Citadel Securities -- (big) Market Maker - Älteste Beiträge zuerst (Seite 3)

eröffnet am 12.12.19 15:17:57 von

neuester Beitrag 30.08.23 13:59:27 von

neuester Beitrag 30.08.23 13:59:27 von

Beiträge: 42

ID: 1.316.870

ID: 1.316.870

Aufrufe heute: 0

Gesamt: 2.364

Gesamt: 2.364

Aktive User: 0

Top-Diskussionen

| Titel | letzter Beitrag | Aufrufe |

|---|---|---|

| 21.05.24, 07:52 | 740 | |

| heute 03:56 | 329 | |

| vor 47 Minuten | 244 | |

| gestern 22:01 | 198 | |

| gestern 23:18 | 157 | |

| heute 01:19 | 129 | |

| gestern 21:55 | 123 | |

| gestern 18:22 | 118 |

Meistdiskutierte Wertpapiere

| Platz | vorher | Wertpapier | Kurs | Perf. % | Anzahl | ||

|---|---|---|---|---|---|---|---|

| 1. | 5. | 18.687,00 | -0,12 | 35 | |||

| 2. | 1. | 9,3450 | -0,11 | 28 | |||

| 3. | 2. | 179,24 | +3,17 | 21 | |||

| 4. | 8. | 0,4100 | -19,61 | 19 | |||

| 5. | 3. | 55,50 | +10,45 | 19 | |||

| 6. | 4. | 1,8500 | -10,63 | 16 | |||

| 7. | 6. | 0,2950 | +5,36 | 14 | |||

| 8. | 7. | 0,0026 | -72,27 | 13 |

18.2.

TESTIMONY OF KEITH PATRICK GILL BEFORE THE U.S. HOUSE COMMITTEE ON FINANCIAL SERVICES

PDF, 5 Seiten: https://t.co/o0APwAy1OF?amp=1

...

On Christmas morning I had only 529 subscribers on YouTube, and 550 followers on Twitter. These numbers are tiny.

There were rarely more than a few dozen folks on the stream on any night. The reality was people didn’t really care about boring, repetitive analysis of GameStop and other stocks, and that was fine. For those of us who did care, the stream provided us an outlet for refining our fundamentals-based thesis. We were able to analyze events in real-time and keep each other honest.

...

As for what I expect moving forward: GameStop’s stock price may have gotten a bit ahead of itself last month, but I’m as bullish as I’ve ever been on a potential turnaround. In short, I like the stock. And what’s stunning is that, as far as I can tell, the market remains oblivious to GameStop’s unique opportunity within the gaming industry.

TESTIMONY OF KEITH PATRICK GILL BEFORE THE U.S. HOUSE COMMITTEE ON FINANCIAL SERVICES

PDF, 5 Seiten: https://t.co/o0APwAy1OF?amp=1

...

On Christmas morning I had only 529 subscribers on YouTube, and 550 followers on Twitter. These numbers are tiny.

There were rarely more than a few dozen folks on the stream on any night. The reality was people didn’t really care about boring, repetitive analysis of GameStop and other stocks, and that was fine. For those of us who did care, the stream provided us an outlet for refining our fundamentals-based thesis. We were able to analyze events in real-time and keep each other honest.

...

As for what I expect moving forward: GameStop’s stock price may have gotten a bit ahead of itself last month, but I’m as bullish as I’ve ever been on a potential turnaround. In short, I like the stock. And what’s stunning is that, as far as I can tell, the market remains oblivious to GameStop’s unique opportunity within the gaming industry.

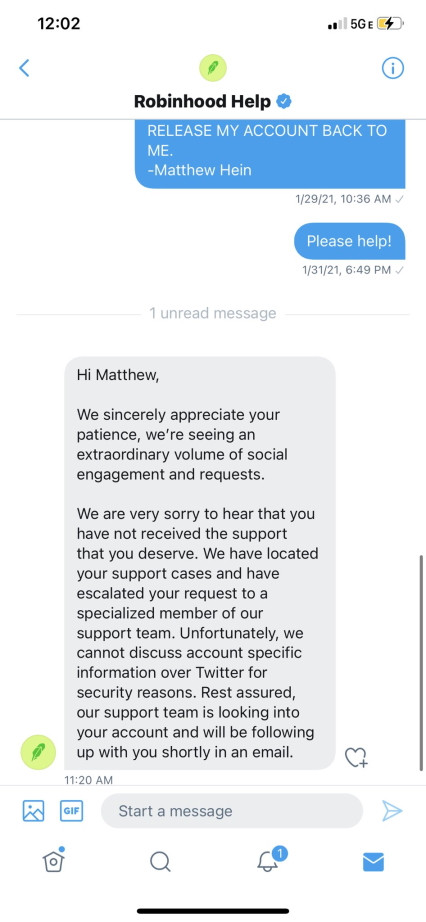

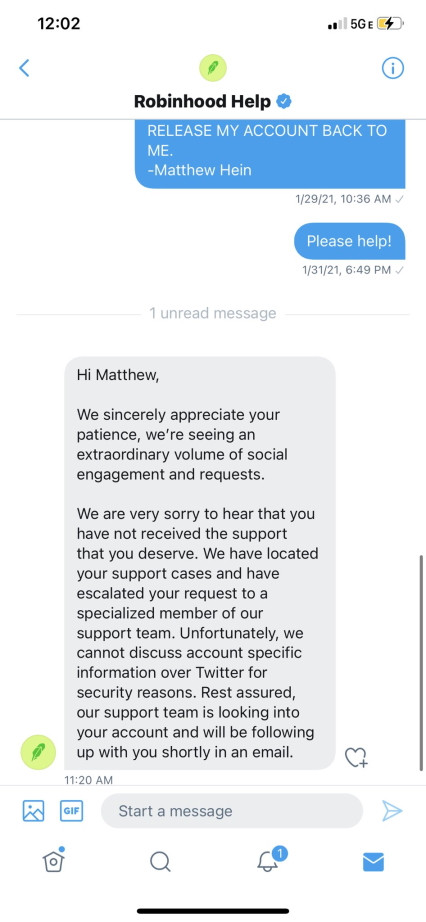

Robinhood ist mMn schon vor dem IPO eine Skandalfirma mit einem entsprechenden CEO, der den Ahnungslosen spielt, an der Spitze:

18.2.

Exposing The Robinhood Scam: Here's How Much Citadel Paid To Robinhood To Buy Your Orders

https://www.zerohedge.com/markets/exposing-robinhood-scam-he…

...

Vlad Tenev's entire background is HFT - he knew from day one that he could create a "free brokerage" if only he were to quietly sell all the orderflow to a generous sponsor, say Citadel. It's also why we find laughable his recent tweet asking, obviously rhetorically, "What exactly is high-frequency trading? And is it evil?"

...

Would it therefore be farfetched to say that Robinhood is nothing more than a client-facing subsidiary of Citadel, one which pretends to offer free trades to tens of millions of young, naive traders, but in reality merely allows Citadel Securities to trade ahead and/or against this orderflow for which it paid over $300 million... and to generate record revenues of $6.7 billion!

...

HFT = High-frequency trading

18.2.

Exposing The Robinhood Scam: Here's How Much Citadel Paid To Robinhood To Buy Your Orders

https://www.zerohedge.com/markets/exposing-robinhood-scam-he…

...

Vlad Tenev's entire background is HFT - he knew from day one that he could create a "free brokerage" if only he were to quietly sell all the orderflow to a generous sponsor, say Citadel. It's also why we find laughable his recent tweet asking, obviously rhetorically, "What exactly is high-frequency trading? And is it evil?"

...

Would it therefore be farfetched to say that Robinhood is nothing more than a client-facing subsidiary of Citadel, one which pretends to offer free trades to tens of millions of young, naive traders, but in reality merely allows Citadel Securities to trade ahead and/or against this orderflow for which it paid over $300 million... and to generate record revenues of $6.7 billion!

...

HFT = High-frequency trading

Antwort auf Beitrag Nr.: 66.849.415 von faultcode am 05.02.21 19:38:39Re CLOV:

Be advised that we take death threats against @HindenburgRes seriously, like this one from Ryan Johnson of Montgomery, AL.

We have, and will continue to refer all similar instances, to local and federal law enforcement, as well as our legal team.

https://twitter.com/ClarityToast/status/1367493134448525317

Be advised that we take death threats against @HindenburgRes seriously, like this one from Ryan Johnson of Montgomery, AL.

We have, and will continue to refer all similar instances, to local and federal law enforcement, as well as our legal team.

https://twitter.com/ClarityToast/status/1367493134448525317

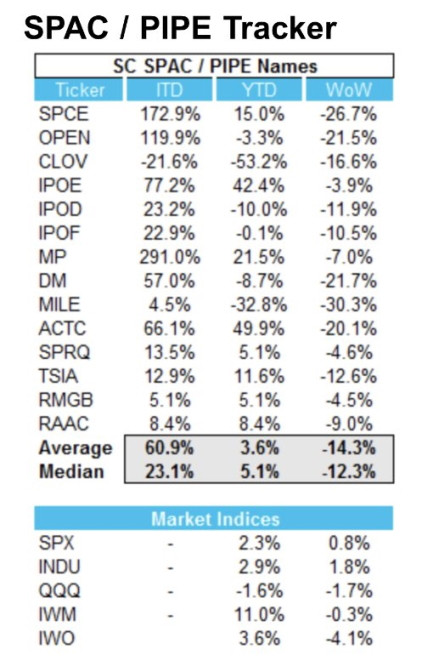

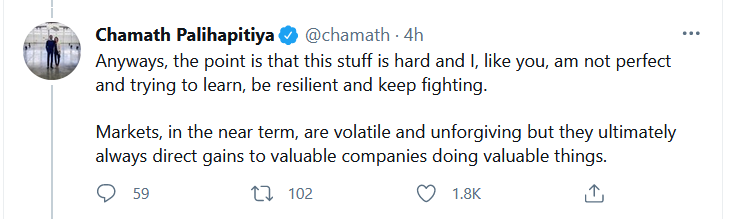

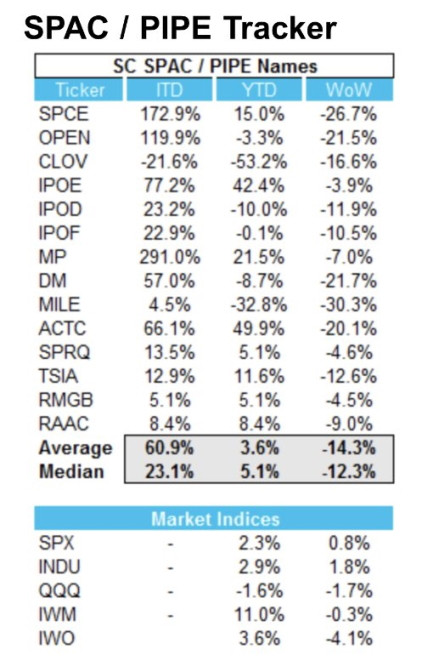

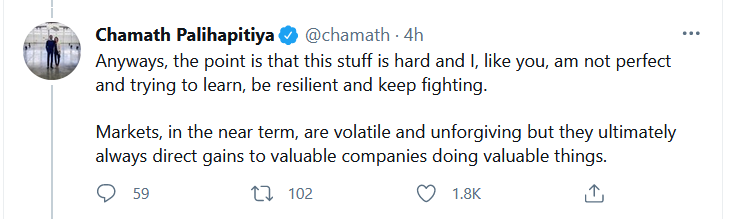

Antwort auf Beitrag Nr.: 66.866.207 von faultcode am 07.02.21 13:59:56es geht nun langsam mit dem "King of SPACs" bergab:

https://twitter.com/chamath/status/1368247773481500673

=> hier wird schon mal moralisch vorgebaut für das, was auf ihn noch zukommen könnte

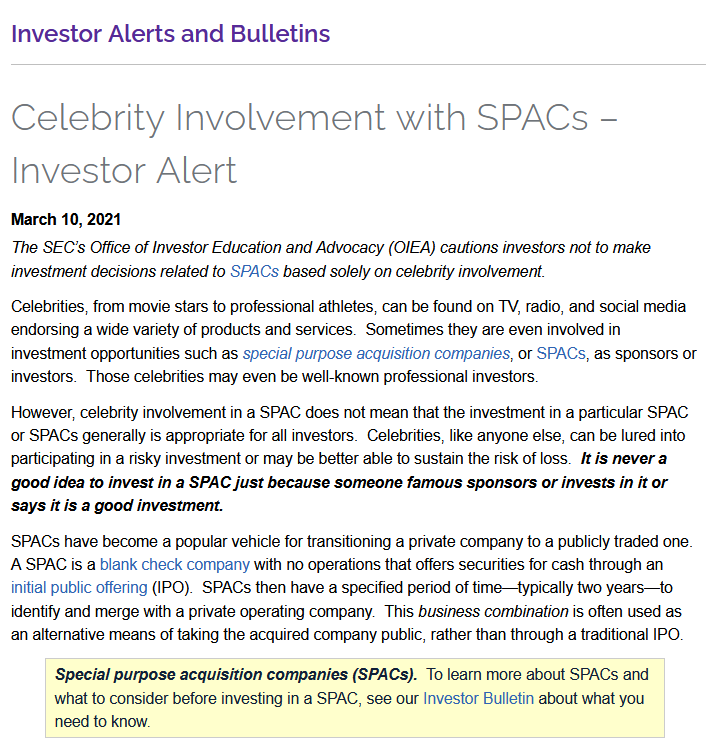

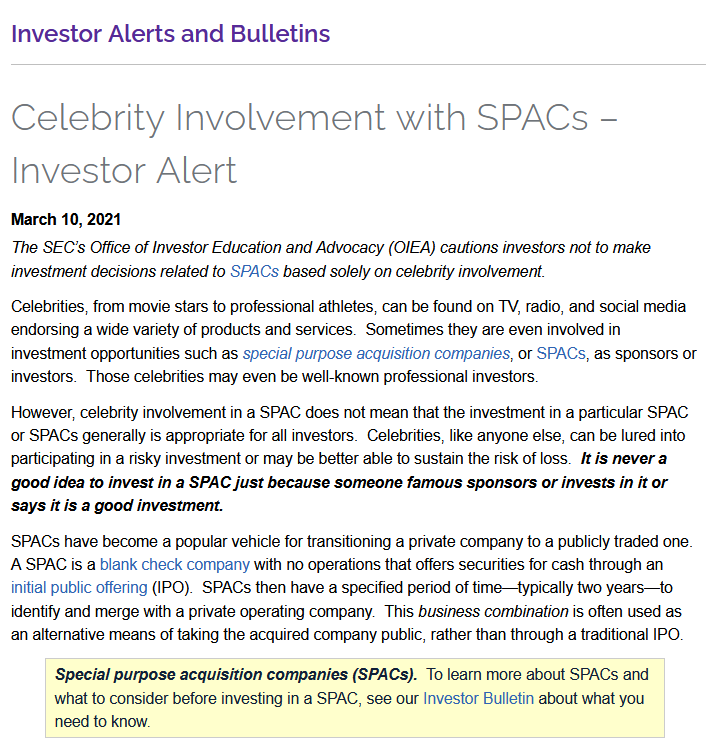

Es ist nicht zu übersehen: bei der SEC weht nun ein anderer Wind. Daher erinnere ich nochmal an:

https://twitter.com/chamath/status/1368247773481500673

=> hier wird schon mal moralisch vorgebaut für das, was auf ihn noch zukommen könnte

Es ist nicht zu übersehen: bei der SEC weht nun ein anderer Wind. Daher erinnere ich nochmal an:

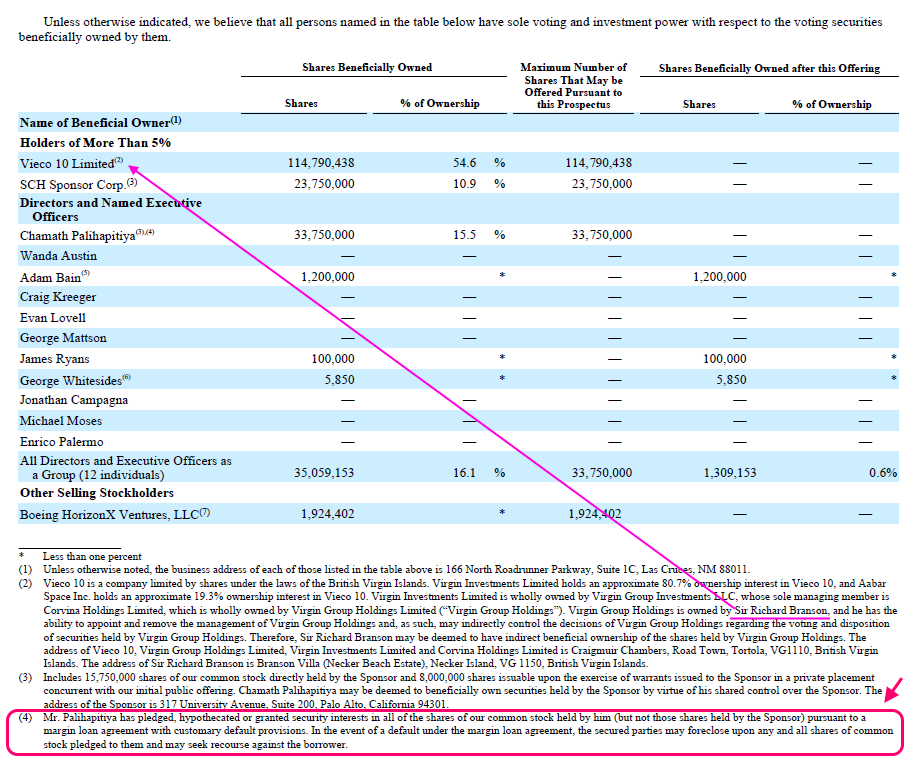

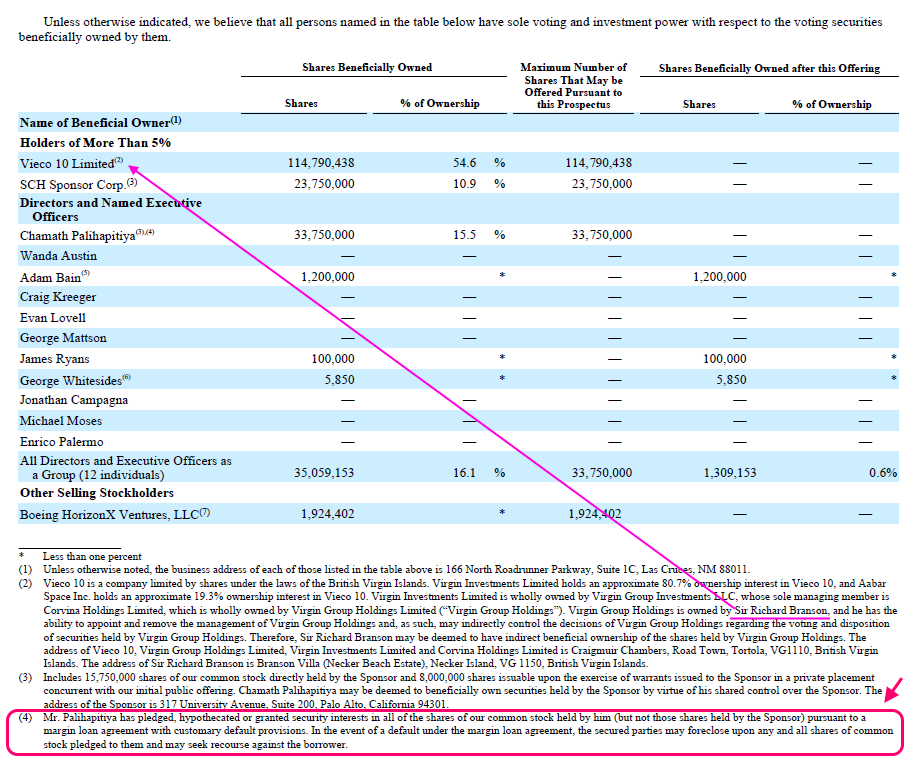

Zitat von faultcode: Chamath Palihapitiya muss von diesem Secondary market offering vor seinem massiven Verkauf gewusst haben:

...

Palihapitiya ist immer noch Chairman of the Board of Directors: https://investors.virgingalactic.com/governance/board-of-dir…

Wenn Palihapitiya dafür eines Tages wegen Insider-Handels bestraft werden sollte, wird sich so ein Verfahren erfahrungsgemäß länger hinziehen...

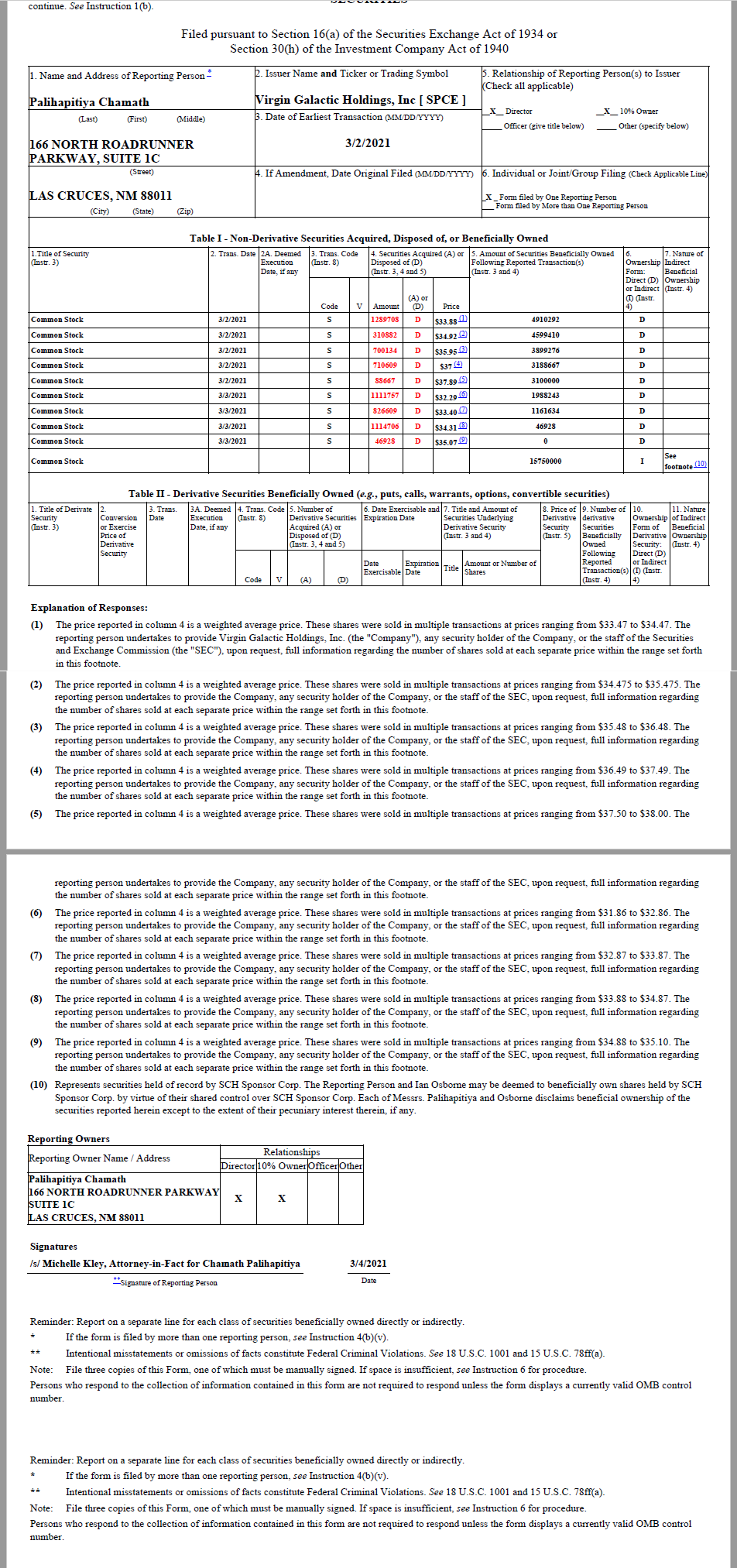

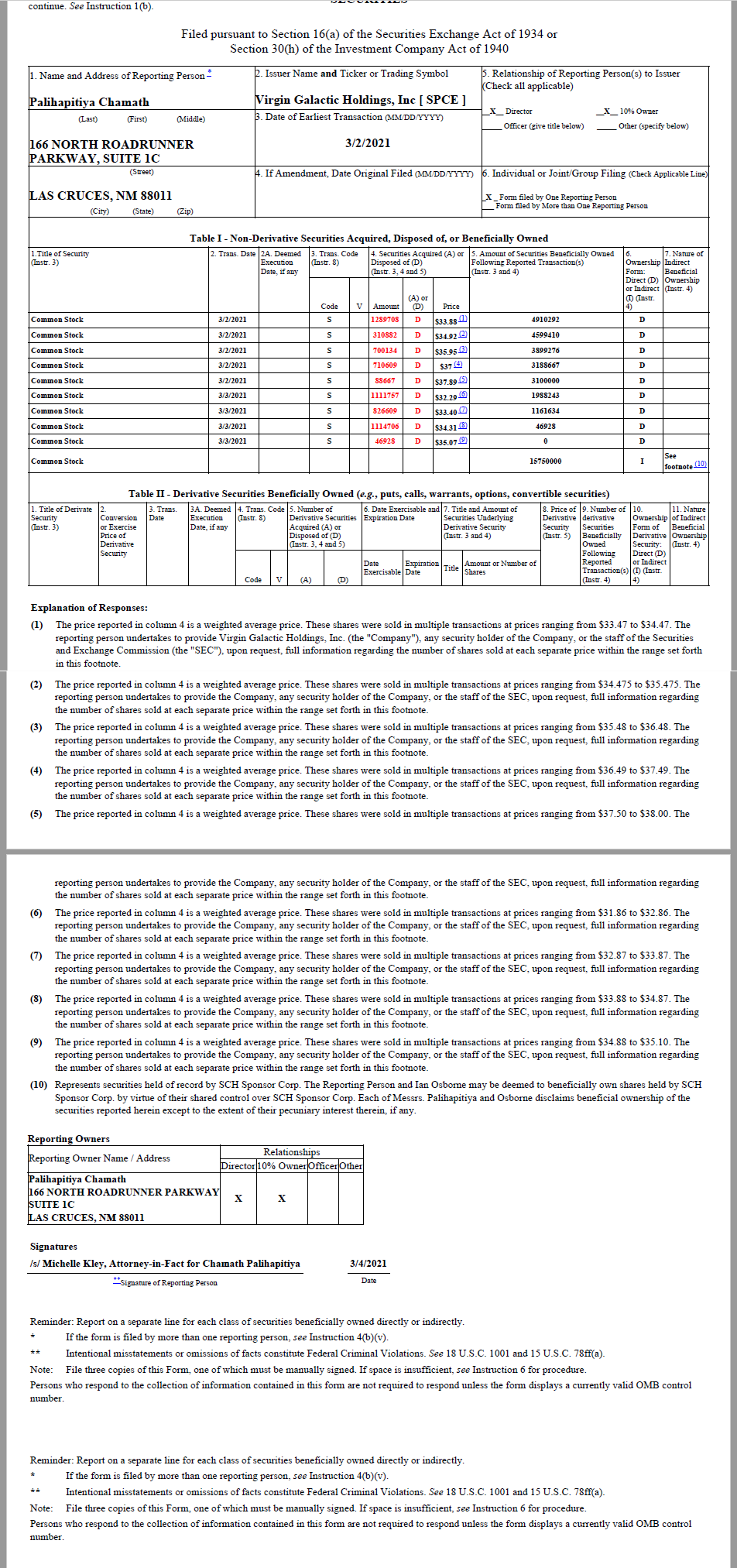

Antwort auf Beitrag Nr.: 67.344.780 von faultcode am 06.03.21 22:36:24Margin Call bei Chamath Palihapitiya 📢

alle persönlich gehaltenen Aktien letzte Woche verkauft (aber nicht die indirekt gehaltenen bei der SCH Sponsor Corp, weil noch im Lockup):

https://investors.virgingalactic.com/financials/sec-filings/…

Siehe auch dazu aus: https://www.wallstreet-online.de/diskussion/1319193-111-120/…

alle persönlich gehaltenen Aktien letzte Woche verkauft (aber nicht die indirekt gehaltenen bei der SCH Sponsor Corp, weil noch im Lockup):

https://investors.virgingalactic.com/financials/sec-filings/…

Siehe auch dazu aus: https://www.wallstreet-online.de/diskussion/1319193-111-120/…

Antwort auf Beitrag Nr.: 67.344.780 von faultcode am 06.03.21 22:36:24die Einschläge beim "King of SPACs" kommen näher:

https://www.sec.gov/oiea/investor-alerts-and-bulletins/celeb…

...

https://www.sec.gov/oiea/investor-alerts-and-bulletins/celeb…

...

Antwort auf Beitrag Nr.: 67.101.396 von faultcode am 19.02.21 12:20:2818.3.

'Big Short' investor Michael Burry says he'll stop tweeting after SEC regulators paid him a visit

https://markets.businessinsider.com/currencies/news/big-shor…

• Michael Burry's Twitter habit led to a visit from federal regulators.

• "The Big Short" investor has blasted Tesla, bitcoin, Robinhood, and meme-stock buyers.

• Burry indicated that he's not planning to tweet anymore.

...

"Tweeting and getting in the news lately apparently has caused the SEC to pay us a visit," the Scion Asset Management boss said in a now-deleted tweet.

...

It's unclear which of Burry's tweets attracted regulatory attention. Scion and the SEC didn't immediately respond to requests for comment from Insider.

'Big Short' investor Michael Burry says he'll stop tweeting after SEC regulators paid him a visit

https://markets.businessinsider.com/currencies/news/big-shor…

• Michael Burry's Twitter habit led to a visit from federal regulators.

• "The Big Short" investor has blasted Tesla, bitcoin, Robinhood, and meme-stock buyers.

• Burry indicated that he's not planning to tweet anymore.

...

"Tweeting and getting in the news lately apparently has caused the SEC to pay us a visit," the Scion Asset Management boss said in a now-deleted tweet.

...

It's unclear which of Burry's tweets attracted regulatory attention. Scion and the SEC didn't immediately respond to requests for comment from Insider.

Antwort auf Beitrag Nr.: 67.101.396 von faultcode am 19.02.21 12:20:28

https://twitter.com/RobinhoodApp/status/1374125455037505536

--> siehe auch hier:

https://twitter.com/MatthewHein3

...

https://twitter.com/MatthewHein3/status/1369712780509581314

Zitat von faultcode: Robinhood ist mMn schon vor dem IPO eine Skandalfirma mit einem entsprechenden CEO, der den Ahnungslosen spielt, an der Spitze:

...

https://twitter.com/RobinhoodApp/status/1374125455037505536

--> siehe auch hier:

https://twitter.com/MatthewHein3

...

https://twitter.com/MatthewHein3/status/1369712780509581314

Antwort auf Beitrag Nr.: 67.560.558 von faultcode am 23.03.21 00:43:42

22.3.

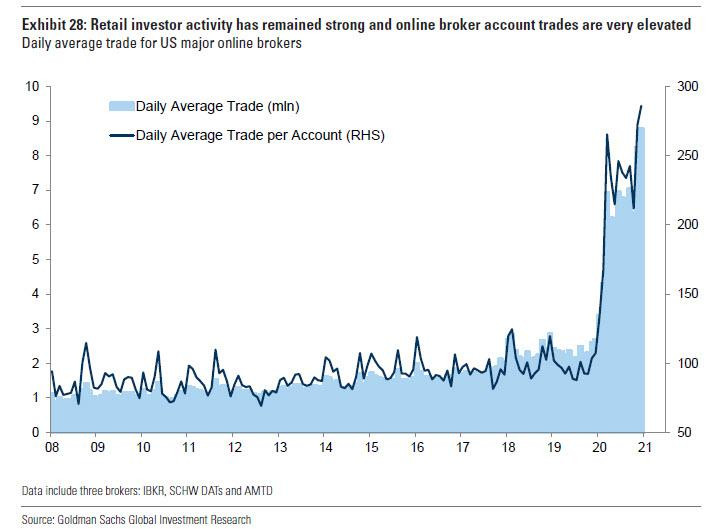

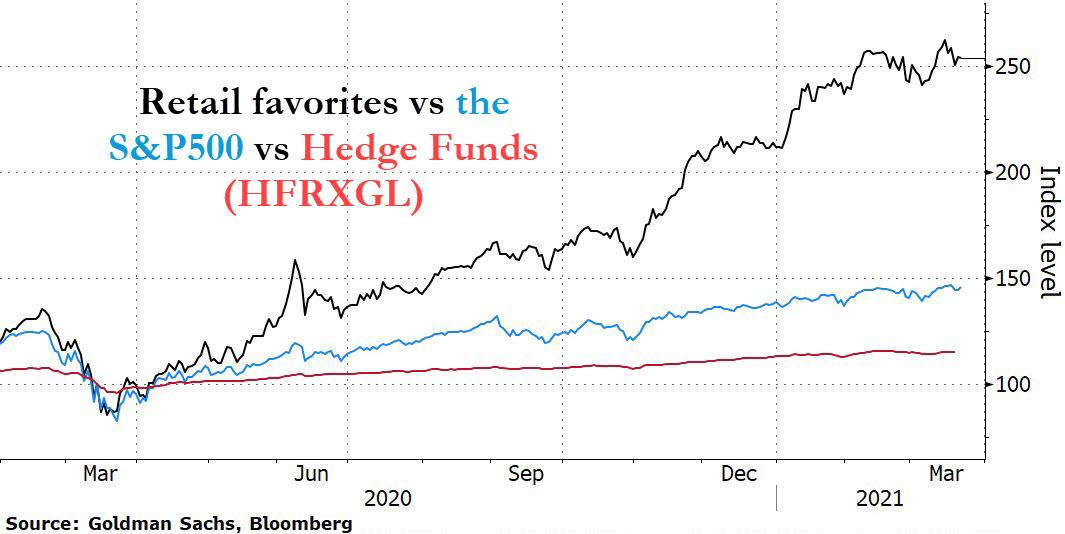

JPM Makes A Surprising Discovery: Daytraders Are Evolving, And Starting To Hedge Their Massive Gains

https://www.zerohedge.com/markets/jpm-makes-surprising-disco…

22.3.

JPM Makes A Surprising Discovery: Daytraders Are Evolving, And Starting To Hedge Their Massive Gains

https://www.zerohedge.com/markets/jpm-makes-surprising-disco…

Antwort auf Beitrag Nr.: 67.575.441 von faultcode am 24.03.21 00:57:014.5.

📢

...Some significant possible regulatory changes to be discussed at Thursday House Financial Services Hearing. Monthly 13F filings including short positions and derivatives. Regulate large family offices. Outlaw payment for order flow.

https://twitter.com/bgrahamdisciple/status/13896800100222976…

...

"Would require broker dealers to disclose to customers the percentage of the broker dealer's retail client accounts that lose money on such options trading"

📢

...Some significant possible regulatory changes to be discussed at Thursday House Financial Services Hearing. Monthly 13F filings including short positions and derivatives. Regulate large family offices. Outlaw payment for order flow.

https://twitter.com/bgrahamdisciple/status/13896800100222976…

...

"Would require broker dealers to disclose to customers the percentage of the broker dealer's retail client accounts that lose money on such options trading"

Beitrag zu dieser Diskussion schreiben

Meistdiskutiert

| Wertpapier | Beiträge | |

|---|---|---|

| 28 | ||

| 21 | ||

| 19 | ||

| 18 | ||

| 17 | ||

| 16 | ||

| 14 | ||

| 13 | ||

| 12 | ||

| 10 |

| Wertpapier | Beiträge | |

|---|---|---|

| 10 | ||

| 10 | ||

| 9 | ||

| 8 | ||

| 8 | ||

| 7 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 5 |