BHP Billiton - ein Basisinvestment im Rohstoffsektor (Seite 16)

eröffnet am 11.06.07 15:37:48 von

neuester Beitrag 23.05.24 14:35:28 von

neuester Beitrag 23.05.24 14:35:28 von

Beiträge: 739

ID: 1.128.624

ID: 1.128.624

Aufrufe heute: 24

Gesamt: 124.863

Gesamt: 124.863

Aktive User: 0

ISIN: AU000000BHP4 · WKN: 850524 · Symbol: BHP1

27,54

EUR

+0,20 %

+0,06 EUR

Letzter Kurs 21:11:51 Tradegate

Neuigkeiten

| Titel |

|---|

25.05.24 · wallstreetONLINE Redaktion |

15:28 Uhr · EQS Group AG |

24.05.24 · EQS Group AG |

23.05.24 · Gold-Silber-Rohstofftrends |

23.05.24 · EQS Group AG |

Werte aus der Branche Rohstoffe

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 13,160 | +22,19 | |

| 207,55 | +17,27 | |

| 1.457,05 | +13,60 | |

| 15,400 | +12,82 | |

| 9,7300 | +10,07 |

| Wertpapier | Kurs | Perf. % |

|---|---|---|

| 14,843 | -8,77 | |

| 8,9700 | -9,85 | |

| 27,46 | -9,97 | |

| 2,4300 | -11,31 | |

| 46,69 | -98,00 |

Beitrag zu dieser Diskussion schreiben

Samarco expects iron ore pellet production to rise up to 11% in 2023

Brazilian miner Samarco Mineracao expects production of iron ore pellets to hit 8 million to 9 million tonnes in 2023, a company executive said on Monday, an increase of up to 11% over this year. Production in 2022 is set to reach 8.1 million tonnes, up 5.2% from 2021. Samarco, a joint venture between Vale and BHP , has a total production capacity of about 30 million tonnes per year, meaning it is currently operating at 26%. The expectation is for it to reach 60% capacity in 2025 and 100% in 2028. The forecasts come after the mining company resumed operations in December 2020, after a five-year shutdown following the collapse of one of its tailings dams in November 2015. "Re-entry into the market has not been difficult. We have strategic partners and have been doing well to strengthen commercial partnerships. Samarco has always been very close to its customers," said the firm's chief operating officer, Sergio Mileipe. Samarco expects to invest 1.6 billion reais ($301 million) in 2023, with a little less than half of that being directed to the decommissioning of tailings dams.This year through November, the miner has invested more than 1.1 billion reais to sustain operations and decommission its tailings dams, it said in a statement. ($1 = 5.3099 reais) (Reporting by Marta Nogueira; Editing by Lisa Shumaker)

https://www.kitco.com/news/2022-12-19/UPDATE-1-Samarco-expec…

Samarco expects iron ore pellet production to rise up to 11% in 2023

Brazilian miner Samarco Mineracao expects production of iron ore pellets to hit 8 million to 9 million tonnes in 2023, a company executive said on Monday, an increase of up to 11% over this year. Production in 2022 is set to reach 8.1 million tonnes, up 5.2% from 2021. Samarco, a joint venture between Vale and BHP , has a total production capacity of about 30 million tonnes per year, meaning it is currently operating at 26%. The expectation is for it to reach 60% capacity in 2025 and 100% in 2028. The forecasts come after the mining company resumed operations in December 2020, after a five-year shutdown following the collapse of one of its tailings dams in November 2015. "Re-entry into the market has not been difficult. We have strategic partners and have been doing well to strengthen commercial partnerships. Samarco has always been very close to its customers," said the firm's chief operating officer, Sergio Mileipe. Samarco expects to invest 1.6 billion reais ($301 million) in 2023, with a little less than half of that being directed to the decommissioning of tailings dams.This year through November, the miner has invested more than 1.1 billion reais to sustain operations and decommission its tailings dams, it said in a statement. ($1 = 5.3099 reais) (Reporting by Marta Nogueira; Editing by Lisa Shumaker)

https://www.kitco.com/news/2022-12-19/UPDATE-1-Samarco-expec…

BHP Group signs scheme deed for $6.4 bln buyout of OZ Minerals

Dec 22 (Reuters) - Australia's OZ Minerals (OZL.AX) said on Thursday it entered into a scheme implementation deed with BHP Group (BHP.AX) in relation to the A$9.6 billion ($6.44 billion) takeover bid the latter made for the copper and gold producer.The board of OZ Minerals, which has unanimously recommended the deal, said its shareholders will vote on it at a scheme meeting scheduled between late March and early April next year.

....

> > https://www.reuters.com/markets/deals/bhp-group-signs-scheme…

BHP makes $6.4 billion binding offer for OZ Minerals

BHP Group Ltd. has made a binding offer to acquire Australian copper producer OZ Minerals Ltd. for A$9.6 billion ($6.4 billion), securing its biggest deal in more than a decade and boosting exposure to key materials used in clean energy and electric cars.The A$28.25-a-share bid, first announced in November, will now go to shareholders for approval in late March or early April, BHP said in a regulatory filing Thursday. It comes nearly five months after OZ Minerals rejected its first offer of A$25 a share.

The deal, unanimously supported by OZ Minerals’ board, is set to consolidate BHP’s position as one of the world’s largest producers of copper, a core metal in the clean energy transition that’s expected to see demand soar by almost 60% over the next two decades.

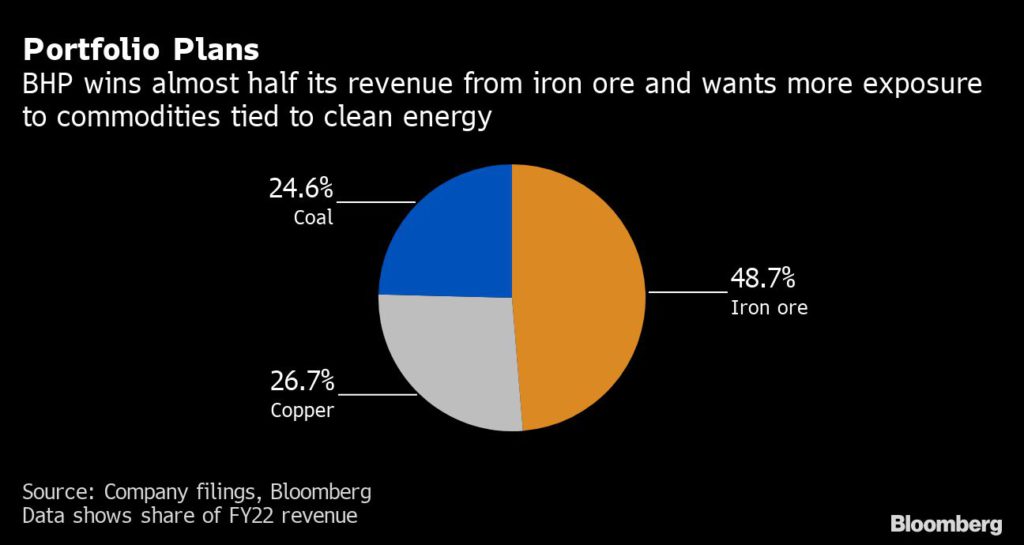

The mining giant has said so-called “future-facing” metals, which also include nickel and fertilizer ingredient potash, are central to its growth as iron ore use plateaus and the world moves away from fossil fuels.

>> https://www.mining.com/web/bhp-makes-6-4-billion-binding-off…

Australia's OZ Minerals extends exclusivity period for BHP's $6.4 bln bid

Dec 20 (Reuters) - Australia's OZ Minerals (OZL.AX) on Tuesday extended exclusivity period for BHP Group Ltd's (BHP.AX) A$9.6 billion ($6.43 billion) bid for the copper and gold producer by a week.In what could be the largest mining deal in Australia in 11 years, BHP made a revised cash offer of A$28.25 per share on Nov. 18, in a bid to take advantage of rising global demand for metals used in clean energy and electric cars.

...

https://www.reuters.com/markets/deals/australias-oz-minerals…

China's new state-run agency to start iron ore purchases -Bloomberg News

BEIJING (Reuters) - China Mineral Resources Group (CMRG), a new state-owned agency, is set to be the world's biggest iron ore buyer as soon as next year, when it will start buying for about 20 of the largest Chinese steelmakers, Bloomberg News reported.CMRG was set up this year to buy raw materials for the country's giant domestic steel industry, as Beijing steps up efforts to increase control over the natural resources needed to feed its economy.

China typically buys about two-thirds of the world market's iron ore.

The agency has started discussing supply contracts with top producers Rio Tinto Group, Vale SA and BHP Group, the report said on Thursday, citing people familiar with the situation.

....

>> https://finance.yahoo.com/news/chinas-state-run-agency-start…

Die Betrachtung der gesamten Peer-Group gibt immer den besten Überblick, ob eine Aktie noch Chancen hat oder ob eine andere aus der Peer-Group besser performt.

Anglo American

BHP Billiton

Vale S.A.

Rio Tinto

Freeport McMorgan

Solaris Resources - mit 500Mio Mkap ein kleineres Explorationsunternehmen

Man erkennt auch wann die Hausse zu Ende ist. Wenn 1-2 zu schwächeln beginnen, geht man am besten aus der ganzen Gruppe heraus.

China hat Riesenprobleme, in USA und Europa stören Zinsängste und mögliche Rezession die Wirtschaft - Rezession ist Gift für Rohstoffmärkte, daher hat die Rallye begrenzte Chancen.

Anglo American

BHP Billiton

Vale S.A.

Rio Tinto

Freeport McMorgan

Solaris Resources - mit 500Mio Mkap ein kleineres Explorationsunternehmen

Man erkennt auch wann die Hausse zu Ende ist. Wenn 1-2 zu schwächeln beginnen, geht man am besten aus der ganzen Gruppe heraus.

China hat Riesenprobleme, in USA und Europa stören Zinsängste und mögliche Rezession die Wirtschaft - Rezession ist Gift für Rohstoffmärkte, daher hat die Rallye begrenzte Chancen.

BHP's CEO expects Chinese economic growth to continue

Nov 30 (Reuters) - BHP Group Ltd (BHP.AX) Chief Executive Mike Henry told the Reuters NEXT conference on Wednesday that "all fundamentals are in place" in China for continued economic growth over the next 20 years.>> https://www.reuters.com/markets/bhps-henry-sees-fundamentals…

Bis 2030 sollen weltweit ca. 100 Mio. E-Autos gebaut werden, und jedes benötigt 83kg Kupfer. Hinzu kommt der Ausbau der Windenergie, wobei ein großes Windrat 25t Kupfer benötigt. Das dürfte dem Kupferpreis, der heuer um 25% eingebrochen ist, wieder Aufschwung geben. Ähnlich ist es mit anderen Metallen.

BHP wird davon profitieren. Die ganze Peer-Group zieht an und hat teilweise vom Tiefpunkt schon 30% zugelegt. Falsch machen kann man eigentlich nichts, denn allein die Dividendenrendite beträgt 6,59%.

BHP wird davon profitieren. Die ganze Peer-Group zieht an und hat teilweise vom Tiefpunkt schon 30% zugelegt. Falsch machen kann man eigentlich nichts, denn allein die Dividendenrendite beträgt 6,59%.

🙄 ...abwarten wie's hier nun weitergeht.

Labour turmoil sweeps Australia as inflation stirs 'spirit of anger'

SYDNEY/MELBOURNE, Nov 29 (Reuters) - After a decade of making up to A$200,000 a year (about US$135,000) on oil and gas rigs as a fitter and subsea equipment specialist in Western Australia, Adam Naylor had had enough.

...

Business leaders say the measures, which are likely to gain Senate approval this week, will hurt the economy.

"We now face the prospect of more strikes and fewer jobs," said Innes Willox, chief executive of the Australian Industry Group. Global miner BHP Group (BHP.AX) says multi-employer bargaining in the mining industry, where it says workers are highly paid, is unnecessary and risks cutting flexibility in wage deals and fueling industrial action.

"It's just so essential that Australia remains competitive," Chief Executive Mike Henry told reporters recently.

...

https://www.reuters.com/world/asia-pacific/labour-turmoil-sw…

Labour turmoil sweeps Australia as inflation stirs 'spirit of anger'

SYDNEY/MELBOURNE, Nov 29 (Reuters) - After a decade of making up to A$200,000 a year (about US$135,000) on oil and gas rigs as a fitter and subsea equipment specialist in Western Australia, Adam Naylor had had enough.

...

Business leaders say the measures, which are likely to gain Senate approval this week, will hurt the economy.

"We now face the prospect of more strikes and fewer jobs," said Innes Willox, chief executive of the Australian Industry Group. Global miner BHP Group (BHP.AX) says multi-employer bargaining in the mining industry, where it says workers are highly paid, is unnecessary and risks cutting flexibility in wage deals and fueling industrial action.

"It's just so essential that Australia remains competitive," Chief Executive Mike Henry told reporters recently.

...

https://www.reuters.com/world/asia-pacific/labour-turmoil-sw…

15:28 Uhr · EQS Group AG · BHP Group |

25.05.24 · wallstreetONLINE Redaktion · BHP Group |

23.05.24 · Gold-Silber-Rohstofftrends · Barrick Gold Corporation |

23.05.24 · wallstreetONLINE Redaktion · BHP Group |

22.05.24 · wallstreetONLINE Redaktion · BHP Group |

22.05.24 · wallstreetONLINE Redaktion · BHP Group |

22.05.24 · dpa-AFX · BHP Group |