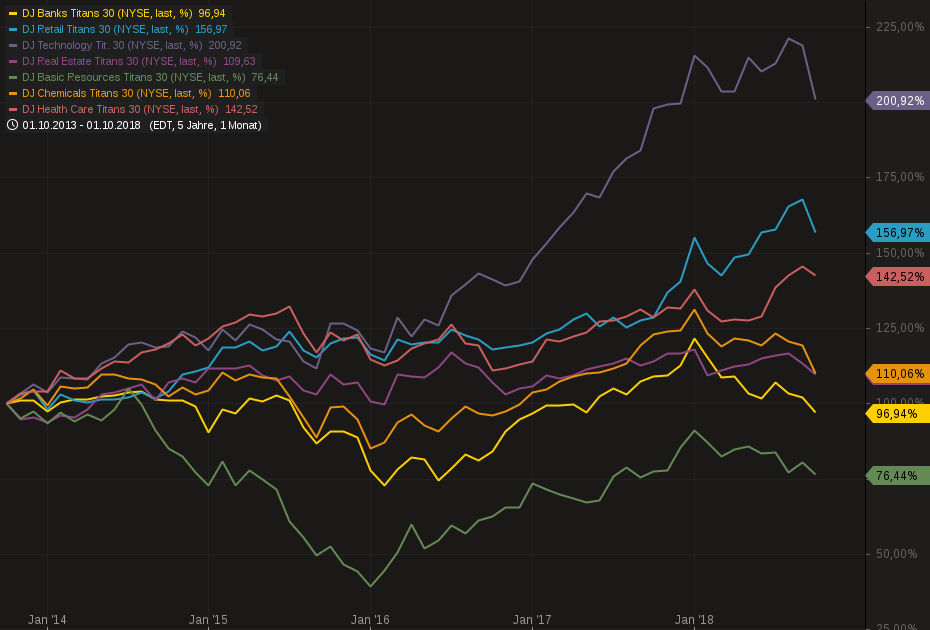

Auf der Branchenebene habe ich ein bisschen recherchiert..

Ich wollte mal schauen, welche Branchen in der Vergangenheit gut gelaufen sind.

Also habe ich einige Branchenindices der letzten 5 Jahre aufgetragen. Wie erwartet Technologie ganz vorn mit 200%, Retail mit 156%. Da steckt vermutlich viel Amazon drin. Und dann Health Care mit 156%.

Es scheint, wir diskutieren über die richtigen Themen….

Vielen Dank clearasil für den Marker Artikel. CAR-T Zelltherapie wird sicher eine grosse Chance. Die Frage ist, ob dieser Einzelwert es schaffen wird. Ich überlege schon eine Weile, wie man die Wahrscheinlichkeit abschätzen könnte, dass eine bestimmte Biotech-Firma überlebt. Die ganze Geschichte mit der Hand aufzuarbeiten, ist ein bisschen mühsam und Zahlen habe ich leider noch keine gefunden.

Somit würde ich nur kleine Positiionen davon kaufen...

Auf der Branchenebene habe ich ein bisschen recherchiert..

Ich wollte mal schauen, welche Branchen in der Vergangenheit gut gelaufen sind.

Also habe ich einige Branchenindices der letzten 5 Jahre aufgetragen. Wie erwartet Technologie ganz vorn mit 200%, Retail mit 156%. Da steckt vermutlich viel Amazon drin. Und dann Health Care mit 156%.

Es scheint, wir diskutieren über die richtigen Themen….

highlights earings call PYPL:

https://seekingalpha.com/article/4212642-paypal-holdings-inc…

+++ Today I'm very pleased to announce that we've signed a multi-faceted partnership agreement with American Express. As one of the leading brands in the world it always made sense that PayPal and American Express would become strategic partners. Steve Squeri and his team have been great to work with, and I'm very pleased with the comprehensive nature of our partnership going forward.

Over the next several quarters PayPal will have enhanced access to American Express as a payment option in our wallet. The agreement will allow PayPal to access American Express tokens and enables a deep integration of our Venmo and PayPal P2P capabilities within the Amex platform. Additionally, PayPal and American Express consumers will be able to use their American Express reward points to pay for their purchases at millions of PayPal merchants around the world.

+++ Most of you on the call know that we also recently announced a significant and growing partnership with Walmart. Working together, Walmart and PayPal have developed innovative new product experiences to create a more affordable and convenient way for the unbanked segment of customers to more efficiently manage and move their money; and as a result, empowering more people to gain access to the digital economy. As part of this deep collaboration, PayPal money services will be available at all Walmart locations in the U.S. beginning in November. Using the PayPal mobile app customers can easily load cash into their PayPal balance, and for the first time customers can withdraw money from their PayPal balance at Walmart retail stores and Walmart money centers across the country. Additionally, customers can use the PayPal cash master card to shop in store on mobile and online at Walmart, as well as withdraw cash at the register or from Walmart's ATM locations nationwide. And this is just the beginning, we are currently working hand-in-hand with the Walmart team to introduce even more capabilities in the future.

+++ I'm especially pleased with the strong overall momentum surrounding Venmo. For the third quarter in a row Venmo posted yet again another record for net new actives. This is driving accelerating network effects as volume groups 78% to $16.7 billion with an annualized run rate now approaching $70 billion. And while it is still early, our monetization efforts appear to be reaching a tipping point. 24% of Venmo users have now participated in a monetizable action; this is up from 17% one quarter ago and 13% in May of this year. Pay with Venmo monthly active users increased approximately 185% month-over-month in September versus August. And across the Uber and Uber Eats apps, we saw more than 300% month-over-month volume growth in September versus August.

Our Venmo cart is also off to a strong start with approximately 320% month-over-month growth in monthly active users from August to September.

+++ As proof of that, Interbrand recently announced that PayPal had increased it's brand value by 22% in the last year, making us one of the Top 6 fastest growing brands in the world. These kinds of results are what create sustainable and long-term value for our shareholders.

https://seekingalpha.com/article/4212642-paypal-holdings-inc…

+++ Today I'm very pleased to announce that we've signed a multi-faceted partnership agreement with American Express. As one of the leading brands in the world it always made sense that PayPal and American Express would become strategic partners. Steve Squeri and his team have been great to work with, and I'm very pleased with the comprehensive nature of our partnership going forward.

Over the next several quarters PayPal will have enhanced access to American Express as a payment option in our wallet. The agreement will allow PayPal to access American Express tokens and enables a deep integration of our Venmo and PayPal P2P capabilities within the Amex platform. Additionally, PayPal and American Express consumers will be able to use their American Express reward points to pay for their purchases at millions of PayPal merchants around the world.

+++ Most of you on the call know that we also recently announced a significant and growing partnership with Walmart. Working together, Walmart and PayPal have developed innovative new product experiences to create a more affordable and convenient way for the unbanked segment of customers to more efficiently manage and move their money; and as a result, empowering more people to gain access to the digital economy. As part of this deep collaboration, PayPal money services will be available at all Walmart locations in the U.S. beginning in November. Using the PayPal mobile app customers can easily load cash into their PayPal balance, and for the first time customers can withdraw money from their PayPal balance at Walmart retail stores and Walmart money centers across the country. Additionally, customers can use the PayPal cash master card to shop in store on mobile and online at Walmart, as well as withdraw cash at the register or from Walmart's ATM locations nationwide. And this is just the beginning, we are currently working hand-in-hand with the Walmart team to introduce even more capabilities in the future.

+++ I'm especially pleased with the strong overall momentum surrounding Venmo. For the third quarter in a row Venmo posted yet again another record for net new actives. This is driving accelerating network effects as volume groups 78% to $16.7 billion with an annualized run rate now approaching $70 billion. And while it is still early, our monetization efforts appear to be reaching a tipping point. 24% of Venmo users have now participated in a monetizable action; this is up from 17% one quarter ago and 13% in May of this year. Pay with Venmo monthly active users increased approximately 185% month-over-month in September versus August. And across the Uber and Uber Eats apps, we saw more than 300% month-over-month volume growth in September versus August.

Our Venmo cart is also off to a strong start with approximately 320% month-over-month growth in monthly active users from August to September.

+++ As proof of that, Interbrand recently announced that PayPal had increased it's brand value by 22% in the last year, making us one of the Top 6 fastest growing brands in the world. These kinds of results are what create sustainable and long-term value for our shareholders.

news zu TPIV, seit heute MRKR, ringing the opening bell at nasdaq. Gestern wurde die Fusion offiziell vollzogen.

damit der Artikel nicht wieder hinter der pay-wall verschwindet, stelle ich ihn hier gesamt ein.

https://seekingalpha.com/article/4212367-marker-therapeutics…" target="_blank" rel="nofollow ugc noopener">

https://seekingalpha.com/article/4212367-marker-therapeutics…

Marker Therapeutics: A Safer And Potentially More Effective CAR-T Alternative

Oct. 18, 2018 8:49 AM ET |

About: Marker Therapeutics, Inc. (MRKR), Includes: ADAP, ALLO, ALXN, ARVN, CELG, CLLS, GILD, MEIP, NVS, RHHBY, TKPYY

George Crist

George Crist

Long/short equity, hedge fund manager, biotech, small-cap

(982 followers)

Summary

CAR-T Therapies are game changers in the blood cell cancer space, not only because of their effectiveness, but because of the complexity in creating them.

While tremendously effective, CAR-T therapies are often times "too good" and create serious adverse events due to "on-target" effects.

The newly merged entity between TapImmune and Marker Therapeutics offers a potentially superior treatment for various cancers that is both similar and unique to CAR-T therapies.

With the merger now complete, the "deal fatigue" that has impacted the share price should be replaced with a valuation that is reflective of recent IPO's and M&A activity in this space.

Marker Therapeutics, is an immunotherapy innovator bringing an antigen-sensitized T cell product to market in a number of different cancer indications. The company is the product of a merger between TapImmune and Marker Therapeutics that completed on Oct 17th, 2018 and on Thursday, October 18th begins trading under ticker (MKMR), retiring TapImmune's ticker (TPIV). While the company is still early stage, the combined entity now offers a valuable pipeline of differentiated immunotherapies that, if successfully brought to market, could realize the dream of optimally utilizing the immune system to both fight cancer and prevent relapse as a maintenance therapy in cancer.

A little history

In 1943, a decade after Erwin Schrodinger won the Nobel Prize for his fundamental contributions to quantum theory, he went on present a course of public lectures entitled, “What is Life”. The lectures were held at Trinity College in Dublin, and were transcribed into a small text in 1944. It was an existential departure from his previous work and in the text he outlined several of the criteria that we recognize are unique to all living things.

Schrodinger proposed the existence of an “aperiodic crystal” that would encapsulate heredity. This notion served as inspiration to Watson and Crick who eventually discovered DNA. He also predicted mutations, and eluded to the complexity in achieving “order from disorder”. Clearly, philosophers had pondered the meaning of life previously, but in the 90 years since it’s penning, Schrodinger's text could almost be considered the old testament of molecular biology. Fitting perhaps since Trinity also holds the Book of Kells, and I've kept an original printing of the book on my desk for about 20 years.

Modern molecular biology has given humanity a lens into life that would have been nothing short of science fiction to Schrodinger. What we know now versus then would give someone like Schrodinger the shivers. But in a simplistic sense, consider these basic facts that remain extant from his original lectures... That evolution requires mutation. Mutations abide with the second law of thermodynamics in the sense of increasing entropy, or chaos. However, critical to life is keeping entropy from running amok. Therefore, regulation is critical too. And these two words, mutation & regulation, govern the rate of genetic change. I suppose put another way they are the effectors of the first derivative of genetics.

I have pre-cancer. You have pre-cancer.

Mutations, lacking proper regulation, lead to abnormal cell growth which can eventually become cancer. The reality is that we are always in a pre-cancerous state. In any living organism, there are always cells that have mutated improperly. It is the job of the immune system to remove them. The innate immune response, via natural killer cells and myeloid cells, can detect and destroy some cancerous cells. Adaptive immunity, on the other hand, is mediated by B lymphocytes and T lymphocytes. Here, the immune system elicits an antigen specific response that must be judicious. Antigen presentation of a cancerous cell is tricky because the immune system is being asked to overcome its resistance to attack itself.

Modern medicine has recognized for decades that the holy grail of cancer therapy is to harness the power of the immune system to eliminate cancer as it already does naturally. But the challenge is that most cancer antigens are antigens that are also present on normal cells. A recent success in this area of science has been the successful reengineering of T-cells to attack certain cancer cell targets. The success of this therapy first required effective gene transfer techniques and the ability to culture T-cells, advances that came from years of HIV research. The idea would be to engineer T-cells to express a Chimeric Antigen Receptor (CAR) capable of recognizing and targeting a specific tumor antigen. The various B cell cancers were an obvious first target.

In 2007, the first IND was approved studying a CAR-T cell therapy targeting CD-19 in B cell leukemias and lymphomas. Although many existing B-cell cancer therapies (like Rituximab) target CD-20, CD-19 was chosen for CAR-T because expression was more specific to B-cells. While the CD-19 became the de-facto extracellular recognition domain, the intracellular region evolved through a few iterations intended to increase T-cell signaling. All generations of CAR’s included a CD3-zeta transmembrane domain, but adding 4-1BB, CD28, and/or OX40 co-stimulatory domains really amps the signaling response.

After several years of promising animal studies, human trials with CAR-T began to show enormous response rates in lymphomas not seen with either small molecule (chemo, PI3Ki, BTKi) or large molecule (anti-CD20, PD-1, etc.) therapies. Approximately one year ago, the FDA approved the first CAR-T cell therapies.

Novartis-owned (NVS) Tisagenlecleucel (Kymriah) was approved in August, 2017 in Acute Lymphoblastic Leukemia (ALL) and carries a price tag of approximately $475,000 for one course of treatment.

While this price has been criticized along with other expensive drugs, it has a far higher cost of production than monoclonal antibodies which are costly to produce. For example, Alexion's (ALXN) Soliris, an anti-C5 therapy in aHUS and PHN, costs around $485k. Rather than just growing a recombinant product, each CAR-T therapy is an individualized medicine requiring the aseptic extraction of a patient’s blood, and then a 22-day process to genetically re-engineer those cells with the CAR and then grow the cells in an incubator, before reinfusing them into a patient. In a sense, since CAR-T therapies are a form of ex-vivo gene modification, patients who receive them become “GMO’s”. Crazy, right?

The current CAR-T landscape includes another approval and several additional pipeline candidates. Axicabtagene ciloleucel (or “Axi-Cil” marketed as Yescarta) was developed by Kite Pharma and granted approval in October of 2017 in second-line Diffuse Large B Cell Lymphoma (DLBCL). Kite was acquired by Gilead (GILD) in August 2017 in an $11.9B all-cash transaction. Each course of therapy will cost $373k, less than Kymriah, but still very expensive. Juno Therapeutics may be the next CAR-T across the finish line with JCAR017, but had to scrap their first candidate, JCAR015 due to patient deaths. Like Kite, Juno was gobbled up by large pharma with Celgene (CELG) paying $9B in a deal announced in Jan, 2018. Cellectis (CLLS) and Adaptimmune (ADAP) are also advancing candidates.

Currently approved CAR-T Cell Therapies are Weaponized against CD-19

Serious Adverse Events (SAE’s) are present with virtually all cancer therapies. With CAR-T, while the efficacy is outstanding, the SAE profile is, in a word, unique. Cytokine Release Syndrome (CRS), is a serious clinical phenomenon arising out of CAR-T therapies due to the rapid killing of cancer cells observed. With most traditional chemo’s, you see off-target drug effects, but with CAR-T, many of the challenges are actually “on-target” meaning that the SAE is a consequence of killing the intended target.

In particular with CAR-T therapies you can observe high levels of cytokines including Interleukin 6. Fortunately, there exists an approved anti-IL6 antagonist, Tocilizumab that is effective in treating CRS and recently the label for Tocilizumab (marketed by Roche (OTCQX:RHHBY)) was expanded to treat CAR-T induced CRS. The probability of development of CRS seems to be directly related to the tumor burden at baseline. In other words, the higher the tumor load, the higher the risk of CRS.

Neurotoxicity is also an issue with CAR-T therapies. The cause of this is not clearly understood, but endothelial insult, blood-brain barrier permeability, and capillary leak are observed. To the patient, this manifests as confusion and disorientation, but deaths have also occurred. Neurotoxicity deaths lead to the termination of one CAR-T therapy with Juno's JCAR015 program.

The bottom line is that along with the high cost of production of CAR-T therapies, there is a high cost of observation and intervention post-treatment that renders CAR-T effective, but less than ideal. Long term, many patients still eventually relapse due to “antigen escape” and the inability of CAR-T cells to expand to other epitopes. In an ideal T-cell therapy, there is adaptation and expansion of the adaptive immune response, but CAR-T, thus far, is more of a “hammer and nail” therapy which only directs to CD-19. Once a cancer cell evolves to not express CD-19, it “escapes” the CAR-T cells and can reestablish itself.

These challenges will hinder CAR-T therapies from effectively expanding into solid tumor indications where tumor heterogeneity is even greater.

Marker Therapeutics: a potential improvement over CAR-T therapies

Marker Therapeutics is the product of the newly minted merger of TapImmune and Marker Therapeutics. TapImmune (TPIV) has a legacy pipeline of cancer vaccines, which are clever and designed to stimulate an immune response. Despite its promise, I think it would be fair to say that the market does not assign significant value to the pipeline. However, in May of 2018, TapImmune announced that it would be merging with Marker Therapeutics, a company developing an ex-vivo T-cell therapy that is similar to CAR-T therapies (dubbed MultiTAA T Cell therapy) but very different to CAR-T in some very important ways. Prior to the announcement Marker Therapeutics had been privately held and born out of Baylor Medicine in Houston. With only nominal funding they have been able to progress an impressive swath of data with their platform in a number of blood cancers including lymphoma, multiple myeloma and acute myeloid leukemia.

In comparing Marker’s technology to traditional CAR-T, there are some key similarities and some key differences. Like CAR-T, Marker’s therapy involves the removal of a patient’s own blood. However, instead of being hooked up to an apheresis machine for several hours in a dedicated blood center, Marker is able to do pull their sample with a single blood draw, needing only 100-400 ml. The T-cells are then incubated in the presence of various tumor-specific antigens and allowed to expand in culture. They are not genetically modified as with CAR-T therapies, only exposed to the antigens, allowing them to more effectively target a variety of tumor antigens rather than only CD-19. The incubation time is shorter with Marker’s therapy and utilizes a smaller more scalable system of GREX incubators, rather than requiring a clean room or million dollar CliniMACS Prodigy machine for the production of each batch of CAR-T cells. It is estimated that the cost of production will be one tenth of what a comparable CAR-T costs, which will enable Marker to offer a more competitive price if successful.

Another key difference is that CAR-T therapies require lymphodepletion prior to infusing the CAR-T cells in order to stimulate an effective immune response. MultiTAA cells do not, rather the mechanism of action appears to involve migration to the tumor site and then helping to initiate an immune response that involves the endogenous immune cells in addition to the MultiTAA cells. Lymphodepleting would eliminate the endogenous immune cells that are being relied upon to help attack the cancer cells. The cellular payload is also far lower with MultiTAA T cell therapy involving the injection of approximately 40M cells, a factor of 1000X less than CAR-T cell therapies. The last point I'll make about MultiTAA vs. CAR-T is that MultiTAA has virtually no SAE's. Beyond the obvious benefit to that is the convenience of being able to release a MultiTAA patient home after treatment versus the intensive monitoring required for a similar CAR-T patient.

Marker’s data in Lymphoma is early, but impressive. Again, take all of these numbers with the appropriate perspective given the number of patients, but they observed Complete Reponse (CR’s) rates similar to Kite’s Yescarta at around 54%. The real differentiator here, however, according to the company is in the duration of response. So far with Marker’s therapy, none of the patients who yielded a CR have relapsed (going out as far as 4 years), whereas with Kite’s CAR-T, within 11 months, 30% of Kite’s patients have relapsed.

One of the primary issues with CAR-T is this phenomenon known as antigen escape. One of the benefits of MultiTAA T cell therapy is that these cells appear capable of “epitope spreading”, or in other words evolving and expanding specificity for new epitopes as the cancer cells evolve. This goal of epitope spreading was one of the original intentions built into the rationale of CAR-T, but does not appear to emerge in the context of the engineered cells. While I don’t think you can yet definitively explain this ability in the MultiTAA T cells, I think that a big part of the answer is that they are still unmodified native T cells. Conversely, since the CAR-T cells have been genetically modified, perhaps they are unable to inform and expand the immune response beyond CD-19.

The SAE profile for Marker’s technology appears to be far better than traditional CAR-T. With Marker’s MultiTAA T cells, no Cytokine Release Syndrome was observed. Marker’s patients also do not see the neurotoxicity that is observed in as many as a third of CAR-T patients. The lack of SAE’s opens up Marker’s therapy for use as adjuvant therapy, a paradigm they have tested in a number of patients. They offer a great deal of granular data on the patients treated in both categories in their corporate presentation and a YouTube presentation by Dr. Hoang.

The company has reported on 30 MultiTAA-treated patients in Lymphoma so far, and has also generated data in Multiple Myeloma and AML (14 and 12 patients respectively). AML is a notoriously difficult to treat cancer and could represent a good regulatory path forward because of the lack of good options in this indication. There are approximately 26,000 new cases of AML annually. "7+3" Induction therapy is curative for 20% newly diagnosed AML patients. For the 80% of patients that fail induction therapy, most of will proceed to receive an allogenic-hematopoietic stem cell transplant (HST)(~20,000 per year). Post-allogenic HST, at five years, 54% of these patients will have died. 25% of them due to other complicating factors from the HST, but 75% of them will be due to AML relapse and progression. And in patients who relapse post-allo HST with AML, the short term prognosis is terrible with a median survival of about 4.5 months (Note: Data source not specified on 4.5 months, this was according to the company. They may be correct, but an independent study that I found was 5.1 months, still pretty poor)

The only therapy approved for use in AML patients post-HSCT is a donor lymphocyte infusion. This is a therapy of last resort with a poor response rate, poor survival rate, and a very high risk of Graft versus Host Disease (GvHD). Marker had treated 5 patients with active disease with MultiTAA Cell therapy in this population (relapsed AML post-allo HST) and yielded interesting results with 1 durable CR, 1 PR, 2 with Stable disease and one who progressed. Again, it’s a small patient population, but worth moving down the field in another trial. The domestic market for patients post-allo HST who have progressed with AML would be approximately 8500 patients annually.

It’s terrible to say, but a trial in this treatment population would move way faster than say a trial in lymphoma because the survival data are so terrible. Contrast that with CLL, however, where you can see Progression Free Survival numbers in the years with some of the emerging therapies. I feel that one of the modern ironies in cancer research is that as more and more promising therapies come to the battlefield of testing, the time required to conduct the types of trials traditionally required by the FDA will only delay great medicines from getting to the clinic. You need to conduct good, safe trials too, but…well I’ll get off the soap box. The bottom line here is that you could see Marker conduct a trial in AML in less time than in lymphoma and with much less competition for trial recruitment and ultimately competition in the market for an approved product. MEI Pharma (MEIP) is another company in the AML space that I like.

In Marker’s antigen cocktail for AML, two antigens, MageA4 and SSX2 were removed because these are not expressed on AML blasts. Similarly, a Wilms tumor antigen 1 (WT1) was added because it is expressed highly in AML blasts. PRAME, Survivin and NYESO1 were kept in the mix. Additionally, it’s worth noting for AML that they are generating MultiTAA T cells from the HST donor, not the patient whereas in Lymphoma the cell samples came from the patient. So there are some differences in the treatment between Lymphoma and AML to be aware of, but the essence is the same.

I spent a good bit of time over the summer reviewing the Marker data and had become so excited about the combined entity that I actually made the trek to the October 16th annual meeting in Jacksonville to witness the approval of the transaction. I am apparently the only nerd in the world who felt this way and I was literally the only shareholder in the audience, which on one hand was a little awkward, but on the other hand amazing because I was able to enjoy some one-on-one Q&A time with Peter Hoang, Marker’s CEO. Let me say, I’m not the only person excited about this merger, his enthusiasm was palpable and I had the honor of congratulating him on the successful completion of these last few months of what I'm sure was grueling work.

I had a few minor questions about some of the legacy pipeline. One of these related to the recent announcement of the DoD funding for the Herceptin combo therapy. This trial will probably not recruit for a while because the number of patients is pretty high and they’ll likely need to approach the trial as a multi-center trial.

My bigger question, and the one that’s been burning a hole in me all summer was on the Marker pipeline clinical development strategy. Dr. Hoang was clear that in the coming months they would be formally laying out the strategy, but it would be fair to expect them to pursue a new trial in AML first. This makes sense because assuming it goes well, this would probably represent the shortest path to market. I expect that they’ll be meeting with the FDA about this trial during 1Q2019 and I’m certain they will discuss an expedited pathway via Breakthrough Therapy Designation. Whether that can be obtained with the currently existing data is uncertain, but any data from a new Phase 2 that reinforces what has been observed so far would certainly warrant it.

What I also heard is that his experience in coming into this position with Marker has taught him to not be running in too many directions at the same time. It sounds like the approach will be sequential and measured, AML first, Lymphoma second and Myeloma third. It is also possible that a solid tumor trial, in particular in pancreatic cancer will receive some bandwidth in the coming year or two. The ability of MultiTAA T cells to adapt to a changing tumor environment may demonstrate efficacy in this difficult to treat cancer. While the Marker pipeline will be front and center, the legacy TapImmune pipeline also has some interesting potential that could further enhance the enterprise value over time.

If you look at how the shares were distributed in the merger, it was half for the legacy TapImmune shareholders, half for the Marker shareholders and then after the private placement, these two groups would hold 55% of the shares. The private placement was for 17,500,000 shares at $4 for proceeds of $70M with warrants to purchase 0.75 shares at $5 (an additional 13,125,000 shares) for 5 years. The underwriter also received 312,500 warrants at $5. Fully diluted postmerger, and if all warrants are eventually exercised, I estimated about 68M shares outstanding. At the end of June, 2018 the company had approximately $10M in cash. The infusion of the $70M from the private placement means that they are well capitalized to get much further down the field in terms of clinical development.

It's also impossible to overstate the value that Baylor has brought to Marker prior to the merger and how the resources of this world class medical center will likely continue to bring value to the new publicly traded Marker. Post-merger, "TapImmune intends to finalize a strategic alliance with Baylor College of Medicine that will include sponsored research, manufacturing support and advancing early stage clinical trials at the institution."

Marker Therapeutics: A new start

I think that the only way to view the newly merged company is as a new company. Given the fervor for biotech IPO's this year, I was honestly a little surprised that Marker didn’t go it alone and do an IPO, but clearly they saw value in the combination of the two organizations. I have no doubt that part of that rationale is that both companies were similar in their goal which goes back to the beginning of this article regarding stimulating the immune system to safely eliminate cancer. CAR-T therapies do a fair job of eliminating cancer cells but safely? Not so much. I also believe that the leadership of the organization under Dr. Hoang, coupled with the outstanding scientific aptitude brought from Marker will be a fantastic combination. If you are considering this company, you SHOULD DEFINITELY spend an hour listening to Dr. Ann Leen's YouTube data presentation, and especially during the Q&A from 1:03-1:19. The rigor and rationale with which they've conducted Marker's studies so far is nothing short of impressive. The advisory board is no slouch either and includes multiple experts in cell therapies including recent Nobel Prize recipient Jim Allison.

When you look the Marker’s intelligent approach and data set of their technology in over 60 patients, and you overlay that with companies like Kite and Juno who won approved therapies with relatively small numbers of patients, and were then bought out for $11.9B and $9B respectively. The company should quickly become multiples of its current value.

Looking at other recent IPO examples, in particular Allogene (ALLO) which recently IPO'd with a value of over $3B, Marker would appear highly undervalued. Allogene is another CAR-T developer, but with a dataset that is aruguably less mature than Marker's and with a safety profile that is consistent with other CAR-T's. UCART19 had been previously on FDA hold due to patient deaths. In their summer 2018 data release with only 6 children in R/R B cell ALL, the data were interesting, but not fantastic. All patients experienced CRS, and other SAE's were observed. While 5 out of 6 experienced a CR, they all underwent allo-HST post-therapy and only 2 survived greater than 6 months post-HST. Allogenes product is differentiated from other CAR-T's, however, in that any donor's T cells can be used as opposed to a specific patient's. This is why many have referred to Allogene's therapy as an "off-the-shelf" CAR-T. It will still be far more expensive to produce than MultiTAA T cells.

Another recent notable IPO, was for Arvinas (ARVN). Arvinas currently has a $500M market cap for a cancer company that has not even entered clinical trials. Again, this is a pre-IND company with an interesting PROTAC cancer treatment paradigm. PROTAC therapies are designed to link proteins intended for destruction via the ubiquitination/proteasome system. Unlike Takeda's (OTCPK:TKPYY) Velcade, which inhibits the proteasome, PROTAC therapies are hoped to use the proteasome in order to "drug the undruggable" by selectively removing unwanted receptors or cell signaling mediators. While a fascinating therapy, they have never put medicine into a human and are not expected to treat their first patient until sometime in 2019.

I feel that if Marker had IPO'd, they probably could have commanded a market value closer to $2B. Fully diluted, that would give them a share price of around $29.41. I think that the time between the announcement of the merger and the late execution of the merger created a little apathy for TapImmune's share price. But with the successful completion of the merger in the rear view mirror, I believe that the merged company will appreciate in value quickly. I think that the rationale for the merger with TapImmune was built on their common interest in antigen-driven immune stimulation. Their approach was the only difference here, with TapImmune performing vaccinations with antigens intended to build an immune response and Marker doing the same ex vivo in culture. There may be crossover opportunities.

While it's difficult to rationalize a more traditional valuation for the company at this point, if a MultiTAA T cell product were to eventually hit the market at half of the price of the CAR-T therapies, the post Allo-HST AML market alone would probably represent over $1.8B annually. The lymphoma market in active disease could probably be 2x that, but I think the real value generator for Marker could be as maintenance therapy. Here, as an adjuvant maintenance therapy, in multiple cancer indications (including hematological malignancies and solid tumors) Marker could yield unprecedented revenues and would have no competition from CAR-T or any of the other traditional therapies, because all of them have adverse event profiles that would contraindicate their use for this. A cogent discussion around future run-rate revenue simply cannot be had at this point.

Its appropriate to point out that Marker is still relatively early stage. If the current pipeline does not produce repeatable results, they would still have the legacy TapImmune pipeline to fall back on. However, any failures in any of their programs could represent negative catalysts for the stock. I will be looking for data consistent with what Marker had presented previously, and any failure to do so would force me to reevaluate my investment thesis. It's also fair to point out that there is a near complete absence of an adverse event profile for MultiTAA T cell therapies. I don't think the world is "used to" the notion of a "side-effectless" cancer medicine and I wonder if that is keeping the market from taking this therapy seriously...yet. After all, the long term effects of MultiTAA appear to be driven not by the MultiTAA cells, but rather the endogenous immune system that was simply pointed in the right direction. But that notion gets us back to the beginning of this article, that the ideal cancer therapy would be one that simply harnesses our own functional immune system. And so for that reason, I feel Marker is worth keeping an eye on.

In Summary:

Advances in Immunotherapies are yielding new "living" medicines capable of leveraging the immune system against cancer.

CAR-T therapies, while enormously effective, also carry significant risks of serious adverse events.

Marker Therapeutics is developing a differentiated T Cell therapeutic that is sensitized against cancer-specific antigens, but not genetically modified like CAR-T therapies.

With the merger now completed, I suspect Marker's value will begin to increase to reflect the potential value of a therapy that could optimally utilize the immune system to fight cancer.

Disclosure: I am/we are long MRKR.

damit der Artikel nicht wieder hinter der pay-wall verschwindet, stelle ich ihn hier gesamt ein.

https://seekingalpha.com/article/4212367-marker-therapeutics…" target="_blank" rel="nofollow ugc noopener">

https://seekingalpha.com/article/4212367-marker-therapeutics…

Marker Therapeutics: A Safer And Potentially More Effective CAR-T Alternative

Oct. 18, 2018 8:49 AM ET |

About: Marker Therapeutics, Inc. (MRKR), Includes: ADAP, ALLO, ALXN, ARVN, CELG, CLLS, GILD, MEIP, NVS, RHHBY, TKPYY

George Crist

George Crist

Long/short equity, hedge fund manager, biotech, small-cap

(982 followers)

Summary

CAR-T Therapies are game changers in the blood cell cancer space, not only because of their effectiveness, but because of the complexity in creating them.

While tremendously effective, CAR-T therapies are often times "too good" and create serious adverse events due to "on-target" effects.

The newly merged entity between TapImmune and Marker Therapeutics offers a potentially superior treatment for various cancers that is both similar and unique to CAR-T therapies.

With the merger now complete, the "deal fatigue" that has impacted the share price should be replaced with a valuation that is reflective of recent IPO's and M&A activity in this space.

Marker Therapeutics, is an immunotherapy innovator bringing an antigen-sensitized T cell product to market in a number of different cancer indications. The company is the product of a merger between TapImmune and Marker Therapeutics that completed on Oct 17th, 2018 and on Thursday, October 18th begins trading under ticker (MKMR), retiring TapImmune's ticker (TPIV). While the company is still early stage, the combined entity now offers a valuable pipeline of differentiated immunotherapies that, if successfully brought to market, could realize the dream of optimally utilizing the immune system to both fight cancer and prevent relapse as a maintenance therapy in cancer.

A little history

In 1943, a decade after Erwin Schrodinger won the Nobel Prize for his fundamental contributions to quantum theory, he went on present a course of public lectures entitled, “What is Life”. The lectures were held at Trinity College in Dublin, and were transcribed into a small text in 1944. It was an existential departure from his previous work and in the text he outlined several of the criteria that we recognize are unique to all living things.

Schrodinger proposed the existence of an “aperiodic crystal” that would encapsulate heredity. This notion served as inspiration to Watson and Crick who eventually discovered DNA. He also predicted mutations, and eluded to the complexity in achieving “order from disorder”. Clearly, philosophers had pondered the meaning of life previously, but in the 90 years since it’s penning, Schrodinger's text could almost be considered the old testament of molecular biology. Fitting perhaps since Trinity also holds the Book of Kells, and I've kept an original printing of the book on my desk for about 20 years.

Modern molecular biology has given humanity a lens into life that would have been nothing short of science fiction to Schrodinger. What we know now versus then would give someone like Schrodinger the shivers. But in a simplistic sense, consider these basic facts that remain extant from his original lectures... That evolution requires mutation. Mutations abide with the second law of thermodynamics in the sense of increasing entropy, or chaos. However, critical to life is keeping entropy from running amok. Therefore, regulation is critical too. And these two words, mutation & regulation, govern the rate of genetic change. I suppose put another way they are the effectors of the first derivative of genetics.

I have pre-cancer. You have pre-cancer.

Mutations, lacking proper regulation, lead to abnormal cell growth which can eventually become cancer. The reality is that we are always in a pre-cancerous state. In any living organism, there are always cells that have mutated improperly. It is the job of the immune system to remove them. The innate immune response, via natural killer cells and myeloid cells, can detect and destroy some cancerous cells. Adaptive immunity, on the other hand, is mediated by B lymphocytes and T lymphocytes. Here, the immune system elicits an antigen specific response that must be judicious. Antigen presentation of a cancerous cell is tricky because the immune system is being asked to overcome its resistance to attack itself.

Modern medicine has recognized for decades that the holy grail of cancer therapy is to harness the power of the immune system to eliminate cancer as it already does naturally. But the challenge is that most cancer antigens are antigens that are also present on normal cells. A recent success in this area of science has been the successful reengineering of T-cells to attack certain cancer cell targets. The success of this therapy first required effective gene transfer techniques and the ability to culture T-cells, advances that came from years of HIV research. The idea would be to engineer T-cells to express a Chimeric Antigen Receptor (CAR) capable of recognizing and targeting a specific tumor antigen. The various B cell cancers were an obvious first target.

In 2007, the first IND was approved studying a CAR-T cell therapy targeting CD-19 in B cell leukemias and lymphomas. Although many existing B-cell cancer therapies (like Rituximab) target CD-20, CD-19 was chosen for CAR-T because expression was more specific to B-cells. While the CD-19 became the de-facto extracellular recognition domain, the intracellular region evolved through a few iterations intended to increase T-cell signaling. All generations of CAR’s included a CD3-zeta transmembrane domain, but adding 4-1BB, CD28, and/or OX40 co-stimulatory domains really amps the signaling response.

After several years of promising animal studies, human trials with CAR-T began to show enormous response rates in lymphomas not seen with either small molecule (chemo, PI3Ki, BTKi) or large molecule (anti-CD20, PD-1, etc.) therapies. Approximately one year ago, the FDA approved the first CAR-T cell therapies.

Novartis-owned (NVS) Tisagenlecleucel (Kymriah) was approved in August, 2017 in Acute Lymphoblastic Leukemia (ALL) and carries a price tag of approximately $475,000 for one course of treatment.

While this price has been criticized along with other expensive drugs, it has a far higher cost of production than monoclonal antibodies which are costly to produce. For example, Alexion's (ALXN) Soliris, an anti-C5 therapy in aHUS and PHN, costs around $485k. Rather than just growing a recombinant product, each CAR-T therapy is an individualized medicine requiring the aseptic extraction of a patient’s blood, and then a 22-day process to genetically re-engineer those cells with the CAR and then grow the cells in an incubator, before reinfusing them into a patient. In a sense, since CAR-T therapies are a form of ex-vivo gene modification, patients who receive them become “GMO’s”. Crazy, right?

The current CAR-T landscape includes another approval and several additional pipeline candidates. Axicabtagene ciloleucel (or “Axi-Cil” marketed as Yescarta) was developed by Kite Pharma and granted approval in October of 2017 in second-line Diffuse Large B Cell Lymphoma (DLBCL). Kite was acquired by Gilead (GILD) in August 2017 in an $11.9B all-cash transaction. Each course of therapy will cost $373k, less than Kymriah, but still very expensive. Juno Therapeutics may be the next CAR-T across the finish line with JCAR017, but had to scrap their first candidate, JCAR015 due to patient deaths. Like Kite, Juno was gobbled up by large pharma with Celgene (CELG) paying $9B in a deal announced in Jan, 2018. Cellectis (CLLS) and Adaptimmune (ADAP) are also advancing candidates.

Currently approved CAR-T Cell Therapies are Weaponized against CD-19

Serious Adverse Events (SAE’s) are present with virtually all cancer therapies. With CAR-T, while the efficacy is outstanding, the SAE profile is, in a word, unique. Cytokine Release Syndrome (CRS), is a serious clinical phenomenon arising out of CAR-T therapies due to the rapid killing of cancer cells observed. With most traditional chemo’s, you see off-target drug effects, but with CAR-T, many of the challenges are actually “on-target” meaning that the SAE is a consequence of killing the intended target.

In particular with CAR-T therapies you can observe high levels of cytokines including Interleukin 6. Fortunately, there exists an approved anti-IL6 antagonist, Tocilizumab that is effective in treating CRS and recently the label for Tocilizumab (marketed by Roche (OTCQX:RHHBY)) was expanded to treat CAR-T induced CRS. The probability of development of CRS seems to be directly related to the tumor burden at baseline. In other words, the higher the tumor load, the higher the risk of CRS.

Neurotoxicity is also an issue with CAR-T therapies. The cause of this is not clearly understood, but endothelial insult, blood-brain barrier permeability, and capillary leak are observed. To the patient, this manifests as confusion and disorientation, but deaths have also occurred. Neurotoxicity deaths lead to the termination of one CAR-T therapy with Juno's JCAR015 program.

The bottom line is that along with the high cost of production of CAR-T therapies, there is a high cost of observation and intervention post-treatment that renders CAR-T effective, but less than ideal. Long term, many patients still eventually relapse due to “antigen escape” and the inability of CAR-T cells to expand to other epitopes. In an ideal T-cell therapy, there is adaptation and expansion of the adaptive immune response, but CAR-T, thus far, is more of a “hammer and nail” therapy which only directs to CD-19. Once a cancer cell evolves to not express CD-19, it “escapes” the CAR-T cells and can reestablish itself.

These challenges will hinder CAR-T therapies from effectively expanding into solid tumor indications where tumor heterogeneity is even greater.

Marker Therapeutics: a potential improvement over CAR-T therapies

Marker Therapeutics is the product of the newly minted merger of TapImmune and Marker Therapeutics. TapImmune (TPIV) has a legacy pipeline of cancer vaccines, which are clever and designed to stimulate an immune response. Despite its promise, I think it would be fair to say that the market does not assign significant value to the pipeline. However, in May of 2018, TapImmune announced that it would be merging with Marker Therapeutics, a company developing an ex-vivo T-cell therapy that is similar to CAR-T therapies (dubbed MultiTAA T Cell therapy) but very different to CAR-T in some very important ways. Prior to the announcement Marker Therapeutics had been privately held and born out of Baylor Medicine in Houston. With only nominal funding they have been able to progress an impressive swath of data with their platform in a number of blood cancers including lymphoma, multiple myeloma and acute myeloid leukemia.

In comparing Marker’s technology to traditional CAR-T, there are some key similarities and some key differences. Like CAR-T, Marker’s therapy involves the removal of a patient’s own blood. However, instead of being hooked up to an apheresis machine for several hours in a dedicated blood center, Marker is able to do pull their sample with a single blood draw, needing only 100-400 ml. The T-cells are then incubated in the presence of various tumor-specific antigens and allowed to expand in culture. They are not genetically modified as with CAR-T therapies, only exposed to the antigens, allowing them to more effectively target a variety of tumor antigens rather than only CD-19. The incubation time is shorter with Marker’s therapy and utilizes a smaller more scalable system of GREX incubators, rather than requiring a clean room or million dollar CliniMACS Prodigy machine for the production of each batch of CAR-T cells. It is estimated that the cost of production will be one tenth of what a comparable CAR-T costs, which will enable Marker to offer a more competitive price if successful.

Another key difference is that CAR-T therapies require lymphodepletion prior to infusing the CAR-T cells in order to stimulate an effective immune response. MultiTAA cells do not, rather the mechanism of action appears to involve migration to the tumor site and then helping to initiate an immune response that involves the endogenous immune cells in addition to the MultiTAA cells. Lymphodepleting would eliminate the endogenous immune cells that are being relied upon to help attack the cancer cells. The cellular payload is also far lower with MultiTAA T cell therapy involving the injection of approximately 40M cells, a factor of 1000X less than CAR-T cell therapies. The last point I'll make about MultiTAA vs. CAR-T is that MultiTAA has virtually no SAE's. Beyond the obvious benefit to that is the convenience of being able to release a MultiTAA patient home after treatment versus the intensive monitoring required for a similar CAR-T patient.

Marker’s data in Lymphoma is early, but impressive. Again, take all of these numbers with the appropriate perspective given the number of patients, but they observed Complete Reponse (CR’s) rates similar to Kite’s Yescarta at around 54%. The real differentiator here, however, according to the company is in the duration of response. So far with Marker’s therapy, none of the patients who yielded a CR have relapsed (going out as far as 4 years), whereas with Kite’s CAR-T, within 11 months, 30% of Kite’s patients have relapsed.

One of the primary issues with CAR-T is this phenomenon known as antigen escape. One of the benefits of MultiTAA T cell therapy is that these cells appear capable of “epitope spreading”, or in other words evolving and expanding specificity for new epitopes as the cancer cells evolve. This goal of epitope spreading was one of the original intentions built into the rationale of CAR-T, but does not appear to emerge in the context of the engineered cells. While I don’t think you can yet definitively explain this ability in the MultiTAA T cells, I think that a big part of the answer is that they are still unmodified native T cells. Conversely, since the CAR-T cells have been genetically modified, perhaps they are unable to inform and expand the immune response beyond CD-19.

The SAE profile for Marker’s technology appears to be far better than traditional CAR-T. With Marker’s MultiTAA T cells, no Cytokine Release Syndrome was observed. Marker’s patients also do not see the neurotoxicity that is observed in as many as a third of CAR-T patients. The lack of SAE’s opens up Marker’s therapy for use as adjuvant therapy, a paradigm they have tested in a number of patients. They offer a great deal of granular data on the patients treated in both categories in their corporate presentation and a YouTube presentation by Dr. Hoang.

The company has reported on 30 MultiTAA-treated patients in Lymphoma so far, and has also generated data in Multiple Myeloma and AML (14 and 12 patients respectively). AML is a notoriously difficult to treat cancer and could represent a good regulatory path forward because of the lack of good options in this indication. There are approximately 26,000 new cases of AML annually. "7+3" Induction therapy is curative for 20% newly diagnosed AML patients. For the 80% of patients that fail induction therapy, most of will proceed to receive an allogenic-hematopoietic stem cell transplant (HST)(~20,000 per year). Post-allogenic HST, at five years, 54% of these patients will have died. 25% of them due to other complicating factors from the HST, but 75% of them will be due to AML relapse and progression. And in patients who relapse post-allo HST with AML, the short term prognosis is terrible with a median survival of about 4.5 months (Note: Data source not specified on 4.5 months, this was according to the company. They may be correct, but an independent study that I found was 5.1 months, still pretty poor)

The only therapy approved for use in AML patients post-HSCT is a donor lymphocyte infusion. This is a therapy of last resort with a poor response rate, poor survival rate, and a very high risk of Graft versus Host Disease (GvHD). Marker had treated 5 patients with active disease with MultiTAA Cell therapy in this population (relapsed AML post-allo HST) and yielded interesting results with 1 durable CR, 1 PR, 2 with Stable disease and one who progressed. Again, it’s a small patient population, but worth moving down the field in another trial. The domestic market for patients post-allo HST who have progressed with AML would be approximately 8500 patients annually.

It’s terrible to say, but a trial in this treatment population would move way faster than say a trial in lymphoma because the survival data are so terrible. Contrast that with CLL, however, where you can see Progression Free Survival numbers in the years with some of the emerging therapies. I feel that one of the modern ironies in cancer research is that as more and more promising therapies come to the battlefield of testing, the time required to conduct the types of trials traditionally required by the FDA will only delay great medicines from getting to the clinic. You need to conduct good, safe trials too, but…well I’ll get off the soap box. The bottom line here is that you could see Marker conduct a trial in AML in less time than in lymphoma and with much less competition for trial recruitment and ultimately competition in the market for an approved product. MEI Pharma (MEIP) is another company in the AML space that I like.

In Marker’s antigen cocktail for AML, two antigens, MageA4 and SSX2 were removed because these are not expressed on AML blasts. Similarly, a Wilms tumor antigen 1 (WT1) was added because it is expressed highly in AML blasts. PRAME, Survivin and NYESO1 were kept in the mix. Additionally, it’s worth noting for AML that they are generating MultiTAA T cells from the HST donor, not the patient whereas in Lymphoma the cell samples came from the patient. So there are some differences in the treatment between Lymphoma and AML to be aware of, but the essence is the same.

I spent a good bit of time over the summer reviewing the Marker data and had become so excited about the combined entity that I actually made the trek to the October 16th annual meeting in Jacksonville to witness the approval of the transaction. I am apparently the only nerd in the world who felt this way and I was literally the only shareholder in the audience, which on one hand was a little awkward, but on the other hand amazing because I was able to enjoy some one-on-one Q&A time with Peter Hoang, Marker’s CEO. Let me say, I’m not the only person excited about this merger, his enthusiasm was palpable and I had the honor of congratulating him on the successful completion of these last few months of what I'm sure was grueling work.

I had a few minor questions about some of the legacy pipeline. One of these related to the recent announcement of the DoD funding for the Herceptin combo therapy. This trial will probably not recruit for a while because the number of patients is pretty high and they’ll likely need to approach the trial as a multi-center trial.

My bigger question, and the one that’s been burning a hole in me all summer was on the Marker pipeline clinical development strategy. Dr. Hoang was clear that in the coming months they would be formally laying out the strategy, but it would be fair to expect them to pursue a new trial in AML first. This makes sense because assuming it goes well, this would probably represent the shortest path to market. I expect that they’ll be meeting with the FDA about this trial during 1Q2019 and I’m certain they will discuss an expedited pathway via Breakthrough Therapy Designation. Whether that can be obtained with the currently existing data is uncertain, but any data from a new Phase 2 that reinforces what has been observed so far would certainly warrant it.

What I also heard is that his experience in coming into this position with Marker has taught him to not be running in too many directions at the same time. It sounds like the approach will be sequential and measured, AML first, Lymphoma second and Myeloma third. It is also possible that a solid tumor trial, in particular in pancreatic cancer will receive some bandwidth in the coming year or two. The ability of MultiTAA T cells to adapt to a changing tumor environment may demonstrate efficacy in this difficult to treat cancer. While the Marker pipeline will be front and center, the legacy TapImmune pipeline also has some interesting potential that could further enhance the enterprise value over time.

If you look at how the shares were distributed in the merger, it was half for the legacy TapImmune shareholders, half for the Marker shareholders and then after the private placement, these two groups would hold 55% of the shares. The private placement was for 17,500,000 shares at $4 for proceeds of $70M with warrants to purchase 0.75 shares at $5 (an additional 13,125,000 shares) for 5 years. The underwriter also received 312,500 warrants at $5. Fully diluted postmerger, and if all warrants are eventually exercised, I estimated about 68M shares outstanding. At the end of June, 2018 the company had approximately $10M in cash. The infusion of the $70M from the private placement means that they are well capitalized to get much further down the field in terms of clinical development.

It's also impossible to overstate the value that Baylor has brought to Marker prior to the merger and how the resources of this world class medical center will likely continue to bring value to the new publicly traded Marker. Post-merger, "TapImmune intends to finalize a strategic alliance with Baylor College of Medicine that will include sponsored research, manufacturing support and advancing early stage clinical trials at the institution."

Marker Therapeutics: A new start

I think that the only way to view the newly merged company is as a new company. Given the fervor for biotech IPO's this year, I was honestly a little surprised that Marker didn’t go it alone and do an IPO, but clearly they saw value in the combination of the two organizations. I have no doubt that part of that rationale is that both companies were similar in their goal which goes back to the beginning of this article regarding stimulating the immune system to safely eliminate cancer. CAR-T therapies do a fair job of eliminating cancer cells but safely? Not so much. I also believe that the leadership of the organization under Dr. Hoang, coupled with the outstanding scientific aptitude brought from Marker will be a fantastic combination. If you are considering this company, you SHOULD DEFINITELY spend an hour listening to Dr. Ann Leen's YouTube data presentation, and especially during the Q&A from 1:03-1:19. The rigor and rationale with which they've conducted Marker's studies so far is nothing short of impressive. The advisory board is no slouch either and includes multiple experts in cell therapies including recent Nobel Prize recipient Jim Allison.

When you look the Marker’s intelligent approach and data set of their technology in over 60 patients, and you overlay that with companies like Kite and Juno who won approved therapies with relatively small numbers of patients, and were then bought out for $11.9B and $9B respectively. The company should quickly become multiples of its current value.

Looking at other recent IPO examples, in particular Allogene (ALLO) which recently IPO'd with a value of over $3B, Marker would appear highly undervalued. Allogene is another CAR-T developer, but with a dataset that is aruguably less mature than Marker's and with a safety profile that is consistent with other CAR-T's. UCART19 had been previously on FDA hold due to patient deaths. In their summer 2018 data release with only 6 children in R/R B cell ALL, the data were interesting, but not fantastic. All patients experienced CRS, and other SAE's were observed. While 5 out of 6 experienced a CR, they all underwent allo-HST post-therapy and only 2 survived greater than 6 months post-HST. Allogenes product is differentiated from other CAR-T's, however, in that any donor's T cells can be used as opposed to a specific patient's. This is why many have referred to Allogene's therapy as an "off-the-shelf" CAR-T. It will still be far more expensive to produce than MultiTAA T cells.

Another recent notable IPO, was for Arvinas (ARVN). Arvinas currently has a $500M market cap for a cancer company that has not even entered clinical trials. Again, this is a pre-IND company with an interesting PROTAC cancer treatment paradigm. PROTAC therapies are designed to link proteins intended for destruction via the ubiquitination/proteasome system. Unlike Takeda's (OTCPK:TKPYY) Velcade, which inhibits the proteasome, PROTAC therapies are hoped to use the proteasome in order to "drug the undruggable" by selectively removing unwanted receptors or cell signaling mediators. While a fascinating therapy, they have never put medicine into a human and are not expected to treat their first patient until sometime in 2019.

I feel that if Marker had IPO'd, they probably could have commanded a market value closer to $2B. Fully diluted, that would give them a share price of around $29.41. I think that the time between the announcement of the merger and the late execution of the merger created a little apathy for TapImmune's share price. But with the successful completion of the merger in the rear view mirror, I believe that the merged company will appreciate in value quickly. I think that the rationale for the merger with TapImmune was built on their common interest in antigen-driven immune stimulation. Their approach was the only difference here, with TapImmune performing vaccinations with antigens intended to build an immune response and Marker doing the same ex vivo in culture. There may be crossover opportunities.

While it's difficult to rationalize a more traditional valuation for the company at this point, if a MultiTAA T cell product were to eventually hit the market at half of the price of the CAR-T therapies, the post Allo-HST AML market alone would probably represent over $1.8B annually. The lymphoma market in active disease could probably be 2x that, but I think the real value generator for Marker could be as maintenance therapy. Here, as an adjuvant maintenance therapy, in multiple cancer indications (including hematological malignancies and solid tumors) Marker could yield unprecedented revenues and would have no competition from CAR-T or any of the other traditional therapies, because all of them have adverse event profiles that would contraindicate their use for this. A cogent discussion around future run-rate revenue simply cannot be had at this point.

Its appropriate to point out that Marker is still relatively early stage. If the current pipeline does not produce repeatable results, they would still have the legacy TapImmune pipeline to fall back on. However, any failures in any of their programs could represent negative catalysts for the stock. I will be looking for data consistent with what Marker had presented previously, and any failure to do so would force me to reevaluate my investment thesis. It's also fair to point out that there is a near complete absence of an adverse event profile for MultiTAA T cell therapies. I don't think the world is "used to" the notion of a "side-effectless" cancer medicine and I wonder if that is keeping the market from taking this therapy seriously...yet. After all, the long term effects of MultiTAA appear to be driven not by the MultiTAA cells, but rather the endogenous immune system that was simply pointed in the right direction. But that notion gets us back to the beginning of this article, that the ideal cancer therapy would be one that simply harnesses our own functional immune system. And so for that reason, I feel Marker is worth keeping an eye on.

In Summary:

Advances in Immunotherapies are yielding new "living" medicines capable of leveraging the immune system against cancer.

CAR-T therapies, while enormously effective, also carry significant risks of serious adverse events.

Marker Therapeutics is developing a differentiated T Cell therapeutic that is sensitized against cancer-specific antigens, but not genetically modified like CAR-T therapies.

With the merger now completed, I suspect Marker's value will begin to increase to reflect the potential value of a therapy that could optimally utilize the immune system to fight cancer.

Disclosure: I am/we are long MRKR.